Trend Exhaustion Detected – Bearish Structure AheadUS100 (NASDAQ) 30-minute chart as of July 26, 2025, with technical insights based on the visible elements.

🔍 1. Trend Analysis

Primary Trend: Uptrend (bullish structure)

The price has been respecting a rising parallel channel, marked by:

Ascending support (lower boundary)

Ascending resistance (upper boundary)

Market structure shows:

Higher Highs (HH)

Higher Lows (HL)

✅ This indicates continuation of bullish momentum until structure breaks.

📐 2. Market Structure Elements

Structure Type Label on Chart Price Zone (approx.)

Break of Structure (BOS) BOS (center-left) ~22,950

Higher Low (HL) HL (2x) ~22,700 (1st), ~23,050 (2nd)

Higher High (HH) HH (2x) ~23,150 and ~23,300

Resistance Labelled ~23,300–23,320

Demand Zones Labelled ~22,450–22,700

🔁 Break of Structure (BOS)

The BOS occurred after a prior swing low was broken, followed by a new higher high, confirming a bullish shift.

🧱 3. Support / Resistance Analysis

🔼 Resistance Zone

The price is testing strong resistance around 23,300–23,320

Multiple rejections in this area

Trendline resistance also aligns here

A rejection arrow is drawn, indicating potential bearish reaction

🔽 Support Zone (Immediate)

23,180–23,220: highlighted green box is a local support block

If broken, likely to revisit 23,000–23,050, or even down to 22,900 range

🟩 4. Demand Zones

Zone 1:

22,450–22,600: Strong bullish reaction historically — likely to act as a key demand if a deeper pullback occurs

Zone 2:

22,850–22,950: Validated with prior accumulation & BOS event

🧠 5. Key Observations

Price is at a critical inflection zone:

Testing a resistance zone

At the upper trendline of an ascending channel

A bearish reaction is projected (black arrow)

Possibly targeting the green support zone around 23,180–23,220

If that fails, demand at ~23,000 will likely be tested

Ichimoku Cloud:

Currently price is above the cloud → still bullish

Cloud is thin → potential weakness or upcoming consolidation

⚠️ 6. Trading Bias & Setup Ideas

✅ Bullish Bias (if price holds above ~23,180)

Long entries can be considered on bullish reaction from support

Target: retest of 23,300–23,350 or even breakout continuation

❌ Bearish Bias (if breakdown below support)

Short entry valid below 23,180 with:

TP1: 23,050

TP2: 22,900

A breakdown from the ascending channel would signal trend exhaustion

🔚 Conclusion

Current Price: 23,298.4

Trend: Bullish, but at resistance

Next move: Watch for reaction at resistance and support box below

Bias: Neutral-to-bullish unless the structure breaks below ~23,180

Ichimoku_trader

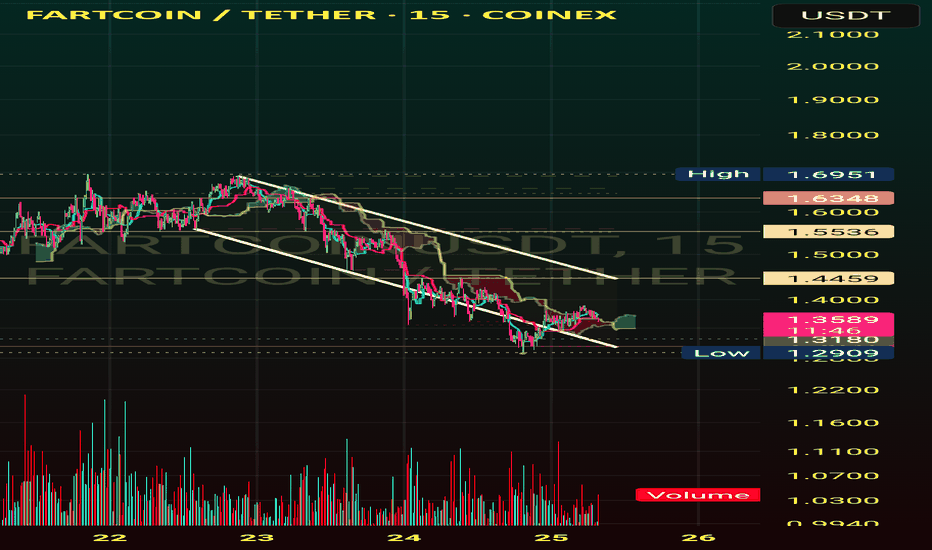

Fart Ichimoku Breakout Test📈 Checking bullish signals on the chart

✅ Positive signs:

- The price is stable above the cloud and the candles show the strength of buyers.

- Indicators such as RSI and trading volume are in a good position.

- The cloud broke with the body

First profit limit 1/451

Second profit limit 1/551

Limit of loss 1/320

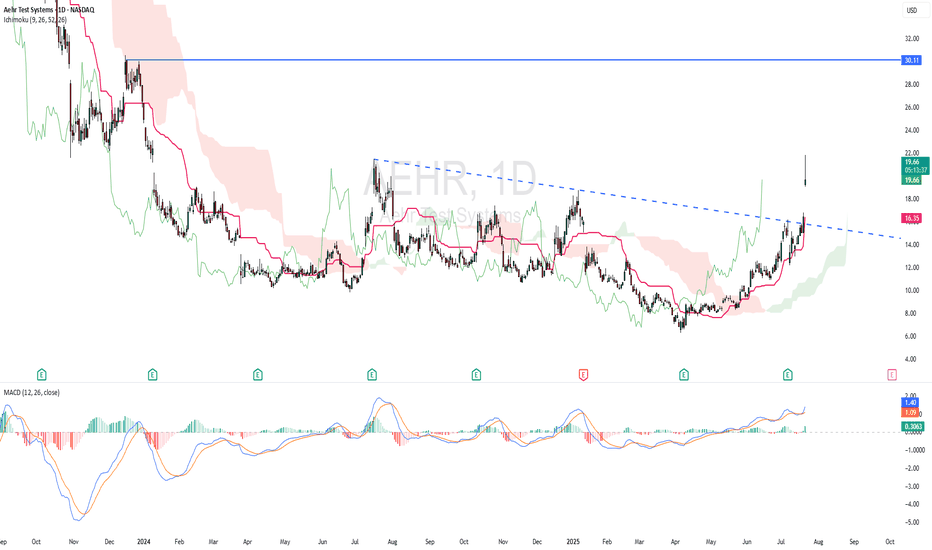

AEHR - RISING WINDOWTechnically AEHR is bullish as the stock made a strong rising window. Based on ICHIMOKU CLOUD, price is above cloud and chikou span is above candlestick - indicating bullish scenario. Kijun Sen is rising. MACD indicator showing bullish momentum.

ENTRY PRICE : 19.30 - 19.70

TARGET : 30.00 (potential almost 50% roi)

SUPPORT : 14.72

XAUUSD 4H AnalysisBased on Ichimoku, we expect short-term uptrend toward 3348 and after that we expect rejection from these levels and starting downward movement to support levels (3228-3179).

we consider all these levels as valuable zones for our trading so be cautious about the reaction of XAUUSD.

ATAIMS - BREAKOUT EMA 200 and CLOUD !ATAIMS - CURRENT PRICE : RM0.305

ATAIMS is bullish as the price is above EMA 50 and 200. The stock broke above EMA 200 and ICHIMOKU CLOUD on last FRIDAY (06 JUNE 2025) with high volume. Supported by technical reading in RSI heading upward, the stock may continue to move higher in the upcoming session.

ENTRY PRICE : RM0.300 - RM0.305

TARGET PRICE : RM0.340 and RM0.370

SUPPORT : RM0.270

MRDIY - Low RISK ?MRDIY - CURRENT PRICE : RM1.62

MRDIY is BULLISH because :

1. Price is above EMA 50

2. Price is above ICHIMOKU CLOUD

3. RSI is above 50

4. The high is getting higher and the low also getting higher

ENTRY PRICE : RM1.60 - RM1.62

TARGET PRICE : RM1.72 , RM1.80 , RM1.90

SUPPORT : RM1.51 (The low of bullish HAMMER candle)

ACHR - KUMO BREAKOUTACHR broke nearest resistance. There is a bullish divergence in MACD. Based on ICHIMOKU CHART, the stock is BULLISH because :

i) Price breakout cloud

ii) Tenkan sen already cross above Kijun sen recently

iii) Chikou Span is above candlestick

ENTRY PRICE : 9.33 - 9.40

TARGET : 10.37 and 12.75

STOP LOSS : 8.16

BTC 4H analysisIn the previous analysis, the zone of 70 was determining level for us, whether it was a correction or a downward trend.

BTC continued it's upward movement from near that area.

Now Bitcoin is near it's historical resistance area, this time the zone of 110 to 114 plays this role for us.

According to ICHIMOKU and according to previous analysis, Bitcoin tends to move to higher levels marked on the chart.

XAUUSDThe long-term trend of gold is completely bullish according to previous analyses, which still shows a strong bullish trend on monthly time frames.

We expect a correction in the chart during next week , but The long term trend of Gold is still bullish and we couldn't see any ICHIMOKU based divergence.

important support and resistance levels on the chart is highlighted.

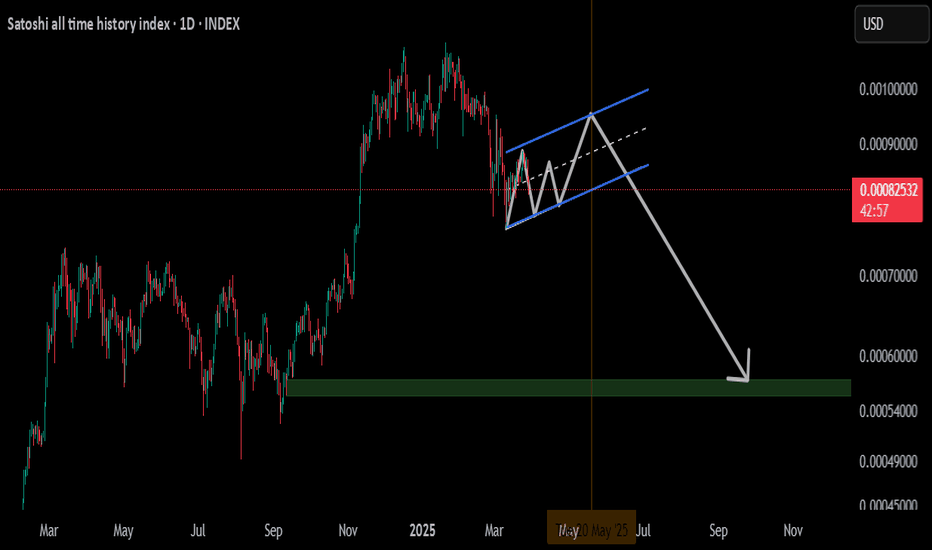

Price drop warning based on historical patternsSo we had a lot of similarities in the CRYPTOCAP:BTC bullish cycle with the previous cycles. I believe it is logical that we will have some similarities in the correction. So I checked based on the Ichimoku indicator and I imagine such a pattern for the future trend of Bitcoin. But this is just one of the possible scenarios. Don't always be bullish. The market has two sides. So always have short trades in your plan. Be with the trend. Be safe.

happy Eid Al-Fitr

XAUUSD Daily AnalysisXauusd Analysis Based on Ichimoku

Gold maintains its bullish trend on higher time frames and has the potential to go to higher levels.

According to Ichimoku data, there is a possibility of a price correction on the chart this week.

The overt trend will remain bullish until the price goes below the $2,894 level.

Key Levels:

All important levels for probable trades have been identified. Monitor the price reaction to these levels.

GADANG - Turning BULLISH based on ICHIMOKU CLOUD ?GADANG - CURRENT PRICE : RM0.355

GADANG is changing trend from sideways to UPTREND. Take note that the high is getting higher and the low is getting higher.

The stock is BULLISH based on ICHIMOKU CLOUD because :

i) CHIKOU SPAN is above candlestick

ii) Price is above CLOUD

iii) CHIKOU SPAN is above CLOUD

iv) There is a bullish crossover (TENKAN SEN crosses up KIJUN SEN) - Personally i don't use TENKAN SEN and KIJUN SEN to trading or analysing.

ENTRY PRICE : RM0.355

TARGET : RM0.385 , RM0.410 , RM0.440

STOP LOSS : RM0.320

Notes : GADANG is a construction company. According to TA Research, the group's construction order book stood at RM1bil as of end-November 2024. The company is syariah compliant.

NATGATE - 11 RECORD SESSION LOWS ?NATGATE - CURRENT PRICE : RM1.79

On 02 August 2024, the stock made a FALLING WINDOW . The selling pressure continues until price starts to stabilize and create a double bottom support level near RM1.65 - 1.68.

On 29 October 2024, the share price closes above the top of FALLING WINDOW resistance level indicates strong bullish momentum. At the same time, the share price also successfully closed above ICHIMOKU CLOUD (after trading below KUMO almost 3 months). This two scenario gives strong bullish outlook for NATGATE. From here, the stock continue moving upside until RM3.03 (ALL TIME HIGH) - upside movement of 40% from the breakout point on 29 OCTOBER 2024.

After reach ALL TIME HIGH, the stock made an EVENING STAR pattern. From there, the stock starts declining and makes 11 RECORD SESSION LOWS.

Here is the important points to have a look. We can expect a rebound from current price as there are some hints given by chart :

1) 11 RECORD SESSION LOWS creates an OVERSOLD situation (The record session topic is discussed by STEVE NISON in his book - BEYOND CANDLESTICK , PAGE 121 - 127)

2) The last two session was bullish HAMMER - the long lower shadows give hint that potential bottom had reached and the bears are getting tired.

3) Price bounce from the previous DOUBLE BOTTOM support level area near RM1.65 - RM1.68 indicates that the BULLS are aggresively buying the shares near the support level.

In conclusion, as a aggresive trader, this is an oppurtunity for me to buy the stock at price RM1.79 - RM1.81. If as expected the share price starts rebound higher, i would take my profit at RM1.95 (+8%) and RM2.05 (+14%). My support level will be RM1.68 (the low of bullish hammer). My time frame for trading this stock is only one month.

ENTRY PRICE : RM1.79 - RM1.81

TARGET PRICE : RM1.95 , RM2.05

STOP LOSS : RM1.68

TIME FRAME - Not more than ONE MONTH

TAYOR !

AUMAS - Positive corelation with GOLD price movement ?AUMAS - Current price : RM0.890

AUMAS is bullish as the share price is above 50-day EMA. Note that the price breakout ICHIMOKU CLOUD on 31 JANUARY 2025 with high trading volume.

Gold future price surge to new high due to uncertainty and weak global sentiment. AUMAS is engages in gold mining business in Malaysia. The share price have a positive corelation with gold price movement. As such, i expect the share price may move higher in the upcoming session.

ENTRY PRICE : RM0.890

TARGET : RM0.980 (+10%)

STOP LOSS : RM0.820 (-7%)

Notes : The company was formerly known as Bahvest Resources Berhad and changed its name to AuMas Resources Berhad in December 2024. AuMas Resources Berhad was incorporated in 2004 and is headquartered in Tawau, Malaysia.

XAUUSD Daily AnalysisGold continues to its predicted bullish movement.

In annual analysis at the beginning of the year, I emphasized that gold will set new ATH.

Last week, gold prices hit our analytical target and the upward movement will be continued.

I will identify new key support and resistance levels for coming weeks.

XRP/USDT Daily Chart Summary (Ichimoku Cloud)Strong Uptrend: XRP is trading above the Ichimoku cloud, confirming a strong bullish trend with reliable support.

Breakout Momentum: A breakout from a triangle pattern, supported by high trading volume, signals the potential for further upward movement.

Key Levels: Resistance at $3.00 is approaching, with $1.00 remaining a critical historical support level.

RSI Insights: The RSI above 70 indicates strong momentum but suggests potential short-term pullbacks due to overbought conditions.

Volume Surge: Increased volume reinforces bullish confidence, supporting a possible continuation of the rally.

Historical Context: External factors like political events are overlaid on the chart, adding an interesting dimension to market sentiment.

Outlook: XRP could test $3.00 in the short term, with the potential for new highs if it breaks resistance. A healthy correction may occur due to overbought RSI before targeting $3.50-$4.00.

KRAKEN:XRPUSDT