Hindustan Unilever looks strong. Hindustan Unilever Ltd. engages in the manufacture of consumer goods. It operates through the following segments: Home Care, Beauty and Personal Care, Foods and Refreshments, and Others. It is one of leading company in FMCG sector.

Hindustan Unilever Closing price is 2453.60. Dividend Yield @CMP = 1.78%. The positive aspects of the company are Stocks Outperforming their Industry Price Change in the Quarter, Companies with Zero Promoter Pledge, Company able to generate Net Cash - Improving Net Cash Flow for last 2 years, FII / FPI or Institutions increasing their shareholding and MFs increased their shareholding last quarter. The Negative aspects of the company are high Valuation (P.E. = 53.9), Increasing Trend in Non-Core Income, Declining Revenue every quarter for the past 2 quarters and PEG greater than Industry PEG.

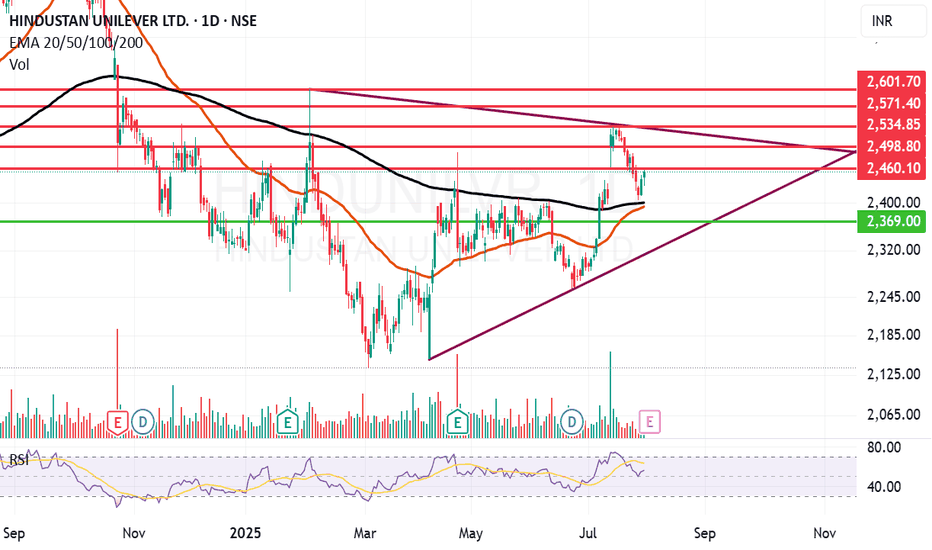

Entry can be taken after closing above 2460 Historical Resistance in the stock will be 2498 and 2534. PEAK Historic Resistance in the stock will be 2571 and 2601. Stop loss in the stock should be maintained at Closing below 2391 or 2369 depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Hindustanunilever

HINDUSTAN UNIL. Long term safe bet for investmentHUL: being a blue chip in the safest sector for FMCG in this extremely volatile market.

Add in this every fall in small quantity to reach 300 quantity so that this position can be used to hedge against CE sell or creating hedge position by sellign Fut lot, or buyin a PE.

But as HUL is a blue chip and has good growth expected in the coming years so this can be a safe bet.

This will have a good rally above 2500 and then above 2700

acc. till 2100-2400, good support at 2100 below 211

Disclaimer: only for educational purposes. not a buy-sell rec.

HUL at Strong Support Zone – Reversal Ahead?Hindustan Unilever Ltd (HUL) is currently trading near a key support level, indicating a potential reversal zone. Watch for price action signals like bullish candles or volume spikes to confirm a bounce. If the support holds, an upward move could follow; if broken, further downside may be seen. Keep an eye on RSI and MACD for additional confirmation. Ideal spot for swing traders and positional entries with proper risk management.

#HUL #HindustanUnilever #SupportLevel #TechnicalAnalysis #SwingTrade #NSEStocks #StockMarketIndia #PriceAction #ReversalZone #TradingViewIdeas

HINDUNILVR : ready to spice up! Hindustan Unilever Ltd (HINDUNILVR)

Technical Analysis

The chart indicates a complex correction with potential wave reversal and long-term upside targets .

Golden Retracement Zone: ₹2,361–₹2,390

This zone aligns with Fibonacci levels and acts as a high-probability buying area .

Deep Retracement Zone: ₹2,263–₹2,348

A last line of defense for bulls, providing better entry opportunities if prices dip further.

Options/Future Target Levels: ₹2,564–₹2,594

Initial resistance zone after a reversal.

First Target Level: ₹2,885

A mid-term target where partial profits can be booked.

Second Target Zone: ₹3,123–₹3,223

A long-term target for swing or positional traders.

Stop Loss: Below ₹2,263

If prices fall below this level, the setup is invalidated.

Educational Tips :

Buy Strategy:

Enter near ₹2,361–₹2,390 with confirmation signals (e.g., hammer or engulfing candles).

Add cautiously near ₹2,263–₹2,348.

Stop Loss: Below ₹2,263 to limit risk.

Target Levels:

Short-term: ₹2,564–₹2,594

Mid-term: ₹2,885

Long-term: ₹3,123–₹3,223

Conclusion and Key Tips :

Always wait for confirmation signals like bullish candles , breakouts , or trendline breaches before entering trades.

Use retracement zones ( golden and deep ) to time entries effectively.

Risk Management:

Place stop losses below critical support levels to limit potential losses.

Never risk more than 2–3% of your trading capital on a single trade.

Target Zones: Plan exits at resistance levels or predefined targets to secure profits.

These setups provide high-probability reversal opportunities with proper risk management and target planning.

HINDUNILVR Trading Within Fresh Demand ZoneHINDUNILVR is currently trading at ₹2389.2, which places it slightly above its demand zone between ₹2387.45 and ₹2344.3, established on 4th June 2024. This fresh zone has not been tested yet, suggesting the possibility of renewed buying interest if the price dips back into this range. Investors may consider monitoring for support near this level, potentially signaling a bullish opportunity.

MACD Crossover Swing Trade📊 Script: HINDUNILVR

📊 Sector: FMCG

📊 Industry: Personal Care - Multinational

⏱️ C.M.P 📑💰- 2231

🟢 Target 🎯🏆 - 2362

⚠️ Stoploss ☠️🚫 - 2172

📊 Script: KPIL

📊 Sector: Capital Goods - Electrical Equipment

📊 Industry: Transmission Line Towers / Equipment

⏱️ C.M.P 📑💰- 1206

🟢 Target 🎯🏆 - 1272

⚠️ Stoploss ☠️🚫 - 1176

📊 Script: CHENNPETRO

📊 Sector: Refineries

📊 Industry: Refineries

⏱️ C.M.P 📑💰- 942

🟢 Target 🎯🏆 - 999

⚠️ Stoploss ☠️🚫 - 912

📊 Script: POWERGRID

📊 Sector: Power Generation & Distribution

📊 Industry: Power Generation And Supply

⏱️ C.M.P 📑💰- 281

🟢 Target 🎯🏆 - 298

⚠️ Stoploss ☠️🚫 - 272

📊 Script: NATCOPHARM

📊 Sector: Pharmaceuticals

📊 Industry: Pharmaceuticals - Indian - Bulk Drugs

⏱️ C.M.P 📑💰- 999

🟢 Target 🎯🏆 - 1069

⚠️ Stoploss ☠️🚫 - 965

⚠️ Important: Always maintain your Risk & Reward Ratio.

✅Like and follow to never miss a new idea!✅

Disclaimer: I am not SEBI Registered Advisor. My posts are purely for training and educational purposes.

Eat🍜 Sleep😴 TradingView📈 Repeat 🔁

Happy learning with trading. Cheers!🥂

HINDUNILVR--Demand Zone @2300 ??This stock is trading in a range bound from long time...

facing resistance on top at 2720 levels, and finding support at 2440 levels multiple times.

on bottom side at 2300, we have great demand zone.

look for buy when price comes to these levels.

A drop base drop, may be possible in this stock...wait until price breaks the trendline and wait for retest then look for short.

or buy when price test this demand zone.

HUL striving for a comeback. Hindustan Unilever Limited (HUL) is one of the biggest FMCG companies of India it is part of global British giant Unilever group. Its products include foods, beverages, cleaning agents, personal care products, water purifiers etc. Hindustan Unilever Limited (HUL) is India's products touch lives of nine out of ten households in the country. Hindustan Unilever Limited (HUL) CMP is 2511.30.

The Negative aspects of the company High Valuation (P.E. = 57.30). FIIs are decreasing stake and MFs are decreasing stake. The positive aspects of the company are No debt, zero promoter pledge, FIIs are increasing stake, improving annual net profit and improving cash from operations annual.

Entry after closing above 2555. Targets in the stock will be 2592 and 2605. Long term targets in the stock will be 2716 and 2769. Stop loss in the stock should be maintained at closing below 2419.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

HINDUNLIVER - SUPPORT TRADEHinduniliver is at multi-support level.

This is the level where it took support multiple times in the past and bounced from it.

Considering the previous price action, chances are that prices might bounce from these levels again.

Hence with a small stop loss, a long trade can be taken in this stock.

I have drawn a downsloping trendline along the previous peaks, the break of which can take stock to 2640 levels in no time.

Current levels: 2468

Support levels: 2457- 2421

Target: 2640

Stop: Below 2400 ( as per risk capacity)

Hindustan Unilever Swing TradeHindustan Unilever Swing Trade

If you look at the chart that's labelled here, you'll notice that there are 5 downward swings. These swings are part of a larger correction that consists of 3 swings. The first part, which is called wave A, has 5 smaller waves within it. The second part, wave B, consists of 3 waves. Then, the final part, wave C, also has 5 waves within it as part of this 3-swing correction. Now, it's possible that we might see an upward movement in the price, possibly reaching a range between 2660 to 2700. This would be part of wave B. After that, it's expected that there could be a downward movement in the price, possibly going as low as 2390. This would be part of the larger correction and could represent the completion of wave C.

Disclaimer : The information provided here is for educational and informational purposes only. It should not be considered as financial or investment advice. Trading or investing in financial markets carries risks, and you should carefully consider your financial situation and consult with a qualified financial advisor before making any trading or investment decisions. Past performance is not indicative of future results, and market conditions can change rapidly. Always do your own research and exercise due diligence before making any financial decisions. The author and this platform are not responsible for any losses or damages that may result from the use of this information.