Help

EURNZD LongAgain, very new to all this and still very new to making my own analysis’ - just looking for honest constructive feedback.

Possible long set up on the EURNZD on the daily chart.

Couple of rejections at resistant. Will look for further confirmation on the support before I look to place a trade on this.

Risk/reward is sitting at 3

Let me know what you guys think 👍

DXY to 97.88 tomorrow (1HR view) SHORT SHORT SHORT USD PAIRSToday 4/14 DXY broke through the support level of 99.19 which was created 4/1/20.

With the current trend of news and shut down of the economy I believe that the DXY will DROP to 97.88.

Confirmations:

on the daily outlook DXY is at .50 at FIBS levels and is likely to retrace to .382 which will be 97.88. The bottom floor is 94.64.

MA 150 (black) is hanging over nicely on the HRLY TF

MA 50/20 is moving quite nicely as well on the HRLY TF

overall on the DAILY DXY is in a 5 day bear trend that does not look anywhere near ending.

in Conclusion,

97.88 is actually 6.18 region for FIBS where the floor is the hell hole level of 88.51.

97.88 tomorrow 4/15/20

(if im wrong DXY shoots up to 100 or 101.3 level)

DXY to 98.7 tomorrow!! SHORT SHORT SHORT USDToday 4/14 DXY broke through the support level of 99.19 which was created 4/1/20.

With the current trend of news and shut down of the economy I believe that the DXY will DROP to 97.88.

Confirmations:

on the daily outlook DXY is at .50 at FIBS levels and is likely to retrace to .382 which will be 97.88. The bottom floor is 94.64.

MA 150 (black) is hanging over nicely on the HRLY TF

MA 50/20 is moving quite nicely as well on the HRLY TF

overall on the DAILY DXY is in a 5 day bear trend that does not look anywhere near ending.

in Conclusion,

97.88 is actually 6.18 region for FIBS where the floor is the hell hole level of 88.51.

97.88 tomorrow 4/15/20

(if im wrong DXY shoots up to 100 or 101.3 level)

WHO F****** KNOWS NOWmore delays for brexit should see big gap down and a return to retest previous lows.

if deal is agreed then we should see gap up and continued strength in the pound.

honestly, i have stopped day trading the pound, it is very volatile and now looking for longer term positions.

As a young person in the UK i feel my views have been forgotten about. To anyone over the age of 50, should not be able to vote simply because it is not their future. At this moment in time i just want us to leave, this is not my political view, it is simply so that we can stop going in circles and sort the country out.

anyone think i should be PM?

AUD CHF Hello guys!

I'm very new to the forex trading, I'm very glad that I found this platform of communication among other traders!

This is my first analysis and I would like if you guys can give some advice this will also keep me motivated to become a better trader!

thank you, guys! and good trading.

Straight From The Horse's Mouth... BTC Is Off To The Races!Here I am, sitting back with a cool bubbly, not a worry in the world.

My BTC trade is 1.2% in profit already, yet the current price is near where I started... How could that be? Maybe BTC will go up, maybe it won't, it's not me worry. I'm likely to make 6%+ on this trade regardless, but even if I'm off a bit... I'm 99% sure I'll walk away with a profit.

WHAT'S MY SECRET? I have a horse story you're going to love (read on)...

How do I do this? Meet Ol' Mr. Gridley...

Actually what I'm doing is pretty easy. But I get a little help... I just jump on Ol' Mr. Gridley here and I'm off to the races. Mr. Gridley is not the horse he used to be, he ZIGS he ZAGS... he never goes in a straight line. Sure, I pick the race track he runs on (and I have some handy indicators that help me do this) and I point him in the general direction, but once Mr. Gridley heads out of the gate, I just let him do his thing.

Now here's where this horse story gets interesting. BTC, ETH, LTC and quite frankly all the crypto coins out there, well guess what? They pay Mr. Gridley all along the way. He zigs down and buys a little, he zigs up and sells it right back. You know... BUY LOW, SELL HIGH. He's a pretty clever horse! It really adds up... in fact me, my friends and my followers mostly make more money riding Ol' Mr. Gridley than betting the bank on a moon shot and sweating out the charts.

In fact, Ol' Mr. Gridley has been doing this so long, most the time I don't even ride him. That's right! I give him his favorite oats, maybe an apple, I point him in the general direction and he goes it alone. Mr. Gridley loves this... I mean, totin' me around all day and night ain't no joy ride! So I let Mr. Gridley run solo and he brings back the money - 100% automated - simple as that.

How long, how much?

Sometimes in a few hours, sometimes in a few days. Just last week he came back after 3 weeks with a 29.44% return! On another occasion, he brought back 9.66% in 14 days -AND- 9.66% in 14 days -AND- 26.98% in 7 days 14 hours -AND- 11.08% in 13 days 8 hours -AND- 18.3% in 3 days. Yada, yada... stop by my discord sometime and I'll show you all my screenshots and proof.

Now you're thinking...

How many people can ride Ol' Mr. Gridley? What if I want to race him on multiple crypto tracks at the same time. How might we do that?

Here's the good news, there's a whole herd of Gridleys out there. Pappa Gridley's, Momma Gridley's, Baby Gridley's, they're everywhere (if you know what you're looking for). Yes some are better than others, they don't all make money. Bummer huh? But you can learn how to pick a winner, it's easy... it's all comes with a little training and the right tools. It's about knowing WHAT to look for, what to feed them, and how YOU can get "GRID SMART" yourself.

I'm here to teach you the ropes.

YES, you can do this! It's easy, safe, and fun. Plus you can HAVE A LIFE beyond watching charts.

My name is Dan Hollings, I'm a Master Grid Trader. I can teach you what I do and before long (maybe even tomorrow) , you could have Ol' Mister Gridley working for you.

HOW DO I LEARN MORE?

1) Review my related IDEAS and TUTORIALS (linked below)

2) Join my Grid Masters Discord Community

3) Explore my GRID INDICATORS (linked Below)

HOW DO I AUTOMATE MY GRID STRATEGY?

Go here: cryptogridbot.com

PLEASE HIT THE LIKE BUTTON

PLEASE HIT THE LIKE BUTTON

PLEASE HIT THE LIKE BUTTON (and follow me... Mr Gridley gets ornery if you don't LIKE him!)

As always, I appreciate your support. Please share this with others.

A Horse Is A Horse, Of Course, Of Course!

Dan Hollings

Master Crypto Grid Trader

Host of the "High Leverage Lounge"

Please Explore My Other Indicators, Scripts, Grids and Educational Ideas.

@ DanHollings on Tradingview

Crypto Grid Bot

cryptogridbot.com

Crypto Grid Master Discord

cryptogridtrader.com

Strong Fundamentals & TechnicalsHey traders! Hope your having a great day! Lets get right into this, there was positive news on this stock today, you can see the snippet on the chart! Technical's are looking strong and the uptrend is still fully intact . I will be watching for a continuation possibility tomorrow, if you are going long then I would consider setting an alert at 2.35 , as a break and re-test off that level would give us additional confirmation to move higher. For the bears, your level to watch is 1.95 , as a break and re-test with rejection at that level would equal a broken structure and we would most certainly have momentum heading downward. Whatever the case, I wish you all good luck! Remember to use smart money management! Make sure to leave a LIKE , and FOLLOW me if this post has helped you at all! And don't forget every single chart that I post, I also have a youtube video you can check out! Thanks again everyone, see you tomorrow!

GOLD - Elliot experts thoughts?!I need your advice on this particular prediction.

Currently in a stage of learning/practicing Elliot Waves.

Therefore, do not copy me!

It's just an idea of mine.

However, everyone can share their own thoughts in the comment section below.

Also, don't forget to support me! :)

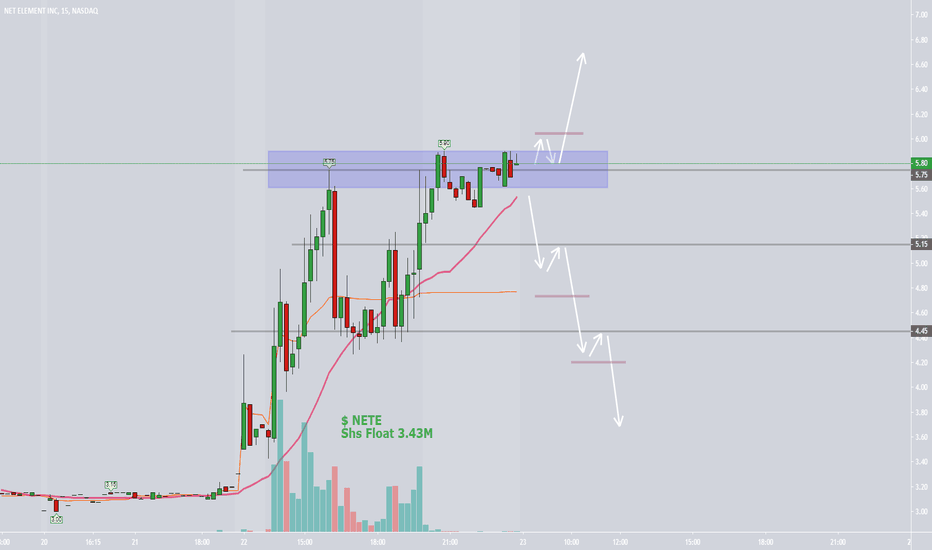

Could This Continue?Hello traders! Hope your having a great trading day. Let's get right into this, tomorrow ill be looking for the continuation trade. I will be watching the important level of 5.90 for a break above, and re-test of that zone to give us a heads up with confirmation for possible entry. Very important to watch that level, because it will need to be broken to move that momentum higher. For shorts, or people holding stock, your going to want to watch the 5.15 level for a break and re-test moving lower, as that would give the chart a bearish outlook. So watch out for both levels tomorrow, and set your alerts! @ 5.90 + 5.15! Good luck everyone! Be sure to leave a "LIKE" and follow me for more great chart analysis in the future!

Shorting ALLK at 65.31. Change from open 124Following is a video of a simulated trade in which I made $724 by shorting ALLK. I saw the stock at FINVIZ after the market had opened and saw that it had risen up to 124%. I quickly went on TradingView to see it was double than most of its days and shorted it knowing it would come down after a while. I didn't know how fast. I started with stocks about 4 months ago. If anyone would like to criticize any part of the trade you are welcome to do so. I'll start trading with real money right before 2019 Q4. Sorry about the noises in the background. Kids playing

Help, what happens to a script if a premium sub expires?I am fairly new at TradingView and I was wondering what would happen to an invite-only script if a premium subscription expires?

Let's say that I have a premium subscription and I create an invite-only script and then the subscription expires - which will reduce me to a free subscription. Will the script become open for everyone and reveal the source code or maybe something else will happen? According to the Terms of Use an idea or script is never deleted (after 15 min at least) so I guess that wont happen.

I hope someone has the answer for me. :)

Thanks in advance!

Best regards.

GOLD to SELLFollowing the trend in pattern observed, market is ready for a sell.

Trade chart at your own risk.

Want to know what indicator I'm using? Send me a polite PM and i'll show you where to find it, plus additional tip if you are a pro (non-pro will not have access to this tip)... no I do not sell anything, all free.

BTC going to the moooooon?Hold on just a minute here.

BTC is just making a bounce, the Mid-term analysis is still down as the SAR printed on the weekly time-frame, you can check out that post in my previous charting.

So what's going on with BTC? Lets break it down, hope you can keep up.

10 SMA - Orange line

21 EMA - Yellow line

20 SMA - Red line or bollinger band medium line

We closed and opened above the 3-day, 21 EMA (yellow line,) on the right-side chart. This usually indicates buying pressure is back into the market and you'll want to see it retest the 10 SMA (orange line,) which sits around

10.5k - 10.7k.

This resistance has some nice confluence on the daily as well, which the 21-EMA (yellow line) and 20-SMA (red line) on the left side chart on the daily comes in around 10.4k - 10.7k.

Lower time-frames wants some upside, but the weekly is showing bear momentum is still here and have not changed. If you look at the left side of the chart, you can see the Bollinger Band I have turned on. From July 15th and July 21st, all price action did was retest that medium line (red line) on the Bollinger Band before sending price right back down. The Bollinger Band is expanding to the down side (the circle I drew,) not to the upside. Meaning, if BTC cannot close/open a candle above the 21-EMA (yellow line) daily, lower prices will be implied as price would want to revisit the bottom of the lower bands.

When do I switch to more upside into the upper 11k's?

Here's the key, if BTC can close and open a candle above the 21-EMA daily (yellow line,) I will enter a long with a stop-loss right below it. Closing and opening a candle above the 21-EMA (yellow line) daily suggest that buying pressure is back into the market and the next likely target is in the upper 12k to retest the top of the Bollinger Bands.

What's the best choice of action?

You do nothing. Allow price action to reveal what it wants to do, if we close/open a candle above the daily 21-EMA , open a long position for more upside. If we open/close a candle below the daily 21-EMA after retesting it , open a short as this is a sign of rejection.

If you like my analysis of the market and it helped you learn or made some money, please consider using my referral links.

www.deribit.com

www.bitmex.com