Gold price today August 5: strong reversalWorld gold prices unexpectedly reversed sharply, as Europe and the US continued to release poor economic data. Specifically, the European economic area announced the investor confidence index released monthly by Sentix GmbH, August at a decrease of 3.7 points, much lower than the increase of 4.5 points in July.

In the US, factory orders released monthly by the US Census Bureau, measuring the change in the value of new orders for goods purchased at US factories, decreased by 4.8% in June compared to the previous month. Although slightly higher than the forecast of a decrease of 4.9%, it decreased sharply compared to the increase of 8.3% in May.

Thus, both the US and the European region are showing weaknesses in economic development. Because new orders in the US are considered a forward-looking indicator of upcoming demand for manufactured goods. Falling orders indicate that the production and business activities of US enterprises will face difficulties in operation.

Ideasdetrading

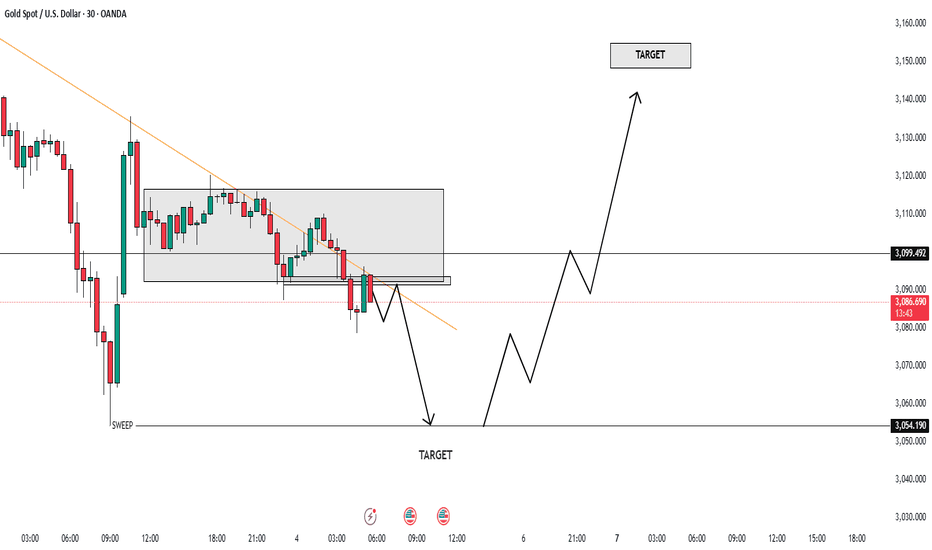

XAUUSD Outlook: Bull or Bear Move Ahead? Manage Risk📊 XAUUSD Market Insight 🌍

Gold is heating up once again, currently testing a tight range between 3080 and 3095. A breakout in either direction could set the tone for the next big move.

🔻 If price breaks below, we may see a slide toward 3060 and 3050—potential areas to watch for bearish momentum.

🔺 However, a strong push above 3095 could spark bullish energy, aiming for short-term targets at 3115 and 3127.

💡 Trade Smart

The market is full of opportunity, but don’t forget: risk management is key. Use proper position sizing, set clear stop-losses, and never overexpose your capital. Stay sharp, trade safe, and let the market come to you. 🧠💼

NFP BIG BULL SETUP BREAKOUT ALERT!🔥 Market Update for Traders! 🔥

Right now, the market is showing BEARISH momentum, and it's looking like we're heading for a dip. We could see the market fall and sweep the area around 3052 👀. Once that happens, expect a *huge* bounce back as the market could be getting ready to **shoot to the moon 🚀🌕!

🛑 KEY BUY LEVEL: 3130 - This is where you want to be ready to go long! 📈

🎯 First Target: Once we hit 3130, eyes on the ATH (All-Time High) for the retest! 🙌 And from there, we're eyeing a target at 3200 🚀🔥.

💥 NFP News Incoming! 💥

After Trump's speech, gold could *fall* around 1000 pips ⬇️, but **NFP could trigger a huge pump 📊💥. Stay sharp and trade with caution.

💡 Risk Management is KEY! Always follow your plan, set stop losses, and protect your capital. Don't let emotions drive your decisions! 📉🔑

Trade smart, stay sharp, and let's get those gains! 💸💥

#BearishMomentum #BullishReversal #RiskManagement #GoldPrice #NFPAlert

Gold reverses sharply after Trump's tax announcementThe world gold price has reversed sharply because the global market has just received information last night (Hanoi time) that US President Donald Trump has just signed an executive order to impose taxes on all goods imported into the US, many countries will have to pay high taxes of up to tens of percent.

Specifically, the UK, Brazil, Singapore will be subject to a 10% tax. The European Union, Malaysia, Japan, South Korea, and India will be subject to 20-26%. China, Thailand, and Vietnam are among the countries subject to the highest tax rates, at 34%, 36%, and 46%, respectively. The highest is Cambodia, which will be subject to a tax rate of up to 49%. This tax rate will be applied from April 9. In addition, Mr. Trump said that a 10% import tax will be applied to all goods imported into the US from April 5.

Mr. Trump said that every year the US loses 1,200 billion USD due to the trade deficit due to 3,000 billion USD of imported goods.

After this information, the global financial market was shaken, in which the US stock market had a strong decline, losing from more than 1% to more than 2%. On the contrary, gold - an asset that ensures capital safety in case of risk - has benefited from a strong increase in price.

Many experts commented that the Trump government's tariff policy has increased global trade tensions. Previously, the US imposed tariffs on some goods from Canada, Europe and China, aluminum and steel. These countries have responded to the tariffs on the US.

Gold prices are no longer affected by investor reactions.Gold and silver prices posted strong gains on safe-haven demand amid escalating geopolitical tensions, with the US dollar index falling sharply as the trading week began.

Market risk appetite was heightened at the start of the week, following a tense meeting on Friday between US President Donald Trump and Ukrainian President Volodymyr Zelensky, which raised concerns about US-Ukraine relations and the prospects of a ceasefire between Ukraine and Russia.

Meanwhile, US trade tariffs on Mexico, Canada and China are set to take effect on Tuesday. Gold prices started the week on a strong note after posting its worst weekly performance in three months.

For April gold futures, the bulls still have the upper hand in the short term, but the uptrend on the daily chart has been temporarily invalidated. The next target for the bulls is to close above solid resistance at the contract high of $2,974/oz.

Meanwhile, the bears' target is to push the price below the key support at $2,800/oz. The first resistance is at $2,920/oz, followed by $2,942/oz. The first support is at the overnight low of $2,866.3/oz, followed by $2,850/oz.

Gold CFDs at Critical Juncture: $2,800–$2,900 Range Dictates Xauusd "Gold" is bullish in long term but in short tem it will be more downward and short positions are strong we have to trade accordingly. As it has break the trend line and make some candles in downward so we have to take proper entry for short time.

Wait for a confirmed breakout/breakdown before committing to larger positions. Scalping is viable if price oscillates within the $2,800–$2,900 range.

Gold is in an extremely strong setupWhile a weaker USD is the main driver pushing gold prices higher, this stems from two factors, including tariff concerns and January's Producer Price Index (PPI) report.

Anxiety continues to increase after US President Donald Trump's announcement of imposing reciprocal tariffs on countries that tax imports from the US. Besides, the US has just released the January PPI index, showing that producer prices increased by 0.4% this month.

"Gold is in an extremely strong setup. As the USD strengthens, we are seeing a surge in gold buying from Asia, including central banks, retail investors, and financial funds."

People still want to invest in gold.World gold prices at times dropped sharply when inflation data in the US heated up. Specifically, the consumer price index (CPI) in January 2025 increased by 0.5%, higher than the forecast increase of 0.3%.

This information has reinforced the message of the US Federal Reserve (FED) not to rush to reduce interest rates due to the unstable economy.

"Higher-than-expected CPI in the US put pressure on gold prices and market expectations for any interest rate cuts were almost extinguished."

The recovery of world gold prices from lows in the past two days shows that investors continue to favor having a safe asset to combat inflationary pressures.

Tariff policy can increase inflation in the USDespite turning down today, world gold prices still maintain an upward trend due to concerns about global trade conflicts provided by US President Donald Trump's new tax regimes.

Gold price on February 12: Suddenly plummeted, buying price of gold pieces decreased by 1.3 million VND/tael photo 2

World gold price chart on December 2. (Photo: kitco.com)

Currently, gold is still affected by tariffs and statements by US Federal Reserve Chairman (FED) Jerome Powell.

US President Donald Trump's announcement of 25% tariffs on imported steel and aluminum, produced without exceptions or exemptions, has raised the stakes on conflicting trade stocks.

The FED Chairman said that the FED is in no hurry to cut interest rates when the economy is still strong and inflation is still above the target level of 2%.

🔥 GOLD SELL 2890 2892 🔥

✔️TP1: 2880

✔️TP2: 2870

✔️TP3: OPEN

🚫 SL: 2901

The Fed's fight against inflation is not over yet➡️ Both analysts and investors expect gold prices to continue to increase in the coming days, as they are being supported by many factors, especially related to US President Donald Trump's tax policy with many trade partners.

➡️ In the latest development, Mr. Trump announced that he would impose a 25% tax on all aluminum and steel imports into the country.

➡️ This information has caused investors to continue to seek gold as a safe haven against fluctuations in the international trade situation.

“The global upward momentum started in October 2023 after the US Federal Reserve (FED) signaled to loosen monetary policy and reduce the pace of interest rate increases. From October to November 2024, after increasing 55% to 2,790 USD/ounce, gold experienced a strong profit-taking phase, pulling the price down to 2,550 USD/ounce, corresponding to a 76.4% correction compared to the previous increase.

After several weeks of struggle between buyers and sellers, stable buying momentum returned at the end of December. The fact that gold exceeded 2,800 USD/ounce at the end of January 2025 opened up expectations for a new wave of growth. If this trend continues, gold prices could reach $3,400/ounce from August to October this year.”

Bharti Airtel Trade Setup | High-Risk, High-Reward OpportunityHere's an exciting analysis of Bharti Airtel Ltd based on the chart! 📊🚀

🔥 Trade Setup & Key Levels

📥 Entry Zone: 1657 - 1674 (Smart buy zone)

🛑 Stop-Loss (SL): 1592 (Risk protection)

🎯 Target Profits (TP):

TP1: 1737 (First milestone 🥇)

TP2: 1778 (Stronger bullish push 📈)

TP3: 1858 (Big breakout potential 💥)

📌 Observations & Strategy

Current Price: 1619.75 (-2.45%) 📉 → Price is below the entry zone, meaning a potential bounce or more downside.

RSI & Indicators: Oversold conditions ⚠️ → Possible buyer interest soon!

Risk-Reward Ratio: A great setup with a high reward vs. risk trade! 🔥

🚀 What’s Exciting?

If support at 1592 holds, we could see a bullish explosion 🚀🔥

A break above 1657 might trigger a rally toward 1737+ levels 📈💰

If 1592 breaks down, a deeper fall might be in play ⚠️📉

This setup is high-risk, high-reward—perfect for traders looking for a strong breakout move! 💎 What do you think? 🤔

⚠ Disclaimer: I am not SEBI registered. Stocks and securities are subject to market risk 📉📈. Please read all levels carefully before making any trading decisions.

📊 Follow for more insights & trade setups! 🚀

World gold prices are under pressureDespite the decline, gold prices are receiving very positive forecasts from experts. Kitco News' latest weekly gold survey shows that industry experts maintain a positive view on the precious metal. Meanwhile, retail investors also forecast that gold prices will reach higher levels in the near future.

9 experts, equivalent to 69%, expect gold prices to exceed record levels this week. There are 4 experts, equivalent to 31%, forecasting that gold prices will decrease. No one thinks gold will move sideways or accumulate this week.

Meanwhile, 147 investors participated in Kitco's online poll, with individual investors as optimistic as experts.

101 traders, or 69%, expect gold prices to rise next week, while 27, or 18%, expect gold to fall. The remaining 19 investors, accounting for 13% of the total, believe that gold will move sideways in the short term.

🔥 XAUUSD SELL 2784 2786🔥

✔️TP1: 2775

✔️TP2: 2765

✔️TP3: OPEN

🚫 SL: 2795

World gold price increased slightly after CPIGold prices rose sharply on the back of a fresh US inflation report that showed the pace of growth was not too hot.

Key US economic data released recently showed that the consumer price index (CPI) in December rose 2.9% year-on-year, in line with market expectations, compared to a 2.7% increase in the November report. The core CPI (excluding food and energy prices) rose slightly more than expected, rising just 0.2% compared to a forecast of 0.3% month-on-month.

US stock indexes are expected to open sharply higher in New York trading, supported by more moderate US inflation data.

In overnight news, the Japanese yen rose sharply on fresh speculation that the Bank of Japan will raise interest rates at its monetary policy meeting later next week.

UK consumer prices came in slightly below market expectations, raising hopes of a resumption of rate cuts when the Bank of England meets early next month.

World gold prices may go up even more.Gold held steady after a strong rally in the previous session amid President-elect Donald Trump’s insistence that US interest rates need to be cut further and China’s second consecutive month of gold purchases.

Gold’s rally eased slightly after the Institute for Supply Management (ISM) released a report showing rising prices in the service sector. Accordingly, the ISM service sector price index rose sharply from 58.2 points last month to 64.4 points in December.

Inflation in the US has recently been forecast to increase again, making the US Federal Reserve (Fed) more cautious with the ongoing interest rate cut cycle.

The stronger USD has put pressure on gold. The DXY index jumped from 108.15 points at the same time of the previous session to 109.24 points.

"HDFC Bank Swing Trade: Key Levels & 3-Month Investment Plan"A investment idea for HDFCBANK with a holding period of up to 3 months (till Q1). Here’s the analysis based on the marked levels:

Key Levels and Strategy:

1. Entry Point:

1,719.00: Recommended entry level.

2. Take Profit (TP) Targets:

TP 1: 1,778.55

TP 2: 1,818.70

TP 3: 1,906.55 (longer-term target).

3. Stop-Loss (SL) Levels:

SL: 1,697.25 (first risk level, can act as minor support).

Strict SL: 1,671.95 (final stop-loss level to limit risk).

Observations:

Risk-Reward: This strategy provides a well-defined risk-to-reward ratio, with three potential profit levels.

Support Zone: The area around 1,697.25 - 1,671.95 is critical. It might act as strong support if the price drops further.

Resistance Levels:

1,778.55: Could face selling pressure as it aligns with prior resistance.

1,818.70: A stronger resistance where bulls need momentum to break through.

Recommendation:

If the price moves to the entry level (1,719.00), ensure to set your stop-loss and gradually book profits at the mentioned TP levels.

Reassess market conditions if it approaches strict SL (1,671.95) to avoid excessive losses.

Disclaimer:

"I'm not SEBI registered. Please take any trade at your own risk. Market securities are subject to market risks. This is for educational purposes only.

Would you like further insights into technical indicators or additional strategies?

Thank you! Subscribe and like @Alpha_strike_trader."

World gold price todayOver the past 10 years, January has typically been the best month for gold. However, Low said that is not necessarily true in the post-pandemic era when countries are still struggling. He pointed out that while recent data shows that Chinese gold demand has been strong over the past 12 months, some US factors could hold back gold prices this month. Investors are still looking at the hawkish factors at the US central bank’s final policy meeting of the year, he said. The revelation that the Fed will slow its pace of rate cuts this year has put the US dollar in a good position, which is not very positive for the precious metal.

Another issue Low noted was that the technical outlook for the yellow metal had deteriorated somewhat over the past week. He observed that prices had fallen below the 100-day moving average for the first time in more than a year. Although prices have rebounded in subsequent sessions on the back of buying from investors, he noted that this is also a negative sign for gold.

USD is recovering because of hawkish policiesLast week, the global gold market had a quiet trading week, with prices capped at $2,650/ounce. This week, gold prices are also expected to remain flat due to the tug-of-war between safe-haven demand and pressure from the recovery of bond yields and the greenback.

Speaking about gold's movements in 2025, City Index market analyst Fawad Razaqzada said that although the US dollar and higher bond yields could negatively impact gold, there are still some supporting factors that could help the precious metal reach $3,000/ounce.

The expert explained that amid persistent inflation concerns, the US Central Bank is expected to be more cautious in its interest rate decisions next year. This is likely to support bond yields and the US dollar, two factors that often reduce the appeal of gold.

Higher bond yields have a significant impact on investment demand for the yellow metal, as they increase the opportunity cost of holding these non-yielding assets. “At the same time, the greenback’s resilience, supported by hawkish central bank policies and strong economic data, makes gold more expensive for buyers holding other currencies. These dynamics could limit gold’s upside potential in the first half of next year.”

🔥 XAUUSD SELL 2625 - 2628🔥

💵 TP1: 2620

💵 TP2: 2610

💵 TP3: OPEN

🚫 SL: 2637

Gold price has 50% chance of being in the range of 2,600-2,900At the beginning of the trading session on December 26 (US time), the world gold price increased slightly after the US announced that the number of weekly unemployment benefit applications reached 219,000, a slight increase compared to the forecast of 218,000 applications. This further strengthens the possibility that the US Federal Reserve (Fed) will delay monetary policy next year.

The world gold market is still under pressure in the context of the Fed's reversal of monetary policy. Accordingly, in the context of "persistent" inflation, the US Central Bank's interest rate cut roadmap may slow down next year.

While the interest rate stance is boosting the dollar and bond yields, experts say that won’t deter investors from owning gold in their portfolios.

Tom Bruce, macro strategist at Tanglewood Total Wealth Management, forecasts the precious metal will rise about 10% next year and stay below $3,000 an ounce.

He said the biggest short-term challenge for gold in 2025 is the expected strong growth in the U.S. economy. However, gold prices will remain supported as central bank purchases create new momentum in the market.

Gold price forecastDonald Trump’s transition team is looking for ways to end conflicts in Ukraine and the Middle East.

The trade war between the US and many countries, including China, may not be too tense. Donald Trump only sees tariffs as a negotiating tool. If the trade deficit improves, the trade war is likely to be less fierce.

Donald Trump's transition team is looking for ways to end conflicts in Ukraine and the Middle East.

The trade war between the US and many countries, including China, may not be too tense. Donald Trump only sees tariffs as a negotiating tool. If the trade deficit improves, the trade war is likely to be less fierce.

In the long term, gold is still expected to rise as inflation signals rise again globally. The West has seen inflation return, while many Asian countries have stepped up monetary easing and have plans to pump money.

The economy is looking to the FedThe Fed has started its two-day policy meeting and is expected to cut interest rates by another 25 basis points. However, the focus will be on the Summary of Economic Projections (SEP) and dot plot, which provide guidance for interest rates in 2025.

While US Treasury yields and real yields both edged lower, the US dollar remained steady. The 10-year Treasury yield fell to 4.379%, while the DXY index rose 0.07% to 107.01.

On the technical front, gold prices maintain their long-term uptrend but are under pressure in the short term. The key support level now is $2,600/ounce, which corresponds to the 100-day simple moving average (SMA). A break of this level could send prices lower to $2,531 – the August 20 high. Conversely, if the price breaks above $2,650, the next target will be $2,670 (50-day SMA), and then $2,700.

In addition to the Fed’s decision, investors are awaiting the release of the core Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, to gauge the future direction of policy. Signs that the incoming Trump administration may push for expansionary fiscal policy have raised expectations of a change in the Fed’s stance in the near term.

SEI/USDT GOT WHAT YOU GUYS HAVE BEEN SEARCHING IN THIS RUN!!!!!The SEI/USDT chart is a treasure map for adventurous investors. Let’s dive into the enticing details:

Upward Trend Momentum: The chart radiates 'Long' signals, especially as the year wanes. This suggests buoyant bullish waves are crashing, hinting at positive market vibes.

MACD Indicators: The MACD line twirls with vibrant crossovers—an invitation to buy. Nestled in a healthy zone, these oscillations beam with rising momentum, teasing the prospect of growth.

Potential Breakout: Recent price action is snugly settling around $0.56. Yet, earlier bullish strides show glittering potential. Should the ascent persist, we might just break free towards $1.00 shortly, with long-term dreams flirting with $5.00 if momentum perseveres.

Volume Analysis: Volume struts in strong and steady, adorned with a playful mix of green and red bars. This reinforces the ongoing trend, elevating our confidence.

Risk vs. Reward: The chart displays a tantalizing risk-to-reward ratio. Investors could seize the moment at current price points, eyeing notable milestones like $1.00 and beyond. With eyes set on $5.00 ahead, keep watch for any looming corrections.

Key takeaway: This asset brims with potential, buoyed by bullish momentum and a mouthwatering setup for astute investors ready to play their cards wisely. Stay vigilant by monitoring key support levels to shield against any downside waves.