Biib - Good Pe & strong market- Bottom fishing?Take position 223.05

Stoploss at after 222,

Take profit 228

if that breaks, switch to short and ride it to to 205.

But PE is really low for a bio stock,fundamentally, it's good value.

If we get a rally again in the market and sector(LABU) continue to push. this will probably go sideways.

Healthcare

Innovate Biopharmaceuticals 3.55 target on good reportinglot of lines and PTs can elevate fast if this breaks out on volume inflation in April

Notice the 1M candle is Red 9 for March. Ideal play here is an entry under $2.00 (on support retest)

if we change cycle from accumulation to Bull Cycle, look for late 2019 take profit area (Sept-Dec)

Pfizer PFE Possible Inverse Head & ShouldersAwaiting completion of a what looks to be a very nice inverse head and shoulders for NYSE:PFE .

Notes:

Bullish TA outlook - PFE broke out of a long-term head and shoulders recently, which is clearly visible on the weekly chart

Buy Rating - 10 analysts cover NYSE:PFE . 5 Buy recommendations and 5 Hold recommendations. This has improve gradually over the past 3 months

Analyst Price Target - Average $48.50 with a high of $55 and a low of $45

Trade:

Buy - Strong breakout above $43.75

Stop Loss - Personally I would do any close under the 200 day MA but you could go as low as $40.33

Stop - Based on the size of the IH&S ($39.50 low to $43.75 neckline), TA theory indicates the stock should head to roughly $48, which just so happens to be right around all time highs (coincidence??)

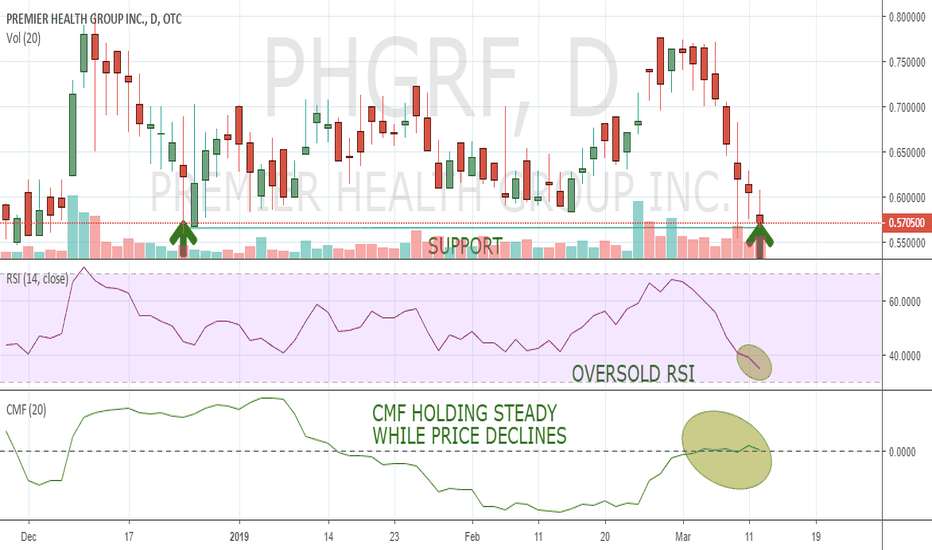

Possible Penny Stock Bounce Set Up(OTC:PHGRF) recently experienced a large sell off with the RSI moving into oversold territory. CMF has held steady during this price decline indicating that investors are not rushing for the exit during this pullback. As (OTC:PHGRF) reaches a support level in the mid .50s the RSI and CMF appear to be signaling a possible bounce from these oversold conditions.

Long GBIO33, Short HYPE3Long GBIO33 and Short HYPE3 on breakout from multiple timeframes negative trend line and GBIO33's strong bounce off lows. Fundamentally, HYPE3 well priced while GBIO33 is an undervalued growth case.

Neovacs - strong bullish trend expectedResults of IFN Kinoide on Lupus research are very significant (95% efficacy observed). Volume increase strongly on the biotech and strong breakout of the 0.25 resistance has been observed. Pullback on the 0.25 level is resolved and the stock is now in perfect conditions for a bullish rally. First target is 0.5

IBB Correction IncomingPsychology of a Market Cycle Cheat Sheet: goo.gl

IBB's chart is identical to the chart on the market psychology cheat sheet linked above.

IBB 5-wave cycle is over + Truncated 5th

Algorithms exit the market after extended 3rd waves, leaving the 5th with no volume nor liquidity, just as it's done for IBB .

Current Market Condition: Complacent. Just "cooling off for the next rally".

50%-60% Downside.

TRON-BREAKOUT-UPDATEOTC:TRON is one bright spot in the market.

toroninc.com

This is an update to a previous idea.

Primary Wave is extending.

Primary Wave:

Fib Time:

Current:

Near-Term Target:

Will update.

-AB

MRK ShortShort based of channels and fibs

My Entry: 75.07 (any entry under 75.00 is okay)

Stop Loss: 78.00

PT: 61.00 area

Risk/Reward: ~1:7

This trade has a low probability of working, but it does fit my system, and if it moves in my direction the reward is very high. This trade will most likely take 6 months to a year.

Long in NVO Established There are several aspects to this chart- the wave analysis is certainly up for debate, but what remains is improving fundamentals.

On this chart we have a corrective sequence ABC starting in 2014 and concluding in early 2017. On this chart, we can see the 30 day MA volume skyrockets in the beginning of 2017. This corresponds to the timing of the Obama administration focusing their healthcare attacks on big pharma, specifically drug pricing. We can even see a faint busted head and shoulders on this chart, with the right shoulder being broken by terrible guidance on earnings

At the peak in 2015, we also see a peak in operating profit margin. Over the next 12 month fundamentals began to draw back with book value/share, liquidity ratios, and margins all slowly declining. As Obamacare got pushed through US congress (where over 50% of revenue is earned), the outlook looked bleak. Then the Man who lives above the Guchi Store was elected, and big pharma saw hope on the horizon and began surging higher. This was a false bull market though; margins and liquidity ratios were not improving for NVO.

Then the surprise happened, President Trump began attacking pharma. Combined with the already volatile stock market NVO plunged to a correction right at the .618 fibonnaci level, if it maintains this as the low a perfect sign that the 2 impulse wave has just completed.

Where we stand now:

Novo Nordisk, one of the largest pill pushers was forced to lower outlooks with increasing competition from generics. With this pressure, the company has been forced to cut many US jobs and refocus R&D spending, rendering some patents and research useless. Over the last few years they've been forced to impair assets for use on their income statement, but NVO still maintains a 2.29 P/Tangible Book ratio, (better than peers: GSK, BMY, LLY). Gross margins have begun improving and P/S has landed at one of the lowest, if not the lowest level in the peer group. Improvement on the liquidity measures could send this stock flying, but most importantly is the deadlock that could ensue in congress. Recently one of the up-and-coming generics plunged as the FDA put a hold on their diabetes drug trial.

I took a long position in NVO on 11/27 and plan on holding this until I either get stopped out at 44 or we rally to previous highs

Sanofi: head and shoulders configurationSanofi has developped a head (h) and shoulders (s1 and S2) pattern from 2013 to 2018. During 2018 a strong pullback has been observed to the resistance R. If the pattern is confirmed, price will begin to decrease in the coming weeks.

Objective 1: 68€ (the neckline)

Objective 2:50€

TORON INC-BIG UPSIDE-LONGTRON is a strong buy.

I'm a Technician and only look at charts for my analysis.

Analysis Method: Fibonacci & Elliot Waves

Thesis: Healthcare is a fragmented market and will be consolidating over the next few years.

Technically: Chart has just completed it's first Primary Wave Sequence + Correction.

Here is a company overview:

Toron Inc. Overview:

Acquisition and development of healthcare companies

Integrating access to electronic data interfaces for healthcare providers and payer systems

Toron, Inc recognizes the tremendous opportunities present in the healthcare space. Zion research recently estimated “global demand for home healthcare market was valued at USD 228.90 billion in 2015 and is expected to generate revenue of USD 391.41 billion by 2021, growing at a CAGR of 9.40% between 2016 and 2021.”

Toron, Inc targets the acquisition of additional healthcare focused companies which present excellent shareholder value. Its management has over thirty years combined experience in the healthcare space and it well positioned to identify and rapidly execute its acquisition plans.

Toron, Inc intends to operate its business to maximize shareholder value and its management will ensure complete transparency in business operations. In today’s public market confidence is the key ingredient. Management will maintain communication of its operations and future acquisitions, mergers and results from its operations. Toron, Inc (The Company), is engaged in the acquisition and development of healthcare companies for the healthcare supplies and healthcare equipment markets. Management has been engaged in the healthcare technologies and will continue to develop additional markets through healthcare IT and other related entities.

toroninc.com

Trade Price: .006

Waves:

Wave %'s:

Indicators: ONB, CMF, Accum/Dist

Spirals:

Fib Time:

Trade:

BLRX-BREAKOUT-UPDATEBLRX had a strong rally today and it's just getting started.

In the related idea my price target was $1.34.

Today's high was $1.78

Check out the weekly chart:

Photo Finish.

$1.34 was 1.618 extension level from Waves 1 & 2.

Since the price-action broke $1.34 we will have an extended 3rd wave.

I expect a very strong rally tomorrow, I will update in the morning before the open to confirm.

Target is hard to predict since its impossible to know what level extending waves will terminate.

I will keep a close eye on the price-action.

Will update.

-AB

APEN - Breakout brewing...NASDAQ:APEN is a buy.

Monthly Chart:

Weekly:

Daily:

Update to related idea.