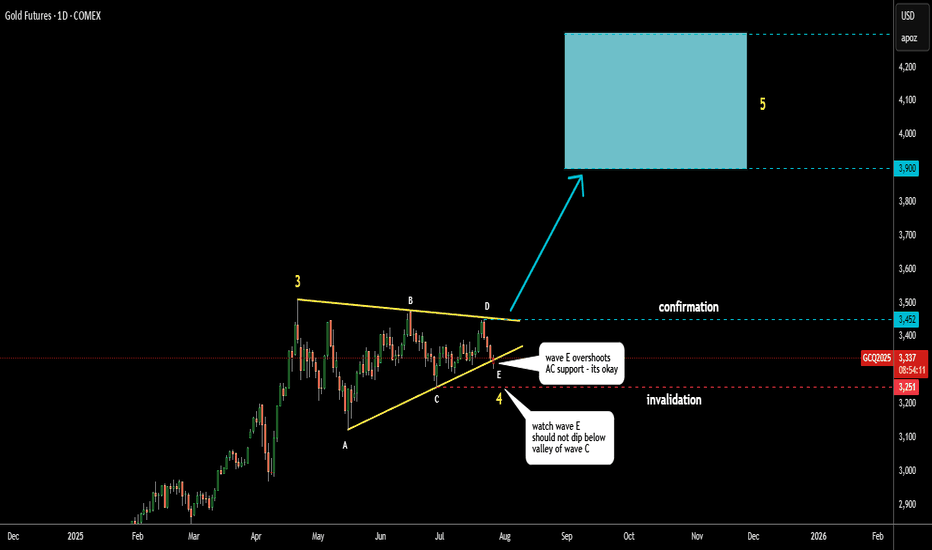

Gold Update 28 JULY 2025: On The EdgeGold is accurately following the path shown in my earlier post.

Wave D respects the triangle rules, staying below the top of wave B.

Wave E appears nearly complete, even piercing the A–C support line.

This is acceptable as long as wave E stays above the wave C low at $3,251.

Keep a close eye on this invalidation point.

The target range remains unchanged: $3,900–$4,300.

HUI

Gold Update: Possible Triangular Consolidation Before New RallyIt looks like corrective wave 4 is in the making within a large Triangle

3 waves A, B and C already emerged in 3-waves structure

which confirms triangle

Wave D should stay under the top of wave B

Wave E could either touch or break down the support line

It should keep above the valley of wave C

Target area changed higher as this consolidation tends to narrowing within a

contracting triangle.

Lowest target now $3,900

Optimistic target is at $4,300

Breakdown below $3,123 would invalidate the pattern

Gold Update: 2 optionsIndeed, the top metal surged well beyond $3,000, as I mentioned in my earlier post (see related post for details).

The price reached a new all-time high of $3,510 before pulling back, as expected.

So far, the retracement has been rejected at the trendline support around $3,123 (futures).

From here, there are two possible scenarios:

1) Blue Labels

The price may have already completed wave 4. If so, we could now see a large wave 5 move to the upside.

This wave could reach the blue target box, which represents 61.8% to 100% of the distance from wave 1 to wave 3, added to the bottom of wave 4.

This target zone lies between $3,700 and $4,100.

Keep in mind that gold is a commodity, and commodities often have extended fifth waves — so the higher end of the blue box is still possible.

2) White Labels

Typically, fourth waves retrace down to the valleys of previous lower-degree fourth waves.

In this case, the market could form another leg down to complete a larger, more complex correction, potentially hitting $2,975 before wave 5 begins.

If that happens, the target for wave 5 may be lower, but with a possible extended fifth wave, it could still reach the blue box area.

Gold Update: $3,000 Is Not the Final DestinationGold futures broke above minor consolidation, so the map should be updated.

Wave 3 becomes extended (blue small waves) and it is looking to test the trendline resistance near magic $3,000 level.

But that's not all as we didn't see wave 4 yet.

It should be complex to alternate wave 2, which was simple.

Wave 4 could hit the $2,500-2,550 area to complete correction.

We can measure it after wave 3 will be completed.

And finally, wave 5 is usually extended in commodities.

It could be huge, wave 3 already travelled over $1,000,

imagine where wave 5 could rocket then.

It will depend on how deep wave 4 would retrace first.

Stay tuned, share your thoughts below, lucky trades to all of you!

Gold futures eyes $2,577 in acceleration of upside impulseA pullback in yellow wave (2) almost hit 61.8% of yellow wave (1).

Now we see the strong minor impulse to the upside.

It can be a part of large yellow wave (3).

The target is projected at the distance of 1.618x of wave (1) with aim at $2,577.

Watch how price breaks above the top of wave (1) beyond $2,086

Risk/reward is 1:2.5, one could get it better if goes on a lower time frame and buys on

minor pullback following minor wave 1 of (3).

Do you see gold futures touching $2,577?

Are we at a bottom for miners?Miners may finally be at or near a medium term bottom. They were up nicely today while gold was down. Also the technical are good. They are at the primary trendline, and there is a bullish RSI divergence. There is major support around 31, but not sure it will get down there.

Gold and Sentiment, Turbo Bear?My favorite ratio for cutting through the noise is an LT view of Gold/Oz($) : HUI (the Gold Bugs Index). Generally when it rises we gold bugs suffer because the price isn't reflecting our buying habits. That's why I'm looking for the next bottom on this chart sometime in July that might coincide with this broadening wedge... A date that keeps recurring for me is June 28th, and I haven't figured why just yet..

The broadening wedge may indicate that some dramatic downside is very possible, I just hope that it's in late summer after some profit-taking. Reasons for hope here:

1] a breakdown from this channel is giving me hope, as sentiment is outstripping gold price performance.

2] it seems to coincide with deep retrace and ultimately a break below the 100Mo MA, the 30Wk Ma, and 30D Ma are firmly below. (Looking for the 30D to cross below 30Wk for TURBO BEAR)

3] downward cloud pressure is huge and respected at this time

See my previous post on GDX/Gold for another view at this pivotal time

Silver structure might have changed. First down then up to 22.50The earlier idea could be completed as structure gets more complex with possible double three WXY to emerge.

The drop into blue box should occur then to make a wave X retracement.

Then the metal could hit 22.50 when another zigzag up in wave Y unfolds.

Gold update: Extended consolidation in wave 4 - down then up Gold got stuck in an extended consolidation of wave 4, which shapes double three WXY.

The completion of the last wave Y down is expected at the low of wave W around $1658.

Then the last wave 5 , that was widely expected long ago could kick off finally.

The target area is highlighted with a blue box between 1805 and 1921.

B2Gold - Huge Volume TodayThe Breakout is confirming as a Trading Range formed with low volumes during the past few weeks.

Following a few weeks of low activity, very-large volumes were registered today.

Price is heading toward the next Resistance of the upper Ranging Channel at $7.8.

This movement could very easily push the price all the way to the next Resistance at $8.0 to a new all-time high.

Support at $7.25 and $7.5

CDE - attractive entryNYSE:CDE is one of the most volatile ideas in the gold mining space. So if enetered correctly it offers relatively quick and attractive rewards.

Currently idea is retesting major support level, through which it broken up in early November. And if uptrend is to continue in this miner, should not go much lower than current spot.

I am entering with idea to hold it as potential long term holding.

Gold update: Head & Shoulders could emergeI combined both H&S pattern with EW analysis.

On EW side we see the 1st impulse down and now we are in a pullback ABC.

The C wave is pending. It is probably the initial move down in gold within a huge drop down

at least we could see 1200 again and it depends on what structure would unfold then.

Pattern is simple and we should watch the breakdown of the Neckline.

Target is at 1409.