EURNZD - 15-19 March 21 Week Trade PlanFX:EURNZD

Previous Month : Bearish

Previous Week : Bullish

Daily : Bullish

- EURNZD still ranging between 1.6700 / 1.6560 after creating low at 1.6320 triggered by Interest Rate Decision and retraced back the whole down move. The range high is contained below the daily support at 1.666x with rejection to hold above 1.6700.

- Looking for either support formation above 1.6700 to trigger Long positions or resistance formation below 1.6570 to trigger shorts. Also, current range trades could be played till we break this range 1.6700/1.6560. So, I may look to Short on 4H Res formation below 1.6700 and Long on Solid 4H formation above 1.6560.

- The COT report showing that NZD buyers are still in control and increasing their NZD long positions. Still NZD sellers are not into market yet and this adds confirmations for EURNZD to continue bearish momentum.

- Seasonality is showing that NZD will weaken till end March, but still NZD holding and continuing it's strength. We could see some reversals on EURNZD as we had created new lows, but still such spikes are opportunities for better shorts.

- So with Current solid bearish momentum, COT and Seasonality; I'd expect EURNZD to continue the bearish momentum and any spike will be treated as a good opportunity for shorts until a solid support formation above 1.7020 level.

- Important news for NZD this week on Thursday GDP and Wednesday Rate Decision which will move the NZD.

Week Trade Plan Daily Chart:

Daily Levels Daily Chart:

HTF

EURNZD - 08-12 March 21 Week Trade Plan EURNZD

Previous Month : Bearish

Previous Week : Bearish

Daily : Bearish

- EURNZD edged a bit higher last week away for ranging zone 6650/6550 at 6760 a bit shy from the major resistance at 6820 that is currently acting as a solid barrier for EURNZD. But on 4H a HH/HL we can see a HH/HL formation that may act as a trigger to test the 6820 resistance.

- A Solid HTF Support formation above 6820 will indicate that a low formed for a 7020 target. Failure to sustain a support above 6820 and with HTF solid resistance formation below 6820 will be a sign for bearish momentum continuation and we may retest the lows created at 6320

- The COT report showing that NZD buyers are still in control and increasing their NZD long positions. Still NZD sellers are not into market yet and this adds confirmations for EURNZD to continue bearish momentum.

- Seasonality is showing that NZD will weaken till end March, but still NZD holding and continuing it's strength. We could see some reversals on EURNZD as we had created new lows, but still such spikes are opportunities for better shorts.

- So with Current solid bearish momentum, COT and Seasonality; i'd expect EURNZD to continue the bearish momentum and any spike will be treated as a good opportunity for shorts until a solid support formation above 1.7020 level.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target created. So i recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- Important news for NZD this week on Friday Business NZ PM and some important news for China on Wednesday may move NZD during Asia Session.

Weekly Outlook Chart:

Daily Outlook Chart:

Weekly Trade Plan:

EURNZD - 01-05 March 21 Week Trade Plan FX:EURNZD

Previous Month : Bearish

Previous Week : Bullish

Previous Daily : Bullish

- EURNZD as expected created a lower resistance below 6660 which pushed EIRNZD to create a new low at 6320 helped by Interest rate news and NZ economical optimism. The new low created triggered a hard pullback as it was Feb End and profit taking which currently pushed EURNZD again above 6660.

- The COT report showing that NZD buyers are still in control and increasing their NZD long positions. Still NZD sellers are not into market yet and this adds confirmations for EURNZD continued bearish momentum.

- Seasonality is showing that NZD will weaken in March, but still NZD holding and continuing it's strength. We could see some reversals on EURNZD as we had created new lows, but still such spikes are opportunities for better shorts.

- So with Current solid bearish momentum, COT and Seasonality; i'd expect EURNZD to continue the bearish momentum and any spike will be treated as a good opportunity for shorts until a solid support formation above 1.7020 level.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target created. So i recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- Important news for NZD this week on Wednesday Building Permits and RBNZ's Governor Orr speech on Thursday.

Monthly Outlook:

Weekly Outlook:

Daily Outlook:

Weekly Trade Plan 4H Chart:

EURNZD 22-26 Feb 21 Week trade Plan FX:EURNZD

Previous Month : Bearish

Previous Week : Bearish

Daily : Bearish

- EURNZD failed to hold above 6820/45 resistance zone and rejected multiple time during last week tide range. Breaking lows on Friday reaching weekly planned TP2 at 6590. Refer to last week plan:

- The COT report showing that NZD buyers are still in control and increasing their NZD long positions. Still NZD sellers are not into market yet and this adds confirmations for EURNZD continued bearish momentum.

- Seasonality is showing that NZD will weaken till end Feb, but still NZD holding and continuing it's strength. We could see some reversals on EURNZD as we had created new lows, but still such spikes are opportunities for better shorts.

- So with Current solid bearish momentum, COT and Seasonality; i'd expect EURNZD to continue the bearish momentum and any spike will be treated as a good opportunity for shorts until a solid formation above 1.7020 level.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target created. So i recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- Important news for NZD this week on Tuesday Retail Sales and Interest Rates for China on Monday.

EURNZD - 08-12 Feb 21 Week Trade Plan EURNZD

Previous Month : Bearish

Previous Week : Bearish

Daily : Slightly Bullish

- EURNZD finally broken the range and closed below 1.6780 reaching 1.6720 and barely 1.6620, meaning we are in a very solid bearish momentum.

- The COT report showing that NZD sellers are picking up for the first time since the start of 2021 but still not a confirmation that buyers are out yet. I anticipate that this could be the spike that EN does with each new low created.

- Seasonality is not correlated with the current PA as NZD strengthen during Feb and created a pick now while Seasonality is showing ranging and a bit of weakness for NZD. I'll wait for this week to clarify a bit to confirm.

- So with Current solid bearish momentum, COT and Seasonality; I'd expect EURNZD to continue the bearish momentum and any spike will be treated as a good opportunity for shorts until a solid formation above 1.7020 level.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target created. So i recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- We have important news for NZD on Tuesday and Friday for Inflation and Business PMI also some news from China on Wednesday which also effects NZD.

Daily Chart :

Weekly Chart :

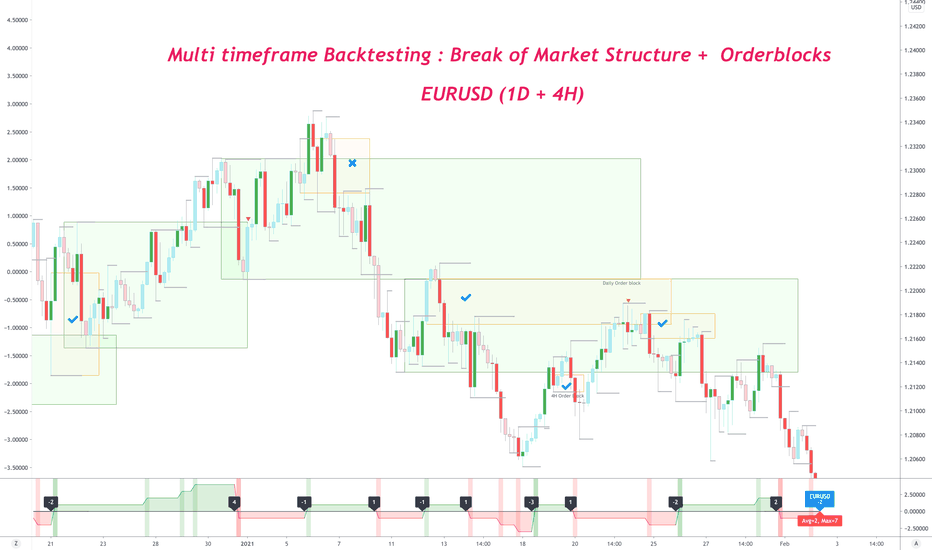

Backtesting retest Break of Market Structure on Multi TimeframeStrategy

Create a zone from the order block which created break of market structure on 1D timeframe

Wait for it to be tested on 4H timezone => which will create new 4H order block

Trade the retest of that 4H order block

Color coding & icon use

Green boxes : 1D order block zone

Yellow boxes : 4H order block zone

Tick icon : Trade won on 4H

Cross icon : Trade lost on 4H

Circle with cross icon : Trade in breakeven

Win / loss assumptions

Win : 3R movement without breaking -1R

Loss : -1R movement

Breakeven : 1R movement, followed by -1R movement

Risk Management

50% TP @ 1R

25% TP @ 2R

25% TP / Trade closure @ 3R

RR achieved = 3R

Net R achieved = 1.75R

Strategy results

Testing duration : Jan 2020 - Jan 2021

Wins = 16

Loss = 7

Breakeven = 4

Non-losers = 74%

Absolute Winners = 59%

Net RR = 21

Avg R/Win = 1.31R

Avg R/Trade = 0.78R

EURNZD - 1 - 5 Feb 21 Week Trade Plan FX:EURNZD

Previous Month : Bearish

Previous Week : Bearish

Daily : Slightly Bullish

- EURNZD since 5Jan still ranging between 6980 / 6840 after a long term bearish trend since the top created on March 2020.

- The COT report still showing that 68% of institutional positions are Long NZD which is a bit less than last week, but still at it's highest levels since 3 years compared to 32% Short positions. This is translated on the chart with EURNZD sustaining it's bearish trend and we are seeing support levels broken every week.

- Seasonality showing that NZD should be ranging during Feb after reaching the top during Jan by reaching 6770 sup and slightly to the weak side.

- So with Current Range, COT and Seasonality; i'd expect EURNZD to be ranging and slightly moving up if we formed Support above 6980.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target created. So i recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- We have important news for NZD on Wednesday for Employment and historical data shows 200 pip range on this news.

GBP/JPY - Clear Breaks to the Upside in line with HTF AnalysisOn the daily we are in an ascending channel. Scale down and you'll find key levels on the 4hr. See how these key levels are being broken to the upside? This indicates bullish momentum in the markets and aligns with our longer term outlook on the pair.

The blue levels here are key levels in the market where price has gravitated to and bounced from more often than not.

Any questions drop me a DM!

EURNZD - 25 - 29 Jan Week trade Plan FX:EURNZD

Previous Month : Bearish

Previous Week : Bullish

Daily : Bullish

4H : Bullish

Nothing major changed from last week outlook, only a break and close above 1.6980 but EURNZD couldn't create a solid support above to extend the bush to upside.

- With all HTFs (M, W, D) are trending down, Monthly pointing to 1.6670 - Weekly pointing to 1.6770 and Daily currently bouncing from a solid support zone 1.6850/20, still the bias is short any bounce.

- The COT report showing that 70% of institutional positions are Long NZD which is the highest since 3 years compared to 30% Short positions. This is translated on the chart with EURNZD sustaining it's bearish trend and we are seeing support levels broken every week.

- Seasonality showing that EURNZD should be strong during the first 2 weeks of Jan which had happened during the last 2 weeks and the highest to reach this month and weakness should be the theme for the remining of Jan.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target. So i recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- We have important news for NZD on Thursday and Friday.

EURNZD - 17-22 Jan Week trade Plan This is my 17-22 Jan 21 Week trade Plan for EURNZD . FX:EURNZD

Previous Month : Bearish

Previous Week : Bullish

Daily : Bullish

4H : Bullish

- With all HTFs (M, W, D) are trending down, Monthly pointing to 1.6670 - Weekly pointing to 1.6770 and Daily currently bouncing from a solid support zone 1.6850/20.

- The COT report showing that 70% of institutional positions are Long NZD which is the highest since 3 years compared to 30% Short positions. This is translated on the chart with EURNZD sustaining it's bearish trend and we are seeing support levels broken every week.

- Seasonality showing that EURNZD should be strong during the first 2 weeks of Jan which had happened during the last 2 weeks and the highest to reach this month and weakness should be the theme for the remining of Jan.

- Through trading several Months EURNZD, I prefer to see retracements to any move in order to have a range to trade to target. So I recommend to Short after retracement or break and Resistance formation below broken Support and vise versa for Longs.

- We have important news for NZD on Tuesday and Friday, Also China is having very important news on Monday and Wednesday.

EURNZD - 11-16 Jan Week trade opportunities for referenceThis is a summary of the trade opportunities during this week according to my Trade Rules: e

1- Momentum

2- HTF close with momentum direction

3- 1H close above / below previous candle in momentum direction

4- Targets for TP points from Week Trade Plan FX:EURNZD

- Jan week 11 - 16

- Previous momentum: Bearish

- Week Close: Bullish

- Range: 171 pip

-A Ranging week for EURNZD between 1.6980 and 1.6880/50 solid levels after the rejection at 1.7100/20 resistance zone.

- The main factor this week was the 2:00pm UK time 4H candle, it showed how market repeats the same behavior at specific times.

- The COT report showing that 70% of institutional positions are Long NZD which is the highest since 3 years compared to 30% Short positions. This is translated on the chart with EURNZD sustaining it's bearish trend and we are seeing support levels broken every week.

- Seasonality showing that EURNZD should be strong during the first 2 weeks of Jan which had happened during the last 2 weeks and the highest to reach this month and weakness should be the theme for the remining of Jan.

- Highlighted 3 opportunities for Short according to my rule of having Momentum and 1H close in my direction, but not according to my trade plan as the nothing triggered to Short or Long.

- Check 4H TF you will find that 4H candle close is Bearish and closing below previous candle.

Why I'm bullish for XRPWhile most people are talking about the fundementals, i look at the charts.

Actually i see a pretty bullish chart.

On the weekly, we see a broken trendline. This trendline is tested now. This is all in line with the fib 78.6% retracement.

The daily fib fulfilled the fib extension target (-0.618) almost PERFECTLY.

So overall, the charts are looking pretty bullish for me. I don't trade fundementals.

NZDUSD Longer Term ShortWe've seen some rapid bullish movement on this pair over the past few weeks, almost 10 weeks straight up. This pair is well overdue a major correction and I really like this area to take a short. We're just about on the 886 reversal on what is a HTF bearish chart. Until price action breaks those previous highs this is still bearish in my eyes and this area gives us a great RR nearly 6 to 1 to short to the 38.2 retracement, that is a modest target I feel as well because if this decides to make another leg down there's a huge trade to be had but let's not get greedy!

EURNZD - 04-08 Jan 21 Week trade PlanThis is my 04-08 Jan 21 Week trade Plan for EURNZD.

With EURNZD ended Dec 2020 with bearish close confirming the bearish momentum, I'm expecting a bounce from the HTF support created 24 Nov 2020 at 6980 which is expected to be rejected at/below 7080/7100 for bearish momentum continuation and retest/break and close below 6980 for targets at 6880 and 6780.

A reversal can also be in place in case of the support/double button formation at 6980, a break of the 7220 and solid support formation above 7180 will confirm this scenario which can trigger longs to retest 7345.

Weekly Close : Bearish

Daily Close : Bearish

4H : Bearish

Overall view is Bearish till a daily close and forming solid support above 7220.

Levels to watch:

- 1.7600

- 1.7450

- 1.7345

- 1.7220

- 1.7080

- 1.6980

EURNZD - Dec 28 -01 Jan Week trade planThis is my trade plan for EURNZD for next week FX:EURNZD Dec 28 -01 Jan based on HTF analysis.

Trades will be executed according to my trading rules:

1- Momentum

2- HTF close with momentum direction

3- 1H close below/above previous candle in momentum direction

4- Targets for 4H recent support/resistance

Please refer to the Daily and weekly outlook for further HTF outlook.

Daily Outlook:

Weekly Outlook:

EURNZD - 21-25 Dec Week trade opportunities for reference- Dec week 21 -25

- Previous momentum: Bearish

- Week Close: Bullish

- Range: 242 pip

- Bullish momentum, break of last week high and retesting Nov 9 resistance level was the first spot at week start. With EURNZD HTF bearish momentum and current unjustified bullish move, failure to break and hold above 9 Nov resistance at 7345, suggests that correction for this up move is due.

- Highlighted 2 opportunities for Short according to my rule of having Momentum and 1H close in my direction and as per my Weekly Plan. the other Long opportunity could be traded but wasn't planed.

- Check 4H TF you will find that 4H candle close is Bearish and closing below previous candle.

Previous week trade plan : FX:EURNZD

XRP - A fundamental case for a long term bias/tradeFacts:

- SEC is suing Ripple Labs for the sale of unregistered securities

- XRP and Ripple are not the same. XRP is the coin, Ripple Labs is the company

- Unless Ripple Labs goes public, XRP it is not a security

Bullish news:

SBI, a Japanese company that has recently acquired multiple crypto exchanges in 2020 and initially invested in XRP with company SBI Ripple Asia in 2016, is interested in a crypto index that is majority XRP

SBI offers shareholders XRP as dividend payouts

SBI Ripple Asia is not being sued by the SEC

SBI Ripple Asia is very interested in using XRP as its blazing fast remittance currency, and MoneyTap (not a U.S. company) will be using it.

" Interbank transfer fees remained high in Japan and have not been changed for more than 40 years, which is unusual by international standards. "

Japan's regulatory body FSA has already declared XRP is not a security .

EURNZD - 14-18 Dec Week trade opportunities for referenceFX:EURNZD

This is a summary of the trade opportunities during this week according to my Trade Rules:

1- Momentum

2- HTF close with momentum direction

3- 1H close above / below previous candle in momentum direction

4- Targets for TP points from Week Trade Plan

Dec week 14 -18

- Previous momentum: Bearish

- Week Close: Bullish

- Range: 180 pip

- Ranging dominated the week after the bearish momentum in last week in-between 1.7080 to 1.7220 zone.

- Highlighted 2 opportunities for Short according to my rule of having Momentum and 1H close in my direction and as per my Weekly Plan. the other 3 are Long opportunities which could be traded but wasn't planed.

- Check 4H TF you will find that 4H candle close is Bearish and closing below previous candle.

Week Trade Plan :

Actual Week:

EURNZD - Dec 07-11 Week trade planFX:EURNZD

This is my trade plan for EURNZD for next week Dec 07-11 based on HTF analysis.

Trades will be executed according to my trading rules:

1- Momentum

2- HTF close with momentum direction

3- 1H close below/above previous candle in momentum direction

4- Targets for 1H recent support/resistance

Please refer to the Daily outlook for further HTF outlook.

BTCUSD Healthy RetraceHey folks,

Pulling the Weekly BTCUSD chart today to see where we are in this pullback and breaking news... We're still bullish!

Sometimes you just need to zoom out a little bit to see the big picture. We gained an important weekly SR level when we broke the 10K level (~$9948).

Generally speaking, all important levels once broken need to be tested so we can confirm the direction of the trend.

We did a perfect pullback to the higher 9Ks. Many expected 9.6K to fill the infamous CME gap. But what is the CME gap exactly? I'm not very compelled by the "fill the gap" narrative and I see absolutely no reason for CME gaps to be filled all the time. Gaps are simply symptomatic of the limited trading periods that CME operates on while we have an asset trading 24/7. There is no fundamental reason why these gaps would need to be filled.

With that said, I'm expecting a bit of sideways from here. Drawing a fractal using the latest swing low PA shows a possible outcome. Note however that fractals are rarely repeated 100%. If BTC manages to close the weekly above $10,450 - $10,500 this should give a solid ground for bulls to step in. The next few weeks leading to the US elections will be decisive in this market on many economical and sociological levels.

Keep an eye open on the SPX and stocks market. This dump was initiated by the weakness of the traditional market after favorable employment reports came out of the US and the US Dollar started to gain strength (look at the DXY chart). We are still very much correlated to stonks so further pain in equities could tank Bitcoin price as people run for cold hard fiat money, at least temporarily. On the longer term, monetary policies are still very much bullish for high-yield assets like Gold and Bitcoin.

Patience and strong hands will be rewarded.

The weaks will be devoured.