Trading Psychology Trap: The Dark Side of Hedging a Bad Trade⚡ Important Clarification Before We Begin

In professional trading, real hedging involves sophisticated strategies using derivatives like options, futures, or other financial instruments.

Banks, funds, and major institutions hedge to manage portfolio risk, based on calculated models and complex scenarios.

This article is not about that.

We are talking about the kind of "hedging" retail traders do — opening an opposite position at the broker to "protect" a losing trade.

It may feel smart in the moment, but psychologically, it can be a hidden trap that damages your trading discipline.

Let’s dive into why emotional hedging rarely works for independent traders.

________________________________________

In trading, there’s a moment of panic that every trader has faced:

"My short position is in the red… maybe I’ll just open a long to balance it out."

It feels logical. You’re hedging. Protecting yourself. But in reality, you might be stepping into one of the most deceptive psychological traps in trading.

Let’s unpack why emotional hedging is rarely a good idea—and how it quietly sabotages your progress.

________________________________________

🧠 1. Emotional Relief ≠ Strategic Thinking

Hedging often arises not from a solid strategy, but from emotional discomfort.

You don’t hedge because you’ve analyzed the market. You hedge because you can’t stand the pain of a losing position.

This is not trading.

This is emotional anesthesia.

You’re trying to feel better—not trade better.

________________________________________

🎭 2. The Illusion of Control

Opening a hedge feels like taking back control.

In reality, you’re multiplying complexity without clarity.

You now have:

• Two opposing positions

• No clear directional bias

• An unclear exit strategy

You’ve replaced one problem (a loss) with two: mental conflict and strategic confusion.

________________________________________

🎢 3. Emotional Volatility Rises Sharply

With two positions open in opposite directions:

• You root for both sides at once.

• You feel relief when one wins, and stress when the other loses.

• Your mind becomes a battleground, not a trading desk.

This emotional volatility leads to irrational decisions, fatigue, and trading paralysis.

________________________________________

🔄 4. You Delay the Inevitable

When you hedge a losing position, you don’t fix the mistake.

You prolong it.

Eventually, you’ll have to:

• Close one side

• Add to one side

• Or exit both at the wrong moment

Hedging here is just postponed decision-making—and it gets harder the longer you wait.

________________________________________

🧪 5. You Build a Dangerous Habit

Hedging out of fear creates a reflex:

"Every time I’m losing, I’ll hedge."

You’re not learning to cut losses or reassess your strategy.

You’re learning to panic-protect.

And over time, you start to rely on hedging as a crutch—rather than developing real confidence and discipline.

________________________________________

✅ The Healthier Alternative

What should you do instead?

• Cut the loss.

• Review the trade.

• Wait for a fresh setup that aligns with your plan.

Accepting a losing trade is hard. But it’s a sign of maturity, not weakness.

Hedging may feel clever in the moment, but long-term consistency comes from clarity, not complication.

________________________________________

🎯 Final Thought

Emotional hedging isn’t about strategy.

It’s about fear.

The best traders don’t hedge to escape a loss.

They manage risk before the trade starts —and have the courage to close what’s not working.

Don’t fall into the illusion of safety.

Master the art of decisive action. That’s where real edge lives. 🚀

Hedging

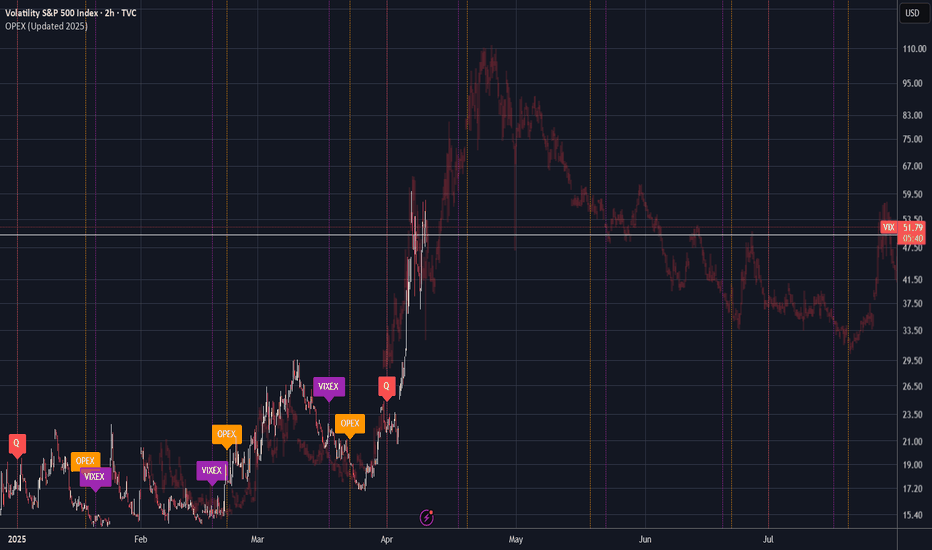

Path to 100 VIXI wrote this note on TVC:VIX a few days ago:

www.tradingview.com

And am now expanding it a bit more.

As someone who was working middle office during the original 2016 Trump Election, Brexit, during the Taper Tantrum and a few other major events - I want to lay out my principles on trading the VIX because spikes like this bring a lot of "first time" VIX traders to something that trades like NOTHING ELSE in the market.

This is not a stock in a short squeeze, this is not a generic index.

This is like nothing you've ever traded before. In fact, I'd encourage you to take advantage of TradingView's chart options and instead look at the chart of -1*$TVC:VIX.

That alone should give you pause.

----------------------------------

So - let's start with the principles of the finance business as laid out in the masterclass which was the movie "Margin Call" .

"John Tuld: There are three ways to make a living in this business: be first, be smarter, or cheat."

1. Be First.

You are not first if you are buying above the historic average of VIX 20-21.

If you were buying CBOE:UVXY since Jan 2025, you'd be up 175% right now and likely looking to re-balance into your desired long term asset positions.

2. Be Smarter.

* Are you taking into consideration the VIXEX Cycle?

* Do you know the effect of VIXEX before or after monthly OpEx?

* Do you know the current implied volatility curve of options ON the VIX?

* Do you know that of the last 4 times the VIX has hit 50, it went on to 80+ 50% of the time after that?

* Yes, I've seen the charts going around about forward S&P X year returns but did you know that after the VIX spike to 80 in October 2008, the market (in a decreasing volatility environment) went on a further 35% decline in the next 4-5 months?

* Where is the MOVE? What are the bond indexes & bond volatility measures doing? And if you don't yet understand that equities ALWAYS reacts to what is going on in the rates / yield world... you'll find out eventually. I hope.

3. Cheat

When things start going wrong, everyone wants an easy solution.

That's why its called a relief rally. It feels like relief - the bottom is in, the worst part is over.

But that is what the really big players have the biggest opportunity to play with the day to day environment.

They know our heuristics. They encourage the formation of cargo cult style investing whether that's HODL in the cryptocurrencies or Bogleheads in the vanguard ETFs.

It's all the same and encourages you to forgot first principles thinking about things like:

1. Is this actually a good price or is it just relatively cheap to recent history?

2. Who's going to have to dilute to survive the next period of tighter lending, import costs from tariffs, or whatever the problem of the day is.

3. VIX correlation - volatility is just a description of the markets. Its not a description of the direction. There is periods where volatility is positively correlated to the price movement (like during earnings beats). Know about this and know when it changes.

4. Etc.

Some have pointed out that is more appropriately a measure of liquidity in the SPX.

When VIX is low, that means there is lots of "friction" to price movement. It means that there is tons of orders on the L2 book keeping the current price from moving in any direction too quickly.

When VIX is high, that means there is very low "friction" to price movement. It means there are very few orders on the L2 book and market makers can "cheat" by appearing to create a low volume rally and then rug pull that price movement very quickly (not via spoofing, more just dynamic management of gamma & delta hedging requirements).

Additionally - volume itself becomes deceptive. Volume is just indicating that a trade happened.

Its not telling you to what degree the spread between the bid and ask has blown out to 1x, 2x, or 5x normal and that trades are executing only at the highest slippage prices in that spread.

All of these things are considerations that the market makers can use to make a "buy the dip" situation that works heavily to their advantage.

TLDR: "If you can't spot the sucker in your first half hour at the table, then you are the sucker"

----------------------------------

So - why / when would VIX go to 100?

In 2020, its easy to forget that a culmination of things stopped the crash at -35%.

* March 17, 2020 VIXEX wiped out a significant amount of long volatility positions.

* March 20, 2020 Opex wiped out a significant proportion of the short term put positions

* March 20, 2020 Fed Reserve announced to provide "enhanced" (i.e. unlimited) liquidity to the

markets starting Monday March 23, 2020.

* April 6th, 2020 Peak of Implied Volatility (point where options "most expensive") - which meant that buyers / sellers started providing more & more liquidity following this point.

In 2025, we have yet to see:

* Any motion towards intervention from the Fed for liquidity.

* Any motion from the significant fundamental investors (we're not close to an attractive P/S or P/E on most stocks for Buffett & Co to start buying)

* Any significant motion from companies on indicating strategies about capital raises, layoffs, or other company level liquidity reactions.

* Any "reset" of options in either volatility or hedging. Numbers below as of April 9, 2025:

- SPY 2.8M Put OI for April 17

- VIX 3.5M Call OI for April 16

Just an example but maybe IF we see those clear and NOT get re-bought for May Opex... we might be ready to call a top here at 50 VIX.

Otherwise.... we're just at another stop on the path to 100.

Trading UVIX for Effective Hedge📊 Trade Idea: UVIX Multi-Layered Entry Strategy (Scalping Volatility Spikes)

The current market environment presents a unique opportunity to trade the Volatility Shares 2x Long VIX Futures ETF (UVIX), which has surged nearly 50% on Thursday and 124% over the last week. With ongoing fears surrounding President Trump's reciprocal tariffs, volatility is expected to remain elevated.

🔍 What Is UVIX?

UVIX is a leveraged ETF designed to provide twice (2x) the daily return of the Long VIX Futures Index. Unlike the VIX itself, which measures expected market volatility, UVIX holds futures contracts on the VIX, aiming to profit from both upward spikes in volatility and the structure of the futures market.

Pros of UVIX:

High Return Potential: Can deliver significant gains when market volatility spikes.

Effective Hedge: A powerful tool to offset losses during broad market declines.

Liquidity: Offers easy access to volatility exposure without directly trading VIX futures.

Cons of UVIX:

High Volatility: Amplified moves can result in large gains or substantial losses.

Decay & Compounding Issues: Daily rebalancing and futures roll costs can erode value over time.

Not Suitable for Long-Term Holding: Designed for short-term plays, not buy-and-hold investing.

Here’s my detailed risk-managed trading plan to profit from continued volatility.

🚀 Entry Strategy: Layered Buy Entries with Trailing Stops

🎯 Initial Entry:

Entry Price: 80.00 (Just above the breached Supply Zone 0: 56.80 - 66.38)

Stop Loss: Below the lower trend line from the recent parabolic move (For example, around 70.00).

📈 Position Scaling: Adding to Winning Positions

Use Buy Stop Orders:

As the price breaks above significant supply zones, place Buy Stop Orders to add positions.

Scale in positions at:

Level 1: Above 89.20 (Top of Supply Zone 1)

Level 2: Above 113.25 (Top of Supply Zone 2)

Level 3: Above 147.24 (Bottom of Supply Zone 3)

Level 4: Above 182.36 (Bottom of Supply Zone 4)

Manual Entries:

Alternatively, you can manually add positions on strong breakouts during or outside Regular Trading Hours (RTH) to catch volatility spikes.

!!!Use Limit Orders Outside RTH!!

Place limit orders during off-hours to capture sharp volatility moves when liquidity is lower.

Market volatility often increases during pre-market or post-market sessions. Capitalize on these moves with well-placed limit orders.

🛡️ Risk Management: Trailing Stops & Break-Even Protection

Initial Stop Loss:

Set below the lower trend line (e.g., 70.00). This provides a wide margin for market fluctuations while still protecting your position.

Trailing Stop Loss:

As the price progresses upward, move your stop loss to higher levels to secure profits.

Use a dynamic trailing stop that follows major support levels or recent lows.

Break-Even :

Once UVIX has moved 10-20% above your entry point (80.00), move your stop loss to break even (80.00) for a risk free trade.

📌 Profit Targets

Target 1: 130.79 (Historical 350% level from July 2024 move)

Target 2: 165.46 (Top of Supply Zone 3)

Target 3: 210.30 (August 2024 High)

Adding positions as the price moves in your favor allows for maximum profit potential while limiting risk on initial entries.

Moving the stop loss to break-even creates a risk-free trade, allowing you to ride the momentum without worry.

Continually adjusting stops protects profits as they accumulate, ensuring that gains are secured even if the market turns sharply.

📣 Final Thoughts

The Volatility Shares 2x Long VIX Futures ETF (UVIX) is a powerful instrument for profiting from short-term volatility spikes. Given the current geopolitical and economic uncertainty, this setup offers a strong risk-reward opportunity.

💡Advice: Avoid Greed & Gambling in Volatility Trading

Trading the Volatility Shares 2x Long VIX Futures ETF (UVIX) offers tremendous profit potential during periods of heightened market volatility. However, the same leverage that can generate huge gains can just as easily cause significant losses. Avoiding greed and gambling behavior is crucial for your long-term success.

Thu 6th Feb 2025 GBP/AUD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/AUD Sell. Enjoy the day all. Cheers. Jim

Wed 29th Jan 2025 AUD/USD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being an AUD/USD Sell. Enjoy the day all. Cheers. Jim

Tue 28th Jan 2025 Daily Forex Charts: 5x New Trade SetupsGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified 5x new trade setups this morning. As usual, you can read my notes on the charts for my thoughts on these setups. The trades being a BTC/USD Sell, XAG/USD Sell, AUD/CHF Buy, EUR/AUD Buy & a NZD/CHF Sell. I also discuss some trade management. Enjoy the day all. Cheers. Jim

Mon 16th Dec 2024 GBP/CAD Daily Forex Chart Sell SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Sell. Enjoy the day all. Cheers. Jim

Riding US Exceptionalism to 2025 with Long SPY & Protective PutsSize begets size. Records are being shattered. US Exchange Traded Funds (ETFs) have attracted >USD 1 trillion inflows YTD 2024 for the first time in history. Pro-business policies under President-elect Donald Trump continues to entice investors into US equities.

US stocks are at record levels. Is that a concern? Yes. But, unlike other rallies which tend to be concentrated and narrow, this rally has been broad. Gains are visible across industries & segments.

The “Trump Bump” has sent S&P 500 above 6,000 for the first time in history. It has attracted additional USD 140 billion of funds into US equities since US elections. Trump’s agenda promise – pro-growth policies, lighter regulations, & lower taxes continue to keep US equities buoyant.

The risk of a fall gets elevated when soaring at heights. Long position in US equities pose risks. Among many alternatives, protective puts using CME Micro E-Mini S&P 500 options is compelling given sanguine implied volatility expectations.

US EQUITIES EXPECTED TO DELIVER SUPERIOR EARNINGS

In the short term, markets are a voting machine. In the long run, they are weighing machines. Regardless of which machine it is, US equities remain unrivalled now. Momentum and fundamentals both favour a long positioning in US stocks.

Stock markets value growth in earnings and profitability. US firms continue to deliver superbly on both. Earnings have risen strong and expected to expand even stronger in 2025. US firms as represented by S&P500 stocks are expected to clock 14.8% in EPS growth (compared to 9.8% in 2024). In sharp contrast, the MSCI AC World ex-US is estimated to deliver 10.8% in EPS growth.

ARE US EQUITIES OVERVALUED?

Ramping up investments or buying into equities when valuations are soaring can give cold feet to any investor. Are we in bubble territory? Perhaps.

The S&P 500 and Nasdaq are at record highs. But it is not without justification. Rising earnings, promise of artificial intelligence, and American Exceptionalism unleashes the animal spirits.

For now, will the bubble pop? Perhaps not yet.

Instead, the bubble may continue to grow in 2025. Timing the markets is hard. Timing a bubble pop is harder still. During such times, investors must navigate markets prudently with adequate risk guardrails.

Significant capex is being poured into Gen AI investments. If commensurate results are not spectacular enough, stock prices could correct sharply to reflect that disappointment.

US EQUITIES ARE EXPENSIVE. BUY THEM ANYWAY IS WHAT ANALYSTS ARE SAYING.

TINA is back in action. TINA stands for “There Is No Alternative.” Where else in the world, apart from the US, is an economy that is large enough, safe, resilient, and offers the greatest upside to growth. No where else. That is American exceptionalism.

Solid earnings growth expectations, rising productivity, consumers in good health, pro-business policy expectations, and light touch regulations collectively contribute to analysts’ overweight rating on the US equities. Fund flows into ETFs vindicates market expectations.

US equities are expensive. It may get even more expensive in 2025. WSJ reported recently that 12-month forward P/E ratios are at 22.3x earnings.

S&P 500 forecasts for end of 2025 remain vastly bullish ranging from 6400 to 7000. In sharp contrast, Peter Berezin of BCA Research expects sharp correction with S&P falling to as low as 4100 by end of 2025.

Source: The Street

FEAR GUAGE REMAINS SANGUINE

Rising asset prices are typically accompanied by elevated implied volatility levels pointing to mounting cost of securing downside protection. Intriguingly that is not the case for US equities for now. The Wall Street Fear Index – the VIX – hovers around multiyear lows.

HYPOTHETICAL PORTFOLIO HEDGING SETUP

Driven by American Exceptionalism, Earnings Growth Expectations, and the Promise of AI, US equities remain compelling. Risk hits hardest when one least expects it. Securing downside protection when it is cheap is what astute investors do.

This paper illustrates method for hedging US equities portfolio represented by 50 units of SPDR S&P 500 ETF Trust holdings (SPY).

For simplicity, this paper assumes that a portfolio manager acquires 50 SPY units at the closing price as of 6th Dec 2024 paying USD 608 per unit valuing the portfolio at USD 30,400. The manager is willing to accept a 5% drawdown and seeks protection for price corrections below.

In this case investors can utilize a protective put, which is an options strategy where an investor buys a put option while holding the underlying asset. It acts as insurance, limiting potential losses if the asset's price drops.

Portfolio manager buys protective put options using CME Micro E-Mini S&P 500 Options (Micro S&P Options) to hedge downside risk. Deploying CME Micro S&P Options expiring on 20th Jun 2025, the portfolio manager buys protective puts at a strike of 5,850 which corresponds to approximately 5% below the underlying futures trading at 6,165 points.

Based on the closing price on Dec 6, the portfolio manager will have to pay a premium of 124 points (USD 620 = USD 5/index point x 124 index points) for one lot of Micro S&P Options to protect a portfolio of USD 30,400.

The pay-off for the portfolio manager under various S&P 500 levels as of 20th Jun 2025 are illustrated below:

*Put options gain in value when the index drops below the strike price. If index remains above the strike levels, the maximum loss from put options are limited to the premium.

This non-linearity in pay-off enables portfolio managers to limit downside even as they can continue to participate in the upside.

MARKET DATA

CME Real-time Market Data helps identify trading set-ups and express market views better. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs tradingview.com/cme .

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

Using Derivatives for Hedging Risks on ForexUsing Derivatives for Hedging Risks on Forex

In the dynamic world of forex trading, understanding how to protect one's position is paramount. This article delves into the strategic use of derivatives, specifically CFDs, to hedge against potential adverse currency movements, offering traders a safety net in the volatile forex environment.

The Concept of Hedging in Forex

Hedging, in the realm of forex trading, refers to the strategic use of certain financial instruments, such as derivatives, to protect an investment or portfolio from adverse price movements. By employing this technique, market participants can potentially offset losses from their primary investments, ensuring a more balanced financial outcome.

Companies that use derivatives to hedge risk, for example, aim to safeguard their operations from volatile currency fluctuations. For individual traders, hedging risk with derivatives becomes a key tactic, especially in the unpredictable waters of forex markets. The primary goal isn't necessarily to profit but to create a safety net against potential losses.

An Overview of CFDs (Contract for Difference)

CFDs, or Contracts for Difference, are derivative financial instruments that allow traders to speculate on price movements of underlying assets without actually owning them. In the forex context, CFDs enable traders to gain exposure to currency pairs' price changes without physically exchanging the currencies involved. Instead, traders enter into a contract to exchange the difference in value of a currency pair between the time the contract is opened and when it's closed.

One of the primary uses of derivatives in risk management is employing CFDs to take an opposing position, thereby potentially reducing exposure to adverse market movements. The perks of CFDs include flexibility, leverage, and the ability to go long or short. However, these benefits come with downsides, such as the risk of amplified losses due to leverage and the possibility of incurring additional costs like overnight funding fees.

The Mechanics of Hedging with CFDs

The mechanics of hedging forex trades with CFDs are the following:

1. Establishing a Primary Position

Traders first establish a primary position in the forex market, predicting a currency pair's direction. For instance, a trader might expect the EUR/USD pair to rise and hence buy or "go long" on it.

2. Recognising Exposure

Once the primary position is established, traders identify potential risks. Is there an impending economic event? Could geopolitical tensions influence the currency pair's movement? Recognising these exposures is pivotal in hedging using derivatives.

3. Taking an Opposing CFD Position

To hedge, traders take an opposing position using a CFD. If our trader has gone long on the EUR/USD, hedging would involve going short on the same pair through a CFD. This doesn't mean expecting the EUR/USD to fall but rather creating a protective stance using derivatives to hedge risk.

Another option is to use a negatively correlated asset from another asset class, e.g. commodities, to the currency pair you trade and open a CFD trade in that asset.

4. Monitoring and Adjusting

Successful hedging isn't a set-and-forget approach. As the forex market fluctuates, the effectiveness of the hedge might change. Platforms like FXOpen's TickTrader provide traders with the necessary tools and real-time data to monitor their positions effectively.

If the primary position experiences an unfavourable move, the opposing CFD position can offset some or all of those losses. Conversely, if the market moves favourably, gains from the primary position can be realised, while the loss from the hedging position is an accepted cost for protection.

5. Closing Positions

When traders believe the risk has subsided or their trading goals are achieved, they can close both their primary and hedging positions. Depending on the market movement, this could result in a net profit, a minimised loss, or a break-even scenario.

In the world of derivatives and risk management, CFDs offer a nuanced tool for traders navigating the often-tumultuous waters of the forex market. When executed correctly, hedging with derivatives, like CFDs, can provide a layer of protection against unwanted market swings.

A Brief Look at Options

Options are a type of financial derivative that gives traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time frame. Unlike CFDs, which track the underlying asset's movement, options are based on the probability of reaching a particular price point.

While they can be used for hedging purposes, their complexity often deters many retail traders. The steep learning curve associated with options means they're not typically the first choice for risk mitigation, especially when simpler derivatives like CFDs are available.

Considerations Before Hedging with Derivatives

Before implementing hedging strategies using derivatives, traders take into account several crucial aspects to ensure their risk management tactics align optimally with their financial objectives. Here are some essential considerations:

Understanding the Derivative's Structure

Before diving into hedging, it's crucial to thoroughly understand the derivative you're using, whether it's a CFD, option, or another instrument. Each derivative has unique features, payout structures, and costs. A lack of understanding can lead to unintended exposures.

If you use derivatives, it's vital to determine the position size, as leverage leads to increased risks. The theory states that a trader’s CFD position shouldn't be larger than the trade they hedge.

Cost Implications

While hedging can safeguard against potential losses, it's not free. Factors like spread costs, overnight financing, leverage, or premiums (in the case of options) can impact the profitability of a hedged position. Traders factor these costs into their risk management calculations.

Duration of Hedge

How long do you anticipate the need for the hedge? The time frame can affect the choice of derivative and its cost. Some hedges might be short-lived due to specific events, while others could be more extended due to ongoing market uncertainties.

Effectiveness of the Hedge

No hedge is perfect. Consider the effectiveness of the derivative in relation to the primary position. How closely does the CFD or option's performance correlate with the asset you're trying to hedge?

Regular Evaluation

Risk management in the derivatives market requires constant vigilance. Market conditions evolve, and what was once an effective hedge might lose its potency. Regularly evaluate the hedge's performance and adjust if necessary.

Seek Expert Advice

Given the complexities, it's beneficial to seek advice from experts and explore in-depth resources. They can offer help in crafting a more tailored hedging strategy.

The Bottom Line

In navigating the intricate waters of forex trading, understanding hedging with derivatives like CFDs can offer traders valuable protection against unforeseen market shifts. This exploration has highlighted the nuances and considerations essential for effective risk management. For those keen to delve deeper into the world of CFDs and optimise their hedging strategies, opening an FXOpen account could be the next step in fortifying their trading arsenal.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

From Tokyo with Love: Key Opportunities with Japan's Top Index1. Introduction

The Nikkei 225 is Japan's premier stock market index and one of the most widely followed indexes in the world. As the representative of Japan's economy, the Nikkei 225 includes many of the country’s most influential companies across various industries, such as Toyota, Sony, and SoftBank. With Japan being the third-largest economy globally, traders who seek exposure to the Asian market find the Nikkei 225 to be a crucial addition to their portfolios.

Now is an opportune time to study and potentially add the Nikkei 225 to your watchlist, as Micro contracts are set to launch later this year, offering greater accessibility to both institutional and retail traders. These micro contracts will allow traders to manage their positions with more precision, capital efficiency, and reduced exposure. With the futures contracts denominated in both US Dollars and Japanese Yen, traders can select their currency exposure based on market preferences.

Contract Specifications:

# Nikkei/USD Futures:

Contract size: $5 USD per index point

Tick size: 5 points = $25 USD per contract

Margin: USD $12,000 per contract at the time of producing this article

Trading hours: Almost 24-hour trading, covering Asian, European, and US sessions

# Nikkei/YEN Futures:

Contract size: ¥500 per index point

Tick size: 5 points = ¥2,500 per contract

Margin: JPY ¥1,200,000 per contract at the time of producing this article

Trading hours: Mirrors the USD futures trading hours for global reach

For traders looking for exposure to Japan’s economy, these contracts offer versatile trading opportunities with sufficient liquidity, price movement, and round-the-clock accessibility. You can access real-time data on these contracts through TradingView - view the data package at www.tradingview.com

2. Global Market Diversification

The Nikkei 225 Index offers more than just exposure to the Japanese market; it’s a portal into Asia’s largest and most developed economy. With Japan being an export-driven economy, exposure to the Nikkei 225 allows traders to capitalize on trends in global manufacturing, technology, and industrials.

Additionally, during periods of macroeconomic divergence—where the economic performance of regions like the US and Asia deviate—the Nikkei 225 can provide a non-correlated trading opportunity.

3. Correlation and Hedge Against US Equities

While Japan is a developed economy like the United States, its market dynamics differ substantially. The Nikkei 225 often shows a lower correlation with US equity markets, meaning that the index tends to react differently to global and local economic events compared to indices like the S&P 500.

This graph illustrates the rolling 30-day correlation between the Nikkei 225 and the S&P 500, highlighting the fluctuating relationship between the two indices and how they decouple at times, especially during periods of heightened market volatility.

4. Japanese Yen and US Dollar Denominated Contracts

One of the unique aspects of the Nikkei futures is the ability to trade the index in either US Dollars or Japanese Yen. This flexibility allows traders to choose the contract that best suits their currency exposure preferences, providing a powerful tool for those who also wish to hedge or capitalize on currency movements.

Nikkei/USD Futures: These contracts are settled in US dollars.

Nikkei/YEN Futures: Conversely, for traders who want to factor in currency risk, the Yen-denominated futures offer exposure not just to the Nikkei 225’s price movements but also to the Yen's fluctuations against the US dollar or other currencies.

As the introduction of Micro contracts approaches, this will add even more flexibility for traders, particularly retail traders who prefer smaller contract sizes and more precise risk management. These contracts will enable traders to adjust their positions with greater capital efficiency, allowing for a wider range of strategies—from short-term speculative trades to long-term hedging positions.

5. Monetary Policy Divergence

Japan's monetary policy, led by the Bank of Japan (BoJ), has been historically distinct from the policies of the US Federal Reserve and European Central Bank (ECB).

Understanding Japan's monetary policy divergence allows traders to better time their entry and exit points in the Nikkei 225, especially as the Bank of Japan navigates its unique approach to economic stimulus and potential shifts in strategy.

6. Sector Opportunities

The Nikkei 225 is heavily weighted towards key sectors that represent the backbone of Japan’s economy, offering traders exposure to industries that may be underrepresented in other global indices. Some of the most prominent sectors within the Nikkei 225 include:

Technology: Japan is a leader in technology and innovation, with major companies such as SoftBank and Sony leading the charge.

Automotive: Japan’s automotive sector is world-renowned, with giants like Toyota, Honda and Nissan among the top constituents of the index. As global trends shift toward electric vehicles and sustainable manufacturing, Japan’s automotive industry stands to benefit.

Manufacturing: As a global manufacturing powerhouse, Japan's output is closely tied to global demand.

The Nikkei futures provide traders with a way to express their views on these industries, capitalizing on global demand trends in high-tech products, automobiles, and industrial manufacturing.

7. Volatility Trading

One of the key attractions of the Nikkei 225 futures is the index's volatility, which is often higher than that of its Western counterparts, such as the S&P 500. Traders who thrive in volatile environments will find the Nikkei 225 particularly appealing, as it presents more frequent and larger price swings. This heightened volatility is especially noticeable during global economic shocks or shifts in local economic policy.

Additionally, since Japan's market opens several hours before European and US markets, traders can use the Nikkei 225 to capture early momentum shifts that may influence sentiment in Western markets as they open.

This graph highlights the elevated volatility of the Nikkei 225 compared to the S&P 500.

8. Japan’s Political and Economic Landscape

Japan has been taking proactive steps toward economic reform in recent years. With initiatives aimed at corporate governance improvements, stimulus packages, and structural reforms. Several factors make Japan's political and economic landscape appealing for traders:

Corporate governance reforms: Japan has been improving its corporate governance structure, making its market more attractive to both domestic and foreign investors.

Economic stimulus packages: These government-led initiatives have provided a tailwind for many sectors within the Nikkei 225.

Weakening Yen: Japan’s export-driven economy has benefited from a weaker Yen, which boosts the competitiveness of Japanese goods on the global stage.

The potential for long-term growth makes the Nikkei 225 an appealing market for those who follow macro-driven opportunities.

9. Geopolitical Events and Trade Dynamics

Japan remains one of the world’s largest exporters, and as such, the Nikkei 225 is heavily influenced by global trade relations, particularly with the US and China. Traders can use the Nikkei 225 to take positions based on their views of the global geopolitical landscape. For example:

US-China trade tensions: Japan, being a major exporter to both countries, finds itself deeply connected to global trade trends.

Global demand for Japanese exports: Changes in global trade agreements or tariff structures could either boost or harm the performance of these industries.

10. Liquidity

Liquidity remains an important consideration, as the S&P 500 contracts offer greater liquidity, but the growing interest in the Nikkei 225 has resulted in increased volumes in recent months. As Micro contracts are introduced, the liquidity of the Nikkei 225 is likely to improve, making it an even more attractive trading instrument for all types of traders.

This graph highlights the trading volumes for both Nikkei 225 and S&P 500 futures.

11. Cumulative Returns Comparison

When comparing cumulative returns over time, the Nikkei 225 has demonstrated significant growth. However, this growth has come with a higher level of volatility than the S&P 500.

The Nikkei 225's higher risk-reward profile makes it an attractive option for traders looking to capture short- to medium-term gains during periods of economic growth or policy shifts in Japan.

This graph shows the cumulative returns of the Nikkei 225 versus the S&P 500.

12. Price Range Opportunities

The average daily price range of the Nikkei 225 is another compelling factor for active traders. The Nikkei 225 frequently exhibits larger daily price movements than the S&P 500, especially during periods of high volatility. This makes it an ideal market for short-term traders looking to capitalize on intraday price swings.

The graph, where daily price ranges have been multiplied by their corresponding point values, demonstrates how the Nikkei 225 has exhibited wider price ranges.

13. Conclusion

The Nikkei futures offer a unique set of opportunities for traders looking to diversify their portfolios, capitalize on volatility, and gain exposure to Japan’s leading industries. It is a powerful tool for both short-term traders and those with longer-term macro views.

In addition, the forthcoming Micro contracts will make the Nikkei 225 accessible to a wider range of traders, allowing for more precise risk management and exposure adjustments.

Key takeaways for traders considering the Nikkei futures include:

Global diversification beyond US and European markets.

The ability to hedge against US equity volatility.

Opportunities in high-growth sectors such as technology and automotive.

The potential for higher volatility, offering both risk and reward.

Flexible contract options in both USD and Yen, allowing for currency risk management.

For traders looking to add a new dynamic instrument to their watchlist, the Nikkei/USD and the Nikkei/YEN futures are a potentially ideal candidate, combining diversification, volatility, and sectoral exposure into a powerful trading product.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

BTCUSD Rejecting Downward Trend @ $57k - Watch What Happens NextThis is a followup video to my earlier BTCUSD analysis - suggesting BTCUSD would find support near $57 and rally (eventually) to over $90k.

I found it interesting that I received a few comments on that last video - some in support and others thinking I was wrong. But, now, with BTCUSD clearly attempting to reject any further downward price action near the $57k level - we get to see how this plays out in REALTIME.

Watch this video to learn why I believe the big move for BTCUSD won't happen till after August 15, 2024 (a +$6k move). Then, we'll have to wait till later in September for the major FLAG pattern to complete - leading to an even bigger upward price breakout.

I love this type of analysis and I love sharing it with everyone. Watch my other videos if you want to learn more about what I do and how I help traders prepare for the biggest opportunities.

Watch this play out in realtime with BTCUSD. If I'm right, we'll see $62k again before August 20th, then move into a broader FLAG formation before the next big breakout happens.

Go get some.

Reupload: How I Pass Prop Firm Challenges Using HedgingHere I explain my strategy on the basics of hedging. Hedging can be a great way to improve your consistency and grow your account but you have to do it properly. It takes time to get it right. If you give up too soon you miss out on winning in trading. You can't be weak if you want to be a trader. You cannot give up so easily on learning. Get tough, up your game and let's win!!!!

How I pass Prop Firm Challenges Using HedgingHere I explain my strategy on the basics of hedging. Hedging can be a great way to improve your consistency and grow your account but you have to do it properly. It takes time to get it right. If you give up too soon you miss out on winning in trading. You can't be weak if you want to be a trader. You cannot give up so easily on learning. Get tough, up your game and let's win!!!!

Options Blueprint Series: Backspreads as a Portfolio Hedge1. Introduction

Backspreads are a versatile options strategy as they allow traders to benefit from significant moves in the underlying asset, particularly when there is an expectation of increased volatility.

2. Understanding Backspreads

A backspread is an advanced options strategy involving the sale of a small number of options and the purchase of a larger number of out-of-the-money options. This setup creates a position that benefits from large price movements in the underlying asset.

3. Generic Uses of Backspreads

Backspreads offer traders a flexible tool to capitalize on significant price movements and shifts in market volatility. Here are some common uses:

Market Sentiment Alignment:

Bullish Sentiment (Call Backspreads): Traders use call backspreads when they expect a significant upward move. This strategy involves selling a smaller number of lower-strike call options and buying a larger number of higher-strike call options.

Bearish Sentiment (Put Backspreads): Conversely, put backspreads are used when traders anticipate a significant downward move. This involves selling a smaller number of higher-strike put options and buying a larger number of lower-strike put options.

Volatility Trading:

Backspreads are particularly useful in trading volatility. They create positions with positive Vega, meaning they benefit from increases in implied volatility. This makes backspreads an excellent choice during times of market uncertainty or expected volatility spikes.

4. Hedging an Equity Portfolio using with S&P 500 Futures Put Backspreads

Put backspreads offer an effective way to hedge a long equity portfolio against sharp downward moves. By setting up a put backspread, traders can create a position that not only provides downside protection but also benefits from increased market volatility.

Setting Up a Put Backspread for Hedging:

Sell 1 OTM Put: The initial step involves selling one out-of-the-money (OTM) put option. This option will generate a premium, which can be used to offset the cost of the puts that will be purchased.

Buy 2 Lower OTM Puts: Next, purchase two lower OTM put options. These options will provide the necessary downside protection. Depending on the strike selected, the cost of these puts will be fully or partially covered by the premium received from selling the higher-strike put.

Constructing a Positive Vega Position:

The structure of the put backspread results in a position with positive Vega. This characteristic is particularly valuable as volatility typically rises during periods of sharp declines.

Risk Profile:

Below is the risk profile of a put backspread used for hedging purposes as described in section #6 below.

5. Market Scenarios

Understanding how a put backspread behaves under different market scenarios is crucial for effective trade management and risk mitigation. Here, we explore the potential outcomes:

Market Moving Up or Staying the Same: Flat P&L

If the market moves up or remains around the current level, the put backspread will likely expire worthless.

Market Moving Down Sharply: Increased Profitability

If the market experiences a sharp decline, the put backspread would potentially become profitable.

Impact of Increased Volatility: Enhanced Gains

A rise in implied volatility benefits the put backspread as higher volatility increases the value of the bought puts more than the sold put, adding to the overall profitability of the strategy.

Maximum Risk and Trade Management:

Maximum Risk: Limited to the difference between the strike prices minus the net credit received (or plus the net debit paid).

Trade Management: It is essential to actively manage the position.

6. Trade Example

To illustrate the application of a put backspread as a hedge, let's consider a detailed trade example using S&P 500 Futures Options.

Trade Rationale:

Current Market Condition: The S&P 500 Futures have just created a new all-time high, indicating that the market is at a crucial juncture. From this point, the market could either continue its upward trajectory or experience a severe change of direction.

Implied Volatility (VIX): The VIX, which measures the implied volatility of options, is currently very low at 11.99. This low volatility environment makes it an ideal time to enter a backspread, as any future increase in volatility will significantly benefit the position.

Trade Setup:

Underlying Asset: S&P 500 Futures

Current Price: 5447

Strategy: Put Backspread

Expiration Date: December 2024

Specifics:

Sell 1 OTM Put: Sell 1 4600 put option

Buy 2 Lower OTM Puts: Buy 2 4100 put options

Entry Price:

Sell 1 4600 Put: Receive $2,160 premium per contract (43.2 points)

Buy 2 4100 Puts: Pay $1,068.5 premium each; total $2,137 for two contracts (21.37 points x 2)

Net Cost:

The net cost of the backspread is the premium paid for the bought puts minus the premium received from the sold put.

Net Cost: $2,137 (paid) - $2,160 (received) = $23 net credit

As seen below, we are using the CME Group Options Calculator in order to generate fair value prices and Greeks for any options on futures contracts.

Maximum Risk:

500 – 0.46 = 499.54 points (distance between strike prices minus the net credit received).

7. Importance of Risk Management

Risk management is a fundamental aspect of successful trading and investing. It involves identifying, analyzing, and mitigating potential risks to protect capital and maximize returns. When implementing a put backspread as a portfolio hedge, understanding and applying robust risk management practices is crucial.

Using Stop Loss Orders and Hedging Techniques:

Stop Loss Orders: Placing stop loss orders helps limit potential losses by automatically closing a position when the market reaches a certain price level. This ensures that losses do not exceed a predetermined amount, providing a safety net against adverse market movements.

Hedging Techniques: Utilizing hedging strategies, such as combining put backspreads with other options or futures contracts, can provide additional layers of protection. This approach can help manage risk more effectively by diversifying exposure and reducing the impact of unfavorable market conditions.

Importance of Avoiding Undefined Risk Exposure:

Defined Risk Strategies: Employing strategies with clearly defined risk parameters, such as put backspreads, ensures that potential losses are limited and known in advance. This contrasts with strategies that expose traders to unlimited risk, which can lead to catastrophic losses.

Position Sizing: Properly sizing positions based on risk tolerance and account size is essential. This involves calculating the maximum potential loss and ensuring it aligns with the trader's risk management plan.

Precise Entries and Exits:

Entry Points: Entering trades at optimal levels, based on technical analysis, support and resistance and UFO levels, and market conditions, enhances the probability of success. In the case of put backspreads, entering when volatility is low and market conditions are favorable increases the potential for profitability.

Exit Points: Setting clear exit points, including profit targets and stop loss levels, helps manage risk and lock in gains. Regularly reviewing and adjusting these levels based on market developments ensures that positions remain aligned with the trader's overall strategy.

Continuous Monitoring and Adjustment:

Regular Review: Continuously monitoring market conditions, position performance, and risk parameters is essential for effective risk management. This involves staying informed about economic events, market trends, and changes in volatility.

Adjustments: Making timely adjustments to positions, such as rolling options, adjusting stop loss levels, or hedging with additional instruments, helps manage risk dynamically and adapt to changing market conditions.

By incorporating these risk management practices, traders can effectively use put backspreads to hedge their portfolios and protect against significant market downturns.

8. Conclusion

In summary, put backspreads offer a powerful tool for hedging long equity portfolios, especially in low volatility environments and/or when markets are at all-time highs. By understanding the mechanics of put backspreads, their application in various market scenarios, and the importance of active risk management, traders can enhance their ability to protect their investments and capitalize on market opportunities.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Options Blueprint Series: The Collar Strategy for Risk ReductionIntroduction to Nasdaq Futures

Nasdaq Index Futures offer traders exposure to the Nasdaq-100 index, a benchmark for U.S. technology stocks, without directly investing in the index's component stocks. Trading on the Chicago Mercantile Exchange (CME), Nasdaq Futures provide a critical tool for managing market exposure on the future of technology and biotech sectors.

Key Contract Specifications:

Point Value: Each point of the index equates to $20 per contract.

Margins: As determined by the CME, margins vary, reflecting the volatility and current market conditions. As of the time of this publication the CME website shows a maintenance margin of $17,700 per contract.

Trading Hours: Nearly 24-hour trading capability, aligning with global market hours to provide continuous access for traders.

It's important to note that similar strategies and benefits are available with Micro Nasdaq Futures , which are scaled down to a tenth of the standard Nasdaq Futures, making them accessible to a broader range of traders due to their lower margin requirements (Margin is 10 times less, point values are 10 times less, etc.)

Basics of the Collar Strategy

The Collar strategy is a risk management tool used by traders to protect against large losses in their investments while also capping potential gains. It is particularly useful in volatile markets or when significant price swings are expected but their direction is uncertain.

Components of the Collar Strategy:

Own the Asset: Typically involves owning the underlying asset, but in the case of futures, it involves holding a long position in the Nasdaq Futures contract.

Buy a Protective Put: This put option gives the right to sell your futures contract at a predetermined strike price, serving as insurance against a significant drop in the market.

Sell a Covered Call: This call option grants someone else the right to buy your futures contract at a set strike price, generating income that can offset the cost of the put option, but it limits the profit potential if the market rises sharply.

This strategy forms a price collar around the current value of the futures contract, protecting against drastic movements in both directions. The use of this strategy in Nasdaq Futures trading can be especially effective given the index's exposure to high-growth, high-volatility sectors.

Application to Nasdaq Futures

Implementing the Collar strategy with Nasdaq Futures involves selecting the right put and call options to effectively hedge the position. Here's how you can set up this strategy:

Choose the Underlying Contract: Decide whether to use standard E-mini Nasdaq-100 Futures or Micro mini Nasdaq-100 Futures based on your investment size and risk tolerance.

Select the Put Option: Identify a put option with a strike price below the current market price of the Nasdaq Futures. This strike should represent the maximum loss you are willing to accept. The graphics of this article show UFO Support Price Levels below which accepting a larger loss could be seen as a form of hope. Using UFO Support Price Levels as a reference to select the Put strike could be an efficient manner to determine the desired risk.

Choose the Call Option: Pick a call option with a strike price above the current market level, where you believe gains will be limited. The premium received from selling this call helps offset the cost of the put, reducing the overall expense of the setup. Selecting a call with its premium equal to the put price would allow for the Collar strategy to be cost-free (not risk-free).

Risk Profile Visualization: A graphical representation of the risk profile will show a flat line of loss limited to the downside by the put and capped gains on the upper side by the call. This visualization helps traders understand the potential financial outcomes and their likelihood.

Forward-Looking Trade Idea

Considering the recent market dynamics, Nasdaq Futures have been experiencing a range-bound pattern after reaching all-time highs. With current geopolitical tensions such as the recent conflict between Iran and Israel, there's a potential for sudden market movements.

Scenario Analysis:

Continuation of Uptrend: If the market breaks above the range, selling the covered call may yield limited gains but will provide premium income.

Significant Drop: If the market drops due to intensified conflicts, the protective put limits the potential loss, safeguarding the investment. That is knowing that if the market was to rebound after a significant drop, the strategy could end up as profitable as long such rebound would happen prior to the Options expiration date.

Trade Setup:

Entry Point: Current market price of Nasdaq Futures.

Put Option: Select a put option below the current market price. The chart example uses the UFO Support Level located around 18,000. Premium paid for the 18,000 Put is estimated to be 511.79 points * $20 ($10,235.8).

Call Option: Choose a call option above the current market price targeting the same level of premium as the premium paid for the put. The 18,300 Call is estimated to provide 522.65 points * $20 ($10,453).

Expiration: Options with a 1-3 month expiration to balance cost and protection level. This trade example uses June Expiration which is 67 days away from expiration.

As seen on the above screenshot, we are using the CME Options Calculator in order to generate fair value prices and Greeks for any options on futures contracts.

This setup aims to utilize the Collar strategy to navigate through uncertain times with controlled risk, taking into account both the potential for continuation of the uptrend and a protective mechanism against a sharp decline.

Risk Management Discussion

Effective risk management is crucial when trading futures and options. The Collar strategy inherently incorporates risk management by design, but understanding and applying additional risk control measures is essential for successful trading.

Key Risk Management Techniques:

Limited Risk: By default, the Collar strategy is a limited risk strategy where the risk is calculated by looking at the current Nasdaq Futures price compared to the Put strike price and adding or subtracting the Collar execution price for a debit or credit respectively.

Use of Stop-Loss Orders: Although the Collar strategy provides a natural hedge, setting stop-loss orders beyond the put option's strike can provide an extra safety net against gap risk and extraordinary market events.

Regular Review and Adjustment: As market conditions change, the relevance of the chosen strike prices may alter. Regularly reviewing and adjusting the positions to ensure they still reflect your risk appetite and market outlook is advised.

Diversification: While the Collar strategy protects an individual position, diversifying across different asset classes can further protect the portfolio from concentrated risks associated with any single market.

Conclusion

The Collar strategy offers Nasdaq Futures traders a structured way to manage risk while maintaining the potential for profit. By capping potential losses with a protective put and limiting gains with a covered call, traders can navigate uncertain markets with increased confidence. This strategy is particularly applicable in volatile markets or during periods of geopolitical tension, providing a buffer against significant fluctuations.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

UVXY crosses over mean anchored VWAP LONGUVXY which leverages the VIX as a measure of volatility / greed/ fear has finally crossed

over the mean anchored VWAP. This is a sign of bullish momentum and perhaps a signal that

traders should hedge or consider their positions in terms of hard risk management. Those

who traded this move up today made 10% or better in the trade. Those who bought call options

expiring tomorrow made 10X and those with call options for next Friday made 5X overnight.

Tomorrow is another day. Likely the market will rise from the correction and UXVY will fade

a bit. No matter, its value for insurance and hedging is reinforced on days like the past day.

I am maintaining a full position aside the call options closed at the afternoon bell which

expire on Friday and had time decay to contend with. My first target is 7.75 then comes

8.05 and 8.45. I will take off 20% at each target and keep the others for insurance for

a true market crash or black swan event to buffer losses while stops get hit.

Following Bitcoin Trade Idea With the drop to 60k already happening, will evaluate if this possible bounce makes it above 67k, at 67 will explore options on possibly opening a hedge short position, while maintaining bag positions. It's an obvious idea with minimal risk vs reward.

Short 66-67k

Leave current bag alone, and hodl

let go of short when or if 60s is breached and we touch the high 50s.

fastlanewinners.com

SPY- Open Put Options to Hedge Long Stocks SHORTSPY on the 15-minute chart seems to have hit a pivot high. With a variety of long positions,

I need some insurance against a bull trap or even a black swan event in geopolitics. It seems

SPY puts would fulfill the purpose. Out of the money below the current price seems

opportunistic. Accordingly, I will take a handful of put options that expire at the mid- March

monthly 1% below current price. If the market is healthy these will drop in value especially

with time decay. They will serve as insurance. On the other hand if the market gets a cold

or worse a bad case of COVID, these will partially offset any losses while managing positions.

SOXL / SOXS , this ratio analysis shows when to trade eachSOXL is the triple leveraged semi-conductor ETF while SOXS is its inverse. While SOXL

is primarily up trending in its intermediate and full-time history, it does from time to time

have a correction mainly when the technology sector gets challenged. I have found that

plotting the ratio of the share values is a very accurate way of pinpointing those corrections

and temporarily buy some SOXS to offset the downward price action and nullifying any

loss. This is more or less insurance in case the overall position must be closed for one reason

or another or transient hedging. As can be seen, these corrections last 1-5 days . This strategy

is effective risk management as during the correction the SOXS gains some of what SOXL

loses especially if the share dollars are equally balanced. Ever better is the same thing on

a 2-3 hour time frame albeit it with more hedging trades.

I have found that this strategy works on a variety of inverse ETF pairs. Most of them however do

not have one side going up more or less continuously and instead oscillate rather than simple

and shallow corrections like this pair. Please give a like if you this this could be helpful to your

trading.

TLT Long Treasury ETF- an options straddle idea TLT is here on a 15-minute chart. Price action is orderly and somewhat related to treasury yield

fluctuations and the value of the existing securities adjusting from those fluctuations. There is

adequate volatility. A straddle options strategy can be employed. Positions can be taken

in both directions. Depending on price action, one leg will rise and the other will fall. Overall

the trades make profit so long as there is volatility in one direction or the other. Additionally,

if the instrument is oversold and upward price action is more likely, the proportions between

the two legs can be skewed toward calls and vice-versa in overbought /overvalued scenarios.

Here in TLT, price is near to support and so relatively oversold. The hypothetical setup

is tipped in favor of the probabilities and expectations for a rise in TLT. Options can be OTM

or ITM depending on trader preference. In this example the calls selected are OTM at the level

of a Fibonacci retracement of the prior trend down and the puts selected are slight OTM at

the horizontal support level and the trade is skewed 70/30 ( by AMEX:USD ) toward the calls.

For a more astute explanation see the webpage from the link

SIRI is pulled back for a LONG entryOn 1 120 minute chart, SIRI is now well positioned having tested the support of

two sets of VWAP bands anchored back two earnings periods and so 3 months apart.

The mean VWAPs are confluent and so form strong support. I expect the price to

return to the early December high and test that level. In the past day a buying volume

aberrant spike was printed. The MACD lines have been crisscrossing under the histogram

signaling support of the cons9olidation of price with a series of Doji candles before the

final engulfing green dandle. Of interest, the next expiration of the options is February 16th.

On that date the dominant option strikes are %5.00 , %5.50 and $6.00

$5.00 is the present level for the strong support of the confluent mean VWAPs aforementioned

It is in this range that I will join the options activity for the time being. I will take a few calls

at each strike level as they are presently priced at $ 12- $ 32 per contract. I will also

take 10-20 shares of stock in a short position to provide a little risk-off hedging.