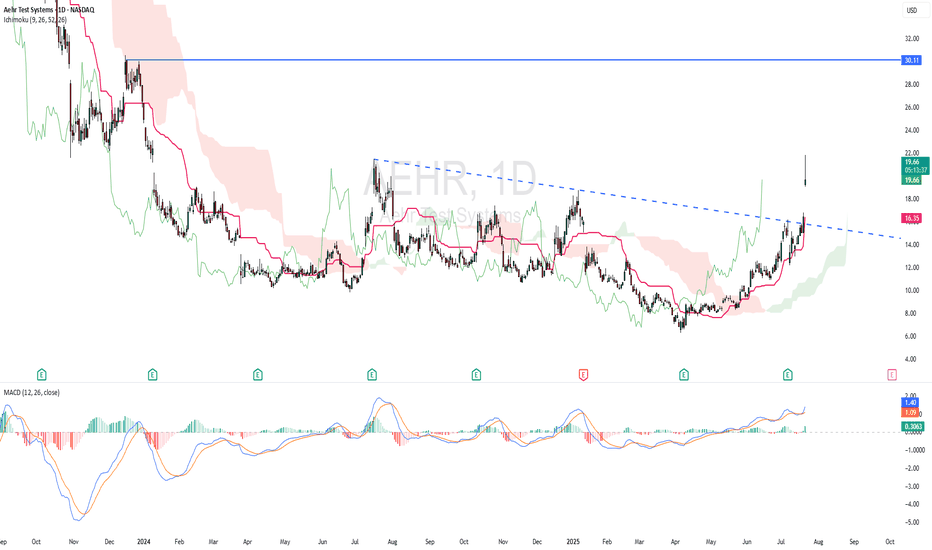

AEHR - RISING WINDOWTechnically AEHR is bullish as the stock made a strong rising window. Based on ICHIMOKU CLOUD, price is above cloud and chikou span is above candlestick - indicating bullish scenario. Kijun Sen is rising. MACD indicator showing bullish momentum.

ENTRY PRICE : 19.30 - 19.70

TARGET : 30.00 (potential almost 50% roi)

SUPPORT : 14.72

Ichimokukinkohyo

BellRing Brands (BRBR) Weekly Gartley@ Key Levels + Kijun SignalIn March 2025, I previously took a look at this budding public company BellRing Brands, Inc. for a long-term investment horizon. It was priced around 74 at the time, then the fall of the overall market status put additional pressure on its stock, although the company itself is booming and meets my fundamental parameters. See the following:

Since then, we had an awesome and confident forward guidance from the company in the last earnings call in May 2025: bellring.com

Now, looking at BellRing Brands (BRBR) once again, on a weekly chart, key technical patterns have formed that look very promising and solid with its many confluences.

TECHNICALS:

WEEKLY:

Many weekly confluences have appeared from a technical perspective. Here is what I see:

(1) There is a clear Bullish Gartley-ish pattern in a weekly retracement to 50% followed by a retracement to 78.6% of a preceding move.

(2) The price is around 78% fib support.

(3) Horizontal area of support: The 50 - 58 area is a whole prior area of horizontal support that was a prior resistance area back in July 2024, and the price has landed back on that area. You know what we say as technicians and investors: past resistance = future support.

(4) MACD Hidden Bullish Divergence (weekly)

(5) The price tested the weekly cloud and broke through; however, bullish extremes were triggered when that happen, which is rare based on all my personal studies. In fact, the current level 55-58 marks the end of a bearish double top cycle that began around March 2025.

(6) A weekly Doji with volume support (classified as a "dVa" in my old notes of Volume Price Analysis).

Here is the weekly chart:

MONTHY:

BRBR is poised to rally Q3 and Q4 2025.

We have a potential monthly bounce of the kijun forthcoming along with good fundamentals going forward supporting the growth of the company in the long term.

** potential monthly Kijun Trend Bounce **

Here is the monthly chart:

Target:

Currently, the price is 58.54. My tentative target is around 140 by March 2026.

Thus, with all the fundamental support, good forward-looking guidance, and the technical I believe that BellRing Brands (BRBR) is at a great price right now. It is prime to continue its stretch of growth for 2025. Looking forward with investor foresight, the case for BellRing Brands and its stock (BRBR) is not only a high-probability outlook of positivity, but a high odds outcome of technical price pattern success. What a great discount.... :)

Bitcoin Strategic Interval – Latency & Asymmetric Bias.⊢

⟁ BTC/USD – Binance – (CHART: 1D) – (June 20, 2025).

⟐ Analysis Price: $106,025.88.

⊢

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA21 – ($105,772.44):

∴ The price remains fractionally above EMA21, retaking the short-term reactive axis;

∴ Despite prior rejection, current candle shows renewed traction with a solid close above;

∴ The slope is flat–rising, signaling the potential reactivation of local trend continuation.

✴️ Conclusion: EMA21 is tentatively reclaimed – a short-term bullish signal under close scrutiny.

⊢

▦ SMA200 – ($95,921.92):

∴ Long-term structure preserved: price maintains a wide buffer over SMA200;

∴ The moving average exhibits a healthy upward slope, uninterrupted since Q4 2023;

∴ No technical threat detected to the macro-trend structure.

✴️ Conclusion: SMA200 acts as the primary institutional defense line. No stress present.

⊢

▦ Ichimoku Cloud – (105,899 | 105,738 | 102,433 | 105,576 | 106,025):

∴ Price is nestled precisely within the flat upper cloud band – a known zone of consolidation;

∴ Span A and B are beginning to flatten, suggesting temporary exhaustion of momentum;

∴ Chikou remains above price – confirming trend integrity.

✴️ Conclusion: Ichimoku signals a pause, not a break – directional clarity pending.

⊢

▦ MACD (12,26,9) – (Histogram: -364.87 | MACD: 257.20 | Signal: 622.06):

∴ Bearish histogram remains negative, but shrinking for three sessions;

∴ MACD line curling upward with initial convergence to Signal line;

∴ Reversal signal forming but not yet triggered.

✴️ Conclusion: Early signs of MACD cross; confirmation requires follow-through.

⊢

▦ RSI – (53.17 | Avg: 51.74):

∴ RSI reclaims neutral-positive zone, stabilizing above 50;

∴ Structure shows divergence fading, with momentum recovering slowly;

∴ Still far from exhaustion thresholds.

✴️ Conclusion: RSI favors the bulls with cautious optimism.

⊢

▦ Volume (Last 5 Days):

∴ Volume remains muted, averaging 110–120k Bitcoin/day;

∴ No aggressive buy or sell pressure confirmed;

∴ Current move lacks conviction – suggests passive spot activity.

✴️ Conclusion: Price is advancing without volume confirmation – fragility persists.

⊢

🜎 Strategic Insight – Technical Oracle:

∴ Structural trend remains intact and undisturbed on the macro scale;

∴ Short-term bullish reclaim of EMA21 within the cloud, but momentum and volume still lag;

∴ Absence of conviction demands validation from price action or macro catalyst.

⊢

∫ II. On-Chain Intelligence – (Source: CryptoQuant):

▦ 🝰 Exchange Inflow Mean - (MA7):

∴ Metric sits near historic lows (≈0.4 BTC), denoting multi-week suppression of inflows;

∴ Correlates directly with reduced sell-side pressure from whales and institutions;

∴ Price structure remains unchallenged by inflow spikes – consistent with strategic holding.

✴️ Conclusion: Absence of fear or distribution among large holders – bullish backdrop intact.

⊢

▦ 🜍 Estimated Leverage Ratio – (Current: 0.259):

∴ Leverage steadily increasing, now entering historical danger zone;

∴ Elevated risk of cascade liquidations on any sharp downside move;

∴ Suggests the current rally is not organically fueled by spot demand.

✴️ Conclusion: Price structure is leveraged, not grounded – risk of synthetic instability.

⊢

▦ 🝗 Exchange Reserves - (Binance) – (≈544.5K BTC):

∴ Continuous net outflows – multi-month drain confirmed;

∴ Reflects silent accumulation or self-custody migration;

∴ No exchange-driven supply pressure visible.

✴️ Conclusion: Structural supply depleting – passive bullish signal.

⊢

▦ ⚒ Miners’ Position Index - (MPI) – (-1.1):

∴ Readings below 0 indicate minimal miner distribution;

∴ Suggests miners are confident, or at least not forced to sell at current levels;

∴ Historically coincides with market support zones.

✴️ Conclusion: Miner behavior aligned with trend preservation – not resistance.

⊢

▦ 🜚 Funding Rate - (All Exchanges) – (+0.003):

∴ Rates mildly positive, indicating slight dominance of long positioning;

∴ No excessive funding imbalance – healthy sentiment baseline;

∴ Reflects controlled bullish bias with no speculative overheating.

✴️ Conclusion: Longs exist, but not in a way that endangers trend integrity.

⊢

🜎 Strategic Insight – On-Chain Oracle:

∴ On-chain metrics echo the technical chart: structurally sound, short-term vulnerable;

∴ Long-term holders remain disengaged from distribution behavior;

∴ The system is healthy, but carries hidden leverage that may trigger volatility.

⊢

⧉ III. Contextvs Macro–Geopoliticvs – Interflux Economicus:

▦ 🇺🇸 United States – Federal Axis & Risk Channels:

∴ Treasury Yield Curve remains slightly positive (+0.44%), removing short-term recession signal;

∴ 10Y yield elevated at 4.42% – reflects sustained inflation resistance and risk demand;

∴ Fed has signaled no rate cuts before September – QT policy remains;

∴ Speculative expectations for only 1–2 cuts in 2025;

∴ Trump administration signals potential military action in Iran, igniting geopolitical risk premium.

✴️ Conclusion: U.S. monetary regime is steady–tight; geopolitical volatility injects asymmetric risk into crypto valuations.

⊢

▦ 🇨🇳 China – Internal Stimulus & Soft Deflation:

∴ Industrial Production slows to +5.8% YoY – weakest in 6 months;

∴ Retail sales climb to +6.4% YoY due to stimulus programs ("618 event", consumption vouchers);

∴ PPI remains deflationary (-3.3% YoY), compressing industrial margins;

∴ Fiscal revenue down -0.3% YTD – signals internal fragility despite easing efforts.

✴️ Conclusion: China is applying targeted stimulus, but lacks decisive global impact – neutral crypto flow effect.

⊢

▦ 🇪🇺 European Union – Disinflation & Rate Reversal:

∴ HICP inflation falls to 1.9% – below ECB’s 2.0% target;

∴ ECB cuts deposit rate by 25bps – now 2.00%;

∴ PMI Composite remains below 50 – economic contraction underway;

∴ ECB forward guidance signals data-dependence and hesitation for further cuts.

✴️ Conclusion: Europe is easing rates amidst stagnation – weak driver for global risk flows.

⊢

🜎 Strategic Insight – Interflux Macro Oracle:

∴ U.S. tight policy + Iran tension = dual pressure point on risk assets;

∴ China’s mild stimulus is not yet globally inflationary – no volatility trigger;

∴ EU drifts silently – supportive, but irrelevant to Bitcoin in current configuration;

∴ Global system is stable in appearance, but tactically charged beneath – setup aligns with Bitcoin volatility potential.

⊢

IV. ♝ Market Sentiment - Media & Institutional Lens:

▦ The Block – Corporate Stockpiling Thesis:

∴ Ongoing accumulation of Bitcoin by public and private entities continues across Q2;

∴ Institutional wallets showing strategic DCA behavior – interpreted as positioning for either macro easing or geopolitical hedge;

∴ Unlike past cycles, no major corporate selloffs have been detected.

✴️ Conclusion: Institutional base remains in passive accumulation – potential catalyst insulation.

⊢

▦ CoinDesk – Sentiment Report – BTC at $92K Risk Threshold:

∴ Despite price climbing above $106K, analysts caution of technical rejection scenarios;

∴ Zones near $92K identified as high-liquidity, high-reaction clusters;

∴ Chart analysis frames current movement as vulnerable if macro catalysts turn hawkish.

✴️ Conclusion: Sentiment remains cautiously bullish but alert to correction windows.

⊢

▦ InfoMoney – U.S. Military Risk – Iran Strike Potential:

∴ Reported internal briefing of U.S. military planning toward Iranian targets;

∴ Trump’s media team leveraging geopolitical strength posture to influence sentiment;

∴ Markets (Dow Futures) showing pre-market decline on the headline.

✴️ Conclusion: Bitcoin holds narrative premium under geopolitical fear – but risk surge remains volatile.

⊢

🜎 Strategic Insight – Media Oracle:

∴ The crypto narrative is suspended between structural trust (institutional accumulation) and external fear (macro-political instability);

∴ Bitcoin presently benefits from asymmetric narrative positioning — but lacks transactional confirmation;

∴ Media flows suggest that sentiment will pivot swiftly if Powell’s tone confirms further hawkish stance or if Iran tension escalates.

⊢

⊢

⚜️ Magister Arcanvm (𝟙⟠) – Vox Primordialis!

⚖️ Wisdom begins in silence. Precision unfolds in strategy.

⊢

⌘ Codicillus Silentii – Strategic Note:

∴ The 1D reclaim of EMA21 inside the Ichimoku flat cloud reflects a market in suspended potential, where trend continuation and failure share equal weight;

∴ On-chain dynamics remain structurally undisturbed, yet veiled in a fragile layer of leveraged positioning;

∴ Exchange reserves continue their descent, detaching the market from traditional sell-side threat, but increasing reliance on thin liquidity zones;

∴ Macro vectors (Fed policy + Middle East tension) hover as dual shadows, capable of igniting volatility without prelude;

∴ Institutional accumulation remains active, but no longer decisive - the market awaits external ignition, not internal strength;

∴ Sentiment is asymmetrically bullish, yet explicitly unconfirmed in transactional volume and price aggression;

∴ The system is quiet - not because it is resolved, but because it is observing itself. This is a moment of ritual latency.

⊢

⌘ Market Status – Tactical Mode:

✴️ Strategic Position: “Structurally Bullish – Tactically Suspended”;

✴️ Primary Mode: “Observation Priority”;

✴️ Tactical Stance:

∴ No active positioning expansion without confirmation beyond Ichimoku flat zone;

∴ Watch for MACD confirmation and volume acceleration;

∴ Monitor geopolitical escalation and Powell’s tone – both capable of shifting structural balance.

✴️ Directional Bias: Neutral–Bullish, contingent upon validation;

✴️ Key Zone of Collapse Risk: $92,000;

✴️ Ascent Gate: $110,800 + (confirmation threshold).

⊢

BTC 4H AnalysisBTC overall trend is still bullish based on previous analysis . nowadays we see exact rejection of price from our resistance level. on higher time frame the trend is still bullish. important support levels are highlighted on the chart. The 93-94 zone is the most important one. this zone will determine the direction of BTC movement

XAUUSD Daily AnalysisGold long-term trend is still bullish. based on ICHIMOKU the Xauusd is in supposed correction. daily support level (3228) was touched. the price is near important support level (3188).

For next weeks:

Support levels:

3188

3166

Resistance levels:

3351

3381

After that waiting for Ichimoku to give us the exact road map.

PENGUUSDTA risky analysis of a popular meme coin..

Based on this analysis, we are in wave 4 and it is expected to end soon and enter wave 5..

Around 0.091 to 0.085, if the price reaches it, it will be suitable for a short swing to the target of 0.0163 and 0.0175..

Ideal time zones are also marked with low tolerance..

This analysis can be easily filled..

PEPEUSDTBased on this analysis, wave E is complete and any retracement to around 0.0000078 is a buying opportunity.. and around 0.000017 to 0.000022 is the possible end zone of wave F..

Even if the price returns to the levels of 0.0000058 to 0.000005 once again, it will still be an ideal buying opportunity to buy spot.. And this is just a simple analysis and there is a possibility of error in it..

Bitcoin (BTC/USD) Weekly Analysis - W3 April | Master The MarketBitcoin continues to dominate the cryptocurrency market, and its price action provides valuable insights for traders. Here's a detailed breakdown of Bitcoin's performance in Week 3 of April:

Monthly Chart: Long-Term Uptrend

The monthly chart shows that Bitcoin remains in a long-term uptrend. However, last month saw some consolidation, with prices pulling back slightly. This indicates a healthy correction after a prolonged upward movement. Traders should focus on key support and resistance levels to identify potential breakout or reversal zones.

Weekly & Daily Charts: Consolidation Below the Cloud

On the weekly chart, Bitcoin’s price is currently trading below the Kumo cloud but above critical support levels. The daily chart highlights a defined trading range between $74,000 and $93,000 . A breakout above the cloud could signal renewed bullish momentum, while a retest of the $74,000 support level may indicate further consolidation.

Key Levels to Watch

Support: $74,000

Resistance: 93,000Tradersshouldmonitortheselevelsclosely.Asustainedmoveabove93,000 could open the door for higher targets, while a break below $74,000 might lead to deeper corrections.

Trading Strategy

Buy Opportunity: Wait for a pullback to the cloud support or a retest of $74,000 before entering long positions.

Risk Management: Place stop-loss orders below key support levels to protect against downside risks.

Bitcoin remains highly volatile, so patience and discipline are crucial. Keep an eye on macroeconomic factors like interest rate decisions and geopolitical events, as they can significantly impact BTC/USD price movements.

XAUUSD Bullish ProjectionsThe wave we've traced is defined as

A=1160

B=2075

C=1676

1) V Calculation = B + (B – C)

2) N Calculation = C + (B – A)

3) E Calculation = B + (B – A)

4) NT = C + (C - A)

so,

V = 2075 + (2075 - 1676) = 2474

N = 1676 + (2075 - 1160) = 2571

E = 2075 + (2075 - 1160) = 2990

NT = 1676 + (1676 - 1160) = 2192

A single candle has pushed us past both B and NT. We technically need a full candle body above B for confirmation, but the 5 lines all pointing straight upwards, and no apparent barriers in our way, I would consider the projected targets to be in play.

Consider this post in relation to my longer term projections shown in the related post

thanks for reading

XAUUSDThe long-term trend of gold is completely bullish according to previous analyses, which still shows a strong bullish trend on monthly time frames.

We expect a correction in the chart during next week , but The long term trend of Gold is still bullish and we couldn't see any ICHIMOKU based divergence.

important support and resistance levels on the chart is highlighted.

March 28 Is XRP's Big Day—Or At Least Better Be

Friday, March 28, 2025, marks exactly 144 days since XRP's breakout from November 4, 2024—right on cue with Gann’s "inner year" cycle, signaling a potential trend reversal (or at least a good excuse to tweet "I told you so").

Conveniently enough, March 28 is also exactly 52 days post the "flash crash" on February 3rd (if we're even calling that hiccup a crash).

The stars (or rather, candlesticks) align for Ichimoku’s Chikou Span to finally clear both the candlestick bodies and the Cloud, creating a bullish setup that even perma-bears might glance at sideways.

If XRP pulls off a daily close at or above $2.61 on March 28, expect Gann and Ichimoku fanboys to show up with wallets wide open and confidence suspiciously high.

XAUUSD Daily AnalysisXauusd Analysis Based on Ichimoku

Gold maintains its bullish trend on higher time frames and has the potential to go to higher levels.

According to Ichimoku data, there is a possibility of a price correction on the chart this week.

The overt trend will remain bullish until the price goes below the $2,894 level.

Key Levels:

All important levels for probable trades have been identified. Monitor the price reaction to these levels.

ONYXUSDTBased on this wave count and other considerations, we are probably in wave 4 and the areas indicated on the chart are ideal ranges for the bottom of wave 4 and the hunt for wave 5.

Buying spot this currency around $0.011 to $0.0125 seems low-risk and reasonable.

March 5th to 10th is an ideal time zone for the end of wave 4.

Just an analysis that could easily be wrong.

GADANG - Turning BULLISH based on ICHIMOKU CLOUD ?GADANG - CURRENT PRICE : RM0.355

GADANG is changing trend from sideways to UPTREND. Take note that the high is getting higher and the low is getting higher.

The stock is BULLISH based on ICHIMOKU CLOUD because :

i) CHIKOU SPAN is above candlestick

ii) Price is above CLOUD

iii) CHIKOU SPAN is above CLOUD

iv) There is a bullish crossover (TENKAN SEN crosses up KIJUN SEN) - Personally i don't use TENKAN SEN and KIJUN SEN to trading or analysing.

ENTRY PRICE : RM0.355

TARGET : RM0.385 , RM0.410 , RM0.440

STOP LOSS : RM0.320

Notes : GADANG is a construction company. According to TA Research, the group's construction order book stood at RM1bil as of end-November 2024. The company is syariah compliant.

Ichimoku Theories - Complicated? Keep it SimpleNYMEX:CL1!

The Ichimoku Strategy is a technical analysis method using the Ichimoku Kinko Hyo indicator, which helps traders identify trends, support/resistance levels, and potential trade signals. It consists of five key components:

Ichimoku Indicator Components:

1. Tenkan-sen (Conversion Line): (9-period moving average)

• Short-term trend indicator.

• A sharp slope suggests strong momentum.

2. Kijun-sen (Base Line): (26-period moving average)

• Medium-term trend indicator.

• Acts as a support/resistance level.

3. Senkou Span A (Leading Span A): ((Tenkan-sen + Kijun-sen) / 2, plotted 26 periods ahead)

• Forms one edge of the Kumo (Cloud).

• A rising Span A suggests an uptrend.

4. Senkou Span B (Leading Span B): (52-period moving average, plotted 26 periods ahead)

• The second edge of the Kumo (Cloud).

• When Span A is above Span B, the cloud is bullish (green); when Span A is below Span B, it’s bearish (red).

5. Chikou Span (Lagging Span): (Closing price plotted 26 periods behind)

• Confirms trend direction.

• If Chikou Span is above past prices, it signals bullish momentum.

Trading Strategies Using Ichimoku

1. Kumo Breakout Strategy

• Buy when the price breaks above the Kumo (Cloud).

• Sell when the price breaks below the Kumo.

2. Tenkan-Kijun Cross Strategy

• Bullish signal: Tenkan-sen crosses above Kijun-sen.

• Bearish signal: Tenkan-sen crosses below Kijun-sen.

3. Chikou Span Confirmation

• Buy when Chikou Span is above past price action.

• Sell when Chikou Span is below past price action.

4. Kumo Twist

• When Senkou Span A crosses above Senkou Span B, it signals a potential bullish reversal.

• When Senkou Span A crosses below Senkou Span B, it suggests a bearish reversal.

5. Trend Confirmation

• Price above the cloud = bullish trend.

• Price inside the cloud = consolidation.

• Price below the cloud = bearish trend.

Advantages of Ichimoku Strategy

✅ Provides a comprehensive market view (trend, momentum, support/resistance).

✅ Works well in trending markets.

✅ Offers clear entry and exit signals.

Limitations

❌ Less effective in ranging or choppy markets.

❌ Can be complex for beginners.

❌ Requires confirmation with other indicators (e.g., RSI, MACD).

Trade Smart - Trade Safe 🚀

NATGATE - 11 RECORD SESSION LOWS ?NATGATE - CURRENT PRICE : RM1.79

On 02 August 2024, the stock made a FALLING WINDOW . The selling pressure continues until price starts to stabilize and create a double bottom support level near RM1.65 - 1.68.

On 29 October 2024, the share price closes above the top of FALLING WINDOW resistance level indicates strong bullish momentum. At the same time, the share price also successfully closed above ICHIMOKU CLOUD (after trading below KUMO almost 3 months). This two scenario gives strong bullish outlook for NATGATE. From here, the stock continue moving upside until RM3.03 (ALL TIME HIGH) - upside movement of 40% from the breakout point on 29 OCTOBER 2024.

After reach ALL TIME HIGH, the stock made an EVENING STAR pattern. From there, the stock starts declining and makes 11 RECORD SESSION LOWS.

Here is the important points to have a look. We can expect a rebound from current price as there are some hints given by chart :

1) 11 RECORD SESSION LOWS creates an OVERSOLD situation (The record session topic is discussed by STEVE NISON in his book - BEYOND CANDLESTICK , PAGE 121 - 127)

2) The last two session was bullish HAMMER - the long lower shadows give hint that potential bottom had reached and the bears are getting tired.

3) Price bounce from the previous DOUBLE BOTTOM support level area near RM1.65 - RM1.68 indicates that the BULLS are aggresively buying the shares near the support level.

In conclusion, as a aggresive trader, this is an oppurtunity for me to buy the stock at price RM1.79 - RM1.81. If as expected the share price starts rebound higher, i would take my profit at RM1.95 (+8%) and RM2.05 (+14%). My support level will be RM1.68 (the low of bullish hammer). My time frame for trading this stock is only one month.

ENTRY PRICE : RM1.79 - RM1.81

TARGET PRICE : RM1.95 , RM2.05

STOP LOSS : RM1.68

TIME FRAME - Not more than ONE MONTH

TAYOR !

A biotech play - Bullish move anticipated Using Ichimoku system on the Daily time frame indicates a possibility of a future bullish move is anticipated. The vertical red and green lines represent the limits of the current range; a stop Loss can be suggested accordingly - to be set at or below the red line, while a price target can be suggested by the anchored VWAP and a simple strategy of reversion to the mean, thus indicating a decent RR.

Oversold/possible BK playanother oversold penny stock but this one seems to be pending bankruptcy filings. Ichimoku system shows possibility of reversal. It could close the gap to 0.5 or go a bit further.