Higherlow

$UAVS - low risk/reward - low float / insider buy/ accumulation$UAVS

1. recent contract news

2. Had major catalyst last month from news

3. Accumulation near .27-.30 range/ Insider buys insideri.com

4. Uptrend - making higher lows

5. low float / low volume

I think this might have another nice catalyst..

IDEA

1. buy near support area .27 - .32 (Someone is watching the tape so I would scale out at any 6-8% and rinse and repeat. / I think over .42 buyers will start to load more.

2. Set a tight Stop loss at .03 below your entry (I would do mental stop and honor it if it breaks that level).

Lots of bag holders from the last catalyst so I think this might run again.

Long term play - do your DD as I think there's growth with this company and contracts. however, it's all speculative unless the company comes out with PR to back it up.

Good Luck and play with smaller size to average down.

CCS - Long - Rectangle Break AboveBreaking out of the rectangle, also fits the ascending wedge pattern with a break above. Will give it a shot and bet on the trend. Positive earnings. Stop set if it falls back into the consolidation range = trend failed.

Wary of extended SP500, but following price as always.

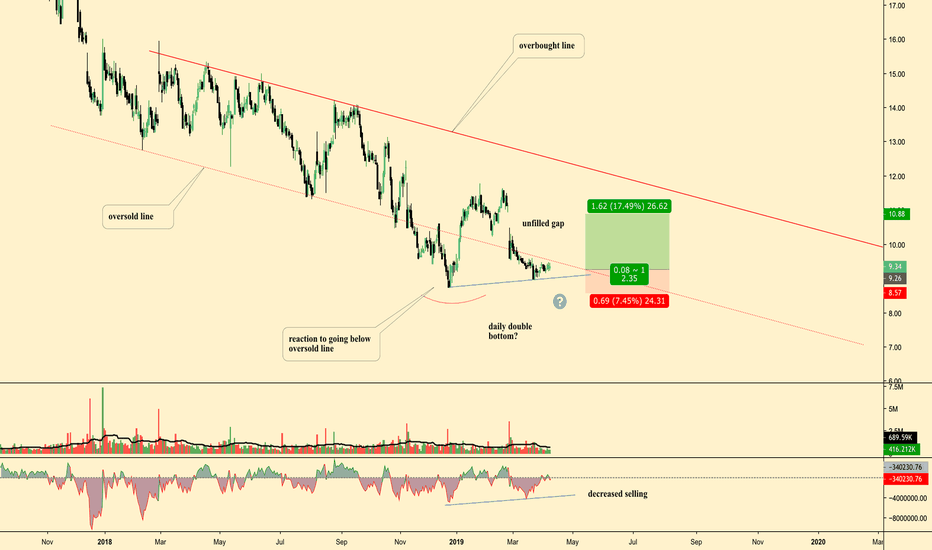

TIVO Long OppAnnotations and Ideas provided on chart

General Idea:

Possible Double Bottom, w/ second bottom forming higher low

decreased selling on second bottom

Price trading in oversold territory (below the channel)

Unfilled Gap that also coincides w/ local HVN (not marked)

DXY - Further Upside Following FOMC ? Looking at the fundamentals this week, we have the CPI data as well as the Core CPI data being released on Wednesday with positive forecasts as well as the FOMC Meeting Minutes later that evening. We then have news affecting a variety of currency pairs as we prepare for the OPEC Meetings, otherwise known as the Organisation of Petroleum Exporting Countries. This group is responsible for 40% of the worlds oil supply which is a substantial % holding, so we can expect major volatility, CAD of course is the most effected pair correlating with Crude Oil. As well as this overall news occurring in the world, we have the PPI data release on Thursday with another positive forecasting.

Jumping to technicals and we are still in this ascending channel that I have shown in a prior article, however, looking at a more refined channel ( this isn't hi-lighted on the chart ), but if you draw out another ascending trend line from the higher wick of the 9th of October in line with the higher wick of the 2nd of January, 15th of February and extended into the future, we can see smaller refined ranging price channel.

Looking at this channel, as well as the monthly key level, we can see we are running out of steam and I believe we can see a pullback before going long on this DXY. The 61.8-78.6% Fibonacci level is hi-lighted in purple on the chart as well as the 71% Fibonacci level is laying on the weekly key level. We had a lower low prior and if price forms a lower high at this current price, we should be set to go short, HOWEVER, we have many significant higher low swing points and thus, I don't see structure as broken just yet.

We also have a new potential Head & Shoulder pattern which will confirm price retracing and falling to the downside to test the weekly key level of 96.25 before going long. With this in mind, Gold should push up, allowing our targets of 1304 being met and a potential reversal/short I anticipate. My bias for the year has been bearish for Gold and I still predict a large downside move to 1260 price region. So this can set us up for a high R/R setup. Drawing a counter trend line from the head to shoulder, we have a 3 anchored wicks showing some favourable downside potential.

I have a current neutral standpoint on this Dollar Index, but I expect price to fall before a continuation to the upside. As always, take risk/money management into consideration and follow these news events as volatility is expected and we can definitely capitalise on the volume around these news events.

Litecoin: 48 And 56 Key Levels For Profit Taking?Litecoin update: I have to give credit to Andrew on this one because he has been calling this long in our chat room since it broke the 34 resistance. And now that Bitcoin has spiked higher (our first profit target at 3825 was reached), Litecoin appears to be on the move again. Andrew actually shared some valuable insight around the higher low and break of the 41.89 level as well for a continuation trade. For those who missed this, now is NOT the time to start buying, especially for short term swing trades. The 48 resistance if anything is a level to lock in profits. The other factor to be aware of is: there is a potential double top formation here. If Bitcoin starts lingering again, LTC is in a position to fake out. That does not mean that it will, it is just that the reward/risk is no longer favorable like it was at lower levels. The next key resistance is the 56 area which is what we are considering as a target when the next long setup appears. Overall, I can't say it enough times: PATIENCE PAYS. All during the bearish environment we were extremely conservative, very selective with our trades and MISSING out on some small moves while avoiding persistent losses. Now as the environment improves, we are in position to profit, not climb out of a hole.

Bitcoin: Structure Still Says Strong. 4K In Sight?Bitcoin update: Price continues to hold up and is now taking out the minor bearish trend line that has been in place over the previous week. It is nothing to get overly excited about, BUT it does add to the argument in terms of further strength. This entire space is not exciting enough to attract a constant flow of new money, so it needs surprise news or catalysts in order to make any significant progress. This limits the effectiveness of technical analysis but does not render it useless.

The news about the SEC's comment about an eventual "ETF" and now JPM's creation of their own currency are certainly positives for the future of this space. And judging from the recent price action, again the short term patterns may not be very reliable, but the broader structure is.

After the news spiked the price over a week ago, it has been lingering lower, but not decisively so. We have been explaining to our followers that as long as Bitcoin does not give back the gains made by the large bullish candle, strength persists. Even in the face of increasing short interest.

We carry long term inventory and a short term swing trade. In order to be in on the next leg up, you just have to be in and wait for the next news item to come out and surprise the herd. Bitcoin is a very emotional and ignorant market and the smart money knows it. And they use this to their advantage with the use of market moving information timed at their convenience.

Just from my observation, there are many examples of analysis all over the internet that over complicate this. Perhaps they do this in order to attract attention since "more is better" appeals to the majority of investors, traders and gamblers.

For us, the situation is very simple: Either Bitcoin takes out the 4K resistance area upon its next catalyst, OR it takes out the 3350 area support. Based on recent structure, price appears to be poised to go for the 4K but we also know that ANYTHING can happen. Some news item can appear out of no where that sparks a push to 3250. You cannot predict these events, but you can prepare.

In summary, when it comes to timing any financial market, everything is about "IFs". IF Bitcoin pushes into the low 4Ks, we have profit targets in place to capitalize on the move. IF price takes out 3350, we will be stopped out of our swing trade, and we then wait for the next setup to get back in. IF price takes out 3250, we step aside until stability can reestablish itself. That is our plan in a nut shell.

Market timing is about having a process and following it. Our process considers many variables, and we make every effort to simplify each step in order to minimize indecision. There comes a point where there are compelling reasons to still be in a trade, and when there are not. At the moment, Bitcoin still provides a compelling argument for longs even though price appears to be static for prolonged periods.

Even though this is a primarily event driven market, that doesn't mean charts are useless, it just means you need to recognize the value behind the subtle clues that are still available. Do not make it more complicated than it is: higher lows often lead to higher highs.

BTC Update! Weekly HIGHER low set. ETF coming?!?Been a while and well honestly, market was boring so had nothing really to discuss. About 10 days or so ago was last post and we sat around $3400 and this morning we were sitting just around there still. And then things took off.

$20k here we come! Right?

Well maybe. So from some brief looks around, it appears everyone is all jazzed up about SECs quick statement regarding a BTC ETF. The quote I read regarding it was as follows:

"eventually, do I think someone will satisfy the standards that we've laid out there? I hope so, yes, and I think so"

Positive? Sure. Time frame given? No.

So everyone rushes in as this is greatest news ever. Price pumps and now we wait, a day, a week, a month? Not sure. But if no sign of ETF approval actually coming anytime soon, I'd be concerned with down everything falls again.

Great trade opportunity if in early here? Absolutely. Especially on LTC or ETH.

But lets take a look at a bigger picture. The weekly chart.

Been a while since I included this in any chart posts but since our plummet from $6500's in November and our eventual bottom at $3129 in December we watched the following:

Bounce from $3129 low to $4239. This becomes a lower high on our weekly.

Bulls then prevented a lower low from coming in and now the low of last week could be a Higher Low which was at $3338. Need to see some further follow through here on BTC to confirm but I'd lean likely $3338 will hold as a higher low.

So in order for bulls to change the trend on this weekly chart, they need to get a Higher High compared to $4239. Anything below is just another lower high and puts the bulls right back on the defensive in trying to prevent a lower low from coming in.

More positive news from SEC would certainly help. An ETF actually being approved would certainly get us the higher high on weekly. But otherwise its still a battle for these bulls. Looking at LTC weekly chart however and they actually did get a higher high on the weekly! LTC had a low of $22.17 followed by a lower high of $41.27 and then a higher low just like BTC is likely giving us and now a higher high on weekly for LTC with it thus far topping out at $44.38 today. So an incredible 100% bounce since the December low on LTC and what is a much healthier pattern on weekly than BTC is at thus far. So bulls need to see BTC follow in LTC's footsteps in terms of patterns on the weekly chart and find a higher high. Unlikely in my opinion as even from todays high so far, still another 14% or so away. But stay patient if bullish, stay protective. If you caught this move early and are in profit, protect them. I personally missed in and have been just too busy to watch the market much this week. But with some consolidation on some of these names, I'd certainly consider scaling into positions to see if they can make a push higher but remain far from changing overall outlook to bullish.

Just My 2 Sats!

Possible long on PSGJSE:PSG has broken out of the sideways trend that it has been trading in for quite a couple of months. It has formed two higher lows in a row and has broken through the long term resistance and bounced off of it as support.

If the price moves above the last high I will enter a long postion.

failed too close above 0.32650. i think more DOWN will comeas we can se, we failed to close above 0.32650 yesterday. and as we can see. the bears are now in control. i think we will go down to the big blue line, that is a very interresting fib. level, and also ( compared to the bull-run off 2017) a very big by zone. if we can go down and reach the levels arround ( 0.31000 - 0.30960 ) in the big green box. we could, put in a HL on the daily RSI. ( PICTURE IN THE COMMENTS) and a VERY TIGTHT LL on the graph. wich is a very good thing!!. and if we close in that area, the RSI will be in a very good zone in general ( 39.6500 - 40.000 ) compared to the fib. levels.

remember to be VERY carefull and look after price action in the " accumulation zone" there we have an opportunity to put in a, BIG dobbelt bottom.

there is a opportunity, to close this day over 0.32200 if we do that, i still be bullish on this pair. but rigth now, i am bearish.

TRADE SAFE!!!

NZDUSD long swing tradeHi traders,

this is my buy setup for NZDUSD on daily timeframe.

As you can see the price have find support in the golden zone and have build a higher low

on the D1 chart. This give us a good Idea to go long with a swing trade long setup.

I wish you a good trading week.

Best wishes Stefan Forex

Bitcoin: Testing Lows Is Part Of The Process?Bitcoin update: Price is beginning its first real test to prove if the recent rally is truly the beginning of a broader recovery, or not. The chart formation that is still developing can be the sign of the bottom that everyone has been waiting for, but it still has a ways to go in terms of proof. On the other hand, if price clears the newly projected support levels, Bitcoin could be testing 3K again quickly.

If you have been following our analysis, you should know by now that tops and bottoms take time to develop. Part of that development process is for price to generate and test new support and resistance levels. How the market chooses to deal with these levels is where trading opportunities can come from, but letting the market decide is key.

Since the move from 3150 to 4230, Bitcoin has two projected support areas of 3800 and 3450 respectively. Simply reaching a level is not enough, the question is what kind of price action appears at the level? Candle stick reversals would be one type of signal that would call our attention to another potential swing trade long.

By waiting for such a signal, you can better avoid the all too common mistake of jumping in too early, only to watch price push to new lows. Remember this market is not out of the clear as far as the short term bearish trend is concerned. Price needs to close above the 4400 area (COINBASE) to increase the probability that a bottom has been established.

Since Bitcoin has not proven that a broader recovery has taken hold just yet, we continue to maintain a strong defense. This means long signals are considered aggressive (small positions), and trade management is tight. This defensive stance is what allowed us to come away with a 192 point profit as opposed to a 240 point loss in a recent swing trade that we shared with our followers.

In summary, timing Bitcoin successfully is possible, but it will not come from following others analysis (ESPECIALLY from the majority of "experts" on here). Success begins with a particular mindset.

We receive a lot of questions from inexperienced investors asking if they have "missed" the bottom since the Bitcoin short squeeze. They ask this from a mindset of "scarcity", which is the natural human reaction and also the first step toward failure.

The fear of missing out is exactly that. And that fear often leads to expensive mistakes, large losses and empty accounts. If you want improve your performance, forget charts and oscillators, start by reshaping your thought process.

Stop chasing scarcity, and instead begin your thought process with the idea that opportunities in any financial market are infinite. What IS scarce is their frequency, but there is a very simple solution to that and it is called patience. Remember missing signals doesn't wipe out your account.

Have you missed the bottom? Buying at or near the actual bottom is a low probability game. You don't need to buy the bottom or sell the top to show a positive performance. If Bitcoin is going to sustain any significant recovery, there is a good chance it will produce more signals along the way. Signals that offer clear and attractive reward/risk. It is just a matter of having the patience to let it prove itself.

This is a game of psychology. Charts can help us measure probabilities that are based on the natural tendencies of human behavior. If you cannot interpret the psychology behind all the pretty graphics that a chart provides, then you are making decisions based on random lines.

BTC Update! Following pattern nicelyYesterdays chart we were watching the bulls as well as the shorts chart and I stated "in order to see these shorts get squeezed, the bulls need to break above $3486 (perhaps to somewhere in the 3500's) and then pull back briefly for a higher low and then break out again and into the 3600s+ for shorts to truly feel any pressure and create the squeeze to give a good size run up"

The bulls were able to break above $3486 and ran another $100 up to $3586 before pulling back to set their lower high which they set down at $3437. Bulls are now back on the move and would love to break into $3600's tonight. If they set a lower high here, they'd then again look for a higher low and just tighten up the pattern before the eventual bear or bull break.

I personally did scale into positions in the upper $3400's on the consolidation yesterday and will comfortably use the stop loss from our higher low. Thus far, volume looks fine with no red flags. EMAs on 4 hour are slowly catching up and could potentially serve as a support (as well as another higher low) tonight or tomorrow. Its nice to see some bullish movement but still a lot of work on daily and weekly charts to reverse any trends on the larger time frames.

Just My 2 Sats!

BTC Update! Bulls beat EMA resistance now want it as support!Last chart we were looking to see which direction BTC broke either Sunday or Monday. The break came Sunday and bulls were able to get to a new high off their recent lows.

$3643 is now the resistance to watch and bulls have a higher low down at $3254 they now want to protect. Bulls were able to get above 12 and 26 EMA resistances on 4 hour chart with the move yesterday but continue to remain under the 12 EMA on daily chart. Since pulling back here the bulls are seeking another higher low and appear to be try to hold 12 EMA on 4 hour as support with bulls buying up anything when it dips below 12 EMA. But anything above $3254 would give a nice higher low and then bulls would seek another higher high to try and shift the trend.

Bears have covered a significant amount of shorts over the last couple of days but never saw enough pressure from the bulls to create a short squeeze and really get BTC running higher. The overall lack of a significant/sustained bounce from our lows has me continue to think long term our low is not set but as one who only trades bullish, sure would like a shift in the trend to give the bulls a little rally even if only for a week or two. But will wait for bulls to show some proof they aren't going to just lay down and let the bears take right back over this week.

Just My 2 Sats!

BTC Update! 4 Hour found its higher low and another higher highYesterdays post we had touched $4350 and I was personally looking for some consolidation as the 4 hour chart was over extended so I had scaled out of 80% of my position and potentially looking to reload on the consolidation. We reached $4365 and then consolidated back to $4078 (so about a 6.5% pullback). Perfectly healthy and expected and then BTC broke out over night (my time) to another higher high at $4415! I am a bit surprised at the higher high as ETH and LTC have not accomplished this and formed their 4 hour higher low and thus far a lower high. I have moved my SL up based on the 4 hour higher low for the remainder of my position and thus far did not reload anything from the portion I had taken profits on. Being a bit cautious as Shorts are still extremely high and just don't care to cover much and with ETH and LTC showing a bit more weakness in not making a higher high again, makes me concerned we may see the same start to show up with BTC. So just staying protective, was a great trade and no need to take on anything risky here. Lets see how the day plays out.

Just My 2 Sats!

BTCUSD - Modeling 29 June as pivot point for BTC recoveryBTCUSD - Was 29 June the pivot point for the future of BTC?

This was my procrastination project for the day in between working.

29 June may have been the turn-around for recovery in the BTC 2018 crash.

What we see since then is a consistent rejection of what appeared to be an establishing downward LL trendline.

While the 14 Aug HL may have been an anomaly, the 08 Sep HL appears to be a confirmation of the changing low trendline.

The tightening market led to some minor confirmations, but I am not personally convinced of an incoming bull market unless BTC can recover from (approx) $6000.

At the moment, this chart is not making any claims to incoming markets. All indications I have are that it is totally unpredictable what is going to happen come the end of the squeeze and volume likely returns.

Today's breakout above the 05 Sep to 22 Sep high trendline possibly is a minor sign of a coming bull market.

It remains to be seen if the 24 July to 05 Sep high trendline can be broken, and most tellingly, the 5 March to 24 July high trendline.