Very bullish HVQ ChannelI drew weekly horizontal levels on the HVQ (Top indicator) creating a channel that when crossed seems to mark the full bull run. We have rejected from this channel a couple of times resulting in a long term top but we could be entering the channel soon.

HVQ measures Volatility with some other magic I don't understand... the levels seem important and the broadening wedge pattern I drew at the very end to the right could be showing that we have broken out of the broadening wedge and headed into the bullish HVQ channel. I'm watching this closely and will be trying to hodl a long term position on leverage if we get into the channel and trend for a bit.

curious to see how this pans out

Today BTC has broken above the heffae cloud on the 1 Day timeframe which could mean its time for more up.

Heffaeclouds

Long chainlink.So I'm long from right here. risking the previous low around this level from a couple weeks ago.

Heffae cloud on 2/2 settings has been solid for Link and as you can see we are right up against the daily cloud which should push the price up ASSUMING we are bullish. This to me seems like a solid risk reward.

I'm seeing a possible Inverse adam and eve on the price and a possible Inverse Head and Shoulders on the QRSI daily...You also have a Daily 9 on price...

Contact me for more info on the Heffae trading suite.

It's not over, just pullback. Bids @ 7150 and up #BTCUSDDaily + weekly volatility is in the bullrun phase for both BTC and "TOTAL" Marketcap.

If BTC flags out in this 6.0 HVQ Volatility Index area, retesting the trend support, bingo = consolidation before megamoon

But, that consolidation could go on for awhile.

I have an overall LONG narrative, but am not buying at these levels. Looking to YOLO/FOMO a breakout, or get in around daily cloud support.

Looking for retest of the Daily cloud top, volatility consolidation, and QRsi trend test and/or build new qrsi flag. 7150-7400 is where I guess support will be depending on the velocity if / when we dip.

HVQ + QRSI + Clouds - Setting up a narrative; market structureThis video goes through my charting process using the trio of indicator's I've developed to work in concert with each other.

This is the process I use to explore historical price action and develop a narrative to use during my near-future trading activity for that asset.

Just as important as entries and exits, understanding market structure and being aware of potential changes to this structure, before price plays out it's new role, is extremely important.

These visualization tools make it possible to find structural influences within an asset that do not necessarily exist, in a classical sense, on a typical price candlestick chart.

Not explored in this video is how to further use these tools to build risk distribution profiles for any trade, long or short, as well as the use of compound tickers to determine individual asset allocations.

Most technical indicators focus too much on entries and exits while not providing nearly enough insight for aligning those buy or sell conditions with the current market structure and meta-analysis. Take a step into my workflow for setting up a trading environment that focuses more on working with the structure of an asset rather than against it. In this video I build rules for potential entries, stop-losses, and set up a narrative for an asset on some historical data (cheating, I know, but this is "educational" content ;)

QuantRsi, Heffae Clouds, and the HVQ Volatility Index are available via PM, there is also a link with access information in my sig.

For your education and entertainment!

Salient indication and evidence for a massive rally: XMR/MoneroBINANCE:XMRBTC

Finding chart patterns in the QRsi candles and combining those signals with Heffae Clouds trading rules results in a highly successful trading strategy. See my prior published ideas for examples of these patterns in use.

You can see prior HnS / IHnS formations on XMR/BTC playing out on the QRsi candles, with one epic failure to rally after the clear reversal signal.

In that failure instance, the price was below daily cloud resistance which made the rejection very harsh taking out that volume node. This breakdown becomes the target for current position.

Unlike the prior IHnS patterns, the current reversal pattern is much larger in scale. Stretching to over 160+ days from shoulder to shoulder, the chart seems to represent the possibility for a larger and longer impulsive move to the upside for this asset.

The current daily candle is at horizontal and trend QRsi resistance, but it is also making an attempt to close above the Daily Cloud, which would be the 2nd cloud rule confirmation of an imminent long-trending reversal.

Consolidation following such reversal signals can take some time, with impulsive moves to the downside expected while big players push index around in order to grab liquidity and fill bags for the coming move.

XMR/USD is a safe bet, but in my case I am blending 3parts BTC pair to 1 part USD pair in order to have a position proportional to R/R estimates, and the USD pair shows less likelihood of a straight-shot move up where I can spend the least amount of time in a position to target.

I will try and keep this updated, feel free to post or message me with any questions.

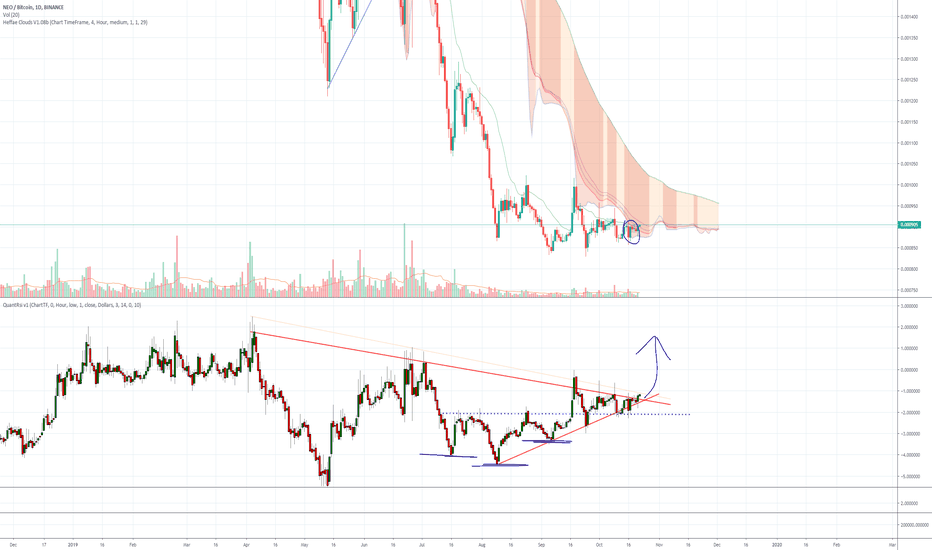

NEO/BTC worth a look - Bullish reversal situation QuantRsi 1DAt first glance this NEO chart looks like consolidation with dwindling volume, however the QuantRsi and Heffae Cloud indicators paint a potential bullish scenario.

First there is the Daily cloud entry, which is a sign of bullish reversal. The inter-cloud paths still pose a threat of heavy resistance, but historically, high timeframe cloud entries like the one here can lead to bullish reversals more often than not.

Second, the QuantRsi has an inverted HnS chart pattern with a clear step above neckline. These QuantRsi chart patterns often lead price reversal.

Third, the QuantRsi trendline that forms a triangle of sorts has crossed, but without confirmation. The prior candles that did cross failed the re-test, as well as Sept 17th rejecting off the daily cloud.

I plan on buying a retest of the QuantRsi trend, with a stop below the daily cloud bottom.

This is a perfect storm for bullish reversal. First takeprofit / re-evaluation level is at the top of the daily cloud around .00103

Apologies for the botched title screenshot, the way TradingView handles chart preview for published ideas is abysmal

XMRBTC 4Hour- QRsi + HeffaeCloudPlay by play, from left-to-right

Price dumps to QRsi - 10 levels

Consolidation at -7 to -10

Volatility Gap on escape candle from -7 consolidation pattern

First trend resistance is a big rejection

Second Trend interaction crosses now as support

Price re-tests this breakout R2S trend while making a lower low, completing

BULL DIVS on the QRsi

Price breaks the last 4H trend acting as resistance in this consolidation pattern, which is also the bottom of 4H Cloud

Once price escapes 4H cloud, I expect minimum 7.9% increase to next QRsi trend.

***Confirm levels with other timeframes***

QuantRsi Trading System Tutorial, Part 1This is part one of a tutorial on the basic principles, techniques, and features of the QuantRsi trading system.

This is Part 1 of the tutorial, and does NOT discuss how the QuantRsi can be used for trading decisions.

Please see part 2 for instructions for how to use these tools for trade entries, exits, risk analysis and more.

We start by building a trading workspace from scratch, loading the indicators, and the first steps of drawing trends on QuantRsi to define market structures.

Begin by familiarizing yourself with the the asset by charting on the QuantRsi candle structure to define larger structures within the asset.

Define the validity that QuantRsi has, and the quality / tradability of the interactions by flipping the QuantRsi preset, and going back through the drawing / definition process.

The preset that results in a clearer definition of that asset's structure is discovered, and now is preferred for that asset.

Typically preset 1 has a higher affinity of valid interactions with most assets, but the QuantRsi is set to preset 0 as default.

The discovery process of fitting trends of asset behaviour to QuantRsi structures, while changing the preset and choosing the most robust configuration is extremely important.

Higher quality and / or a greater number of trend incidents a particular QuantRsi configuration and an asset has, the more certainty that future interactions will coincide with developing market structures, and tradable decisions can be made based off of QuantRsi trend structure definitions.

Please continue to Part 2!

SPX a look from the clouds (Heffae Clouds)I've been racking my brain trying to get a feel for these indices after their panic dump mid-late Friday and decided to pull up an old favorite indicator to see what it was saying. Snow City has put a ton of work into this indicator and has the aesthetics looking absolutely gorgeous in its current incarnation. It happens to absolutely nail some important support and resistance levels as well. If you want a more advanced version of Ichimoku this is the toy to use. Also check out his Quant RSI which is a candle-ized version of RSI and provides some really cool signals if you know your candles. And no, i'm not a paid shill, just know the guy and appreciate the work he's put in. check it out

ETHUSD Meets the 4Hour Cloud - Heavy ResistanceETHUSDhas come up nicely off of support; I was in a long position from ~130 based off the 3Day QRsi trend support here:

However, I'm currently FLAT due to the massive interruption the 4H cloud brings to the rally.

This particular 4H cloud path has proven it's strength, and price will need to push it's way through this level with energy left to clear the top of the cloud as well.

Trading Ideas; Scalp the pullback (short) until trend support levels are established and confirmed on 30Min QRsi trend; at which point go long and target the 3D QRsi resistance or 3D HeffaeCloud bottom, whicherver comes first. This is likely to be $164-175 depending on when it moves.

30Min QRsi trend structure on bitmex quanto:

Note lower QRsi Trend paints to the stop-run wick as support

(this looks bullish to me, and screams continuation!)

Short a failed rally! Don't close until QRsi trend support is established and tested! Don't get stuck in one sentiment :D

Long the support area of this pullback with stops under clear breaks from QRsi trends as well as lazy candle closes under support. Chart ETHUSD on different exchanges, right now FINEX, GDAX, and BMex Quanto are all charting differently on the lower timeframes.

As well as the 30Min QRsi trend pointing to bottom of stop-run wick as support, the 3H did the same. Multiple timeframes showing confluence with SnR levels == winning trades!

QuantRsi trendlines functioning as Support / Resistance:

XRP Bullish trend cross on 4H QRsi, long TF's signal *a move*XRP is getting tighter, and as much as I fundamentally dislike the coin, I will trade it.

There is a bullish trend cross on the 4H QRsi. First target is ~2.15% up from here. SL is ~ 1.25% down.

There is a good chance of continuation here, this trade might be worth holding.

LTC/BTC - QuantRsi + Heffae Cloud, weak LONG signal, no confirm

LTC/BTC has had quite the selloff, however all hope is not lost yet.

On the 4Hr chart, there are some signs of life as LTC/BTC makes a weak bounce on the 4Hr Cloud as well as vauge QuantRsi support. The 4Hr Cloud interaction has broken through the bearish side and is signaling that the levels we came from won't be revisited anytime soon... but this could change after some consolidation.

The next trend incident LTC/BTC must cross will paint a clear picture as to whether this dump is over, we go sideways, or if we can find a bullish channel.

The 8Hour has clear signals on the entry and a little late on the exit, showing some weak trend support here:

The trendline that's drawn from the lower high wicks might not be as valid, since the interactions aren't as clear.

On Longer timeframes, the trend has been broken; but this horizontal level is strong.

Weak buy signal on 4Hr QRsi trend interaction & Heffae Cloud path. Heffae cloud violated, QRsi signal still holds, pending next interaction.

The majority of this TA is pointing towards a longer period of consolidation - sideways.

BTC to $3550 - Inverse Chart comparisonLeft is current BTC price action on the daily timeframe, on the right is BTC on the 12H Timeframe.

Using the QuantRsi to find hypothetical Support targets, and Heffae Clouds as a guide for price movement. In this case, both indicators align to paint the same target.

Showing a prior instance of similar setup on the right pane.

WTI trade to $51, 3Day RT Bottom, Inverse HnS 1D QRsiWTI paints some impressive bullish signals on Heffae Clouds + QuantRsi longer timeframes. The idea of this trade is driven purely by technicals, I am not in the loop on fundamentals whatsoever.

Daily chart shows inverse HnS on the QuantRsi as well as a new trend developing that shows upside potential:

As warning, The last time Qrsi ran -7 on the 3Day QRsi, there was a small bounce, but there was significant continuation to the downside.

Compared to our current levels, the potential for a further slide is possible:

Regardless of this, I think a long trade has decent risk / reward as long as best practices are used when setting stops and take-profit.

Is this the moment I've been waiting for?The idea is pretty straight forward. I'm looking for a wick slightly below the real time low (the red line) followed by a bounce before end of year. I'm thinking the dip happens on December 17th which is one day before the 3 day close. That would set us up for a year or so of sideways A.K.A. ACCUMULATION.

ETH/USD - Longer timeframes signaling down; 4H support holdsChart is Heffae Clouds 4Hour (left) and 8Hour (right)

I added arrows to highlight signals you may trade on with the cloud SnR paths.

The "target" on the current 4H candle is the RealTime Additive, which is a trend indicator, and can act as resistance here if the trend is to continue down.

The 8Hour has signaled a drop out of cloud bottom, which is bearish.

Soon price will interact with the Daily:

Pictrued is both alternate path preset 1,1 as well as default settings (0,0)

Targets 210 -206

"Fool me once, shame on...me. Fool me twice...shame on......well the point is you can't get fooled again. "

Magical words once spoken by one of the greatest orators of our time, George W. Bush. I feel like I've seen this ETH song and dance before. If you like fractals that probably won't play out this chart is for you.

AVTUSD Aventus - Ready for Liftoff - HeffaeClouds 3D + 1D + 4HAVT looks like it's ready to make a serious run up based on double bottom on QRsi & it's contention with 4Hr cloud.

Marked are expected levels for resistance.

I have no idea what this coin is, or what it does. Speculation based solely on HeffaeClouds and QuantRsi

Consolidation on the 4Hr Cloud, and closes above Cloud top are bullish signals. The inverse is true for breakdowns, circled is a green cloud breakdown.

How it paints - Replay mode on ETH/USD - Heffae Clouds 3XTFIt's difficult to see from a chart that does not move how the clouds work, so I made this short video on Replay Mode to demonstrate.

Watch how the price reacts to the cloud tops, bottoms, intracloud SnR lines, and the RealTime additive (thin green line).

How It Paints - Part 2 - ETH/USD Replay Mode on Heffae CloudsSit back, relax, and watch the clouds paint on ETH/USD.

In this video, watch Heffae Clouds paint the Predictive / Adaptive Support and Resistance clouds.

Multiple Timeframes, 3X indicators set to 1Hour, 4Hour, and Daily timeframe.

The Heffae Clouds indicator is a kind of spiritual successor to the Ichimoku Cloud. Read the full description here:

PM SNOW_CITY for evaluation access to the Heffae Clouds Indicator!

All 3x #heffaeclouds indicators in this video use the 1,1 PathFitting Preset for FOREX, which changes the adaptive path-fitting "seed" value as well as the adaptive cloud offset to align better with assets involved in more complex ecosystems. Preset 1,1 relaxes the time-domain and works well on assets with dependencies (erc20 ecosystem).

Please note that these settings were developed far prior to these price movements; the indicator is not tailored to this asset. You can see interactions such as this with a wide variety of stocks, indices, futures, and cryptocurrencies.

This indicator is organic and interpretive, you may see the cloud interactions better than I! Post your analysis and trading ideas in the HeffaeClouds Public Chat:

www.tradingview.com

Thanks for watching, please leave a thumbs up if you enjoy these posts or find this interesting!