HK50 Index Robbery Plan – Bulls in Control, Load Up🚨💸💥**HK50 MONEY HEIST ALERT – Thief Trading Style Entry Plan!**💥💸🚨

"Swipe the Trend, Rob the Risk – The Hong Kong Vault is Open!"

🌍🌎Hey there, Global Money Movers, Heist Planners & Market Robbers!🕵️♂️💰

Welcome to another high-stakes operation brought to you by the Thief Trading Style – where strategy meets chaos, and profits are earned with precision. 🏴☠️📊

🎯 Mission Brief: HK50 Index Robbery – Long Entry Blueprint

Based on our exclusive blend of technical & fundamental analysis, the HK50 (Hong Kong Index) is entering the Loot Zone – bullish bias detected and price action confirming a strategic long opportunity. Here's how we execute the plan:

🔓 ENTRY – The Vault is Open!

🎯 Strike anywhere near recent swing lows/highs on the 15m or 30m timeframe.

💡 Ideal Entry Zones: Closest bullish structure or reversal support.

📌 Tip: Set alerts at key reaction zones – timing is the true thief’s edge.

🛑 STOP LOSS – Escape Hatch Point

🛡️ SL placed below nearest swing low on the 4H timeframe (~23640.0).

💡 Adjust based on your risk tolerance, lot size, and trade stacking.

🏁 TARGET – The Getaway Route

🎯 TP zone: ~25200.0

🚀 Optional: Use Trailing SL to maximize robbery exit on spikes or trap fails.

💬 “Escape before target” if market sentiment flips or volatility surges.

🧲 Scalper Alert: Ride the Bull Only!

💵 Scalping allowed on buy side only.

If you’ve got capital power – go direct. Otherwise, join the swing thieves and ride with momentum. 📈💣

🧠 Why Bullish? | Heist Justification

📊 Current momentum supported by:

🔎 Technical Trend Reversal Patterns

📉 ATR exhaustion near previous downside levels

📰 Positive Macro, Global Cues, & Institutional Sentiment

👉 For the full scoop – combine this with:

📰 COT Data & Market Sentiment

🌐 Intermarket & Geopolitical Outlook

📈 Index-Specific & Seasonal Cycle Studies

Stay ahead, rob smart! 💼💼

⚠️ Risk & News Alert – Don’t Get Caught!

🔔 Avoid entries during major news drops!

✅ Use trailing stop-losses on running trades.

🚷 Protect your loot at all costs – market volatility is the real SWAT team! 🚓

💥Support Our Robbery Crew!

📢 Smash the Boost Button 💣💥 to support the Thief Trading Style revolution!

Together, we rob with discipline, plan with clarity, and exit with satisfaction.

💰Let’s stack profits, not just candles. 📈🤑

📝 Disclaimer:

This is a high-level market outlook, not financial advice. Adjust based on your capital, risk tolerance, and analysis. Always monitor your trades and adapt to the ever-changing market landscape.

Follow for more Heist Plans – this is just the beginning! 🕶️🔐

**See you at the next vault…**🚁💼📈

#ThiefTrading #HK50 #MarketHeist #IndexAnalysis #BullishBreakout #SmartMoney #ScalpersWelcome #SwingTrading #TechnicalAnalysis #RiskReward #TradingViewElite #ProfitWithStyle

Hongkongindex

The HK50 Robbery: Can You Grab the Cash Before the Cops Arrive?🚨 HK50 "Hong Kong 50" HEIST ALERT: Bullish Loot & Trap Escape Plan! 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on 🔥Thief Trading Style🔥 (technical + fundamental analysis), we’re plotting the ultimate heist on the HK50 "Hong Kong" Index Market Cash market! Our master plan focuses on a long entry—targeting the high-risk ATR Zone (overbought, consolidation, potential reversal). Beware: Bears are lurking, and traps are set! 🏆💸 Book profits fast, stay wealthy, and trade safe! 💪🎉

🔓 ENTRY: The Vault Is Open – Swipe the Bullish Loot!

Buy Limit Orders: Place within 15-30min (recent swing low/high).

Alert Recommended! Don’t miss the heist.

🛑 STOP LOSS: Escape Route

Set near the latest swing low or below 4H MA (~23500.00).

Adjust based on risk, lot size, and multiple orders.

🎯 TARGET: 24700.00 (or Run Before It Hits!)

Scalpers: Only long-side plays! Use trailing SL to lock profits.

Swing Traders: Execute the robbery plan patiently.

📡 MARKET INTEL: Why HK50 "Hong Kong" Index Market is a Bullish Target

Fundamental Drivers: Macro trends, COT data, geopolitics, sentiment.

Intermarket & Index-Specific Factors in play.

👉 For full analysis, check the linkss below! 🔗🔗

⚠️ TRADING ALERTS: News & Position Safety

Avoid new trades during high-impact news.

Trailing SL is a MUST to protect profits.

💥 BOOST THE HEIST! Hit Like & Follow!

Support the plan → More profits → Easier robberies! 💰🚀

Stay tuned for the next heist! 🤑🐱👤🤩

HK50 "HongKong" Index Market Bullish Robbery (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the HK50 "Hong Kong" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk ATR Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (21000.0) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 24200.0 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸HK50 "Hong Kong" Index Money Heist Plan is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Future trend targets with Overall outlook score... go ahead to check 👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰🗞️🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

HK50 Heist Alert: Snatch the Bullish Loot & Escape the Red Zone!🌎 Greetings, global fortune hunters! Bonjour, Shalom, Salut, Hola! 🌟

Dear Cash Commanders & Market Marauders, 💰⚡️

Forged in the 🔥 Rogue Trader’s crucible of technical and fundamental sorcery 🔥, here’s our sly scheme to plunder the HK50 “HongKong50” Index Market. Stick to the chart’s blueprint, homing in on long entries. Our endgame? Sneak out near the perilous ATR Red Zone, where overbought signals, consolidation, trend reversals, and traps await, with bearish outlaws ready to pounce. 🏴☠️💸 “Lock in profits and spoil yourself, traders—you’re unstoppable!” 🎉💥

**Entry 📈**: The safe’s wide open! Grab the bullish treasure at any price—the raid’s in motion!

For sharper moves, place buy limit orders on a 15 or 30-minute chart at the most recent swing low or high. Hot tip: set chart alerts to stay one step ahead!

**Stop Loss 🛑**:

📍 Rogue SL anchored at the recent swing low on the 4H timeframe (22700.00) for day or swing trades.

📍 Adjust SL based on your risk tolerance, lot size, and number of open orders.

**Target 🎯**: Aim for 24700.00—or slip away early if the market turns dicey!

🧲 **Scalpers, stay sharp!** 👀: Focus on long-side scalps only. Big bankroll? Jump in now! Smaller stack? Team up with swing traders for the heist. Use trailing SL to guard your gold 💰.

💵 **HK50 Market Heist (Swing Trade Breakdown)**: Sitting in a neutral zone with a bullish spark, driven by key market currents. ☝

🗞️ **Dig into the details**: Explore Fundamental Insights, Macroeconomic Trends, COT Reports, Geopolitical Shifts, Sentiment Signals, Intermarket Connections, Index-Specific Factors, Positioning, and Future Targets for the full picture! 👉🔗🌍

⚠️ **Trading Alert: News & Position Tactics** 📰🚨

News events can rattle markets like a tempest. To protect your profits:

- Steer clear of new trades during news releases.

- Deploy trailing stop-losses to secure gains and shield open positions.

💖 **Power up our raid!** 💥 Tap the Boost Button 💥 to amplify our profit-snatching prowess. Join the Rogue Trading Style posse and rake in riches daily with finesse. 🏆🤝🚀

See you at the next market ambush—stay vigilant! 🤑🐱👤🎯

Hang Seng Index Pulls Back as Trade Deal Optimism FadesHang Seng Index Pulls Back as Trade Deal Optimism Fades

Yesterday, Hong Kong’s Hang Seng Index (Hong Kong 50 on FXOpen) climbed above the 23,600 mark, supported by progress made during US–China tariff negotiations.

However, today the Hang Seng Index (HSI) has dropped towards the 23,100 level, which may be explained by fading optimism that dominated the market a day earlier.

According to Reuters, Christopher Hodge, Chief Economist at investment bank Natixis, stated that “these talks will yield nothing of long-term value. Ultimately, tariffs will still be significantly higher and will weigh on US economic growth.”

Technical Analysis of the Hang Seng Index (HSI) Chart

Price movements are forming an upward trend channel (marked in blue), with the following features:

→ The price is situated in the upper half of the channel (a sign of demand), and the upper boundary appears to act clearly as resistance;

→ Yesterday’s reversal suggests that bears became active above the former support area near the 23,385 level.

In this context, it is reasonable to assume that the Hang Seng Index (Hong Kong 50 on FXOpen) may test the support zone formed by the psychological level of 23,000 and the median line of the ascending channel. If the fundamental backdrop gives markets more reasons for caution, a deeper correction towards the lower boundary of the blue channel cannot be ruled out.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

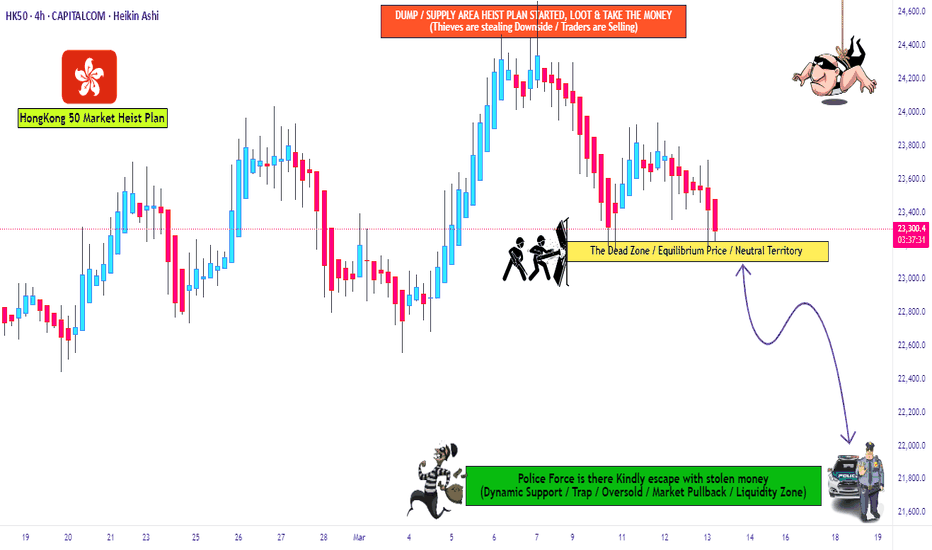

"HK50" Indices Market Bearish Heist Plan (Swing / Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "HK50" Indices Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (23100) then make your move - Bearish profits await!"

however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest. I Highly recommended you to put alert in your chart.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (24200) Swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 22000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"HK50 / HongKong50" Indices Market Heist Plan is currently experiencing a bearishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Index-Specific Analysis, Positioning and future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

HK50 "HongKong50" CFD Index Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the HK50 "HongKong50" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (23000) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (24000) swing Trade Basis Using the 2H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 21800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

HK50 "HongKong50" CFD Index Market is currently experiencing a Neutral trend to Bearish., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Hang Seng Index Reaches Three-Year HighHang Seng Index Reaches Three-Year High

A month ago, while analysing the uptrend in the Hang Seng index (Hong Kong 50 on FXOpen), we noted that:

→ Positive sentiment was driven by the success of the DeepSeek startup, boosting Chinese tech stocks and mobile operators.

→ Price movements formed a bullish structure based on Fibonacci proportions.

→ Analysts predicted the uptrend could persist until the second half of March.

Today, the Hang Seng index (Hong Kong 50 on FXOpen) surged above the 24,500 level for the first time since February 2022. According to Reuters, investor enthusiasm for artificial intelligence continues to fuel the rally.

Technical Analysis of the Hang Seng Chart

New price data support the construction of a large-scale upward channel (marked in blue).

From a bullish perspective:

→ The median line of the blue channel has shifted from resistance to support (as indicated by arrows).

→ The price remains within the intermediate purple ascending channel.

From a bearish perspective:

→ The last two candlesticks show long upper wicks—an indication that sellers are active, possibly locking in profits.

→ The RSI indicator is forming a bearish divergence.

Given these factors, the price appears vulnerable to a pullback. However, the future trajectory will largely depend on fundamental factors, particularly the ongoing tariff tensions between China and the United States.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GPS recalculating, HSI is finding its way back to the bull routePEPPERSTONE:HK50

D chart : it tries to returning into uptrend channel.

HSI:HSI

D Chart

We look forward to see it at 24192, 24385! Let's continue to monitor.

W Chart PEPPERSTONE:HK50

in 1H 4H chart mentioned the Index is intact and in the Bullish runway!

Look at longer term and trade zen-ly!

Cultivating and nurturing your trading mindset:

Pay attention to your trading strategy becoming a great trader but not profits from one trade.

Happy Trading Everyone.

** Please Boost 🚀/LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Share your trading journey to encourage the trading buddies *

HK50 "HongKong50" CFD Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the HK50 "HongKong50" CFD Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (20500.0) then make your move - Bullish profits await!"

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 2H period, the recent / nearest low or high level.

Goal 🎯: 21500.0 (or) Escape Before the Target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

🔆Fundamental Analysis

- The HK50 index has experienced a significant rally in recent months, driven by China's easing of Covid-19 restrictions and monetary policy support.

- The index is currently trading at a price-to-earnings (P/E) ratio of 6.82, which is lower than its three-year average of 12.3.

- Earnings growth for HK50 constituents is expected to be moderate in the coming quarters, driven by a recovery in consumer spending and investment.

🔆Macro Economic Analysis

- China's economic growth is expected to recover in 2023, driven by policy support and a rebound in consumer spending.

- The People's Bank of China (PBOC) has been easing monetary policy, cutting interest rates and reserve requirements to support growth.

- Hong Kong's economy is closely tied to China's, and is expected to benefit from a recovery in Chinese growth.

🔆COT Analysis

- The CoT report shows that institutional traders are net long the HK50 index, indicating a bullish sentiment.

- Retail traders are net short the index, indicating a bearish sentiment.

- The disparity between institutional and retail trader sentiment could indicate a potential buying opportunity.

🔆Sentimental Analysis

- Market sentiment for the HK50 index is currently neutral, with a sentiment score of 50.

- The index has experienced a significant rally in recent months, and some investors may be taking profits, leading to a neutral sentiment.

🔆Institutional Trader Positioning

- Institutional traders are net long the HK50 index, with a positioning score of 60.

- This indicates that institutional traders are bullish on the index and expect it to continue rising.

🔆Retail Trader Positioning

- Retail traders are net short the HK50 index, with a positioning score of 40.

- This indicates that retail traders are bearish on the index and expect it to fall.

🔆Future Market Prediction

- Based on the analysis, the HK50 index is expected to continue rising in the long term, driven by a recovery in Chinese growth and policy support.

- However, the index may experience some volatility in the short term, driven by profit-taking and geopolitical risks.

- A breakout above 20,500 could indicate a continuation of the uptrend, while a breakdown below 19,600 could indicate a reversal.

🔆Institutional Trader Positioning

- Long Positions: 62%

- Short Positions: 38%

🔆Retail Trader Positioning

- Long Positions: 42%

- Short Positions: 58%

Please note that these percentages are approximate and based on general market sentiment. They should not be taken as investment advice.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

Hang Seng Index Hits Four-Month High Amid DeepSeek’s SuccessHang Seng Index Hits Four-Month High Amid DeepSeek’s Success

As shown in the Hang Seng (Hong Kong 50 on FXOpen) chart today, the index has risen above the 21,500 mark for the first time since October 2024.

According to Reuters, bullish sentiment is fuelled by optimism surrounding the success of the DeepSeek startup. Leading gainers include tech stocks:

→ Chipmaker Cambricon Technologies surged 6.2%;

→ AI firm CloudWalk Technology hit the 20% upper limit;

→ Major telecom operators China Mobile, China Unicom, and China Telecom also saw gains after announcing their collaboration with DeepSeek’s open-source model to "promote the inclusive adoption of cutting-edge AI technologies."

Analysts at China Securities believe the uptrend could persist until the second half of March.

Technical Analysis of the Hang Seng Chart

Applying Fibonacci retracement levels using the August low (A) and the October 2024 high (B), we can see how these levels acted as temporary support (marked with arrows) as the price retraced to the January low (C).

In the most optimistic scenario:

→ The rally over the past three weeks may signal the resumption of the A→B uptrend;

→ Based on Fibonacci proportions, bulls may target the 1.618 extension of the initial move, implying a potential price level 61.8% higher than the previous peak.

This suggests a possible target around 25,520, though this appears somewhat ambitious for the Hang Seng (Hong Kong 50 on FXOpen) given:

→ Rising inflation in China—today’s data shows the annual CPI climbed from 0.1% (previous reading) to 0.5%;

→ The prospect of escalating tariff tensions with the US after China retaliated against Trump’s 10% tariffs on Chinese imports.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

"HK50 / Hong Kong 50" Index Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical analysis🔥, here is our master plan to heist the "HK50 / Hong Kong 50" Index market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 👀 So Be Careful, wealthy and safe trade.💪🏆🎉

Entry 📈 : You can enter a Bull trade at any point,

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Using the 4H period, the recent / nearest low or high level.

Goal 🎯: 21,600

Scalpers, take note : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

Warning⚠️ : Our heist strategy is incompatible with Fundamental Analysis news 📰 🗞️. We'll wreck our plan by smashing the Stop Loss 🚫🚏. Avoid entering the market right after the news release.

Take advantage of the target and get away 🎯 Swing Traders Please reserve the half amount of money and watch for the next dynamic level or order block breakout. Once it is resolved, we can go on to the next new target in our heist plan.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

HK50 "Hong Kong 50" Index Market Heist Plan on Bullish SideHello!! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist HK50 "Hong Kong 50" Index Market Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry 📈 : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Low Point take entry should be in pullback.

Stop Loss 🛑 : Recent Swing Low using 4H timeframe

Attention for Scalpers : Focus to scalp only on Long side, If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

HK50 Hong Kong 50 Index Market Money Heist Plan on Bearish SideOla! Ola! My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist HK50 "Hong Kong 50 Index" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Near the Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry 👇 📉: Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe, Recent / Nearest High Point.

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : Focus to scalp only on Short side, If you've got a money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss 🚫🚏. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

💖Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

HK50 "Hong Kong" CFD Market Money Heist Plan on Bullish Side.Nǐ hǎo! My Dear Robbers / Money Makers & Losers, 🤑 💰

This is our master plan to Heist HK50 "Hong Kong" CFD Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal / Trap at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss 🛑 : Recent Swing Low using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

HK50 "Hong Kong 50" Market Heist Plan on BearishHello My Dear Robbers / Money Makers & Losers, 🤑💰

This is our master plan to Heist HK50 "Hong Kong 50" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Short entry. Our target is Green Zone that is High risk Dangerous level, market is oversold / Consolidation / Trend Reversal / Trap at the level Bullish Robbers / Traders gain the strength. Be safe and be careful and Be rich 💰.

Entry : Can be taken Anywhere, What I suggest you to Place Sell Limit Orders in 15mins Timeframe Recent / Nearest Swing High

Stop Loss 🛑: Recent Swing High using 2h timeframe

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money 💰.

Warning : Fundamental Analysis news 📰 🗞️ comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan..... 🫂

HK50 "Hong Kong 50" Market Robbery Plan on Bullish SideHola ola My Dear,

Robbers / Money Makers & Losers,

This is our master plan to Heist HK50 "Hong Kong 50" Market based on Thief Trading style Technical Analysis.. kindly please follow the plan I have mentioned in the chart focus on Long entry. Our target is Red Zone that is High risk Dangerous level, market is overbought / Consolidation / Trend Reversal at the level Bearish Robbers / Traders gain the strength. Be safe and be careful and Be rich.

Attention for Scalpers : If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Note: If you've got a lot of money you can get out right away otherwise you can join with a swing trade robbers and continue the heist plan, Use Trailing SL to protect our money.

Entry : Can be taken Anywhere, What I suggest you to Place Buy Limit Orders in 15mins Timeframe Recent / Nearest Swing Low

Stop Loss : Recent Swing Low using 2h timeframe

Warning : Fundamental Analysis comes against our robbery plan. our plan will be ruined smash the Stop Loss. Don't Enter the market at the news update.

Loot and escape on the target 🎯 Swing Traders Plz Book the partial sum of money and wait for next breakout of dynamic level / Order block, Once it is cleared we can continue our heist plan to next new target.

Support our Robbery plan we can easily make money & take money 💰💵 Follow, Like & Share with your friends and Lovers. Make our Robbery Team Very Strong Join Ur hands with US. Loot Everything in this market everyday make money easily with Thief Trading Style.

Stay tuned with me and see you again with another Heist Plan.....

Hang Seng _ Wedge Pattern forming, Target 1_(20694), T2_(29000)Long Term Analysis : "Wedge Pattern" forming in "Hang Seng" and down trendline is "Breakout". So market move to Bullish Trend, wait for if Retest or Trend Continuation. And the 1st Target is 0.5 Fibonacci Retracement price (20694), 2nd Target is Wedge Pattern Top is 29000.

After Reach the Wedge Pattern Top (29000) expect Breakout the Pattern.

I want to help people to Make Profit all over the "World".

HK50 / HongKong50 Bullish plan to RobberyOla Chicos,

This is our master plan to Rob HK50 in Bullish side am currently Looting some profits in Hongkong50. Guys U can enter at any time any point before the high voltage electric trap area, Our target is Trap area. We can escape before the area its very safe.

HK50 - Range Bounded mess continuesHK50 is one of those nightmare indices that you can just hold and hope (long or short).

They are money eaters when you pay interest on the daily. ANd right now it needs a serious break up or down.

I am going to remain neutral in terms of position and the bias remains down as there are lower lows and lower highs.

HANG SENG: Buy signal on the bottom of the Channel Down.Hang Seng got rejected on the 1D MA50 two weeks ago and is headed again to the bottom of the Channel Down pattern. The 1D timeframe turned red again on its technical outlook (RSI = 41.280, MACD = -221.700, ADX = 20.498) and this is becoming a buy opportunity again. Every prior rise inside this Channel Down has been at least +10.90% so the one that started on the August 22nd low isn't technically completed. Buy and attempt contact with the 1D MA200 (TP = 19,400).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Hong Kong50 Hang Seng Short Bears Remain in Controlbearish start to the week, with hawkish central banks and growth fears continue weighing on investor sentiment ahead of a busy week.

The theme remained the same, with investor jitters over the economic outlook weighing on investor sentiment.

There were no economic indicators from the region to change the mood.

Market Overview

It was a bearish morning session for the Asian markets. The ASX 200 led the way down, with the Hang Seng and the Nikkei also struggling.

The Asian equity markets tracked the US equity markets into the red, with fears of central banks sending the global economy into a recession weighing. Hawkish Fed Chair Powell testimony continued to resonate this morning. Last week’s Bank of England 50-basis point interest rate hike was a reminder of central bank commitments to tame inflation.

Despite softer US private sector PMI numbers on Friday, the markets are still betting on a Fed 25-basis point interest rate hike in July. According to the CME FedWatch Tool, the probability of a 25-basis point July Fed rate hike stood at 71.9% versus 74.4% one week ago.

Significantly, the chances of the Fed lifting rates to 5.75% in September stood at 11.5%, up from 8.9% one week earlier.

Bank stocks also had a mixed morning. HSBC Holdings PLC and The Industrial and Commercial Bank of China (HK:1398) saw losses of 0.33% and 0.24%, respectively, while China Construction Bank (HK: 0939) rose by 0.40%.

Strategy Bearish Short

RSI confirming permanent trend continuation

Bulltraps can be used to sell more and stronger

Trendlines shold be used in 2 ways:

bearish breakout of the trendlines should be sed to new bearish enries or position sizing only.

Bullish breakouts should be used as profit taking or trading the 2nd wave only.

Bullish breakouts are often traps.

Hong Kong Stock Index (It shall swing UP higher)

View On Hong Kong Stock Index (13 Apr 2023)

HSI is in

* Uptrend in short term

* Uptrend in Mid term

* Downtrend in Long term

We are seeing a good swing back UP in HSI and it shall go UP higher.

20400~20600 will be the immediate resistant for now but the price shall break UP sooner or later.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading crypto, foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you.

Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.