fcx with another flag.. but ...what about the tariffs?fcx buyers are very excited for the future! has been a good run. but, seems we never really got past phase 0 on the trade deal.. will the tariffs start to become bullish? Harder us pushes maybe quicker we find a solution.. agree to disagree?

Taking a bit off table.. keeping close eye on copper.. who knows how high it may run. has been depressed for so long.. 4? 5? 10?! haha

GOOD LUCK!

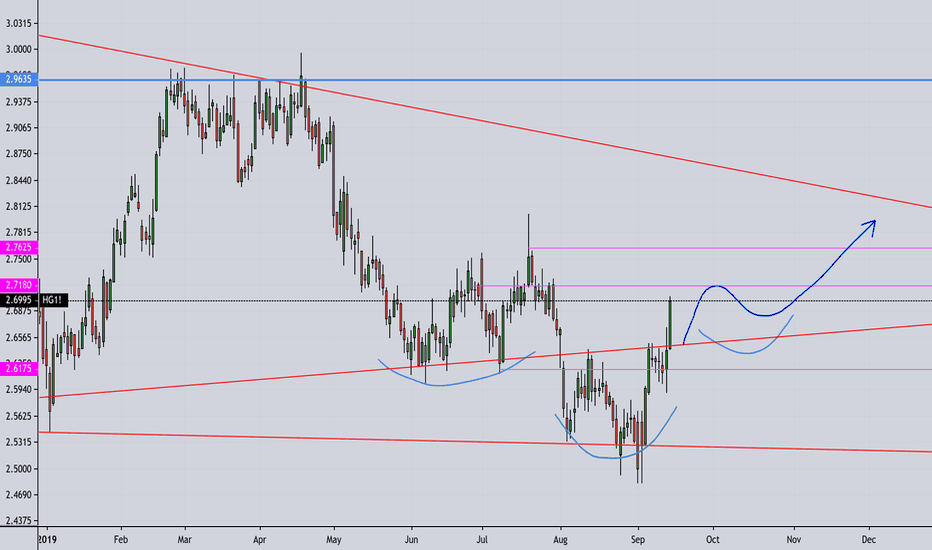

Copper Futures HG1!

Lets see where Copper wants to run- Because well, it wants to.Spoke with someone last night who emphasized the uptick in security at construction sites more or less specifically for people stealing COPPER. I am going to COP some COPPER. Don't do what I do. This is not financial advice. I do not know how to trade or chart, and this idea is just art : )

- Namnaste'

Happy Monday fam

P.S. Trade Futures? Send me a PM. Opening the doors to my small Discord today. If you are a serious trader- would love you to check out our community!

Copper: Short opportunity within an Ascending Triangle.Copper (XCUUSD) is trading within a 1D Ascending Triangle (RSI = 56.277, MACD = 0.016, Highs/Lows = 0.0000). Last week it was rejected on the 2.7000 1D Resistance and that should make it test at least the 1D MA50 (blue line). In our opinion since the RSI has been consolidating in the past 2 months, the potential pull back can make a Higher Low on the 1D Ascending Triangle so our Target is lower at 2.57000.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

FCX and the looming recession?pure play copper not exactly best idea for global recession positioning.. but, who knows how this thing is going to go down. Copper is so important, it cant be left behind for long? Maybe it can? But accumulation at least shows some promise.. Should be fun next few months! Please let me know your thoughts.. FCX performance lately is scary. Big money know some details the little guys arent privy to just yet?

Copper testing bounds of decade necklineCopper is interestingly a great gauge of economic health coming from Asia, and also a relevant view on global growth / inflationary expectations. We've been battling two head and shoulder formations since the GFC. First, the very large commodity bubble formed a big head and shoulders that peaked roughly around 2012, a time where China had maxed out its credit expansion. We got a smaller head and shoulders in the post 2015-2016 deflationary episode that tested the original trendline and bounced during the 2016-2018 bull market.

The smaller head and shoulders finally broke down, which led to Copper testing the boundary of the bigger head and shoulders. I expect this to break, although there will likely be some testing of this first.

Note: this is not just a technical move. There are many fundamental reasons Copper is breaking down, mostly macro related to USD strength, asian weakness, over-expansion of Chinese credit, weakening demand, etc etc. Copper interestingly mirrors the Korean Kospi index very closely, and that is also breaking down from a major long term trendline right now. Expect more deflation, and some big market problems when this finally confirms the break of the lower trendline.

Elliott Wave View: Copper Expected to Turn Lower SoonShort Term Elliott Wave structure in Copper suggests the rally to $2.64 ended wave (2). The metal has since resumed lower in wave (3). The internal of the move lower is unfolding as an impulse Elliott Wave structure. Down from 2.64, wave ((i)) ended at $2.578, wave ((ii)) ended at $2.626, wave ((iii)) ended at $2.547, wave ((iv)) ended at $2.575, and wave ((v)) ended at $2.49. This move lower from August 14 high (2.642) to 2.49 completed wave 1 in the higher degree.

Wave 2 bounce is currently in progress to correct the cycle from August 14 high. The internal of the rally is proposed to be unfolding as a double three Elliott Wave structure. Up from $2.49, wave ((w)) ended at $2.549 and wave ((x)) ended at $2.528. Wave ((y)) of 2 is expected to reach the blue box area of 2.587 – 2.623. From this area, Copper should then resume lower or pullback in 3 waves at least. We don’t like buying the metal. Expect the metal to find sellers and extend lower soon or at least pullback in 3 waves as far as pivot at 2.642 high stays intact.

"COPPER (XCUUSD): ready to go up" by ThinkingAntsOkDaily Chart Explanation:

- Price is against a Weekly Support Zone.

- Price is under a Descending Trendline.

- Bullish Divergence on MACD.

- If price breaks the Descending Trendline at 2.68, potential to move up towards the Resistance Zone at 2.96 and, then, to the Weekly Resistance Zone at 3.2.

Our Weekly Vision supports this potential long idea. Take a look!

Weekly Vision:

Updates coming soon!

Copper: Buy Opportunity after a successful 1M Support test.Copper has touched the 1M Support (2.5400 - 2.5300) on the first week of August and has been rising since. This indicates that this long term demand level may once again accumulate long term buyers. It is still though on the early stages as 1D remains mostly on neutral grounds (RSI = 46.067, Highs/Lows = 0.0016, MACD = -0.018) so investors still have time to enter. The Resistance levels on 1D are two: 2.74500 provided by the MA200 and 2.8000 - 2.84000 provided by the symmetrical Resistance Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

HG1! - COPPER FUTURES - What to expect on DAILY/PREDICTIONI picked a random futures chart and copper seemed to have a nice setup in process. Might actually take this trade. Red circle shows closes above last move down to make our low, signaling possible trend reversal. At this point we are now in the middle of the pullback and it looks like it might make the desired higher low. This is where I would get long and take profits as it pushes to make the swing upward. Green hand drawn line is my predicted path of price action, just for fun. NOT TRADING ADVICE. TRADE SAFE.