ICPUSDT

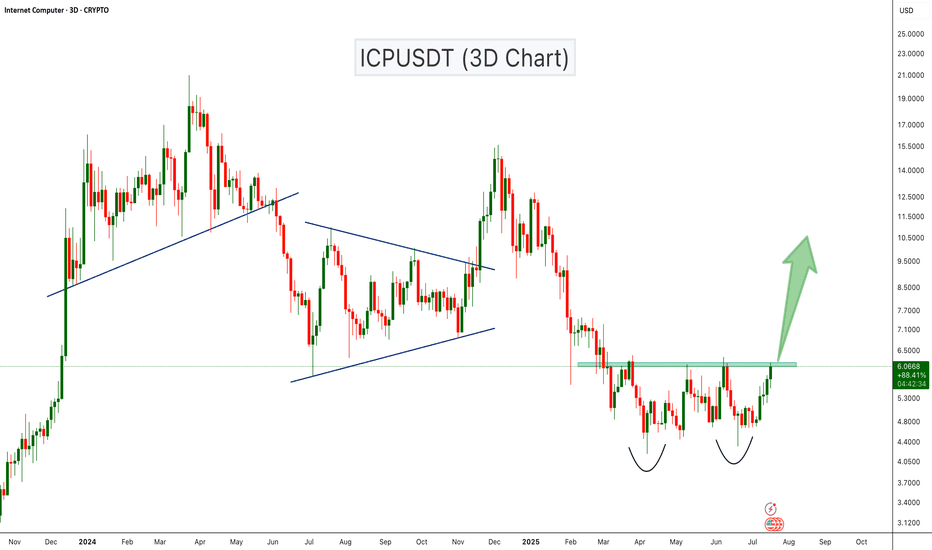

ICPUSDT Double Bottom Breakout Loading?ICPUSDT is showing a strong bullish setup with a classic double bottom pattern forming on the 3-day chart. The price has tested the support zone twice and is now approaching the neckline resistance around the $6.10 level. A confirmed breakout above this resistance could trigger a strong bullish move toward the next key resistance levels near $9.50 and $15.

Cheers

Hexa

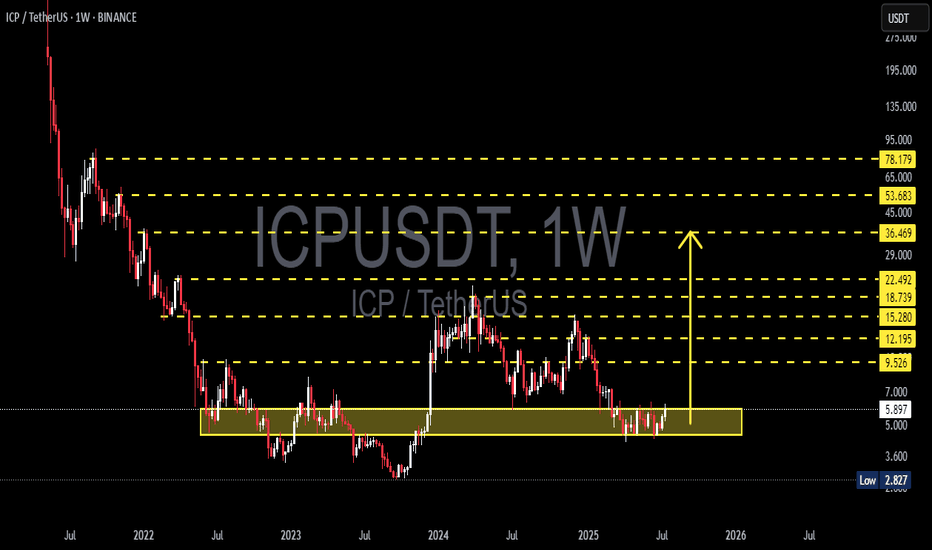

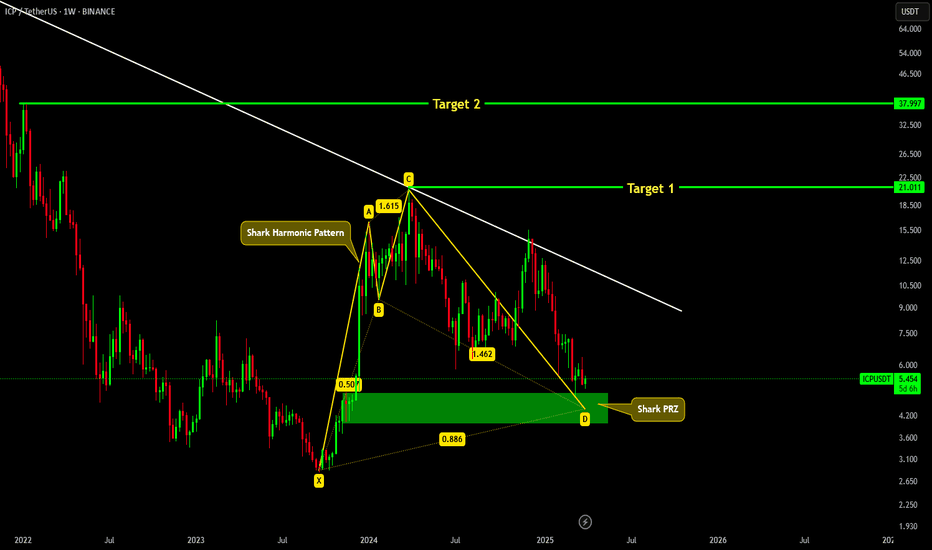

ICP/USDT Weekly Analysis: Multi-Year Accumulation Base🔍 Macro Outlook & Context:

ICP has been in a prolonged downtrend since its initial listing, dropping over 95% from its all-time high. However, since late 2022, ICP has been forming a strong and well-defined accumulation base between the $3.00 – $6.00 range.

Currently, price action and structure indicate that a potential breakout from this multi-year base is imminent. The setup is beginning to mirror a Wyckoff Accumulation Phase, where smart money accumulates quietly before launching into the next markup phase.

📐 Technical Structure & Pattern Breakdown:

✅ Accumulation Zone

Over 80 weeks of consolidation within a tight horizontal range.

This forms a strong foundation for a powerful breakout move if confirmed.

✅ Multiple Bottom Formation

Repeated failures to break below $3.50 suggest growing bullish pressure and seller exhaustion.

✅ Bullish Compression

Higher lows forming inside the range.

Resistance at $6.00 is being tested more frequently, indicating a breakout buildup.

✅ Volume Profile

Declining volume during sideways action = typical of supply exhaustion.

Surge in volume during breakout would confirm entry into markup phase.

🚀 Bullish Scenario (Primary Setup):

If price breaks and closes above $6.00 on the weekly timeframe:

Key Resistance Targets:

$9.52 → $12.19 → $15.28 → $18.73 → $22.49

Extended Bull Market Targets:

$29 → $36 → $45+

Potential ROI from base zone: +200% to +600%

Bullish Confirmation Signals:

Strong weekly candle close above $6.00

Volume breakout

RSI crossing 50 and MACD bullish crossover

🐻 Bearish Scenario (Alternative):

If the breakout fails and rejection occurs at $6.00:

Possible retracement back to lower support zones:

$4.50 → $3.00

A breakdown below $3.00 would invalidate the bullish structure and open risk for new lows.

Bearish Red Flags:

Long upper wick near resistance without volume

RSI drops back under 40

Breakdown of $3.50–$4.00 support zone

📊 Trading Strategy & Risk Management:

Entry Type Price Range

Breakout Entry $6.20–$6.50

Conservative SL $5.20

Aggressive SL $4.70

TP Range $9.5 to $22.4

Long-Term TP Up to $45+

Use scaled take-profits to secure gains gradually and reduce risk.

🧠 Market Sentiment & Psychology:

Sentiment is slowly shifting from fear to anticipation. Long-term accumulators and institutional players often target setups like this — low prices with solid structure and untapped upside. If breakout confirms, ICP could become one of the top-performing altcoins of the next cycle.

> “Accumulation is where smart money buys. Breakout is where the public chases.”

📌 Final Thoughts:

ICP/USDT is at its most critical point in over two years. A confirmed breakout from this long-standing base could be the launchpad for a multi-stage rally. This is a setup worth watching closely — or acting on with tight risk control.

#ICPUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #WyckoffAccumulation #LongTermSetup #CryptoReversal #BullishCrypto #ICPAnalysis #AltcoinSeason #BreakoutTrade #Cryptocurrency

TradeCityPro | ICP Eyes Breakout as Altseason Speculation Grows 👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ICP coin for you—one of the DePIN and AI-related coins, ranked 37 on CoinMarketCap with a market cap of 3.11 billion.

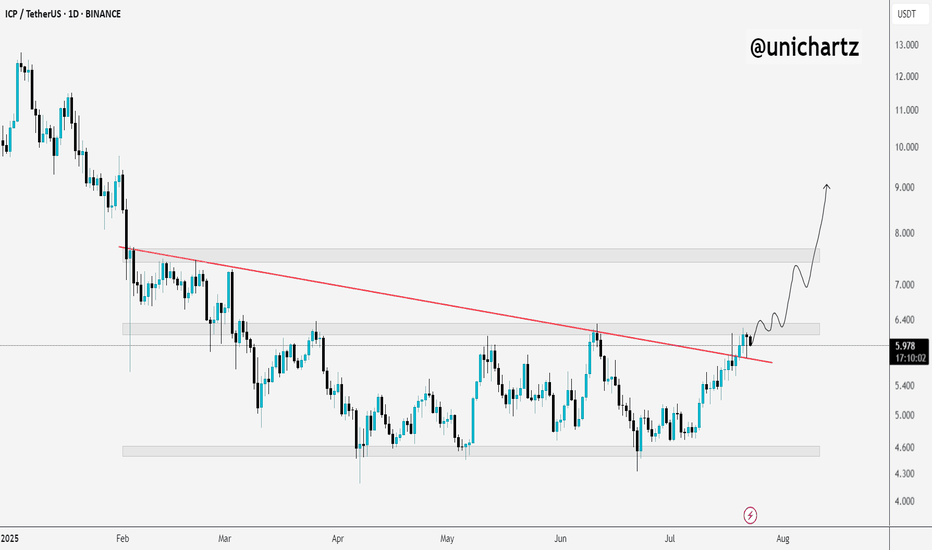

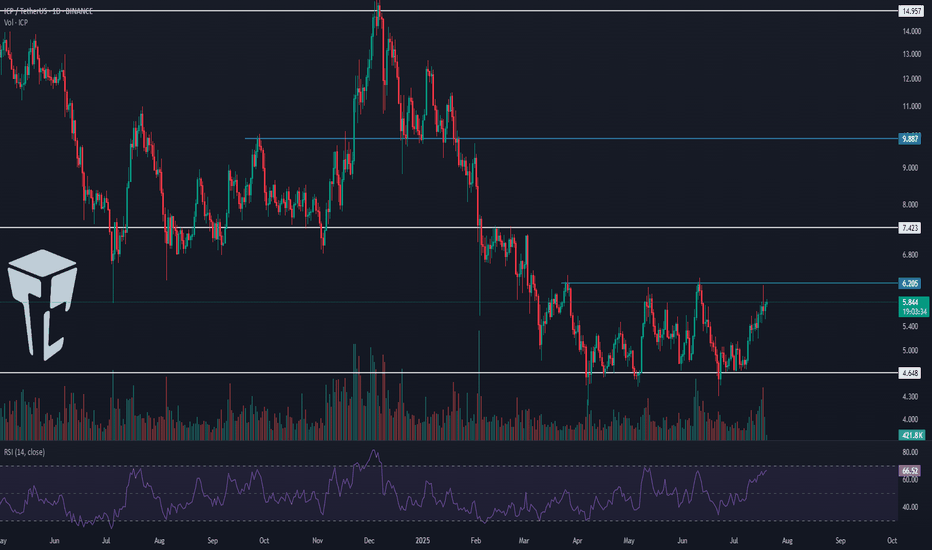

📅 Daily timeframe

As you can see on the daily timeframe, a ranging box has formed around the key support at 4.648, and price is fluctuating inside this box.

🔔 The top of the box is at 6.205, and price has touched it multiple times. It just wicked into it again and got rejected.

📈 This level has become a very important resistance. If it breaks, we can enter a long position—and it’s even suitable for a spot buy.

🛒 I already hold this coin in spot from lower entry points and don’t plan to increase my spot volume, but I’ll open a futures position if 6.205 breaks.

🔽 If Bitcoin Dominance moves downward, the 6.205 trigger will be a very good entry point. A break above 70 on the RSI will also be a strong momentum confirmation.

📊 If price gets rejected from the top of the box and drops to the 4.648 support, we can open a short position in lower timeframes. A break below 4.648 would confirm the bearish outlook.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

#ICP/USDT#ICP

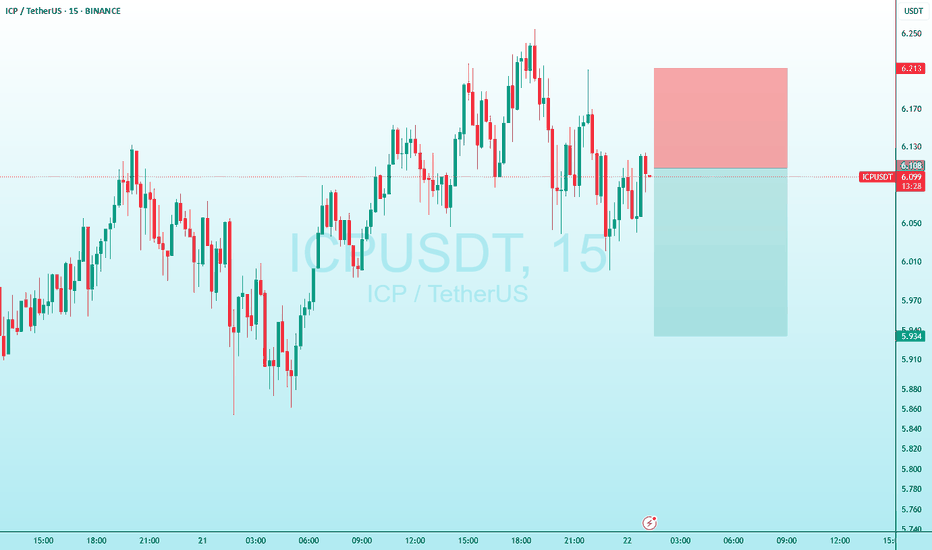

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.85.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 6.04

First target: 6.13

Second target: 6.28

Third target: 6.50

TradeCityPro | ICP Approaches Key Resistance with Rising Volume👋 Welcome to TradeCity Pro

In this analysis, I want to review the ICP coin for you. The Internet Computer project operates in the fields of artificial intelligence and DePIN.

⭐ The coin of this project, with the symbol ICP, has a market cap of 3.25 billion dollars and ranks 32nd on CoinMarketCap.

📅 Daily Timeframe

As you can see in the daily timeframe, there is a descending trendline visible on the chart, which has been tested multiple times. The price has broken above it and is now sitting just below the 6.205 resistance level.

🔍 In recent candles, the volume has increased significantly, which raises the likelihood of a breakout above 6.205.

🔔 If the 6.205 level is broken, ICP's bullish trend could begin. In that case, the price could move toward the 7.423 and 9.887 levels.

📊 Entering a position with the breakout of 6.205 is supported by volume confirmation, and we will get RSI momentum confirmation if it enters the overbought zone.

📉 For the bearish scenario to play out, the price must first get rejected from 6.205, and then we’ll look for confirmation of a trend reversal with a break below 4.468.

🛒 You can also use this same 6.205 trigger for a spot buy, but keep in mind that Bitcoin dominance is still in an uptrend, so in my opinion, it’s not yet the right time to buy altcoins.

✔️ The best trigger for buying any altcoin is to wait for confirmation of a trend reversal in Bitcoin dominance. Once that’s confirmed, you can start buying the altcoins you’ve selected.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Internet Computer Protocol $81 Easy Target Yields 1,450% ProfitsIf you saw the Injective chart you know what happens after a correction, a classic ABC correction. What follows a correction is a bullish impulse.

A target of $81 gives us more than 1,450% profits potential for this pair, ICPUSDT (Internet Computer Protocol).

This is a project that was damaged by the SEC's decision to label it a security, remember? The SEC today is no longer the same as back in those days. It is different now. The SEC is crypto-bullish, the SEC is friendly and whatever damage was caused will be reversed, make no mistake.

Right now ICP is moving within it's long-term accumulation zone. As the name implies, a zone that is good to buy for those focused on long-term hold. Even if you are looking at the short-term or mid-term, this right now is a great entry, great timing, the best possible prices preceding the 2025 bull market phase.

It was a while back when I first saw the possibility of the bull market extending beyond late 2025. This scenario/possibility is now becoming stronger with many projects supporting this view. The chart of many stable, long-term projects are pointing to growth leading into the first half of 2026. Q1 and Q2 2026. This would definitely be the best ever.

Will the next bull market peak in late 2025 or early 2026? Make your guess. What cannot be doubted is that we are going up next. Up, up, up. Are you prepared?

Preparation comes in the form of a plan, and lots of money injected into the market. Buy like the world is about to end. Start buying and continued buying, everything you can. You will be very happy with the results, I promise.

Thank you for reading.

Namaste.

ICP - Perfect Long OpportunityDescription

---------------------------------------------------------------

+ ICP has started reversal inside the channel and the price is heading towards the resistance zone, this gives a bullish trade opportunity.

---------------------------------------------------------------

VectorAlgo Trade Details

------------------------------

Entry Price: 5.3

Stop Loss: 3.3

------------------------------

Target 1: 6.9

Target 2: 12.7

Target 3: 22.5

------------------------------

Timeframe: 1W

Capital Risk: 1-2% of trading amount

Leverage: 5-10x

---------------------------------------------------------------

Enhance, Trade, Grow

---------------------------------------------------------------

Feel free to share your thoughts and insights. Don't forget to like and follow us for more trading ideas and discussions.

Best Regards,

VectorAlgo

ICP / USDT: In the Macro Support Zone

The price has reached the target macro support zone for the formation of a long-term bottom.

As long as the price stays above the April 7th lows, my main scenario is that the macro correction (wave (2)) has ended and a new multi-year growth cycle has begun.

Weekly Projection:

Thank you for your attention and I wish you successful trading decisions!

Previous ideas on ICP :

Nov'24:

Jun'24:

Dec'23:

TradeCityPro | ICP: Breakout Watch in Web3 Veteran’s Price Range👋 Welcome to TradeCity Pro!

In this analysis, I’m going to review the ICP coin for you. The Internet Computer project is one of the older projects in the crypto space, focused on Web3 and gaming.

⚡️ The coin currently has a market cap of $2.65 billion, placing it at rank 36 on CoinMarketCap.

⏳ 4-Hour Timeframe

As you can see in the 4-hour timeframe, a range box has formed between the levels of 4.648 and 5.239, and the price has currently reached the top of the range.

✔️ During this upward leg from the bottom of the box, market volume has been increasing, which indicates that the probability of breaking through 5.239 is high.

🔍 If 5.239 is broken, we can enter a long position. The next resistance levels are at 5.558 and 6.313.

✨ There’s also a larger range box between 4.648 and 6.313, and as long as the price stays above 4.648, we can say that this broader range is valid and price is fluctuating within it.

📉 To open a short position, wait for the break of 4.648. The momentum in higher timeframes for this coin is bearish, so if this level breaks, the trend may continue downward with another leg to the downside.

📊 For that to happen, selling volume must increase, so that when 4.648 breaks, there is no volume divergence, ensuring a healthy continuation of the trend.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ICPUSDT READY TO FLY AGAIN ?? ICPUSDT is currently forming a classic falling wedge pattern on the chart, which is widely recognized as a bullish reversal signal. The price has been compressing within this narrowing range and is now approaching a key point where a breakout is highly likely. With strong support being respected and buyers gradually stepping in, the setup is aligning well for a potential upside move.

Volume levels have been steadily increasing, confirming growing investor interest in Internet Computer (ICP). This increasing participation from traders and investors alike can often serve as a reliable indicator that a breakout may occur soon. Technical indicators such as RSI and MACD are also hinting at a momentum shift that aligns with a bullish scenario.

Given the strength of this chart formation and the positive volume dynamics, ICPUSDT could potentially see a price gain in the range of 90% to 100%+ from current levels. The risk-to-reward ratio is favorable, especially for those who are entering early before the breakout confirms with stronger candles above resistance. A retest of the wedge breakout, if it happens, could also provide a second opportunity to enter.

ICP is also gaining traction among long-term investors due to its unique blockchain technology aimed at decentralizing the internet. The ongoing development and community support around the project adds more fundamental strength to this setup. Keep an eye on it for confirmation of the breakout!

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!