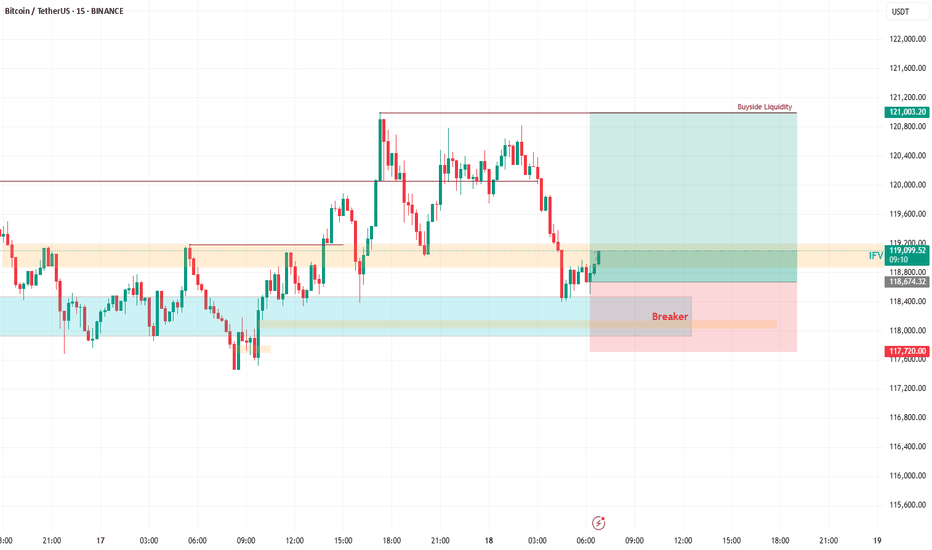

The Setup: Bullish Breaker in Play!Yesterday, BTC smashed into a strong bullish breaker and bounced like a champ. Today, it’s retracing back to this key level, setting up for what I expect to be another explosive buy reaction. Why? Because this breaker is rock-solid, and the price action is giving us all the right signals! Plus, it’s Friday—the last trading day of the week—and I’m betting BTC will stretch its legs to cover the weekly range. 🏃♂️

🎯 Trade Details: Where to Jump In

Buy Area: Right now, the price is teasing the breaker zone.

Stop Loss: Protect your capital with a stop loss at around ~117,700.

Target: We’re aiming for the Buyside Liquidity sitting pretty around 121,000. That’s a juicy move with solid risk-reward potential! 💪

🧠 Why This Trade Makes Sense

Bullish Breaker Strength: This level has proven itself as a springboard for price action.

Weekly Range Play: Fridays often see BTC push to cover its weekly range, and we’re in prime position to catch it.

Liquidity Grab: The Buyside Liquidity at 121,000 is like a magnet for price—let’s ride it there!

⚠️ Risk Management Reminder

Always trade smart! Use proper position sizing, stick to your risk management rules, and don’t go all-in like it’s a casino. Keep those stops tight to avoid getting wrecked by any sudden volatility. 😎

💬 Join the Conversation!

What do you think of this setup? Are you jumping on this BTC train or waiting for more confirmation? Drop your thoughts in the comments below! 👇 Also, if you like this idea, smash that LIKE button ❤️ and follow for more trade ideas to keep your portfolio poppin’! 🚀

Happy trading, and let’s stack those pips! 💰

#BTC #CryptoTrading #BuyTrade #Bullish #TradingView

Hodler

Very Suitable For Hold Baskethello friends

This coin faced a price drop after being listed as expected.

Now, by holding his own and making a reliable floor, he proved that he can calculate the method...

We have specified the entry steps for you and don't forget capital management.

Be successful and profitable.

The Next Cycle Peak? Insights from Long-Term Holder BehaviorDuring every cycle, long-term holders start selling their CRYPTOCAP:BTC as it moves to new highs. This data provides key insights into the bull market.

The selling of these holdings is shown through the collective balance of long-term holders, as indicated by the gray arrows.

Typically, the balance reaches its lowest point shortly after the market peak.

In the 2017 bull market, it took around 270 days for the hodler balance to hit its lowest point, which came right after the market cycle peak.

In the last bull market, the exact peak is debated. The first peak occurred 210 days after the hodlers started selling, while the second peak took place 410 days after the initial decrease in their balances.

As in previous cycles, long-term holders have started selling again. We can identify late December as the starting point. Assuming the peak occurs within a similar timeframe, we can estimate the next peak will happen within the next 140 to 260 days, or between October 2024 and March 2025.

OP LongAfter a long wait, I am currently waiting for this pair to give me my confirmation for a long position.

Price already in my area of value, just waiting for the market to tell me to get in on a Buy.

Buy bias for the coming Months.

Hello Friends!

- ---------------

**First Scenario - Long:**

Initial Target: $3.3

Entry: $2.4

Stoploss: 2.2

**Second Scenario - Short:**

It's already tested at $3 in price.

Less probability of going down, but if you're shorting, double-check your stop loss.

In a general bear market, prices can drop to $1.8 or $1.6 if they go below $2.2 level.

- ---------------

Take into consideration:

Holders have been rising since the start of the year.

Psychological Resistance at $4

Psychological Support at $1.8

- ---------------

NFA

DYOR

Good Luck!

⚠️Caution: Just because I've set my buy and sell position Settings or drawn direction lines on my chart doesn't indicate I've opened a position or am obsessed with a particular bias. This is only a forecast; I don't trade when the price reaches my level; I have rules of engagement. Perhaps the most crucial element is 🆘RISK MANAGEMENT🆘.

BTC long term viewView is calculated based on the NASDAQ composite bubble in Jan 2000.

Roughly every 4 days in IXIC correspond to 1 day in BTC

Since the IXIC keeps going solid, the written BTC target is not really a target, but just a point based on the current IXIC status.

OFC, there is no guarantee that BTC will follow IXIC, but so far it has been pretty close

DISCLAIMER:

I am not a trader and don't know what I am doing!

And on top of that BTC is very unpredictable...

Bitcoin 773% potential (Elliott Wave) Hey friends, yesterday brought some new volatility to the market and interesting price movements emerged in the various coins.

Even before that, I suspected that we haven't seen the low in bitcoin yet. However, our new low around $15,500 may have been it now. To generate a sustainable uptrend, we would now need to move up in an impulse move.

If we reach a level of at least 19396.56$ and then correct again, that could actually be the start of a new upward structure

Unfortunately, however, it is still too early to have any real insight there. Bitcoin's long-term potential is enormous. Over 700% possible rise, in the upcoming wave 3 alone.

Cryptocurrency #1Well well, so who is here a diamond hand?, hop up!. That is crypto. It is an asset. it is not like something we can sell and buy quick. Asset is not work like that. Do we buy house today and sell it tomorrow?, Do we buy land today and sell it tomorrow and expecting some huge insane profit and be a millionaire in 1 night?. No way, be a diamond hand, because diamond hand always win. Even so say that, yet need to clarify and clear what coin are we holding. Utilities?, core team? marketing? market supply? usecase? crowd? etc etc. A lot of things we need to look after because once we buy it, that's it. HODL it until our mother "Bitcoin" wake up and do bearish movement. And then we will experience Alt-coin season like before. Ahhh what a day, i really miss that moment when numerous of alt coin spike up easily 1000%

TRADING SIDE WAYSIt seems that bitcoin has been down for a while since all of the news around cryptocurrency. My question is, if the market goes lower, will the man behind the New Market reveal himself, or would he continue to be a mystery? Either way, keeping your discipline and leaving or building your positions is best. Remember to put your STOP LOSS on.

Ten Reasons Why I'm Buying Bitcoin Right NowThis is a log-adjusted chart of the entire price history of Bitcoin (BTC) since data became available on Trading View. I applied a basic Fibonacci retracement overlay from the highest high to the lowest low. I also applied a trend line that connects the two lowest (reaction low) price points in Bitcoin's history to illustrate the level where price typically drops during peak fear (the line is based on a log-adjusted scale and is therefore a log-linear trend line).

With this said, here are 10 reasons why I'm buying Bitcoin right now.

(1) Price is approaching a very significant Fibonacci retracement level (around $17,381).

(2) Price is also approaching the log-linear trend line created by the price points at past bottoms.

(3) These lines have roughly converged in the same general range, which is rare. They also coincide with important trend-based Fibonacci retracement levels, as well as EMA exp ribbons that have previously supported Bitcoin's price.

(4) The Crypto Fear/Greed Index shows historic fear is occurring right now. Today we've reached the second-lowest rating on the index ever, indicating that fear is likely at or nearly at its peak. As experienced traders know: Sell when others are greedy, buy when others are fearful. Link: alternative.me

(5) The Bitcoin hash ribbon indicates that capitulation has started. The moment a sudden, rapid move higher occurs, that indicator will switch from capitulation to buy.

(6) The Fibonacci Time Zone indicator suggests that Bitcoin's next major impulse wave may be underway in late 2023, at which point the price can easily push over $100,000 if Bitcoin's log growth curve continues as expected.

(7) Recently, Bitcoin has been inversely correlated to the U.S. dollar currency index (DXY) on the weekly chart (R= -0.733, P-Value: 0.0003, R-Squared: 0.3426). The DXY chart is showing signs of a topping candle near an important Fibonacci level. It is my belief that we are at peak inflation right now, and that the dollar index will soon top if it hasn't already. The corollary, therefore, would be that Bitcoin's drop may stop, assuming the negative correlation continues. Even if I'm wrong, there is a good risk-to-reward setup here.

(8) The price of Bitcoin has reached the 250-week moving average. This moving average successfully supported price at its previous reaction low in March 2020. Many traders are entering Bitcoin for this reason alone. Smart money has steadily been flowing in as weak hands sell to strong hands.

(9) The price of Bitcoin has been strongly positively correlated to the Nasdaq 100 ETF (QQQ) (R= 0.939, P-Value: 0, R-Squared: 0.6647). The charts show that QQQ is likely at a significant bottom. The NDTH is near the lowest it can go. The short derivate of QQQ (SQQQ) is already showing signs of fewer and fewer market participants opening up new short positions on tech, which is the first sign that a bottom is in for tech, and which can actually set the stage for a major short squeeze. All of this is extremely encouraging for Bitcoin which is highly correlated to QQQ.

(10) I can afford to take on the risk of Bitcoin falling all the way down to the next important level $8,000 - $11,000. This lower level is where the Visible Range Volume Profile suggests an absolute bottom may occur. Of course, the next Fibonacci level is also in play as an absolute bottom as well. That level is all the way down at $5,888. Reaching these levels on any sustained basis would be unlikely if the Bitcoin log curve is to continue. Perhaps a momentary blimp down to here is possible, or if a major Black Swan event further exacerbates unfavorable market conditions. It's always important to use stop losses unless you have a long-term plan to accumulate an asset and not sell in an emotional state, and of course, if you will not be subject to a margin call.

While only time will tell if this analysis proves true, there are too many reasons to buy Bitcoin right now for me to not buy. I will accumulate up to 10% of my portfolio and my average down amounts will increase at each important level until I reach 10% of my portfolio. Again, averaging down only works if you're a long-term trader (the time horizon is years) and you only bet a set percentage of your portfolio.

Blockchain technology is the future.

Not financial advice. As always anything can happen.

NYMUSDTNYMUSDT

While in the market, MM is trying to knock out everyone who still believes even a little bit in the bull market (one of which are you and me)

I think this project is extremely underestimated.

NYM is developing an infrastructure to prevent data leakage from existing Internet protocols.

This whole thing is achieved by protecting the metadata of each package at the network and application levels. In particular, NYM protects against even the most powerful network intruders who can monitor every incoming and outgoing packet of your Internet connection.

With NYM, you can surf the Internet without fear of being followed.

The project received an initial investment of $2.5 million from the Binance incubator back in 2019. Then $6.5 million was invested by Polychain Capital.

And the foundation is a $13M Series A funding round led by Silicon Valley monolith Andreessen Horowitz (a16z Crypto), with Barry Silbert's Digital Currency Group, Huobi Ventures, HashKey, Fenbushi Capital, Tayssir Capital.

why did NYM come out so badly?

the key problem is the "cheese-boron" between the development team and the coinlist (which can be said to have thrown 50k people with allocations and took them for themselves), but as far as I know all the misunderstandings have already been resolved and the team continues to develop

TOTAL:

TIR1 investor with an incubator in the form of Binance,

unique product, great roadmap and huge growth potential.

I showed you the selection zones on the chart,

I advise you to observe the risks and not enter the project by more than 7% of the deposit

XRP LongAlthough I'm bearish on crypto as a whole due to geopolitical tensions, I think XRP could hold its value even if Bitcoin continues to drop. The .7 Fib is indicated by the green horizontal line and I believe it will behave as a solid support zone moving forward. We also have strong RSI divergence suggesting a potential increase in price. Anything below $1 is a solid investment IMO. Swift plays a huge inverse role for the fundamentals of this, so any negative catalyst towards swift is a good sign. Do your DD of course, but definitely consider my analysis. Let me know your thoughts.

BTC point of no return, something tragic between now and 2034Maybe BTC has fuel for a last 10x pump but after that,

look at the angles, the probabilities are that BTC is going to form a gigantic H&S and then return to the 6k market bottom of 2017.

The other probability is that the Dollar is going to collapse and the world we are living in right now will have no resemblance whatsoever in 10 years time, I am very skeptical about that. I think BTC is about to enter a very rough pathway, 5 to 10 years bear market. Red flashing lights for those who decided to HODL from here.

ADA: SHOULD WE WORRY?Hey guys, this is Julie 😄

Let's talk about ADA today:

ADA is falling more than 6% today, should we worry about that?

Honestly, I don't see any reason to worry, ADA is just in the 21 EMA region and today seems to be a red day for some cryptos as well, so it seems like a normal movement, I don't think it will fall again.

As I said in my last analysis, it is very unlikely that ADA will trigger another downtrend because we have some interesting support levels holding it:

Fibonacci 61.8%

Green line support

- I must say that I would be worried if ADA fell below the green line, but even if that happened, we would have the pink line support level (but it is VERY unlikely that ADA will reach that price).

As I always say, I believe in ADA and I really think it will fly again; we just need some time for it to regain its strength.

I am more interested in ADA's weekly chart, so let's wait and see how this chart plays out by the weekend.

Thanks for reading!

Follow me and like this idea, please! 😊

Have a nice day, bye!

Gold to 2000? Just a clear chart. No drawings. Sometimes simple look shows the way. Inflation, technical analysis, sentiment analysis and no trust in fiat will push the gold up. Not suitable for day traders. Think long term.

My opinion only. The trade u gonna make which you would gain or loss is ur responsibility.