High-Frequency Trading (HFT) in Forex and StocksHigh-Frequency Trading (HFT) in Forex and Stocks

High-Frequency Trading (HFT) has garnered significant attention due to its transformative impact on markets, reshaping the way they operate, influencing liquidity, price discovery, and overall efficiency. In this FXOpen article, we focus on high frequency forex and stock trading, its definition and its specific applications, pointing out the opportunities and challenges that this trading method presents.

High-Frequency Trading: An In-Depth Analysis

High-frequency trading represents a dynamic and swiftly evolving facet of the financial world. Understanding the basic HFT concept can help traders develop and employ advanced trading strategies.

Definition

At its essence, high-frequency trading is characterised by the swift execution of a substantial number of orders within exceptionally brief time intervals, often measured in milliseconds or microseconds. Traders engaged in HFT within the market leverage robust algorithms and state-of-the-art technology to scrutinise extensive sets of market data, facilitating swift and informed trading decisions. At the heart of HFT is its ability to harness even the slightest price differentials, allowing traders to take advantage of market inefficiencies that may elude traditional counterparts.

Key Features

The key attributes of high-frequency trading encompass remarkable speed, elevated order-to-trade ratios, and a dedicated focus on exploiting short-term fluctuations in the market. The primary objective is to execute a considerable volume of orders with precision, enabling traders to capitalise on momentary opportunities. This approach aligns with the broader domain of algorithmic trading, where pre-programmed instructions are believed to guide strategic decision-making for potentially efficient market participation.

HFT isn’t very common for retail traders. Usually, it’s done by institutional investors as this method requires significant funds and advanced software.

Strategies Employed in HFT Forex and Stock Trading

High-frequency trading encompasses a variety of strategies, each designed to exploit specific market conditions.

- Market Making involves the continuous quoting of buy and sell prices for currency pairs and stocks. HFT investors aim to capture the bid-ask spread swiftly, contributing to market liquidity. By providing liquidity, market makers facilitate seamless transactions on HFT trading platforms and play a crucial role in the efficient functioning of the markets.

- Order Flow Analysis: HFT traders analyse the order flow, seeking insights into the direction of large institutional orders. They may front-run these orders, quickly buying or selling to take advantage of subsequent price movements.

- Tick Scalping: This strategy involves making numerous small trades on tiny price fluctuations within milliseconds. HFT algorithms are designed to capture these minuscule movements.

- Machine Learning and AI: Advanced machine learning and AI techniques are increasingly used in HFT. These algorithms continuously learn from market data to refine strategies and adapt to changing market conditions.

Choosing the Right Tools in the High-Frequency Trading Landscape

The selection of the right tools is paramount for forex and stock traders, whereby several key components have to be considered.

Best High-Frequency Trading Software Can Unleash Algorithmic Power

At the heart of every high-frequency trading strategy lies powerful software designed to execute trades with speed and precision. The best high-frequency trading software incorporates advanced algorithms, machine learning, and artificial intelligence to analyse market data swiftly. These algorithms may help traders to make split-second decisions, leveraging the smallest market differentials. High-frequency trading software should also evolve quickly to meet the demands of modern traders. Such software cannot be launched on a regular PC.

High-Frequency Trading Brokers Should Facilitate Swift Execution

High-frequency trading brokers facilitate the rapid execution of trades and provide access to market liquidity. These brokers often offer low-latency connections, specialised infrastructure, and co-location services to minimise execution delays. The selection process involves the careful consideration of factors such as execution speed, fees, and reliability. High-frequency trading brokers typically offer integrated high-frequency trading apps that allow for real-time monitoring, instant decision-making, and swift trade execution. As the demand for flexibility and accessibility continues to grow, high-frequency trading technology has become an indispensable tool.

The Impact of High-Frequency Trading

High-frequency trading brings forth a dual-edged sword for forex and stock markets, with both advantages and concerns shaping its impact on financial markets. Striking the balance is essential for fostering a financial environment that encourages innovation while upholding the principles of transparency and fairness that retail traders rely on.

Advantages of HFT

One of the primary advantages of high-frequency trading is its positive impact on market liquidity. HFT strategies contribute to a continuous flow of buy and sell orders, which may ensure there is a ready market for traders to execute transactions. This increased liquidity may lead to narrower bid-ask spreads, benefiting market participants by reducing transaction costs.

Concerns and Criticisms

Critics argue that the speed and volume of HFT trades can be used to influence prices in a way that may not align with fair market practices. Strategies such as spoofing, layering, and quote stuffing have raised apprehensions about the integrity of market dynamics. HFT's role in the market has also been linked to increased volatility, especially during times of stress or uncertainty. The rapid execution of trades by algorithms responding to changing market conditions can amplify price swings, leading to concerns about stability.

Final Thoughts

Though institutional and professional traders are more likely to have the required financial resources to invest in cutting-edge high-frequency trading technology and infrastructure, retail traders can also take advantage of the HFT concept by researching the available options and understanding the market implications.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Highfrequencytraders

BA Buy Zone Triggers Short-term ProsNYSE:BA is definitely below its current fundamentals for the 1st quarter of 2024. This was the biggest gain of all the Dow 30 components yesterday.

It was an obvious reversal point at a prior Buy Zone at October's lows. Yesterday was driven by pro traders with a run up at open rather than an HFT gap up at open. We can also see the pro trader nudge pattern in the candlesticks before yesterday's move up.

It may consolidate before running up, but this support level is now established for the next move up.

Uninspiring Technical Patterns Ahead of NFLX EarningsLike many others, NASDAQ:NFLX has shifted to a wide sideways trend ahead of its earnings report today after the close. There is no pre-earnings run here. Current volume and price trend are not patterns that inspire a good earnings surprise.

HFTs are always watching news ahead of open on high-profile stocks to get ahead of retail market orders. A gap is likely at tomorrow's open.

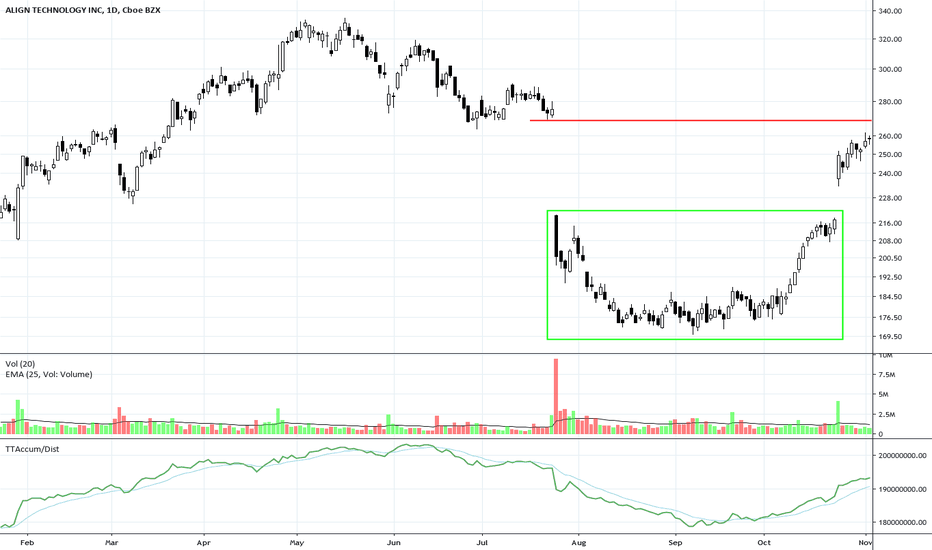

SYNA Platform Position Trading SetupSYNA formed a strong bottom based on hidden Dark Pool Quiet Accumulation that continues intermittently as the stock moves up over several months. There is High Frequency Trader trigger momentum periodically, which triggers Smaller Funds Volume Weighted Average Price orders. The control of price continues to remain in the giant Buy Side Institutions Dark Pool buying activity.

MCD Attempting to BottomMCD is struggling to form a short-term bottom at a non-support level. The stock had been under heavy distribution which triggered High Frequency Traders selling short as well as Pro Traders selling short, even while new Retail App Broker Investors were buying into the downtrend. Buy on the Dip strategies are in play, but the large lots overwhelmed the retail small lots. There is no Dark Pool Quiet Accumulation in this bottoming attempt.

EPZM High Frequency Trader Buying FrenzyEPZM ran quickly out of a very short-term bottom with High Frequency Trader action. High Frequency Trader algos are focused on 3 major industries at this time. This is creating opportunities for retail Swing and Day Traders who can enter with the Professional Traders, who are setting up for the High Frequency Trader algo triggers.

CTXS at Strong ResistanceCTXS has risen with momentum to challenge its previous all time high resistance level. It is currently in a retracement that has been triggered by High Frequency Trader selling. Support is weaker at this price level.

TGT Platform Position TrendTGT has a Platform candlestick pattern which is a Position Trading style sideways price action. It is indicative of Dark Pool Quiet Accumulation that then triggers High Frequency Trader gaps. The resumption of another Platform candlestick pattern indicates the accumulation is not over.