XRPUSD Double BottomHi all, looking on the weekly, this might be a larger run ahead of us.

The weekly shows a Double Bottom, With Hidden Bullish Divergence.

Should reach $4.5 according to the larger cup size, maybe $5.

The divergence makes it more probable to break out.

Not financial advice, just my next move.

Happy & safe trading.

Hidden Bullish RSI Divergence

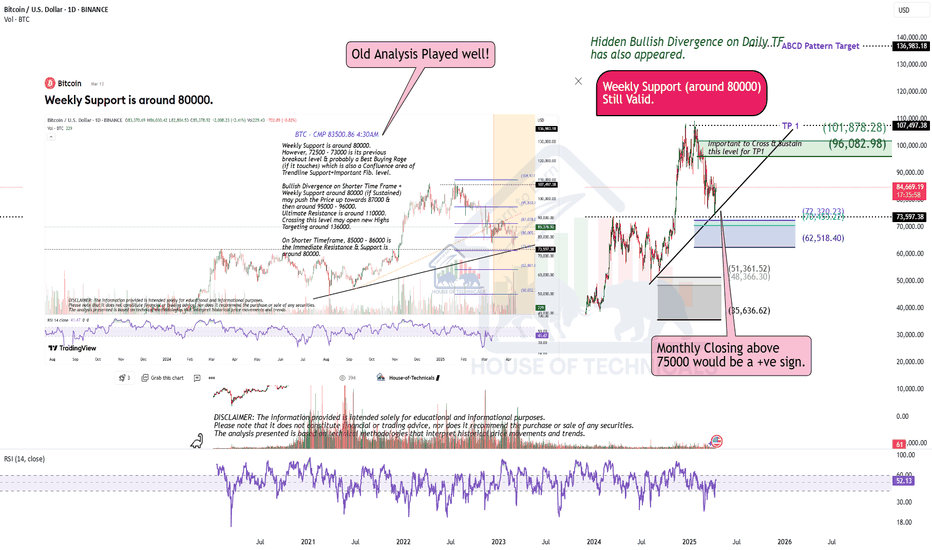

Hidden Bullish Divergence on Bigger tf.IMAGE

Closed at 21.94 (27-05-2025)

Hidden Bullish Divergence on Bigger tf.

Monthly Closing above 20.70 will be a

positive sign.

Upside Targets can be around 26 - 26.50

On the flip side, 20.50 - 20.68 is a Good

Support zone and then around 19.

Should not break 17.30, otherwise we may

witness nd Reversal.

Hidden Bullish Divergence will play?as mentioned during market

timings, 36.50 was important to

sustain. It could not and hit the

Lower Lock at 36.03

Next Support is around 34.50 - 34.62

Now it is Important to Sustain 36.50 - 36.70

on Weekly basis.

Monthly Support is around 35.

One +ve sign: Hidden bullish divergence has

also appeared.

Played exactly the same as predicted last week. KSE100 Closed at 114113.94 (02-05-2025)

Played exactly the same as predicted last week.

Now seems like Hidden Bullish Divergence is appearing.

Important Supports :

S1 around 113100 - 113400

S2 around 110500 - 110800

Important Resistances :

R1 around 114630 - 115120

R2 around 117000 - 117500

Tue 15th Apr 2025 GBP/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Buy. Enjoy the day all. Cheers. Jim

XRP Continues to Mirror BTC's Macro Pirce-Action; Only Slower.XRP since it was listed on Poloniex back in 2014 seems to have mirrored the overall price action of BTC over the years but at a much slower pace.

It would appear that BTC makes the move first then XRP takes about 65% longer to make a move of equal significance.

We can see that BTC had a Major Pump in 2013 and that from there it traded within a range until 2017 before rising 5,424%

XRP's story appears to be the same but with the small twist that it is still trading within it's Multi-Year-Range that it's found itself trading within after a huge 2017 rise.

2022 will be coming to and end soon and it will soon be that XRP has traded 6 Years within this range and just like BTC in the past it appears to be holding on to a trendline, if XRP goes like how BTC went, then we should expect XRP to be nearing or even above the top of the range Several Months after it's first test of the trendline which would point us to February 2023.

If XRP's Multi-Year-Range Breakout lives up to BTC's, I would expect to see an approximate 5,400% pump from XRP's Range Highs which would take it up to the seemingly insane and "unreachable" target of $120.94

We even have some added Monthly MACD Hidden Bullish Divergence to back XRP up.

Fri 4th Apr 2025 AUD/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/USD Buy. Enjoy the day all. Cheers. Jim

Thu 3rd Apr 2025 NZD/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a NZD/USD Buy. Enjoy the day all. Cheers. Jim

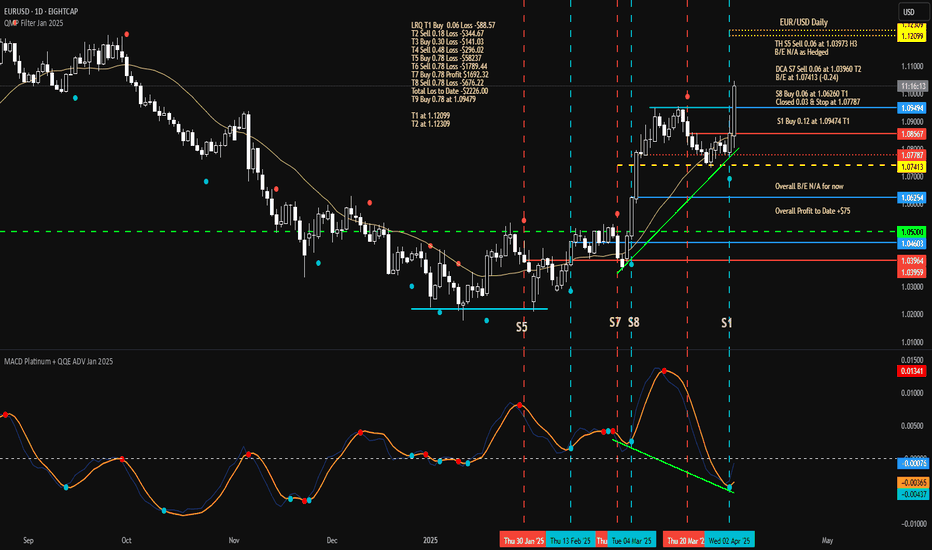

Thu 3rd Apr 2025 EUR/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Buy. Enjoy the day all. Cheers. Jim

Thu 3rd Apr 2025 GBP/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/USD Buy. Enjoy the day all. Cheers. Jim

Bullish Divergence on Monthly TF.Bullish Divergence on Monthly TF.

Weekly Support seems to be around 30.

& Important Resistance is around 32-33.

Though a re-testing of breakout done. but

Important to Sustain 24.90

As of now, Stock is in sideways movement;

& it will be Bullish once it will cross 36.

A positive point is that there are multiple

bullish / hidden bullish divergences on

different time frames.

Hidden Bullish Divergence appeared.Hidden Bullish Divergence appeared.

Breaking Out a long Consolidation Box around

145 - 149.

164 - 169 is a Strong Resistance zone.

If this Level is Sustained, we may witness

200+

However, if 135 - 136 is broken, more Selling

Pressure will be witness & it may drag the price

towards 113 - 115.

Tue 18th Mar 2025 BTC/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Buy. Enjoy the day all. Cheers. Jim

Wed 5th Mar 2025 XAG/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAG/USD Buy. Enjoy the day all. Cheers. Jim

Fri 28th Feb 2025 USD/SGD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Buy. Enjoy the day all. Cheers. Jim

Bitcoin - preparing for a Mega bullish waveThe weekly chart is bullish for Bitcoin.

It shows a hidden bullish divergence on RSI, indicating that the price trend is likely to continue upward.

Additionally, the chart highlights a double bottom pattern on HTF.

Bitcoin maintaining support at 0.786 Fibonacci will give it the momentum needed to create a new high.

A new all-time high (ATH) for Bitcoin is expected in the coming weeks.

Best regards Ceciliones🎯

Fri 21st Feb 2025 BTC/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Buy. Enjoy the day all. Cheers. Jim

Mon 27th Jan 2025 GBP/AUD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/AUD Buy. Enjoy the day all. Cheers. Jim