Hell

Oil Bearish HaramThere's a bearish Harami on daily.

Education(HARAM): This pattern consists of a white body and a small black body that is completely inside the range of the white body. If an outline is drawn for the pattern, it looks like a pregnant woman. This is not a coincidence. “Harami” is an old Japanese word for “pregnant”. The white candlestick is “the mother” and the small candlestick is “the baby”.

Pattern Requirements and Flexibility

The pattern consists of two candlesticks, in which the first day’s white candlestick engulfs the following day’s black candlestick. The first one should be a normal or a long white candlestick. Either the body tops or the body bottoms of the two candlesticks may be at the same level, but whatever the case, the black body should be smaller than the previous white body.

CADJPY SELLER CONTROL CAD/JPY SELLER ON POINT

has reached a point where it is not known whether it goes high or goes down but know that we have to expect the support break in point 83.3 where this would be a very powerful success for the seller and a lost round for the buyers since it will be quite difficult to set up and manage to keep the market in check.

This would send us to point 82.5 with where our second profit will be and if it breaks and the support at this point reaching 80.0 then the bet will be big enough for the seller

t.me

CADJPY Bearish Bat PatternCADJPY Bearish Bat Pattern and Short Opportunity

Description: CADJPY completed a Bearish Alt Bat PAttern on the H4 Chart. Bearish correction is predicted.

OSMA divergence confirms the bearish reversal

Trade Setup

TRADE: Short

Trade Period:Intraday / Midterm

Estimated completion time: 2-8 H4 Candle Stick

The trend in the Timeframe: Bullish

The trend in the Daily Chart: Bullish

The accuracy of the pattern: 86 %

Recommended Lot Size: 0.10 at 10K

Entry: 83.60-83.65

Stop: Above X 84.05

Target 1: 83.40 / Reached … We take partial profit and move Stop Loss to entry.

Target 2: 83.10

Target 3: 82.88

GOLD SHORT SELLGold Prices Decline as China Manufacturing Data Lifts Confidence

China's Caixin/Markit Manufacturing Purchasing Managers' Index (PMI) rose to 50.8 from 49.9 in February. That was the strongest reading in eight months and followed an uptick in the official PMI, which tracks mainly state-owned enterprises.

The data suggested China's ailing manufacturing sector is on a path to recovery after a sharp slowdown around the turn of the year.

Comex gold futures were down $4.25, or around 0.3%, to $1,294.25 a troy ounce by 7:00AM ET (11:00 GMT).

Meanwhile, spot gold was trading at $1,289.81 per ounce, down $2.28, or roughly 0.2%, after touching its lowest since March 8 at $1,286.35 on Friday.

The Chinese data also triggered a reversal of some of the gains in U.S. Treasuries. The 2-year note yield rose 3 basis points to 2.29% in the wake of the news. Higher yields generally depress demand for gold, a non-interest bearing safe haven asset.

The market is looking ahead to a busy week of U.S. data, which should bring further clarity on whether the economy is losing steam or just stumbling through a soft patch.

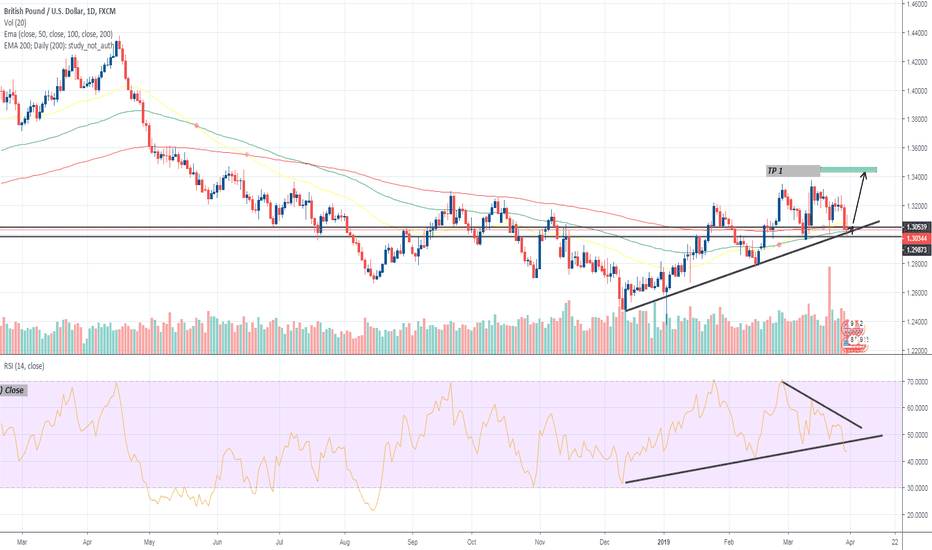

GBP/USD RATE DAILY CHARTThe broader outlook for GBP/USD is no longer bullish as both price and the Relative Strength Index (RSI) threaten the upwards trends from late last year, and the advance from the 2019-low (1.2373) may continue to unravel following the string of failed attempts to close above the Fibonacci overlap around 1.3310 (100% expansion) to 1.3370 (78.6% expansion).

Recent series of lower highs & lows raises the risk for a further depreciation in GBP/USD, but need a break/close below the 1.2950 (23.6% retracement) to 1.3000 (61.8% retracement) area to open up the next downside hurdle around 1.2880 (50% retracement) to 1.2890 (23.6% expansion).

The 1.2760 (38.2% retracement) to 1.2800 (50% expansion) zone comes up next followed by the overlap around 1.2610 (23.6% retracement) to 1.2640 (38.2% expansion).

DXY 1D (BUY) TVC:DXY

DOLLAR TO CONTINUE TO TRADE HIGHER IN DAYS AHEAD

The US Dollar index (DXY) reversed last week after hitting confluent support by way of a trend-line and the 200-day MA. The underside trend-line remains a line of significant interest as it holds together the bottom of a developing ascending wedge.

The wedge may take a couple of months or longer to fully mature, but for now there appears to be a solid gradually rising floor in the Dollar. The reversal candle from last week suggests there will at least be an attempt to trade higher in the days ahead.

The mood chart for Bitcoin and the restThis started out as a joke about a week ago but I think it has proven to be a rather accurate description of the mood in cryptocoin markets and how many of you probably feel when looking at those convoluted charts with hundreds of indicators - all showing what happened, none telling the future.

NB! This chart can and will be used against you in coming days and maybe even months. Be aware of sudden changes.

6600 before going to hell? Bart patterns and such a manipulation is going on, we may bounce back a bit and then go straight forward to 6600. In previous analysis we did not hit the support levels which was 30% chance, but going above 6360 as i mentioned with 6400 breakout (My sl tooked) This may change a game for a short time only.. Or we may see another bart thing on the 6600 ? I could wait for a little bounce back to long 6380 level with even closer stop loss like 6365 with bigger laverage .

You must sell while you canthe head and shoulders PATTERN shown a downtrend to 7.300

the simetrical triangle has an amplitude line wich indicates the same objetive

The same is indicated by Fibbonacci ext. 7.300

Besides, the elliot waves indicates that we just are starting the C wave (the longest corrective wave)

Besides, we can see, the a to b channel is just a flag