An intraday trade zone on EURUSD using standard deviationI calculate the zone by using implied volatility from the futures to solve for a one standard deviation price range. Then multiply that by 1.5 for the bottom and .75 for the top of the zone. To pick direction I simply use the Ichimoku Kinko Hyo. When the price is above the kumo I'm short, when its below the kumo I'm long. The success rate should hover around 50% but you'll find that your average wins is normally bigger than your average losses. I close it at the end of the New York session.

Ichimoku Cloud

An intraday trade zone on EURJPY using standard deviationI calculate the zone by using implied volatility from the futures to solve for a one standard deviation price range. Then multiply that by .75 for the bottom and 1.5 for the top of the zone. To pick direction I simply use the Ichimoku Kinko Hyo. When the price is above the kumo I'm short, when its below the kumo I'm long. The success rate should hover around 50% but you'll find that your average wins is normally bigger than your average losses. I close it at the end of the New York session.

An intraday trade zone on EURUSD using standard deviationgo

I calculate the zone by using implied volatility from the futures to solve for a one standard deviation price range. Then multiply that by 1.5 for the bottom and .75 for the top of the zone. To pick direction I simply use the Ichimoku Kinko Hyo. When the price is above the kumo I'm short, when its below the kumo I'm long. The success rate should hover around 50% but you'll find that your average wins is normally bigger than your average losses. I close it at the end of the New York session.

An intraday trade zone on AUDUSD using standard deviationI calculate the zone by using implied volatility from the futures to solve for a one standard deviation price range. Then multiply that by .75 for the bottom and 1.5 for the top of the zone. To pick direction I simply use the Ichimoku Kinko Hyo. When the price is above the kumo I'm short, when its below the kumo I'm long. The success rate should hover around 50% but you'll find that your average wins is normally bigger than your average losses. I close it at the end of the New York session.

An intraday trade zone on EURUSD using standard deviationI calculate the zone by using implied volatility from the futures to solve for a one standard deviation price range. Then multiply that by .75 for the bottom and 1.5 for the top of the zone. To pick direction I simply use the Ichimoku Kinko Hyo. When the price is above the kumo I'm short, when its below the kumo I'm long. The success rate should hover around 50% but you'll find that your average wins is normally bigger than your average losses. I close it at the end of the New York session.

CADJPY Bullish in Ichimoku Time CyclesCADJPY is still uptrend in long term based on below Ichimoku confirmations.

- Kumo (Senko span A) is bullish

- Tenkan sen up

- Chiko span above candles

The swing highs are found to be in time cycle of 24 (The most recent highs are in 23 cycle).

Therefore, if market breaks the forecast lines, then the market can be continuously bullish to the next Henka-Bi which is around 20th April.

XTZUSDT entry: around 4.40

TP1: 5.04

TP2: 5.59

TP3: 5.79

TP4: 5.985

TP5: 6.29

SL: 3.79

Check my website for tutorials, examples and calls :)

cry-pto-surf.com

- My trades are not financial advices

- always use stop-loss

- invest only the amount of money you are ready to lose

- trade with a strict money management method

EURCAD downtrending by Ichimoku Time CyclesEURCAD Daily chart shows a continuous downtrend by below Ichimoku confirmations.

- Kumo (Senko span A and B) down

- Kijun sen down

- Tenkan sen down

- Chiko span below candles

After breakout of the forecast lines market has been continuously downtrending.

In terms of the time cycle the previous highs are in 9 candles, which is one of the Kihon Suchi numbers. Therefore next Henka-bi can be on 22 Mar.

CADJPY continuously uptrend by IchimokuCADJPY Daily timeframe shows continuous bull market based on below Ichimoku confirmations.

- Kumo (Senko span A and B) up

- Kijun sen up

- Tenkan sen up

- Chiko span above candles

After breakout of forecast lines market has been stably bullish, however, Doji candles appear since 15th Mar.

Whether market breaks the previous Doji high 87.68 is the key for this week.

GBPJPY under temporary retracement by IchimokuGBPJPY Daily chart shows the market is under retracement as below Ichimoku confirmations.

- Kumo (Senko span B) flat)

- Kijun sen flat

However the market is still in bullish momentum as below.

- Thick bullish Kumo

- Tenkan sen is still up

- Chiko span above the candles

Below is the next possible scenarios.

1. If market will be supported by the trend line, it could break the previous Doji high and reach up to 153.00.

2. If market breaks the support line and Tenkan sen, it could go down back to Kijun sen at 148.1 level.

EURGBP retracing after Tenkan sen breakout by IchimokuEURGBP Daily chart now shows it broke the Tenkan sen and now ranging by below Ichimoku confirmations.

- Kumo (Senko span B) flat

- Kijun sen flat

The momentum is still bearish by below Ichimoku confirmations.

- Chiko span below candles

- Price below forecast lines

The market is continuously bearish as long as price being below Kijun sen and Chiko span below candles.

Ichimoku entry XRAYthis one's a little weird on the ichimoku front, as the base and conversion lines shared values ever since earnings, but it does count as a cross when it popped over today. Meanwhile there's a lot to like about this chart; nice boost after earnings that persisted without giving back ground, and now momentum is building behind it (i think this is what Ichi is finding here). So if not a pop, it looks like most likely we'll see steady upward creep, which we don't mind harvesting for a few days. We'll hope to get out around $64

Ichimoku entry ANTMStrong momentum here, looking for continuation based on the leading span crossover. GO ANTMAN

Gold shows temporary retracenment by IchimokuGold Daily chart shows a temporary retracement by below Ichimoku confirmations.

- Kumo (Senko span A and B) flat

- Kijun sen flat

- Tenkan sen flat

Chiko span is below the candles so the momentum is still bearish.

Below are the next possible scenarios.

1. Price will be resisted by the trend line and continues to go down

2. Price will be resisted by Kijun sen and continues to go down

However, if market breaks the Kijun sen, Chiko span could touch the candles and the market will be in a range.

EURJPY continuously bullish by IchimokuEURJPY daily chart shows continuously bullish trend by below Ichimoku confirmations.

- Kumo (Senko span A and B) up

- Kijun sen up

- Tenkan sen up

- Chiko span above the candles

After breaking the psychological line of 130.00 last week it can go up to the next round number of 131.00 level.

The market has been supported by Tenkan sen as circled, therefore it could go up above the Tenkan sen.

OCEANUSDTentry: around 1.4

TP1: 1.52

TP2: 1.66

TP3: 1.76

TP4: 1.82

TP5: 1.89

SL: 1.24

Check my website for tutorials, examples and calls :)

cry-pto-surf.com

- My trades are not financial advices

- always use stop-loss

- invest only the amount of money you are ready to lose

- trade with a strict money management method

LTCUSDTentry: around 199

TP1: 222

TP2: 234

TP3: 246

TP4: 258

TP5: 269

SL: 178

Check my website for tutorials, examples and calls :)

cry-pto-surf.com

- My trades are not financial advices

- always use stop-loss

- invest only the amount of money you are ready to lose

- trade with a strict money management method

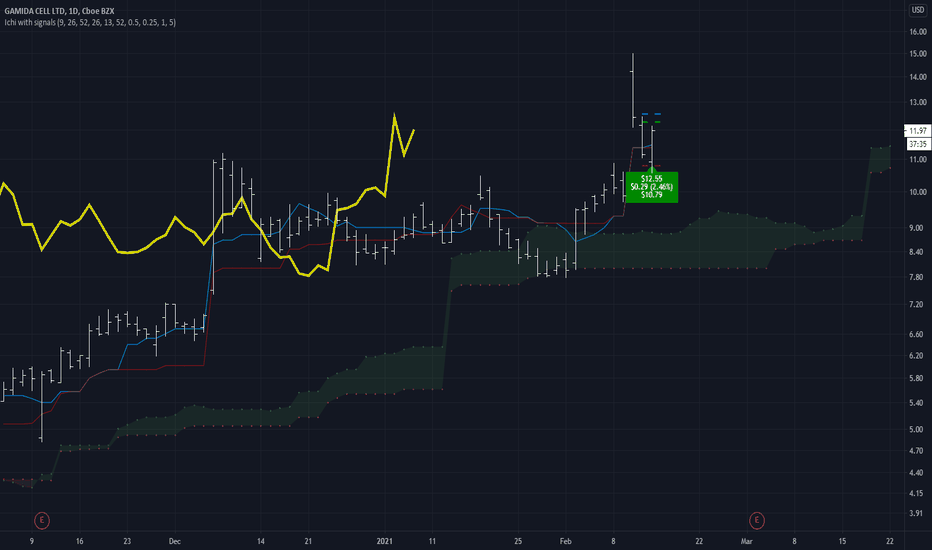

Ichimoku entry GMDAI'm a little biased against this type but we've seen a few go really big lately so let's go for it.

Ichimoku entry TOTrevisiting exit strategy yet again. I now think 0.5/0.1/1 is the way to go. That super tight stop loss def seems like more of a stop profit in most cases.