HOOD Weekly Options Outlook — June 3, 2025📈 HOOD Weekly Options Outlook — June 3, 2025

🚨 AI Model Consensus: Moderately Bullish Into June 6 Expiry

🧠 Model Summary

🔹 Grok (xAI)

Bias: Moderately Bullish

Setup: Near 10 EMA, RSI oversold (34.7), strong 5-min EMA alignment.

Trade: Buy $72C @ $0.78 → PT +50%, SL −20%

🔹 Claude (Anthropic)

Bias: Moderately Bearish

Setup: Price below M5 10 EMA, high sell volume; RSI overbought daily.

Trade: Buy $69P @ $2.63 → PT +50%, SL −30%

🔹 Llama (Meta)

Bias: Moderately Bullish

Setup: RSI oversold (5-min), MACD mixed; Daily RSI high.

Trade: Buy $73C @ $0.60 → PT $0.90, SL $0.30

🔹 Gemini (Google)

Bias: Moderately Bullish

Setup: RSI oversold intraday; resistance near $73.15

Trade: Buy $74C @ $0.44 → PT $0.80–0.88, SL $0.22 or below $71

🔹 DeepSeek

Bias: Moderately Bullish

Setup: Oversold bounce potential in strong trend

Trade: Buy $73C @ $0.60 → PT $0.90–1.20, SL $0.30

✅ Consensus Summary

📈 Daily uptrend remains strong across all models

📉 Short-term RSI is oversold → bounce setup likely

📰 Bullish news + falling VIX = supportive backdrop

🧲 Max Pain @ $65 = caution for Friday pin

4 out of 5 models favor bullish call plays

🎯 Recommended Trade Setup

💡 Strategy: Bullish Naked Weekly Call

🔘 Ticker: HOOD

📈 Direction: CALL

🎯 Strike: $73

💵 Entry: $0.60 (limit order suggested)

🎯 Profit Target: $0.90 (+50%)

🛑 Stop Loss: $0.30 (−50%)

📏 Size: 1 contract

📅 Expiry: 2025-06-06

⏰ Entry Timing: Market Open

📈 Confidence: 70%

⚠️ Risk Factors to Watch

📉 Daily RSI >79 = potential for broader pullback

🔄 Max Pain @ $65 could act as drag near expiration

📉 Break below $71.10 invalidates bullish thesis

⌛ Theta decay accelerates after Wednesday

HOOD

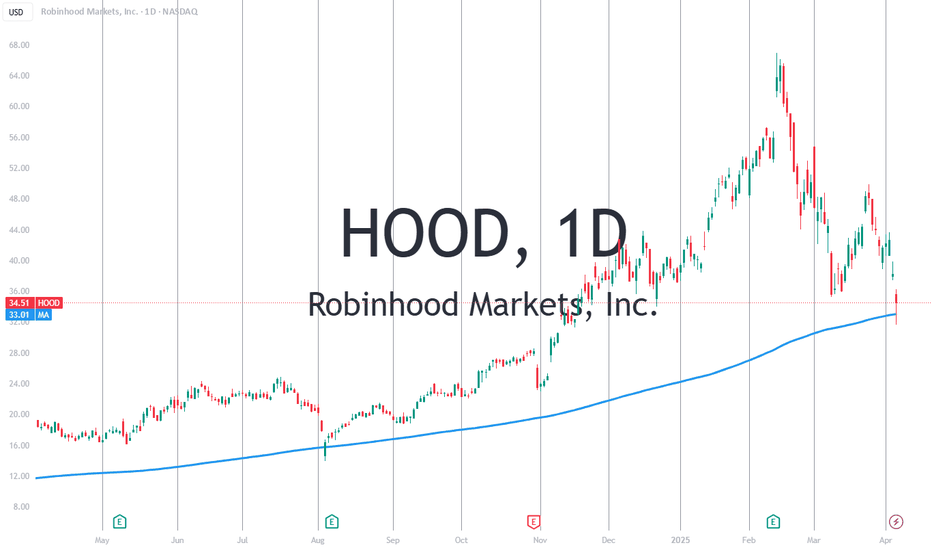

$HOOD great product but short term pull back here $58-$60Hello, I have multiple time frames up here: Daily, Weekly, and Monthly. I love Robinhood NASDAQ:HOOD as a broker, product and revolutionary company in the financial space. This is a great long term hold equity wise in my opinion but right now I am looking to short this name for a necessary pullback into $58-$60. It's overbought on the big time frames as you can see highlighted, it is possible it can break out of course but I believe with declining weekly volume this name will resort to some pullback. Also, Bitcoin can have some downside as well which will bring this name down with it. This ticker is volatile and can move 5-8% in either direction in just one session. I am looking for $60p about 3 weeks out, 6/20 date.

WSL

OptionsMastery: Looking for a breakout on HOOD!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

HOOD daily chart: breakout or fakeout? Key zone approaching.Robinhood's stock has formed a falling wedge pattern on the daily chart, indicating a potential bullish reversal. The price has broken above the 0.618 Fibonacci level at $44.00, suggesting further upside potential. Next targets are $48.40, $52.79, $58.22, and $67.00. RSI and MACD indicators confirm bullish momentum.

Fundamental Factors:

Robinhood continues to show revenue and profit growth, supporting positive investor sentiment. The company is expanding its services and attracting new users, strengthening its market position.

Scenarios:

Main scenario: continued rise to $48.40, then to $52.79 and higher.

Alternative scenario: pullback to $39.71 with potential decline to $36.00.

$10 to $80 in 1 day $BULL$10 to $80 in 1 day 💣 How do you know market is in a bubble?

When NASDAQ:HOOD valuation is so high their competitor NASDAQ:BULL decides to do IPO to catch some of the makert delusion going on and they fit right into all of it with their value going from $260 Million to $2 Billion in a day

why Robinhood’s stock ($HOOD) could be considered bullish:Analyst Upgrades : Robinhood has received positive upgrades from analysts, with a target price suggesting a significant upside. The company's growth in digital wealth management, AI-powered investing, and new banking features contributes to these bullish forecasts.

Strategic Investments : High-profile investors, such as Cathie Wood’s ARK Invest, have increased their stake in Robinhood, signaling strong confidence in its future growth potential.

Product Diversification: The company continues to expand its services, with new offerings like Robinhood Strategies, an affordable robo-advisor, which is expected to attract a broader customer base seeking wealth management solutions.

Positive Analyst Sentiment: Robinhood has an average "Buy" recommendation from analysts, reflecting general market optimism and the stock's positive outlook over the next 12 months.

Strong Earnings Growth: Robinhood's robust revenue growth rate (over 58% in the last 12 months) reflects its expanding market share and the potential for continued financial success.

Analyst Price Targets: Multiple analysts have set a price target for Robinhood with significant upside potential, indicating that there is room for further price appreciation in the coming year.

Market Positioning: Following political shifts, Robinhood's stock has benefited from increased interest in cryptocurrency trading and favorable market conditions, showing how external factors can favor its performance.

Technological Advancements: Robinhood’s investment in AI tools like Robinhood Cortex enhances its platform’s value proposition, improving user experience and engagement, which could lead to increased retention and growth.

Diversified Revenue Streams: Robinhood’s move into banking, offering high-yield savings accounts, allows the company to tap into new revenue streams, reducing its reliance on traditional brokerage commissions.

Favorable Market Sentiment: Robinhood is seen as part of a broader trend of stocks benefiting from shifts in market sentiment, particularly around the "Trump trade," showing how political and economic cycles can impact stock performance positively.

These factors together suggest a promising outlook for Robinhood’s stock, positioning it for continued growth and potential upside.

cup and handle pattern may be forming on the weekly chart HOOD"Potential Cup and Handle Pattern on NASDAQ:HOOD

A cup and handle pattern may be forming on the weekly chart of HOOD. The cup formation can be seen from August 2024 to February 2025, with a high point of around $55.00 and a low point of around $14.00. The handle formation started in late February 2025 and is currently ongoing.

Key levels to watch:

Resistance: $50.00

Support: $39.00

A breakout above the resistance level could confirm the pattern, potentially leading to a bullish trend. Keep a close eye on this stock! Weekly Daily and Monthly all look good.

#HOOD #cupandhandle #stockmarket #trading"

Robinhood’s Moment of Truth! Breakout, Retest, and Go? Hi,

Robinhood is one of the potential candidates to be included in the S&P 500 index. The new grouping will take place in 21. March

From a technical perspective, this is one of the possible zones where, after a short pause, we saw a breakout and now the price has come back to retest the consolidation area.

Of course, fundamentals play a big role here, but historically, a similar setup has worked well last year.

So, the zone is set—let’s see if this move repeats itself. Technically, the key range is $35 - $44.

Cheers,

Vaido

Magnificent Seven & Hot Stocks: A Technical OverviewHello,

The past few days and weeks have brought a lot of movement in the stock market, and things seem a bit more redish than before. However, these kinds of moments also bring good opportunities—if you know where to look.

That’s why I decided to take a closer look at the some stocks from Magnificent Seven, scan some of the top market cap stocks, and give a short overview of what’s happening and what to watch.

Since technical analysis helps bring clarity in uncertain times, I will go over some key levels and liquidity zones that could present good opportunities. I will also cover a few stocks that are currently making headlines and generating a lot of interest in the investment world—such as Robinhood (HOOD) and Palantir (PLTR).

Let’s see what the market has to offer.

Microsoft (MSFT)

Microsoft has not made any major moves in the past few weeks, but selling pressure has started to build up, and the stock is now trading at its lowest levels in the past six months.

The most interesting and strongest support area is between $290 and $300. This is a level worth keeping an eye on.

--------------

Amazon (AMZN)

Yesterday, I got an alert from TradingView that AMZN has dropped into an interesting price zone after a small correction. If you don’t already use alerts, I highly recommend setting them up—keeping track of every stock manually is nearly impossible.

The $175–$210 zone is technically solid. Yes, it’s a wide range but there are different strategies you can use here.

Amazon (AMZN) – What to do?

If you don’t own AMZN yet, this could be a good spot to start building a position slowly. Buy a little in the upper part, a little in the middle, and a little in the lower part of this zone to get a balanced entry.

If you already own AMZN, I’d rather wait and aim for the middle of the range if you want to add more. If the stock takes off from here, you already have a position, so there’s no real FOMO. No need to rush.

Of course, this is just a technical view—you should still analyze the fundamentals and your investment thesis. The technicals have spoken and now it’s time to listen to the fundamentals. That way, you get the full picture and can react accordingly.

--------------

Alphabet (GOOG)

GOOG failed to break through the psychological $200 level. It has tested this level multiple times since the start of the year, but the result has been red candles.

If you already own the stock and are considering adding more, or if you are thinking about an entry, the $140–$160 zone is worth watching. At the moment, I don’t see a more logical technical entry.

--------------

Meta Platforms (META)

META has dropped 12% from its all-time high in just a few weeks. The stock has now slowly come to, what I call, a "picking zone" (if you have a better name for it, let me know! :D)—meaning a price range where those who make regular buys might want to pay attention.

Right now, the key levels to watch are ~$612 and ~$500, with $500 being the stronger level. The price has consolidated there a bit longer than around $612, and it also acts as a psychological support level.

--------------

Berkshire Hathaway (BRK.B)

Berkshire has reached what I consider a profit-taking zone. If your fingers are itching and your wallet is waiting for a top-up, then why not? This doesn’t mean selling everything, but it could be a good spot for a partial exit—especially if you need capital for something else.

Why is this a logical profit-taking point?

Looking at previous price behavior around round numbers, we can see a pattern that works every time and your money can be “stuck” for years.

When a stock approaches a big round number for the first time, it tends to:

Consolidate – move sideways for a long time.

Get a strong correction – like Berkshire has done before.

Let’s make the round number concept clearer.

Imagine a stock price starts moving up from $30 and eventually reaches $1000.

Within this range, the key round numbers for me are: $50, $100, $200, $500, and $1000. These are levels where major market reactions often occur or levels that I trust the most as a criterion.

Let’s take Berkshire for example, touching these numbers for the first time:

$50 → 50% drop, took 5 years to recover.

$100 → Another 50% drop, also took 5 years to break higher.

$200 → Multi-year consolidation, 20% drop.

$500 → And now we’re here—your choice!

In a long-term portfolio, there are essentially two types of sales:

The investment thesis is no longer valid

Capital is needed for another purpose

If neither of these conditions is met, there’s no real reason to sell. However, if you need capital within the next six months, this could be a good point to do so. Historically, we’ve seen a pattern where the stock either undergoes a correction or remains stagnant for an extended period.

That makes it a perfect candidate for profit-taking—and if a correction does happen, there’s always the opportunity to buy back at lower prices.

At the moment, buying this stock could mean it stays within this price range for a few years, so I wouldn’t rush into new purchases.

--------------

Tesla (TSLA)

Historically, Tesla has followed technical analysis well due to its high volatility. It reflects market psychology very clearly, leaving visible footprints on the chart...

-----

I also cover these topics in-depth over on my Substack channel, where I break down the full picture and share my insights on the rest. If you want the complete breakdown and my take on what’s next, head over to my Substack (ENG).

🔗 Find the link in my BIO under the Website icon or simply copy and paste it directly.

See you there! 👀

Cheers,

Vaido

ROBINHOOD’S Q4 2024—TRADING BOOM FUELS RECORD GAINSROBINHOOD’S Q4 2024—TRADING BOOM FUELS RECORD GAINS NASDAQ:HOOD

(1/9)

Good morning, Tradingview! Robinhood’s Q4 2024 earnings are out 📈🔥—$1.01B in revenue, up 115% YoY, smashing $945M estimates. Post-election trading frenzy in equities and crypto lit the fuse. Let’s break down HOOD’s monster quarter! 🚀

(2/9) – REVENUE & EARNINGS HIGHLIGHTS

• Q4 Revenue: $1.01B, +115% YoY 💥

• Q3 Recap: $637M, +36% YoY

• Q4 EPS: $1.01, beats $0.43 est. 📊

• Net Income: $916M, up 510% from Q3’s $150M

• ARPU: $164, +102% YoY

Record profits, driven by a trading surge!

(3/9) – KEY WINS

• Net Deposits: $16.1B, +42% QoQ 🌍

• New Tools: Index options, futures, Robinhood Legend launched late 2024 🚗

• SEC Settlement: $45M in Jan 2025 clears past compliance woes ✅

HOOD’s expanding fast and cleaning house!

(4/9) – SECTOR SHOWDOWN

• Market Cap: $56.4B, Stock: $65.28 🌟

• Trailing P/E: 40.9x vs. IBKR (50x), SCHW (20x)

• Revenue Growth: 115% YoY crushes sector avg (5.7%)

Outpaces peers in growth, but valuation’s a hot debate!

(5/9) – RISKS ON DECK

• Market Volatility: Trading boom could fade 📉

• Regs: $45M SEC hit flags ongoing scrutiny 🏛️

• Competition: Schwab, Coinbase closing in ⚔️

• Economy: $1.21T credit card debt, layoffs loom ⚠️

Big gains, big risks—tightrope ahead!

(6/9) – SWOT: STRENGTHS

• Revenue: 115% YoY, $916M profit shines 🌟

• User Loyalty: $16.1B deposits, 2.2M+ Gold subs 🔍

• Innovation: Futures, options expand the game 🚦

HOOD’s firing on all cylinders!

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES

• Weaknesses: Trading reliance, reg baggage 💸

• Opportunities: Futures growth, crypto-friendly regs, global push 🌍

Can NASDAQ:HOOD turn momentum into a dynasty?

(8/9) – HOOD’s Q4 is a banger—where’s it headed?

1️⃣ Bullish—Growth keeps roaring.

2️⃣ Neutral—Solid, but risks loom.

3️⃣ Bearish—Peak’s in, fade coming.

Vote below! 🗳️👇

(9/9) – FINAL TAKEAWAY

Robinhood’s Q4 is a SEED_TVCODER77_ETHBTCDATA:1B thunderclap—trading, deposits, and profits soar 🌍. But volatility and regs lurk. Undervalued or overhyped?

Robinhood (HOOD) AnalysisCompany Overview:

Robinhood NASDAQ:HOOD is a pioneer in commission-free trading, catering to younger investors with its intuitive, mobile-first platform. The company’s ecosystem includes 25.1 million investment accounts and $152 billion in assets under custody, creating opportunities for recurring revenue streams and cross-selling financial products.

Key Catalysts:

CME Futures Integration 📊

The recent integration of CME Group futures trading allows users access to commodities and index futures, expanding Robinhood’s offerings for more advanced traders. This could add over $200 million in annual revenue, enhancing platform monetization.

Crypto Market Expansion ₿

With a strong presence in bitcoin and ether trading, Robinhood is well-positioned to capitalize on growth in crypto adoption, particularly as regulatory clarity improves in the U.S.

Recurring Revenue Streams 💵

Robinhood’s diversified revenue base includes interest income, premium subscriptions (Robinhood Gold), and securities lending, all of which provide consistent income and bolster financial stability.

Expanding User Base 📈

Continued growth in Robinhood’s user base and account activity drives the platform’s potential for monetization, supported by new product launches and user engagement strategies.

Investment Outlook:

Bullish Case: We are bullish on HOOD above the $46.00-$47.00 range, supported by product expansion, crypto growth, and increasing user engagement.

Upside Potential: Our price target is $80.00-$82.00, reflecting confidence in Robinhood’s ability to diversify revenue streams and capitalize on new financial products.

📢 Robinhood—Redefining Retail Trading with Innovation and Expansion. #CommissionFreeTrading #HOOD #Crypto

Renaissance of FinTech and $ARKF recent outperformanceSince the bear market lows of 2022, ARK ETF have gained some ground since then. Today we specifically look at the AMEX:ARKF which holds the fintech stocks. Since then, the ETF has seen a renaissance and has broken out of various Fib retracement levels. When we look at the fintech stocks like NASDAQ:UPST , EURONEXT:ADYEN , NASDAQ:PYPL , NYSE:LMND , NASDAQ:HOOD , $ COIN, NASDAQ:SOFI , $XYZ. Even the traditional stocks like NYSE:ICE and NASDAQ:NDAQ have a similar chart.

In terms of chart there was a huge bottom formation, and the recent price action has shown that the Fintech ETF is breaking out of the huge base. The next levels to watch will be 0.618 and 0.786 Fib levels with up to 25% upside potential in price.

Long $ARKF.

Crypto Stonks Are Booming! Top Crypto Stocks to Watch NowFrom Memecoins to Mega Stocks

While crypto traders have been focused on finding the next big memecoins like Doge , crypto-related stocks have also been performing well this year. In today’s analysis, we’ll dive into some crypto related stocks you might want to keep an eye on

1. Coinbase ( NASDAQ:COIN )

First on our list is Coinbase, the top US crypto exchange with a market cap of $48 billion. Since its IPO in April 2021, Coinbase has gained a reputation as a trusted exchange known for its regulatory compliance.

Besides its exchange services, Coinbase offers a self custody wallet popular among the crypto community, with over 10 million downloads. In February 2023, Coinbase launched its own layer 2 blockchain, Base , which has since recorded over $1 billion in total value locked and averages daily transaction volumes of over $400 million.

Coinbase has also played a part in advancing spot Bitcoin ETF approvals, forming a surveillance-sharing agreement with the Chicago Board Options Exchange in July 2023. Additionally, Coinbase partnered with **Stripe** in June to boost the global adoption of USDC. This partnership enables crypto payouts and a fiat-to-crypto onramp, making it easier for users to buy crypto with credit cards and Apple Pay through Coinbase Wallet. Coin is up over 350% since our first signal

2. MicroStrategy ( NASDAQ:MSTR )

Next up is MicroStrategy, with a market cap of $26 billion. Known for its business analytics software, cloud services, and AI-powered analytics, MicroStrategy is more famous for its Bitcoin holdings, driven by the advocacy of Executive Chairman Michael Saylor.

Under Saylor's leadership, MicroStrategy became the first public company to adopt Bitcoin as a strategic investment in August 2020, citing its potential as a store of value. The company accumulated over 121,000 BTC by late 2021 and continued adding to its holdings, despite price volatility and leverage risks. As of 2024, MicroStrategy’s Bitcoin holdings have reached 226,500 BTC, and the company’s stock hit new all time highs, demonstrating its strong correlation with Bitcoin's performance. Mstr is 100% up since our first signal

3. Block ( NYSE:SQ )

Formerly known as Square, Block is a fintech company founded by Jack Dorsey and Jim McKelvey, with a market cap of $38 billion. Starting with small-business payment solutions like Square POS, Block launched **Cash App** in 2013 to provide a user-friendly platform for consumers, competing with services like PayPal and Venmo.

Cash App generates revenue through transaction fees, subscription payments, and Bitcoin sales. It even supports the Lightning Network for quick Bitcoin transactions. Beyond payments, Block owns a majority stake in Tidal, a music streaming service, showing its diverse portfolio.

4. Robinhood ( NASDAQ:HOOD )

Lastly, we have Robinhood, with a market cap of over $15 billion. Founded in 2013 by Stanford graduates Vladimir Tenev and Baiju Bhatt, Robinhood became known for its free, user-friendly trading app, which gained significant popularity during the COVID19 pandemic

Robinhood found itself in the spotlight during the 2021 GameStop and WallStreetBets saga, where it faced backlash for restricting trades on memestocks like $GME. This led to a lawsuit and a $70 million penalty from FINRA for misleading customers and service outages. Despite this, Robinhood continues to grow, boasting 23.9 million funded accounts and nearly $130 billion in assets under custody as of May 2024.

Robinhood has made some notable moves recently, including acquiring Pluto Capital, which provides AI-driven investment advice, and securing a deal to acquire crypto exchange Bitstamp.

Wrap up

If you’re wondering about Bitcoin mining stocks, don’t worry we had a separate analysis just for that. Crypto Bull market just started and be ready for more analysis

which stock or crypto coins you are bullish now and why?

Robinhood Markets. Following the footsteps of Roaring Kitty

Keith Gill, the YouTube streamer known as Roaring Kitty, made tens of millions of dollars in a day from the GameStop meme stock.

YouTube blogger Keith Gill, known as Roaring Kitty, earned a paper profit of $79 million in one trading day from the growth of shares of the GameStop video game store chain, recently wrote CNBC. During trading on Monday, June 3, GameStop shares rose by 21% and closed at $28 per share.

On Monday, June 3, Keith Gill took to Reddit to share what appears to be a screenshot of his investment portfolio. The blogger revealed that he still holds 5 million shares of the video game store chain GameStop and 120 thousand call options on the stock with a strike price of $20 and an expiration date of June 21. Gill's bet on GameStop netted him an intraday profit of $33.6 million from stock gains and $54.3 million from options. As a result, these positions increased in value by $79 million.

A day earlier, Keith Gill posted on the social network Reddit a screenshot of the portfolio, which shows 5 million shares purchased at $21.27 per share and 120 thousand call options purchased at approximately $5.68.

A call option gives the buyer the right to purchase an asset at a fixed price on or before a predetermined date, and creates an obligation for the seller to sell it when requested. By purchasing such an option, a trader or investor takes a long position - long. It is opened in the hope of making money on the rise in the price of an asset, such as a stock.

If GameStop's stock price rises above $20 on June 21, Gill will be able to exercise the options at $20 per share. As a result, he will receive another 12 million shares of GameStop. In total, he will own 17 million shares, making him GameStop's fourth-largest shareholder behind Vanguard, BlackRock and RC Ventures, according to FactSet. At Monday's closing price of $28 per share, his stake is valued at $476 million.

Keith Gill rose to prominence in 2021 after posting a series of videos that investors took as a signal to buy GameStop stock. As a result, in January 2021, the price of securities of the GameStop video game store chain soared from $20 to $483 in two weeks, and the shares themselves began to be called meme.

Did you miss something? That's all right!... as frenzy trading is back to Robinhood Markets.

The main graph indicates on strong Bullish momentum in Robinhood Markets (HOOD) stocks, that are trying to recover after huge 80+ percent post-IPO decline.

3 Stocks in ACCUMULATION Phase | STOCKS | BABA, HOOD, PYPLIf you have patience, stock trading can be very rewarding.

Something a little different today - SOCKS ! 🧦 These are my top 3 picks for stocks at the moments - for the sake of duration, we'll look at 3 per video.

What I look for in stocks, is longer term holds. Ideally they must be in accumulation phase, or have just broken out of my ideal buy zone.

_____________________

NYSE:BABA NASDAQ:HOOD NASDAQ:PYPL