Honeywell: Quantum Leap or Geopolitical Gambit?Honeywell is strategically positioning itself for significant future growth by aligning its portfolio with critical megatrends, notably aviation's future and quantum computing's burgeoning field. The company demonstrates remarkable resilience and foresight, actively pursuing partnerships and investments designed to capture emerging market opportunities and solidify its leadership in diversified industrial technologies. This forward-looking approach is evident across its core business segments, driving innovation and market expansion.

Key initiatives underscore Honeywell's trajectory. In aerospace, the selection of the JetWave™ X system for the U.S. Army's ARES aircraft highlights its role in enhancing defense capabilities through advanced, resilient satellite communication. Furthermore, the expanded partnership with Vertical Aerospace for the VX4 eVTOL aircraft's critical systems positions Honeywell at the forefront of urban air mobility. In the realm of quantum computing, Honeywell's majority-owned Quantinuum subsidiary recently secured a potentially $1 billion joint venture with Qatar's Al Rabban Capital, aiming to develop tailored applications for the Gulf region. This significant investment provides Quantinuum with a first-mover advantage in a rapidly expanding global market.

Geopolitical events significantly influence Honeywell's operational landscape. Increased global defense spending presents opportunities for its aerospace segment, while trade policies and regional dynamics necessitate strategic adaptation. Honeywell addresses these challenges through proactive measures like managing tariff impacts via pricing and supply chain adjustments, and by realigning its structure, such as the planned three-way breakup, to enhance focus and agility. The company's strategic planning emphasizes leading indicators and high-confidence deliverables, bolstering its ability to navigate global complexities and capitalize on opportunities arising from shifting geopolitical currents.

Analysts project strong financial performance for Honeywell, forecasting substantial increases in revenue and earnings per share over the coming years, which supports expected dividend growth. While the stock trades at a slight premium to historical averages, analyst ratings and institutional investor confidence reflect positive sentiment regarding the company's strategic direction and growth prospects. Honeywell's commitment to innovation, strategic partnerships, and adaptable operations positions it robustly to achieve sustained financial outperformance and maintain market leadership amidst a dynamic global environment.

HON

HONEY won't fall down the WELL! Bottom is nearNASDAQ:HON - HoneyWell

- Uptrend since COVID (2020)

- At the bottom of the channel

- Massive Volume Shelf

- Key Support/ Resistance Area (S/R)

- Wr% at Green Support Beam

To me the downside looks limited here. When this ship turns it probably goes to $300🎯

Not financial advice

Honeywell: Swoop 🦅For two weeks now, Honeywell stock has been heading south, losing more than 10%. It has completed the magenta wave (B) and is currently in the same colored wave (C). Even though the price has rallied a bit this week, we believe that the end of this wave is only in sight further south in our green target zone between $182.14 and $173.09 and that the price should continue to fall. At the green target zone, the overarching correction in the form of the green wave (2) will be completed, which should set the stage for very substantial gains.

Honeywell: Into the Honeypot 🍯Honeywell should push its fingers deep into the green honeypot between $194.17 and $178.41, breaking through the support at $196. There, the share should gain new strength by finishing wave 2 in green and turn upwards again. First, it should climb back above $196 and then take off from this mark, aiming for the resistance at $222.56. Once above this level, the course should gather further momentum and continue the ascent.

HON Daily Technical AnalysisA SHORT Position

Support Price: 204,26 - 206,40 - 207,84

Resistance Price:200,50 - 193,67 - 184,36 - 179,77

Daily and Hourly indicators NEGATIVE. With market stuation price can DOWN. All Market index looking like will go DOWN. So HON can be good for short position.

Its i my mind. it is not a investment mind

Honewell downgrading. HONPivot confirmed in a zigzag, going south inline with the major indices.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

More honey, Honeywell. HONA nice bounce off on the 1.272 border on the Fib Channel. This is resonantly reassuring. Looking for a move up now, supposedly X Wave.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

Industrials needs a breatherXLI, the Sultan, was the ultimate DOW mover. He ruled over everyone including hedge fund managers. Tuesdays action to the upside was great but gave it up at the end of the day. Wed and Thursday continued to the downside. On Friday, the Sultan tapped the 8 day EMA and came back up but closed below previous day high. The issue with XLI is the channels are small. If this low channel is to break, look out below cause I'm thinking of a 3 point move down to 102 as support. Based on HON, FDX, and UPS, Sultan's rule might be done for this coming two weeks.

Long | HONNYSE:HON

Possible Scenario: LONG

Evidence: Price Action

This is my idea and could be wrong 100%.

$HON Bearish Swing Trade from the TT BlackboxPink - Stop-loss

Green - Entry Target

Red - Exit Target

Adjust the exit targets as needed.

www.ttblackbox.com

Honeywell path and directionHello everyone

Honeywell started a uptrend channel in march

So far channel is intact and respected

Look for key notes in chart and levels

for any question feel free to ask :)

UAV TechHoneywell is expanding their drone technology services. Growing their satellite network and increasing the services which they provided geared towards drones.

$HON Tests Channel Support as COVID Cases Soar in Sun BeltHON shares sit in a clearly bearish pattern, but continue to hold up, frustrating bears. The company is a prime supplier of personal protection equipment as COVID-19 stats press to new highs on a case-per-day basis.

In addition, the anti-mask movement is rapidly losing support as rational thought ascends.

Honeywell in Wave 3 (daily); Run up to earningsI believe we're in a Wave 3 on the daily chart. Price target $195. I think, between now and earnings (1/27), there will be global forces (i.e., trade deals, appeasing fed, etc.) that will run this (and similar equities) up a to earnings. My price target may be included with the result of earnings , which from what I've briefly read should be a turnaround story from Q319. I'll look to buy Call Weekly Call options expiring right before earning if price breaks through and closes above the supply zone of $180.68.

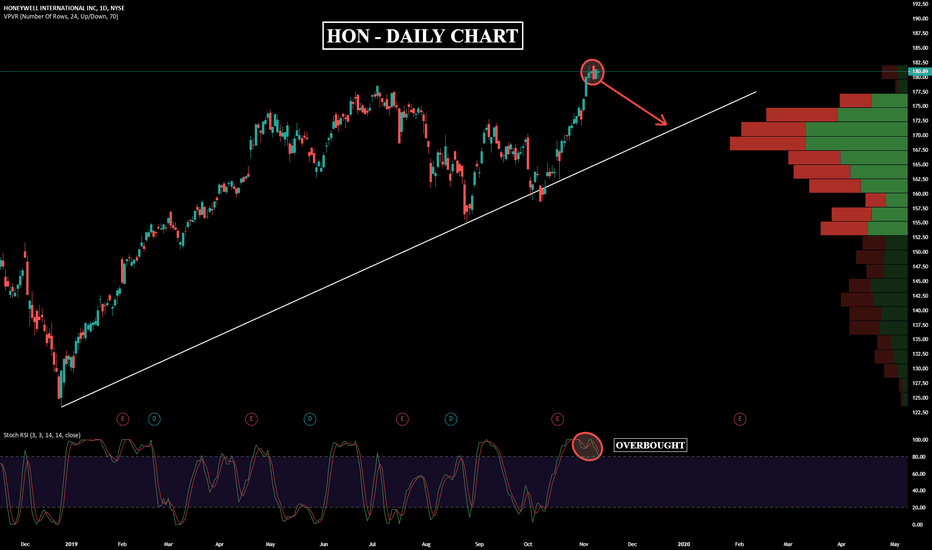

HON - DAILY CHARTHoneywell today steps in the spotlight as the company pointed its new President on China, its largest country market outside the U.S. Scott Zhang now replaces William Yu that was promoted to the global leadership. Zhang has a hard task ahead to help the company to continue to thrive in the Asian Market amid the clashes of the Trade War. On the overall aspect, Honeywell seems to be in good shape as it continues to pursue going deep into the building market by implementing its Internet of Things products, which can bring good results in the long term scenario.

Honeywell - possible pipe bottom on monthly timeframe 7% longWait for continued confirmation, but looks like target of 159 and stop of 129 for this long trade following a pipe bottom pattern.