USDCAD: Shorts to 1.24000!4hr Time Frame: Reading price action we can see that we are on a long term down trend and a short term up trend that is looking like it is going to reverse. Price is testing a key psychological support and resistance zone in confluence with a rejection candle. If price holds below this zone, anticipate shorts down to 1.24000. However, if price breaks above, we must reevaluate price action. Due to the uncertainty of market fluidity, risk management is highly recommended.

Highertimeframes

EURAUD: Shorts to 1.52500!6hr Time Frame: Price is on an overall down trend which means we should be looking for long-term selling positions. Price has broken support and is testing resistance with signs of rejection. If price holds below resistance, we can expect price to fall to 1.52500. However, if price breaks above, we must reevaluate price action. Due to the uncertainty of market fluidity, risk management is highly recommended.

GBPUSD: Longs to 1.417500!12hr Time Frame: Price is on a long-term uptrend and has broken above previous areas of resistance as new support. At the same time, we can see price is creating an inverted head and shoulders formation in confluence with long wicks pointing to the downside. If price holds above this zone, we can anticipate longs to 1.40000 and potentially 1.417500. However, if price breaks support, we must revaluate price action. Due to the uncertainty of market fluidity, risk management is recommended.

EURGBP: Shorts to .85750!Reading price action, we can that EURGBP is on a long term down trend so we should be looking for long term shorting opportunities, we can also see we had a huge shift to the downside with a potential retest of new resistance. If price manages to hold below this zone, we can look to sell it down to .85750. However, if price breaks back above current resistance, we must reevaluate price action. Due to the uncertainty of market fluidity risk management is key.

EURUSD: Potential Reversals!6hr Time Frame: Reading price action we can see EURUSD has shifted in momentum and has created higher swing lows in confluence with the break of the counter trend line and potential inverted head and shoulders. If price manages to hold above this zone, we can look for longs too 1.23000. If price breaks the current support zone, we must reevaluate price action. Due to the uncertainty of market fluidity, risk management is highly recommended.

EURGBP: Wait for Pullbacks!Reading price action, we can see EURGBP had a huge shift in momentum to the downside, clearing .88000 key psychological support. If price pulls back and tests as new resistance in confluence with signs of rejection look to short this down to .87000 key psych. If price breaks above .88000, we must reevaluate price action. Due to the uncertainty of market fluidity, risk management is highly recommended.

USDCAD: Play the Levels!Reading price action, we can see USDCAD has been making a series of higher highs and lows. Price created a double bottom at 1.27500 key psychological and reacted however we failed to clear 1.28500. soon after price aggressively snapped back to 1.27500. If price breaks below, we will be looking for shorts down to 1.27000. If price manages to hold look for longs back to 1.28500. Due to the uncertainty of market fluidity, risk management is highly recommended.

GBPAUD: Longs to 1.80250!Daily Time Frame: Starting on the higher time frame we can see price has cleared strong areas of resistance and testing as new support. Reading the previous daily closure, we can see that price is reacting to 1.78750 key psychological support.

4hr Time Frame: Scaling down we can see price is testing support in confluence with the trend. If price manages to react, we will be looking for longs to 1.80250. However, if price breaks support and the uptrend, we must reevaluate price action. Due to the uncertainty of market fluidity, risk management is highly recommended.

BTCUSD: Potentially Setting Up A Move Higher Looks like this pair is setting up another impulse move higher — it is building momentum right below the ATH — the further it goes sideways here, the better it is for bullish continuation projection. If the time factor is scaled at the highlighted rate, and if this scale happens to be correct, the target area should be hit by 22 of March 2021.

If higher timeframes close above this key area , an immediate target would be the mid 60k area aka the 1500% increase point from Mar'20 low.

Staying tuned for further tells.

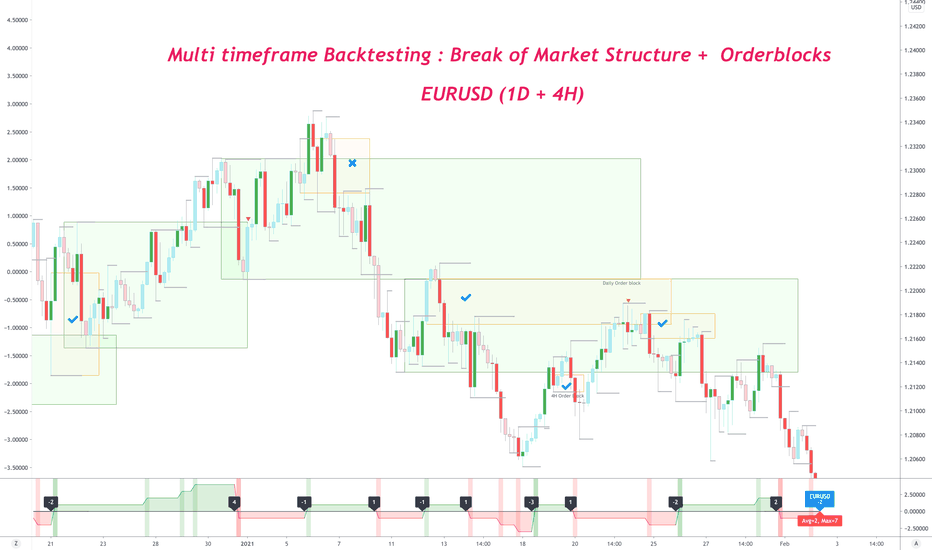

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

EURGBP: Are Bulls Back?Daily Time Frame: Starting on the higher time frame we can see price is testing a strong area of demand as price has reacted multiple times from this zone in the past. Reading the last few daily candle closures, we can see price is showing signs of slow down and potential reversal if we hold.

4hr Time Frame: Scaling down a time frame we can see price has had a bullish run and is potentially setting up for a reversal formation. If price manages to hold above .88500 key psychological support, we can see price rally to .90800. Due to the uncertainty of market fluidity, risk management is highly recommended.

AUDJPY: Read the Clues!6hr Time Frame: Reading our price chart above we can see price is trending up with that being said we should be looking for long-term buying opportunities. Reading the data, we can see time and time again price has faked out in one direction and snapped back in the opposite direction causing trader to get enticed thus generating more liquidity. Once you read the clues left behind you will be able to understand what the market may do next. AUDJPY is showing strong signs of confluence to the upside and if it holds above 80.000, we will be looking for longs. Due to the uncertainty of market fluidity, risk management is highly recommended.

bullish idea institutional trader price in re accumulation .. may price go down and kiss fair value gap and go higher. For entry go to lower timeframe .

EURGBP: Are Bears Back?8hr Time Frame: Reading price we can see that EURGBP was created a new swing low and has failed to make any new highs beforehand. after the double top formation at .92000 key psychological resistance and immediately reacted and broke through .90000 key psychological support. If price holds below .90000 look for shorts down to .88750 key support. However, if price snaps back above .90000 key psychological and retests look for potential longs. Due to the uncertainty of market fluidity, risk management is highly recommended.

EURGBP4hr Timeframe: Reading price we can see EURGBP is still creating higher lows. Although we can see strong shifts in momentum to the downside. A price approached .90000 key psychological support price could not break and close below for the 3rd or 4th time. Notice price created a double bottom and had a reaction. Price broke our first counter trend line and is hovering around our second trend line. If price holds above our blue support zone, we can anticipate further movement to the upside. However, if we fail to hold, we can anticipate shorts down to .90000 key psych. Due to the uncertainty of market fluidity, risk management is highly recommended.

AUDJPY: Bulls Breaking Levels!Daily Timeframe: Reading the daily chart above we can see that price is creating new highs and lows and closing bullish. With this type of momentum, we want to be trading in line with the market!

4hr Timeframe: Scaling down we can see price is on an uptrend and testing strong areas of support in confluence with the trend line. If price holds above this zone, we can see price push up to 78.750 key psychological. Until price violates this trend line, we will be looking for longs. Due to the uncertainty of market of fluidity, risk management is highly recommended.

NZDUSD, possible sell coming.Price looks like it could possibly form a head and shoulders pattern before selling back to this 4H trend line. Wait to first see price break below this gray support and resistance zone with the blue line passing through it before looking for a sell entry on a lower time frame. If this happens we can lookout for the break and retest before taking a bearish trade.

However, there is also the possibility that price could decide to respect this zone and continue to use it as resistance for future buys. Wait for additional confirmations before taking either trade.