HK50 "HongKong" Index Market Bullish Robbery (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the HK50 "Hong Kong" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (21000.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24200.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸HK50 "Hong Kong" Index Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Hongkongdollar

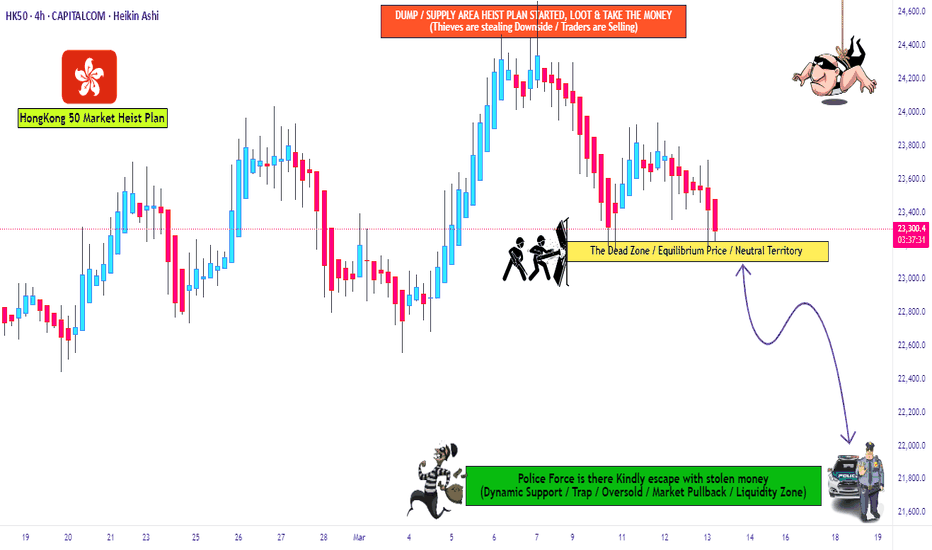

HK50 "HongKong50" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the HK50 "HongKong50" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (23000) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (24000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

HK50 "HongKong50" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

HK50 "Hong Kong" CFD Market Money Heist Plan on Bullish Side.Nǐ hǎo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist HK50 "Hong Kong" CFD Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

USDHKD One of the best buys in the market.The USDHKD pair just formed a 1W Death Cross this week but the current 1W candle is a green one. The reason is that it is rebounding after reaching last week the 2-year Support Zone. We believe that we will see an aggressive rise next that will approach the Lower Highs trend-line. Our target is just below it at 7.82500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD Bounced off the 2022 Support! Strong buy!The USDHKD pair hit amidst Monday's turmoil the top of the Support Zone that was established back on the week of December 05 2022 and instantly rebounded. This naturally shows the strong technical demand of that level.

Even tough another 1-2 weeks of consolidation is possible, on the long-term, we expect a test of the May 01 2023 Lower Highs trend-line. Our Target is 7.8300.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD Be ready for a long-term buy.The USDHKD pair has been giving us excellent trades in the past 12 months and the latest (April 18, see chart below) almost hit our 7.79500 Target about 3 weeks ago:

With the price approaching yet again the 11-month Support Zone, there is no reason to diverge from this successful pattern. Right now by being so close to the Support Zone, the R/R ratio favors buying towards the Resistance Zone.

Our Target will be slightly lower at 7.83900 (April 08 High).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD Approaching the 2-year Resistance Zone. Major Sell.The USDHKD pair has been rising since November 2023 after hitting the Support Zone and is approaching the 2-year Resistance Zone. The Sine Waves help us understand the cyclical nature behind it. This is a low risk sell opportunity for the long-term. Our Target is 7.79500 (top of Support Zone).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD Wave trading continues for high percentage profits.We have been using the USDHKD pair for wave trading for a very long time (see standard example below) due to its distinct characteristic and tight correlation:

It is more than obvious on this 1D chart that the application of the Sine Wave tool gives high probability entries and exits for bottom/ top buying and selling. Currently we are on an uptrend that should start topping in February. That will be our next low risk trade and it will be a sell. Profit taking will be made towards the end of June as the Sine Wave approaches its bottom.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD: Rejection on the 1D MA50 and LH trendline. Sell.USDHKD is on a neutral 1D technical outlook (RSI = 47.421, MACD = -0.002, ADX = 19.830) as it is approaching the end of a Descending Triangle pattern. Yesterday it got a double rejection on the 1D MA50 and the LH trendline.

A harmonic Descending Triangle broke down to the S1 level after after its third contact with the LH trendline. Consequently we trrat this as a sell opportunity (TP = 7.7940).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDHKD The wonderful wave trading of this pair.It has been almost 1 year since we published a long-term perspective on the USDHKD pair (chart below) based on a cyclical behavior and as you see it has worked wonderfully:

Basically the Sine Waves couldn't have mapped it better and have successfully projected the sharp fall straight after our article as well as the one that started in May (2023). Right now this Cycle has bottomed and we should again see it rise to the pivotal 7.8500 level. What we want to see after that is a series of Lower Highs on the 1D RSI and as usual that will be the signal to sell.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Hong Kong50 Hang Seng Short Bears Remain in Controlbearish start to the week, with hawkish central banks and growth fears continue weighing on investor sentiment ahead of a busy week.

The theme remained the same, with investor jitters over the economic outlook weighing on investor sentiment.

There were no economic indicators from the region to change the mood.

Market Overview

It was a bearish morning session for the Asian markets. The ASX 200 led the way down, with the Hang Seng and the Nikkei also struggling.

The Asian equity markets tracked the US equity markets into the red, with fears of central banks sending the global economy into a recession weighing. Hawkish Fed Chair Powell testimony continued to resonate this morning. Last week’s Bank of England 50-basis point interest rate hike was a reminder of central bank commitments to tame inflation.

Despite softer US private sector PMI numbers on Friday, the markets are still betting on a Fed 25-basis point interest rate hike in July. According to the CME FedWatch Tool, the probability of a 25-basis point July Fed rate hike stood at 71.9% versus 74.4% one week ago.

Significantly, the chances of the Fed lifting rates to 5.75% in September stood at 11.5%, up from 8.9% one week earlier.

Bank stocks also had a mixed morning. HSBC Holdings PLC and The Industrial and Commercial Bank of China (HK:1398) saw losses of 0.33% and 0.24%, respectively, while China Construction Bank (HK: 0939) rose by 0.40%.

Strategy Bearish Short

RSI confirming permanent trend continuation

Bulltraps can be used to sell more and stronger

Trendlines shold be used in 2 ways:

bearish breakout of the trendlines should be sed to new bearish enries or position sizing only.

Bullish breakouts should be used as profit taking or trading the 2nd wave only.

Bullish breakouts are often traps.

hong kong longterm view and long setup hong kong long

😊

Im looking at hong kong 33 and I can see new wave coming for up

There is two look:

The first:

We are in the end of the correction wave (b) and we are going to start the fast (c) wave to make new top

The first part of it going to be the orange (a) and it will be an impulse wave and the target 50% of the (b)

The second:

We are in higher degree B wave and we could have correction then continue the down move to second area (the yellow box ) then will start out impulse wave (historical start)

So in both look we are looking to up move 😊

I put my setup in the chart

Good luck!

Please let me know what you think

USDHKD Drop imminent on a 5-year RSI signalThe USDHKD pair naturally has a tight trade but at times gets volatility shocks. A signal that since 2017 has triggered such shocks to the downside has been flashing on the 1D RSI.

As you see during that period, every time the 1D RSI formed Lower Highs while the candle action was either rising or flat, a strong drop occured. We have another 5 such occurrences. The price is right now on the multi-year Resistance level, supported by the 1D MA50 (blue trend-line) and the most likely target is the 1D MA200 (orange trend-line), which has been untouched since February 2021.

Notice also the nice flow provided by the Sine Waves that have fairly accurately caught major market lows since 2016. Such a low is next projected by this indicator for the last week of November. The timing seems perfect for a sell on the USDHKD pair.

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇