Heromotors Daily Trend Analysis"As per my Daily Trend Analysis, Heromotors Ltd has broken out of a 41-bar range and closed above it today. This breakout indicates a potential upward move toward the resistance zone of 4600 to 4607 in the coming sessions.

Traders are advised to perform their own technical analysis and ensure proper risk management before entering the trade."

Heromotocorp

Hero MotoCorp — Daily Chart Breakout Trade SetupHero MotoCorp — Daily Chart Breakout Trade Setup

Range Bound: The stock has been consolidating between ₹4,170–₹4,400 for the past several weeks.

Structure: This is a classic rectangle consolidation, often a continuation pattern.

Volume: Watch for volume expansion on the breakout; prior breakouts lacked follow-through due to low volumes.

Higher Timeframe (Weekly/Monthly) charts show a bullish continuation since mid-May, with high-volume candles across weekly and monthly charts

Key resistance zones: Weekly resistance lies between ₹4,930–₹5,000.

Strong fundamental macro tailwinds: March sales show robust performance in both domestic ICE and EV segments (Vida)

🔍 Key Confirmation Signals for a Potential Trade

✅ Strong daily candle close above ₹4,420

✅ Above-average volume on breakout

✅ RSI crossing 60 on breakout adds momentum confirmation

⚠️ Risk Management Notes

Avoid early entry within the range (false breakouts possible)

Wait for EOD close above resistance for confirmation

Consider a trailing SL once the stock crosses ₹4,500

Levels to watch out As of January 2025, the intrinsic value of the stock is estimated to be approximately 4,137.50 per share, based on fundamental analysis and available data. With the current market price hovering around 4,130, the stock is trading just below its intrinsic value, suggesting that it is fairly priced at the moment.

For investors seeking attractive entry points, prices around 3,900 could offer a discount to the intrinsic value, presenting an opportunity to buy at a potentially undervalued level. This price range could be seen as a good long-term investment opportunity, assuming the company continues to perform well and the market remains favorable.

Furthermore, for those with a more conservative approach or seeking a greater margin of safety, prices near 3,300 could represent a deeper undervaluation.

Levels to watch out As of January 2025, the intrinsic value of the stock is estimated to be approximately 4,137.50 per share, based on fundamental analysis and available data. With the current market price hovering around 4,130, the stock is trading just below its intrinsic value, suggesting that it is fairly priced at the moment.

For investors seeking attractive entry points, prices around 3,900 could offer a discount to the intrinsic value, presenting an opportunity to buy at a potentially undervalued level. This price range could be seen as a good long-term investment opportunity, assuming the company continues to perform well and the market remains favorable.

Furthermore, for those with a more conservative approach or seeking a greater margin of safety, prices near 3,300 could represent a deeper undervaluation.

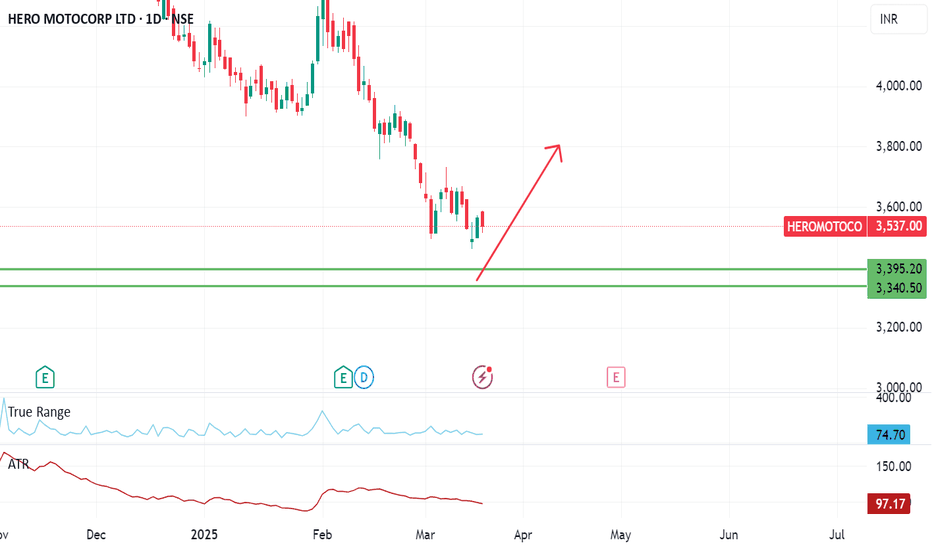

HERO MOTOR- MAJOR CORRECTIONHero Motor Corp- Almost a 3x from March 2023 to Sept 2024. Now under a severe correction, macro and tech factors in play.

Demand zone is 3600-3850, if breaks crucial 4K level.

Sideways in that zone will be good for accumulation for target back 4500+.

Large caps getting attractive in this fall.

HERO MOTOR- SUPPORT TESTHero Motor broke out of a crucial level at 2900 where multi month resistance was seen. Post that its rise was halted at 6K+ and now its testing a crucial level of support- 0.618 FIB level , break of which can be bad for the stock -mid term. Correction is heavy on this stock, should watch this level carefully over the next 2-3 weeks.

HEROMOTOCO : Building Momentum from Correction Lows HERO MOTOCORP

Learning Points:

Wave Analysis: Wave C zones typically offer high-probability reversals.

Golden Retracement Zone: The Fibonacci 50%–78.6% zone is a critical demand area.

Demand and Supply Dynamics: Understanding these zones improves entry and exit precision.

Trading Plan:

Entry Strategy:

Enter between ₹4560–₹4688, within the Golden Retracement Zone for Wave C correction. Confirmation from bullish divergence or candlestick patterns is key.

Stop-Loss Placement:

₹4540, slightly below the Golden Retracement Zone.

Target Strategy:

Short-Term: ₹4950–₹4995, a supply zone.

Swing Target: ₹5106, aligning with Wave C completion and Fibonacci extensions.

Predictions:

A reversal from ₹4560–₹4688 is expected, targeting ₹5106. Demand confirmation is essential before entering.

Disclaimer:

I am not a SEBI-registered analyst. This analysis is for educational purposes only. Conduct your research or consult a financial advisor before trading.

Is Hero MotoCorp Set for a Bullish Turn..?HERO MOTO CORP has experienced a significant decline of approximately 24% from its all-time high. This downward trend has been marked by a clear trendline that, as of late, has been broken, indicating a potential shift in market momentum. Additionally, a failed breakout was observed at the support level around 4920, which could enhance the likelihood of a rebound or upward movement in the near future.

It's important to note that the company's quarterly earnings report is scheduled for November 4. This upcoming announcement could be critical in influencing market sentiment and should be carefully considered before making any trading decisions.

hero

**Chart Overview:**

**Stock:** Hero MotoCorp Ltd. (NSE: HEROMOTOCO).

- **Indicators:**

**EMA (Exponential Moving Average)**:

- 9-period EMA: \(5,759.37\)

21-period EMA: \(5,618.91\)

- 50-period EMA: \(5,472.63\)

**200-period SMA (Simple Moving Average):** \(4,788.98\)

**Volumes**: Shown below the price chart, indicating trading activity.

**Highlighted Levels:**

**18th June 2024**: The price touched a resistance level, as indicated by the orange circle. The price struggled to break through that level.

**10th September 2024**: Again, the price tested this resistance level and initially rejected it but managed to make a new attempt to break above in the current phase.

The **horizontal line** shows the resistance level around \(5,860 - 5,961\), which the price is trying to break.

**Analysis of Last Three Candles:**

1. **Candle 1 (Two days ago)**:

**Small Body, Small Wicks**: Indicates a **doji**-like candle, showing indecision in the market as the price consolidates at the resistance level.

**Volume** : Low volume during this session could suggest a lack of strong conviction from buyers or sellers.

2. **Candle 2 (Yesterday)* *:

**Green Candle** : Indicates a bullish move, as the closing price was higher than the opening price.

**Medium Wick on Top* *: Suggests some selling pressure near the end of the session, with buyers unable to close at the day’s high.

**Volume** : Increasing volume compared to the prior session, signaling growing interest from buyers as the stock tries to break resistance.

3. **Candle 3 (Today)**:

**Strong Green Candle** : This is a large bullish candle with little to no wick on top, signaling that buyers were in full control throughout the day, pushing the price significantly higher.

**Volume** : High volume compared to previous days, confirming the bullish momentum and increasing the likelihood of a breakout above the resistance level.

**Conclusion from Last Three Candles:**

The stock has made two attempts (June and September) to break the resistance level around \(5,860 - 5,961\), and the third candle (today) shows a strong breakout attempt with substantial volume. This indicates that the stock might be gaining bullish momentum and could sustain a breakout if buying pressure continues.

#Heromoto 4th time tested 4950, above 4955 fatega kya?Heromoto since Feb'24 4th time has tested the fib resistance of 4954.A day close above 4954 can take this stock towards 1) 510 2)5177 3)5329 4)5473, below 4632 will be exit for me. Since my indicator is also not giving any negative signs, I have high hopes from this setup. Only thing is weakness in overall market can affect it. Lets see

#HERO/USDT#HERO

The price is moving in a bearish channel pattern on the 12-hour frame, and it adheres to it well and is expected to break it upwards.

The price rebounded well from the lower border of the channel at the green support level 0.003680

We have a tendency to stabilize above the Moving Average 100

We have oversold resistance on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price is 0.003680

The first target is 0.004300

The second goal is 0.004718

The third goal is 0.005270

HEROMOTO WAVE 3 IS ONN

Wave 1 is a 5 Wave Impulse Sequence Structure in 6 Month chart, and Wave 2 is a 3 Wave Correction structure.

Wave 2 has retraced Wave 1 by 61.80% which suffices by the Elliot Wave Theory Correction rules.

Now Wave 3 is on and as per the Elliott Wave Theory and Fibo Extension Levels 161.80% is the minimum Wave 3 achieves, hence projection is Rs. 7793.20.

Hero Motor Corp | Elliott Wave Analysis | Learn with me...Wave Analysis:

Within the completed fifth wave, we can see that the corrective wave II has completed a WXY correction, which is a complex correction pattern consisting of two zigzag corrections and a connecting wave. The internal degree 1 wave within the WXY correction has also completed, indicating a potential uptrend.

Currently, the stock is in the early stages of the second wave, which is a corrective wave. It has completed the internal degree 1 wave, which consisted of a zigzag correction. However, the corrective wave is likely to continue, and the stock may find support near the 2500 level.

In conclusion, Hero MotoCorp has a strong long-term trend and is currently in a corrective wave, which is likely to find support near the 2500 level. Traders and investors should keep a close eye on the stock's price movements to identify potential entry and exit points.

Thank you for your love and trust...!