HD: RECTANGLE PATTERN AND FULL TECHNICAL ANALYSISHD ( HOME DEPOT ):

Consumer Cyclical - Home Improvement Retail.

Home Depot is included in the Down Jones Industrial Average.

My technical analysis on the stock:

The current downtrend took the stock 37% of its all time high of January 2022.

On June 23, HD initiated a strong bounce to $333 off the $265 level.

On August 17, HD initiated a huge drop back to 265, to bounce back again to the 330 zone where we currently are.

The stock is currently down 22% off its all time high.

Is this a buy?

No one knows, but let's look at technical analysis to help us make a decision.

As we see from the chart, the 265-269 zone is acting as a strong support while the 328-333 zone is acting as a strong resistance.

All of the above has created a nice range in the shape of a rectangle.

A rectangle is formed when the price is confined to moving between the two horizontal levels, creating a rectangle.

The pattern can indicate a few things:

- that the downtrend has paused and the stock is now consolidating before a continuation down. So back at the bottom of the rectangle and break down.

- that the downtrend has stopped and we're looking at a change of trend. Kind of bottoming pattern. So basically it can keep ranging for a while and break to the upside OR break to the upside in the next few days.

The rectangle ends when there is a breakout, and the price moves out of the rectangle.

Considering the above there are several ways to trade it:

1. If you think the price will keep consolidating within the range, you can short the stock at the top of the range . Your target is the bottom of the rectangle, with a stop just above the rectangle.

2. if you have a more bullish view, you can wait for a breakout off the rectangle and go long the stock , with a stop below the top line of the rectangle. All targets are mentioned on the chart (blue lines). Rectangle ultimate target being $400.

I'm leaning slightly bullish here because moving averages have started to rise, and I like the triple bottom, but who knows. Whatever your opinion is, best is to manage your risk.

Trade safe.

Homedepot

C+H into H+S as left shoulder is the top right side of the CupThis particular formation is something I seldom experience in my daily chart readings, but when it arises tends to guarantee a profit given this entry. First time I ever saw this I questioned, can two patterns be combined? I would have to agree. Proper confirmed entry would be at 328, as soon as I witnessed the potential first indication of a reversal of trend, a lower high in a previous uptrend. Another thing that added conviction was the appearance of larger than the other wicks in the formation of the H+S specifically that right shoulder. I entered Friday in this situation because of the conviction I had in regard to experiencing this formation previously. 5 min time frame is my preference for day trades. Hope this helps.

HD: Double bottom?Home Depot Inc

Intraday - We look to Buy at 285.03 (stop at 271.38)

Buying pressure from 265.00 resulted in prices rejecting the dip. Posted a Double Bottom formation. The reaction higher is positive and highlights a clear reversal. A weaker opening is expected to challenge bullish resolve. Dip buying offers good risk/reward.

Our profit targets will be 328.98 and 340.00

Resistance: 300.00 / 330.00 / 418.00

Support: 285.00 / 265.00 / 150.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’) . Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

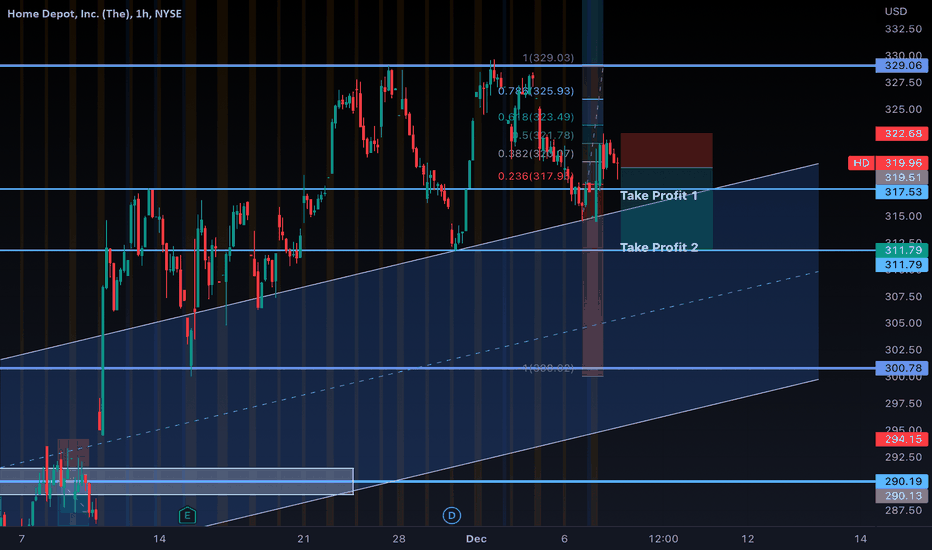

Dead Cat Bounce on Home Depot. HDThat is what it appears like to us at this stage. Overbought on the daily, possibly a result of the ascending pennant (?A Wave) signaling a fair chance of a reversal now to the shown levels. The fact that this is another short idea should not be all surprising given the general pessimism on the markets right now.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

Hurricanes and Home RepairIt is time to put HD and LOW on your radar for two reasons. One I like how the technical complex looks and the other is the fact a major hurricane is going to rip into Tampa, FL (where I'm at), or somewhere into the U.S.

In that same breadth it is imperative that we keep an eye on the Oil Stocks such as OXY and XOM, of which, I will be looking at and posting shortly with levels.

I will try to link all of those charts together for simplicity purposes.

My support/resistance lines are represented with the horizontal lines. You can use those as targets and/or entries for positions based on bounces of those areas or rejections.

Nordstrom JWN - A Latent ScalpI hear that the economy is pretty bad right now. So bad that we're in a recession, although the Government doesn't like the word "recession."

The real word to describe the situation humanity is facing that nobody is saying yet, however, is "Depression."

Here in North America, we aren't quite there yet, but no amount of money printing and astroturfing is capable of keeping the true state of the environment, the food supply, the water sources, and our energy reserves hidden for all that much longer.

So, they say that for a company like Nordstrom, it's surely "a strong sell." After all, the whole sector is going down the drain because even the middle-upper class is spending less, and that surely is true.

Yet, one doesn't have to back up the dump truck to buy and hold something for 6 years, either.

Nordstrom's post-dump price action has some unique characteristics. Mainly, that for the better part of two weeks, it's been completely bearish.

It also has not retested the $20 psychological level to find buyers, or rebalanced the dump's gap. That all on its own is peculiar in a market that just loves to flirt with gaps after making them, at least a little bit.

With price trading as low as $16.84 on Friday, a run to $21 yields a 22% trade. Ideally, if price action is to do the pseudo fakeout dump I am expecting when markets open on Tuesday:

SPX / ES - Bull Whips and Bear Saws

One can get in cheaper than $16.84, and then the risk/reward is all the sweeter.

I believe it's without a doubt that an exceptional shakeout is coming in the markets, a fundamental correction that will crack the pre-COVID highs and have everyone questioning what's going to happen with their happiness and their investments.

So JWN Nordstrom is not something you would want to hold. You want to drop it like a hot potato. But its current setup does provide what may be an imminent opportunity.

$HD building up to retest high's. 🔸️Ticker Symbol: $HD timeframe: 4 Hour 🔸️3X Bull Pattern 🔸️Investment Strategy: Long

TECHNICAL ANALYSIS: $HD looking to retest $332 with new guidance to buy back millions. We are currently on a nice uptrend, as you can see with our regression channel; money momentum is on the way up and our middle band depicts bullish trend. The price retracement to about the 50 is also a clear sign to look for some intraday trades going in to tomorrow's trading session. I will be loading up on some shares in the pre-market tomorrow to see how we react to $332!

We are at a major (but necessary) corrective wave on $AAPL, and I will be loading up positions waiting for a drop back to the lower 160's, potentially lower if price respects Fib retracement.

HD:Bear market rally???Home Depot Inc

Short Term - We look to Buy at 311 (stop at 301)

A bullish reverse Head and Shoulders is forming. This is positive for sentiment and the uptrend has potential to return. Horizontal support is seen at 310. Further upside is expected although we prefer to set longs at our bespoke support levels at 310, resulting in improved risk/reward.

Our profit targets will be 339 and 345

Resistance: 340 / 370 / 420

Support: 310 / 280 / 150

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Signal Centre’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Signal Centre.

Home Depot (NYSE: $HD) Breaks 0.5 Fibonacci Range! 👀The Home Depot, Inc. operates as a home improvement retailer. It operates The Home Depot stores that sell various building materials, home improvement products, lawn and garden products, and décor products, as well as facilities maintenance, repair, and operations products The company also offers installation services for flooring, cabinets and cabinet makeovers, countertops, furnaces and central air systems, and windows. In addition, it provides tool and equipment rental services. The company primarily serves homeowners; and professional renovators/remodelers, general contractors, maintenance professionals, handymen, property managers, building service contractors, and specialty tradesmen, such as electricians, plumbers, and painters. It also sells its products through websites, including homedepot.com; blinds.com, an online site for custom window coverings; and thecompanystore.com, an online site for textiles and décor products. As of December 31, 2021, the company operated 2,317 stores in the United States. The Home Depot, Inc. was incorporated in 1978 and is based in Atlanta, Georgia.

5/4/22 HDHome Depot, Inc. (The) ( NASDAQ:MSFT )

Sector: Retail Trade (Home Improvement Chains)

Market Capitalization: $325.831B

Current Price: $315.31

Breakout price: $319.40

Buy Zone (Top/Bottom Range): $313.75-$299.15

Price Target: $337.20-$340.60 (1st), $367.50-$372.80 (2nd)

Estimated Duration to Target: 42-44d (1st), 99-106d (2nd)

Contract of Interest: $HD 6/17/22 330c, $HD 7/15/22 340c

Trade price as of publish date: $7.06/contract, $6.60/contract

Bullish Swing Trade on Home Depot (HD)The market is looking very bullish going in to this week. I see a setup on HD that has an 80% chance to be profitable based on Trademiner 5.0. the technical analysis sees bullish divergence on the weekly and daily charts. The latest earnings report was positive on eps and revenue. And finally, the DJIA for the past 30 year has had positive gains from March to April.

So entry is ~341.00 stoploss = 285.00 and /TP1 = 406.00 and /TP2 = 465.00 /Time stopout is May 2 2022.

Home Depot ready for a renovation. HDGoals 335, 344, 357. Invalidation at 298 .

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

Home Depot packing up and going home. HDImmediate targets 345, 325. Invalidation at 458.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

NAIL potential retest of breakoutI bought NAIL in the pullback this morning as I believe this is a retest of the breakout in the downtrend. The daily indicators also look strong right now.

I'm keeping a stop just below the previous lows at 62.94 since if this is a bull trend now, it shouldn't break that support.

I believe around a 30% gain is possible in this breakout if you can be patient. Good luck!