Home / UsdtHTX:HOMEUSDT

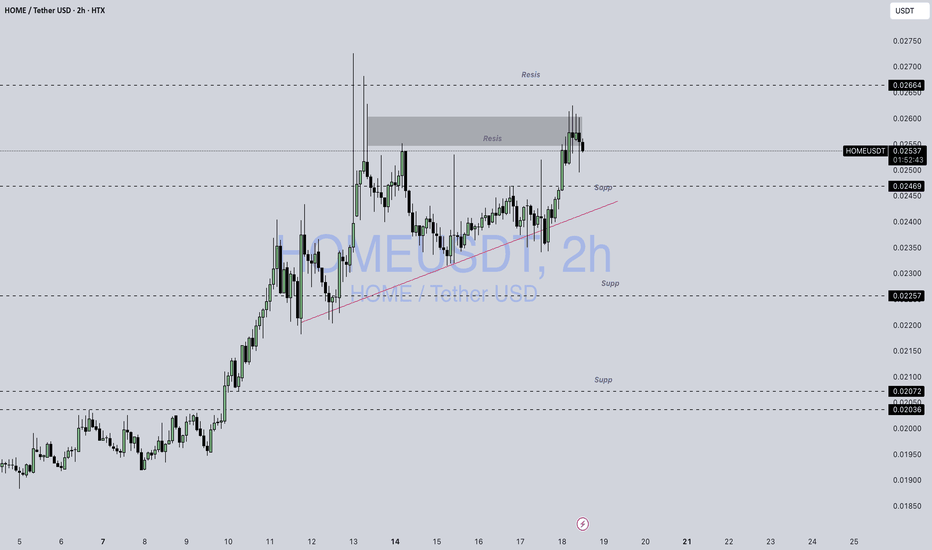

### 🧠 **Technical Breakdown of HOME/USDT (2h chart)**

#### 🔲 **Supply Zone (Resistance)**

* **Price Range:** 0.02550 – 0.02633

* This gray zone has previously caused multiple rejections.

* Several upper wicks indicate sellers are active here, absorbing buying pressure.

#### 📍 **Current Price Position**

* Price is **hovering at the edge of the supply zone** (\~0.02549).

* Candle bodies are struggling to close strongly above this region.

#### 🕳️ **Liquidity Wicks**

* A spike near **0.02664** signals liquidity hunts or stop-loss triggers.

* Repeated failures to close above this area suggest **supply dominance** for now.

#### 🔻 **Support Levels**

* **0.02469** – Weak intraday support

* **0.02257** – Strong structure support (tested and held)

* **0.02072 & 0.02036** – Deep support area; significant bounce occurred here previously

---

### 📌 Summary:

* The asset is **testing a known resistance** after recovering from lower levels.

* Behavior in the 0.02550–0.02633 zone is **critical**: either price gets absorbed and reverses, or buyers overpower and break higher.

* Support levels below are clearly defined in case of a retracement.

HOME

U.S. Home Price Index (CSUSHPINSA) priced in Bitcoin (BTCUSD) Why do we measure Bitcoin value in the fraud of fiat? Instead, measure it in something that most people want - a home. Here is the average US home priced in #Bitcoin from 2012 to now. House prices are falling for those who save in Bitcoin.

FRED:CSUSHPINSA*1000/BITSTAMP:BTCUSD

Federal Home Loan Bank is Draining Off LiquidityThe chart below is comparison between Schiller Housing Index (barchart) vs Federal Home Loan Bank (FHLB) balance sheet (linechart). In case you don't know what is FHLB - it's a second to last resort of lender that provides liquidity to US home loan after the FED. Quite recently FHLB is reducing their balance sheet from 1T to around 800B to take out liqudity from housing system. If these trends continue it will make it difficults for the bank to provide mortgage to the homeowners, which in turns will bring a cooling measure to housing price.

In 2008 when the US housing crash happen, FHLB increase their balance sheet to provide support for housing market from crashing too fast. Which cause the housing market to cool down substantially. However, in 2020 during pandemic, FHLB is reducing their balance sheet in line with the reduction of housing supply, so the housing price remains goes up until 2023. However, in the end of 2023 FHLB starts to reduce their balance sheet to break-stop the housing price from overshooting. Which they quickly realized it's a big mistake because it triggers several banking collapse such as SVB, First Republic, Signature Bank, etc.

So they reverse it to quantitative easing called BTFP (Bank Term Funding Program) to provide 1 years liquidity to prevent contagions of local banking collapsed until mid of 2024. Which at the same time there will be increase supply of housing in the next couple years that will definitely cool down or even bring down the housing price from mid 2024 onward. So I believe housing price will start to continue downward direction from mid 2024 until probably 2027 at least when the corporate debt wall are deteriorating causing several mass layoffs in the next couple of years.

Zoom seems to be bottoming outZoom seems to be bottoming out below $100, making a great buying opportunity for higher highs above entry price of $100.

Oversold stochastic

Market Exhaustion to the downside of the RSI

Bullish divergence on the weekly time frame and more.

Target Price: $163 - $277 - $400 and higher in the months and years to come.

Weak earnings on end of cycleHome Depot reported weaker earnings – revenue fell 4.25% YoY earnings fell 8.8%. It reflects a weaker building + DIY market in the US, which is what we’re seeing across the board – specialist store Restoration Hardware (RH) reported similarly weak sales. HD fell 2.15% in response, which isn’t enough value for us yet. We initiated coverage of HD back in December where we said that HD is a best in class retailer but too expensive, citing slowdown fears. Those slowdown fears have come to pass yet now we’re anticipating more slowdown versus HD’s 3-5% projected decline in sales for the FY. We think this is too little. Home Depot’s customers tend to be “tradies” and homeowners. Typically having homeowners as a customer base is a good thing – they are cashed up and have equity. Yet we’re in an environment of rising interest rates for mortgages, which will strain that previously strong “homeowner” dollar. We still consider HD to be an exemplary business – even in a recessionary environment they still have net margins of ~20% (vs James Hardie’s 12% and Fletcher’s ~8%) and they maintain an average “ticket” price per sale of ~$92. The headline here is Pandemic spending is over and that goods spend we were seeing previously has shifted to services. See upside as $+$230 and downside as +$190. Read more at: research.blackbull.com

Home Depot Potential for Bearish Drop | 28th February 2023Looking at the H4 chart, my overall bias for HD is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market.

Looking for a sell entry at 311.69, where the overlap resistance and 38.2% Fibonacci line is. Stop loss will be at 331.31 where the overlap resistance and 78.6% Fibonacci line are. Take profit will be at 279.90, where the overlap support and 78.6% Fibonacci line is.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary, and do not constitute investment advice. The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interest arising out of the production and dissemination of this communication. The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed on the website

HOME 2.10 | a different kind of niche in the HOME DEPOT spacefinding value in a greater bull run is a matter of luck or faith

this could eventually be a runner

great finds value for money and expanding across the islands

catering to new markets and the rise of middle class

the ecommerce site is made simple .. intuitive for first timers and OGs in the online shopping world

GPBUSD LONG (UPDATED)updated long for gbpusd, looking for bullish continuation as there have been lots of targets created, first waiting on retracement of the monthly spring to enter in a long position and ride it to gbpusds quarter level @ 1.25 along with the equal highs just below 1.25 price is screaming to go up im hoping gives us the dip to enter us in, also hope price doesent blow through my stop before going back on i will keep an eye on it as it arrives at entry. this could be big considering we've had 4 months straight of bullish candles now retesting the lows. the resistance was broken so ideally there should be plenty of support on this retest.

will we get a 5th bullish month in a row?

will we miss the Bull train?

will price decide it has been bullish for long enough?

the charts tell a story let's see what happens next on gbpusd!

Home Depot dips continue to attract.Home Depot Inc - 30d expiry - We look to Buy at 312.12 (stop at 298.22)

The stock is currently outperforming in its sector.

This stock has seen good sales growth.

Bespoke support is located at 312. 307 has been pivotal.

The primary trend remains bullish.

We look to buy dips.

Our profit targets will be 346.86 and 349.86

Resistance: 324 / 330 / 335

Support: 312 / 307 / 300

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

SOLUSDT SHORT 1:3 RR 15 MINSolana is an open-source blockchain platform that aims to provide fast, secure, and scalable decentralized solutions. Solana's native cryptocurrency is called SOL, and it serves as the primary token for transactions and fees on the Solana network.

If you are looking to trade Solana (SOL) on a 15-minute time frame with a 2% risk, it means that you would be analyzing price movements of SOL over 15-minute increments and limiting your potential losses to 2% of your trading account. This is a common approach in risk management for traders and investors, as it helps them to control their exposure to losses and keep their trading capital safe.

It's important to note that no investment strategy is foolproof and there are always risks involved when trading cryptocurrencies. Before making any trade, it's advisable to carefully consider your investment objectives, risk tolerance, and market conditions to determine if Solana (SOL) is a suitable investment for you. Additionally, it's important to do your own research, understand the technology and economics behind Solana, and stay up-to-date with the latest developments in the Solana ecosystem.

⚫️Existing Home Sales🔵Home prices🔴Top S&P500Not an easy chart but give it a try dear Bitcoin and Crypto Nation

Look at connections of different Tops in financial crisis 2008 and possible hints for near future:

⚫️Top Existing Home Sales

precursor of

🔵Top Home prices

precursor of

🔴Top S&P500

Let me know your thoughts in the comments🤗

⬇️⬇️⬇️

Likes and Follow for updates appreciated🤗

Disclaimer:

Not financial advice

Do your own research before investing

The content shared is for educational purposes only and is my personal opinion

Hurricanes and Home RepairIt is time to put HD and LOW on your radar for two reasons. One I like how the technical complex looks and the other is the fact a major hurricane is going to rip into Tampa, FL (where I'm at), or somewhere into the U.S.

In that same breadth it is imperative that we keep an eye on the Oil Stocks such as OXY and XOM, of which, I will be looking at and posting shortly with levels.

I will try to link all of those charts together for simplicity purposes.

My support/resistance lines are represented with the horizontal lines. You can use those as targets and/or entries for positions based on bounces of those areas or rejections.

5/4/22 HDHome Depot, Inc. (The) ( NASDAQ:MSFT )

Sector: Retail Trade (Home Improvement Chains)

Market Capitalization: $325.831B

Current Price: $315.31

Breakout price: $319.40

Buy Zone (Top/Bottom Range): $313.75-$299.15

Price Target: $337.20-$340.60 (1st), $367.50-$372.80 (2nd)

Estimated Duration to Target: 42-44d (1st), 99-106d (2nd)

Contract of Interest: $HD 6/17/22 330c, $HD 7/15/22 340c

Trade price as of publish date: $7.06/contract, $6.60/contract

DocuSign Inc. and the lesson to be learnt. (TL;DR at end)When the Covid pandemic began affecting many people throughout the workplace and in their homes, companies such as NASDAQ:MSFT , Zoom and NASDAQ:GOOGL began rapidly designing software to accommodate for this very new sprouting market that nobody had ever seen before. A whole line of business dedicated to allowing people to perform their work assigned tasks from anywhere in the world or from the comfort of their couch at home. Despite the major sell-off due to the pandemic and fears of complete economic collapse in some places, a number of people and companies became considerably wealthier. A prime example that I am writing about today is DocuSign and their virtual document signing services which are in competition with NASDAQ:ADBE .

There was a massive craze over this whole digital work idea and many investors believed it was a "money-pot" for a future dominating market. Many investors began pumping money into such companies for long and short term investments. The thought behind it being, "people prefer working this way and now that they have used it, they'll never go back". This mentality obviously allowed companies like DocuSign to advance in price dramatically, because how else are you supposed to sign off a document on a desktop for instance. Despite the thought process seeming "sound", there was one major downfall.

The anticipated growth for a company like DocuSign and other competitors was astronomical. But, as Covid restrictions began to ease up slightly between the time of the announcement of the Delta variant and then Omicron, many people realised that they didn't quite enjoy working from home and/or owners of companies brought many employees back into the workplace, sales for products provided by a company like DocuSign slipped and this sent shivers through countless investors' spines as they realised how overpriced the company may have actually been in comparison to its inherent value. Needless to mention, DocuSign announcing that the "pandemic boom" in business was slowing down after they presented their slipping sales did not help in any which way, shape, nor form. This resulted in a horrific sell-off of countless stocks causing price a catastrophic price drop (especially for traders) of around $100 in Docusign and major price drops with their competitors. Consequently, Adobe had a stock price drop too as investors lost faith in their ability to maintain growth in sales (From $698 all the way through to $616 (at the time of writing)).

Now there is one major lesson to be learnt regarding this scenario and like so many before it. Deciding to become a shareholder in a company due to the potential in their industry and their presence within it alone can end horrifically. Especially when the media "hypes up" such companies resulting in horrific over-evaluations. One must perform their own investigation into the safety of such company regardless of how long you plan on holding their stock for. There is no point in putting money into a company that may not be profitable or the management consists of a number of incompetent monkeys for instance just because everybody is talking about it. You must perform your own investigation and create your own judgement on whether this company is actually worth your time. As an investor or trader, you must be careful, now as much as ever. There are countless startups having their prices floated by the media and the public's attitude towards the company which inevitably come crashing back down, even though all that could be avoided if the investor/trader actually held back until they deemed the price "acceptable or attractive" for the company.

As always, further opinions, facts and news that I may not be aware of are always welcome in the comments, it is always good to bounce ideas off of others, so comment away!

TL;DR: The work from home craze at the beginning of the pandemic ('hyped' by the media) caused many to pump money into companies that would later lose business as many returned to the workplace or their financial infrastructure was realised to be dysfunctional. One must do their own homework into companies and only pay a suitable price for the stock they're getting.

ClearOne (CLRO) - Good M&A target, revenue growthNASDAQ:CLRO describes themselves as a global market leader enabling conferencing, collaboration, and AV streaming solutions for voice and visual communications. With businesses becoming more comfortable and familiar with remote work, ClearOne has a competitive product line (and is actively developing new products) to cater towards that market, with a product line dedicated to improving remote conferencing for those who work from home. Another benefit is that their product line also offers solutions for corporate offices, allowing themselves to be at the forefront of an enterprise's conferencing equipment.

With a market cap in the ballpack of $30 million, ClearOne is an obvious M&A target for industry competition like Cisco, Polycom, Avaya, etc. A smaller competitor, Shure (although ~3x larger in annual revenues) has filed lawsuits claiming ClearOne has been infringing on patents, with rulings constantly siding in the favor of ClearOne - an indication that competitors see them as a threat.

The stock took a big tumble in 2018 when Shure began its patent infringement claims, forcing ClearOne to suspend its dividend indefinitely. Then, the company took a bigger tumble recently as it announced a private placement offering for 2.1 million shares at a purchase price equal to $2.4925 per share, along with warrants to purchase 1.1 million shares (immediately exercisable at $2.43 per share). Insider buying since the latest crash indicates that those closest to the company see it as extremely undervalued.

According to recent filings, ClearOne has announced a product to give enterprises the ability to actively monitor their network of ClearOne products - a gateway to recurring revenue in the future - and plans on using the recently gained working-capital from the private placement to develop products that fit the changing landscape post-COVID.

We will gleam a better insight into where revenue will trend in the year-end 2021 report, and hope to see revenue show signs of real growth throughout 2022.

Full Disclosure: I am long CLRO at an entry of $1.35. I view this as a ~three-year play.

This is not financial advice and the words above reflect only my opinion. You should always do your own due diligence before making any investment.

Reassessment to 1X 100% DOTUSDT Long Haul Trade TargetI've decided that it's a good goal to set a 1X trade on this swing trade. Exactly as i didn't expect it to go so long and high but i kinda realised this re assement will be a good goal and target to go for. That's 100% ROI.

If you didn't get in way back then too bad really.

$RBLX: Will Delta Reopening Imply Pain For Stay-At-Home Names?We can see some significant underperformance by RBLX as it makes it way to the bottom end of this triangle, as the market begins to favor reopening names like consumer services space evidenced somewhat by XLY's relative strength in the current market, will that mean RBLX will continue to underperform? We shall see. Good luck traders

$TPX: Sleep Tight BearsXHB broke through an important 77.5 low volume node today and TPX has just been on fire. You might be asking how a mattress company and homebuilders are correlated well I'm playing it as a proxy and potentially one that could outperform the homebuilder index in general. You gotta have mattress for those homes :)