HMMJ

HMMJ - End of descending channel ?Looks like TSX:HMMJ is about to breakout of his descending channel but we still need more confirmation + daily close today looks really good (hammer).

Also, something I'm not familiar with enough, could this be an inverse H&S formation ?

Oh well, let's keep following this MARIJUANAAAAAA sector, a lot of promising stock at the moment.

It still going down. :PNot much news from the Cannabis industry beside all the ones you probably know.

Yea, Canadian work slow~~ and the citizens are rebellious at times with their own weed plants and cooking up their own cookies. :P

Something interesting came to mind.

Why not look for stock that serve the Cannabis industry like [ Innovative Industrial Properties, Inc (IIP) ]

There are probably dozen more stocks surrounding Cannabis. Will keep you guys up-to-date :P

$CGC: Good buy entry here$CGC has reached support at the bottom of the 'Jeff Sessions resignation' key level. There's an active monthly uptrend, daily is oversold and making a higher high above a previous day high, whilst RgMov shows an active daily uptrend, so this would qualify as a valid long entry. You can risk either 3 daily ATR down, a drop under this last daily lowest low, use a monthly mode stop loss @ 25.28 for sizing, or size it for a long term position with 1-10% exposure and no stop.

Best of luck,

Ivan Labrie.

HMMJ going back down to 15$The cannabis market is a volatile one.

HMMJ has risen quite a bit in the last couple weeks and is now overbought. It's time to come back down at around 15$.

Selling will start after they pay out the dividends on April 11.

I'm LONG in the longterm!

But taking profit here makes sense.

Short Aurora Cannabis (ACB) for short-term gain- Prices are trading near top end of a rising channel

- A 12% move for a new board member is an exaggeration.

- Bearish divergence with money flow reporting a lower high while prices are posting a higher high (bearish reversal)

- $HMMJ (weed etf) is signalling bearish divergence with MACD posting a lower high while prices post higher highs.

TSX:ACB

Long KHRN- KHRN rebounded off an interesting overlap level near $3

- bullish divergence with lower lows on prices but higher lows on Money Flow

- MACD is about to turn positive.

- Huge bullish engulfing pattern on the daily chart.

Charting #weedstocks - Macro view 7 Feb 2019New to #weedstocks, my experience is in trading crypto for 2 years.

I am charting the HMMJ as a macro benchmark of the whole #weedstocks market.

Experimented with a few different indicators here, the principle was to find indicators that would have been reliable over the last 18 months.

Settled on:

MA's (10 and 30), looking for crossovers to signify a change in trend

Good old RSI

Volume (not currently pictured)

Clean charts approach, I want to minimise distractions and focus on the big picture.

What I am getting from this:

- #weedstocks tend to yo-yo, with short bursts of uptrend followed by prolonged declines. Expect this to continue in 2019 - but the pace might be different this year, it would be a mistake to assume it will trend in the same time intervals

- I am looking for MA crossovers over a certain number of periods

- RSI was clearly oversold in the last few days, would have provided a great indication of the current correction

- As long as price is above the 10 MA, I think we're in bullish territory

Will be good to see if this is borne out by the next few weeks.

The ideal place to get in would be on support, at the point of a crossover. Yes, there have been fakeouts, this is where I'd look to employ leading indicators and look at their historical performance as a heads-up of the change in trend.

My honest hope? We go back to support and I'm able to load up at that level on the big weedstocks like CGC, assuming there's confluence on those individual charts.

Weed - RSI Overbought, hitting previous resistance at $65Weed - RSI Overbought, hitting previous resistance at $65. I was wrong with my short at $58 level. Short interest went up 4x from jan 1-16th, shortdata.ca. Earnings is Feb 14th, so I am on sidelines and will wait post ER. If spy breaks over 270 next week, weed can go higher! FOMC is Jan 30th. Holding $TGOD shares from 2.99. Safe trading!

Weed - Hit .618 Fib level, pull back on 4 hour chart to $55Weed - Hit .618 Fib level, pull back for higher low. Look for back test $54.62 on 4 hour chart as support. RSI overbought, good news about hemp facility in NY. I will wait for support level to buy more shares. Picked up some TGOD for long hold last week at $2.99. Good luck!

$weed looking for pull back on daily chart , RSI OB, Fib level$weed looking for pull back on daily chart , RSI OB, Fib level closed right around .382 level or $50.80. Looking for consolidation and higher low, volume is not bullish and $spy is hitting resistance at $259. Tech Earnings next will set market direction. *own canopy shares, $nbev calls and bought $pyx feb calls friday. Shortdata.ca for short interest information. Good luck, happy trading!

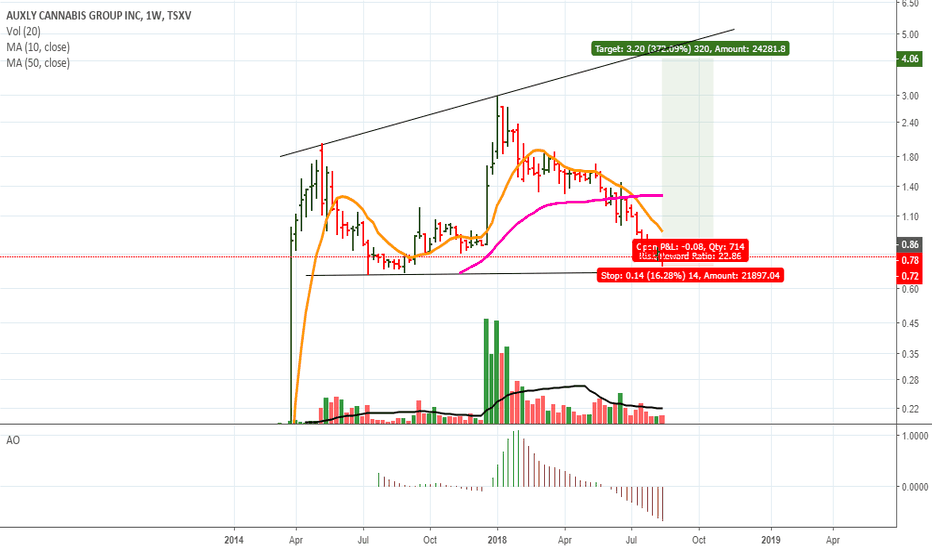

LONG set up in XLY.ca (TSX)Long over 0.85 based on a break above the recent lower high on daily. volume support as well. $WEED.ca $CGC $MJ $APH.ca