Ethena (ENA): Why we’re betting BIG on this dip!We're setting up a swing entry for $BINANCE:ENAUSDT. There are several reasons for this decision, including the fact that we've captured all the buy-side liquidity we had previously marked and reclaimed these demand zones. Recently, we observed a Stop Fishing Point (SFP) during the second dip and now anticipate rising at least to the supply levels between $1.26 and $1.40. This is the range we are targeting. Additionally, we believe this could be a very interesting coin in the coming days or weeks. Therefore, this is our swing entry on a lower time frame for ENA.

Highprofit

Build Your Dreams (BYD): Moving Higher!Build Your Dreams (BYD): HKEX:285

After closely examining the Chinese electric vehicle manufacturer BYD, we've concluded that there is a very appealing and interesting opportunity to start building positions. We are currently in an overarching Wave III. Wave II concluded at the low of 13.20 HKD, and the all-time high is currently at 63.10 HKD. We are now likely in a Wave 5, which should coincide with the completion of Wave (1). Subsequently, a deeper correction to Wave (2) is expected, where we aim to place our next long-term entries, but we also want to place a short-term entry now.

We have successfully completed Wave 4 and since developed Waves ((i)) and ((ii)). This Wave ((ii)) held precisely at the 61.8% Fibonacci retracement level at 28.19 HKD, and we should not fall below this before completing the overarching Wave 5 or Wave (1). We should also surpass the Wave 3 high of 40.40 HKD.

Ford: On the road towards profits?🚗Ford #F NYSE:F

Looking ahead, our analysis and entry points have proven to be accurate. We are maintaining our long-term position, with a stop-loss set at $10.31. As for our recent short-term trade, we have already secured 75% profits and adjusted our stop-loss to the entry price. We now believe that Wave 1 has concluded, and we anticipate a three-part correction down to Wave 2, followed by Wave 3. We are expecting an Expanded Flat correction, which should not exceed 138%; the precise level will be determined once we confidently identify where Wave (a) ends.

As we prepare for Wave (c) and simultaneously Wave 2, we anticipate a retracement between 50 and 78.6%. Given that this is Wave 2, we are broadening our entry range due to the larger upside potential. We are looking at a risk-to-reward ratio of 4.8 for Wave 3, targeting a minimum of $16.75. Our entry zone ranges from $11.30 to $10.37. 📈

Polygon (MATICUSD): EXTREME Potential Long-Term Opportunity Matic presents a similar narrative to PolkaDot BINANCE:DOTUSDT . Since the low, marking our Wave (2), we find ourselves engaged in an overarching Wave (3). Currently, we're contemplating a completed Wave 1 scenario, and the path ahead entails a Flat correction for Wave 2.

This Wave 2 correction is anticipated to pivot between 50% and 78.6%. A breach beyond the 78.6% level could lead to a decline towards the $0.50 mark. If this level is breached, further downward movement may unfold, painting a bearish scenario.

Nevertheless, a positive turn within this range could pave the way for an upward journey towards $2.50. :stock_up:

We possible could never see this opportunity and price ever again. So load up your bags!

Cosmos (ATOMUSD): To the moon!Cosmos (ATOMUSD): BINANCE:ATOMUSD

For Cosmos (ATOM) , the analysis begins with the correction phase that concluded around $5.65, following the first bull market. Since this point, Waves (1) and (2) in blue have been formed and completed, with the local high of Wave (1) at $17.16. This correction was a three-part downward move ABC. Upon closer examination, it's evident that since the end of Wave (2), a subordinate 5-wave cycle has concluded, that we expect to be the Wave (i) followed by a more complex Wave (ii) correction in black. Now, it appears that Wave (i) in blue of the second smallest wave structure has potentially finished.

Our expectation now is a significant pullback to the 50-78.6% retracement levels, which are between $10.12 and $9.33. This zone is where the market should find support, particularly around the 61.8% level, where significant buying volume is anticipated. The strategy for ATOM is to aim for a longer-term hold, especially with this being part of a smaller wave, suggesting a relatively advantageous entry point could be identified with this Wave (ii) correction.

The analysis strongly indicates that ATOM should reach or surpass the $17.16 mark relatively quickly, suggesting confidence in the asset's potential for appreciable growth from its current phase. This perspective underscores the analyst's interest in frequently and thoroughly analyzing Cosmos due to its perceived potential and interesting dynamics within the cryptocurrency market.

Cardano (ADAUSD): Fasten your seatbelts! 🚀📈Cardano emerges with a distinctive journey. Having sculpted Waves 1 and 2 within a Flat structure, the focus now shifts to the probable completion of Wave 3, reaching a potential range between 227% and 261%.

Anticipating the onset of Wave 4, we pinpoint a pivotal zone between 50% and 61.8%. A breach beneath this range would jeopardize the entire scenario, potentially falling into the territory of Wave 1. The support offered by Wave B within the Flat structure stands as a crucial level, poised to become a notable buy zone.

With these dynamics in play, we anticipate a surge to at least 90 cents!

Polkadot: 2-Hour Chart AnalysisLet's take a deep dive into the Polkadot BINANCE:DOTUSD 2-hour chart. We may have already completed Wave (2). However, there's a possibility of a further descent to the 61.8 or 78.6% retracement levels. This wouldn't be surprising, given that it's quite brief for a Wave (2) in the time-based Fibonacci zone. Despite this, the overall chart still appears predominantly bullish and suggests we might have initiated a trend reversal.

🌊 Potentially, we should watch for a subordinate Wave 2 soon, which would lay the groundwork for an overarching Wave (3). Nevertheless, this Wave (3) seems to be in the distant future, with a target of at least near $16, which is considerably far off. It's entirely feasible that we'll see this in the future.

The key question is...when? Will we see it immediately, or will there first be a pullback that goes deeper, possibly filling our overarching chart limit order at $5.87? Only time can tell, be patient, we will keep you updated

Aarti Industries Stock Analysis: Potential Breakout or Short OppHello traders,

Aarti Industries stock is showing a potential trend reversal from downward to upward on the 1-hour candlestick chart. However, there is a strong resistance level that needs to be broken for a bullish movement. On the other hand, there is a 60% chance for a short opportunity with high profit but high risk . The golden crossover below the current market price may act as a support level. Traders should watch for any bullish movement inside the triangle pattern and bears should exit if there is a breakout from the marked resistance level. It is better to take the short entry before it touches the support level.

Thanks & regards,

Alpha Trading Station

Disclaimer: This view is for educational purpose only & any stock mentioned here should not be taken as a trading/investing advice. We may or may not have position in the stocks mentioned here. Please consult your financial advisor before investing. Because Price is the "King of Market

ZILUSDT Testing Support and Into A New ATH After Correction EndsZIL Uptrend Looks Decent, Currently Testing Support levels and waiting for the correction to end so we can Resume our way to the Top, No Solid Trend penetration till this moment, It's Possible to break the trend line, an update is coming after a technical sign shows up, Till now we are eligible to enter the trade.

Trade Infos>>>>>

Entrance Candle: Bullish Harami ( Reversal Of Bear Price )

Trade Type: Swing

Average Time: 1 - 2 Months

Wallet % : 10%

Entry Area: 0.185 - 0.16

TP: New All Time High ( 0.28 )

Estimated Profit: Average 70%

...............

Notices: 1- Sticking to instructions is better for maximizing profits.

2- check the trade type and average time... If you are not patient ignore this trade.

3- Stop Loss isn't required since we are in a bull run and Targets will be reached eventually.

4- If you are willing to take the trade with more than 10% of your wallet .. do so at your own risk ( mentioned Percentages are recommended ).

5- This is not a Self-Biased thought... it's an Analysis based idea.

SXPBTC Testing Support and Into A New ATH After Correction EndsSXP Uptrend Looks fine, a Few Tests for Support levels are needed every once in a while, No technical marks indicating a freefall.

Trade Infos>>>>>

Trade Type: Swing

Average Time: 1 Month

Wallet % : 10%

Entry Area: 8000-6000 ( Satoshi )

TP: New All Time High ( 10250 Satoshi ) - Could be changed if higher than expected when updating the trend

Estimated Profit: Average 60% - Lowest 40%

...............

Notices: 1- Sticking to instructions is better for maximizing profits.

2- check the trade type and average time... If you are not patient ignore this trade.

3- Stop Loss isn't required since we are in a bull run and Targets will be reached eventually.

4- If you are willing to take the trade with more than 10% of your wallet .. do so at your own risk ( mentioned Percentages are recommended ).

5- This is not a Self-Biased thought... it's an Analysis based idea.

LIT USDT about to break out. Low risk / high profitsLIT is about to break out from the strong demand zone. The chart shows little resistance so once the price starts moving up, it will fly! First stop will be $13-$14. I consider this trade as low risk because of the strong demand zone.

Stop loss not needed, exit the trade when a weekly candle closes below the demand zone.

#REQ : To The Red Planet? Upto 8X Profits Opportunity #LongTermPair : #REQ / #BTC

REQUEST NETWORK : Is It Going To Be Listed On CoinBase Custody?! If So The Charts Are Also Going To Help It Fly To The Moon!!!

By : @TogetherWeAccumulate

# Blowing out of the falling wedge and this is going to be a huge blast for upto 8X profits in the mid term.

- High Volume detected.

If fundamentals are going to be true and if this coin can be listed in Coinbase's custody - it is going to be a blast. No tweets till this post is submitted but rumors are saying that though after the huge stable pump with a big volumes get ins.

Accumulation Recommendation Area : 175 sats to 195 sats

Distribution Area :

🎯Target 1 : 261 sats

🎯Target 2 : 321 sats

🎯Target 3 : 381 sats

🎯Target 4 : 466 sats

🎯Target 5 : 575 sats

🎯Target 6 : +889 sats to anywhere.

Stop Loss : Close below 160 on the weekly chart.

This is for hodler's trade option. We will made an analysis on for the shorter time frames on the next post. Stay Tuned for Live updates. With Regards. #TeamTWA.

@togetherweaccumulate

Zil/Usdt Possible targetsWarning: This is only my idea.

If you want to long zil/usdt based on my view, Do it with your risk management system.

Ok before we start we need to know these:

1- Zilliqa Daily time frame is on impulsive wave.

2- Zilliqa weekly time frame is Bullish.

3- We are in the bullish season of crypto market.

-As you can see we have a bullish flag in daily time frame and we had successful breakout. So price can rise up to 0.168$ based on flag's pole

-Right now Zil is experiencing impulsive wave so if we want to predict how far it can reach, We use trend based fib(Impulsive wave 1 and corrective wave 1 are used for trend based fib extension)

Let's see possible targets based on trend-based fib extension:

1- 0.16860

2- 0.18727

3- 0.21751

4- 0.26904

Also we had a good new about Zil which said EGW Capital is looking to invest another 20-25$ million in Zil Coins in the coming weeks.

Please note that all of these possible targets depend on if crypto market remain bullish.

#EFL : Looking too much bullish for the mid term 2X profits. Accumulation Area : Below 500 sats

Short Term Target 611 sats

Mid To Long Term Target : +1350 sats

Stop Loss : For Short Term Traders close below 440 sats and for mid and long term traders close below 287 sats.

TogetherWeAccumulate

#TeamTWA

BTC scalping using GreenCrypto IndicatorAs you can see using the GreenCrypto Scalping indicator we have lot of trade opportunity for quick scalping in 4h chart.

Backtest result given below shows how the scalping performs in the long term if you follow all the signals given by the indicator.

Feel free to drop a message if you would like tryout this scalping indicator.

Thanks

#TROY : Upto 100% Profits Opportunity in The Mid Term.#Achievement_Recommendation

Pair : TROY / BTC

Trading Note :

Troy has been in a downward move for the past and tried to rebound at the beginning of February breaking out from the falling wedge formed. If we take the stated falling wedge in to consideration we already have seen the 1st and 2nd elliott waves done and are on the verge of a start to rebound for the 3rd impulsive wave.

Indicators :

Volume : Needs to be growing.

MACD : Looking healthy for now.

EMA : Currently bullish.

RSI : At 52 for a fairly good entry indication.

Accumulation Area : 54 sats - 60 sats

Distribution Targets :

Target 1 : 68 sats

Target 2 : 72 sats

Target 3 : 80 sats

Target 4 : 87 sats

For Mid Term Traders

Target 5 : 99 sats

Target 6 : +113 sats

Stop Loss : 49 sats

46 sats

Invest: 3%

Harmony [#ONE] : Upto 80% Profits Opportunity In The Mid Term.#Accumulation_Recommendation

Pair : #ONE / #BTC

Accumulation Area : 60 sats - 68 sats

Distribution Targets :

Short Term :

🎯 Target 1 : 75 sats

🎯 Target 2 : 82 sats

🎯 Target 3 : 90 sats

🎯 Target 4 : 100 sats

🎯 Target 5 : 113 sats

🎯 Target 6 : 140 sats+

Stop Loss : 49 sats

Invest: 3%

Risk/Reward: 4.81

Fetch.AI [FET] : Upto 100% Profits Opportunity.#Accumulation_Recommendation

Pair : #FET / #BTC

Accumulation Area : 440 sats - 480 sats

Distribution Targets :

Short Term :

🎯 Target 1 : 536 sats

🎯 Target 2 : 609 sats

🎯 Target 3 : 677 sats

Mid / Long Term Targets

🎯 Target 4 : 745 sats

🎯 Target 5 : 841 sats

🎯 Target 6 : 964 sats+

Stop Loss : 389 sats

Invest: 3%

Risk/Reward: 15% / 100%

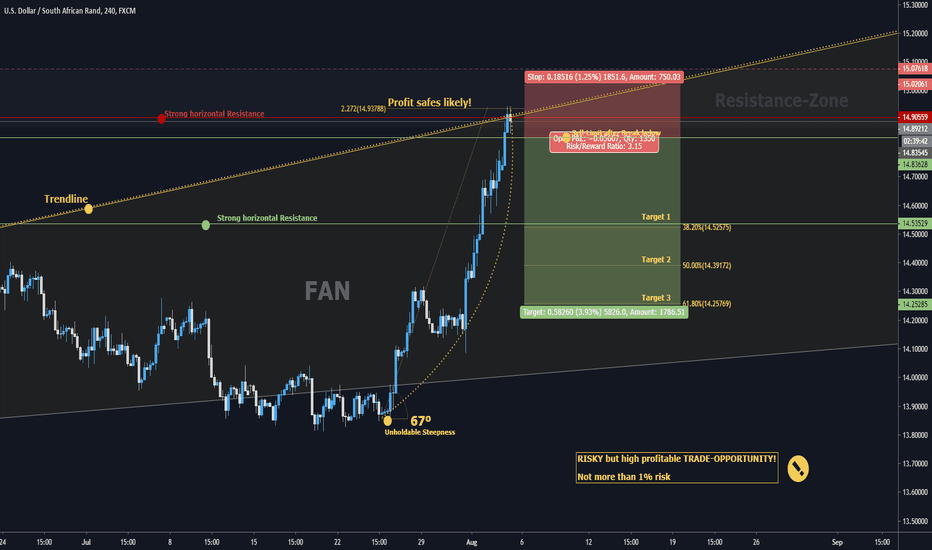

USD/ZAR: Swingtrade-Opportunity!#Sell on h4Hey tradomaniacs,

welcome to another free signal!

Important: This is a risky trade! Not more than 1% risk here! :-)

-----------------------------

Type: Swingtrade

Sell-Limit after break below: 14,83400

Stop-Loss: 15,02145

Target 1: 14,53143

Target 2: 14,39368

Target 3: 14,25285

-----------------------------

LEAVE A LIKE AND A COMMENT - I appreciate every support! =)

Peace and good trades

Irasor

Wanna see more? Don`t forget to follow me.

Any questions? PM me. :-)

ETH : Upto 100% Profits Opportunity in the Mid TermMID TO LONG TERM Trading Opportunity

RSI : 58

Volume : Looking Good

Accumulation Area : 175 USD - 225 USD

Distribution Area :

Shorter Term

Target 1 : 259 USD

Target 2 : 293 USD

Target 3 : 367 USD

Target 4 : 450 USD

MID To Longer Term Trading

Target 1 : 389 USD

Target 2 : 584 USD

Target 3 : 742 USD

Target 4 : 900 USD

Target 5 : 1124 USD

Target 6 : +1410 USD

Stop Loss : 115 USD and 158 USD