Icpusdtanalysis

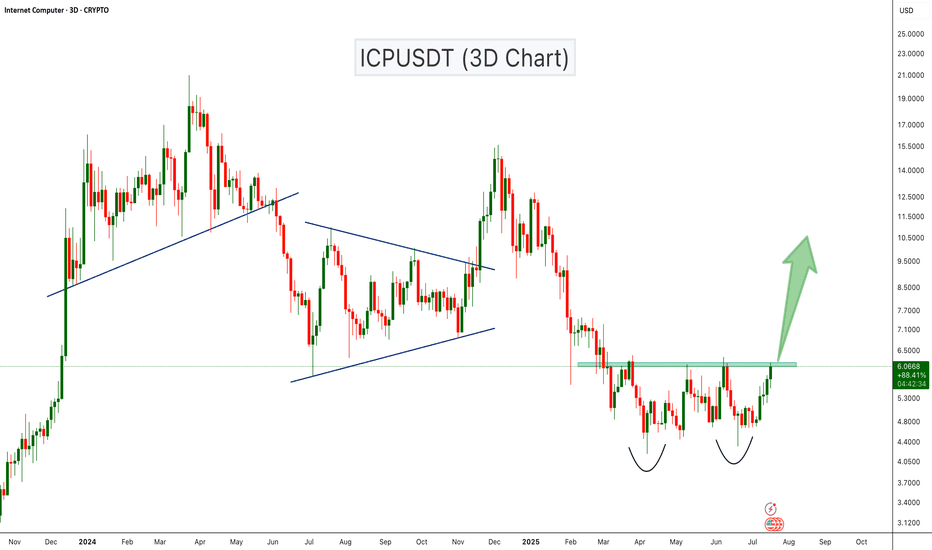

ICPUSDT Double Bottom Breakout Loading?ICPUSDT is showing a strong bullish setup with a classic double bottom pattern forming on the 3-day chart. The price has tested the support zone twice and is now approaching the neckline resistance around the $6.10 level. A confirmed breakout above this resistance could trigger a strong bullish move toward the next key resistance levels near $9.50 and $15.

Cheers

Hexa

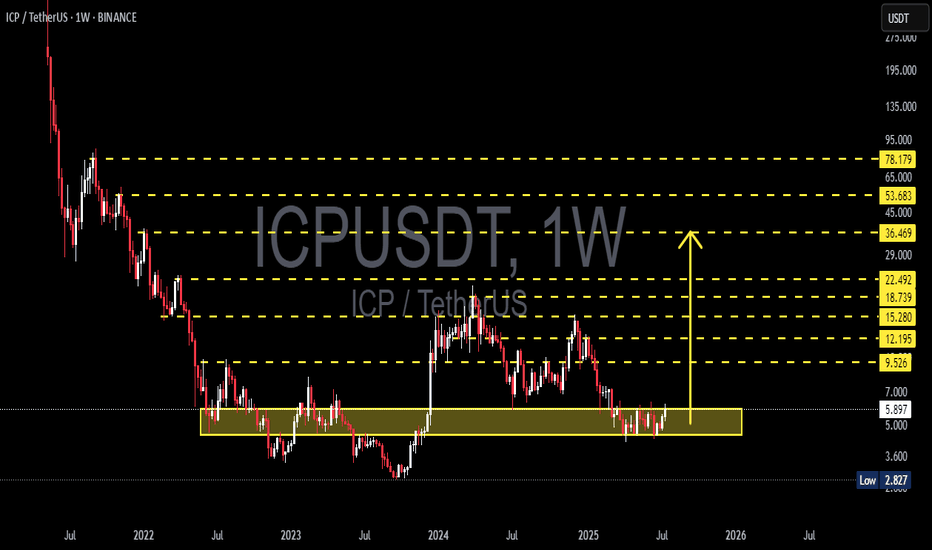

ICP/USDT Weekly Analysis: Multi-Year Accumulation Base🔍 Macro Outlook & Context:

ICP has been in a prolonged downtrend since its initial listing, dropping over 95% from its all-time high. However, since late 2022, ICP has been forming a strong and well-defined accumulation base between the $3.00 – $6.00 range.

Currently, price action and structure indicate that a potential breakout from this multi-year base is imminent. The setup is beginning to mirror a Wyckoff Accumulation Phase, where smart money accumulates quietly before launching into the next markup phase.

📐 Technical Structure & Pattern Breakdown:

✅ Accumulation Zone

Over 80 weeks of consolidation within a tight horizontal range.

This forms a strong foundation for a powerful breakout move if confirmed.

✅ Multiple Bottom Formation

Repeated failures to break below $3.50 suggest growing bullish pressure and seller exhaustion.

✅ Bullish Compression

Higher lows forming inside the range.

Resistance at $6.00 is being tested more frequently, indicating a breakout buildup.

✅ Volume Profile

Declining volume during sideways action = typical of supply exhaustion.

Surge in volume during breakout would confirm entry into markup phase.

🚀 Bullish Scenario (Primary Setup):

If price breaks and closes above $6.00 on the weekly timeframe:

Key Resistance Targets:

$9.52 → $12.19 → $15.28 → $18.73 → $22.49

Extended Bull Market Targets:

$29 → $36 → $45+

Potential ROI from base zone: +200% to +600%

Bullish Confirmation Signals:

Strong weekly candle close above $6.00

Volume breakout

RSI crossing 50 and MACD bullish crossover

🐻 Bearish Scenario (Alternative):

If the breakout fails and rejection occurs at $6.00:

Possible retracement back to lower support zones:

$4.50 → $3.00

A breakdown below $3.00 would invalidate the bullish structure and open risk for new lows.

Bearish Red Flags:

Long upper wick near resistance without volume

RSI drops back under 40

Breakdown of $3.50–$4.00 support zone

📊 Trading Strategy & Risk Management:

Entry Type Price Range

Breakout Entry $6.20–$6.50

Conservative SL $5.20

Aggressive SL $4.70

TP Range $9.5 to $22.4

Long-Term TP Up to $45+

Use scaled take-profits to secure gains gradually and reduce risk.

🧠 Market Sentiment & Psychology:

Sentiment is slowly shifting from fear to anticipation. Long-term accumulators and institutional players often target setups like this — low prices with solid structure and untapped upside. If breakout confirms, ICP could become one of the top-performing altcoins of the next cycle.

> “Accumulation is where smart money buys. Breakout is where the public chases.”

📌 Final Thoughts:

ICP/USDT is at its most critical point in over two years. A confirmed breakout from this long-standing base could be the launchpad for a multi-stage rally. This is a setup worth watching closely — or acting on with tight risk control.

#ICPUSDT #CryptoBreakout #AltcoinAnalysis #TechnicalAnalysis #WyckoffAccumulation #LongTermSetup #CryptoReversal #BullishCrypto #ICPAnalysis #AltcoinSeason #BreakoutTrade #Cryptocurrency

#ICP/USDT#ICP

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.85.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 6.04

First target: 6.13

Second target: 6.28

Third target: 6.50

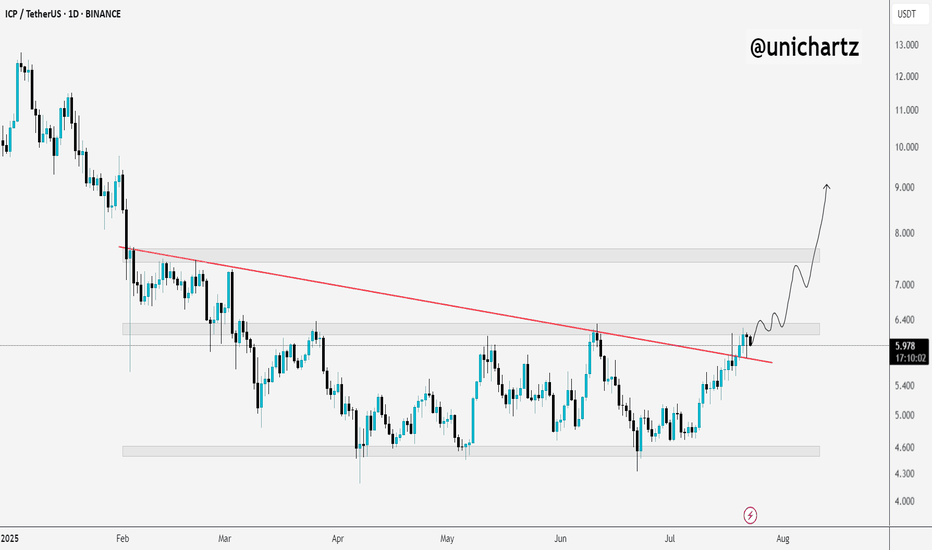

ICP Trading Plan: Buying Dips with a 1:3 Risk-Reward RatioLike most altcoins, ICP has been declining since December. At the beginning of February, it reached a key support level around $6. After this drop, the coin began to consolidate, but recent price action suggests a potential reversal to the upside.

A confirmed breakout above $7 would strengthen this outlook, potentially leading to a test of the psychologically significant $10 level.

I’m looking to buy dips in anticipation of this scenario, aiming for a minimum risk-to-reward ratio of 1:3.

ICP / ICPUSDTGood Luck >>

• Warning •

Any deal I share does not mean that I am forcing you to enter into it, you enter in with your full risk, because I'll not gain any profits with you in the end.

The risk management of the position must comply with the stop loss.

(I am not sharing financial or investment advice, you should do your own research for your money.)

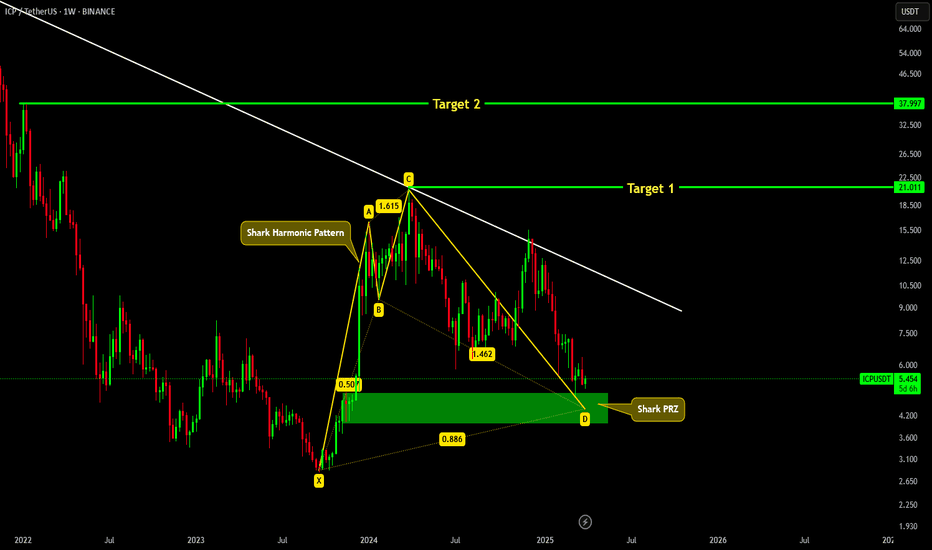

Internet Computer (ICP)Comprehensive Analysis of ICP

Introduction

The Internet Computer Protocol (ICP) is one of the leading projects in the blockchain space, developed with the aim of creating a decentralized internet. This project enables decentralized applications (dApps) to run directly on the blockchain without relying on centralized infrastructure. Due to these features, ICP has captured the attention of developers and investors alike, showcasing significant growth potential in the future.

From a price perspective, ICP has experienced substantial volatility since its launch. It is currently trading within a medium-term ascending channel, which plays a critical role in determining its future price trend.

🔍 Current Status

At present, ICP has entered a correction phase after encountering a weekly resistance zone at $14.623 - $15.704. It is now approaching the lower boundary of its ascending channel and the key weekly support zone at $6.166 - $6.944, which are crucial for preventing further price decline.

Conversely, significant resistance levels at higher zones could limit the upward momentum of the price.

🚀 Key Levels Analysis

Support Levels:

Lower boundary of the ascending channel

Weekly support zone: $6.166 - $6.944

Resistance Levels:

Daily resistance zone: $11.089 - $11.767

Weekly resistance zone: $14.623 - $15.704

Breaking these resistance levels, accompanied by increased trading volume, could strengthen the bullish price movement.

📈 Entry Strategy and Stop Loss

First Entry Point:

When to Enter: If the price bounces off the lower boundary of the ascending channel and the gray support zone ($6.166 - $6.944), a gradual entry is recommended.

Stop Loss: Below the gray support zone at $6.

Second Entry Point:

When to Enter: If the daily resistance zone ($11.089 - $11.767) is broken, initiating a second entry is advisable.

Stop Loss: Below the gray support zone at $6.

Complementary Entry:

A breakout of the 50-level on RSI can serve as an additional confirmation signal for entry.

🎯 Price Targets

Target 1: $21.158 - $23.555

Target 2: $36.722 - $40.641

Achieving these targets requires a confirmed breakout above the weekly resistance zone ($14.623 - $15.704).

⚠️ Key Considerations

Trading Volume: Resistance breakouts must be confirmed by a significant increase in trading volume.

Risk Management: Gradual entry strategies and defined stop losses are essential for minimizing risk.

Ascending Channel: As long as the price remains above the lower boundary of the ascending channel, the medium-term uptrend remains intact.

Alternative Scenario

If the weekly support zone ($6.166 - $6.944) is broken and a candle closes below it, the price could drop further toward $4.5. In this scenario, exiting long positions is recommended.

🔗 Conclusion

The analysis indicates that ICP holds considerable growth potential. However, maintaining proper risk management and closely monitoring key support and resistance zones is crucial. Entering at support zones with a stop loss below $6 and confirming resistance breakouts with high trading volume can be a solid strategy for investment.

ICP/USDT Bull Flag Breakout is Loading....The chart highlights a classic Bull Flag pattern, which signifies a potential continuation of the upward trend. At present, the price is consolidating within the confines of the flag, indicating a phase of market indecision as it builds momentum for a breakout.

Key Observations

1. The Bull Flag structure remains well-defined, with the price oscillating inside a descending channel.

2. Support is evident along the lower boundary around the $11.5 mark, offering a logical entry point for buyers.

3. A decisive breakout above the upper boundary of the flag would confirm the bullish outlook and could trigger a strong upward surge.

4. The projected target for this move lies above $14, aligning with significant resistance levels observed previously.

Strategic Implications

Patience and vigilance are crucial. Focus on identifying a breakout above the upper boundary, ideally accompanied by increased trading volume to affirm the move. In the event of a retest near the $11-$11.5 support zone, it could provide a favorable opportunity for initiating long positions. Be mindful of potential false breakouts and use risk management strategies, such as setting appropriate stop-loss levels, to protect your capital.

Public trade #4 - #ICP price analysis ( Internet Computer )It looks like CRYPTOCAP:ICP holders have to wait a little longer (of course, everything is in comparison) before the long-awaited growth begins!)

‼️ Buy zone for OKX:ICPUSDT - $8.20 - 10.50

Another downward correction wave is “asking for it” - if it is weak, then the price of #InternetComputer should not fall below $10.50, and if the alt market is sharply “merged”, then the pending buy order at $8.20 will be just right.

🙏 And then we just have to keep our fingers crossed that #ICP reaches the medium-term target of $40+, and if we're lucky, $50+

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

ICPUSDT Analysis: Key Resistance and Potential DropThe red box marks the first serious resistance point for ICPUSDT. If the price fails to break above this level, it may fall towards the blue box . However, if the price breaks through with volume and retests this level, there’s minimal resistance ahead, and the price could rise significantly.

Key Points:

Red Box: This is the first major resistance. A failure to break it could lead to a drop towards the blue box.

Break and Retest: If the price breaks the red box with volume and retests, it may continue higher due to lack of resistance.

Confirmation Indicators: Validate entries with CDV, liquidity heatmaps, volume profiles, volume footprints , and upward market structure breaks in lower time frames.

Learn With Me: Want to learn how to use CDV, liquidity heatmaps, volume profiles, and volume footprints to identify key demand zones? DM me for details.

If this analysis helps you, please don’t forget to boost and comment. Your support motivates me to share more!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

ICP | Massive Upside PotentialWe have shared many analyzes here and achieved pinpoint success in most of them.

Have some trust in the brand, this is XU99.

I'm longing from bluebox.

There is a nice volume in ICP. Sounds like it gives a sweet buy on Sunday evening's pullback.

I don't overcomplicate things and add a ton of dirty crap to my charts, but you can check out the success of my analysis below.

I approach trading with confidence backed by experience and past success in identifying high-probability setups.

While I don’t claim to be the best, my track record speaks for itself, and I strive to let my analysis and results do the talking. Watch these levels closely—markets can confirm what charts already whisper. Let’s see how this plays out together.

My Previous Hits

🐶 DOGEUSDT.P | 4 Reward for 1 Risk (or more if you’re bold).

DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P | HTF Sniper Precision

RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P | Buyer Zone So Accurate You’ll Double Check

ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P | Buyer Zone Mastery (CZ vibes).

BNBUSDT.P: Potential Surge

📊 Bitcoin Dominance | Called it Like a Pro

BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P | The Blue Box: A Demand Zone with Potential

WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P | Long-Term Trade

UNIUSDT.P: Long-Term Trade

Now sit back, relax, and watch the market do its thing. Or don’t, FOMO is real. 😉

Will ICP reach $40?BINANCE:ICPUSDT was in a downtrend throughout the 2022-2023 period. However, with the start of 2024, the first bullish move pushed the price from $3 to $20.

The selling pressure in the $20-23 range was not surprising, and the resulting decline caused the price to drop by as much as 72%.

The second half of 2024 mostly consisted of consolidation. Following the election results in the United States, the price began trending upward again.

I believe the price will continue its upward movement from the last consolidation zone, first reaching $23 and then potentially moving towards $38.

The positive market sentiment and notable advancements in ICP's use cases will likely support the price.

ICP EOY targets and OctoberHello Tradingview community!

As always: If these patterns I'm showcasing doesn't work as predicted..

then please don't come crying to me (ty) -> NFA DYOR

The chart explains itself pretty much..

We got 2 scenarios for EOY:

Bull target: 15 - 17 dollars

Bear target: 5.5 - 4 dollars

and of course the October target: 9-10 dollars

I think BINANCE:ICPUSDT is a great project/coin overall

But it's simply not the strongest when it comes to price action

- I do believe in the project and i do own a small amount of it

All of this is just an idea that could very simply be WRONG.

NFA DYOR <<<<-----