MVST, beginning of the new lithum hype? With ongoing US-China trade war, one of the key issues resides on lithium battery technology . Lithium technology is brought up as a national security concern . This is a tailwind for the industry .

Now let's get to the technicals.

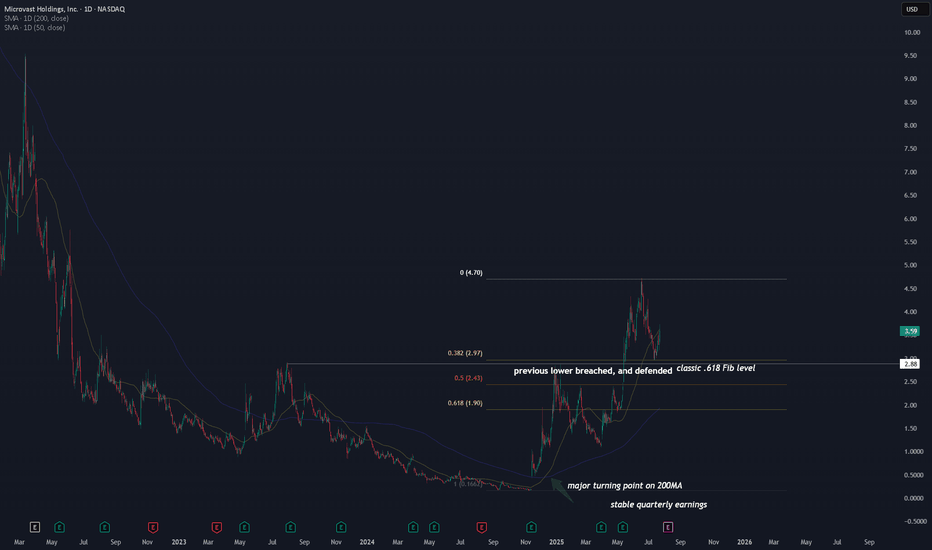

A major turning point on the 200MA . We haven't seen this happening since Dec 2020, when the stock first went public.

$3.00 key level is tested three times . This is not just a .618 Fib level, but the previous cycle high in 2023.

First test happened during Dec 2024, which it failed. Second time we saw the stock blew through this key level on May 2025. Lastly we saw a solid defense on this level on July 2025. If this level were to hold, the upside can be very high .

In addition to the technical side, the company is generating $100M revenue with neutral/break-even earnings this year, up from $60-80M in 2023 and 204. A steady increase in revenue , while not losing much from earning perspective.

This places NASDAQ:MVST at a tipping point . All it needs is some tailwinds from the new geopolitical conflicts , and we will see either an increase in revenue (scale up) or an improvement in profitability. Or both. If that were to happen, MVST will skyrocket.

I am watching and monitoring this stock as right now, I am expecting to add MVST to my portfolio once I see further confirmation.

Highgrowth

PERI : POSITIION TRADEQ3 : EARNINGS CALL HIGHLIGHTS:

Looking at the last 8 quarters, our ability to exceed the rule of 40 is not a series of anomaly or a one-off success. Quite the opposite, we are outperforming the industry because we are built on the fundamental recognition that adtech must be able to respond, underlying response to the trend with ability and agility.

Revenue of $158.6 million, reflecting 31% year-over-year growth, the highest quarterly revenue since 2014. Adjusted EBITDA of $33 million, 21% of revenue compared with 15% last year, reflecting 87% year-over-year growth. Net -- GAAP net income of $25.6 million, 141% year-over-year growth, the highest quarterly net income since 2014. Non-GAAP diluted earnings per share of $0.61, reflecting 53% year-over-year growth.

The third quarter revenue was $158.6 million, an increase of 31% year-over-year. The strong continued revenue growth reflected a CAGR 38%. Display advertising revenue increased by 26% year-over-year to $86.8 million, 55% of total revenue. Market adoption of our holistic video platform solution continued to rise. Video revenue more than 3% year-over-year, representing 44% of display advertising revenue. The number of video platform publishers increased by 88% year-over-year from 34% to 64%, and the revenue from retained video platform publishers increased by 67% year-over-year.

Third quarter OpEx and COGS amounted to $31.7 million or 20% of revenue compared with $33.1 million or 27% of revenue last year. This impressive achievement reflects the execution of our business strategy.

On a GAAP basis, net income was $25.6 million or $0.53 per diluted share, an increase of 141% compared with $10.6 million or $0.28 per diluted share in the third quarter of 2021. On a non-GAAP basis, net income was $29.9 million or $0.61 per diluted share, an increase of 94% compared with $15.4 million or $0.40 per diluted share in the third quarter of 2021.

Adjusted EBITDA of $33 million, reflecting 94% year-over-year growth, adjusted EBITDA margin of 21% compared with 15% last year. Adjusted EBITDA to revenue, excluding TAC increased from 37% in the third quarter of 2021 to 51% during the third quarter of 2022.

Operating cash flow was $34.7 million compared with $14.2 million in the third quarter of 2021, reflecting 145% year-over-year growth. As of September 30, 2022, cash, cash equivalents, and short-term bank deposits of $390 million compared with $322 million as of December 31, 2021; continuously generating positive cash flow.

Full earnings call transcript and presentation on the links below:

Transcript / Audio : seekingalpha.com

Presentation : wp-cdn.perion.com

The Great Reset of 2022In the light of a recession with the GDP seeing negative growth in Q1 and a tighter monetary policy from Fed as well as rate hikes from Fed does the high profile growth stocks see a slow down.

The main buyer of these high profile growth stocks is NASDAQ where many of these stocks see a bearish market (e.g. Meta Platforms, Zoom and Netflix) as investors go from high profile growth stocks to safer investments such as commodities and real estate in fear of a recession.

Also consumer spending is lower than before as consumers does not buy multiple streaming services, delivery services or technology in general but instead safe money and keep e.g. dollar instead of stocks and cryptocurrencies.

This negative consumer spending causes these high profile growth stocks to see a slow down in growth as their balance sheets are negative.

NASDAQ may see correction towards the green part of the green cloud but after that a more drastic drop off as the price crossed underneath the green cloud.

To support this claim does the EMA and the RSI are both showing this correction is likely to happen.

In tune with inversion of the yield curve may the NASDAQ see negative movements like it did during the last times this happened in: 2001 and 2007 right before the Dot com bubble and the Great Recession respectively.

CRWD : RESET / POSITION TRADECrowdStrike: Another Solid Quarter; Buy Opportunistically

~ After solid F1Q22 results, we reiterate our buy rating on CrowdStrike. We urge long-term investors to buy shares on weakness and existing shareholders to remain invested in the stock.

~ Elevated security spending, new customer additions and upsells into its install base, low churn, and displacement of legacy vendors will drive CrowdStrike revenue.

~ CrowdStrike will become a formidable competitor to Splunk with its Humio acquisition. CrowdStrike hinted on the call that it displaced Splunk at a major customer.

~ CrowdStrike reported another exceptional quarter beating all metrics and guided up. We expect CrowdStrike to remain a dominant security vendor in the near term.

~ CrowdStrike stock will remain expensive and volatile. Hence investors should be buying shares on weakness as when opportunities are presented.

SOURCE : Tech Stock Pros, SeekingAlpha, 04-Jun-21

seekingalpha.com

NTLA : SWING TRADEIntellia's Data Has Underlined Huge Potential Of Gene Therapeutics And There Will Be More Soon

Summary :

Intellia is a gene therapy specialist pioneering CRISPR-Cas9 technology.

Its recently released data in ATTR Amyloidosis stunned analysts, showing mean reduction in TTR Serum levels of up to 96%.

This was the first ever clinical proof of the safety and efficacy of an in-vivo CRISPR genome editing technology in a human trial, and sent Intellia's share price up by >100%.

Intellia will release more data from the trial and initiate a single-dose expansion cohort before the end of the year.

SOURCE : Edmund Ingham, Aug. 31, 2021, Seeking Alpha

seekingalpha.com

DDOG : BLUE SKY / SWING TRADEDatadog's (DDOG) stock is not cheap, but the company is highly innovative and showing no signs of slowing down. To illustrate, not only is Datadog's guidance for the year strong, but its billings were up 69% y/y as of Q2 2021.

Having said that, at 32x next sales, the stock is far from cheaply valued. Investors intent on being shareholders here should look to dollar-cost average into their position over time, rather than being too imprudent with one's capital.

Overall, investors should adopt a long-term buy-and-hold strategy, rather than just looking for quick gains in the name.

SOURCE : Michael Wiggins De Oliveira, Aug. 18, 2021, Seeking Alpha

seekingalpha.com

Can SAVA get back to $100 in the short term? $SAVA (Cassava Sciences) saw an insane rally in 2021 from $7 to $145 on the hopes that its groundbreaking Alzheimer's treatment will yield promising results never before seen in the history of the disease. Currently there are no Alzheimer's modifying therapies on the market and if the data surrounding Cassava's main drug, simufilam, is accurate then it could be the first of its kind.

SAVA saw a sell-the-news event when it announced its promising results, suffering a 23% drop on July 29. Soon thereafter a Stat News article was released criticizing Cassava's results, citing a group of independent researchers. The stock dropped a total of 55% from highs.

Is this a buying opportunity? Obviously we are largely delving in uncharted territory and financial analysts/traders won't be able to infer whether the science is reliable or not. However, traders know how market cycles largely work. There is often a second wave of optimism after negative news coverage (whether a short report or a hit piece), driven by those who are willing to speculate.

SAVA is showing a bullish harami on the 1D and it has dropped to the Fibonacci golden pocket level, also at the 100 MA where it has routinely found support. This could be a buying opportunity for those who are in the market for a bit of risk. As long as #SAVA is above the 100 MA, I'm willing to hold it in the mid term and will ride the next wave of positive financial/medical news.

Entry: $79

SL: soft SL with manual monitoring if it breaches the 100 MA

TP: $88, $94, $100

SRAC (Momentus) - waiting for merge Srac (Momentus), is a Space company, possibly ARKX target.

Support: 22$ (volume pad); 20$ (strong support)

PT1: 40$ /R3/ (pre merge price target)

INPX - IoTINPX the IoT company, hourly chart.

The closing of the offering is expected to occur on or about February 18, 2021 subject to the satisfaction of customary closing conditions.

finance.yahoo.com

After closing the offering it could jump nice.

Offering price: 2.01$

Support: 1.69$ (volume pad)

Resistance: 2.15$ (Pivot Point)

PT1: 4$ (R3)

TRXC - Ready to jump in to the double digit's area TRXC robot surgery company, with unique laparoscopy technology called Senhance. You can see more on February 23. on a virtual conference. finance.yahoo.com

PT1: 6.5$ done

TOP: 6.95$

Between R1 (4.74) - MA20 (4.14) Moderated BUY, under 4.14 (blue arrow) Strong BUY and they also have some good news today.

finance.yahoo.com

PT2: 10.10$ /R4 - blue arrow/

NNDMbesides the fundamentals, the chart has a lot to offer

we can see here, that it can be at the top, almost ready to fall back, even to $4 per share.

tho, as we can also see here, it can also be the last low, after that we will see a parabolic upturn, that could drive the price +10x in less than 3 months.

or else, as we can see here, price is at top of the channel, ready to go down to the previous high, the now support (which worked as resistance for almost 5 months), before we can see any other upturn.

and can also be sideways nearly until the end of April, as we see here with this flag, waiting for the MA200 to get closer and offer support for more gain.

anyway, we have to keep in mind, RSI and MACD are all overbought, volume has almost been the same since this started climbing, which is synonymous of people's attention, at least. and also that NNDM has a 30% short float, according to finviz data.

if we want to talk about market cap, it is up to now, worth almost 800 Million.

if it, let's say, do a 10x (as we said as an option), the company will be worth 8 Billion dollars.

those are all different possibilities, I CAN NOT know which one is gonna be real in the future, but I know, for sure, this stock seems everything else than easy to predict.

play it carefully, keep in mind that those so much spoken among investors have high volatility, and so you could "win" doubling your value or losing half or more of it, in just a single day.

a lesson for everyone: as you do analysis about something, consider that your POV could not be the right one, or, more probable, could not be the only one. that's why we all should always consider something through someone else POV and change our first impression, by starting again with a free mind. (in order to have those 3 possibilities, I had deleted all the previous ones, and made a new one, totally based on something new, that I had not thought about before)

IPHI : COIL4-WK CONSOLIDATION BREAKING OUT OF PATTERN RESISTANCE. 38% PRICE RETRACEMENT ON PROFIT TAKING. OBSERVE VOLUME ACCELERATION FOR TRADE ENTRY CONFIRMATION.

$OLLI Long over 105 Multi-year break out!Ollie’s Bargain Outlet Holdings, Inc. Provides Second Quarter Outlook

Ollie's Bargain Outlet Holdings Inc :

• OLLIE’S BARGAIN OUTLET HOLDINGS, INC. PROVIDES SECOND QUARTER OUTLOOK

• OLLIE'S BARGAIN OUTLET HOLDINGS INC - FOR Q2 OF FISCAL 2020 EXPECTS TOTAL NET SALES OF ABOUT $515 MILLION

• OLLIE'S BARGAIN OUTLET HOLDINGS INC - FOR Q2 OF FISCAL 2020 EXPECTS COMPARABLE STORE SALES GROWTH OF ABOUT 40%

• OLLIE'S BARGAIN OUTLET HOLDINGS INC - FOR Q2 OF FISCAL 2020 EXPECTS GROSS MARGIN OF APPROXIMATELY 39%

Ollie's Bargain Outlet sees Q2 revs above consensus

Co issues upside guidance for Q2 (Jul), sees Q2 (Jul) revs of ~$515 mln vs. $388.35 mln S&P Capital IQ Consensus.

Other Q2 Guidance:

Comparable store sales growth of approximately 40%;

Gross margin of approximately 39%, returning to historical second quarter levels;

Operating margin1 of approximately 16%

"The robust comparable store sales growth has decelerated in recent weeks, tracking in the positive mid-teens, and we expect growth to continue to moderate in the third and fourth quarters."

CHGG - BREAKOUT / NEW HIGHSChegg, Inc. operates direct-to-student learning platform that supports students on their journey from high school to college and into their career with tools designed to help them pass their test, pass their class, and save money on required materials. Strong fundamentals showing increasing earnings for the past quarters above +40%, revenues accelerating +35% consistently for the past quarters, with margins expanding and positive earnings revisions for 2021. One of the stronger stocks on my watchlist of companies whose earnings are growing not despite of the pandemic but because of it.

Stock already broke out from a pattern resistance last week with accelerating volume and an entry position for potential range expansion is shown on the chart. Expectation is for price to continue its trend up from an early stage breakout with above average volume and find support on it's 10-day EMA on pullbacks.