Copper Futures HG1!

Copper in RiseIt is not new that this year 2019 with the rumors and the suspension of tariffs added to it the good perspectives on a possible agreement between China and the United States. pushed the red metal ( copper ) ,but approaching a great ressitencia, follow the good forecasts is not unreasonable the price continues to climb positions, but all this will be seen soon.

Copper (HG1!) - Aiming for 618 Fib (18% move from January bottomFundamentals:

No major supply disruptions occurred in 2018 and most labour negotiations have been agreed. However, overall growth has been negatively affected by lower output at some mines in Canada and operational problems in China, Peru and the United States. As a consequence the ICSG growth forecast for mine production was revised down to 2% compared with the previous forecast of 2.9% made in April 2018. knowing this growth in 2019 world mine production, adjusted for disruptions, is predicted to be around 1.2% and is expected to be impacted by a sharp decline in Indonesian output.

Copper also tends to more sensitive to inflation and moves correlated. Inflation base case is mild inflation which should support copper prices.

Technicals:

Copper had a double top formation in 2018. First peak hitting in January 2018 and second in June. From there the commodity dropped nearly 25% from a high of $3.30 to a bottom in Aug 2018 at $2.50. The metal climbed to its 38.2% Fib extension before trading down for a double bottom technical bounce in Jan 19'.

Indicators:

Stochastic: Overbought

RSI: 69. Near overbought

ADX: 23. Bull trend confirmation intact.

Copper Bulls have the technicals, momentum and industry production support for a continued bull run in all of 2019. We expect prices to test in 2019 the 618 Fib, which would be a 18% bounce from the January bottom this year at a target price of $3.01.

Copper: Sell opportunity on 1D.Copper has been trading sideways on 1W (RSI = 50.950) since late July within a strong 2.5425 - 2.8715 consolidation zone. The price was rejected last Friday on the 2.8390 - 2.8715 Sell Zone and since 1D turned already to neutral CCi = 33.6567, Highs/Lows = 0.00000, a strong sell opportunity is presented. We are taking this short signal with TP = 2.6665.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

Copper Futures (HG1!) Summary for End Week 4 - 2019So copper seems to have bottomed twice around the 2.60 area and is trying again to push higher following its rapid demise mid 2018.

Technically we can see the chikou san is still below price 'N' periods back and the tenkan san is yet to cross the kijun san to signify the possible start of an uptrend. However it's going to have to push through well set resistance at around 2.74 before hitting further potential resistance at the bearish kumo above.

Fundamentally the elephant in the room is of course China and much depends on the on-going trade spat with Trump and the apparent slow down in growth. We still need to keep an eye on the strength of the US$ which seems to be treading water right now. All that said, potential supply constraints are likely to help support price and if two or more of the above conclude favourably, we may well be able to retest the 2018 highs of 3.30 and above.

[Do your own research - above not investment advice and for my own analysis, though constructive comments always welcome)

WAIT FOR NOW

XCUUSD Copper: Bearish Trendline is brokenXCUUSD Copper ( Spot FX Rate ) is trading at 2.6570 as of writing.

We see a bullish bias in the industrial metals sector, triggered by the US/China trade talks.

On the smaller charts, Copper broke the bearish trend line. Metal is printing a cup and handle pattern.

Copper: Buy opportunity on a 1W Rectangle.Copper has been trading within a long term 1W Rectangle (STOCH = 49.048, Ultimate Oscillator = 49.708) with 2.52850 - 2.53850 as the Support zone and 2.83470 - 2.84595 the Resistance. A repetitive pattern that stands out is a sharp rise that is followed every time after a 1D Lower High sequence breaks to the upside. We are currently close to such an event so we are on a medium term long with TP = 2.78300.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

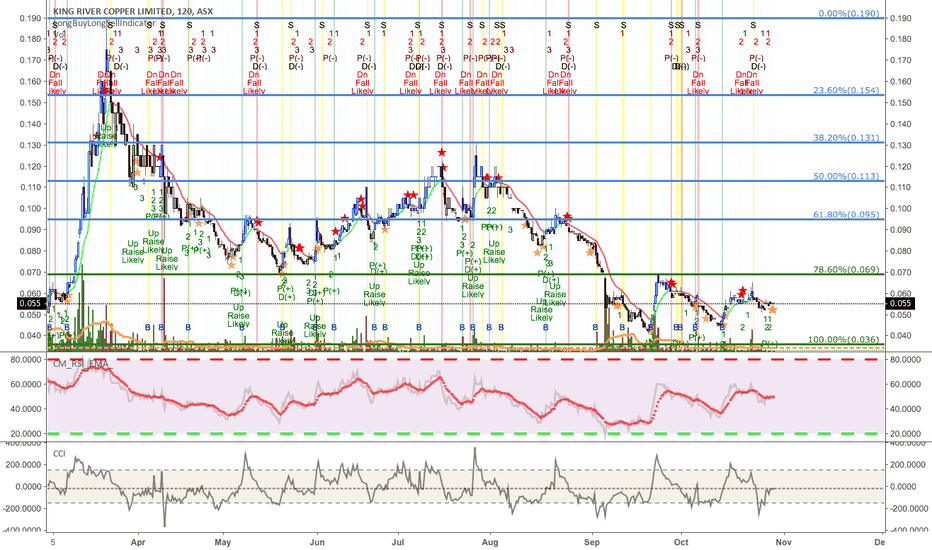

King River Copper - ready to go up as Cu/V2O5 ready to go upKing River Copper: KRC HG1!

Copper is showing key crossing of 20/50/100 day MAv and this Australian miner also produces Vanadium Pentoxide used for High Strength Steel, Aerospace engines, and rebar for concrete reinforcement. Currently below 786 Fibonacci Retracement and low bid entry 0.05 area.

What Can Doctor Copper Tell Us?With a PhD in Economics, what can Doctor Copper tell us is going to happen next in the economy? Since 2004, the price of copper has exploded above $1.5 a pound, seemingly corresponding with the timing of tremendous growth in the Chinese economy. Now that their economy is slowing down, what can we expect?

Doctor Copper says to expect lower economic activity over the next couple of years…

HG1!Southern Copper Corporation is an integrated copper producer. It produces copper and, in the production process, obtains several by-products, including molybdenum, silver, zinc, sulfuric acid and other metals. Its segments include the Peruvian operations, the Mexican open-pit operations and the Mexican underground mining operations segment identified as the IMMSA unit. The Peruvian operations segment includes the Toquepala and Cuajone mine complexes, and the smelting and refining plants, including a metals plant industrial railroad and port facilities that service both mines. The Mexican open-pit operations segment includes the La Caridad and Buenavista mine complexes, and the smelting and refining plants, including a metals plant and a copper rod plant, and support facilities that service both mines. As of December 31, 2016, the Mexican underground mining operations segment included five underground mines that produce zinc, copper, silver and gold, a coal mine and a zinc refinery.

SCCO

HG

AMEX:COPX

Copper: 1D Channel Down. Short.Copper (XCUUSD) is trading within a 1D Channel Down (Highs/Lows = -0.0144, B/BP = -0.0590) after having made a Double Top at 2.8400 (late Sep, early Oct). If the previous 2.6887 Lower Low and 1D support is crossed then HG1! should make a new 2.6600 Lower Low and attempt a break out. Otherwise the Channel Down will make a new Lower High near 2.7800 before it attempts to break the 2.6887 Support again. In any case the long term trend as suggested by 1W remains bearish (RSI = 43.931) so shorting every Lower High is the most optimal approach. Our TP is 2.6600 and 2.6000 in extension.

HG1! Is Copper ready to make a move?HG HG1!

Copper has been bottoming for quite some time. Economic trends are plumbing/housing, electronics, and EV vehicles, so let's step back and review.

* Oversupply for quite some time.

* Copper prices are historically peak in December.

* Housing/construction build rates for SF/MF/5+units is steady Yr/Yr for 5-yr and slight growth if any.

* Electronics is in steep decline from overstock parts and US-China trade war

* Electric vehicles are the new growth at 150+ lb. / vehicle for motor windings for copper, trend to continue as EV Class 8 heavy trucks will use 300+ lb. / truck (TESLA/NAV)

* Current chart showing upward movement from 618fibretracement to 500fibretracement as positive.

Maybe a micro trend without larger scope of current global economy, but something to watch for safe haven opportunities. VIX

The yuan hit a fresh 21-month low against the U.S. dollar Thursday, and the Shanghai Composite Index has lost about a quarter of its value so far in 2018.

ASX:KRC NSE:HINDCOPPER ASX:NZC OTC:CPPMF AMEX:COPX NYSE:SCCO ASX:CCZ TSX:NCU FWB:COQ OTC:HDRSF CCJ

Trading inside a Rectangle. Short.Copper is trading sideways for more than a month now within a 2.5400 - 2.7350 Rectangle on 1D (RSI = 56.012, MACD = 0.000) and the High Volatility (ATR = 0.0544) ensures the preservation of this neutral action. As seen the price has just been rejected on the Resistance, so we are now short aiming at 2.565.

Copper: Trade war fatigue and 2-week high is bullishThe news has been bad around China and the trade war- but perhaps some relief is due as fatigue sets in

Copper has broken out of a triangle base

Scenario A) Broken trend line provides support on a pullback for bigger move to 2.86

Scenario B) Old highs at 2.75 hold and price drops back into its range