My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

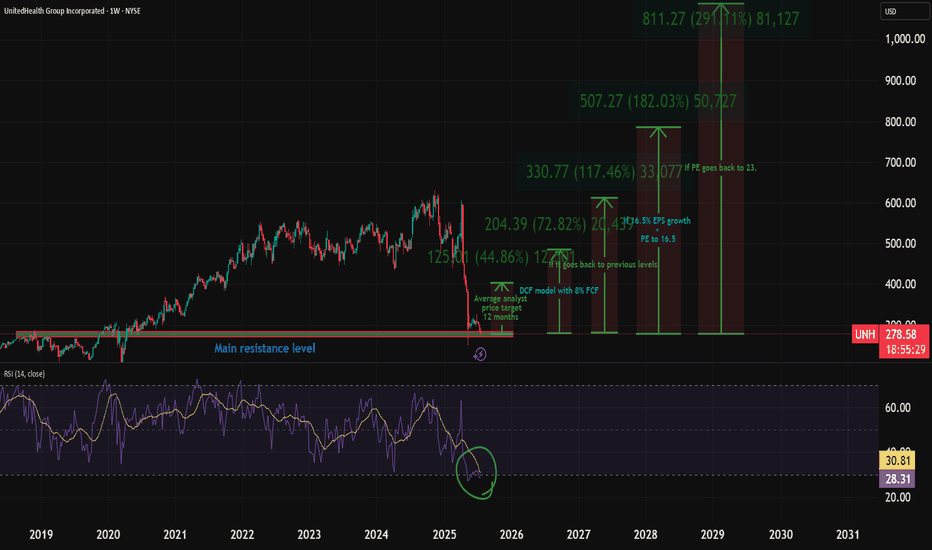

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) earnings could flip the script. As a historically dominant player, UNH is now undervalued amid sector weakness, offering massive upside if regulatory fears ease.

Here's my full bull case. 👇 FUNDAMENTAL ANALYSIS

Why the Sell-Off? A Perfect Storm of Bad News

UNH crushed the market for 15 straight years (2009-2023) with positive returns, predictable EPS growth, and 134% gains over the last decade.

But 2024 brought chaos:

Feb: Massive cyber attack caused a one-time EPS hit (non-recurring).

Ongoing: DOJ antitrust probe, criminal fraud investigation, rising Medicare costs, and Optum losses.

April: Disastrous Q1 earnings miss + lowered guidance.

Leadership drama: CEO death.

This erased gains (down 7% over 5 years), amplified by healthcare sector outflows—the biggest since 2020. But is this overblown? Signs point to yes. The markets almost always overreact to bad news.

Bullish Signals: Insiders Betting Big

The tide is turning:

Insider Buying Boom: $32M+ in 2024 (vs. $6.6M in 2019), including new CEO/CFO—highest in 15 years.

Congress Buying: Q2 2024 saw net purchases for the first time in 5 years (vs. historical selling).

DOJ Shift: Probe refocusing on pharmacy benefits (PBM) unit, dropping acquisition/monopoly scrutiny—implies no major findings. Great news!

Sector Tailwinds: Healthcare is one of 3 S&P sectors below historical valuations. Super investors (usually tech-obsessed) are piling in, despite the sector's -10% YTD vs. S&P's +13%.

Plus, UNH's dividend yield is at a record ~3% (vs. 1.5% avg), with 16%+ historical growth and 100%+ free cash flow conversion. Rare combo of yield + growth!

Valuation: Screaming Buy?

UNH trades at PE ~11.9 (vs. 10-year avg 23)—a steal.

Analysts project 16.7% EPS CAGR through 2029.

Conservative Scenario: 16.5% EPS growth + PE to 16.5 = $780/share by 2030 (173% total return, 18% CAGR ex-dividends).

Optimistic: PE back to 23 = $1,084/share (280% return).

Models confirm:

DCF (8% FCF growth): ~$484/share (70% upside).

DDM (7% div growth): ~$607/share (112% upside).

Blended Fair Value: ~$545/share (75-90% upside from ~$300). Buy below $436 for 20% safety margin.

Still, there is fear of DOJ uncertainty—investors hate unpredictability and that's why the stock is so low.

Key Catalyst: July 29 Earnings

This could be UNH's "most important report ever." Watch for:

Regulatory/legal updates (DOJ progress).

Full-year guidance revisions.

Metrics like medical loss ratio and PBM performance.

Positive news = potential rocket 🚀. Expectations are low (20 bearish EPS revisions vs. 0 bullish), so a beat could spark volatility... upward.

Risks: Not Without Bumps

Regulatory escalation (e.g., PBM issues) could tank it further.

Short-term headwinds: Medicare costs, sector selling.

Mitigants: DOJ de-risking, strong FCF buffer, insider confidence. Enter cautiously—size positions small.

TECHNICAL ANALYSIS

I also did a little technical analysis:

UNH price is at a resistance level

My EVaR indicator tells me we are in a low-risk area

RSI says the stock is oversold

I added the different price targets for better visualization

THE PLAN

My plan:

Later today, I will allocate 1% to 1.5% of my portfolio to the stock. If it drops, I will continue to DCA. The stock is already really beaten down, and I think a company this large cannot drop much more.

Quick note: I'm just sharing my journey - not financial advice! 😊

Healthcare

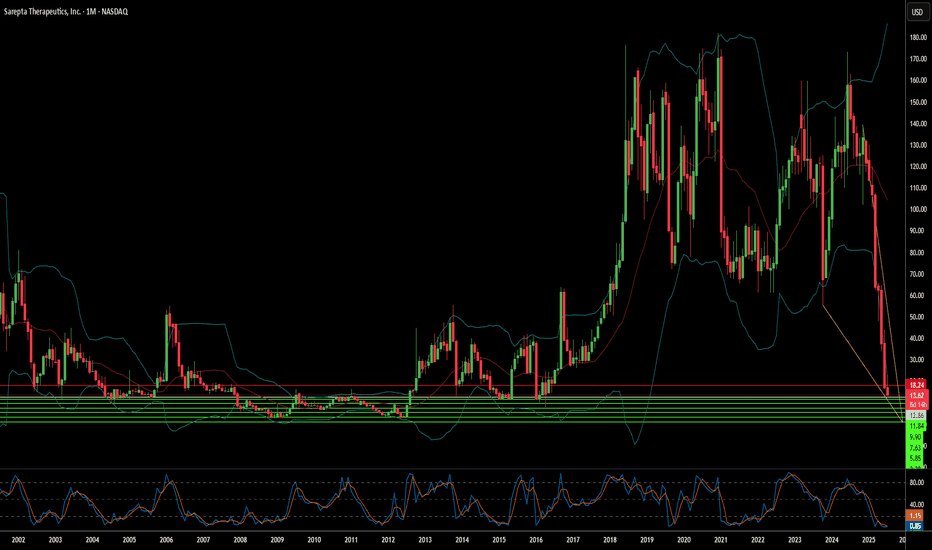

Sarepta's Plunge: A Confluence of Challenges?Sarepta Therapeutics (SRPT) faces significant market headwinds. The company's stock has seen a notable decline. This stems from multiple, interconnected factors. Its flagship gene therapy, ELEVIDYS, is central to these challenges. Recent patient deaths linked to similar gene technology raised safety concerns. The FDA requested a voluntary pause in Elevidys shipments. This followed a "black box warning" for liver injury. The confirmatory EMBARK trial for Elevidys also missed its primary endpoint. These clinical and regulatory setbacks significantly impacted investor confidence.

Beyond specific drug issues, broader industry dynamics affect Sarepta. Macroeconomic pressures, like rising interest rates, reduce biotech valuations. Geopolitical tensions disrupt global supply chains. They also hinder international scientific collaboration. The intellectual property landscape is increasingly complex. Patent challenges and expirations threaten revenue streams. Cybersecurity risks also loom large for pharmaceutical companies. Data breaches could compromise sensitive R&D and patient information.

The regulatory environment is evolving. The FDA demands more robust confirmatory data for gene therapies. This creates prolonged uncertainty for accelerated approvals. Government initiatives, like the Inflation Reduction Act, aim to control drug costs. These policies could reduce future revenue projections. Sarepta's reliance on AAV technology also presents inherent risks. Next-generation gene editing technologies could disrupt its current pipeline. All these factors combine to amplify each negative impact.

Sarepta's recovery depends on strategic navigation. Securing full FDA approval for Elevidys is crucial. Expanding its label and maximizing commercial potential are key. Diversifying its pipeline beyond a single asset could de-risk the company. Disciplined cost management is essential in this challenging economic climate. Collaborations could provide financial support and expertise. Sarepta's journey offers insights into the broader gene therapy sector's maturity.

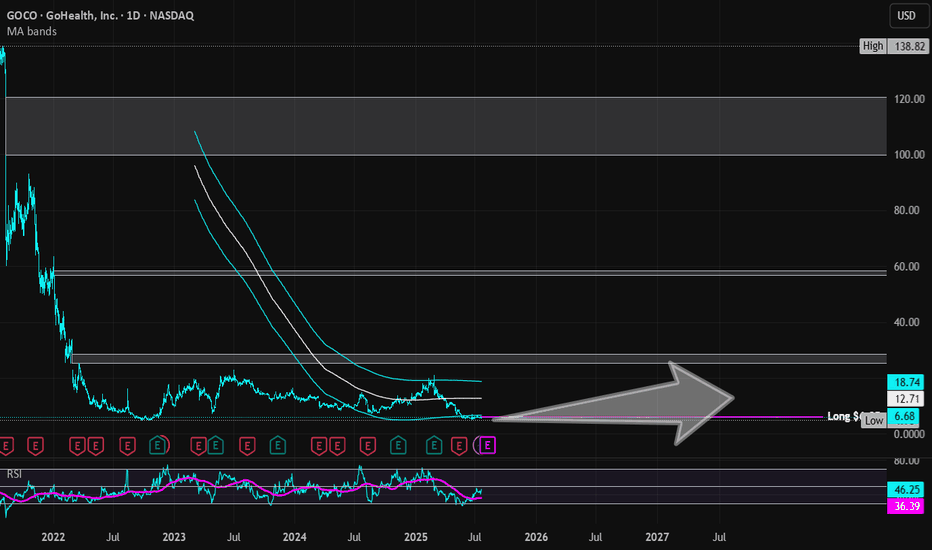

GoHealth | GOCO | Long at $6.05GoHealth NASDAQ:GOCO is a health insurance marketplace and Medicare-focused digital health company that uses a technology platform with machine-learning algorithms to match consumers with Medicare plans (Advantage, Supplement, Part D) and individual health insurance. Understandably, a lot of investors aren't bullish on this stock given all of the healthcare provider and services headwinds. However, if the company can overcome some of their financial issues and bankruptcy risk (debt-to-equity: 1.6x; quick ration of 1.1x, Altman's Z score of .3x), it may dominate the health insurance marketplace (but do not hold my word to that...). This is a purely speculative play at this point - those who are risk averse should absolutely stay away.

What truly caught my eye with this stock is that it is consolidating nicely within my historical simple moving average area. Often, but not always, this leads to a future change in momentum and propels the stock higher. It doesn't signal a bottom and there may be more room for it to plummet, but it is a bullish (overall) sign that shares are likely being accumulated by investors. Given the need for health insurance, particularly Medicare as the US / baby boom population ages, this is a company that may prosper IF it can get its financials in order.

Thus, at $6.05, NASDAQ:GOCO is in a personal buy zone (but very risky). Further declines may be ahead before a stronger move up.

Targets into 2028:

$10.00 (+64.5%)

$12.00 (+97.4%)

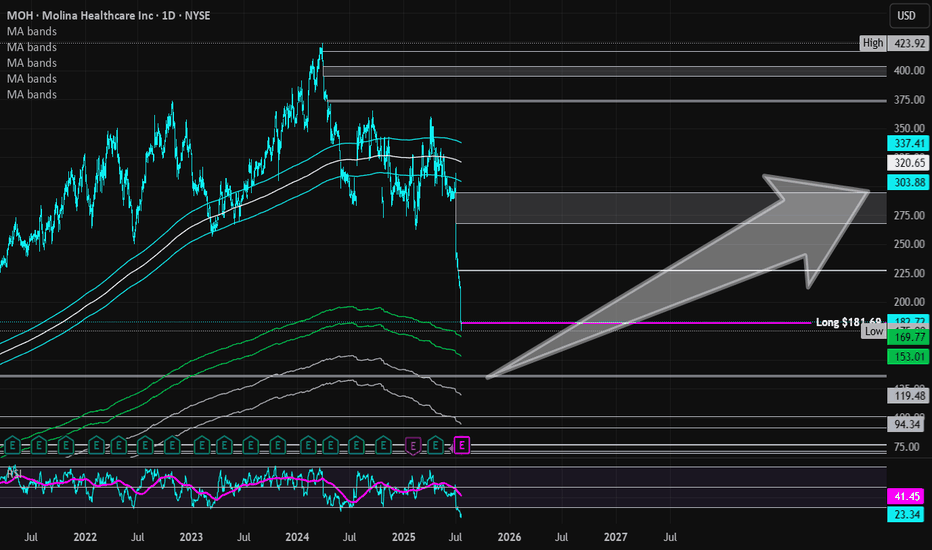

Molina Healthcare | MOH | Long at $181.69Healthcare providers and services are at a major discount right now: and may be discounted even more this year. I am personally buying and long-term holding the fear, knowing the baby boom generation is going to utilize our healthcare system at a rate unseen in modern times. While the price discounts are valid "right now" given the current political administration's cuts, long-term it is far from valid... The strategy I am using with healthcare stocks ( NYSE:MOH , NYSE:CNC , NYSE:UNH , NYSE:ELV , etc) is cost averaging: not buying one single large position in an effort to predict bottom but buying smaller positions over time to create a cost average "near" bottom. If you are a day trader or want a quick swing in healthcare, I don't think it's going to happen for a bit. But those not entering in the coming months / year will likely miss out on a very large healthcare boom - especially when AI truly enters the picture in this sector...

Fundamentally, Molina Healthcare NYSE:MOH is a very strong company. Low debt-to-equity (.9x), P/E of 8.8x, quick ratio of 1.7x, $41 billion in revenue in 2024. Yes, there will be issues in the near-term due to Medicaid and other funding cuts. But long-term, this sector is primed to benefit from an aging population.

So, while NYSE:MOH is in a personal buy zone at $181.69, I don't think this is necessarily bottom. I anticipate this stock to drop even further, eventually closing the daily price gap at $135.00. My next buys are in the $150's and $130's, thus cost averaging into a larger position. For true value investors, those prices and anything below is a steal. Today's negative healthcare sector noise is loud, but it does not represent the future.

Targets into 2028:

$226.00 (+24.3%)

$290.00 (+59.6%)

ABCL: When biotechnology not only curesABCL: When biotechnology not only cures, but also makes your wallet happy!

Hello, fellow investors and those who just like to tickle your nerves on the stock exchange!

Today we have on our agenda (and on the chart) - the stock AbCellera Biologics Inc. (ABCL), which seems to have decided to prove that even at the bottom there is life, and then even throw a party with a breakthrough!

As you can see, our hero ABCL has been playing ‘hide and seek with the trend line’ for a long time, showing an enviable resilience in the fall, just like your sofa after a day at work. However, if you look closely, the ‘ma/ema below price’ signalled that buyers, like secret agents, had already taken control of the situation, preparing for the decisive throw.

And here it is, it's happening! The recent ‘breakout + retest’ is not just a technical term, but a real escape from the ‘bearish’ prison with a subsequent test of strength. Not only did price break through resistance, but it came back to see if it was indeed broken. It's like going out of the house, forgetting your keys, coming back in, getting them, and then going out again - only in the stock market it's a sign of strength and determination!

Now that the dust has settled and the ‘1d’ trendline is behind us, our sights are set on the upside. Targets? Of course! ‘tp1-4.81’ and ‘tp2-6.00’ are not just numbers, they are potential points where we can pat ourselves on the shoulder and say, ‘I told you so!’. А ‘2,618 (6,61)’ - is for the very brave and patient who are willing to wait for the true bull dance.

All in all, ABCL seems to have turned a page in its history, swapping sad ballads for upbeat dance hits. But remember, friends: the market is a capricious thing, and even the most beautiful charts can bring surprises. So, act wisely, don't forget about risks and, of course, enjoy the process! Have a good trading!

Elevance Health | ELV | Long at $286.00What are seeing in the healthcare and health insurance provider industry right now is destruction before a once-in-a-lifetime boom. The baby boomer generation is between 60 and 79 right now and the amount of healthcare service that will be needed to serve that population is staggering. Institutions are crushing them to get in - it's just near-term noise, in my opinion. My personal strategy is buy and hold every healthcare opportunity (i.e. NYSE:CNC , NYSE:UNH , NYSE:HUM etc).

Elevance Health NYSE:ELV just dropped heavily due to lower-than-expected Q2 2025 earnings, a cut in full-year profit guidance from $34.15-$34.85 to ~$30 EPS, and elevated medical costs in Medicaid and ACA plans. It's near-term pain (may last 1-2 years) which will highly likely lead to long-term growth. The price has touched my historical simple moving average "crash" band. I would not be shocked to see the price drop further into the $260s before a rise. However, the near-term doom could go further into the year. I am anticipating another drop to the "major crash" simple moving average band into the $190s and $220s to close out the remaining price gaps on the daily chart that occurred during the COVID crash. Not to say it will absolutely reach that area, but it's locations on the chart I have for additional buys.

Thus, at $286.00, NYSE:ELV is in a personal buy zone (starter position) with more opportunities to gather shares likely near $260 before a bounce. However, if the market or healthcare industry really turns, additional buys planned for $245 and $212 for a long-term hold.

Targets into 2028:

$335.00 (+17.1%)

$386.00 (+35.0%)

UNH bear flag and gapsUNH has been top of my radar for a bullish reversal. With 2 major gaps to fill after the epic collapse in share price this ticker has a lot of potential. Currently sitting in what appears to be a bear flag, it is holding above the monthly 200EMA (overlayed on this 4H chart). However price recently rejected off the daily 21ema (overlayed on this 4H chart) and if the bear flag is any indicator price may head lower for another liquidity sweep before the inevitable bullish reversal.

A side note: insiders have been buying $millions since the share price collapsed which is always a good indicator of what's to come.

Agilon Health | AGL | Long at $2.36Reentering this trade (original: )

Agilon Health NYSE:AGL

Pros:

Revenue consistently grew from 2019 ($794 million) to 2024 ($6.06 billion). Expected to reach $9.16 billion by 2028.

Current debt-to-equity ratio 0.07 (very low)

Sufficient cash reserves to fund operations and strategic initiatives

Strong membership growth (659,000 in 2024, a 38% year-over-year increase)

Recent insider buying ($2 - $3) and awarding of options

Cons:

Rising medical costs - currently unprofitable and not forecast to become profitable over the next 3 years

Medicare Advantage Membership issues with the new political administration

No dividend

It's a gamble and I think it's a possibility this could drop near $1 in the near-term due to the Medicaid changes/fear... regardless, long-term, personal buy-zone at $2.36.

Targets in 2027

$3.70 (+56.8%)

$5.25 (+122.5%)

Figs Inc | FIGS | Long at $5.24Figs Inc $NYSE:FIGS. Technical analysis play first, fundamentals second.

My selected historical simple moving average lines have converged with the stock price, which often leads to sideways trading and a reversal in the downward trend (i.e. future price increase). The downward trend is flattening, but that doesn't mean post-earnings drop to $1.50-$2.00 isn't out of the question...

The FIGS brand is growing within the healthcare world with significant opportunities overseas. While economic headwinds may impede near/medium-term growth, revenue is anticipated to grow into 2027. EPS is expected to rise from 0.01 in 2024 to 0.20 by 2027. While this is not a "value" play and there is high risk for rug pulls, something may be brewing within the chart for a move up. Tread lightly, however...

Targets

$6.00

$6.40

$7.00

$8.00

Walk This Way...This S. Korean company focuses on treatment of cystic fibrosis and chronic kidney disease, et al. Future Medicine, Limited.

Godspeed to this company as they search for cures for primary biliary cirrhosis; colorectal, prostate, and lung cancers and rheumatoid arthritis, et al. They target metabolic cancers, inflammatory and autoimmune diseases, to produce anticancer drugs, anti-fibrotics and antiviral remedies. Not only persistent, but painful diseases, as well. Who on earth wouldn't want this company to succeed ?

Selling Volume has completely Dried-up and the stock is in the process of setting Higher-Lows. MACD, StochasticsRSI, Rate-of-Change, and %r are all additive tenets of confirmation for the astute and intrepid investor.

Go Long.... it's at the 20... the 10... the 5... and Touchdown

Centene Corp | CNC | Long at $35.00Centene Corp NYSE:CNC is a healthcare enterprise providing programs and services to under-insured and uninsured families, commercial organizations, and military families in the U.S. through Medicaid, Medicare, Commercial, and other segments. The stock dropped almost 40% this morning due to recent challenges, such as a $1.8B reduction in 2025 risk adjustment revenue and rising Medicaid costs (leading to withdrawal of 2025 earnings guidance). However, the company has a book value near $56, debt-to-equity of 0.7x (healthy), a current P/E of 5x, and a forward P/E of 9x.

It may be a few years before this stock recovers. But the price has entered my "crash" simple moving average area (currently between $32 and $36) and there is a price gap on the daily chart between $32 and $33 that will likely be closed before a move higher. Long-term, and potentially a new political administration, new life may enter this stock once again as the baby boom generation requires more healthcare services. But holding is not for the faint of heart...

Thus, at $35.00, NYSE:CNC is in a personal buy zone with a likely continued dip into the low $30s or high $20s before a slow move higher (where I will be accumulating more shares). Full disclosure: I am also a position holder in the $60s and cost averaging down.

Targets into 2028:

$45.00 (+28.6%)

$54.00 (+54.3%)

KALH Upside Potential?Looking purely off of KALV with the range that it has been in and the healthcare sector that it is a part of. IF healthcare sector will continue to rebound, this stock could potentially rebound as well back to the $13-$15 range. It is currently sitting right below the 200 day moving average and seems to be holding support there. I'm considering a stop loss just below $11 since this stock can move $0.83 a day with a trailing stop loss of 9%. I see it is valued under pressure of the VWAP that is currently at $12.20. This could be a beautiful continuation of the long trend that it has been in since January 2025 with an entry on this pullback. RSI looks like it is exhausting out with oversold conditions at 37.30. I like the inverted hammer that was placed and the fact that we have 3 days worth of support on the 200 day moving average.

On the fundamentals, this company is a cash king in the fact they have more cash than debt. Market Cap 567.26M vs. Enterprise Value 420.76M and Insider ownership is key: Insider Ownership: 22.58%. All of which show that management are in charge and have a vision.

As always, do your own research and due diligence. Not trading advice.

HIMS 1D — This pattern didn’t cook for nothingOn the daily chart of Hims & Hers Health, we’re looking at a textbook cup with handle formation — not just a pattern, but a structure backed by time, volume, and classic price behavior. The base of the cup formed steadily from February to May 2025, and as soon as the curve was complete, price transitioned into a tight consolidation — the "handle" that often masks real accumulation.

Right now, price is testing the resistance area. And it’s not just floating up there — it’s coming in hot: price has already broken through EMA 20/50/100/200 and SMA 50/200. That’s a full stack flip. This isn’t sideways noise — it’s a structural shift in control.

Volume is starting to build as price rises, confirming that demand is real and institutional positioning likely active. We’re watching a breakout zone above the handle — and when that breaks, the structure unlocks with a clear target: $107.25, roughly a 2x move from current levels.

This setup isn’t noise. It’s a long-cooked formation that’s now about to boil over. If the handle holds and price breaks through — the rest is just follow-through.

eHealth | EHTH | Long at $4.22eHealth NASDAQ:EHTH , the largest online private health insurance marketplace, may be undervalued. The book value is listed around $19 a share and it has a debt-to-equity of 0.07x (healthy), a quick ratio of 2.5 (strong liquidity, can cover liabilities), growing revenue since 2021 (over $500M in 2024), and insiders have recently bought shares/awarded options. However, profitability is still a concern, but the company is expected to be profitable by 2026. With the US's aging population and the need for affordable healthcare coverage, eHealth *may* standout as a major insurance marketplace... but time will tell.

From a technical analysis perspective, the stock price is near the bottom of its historical simple moving average. I do not doubt, however, that the stock may slip to cover the small price gap between $3.09 and $3.23 (which will be another entry point if fundamentals do not change). This stock may trade sideways for some time. But it has a 27M float and as we saw in 2014 and 2020, it can REALLY get going if buyers see the opportunity...

Thus, at $4.22, NASDAQ:EHTH is in a personal buy zone with more opportunity potentially near $3 in the future.

Targets:

$6.00 (+42.2%)

$8.00 (+89.6%)

UNH : Are Bad Days Over ? (Cautious)UNH shares have moved above the 50-period moving average but are trading below the 200-period moving average.

For now, since the 200-period moving average is very high, a small trade can be tried by keeping the stop-loss level a little tight.

A few weak movements may pull the average down and the price may break the average.

Therefore, small position sizes are ideal.

NOTE : If we can maintain persistence on 376(Which will take a few days),

then we will look at the other gaps.

Risk/Reward Ratio : 2.39

Stop-Loss : 274.99

Take- Profit Level : 376.38

Regards.

Regeneron Pharmaceuticals | REGN | Long at $502.28Regeneron Pharmaceuticals NASDAQ:REGN stock dropped more than 17% today due to mixed Phase 3 trial results for itepekimab, a potential COPD drug. However, the company has an extensive drug pipeline, raked in over $14 billion last year, and is currently trading at a price-to-earnings of 15x. Debt-to-equity is 0.09x (extremely healthy) and earnings are forecast to grow 7.5% per year. While 2025 is anticipated to be its "worst" earnings year, the outlook through 2028 looks like steady growth in revenue and cash flow.

From a technical analysis view, the stocks entered my "crash" simple moving average zone today (currently between $466 and $502). More often than not, this area signals a bottom in the near-term, but it's not guaranteed. I wouldn't be surprised if the $450s-$460s get hit before a reversal if the market shifts negatively - which will be another entry for me. If it moves into my "major" crash zone in the $300s to close more gaps on the daily chart, I will be piling into this stock heavily (like I did with NYSE:UNH ) for a longer-term hold - of course, unless fundamentals change. I'm going to keep my target small unless there is a "major crash" and eye the closing of the nearest price gap on the daily. There is another between $883-$914...

Targets:

$590 (+17.5%)

Is Gene Editing's Investment Promise Within Reach?CRISPR Therapeutics stands at the vanguard of the gene editing revolution, transitioning into a commercial-stage biopharmaceutical entity following the landmark approval of CASGEVY. This first-of-its-kind gene editing treatment targets sickle cell disease and beta-thalassemia, validating the transformative potential of CRISPR-Cas9 technology and signaling the dawn of a new medical era. CASGEVY's market entry provides critical proof of concept, paving the way for broader gene editing applications in treating genetic disorders.

Despite this scientific triumph, CASGEVY's commercial launch faces immediate hurdles, primarily its high cost and complex administration, contributing to slow initial sales. While development partner Vertex Pharmaceuticals reports the revenue, CRISPR receives a profit share. The company currently operates at a loss, with operating expenses significantly exceeding revenue, primarily from grants. However, a robust cash reserve provides financial stability as CRISPR pursues an ambitious pipeline targeting widespread diseases like cancer, diabetes, and cardiovascular conditions, alongside its commercial efforts with CASGEVY.

The intellectual property landscape remains dynamic, marked by ongoing patent disputes over the foundational CRISPR-Cas9 technology, which could influence future licensing and competition. Simultaneously, CRISPR Therapeutics contributes to advancements in personalized medicine and delivery systems. A notable achievement includes the rapid development and delivery of a personalized mRNA-based CRISPR therapy for a rare metabolic disorder using lipid nanoparticles, demonstrating a potential model for swift, patient-specific treatments and highlighting the crucial role of advanced delivery technologies in expanding gene editing's therapeutic reach.

For investors, CRISPR Therapeutics presents a high-risk, high-reward opportunity. The stock has experienced volatility, reflecting current unprofitability and market conditions. Yet, strong institutional ownership and optimistic analyst ratings underscore confidence in the long-term potential. The company's deep pipeline and foundational technology position it for significant future growth if clinical programs succeed and commercial adoption of its therapies expands, suggesting that for those with a long-term perspective, the promise of gene editing may indeed be within reach.

OSCR (Long) - Impressive growth, with low but improving marginsMy last healthcare idea, which is also my most recent, has gone spectacularly wrong after the stock fell precipitously on news which I was not able to source despite my extensive efforts. So, what else to do then than to jump on another attractive healthcare idea - NYSE:OSCR

Fundamentals

The underlying growth of NYSE:OSCR can only be described as impressive, with the firm growing by more than 40% every quarter (y-o-y) ever since it has gone public back in 2021 (despite already reaching over 10b in annual sales) - I left the numbers in the chart for a reference

The reason why its valuation is so low (0.4 P/S) compared to its peers is mainly the razor-thin margins , with EBITDA margins hovering only around 2% - but this is coming from a negative territory and most importantly, continues improving.

The firm just reported another stellar earnings and from the public discourse, its insurance solutions seem to steaming through the market and gaining market share

The main risk, which is pretty significant if realized, is political, and tied to the ACA subsidies - for a great article you can read about it here

However, for someone who plans to hold for the next 3-6 months (like myself), this shouldn't be an issue

Technicals

As mentioned, the firm recently released stellar earnings which propelled the price >20% higher. After a little consolidation, the price seems to have held its ground and is now poised to go higher

The stock price also broke out from a base as depicted on the chart, though I have to admit, it does not have the degree of accumulation I would prefer but the overall setup still looks very attractive

Momentum indicators like Stochastic and MACD are all entering positive territory, meaning we are likely only entering the upside potential

Trade

I entered the trade right after the breakout as I had been eyeing the stock for some time. The next few days confirmed the breakout and the stock is now seemingly heading higher, providing another good entry point

The low of where the stock price now consolidated also represents a great stop loss point (marked by the red line on the graph)

No price targets as I am just looking to watch how the price action evolves over next weeks, but breaking the previous local high would be a good point for potentially adding

Follow me for more analysis & Feel free to ask any questions you have, I am happy to help

If you like my content, Please leave a like, comment or a donation , it motivates me to keep producing ideas, thank you :)

UnitedHealth Group | UNH | Long at $323.00UnitedHealth Group NYSE:UNH currently has a P/E near 15x, steady rising revenue (2024 = $400+ billion), EPS of 6.24x, dividend of 2.2%, and earnings are forecast to grow by 10.8% per year. The stock, however, has plummeted recently due to negative news, rising healthcare costs, CEO changes, and suspension of 2025 outlook. Every company has bumps, but I view solid companies like NYSE:UNH as pure opportunities for long-term investment - especially with America's aging population.

From a technical analysis perspective, the stock price has entered my "crash" simple moving average zone (which currently extends down near $307.00). Personally, this is the zone I am starting a position due to the odds of a future bounce from here. However, I am very aware that there is an open price gap near $265.00 that may get filled this year or early next. I could see a bounce in my crash zone to bring in the bulls and then a drop to that level to heighten the fear. That is another area I plan to grab more shares and build a strong position. But, in case it doesn't extend that low, I have started a position at $223.00, with future investments near $307.00 and below. I doubt this will be a quick turnaround stock - patience is where money is made.

Targets (into 2028):

$375.00

$475.00

$580.00

AI in Biotech: The Future of Cancer Therapy?Lantern Pharma Inc. is making waves in the biotech sector, leveraging its proprietary RADR® AI platform to accelerate the development of targeted cancer therapies. The company recently achieved significant milestones, including FDA clearance for a Phase 1b/2 trial of LP-184 in a difficult-to-treat non-small cell lung cancer (NSCLC) subset. This patient population, characterized by specific genetic mutations and poor response to existing treatments, represents a substantial unmet medical need and a multi-billion-dollar market opportunity. LP-184's mechanism, which selectively targets cancer cells overexpressing the PTGR1 enzyme, offers a precision approach aimed at improving efficacy while reducing toxicity.

LP-184's potential extends beyond NSCLC, having received multiple FDA Fast Track Designations for aggressive cancers like Triple-Negative Breast Cancer (TNBC) and Glioblastoma. Preclinical data support its activity in these areas, including synergy with other therapies and favorable properties like brain penetrance for CNS cancers. Furthermore, Lantern Pharma has demonstrated a commitment to rare pediatric cancers, securing Rare Pediatric Disease Designations for LP-184 in MRT, RMS, and hepatoblastoma, which could also yield valuable priority review vouchers.

The company's financial position, marked by strong liquidity according to InvestingPro data, supports its ongoing investment in R&D and its AI-driven pipeline. While reporting a net loss reflecting these investments, Lantern Pharma anticipates key data readouts in 2025 and actively seeks further funding. Analysts view the stock as potentially undervalued, with price targets suggesting future growth. Lantern Pharma's strategy of combining advanced AI with a deep understanding of cancer biology positions it to address high-need patient populations and potentially transform oncology drug development.

ImmunityBio: Catalyst for a New Era?ImmunityBio, Inc. is rapidly emerging as a significant force in the biotechnology sector, propelled by the success and expanding potential of its lead immunotherapy asset, ANKTIVA® (nogapendekin alfa inbakicept-pmln). The company achieved a pivotal milestone with the FDA approval of ANKTIVA in combination with BCG for treating BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ. This approval addresses a critical need and leverages ANKTIVA's unique mechanism as a first-in-class IL-15 agonist, designed to activate key immune cells and induce durable responses. Building on this success, ImmunityBio is actively pursuing global market access, submitting applications to the EMA and MHRA for potential approval in Europe and the UK by 2026.

Beyond regulatory progress, ImmunityBio proactively tackles challenges in patient care, notably addressing the U.S. shortage of TICE® BCG. Through an FDA-authorized Expanded Access Program, the company supplies recombinant BCG (rBCG), providing a vital alternative source and expanding treatment access, particularly in underserved areas. This initiative supports patients and establishes a new market channel for ImmunityBio's therapies. Commercially, ANKTIVA's U.S. launch gains momentum, facilitated by a permanent J-code that simplifies billing and broadens insurance coverage, reaching over 240 million lives.

ImmunityBio's strategic vision extends to other major cancer types. The company is advancing ANKTIVA's potential in non-small cell lung cancer (NSCLC) through a confirmatory Phase 3 trial with BeiGene. This collaboration follows promising Phase 2 data demonstrating ANKTIVA's ability to rescue checkpoint inhibitor activity in patients who have progressed on prior therapies, showing prolonged overall survival. This highlights ANKTIVA's broader potential as a foundational cytokine therapy capable of addressing lymphopenia and restoring immune function across various tumors. ImmunityBio's recent financial performance reflects this clinical and commercial traction, marked by a significant revenue increase driven by ANKTIVA sales and positive investor sentiment.

Can Lilly Redefine Weight Loss Market Leadership?Eli Lilly is rapidly emerging as a dominant force in the burgeoning weight loss drug market, presenting a significant challenge to incumbent leader Novo Nordisk. Lilly has demonstrated remarkable commercial success despite its key therapy, Zepbound (tirzepatide), entering the market well after Novo Nordisk's Wegovy (semaglutide). Zepbound's substantial revenue in 2024 underscores its rapid adoption and strong competitive standing, leading market analysts to project Eli Lilly's obesity drug sales will surpass Novo Nordisk's within the next few years. This swift ascent highlights the impact of a highly effective product in a market with immense unmet demand.

The success of Eli Lilly's tirzepatide, the active ingredient in both Zepbound and the diabetes treatment Mounjaro, stems from its dual mechanism targeting GLP-1 and GIP receptors, offering potentially enhanced clinical benefits. The company's market position was further solidified by a recent U.S. federal court ruling that upheld the FDA's decision to remove tirzepatide from the drug shortage list. This legal victory effectively halts compounding pharmacies from producing unauthorized, cheaper versions of Zepbound and Mounjaro, thereby protecting Lilly's market exclusivity and ensuring the integrity of the supply chain for the approved product.

Looking ahead, Eli Lilly's pipeline includes the promising oral GLP-1 receptor agonist, orforglipron. Positive Phase 3 trial results indicate its potential as a convenient, non-injectable alternative with comparable efficacy to existing therapies. As a small molecule, orforglipron offers potential advantages in manufacturing scalability and cost, which could significantly expand access globally if approved. Eli Lilly is actively increasing its manufacturing capacity to meet anticipated demand for its incretin therapies, positioning itself to capitalize on the vast and growing global market for weight management solutions.