INDF - VCP (13W 10/3 3T)IDX:INDF - VCP

+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 > 150 > 200

4. Price is within 25% of its 52-week high.

5. Price is over 25% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (71).

EPS Growth:

a. Quarterly QoQ: -

b. Quarterly YoY: +11.20%.

c. TTM YoY: +32.14%.

d. Annual YoY: +6.07%.

(-)

1. There is no significant breakout with substantial volume.

Ihsg

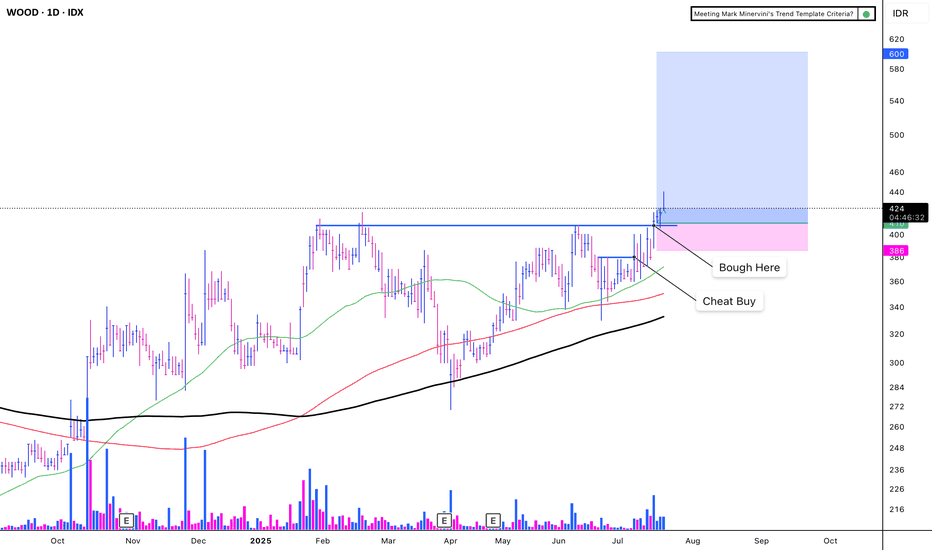

WOOD - CUP WITH HANDLEIDX:WOOD - CUP WITH HANDLE

(+):

1. Low risk entry point

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (85).

8. Carbon sales increase 503%

9. Price breakout with VCP criteria

EPS Growth:

a. Quarterly QoQ: -13.24%.

b. Quarterly YoY: +68.81%.

c. TTM YoY: +49.09%.

d. Annual YoY: +33.27%.

(-)

Trump Implements a 32% Increase in Tariffs on Indonesia

The market is volatile due to the ongoing war

TAPG - VCP (11W 18/4 3T)IDX:TAPG - VCP

(+):

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (86).

8. There has been a significant breakout with substantial volume

**EPS Growth:**

a. Quarterly QoQ: -46.42%.

b. Quarterly YoY: +117.27%.

c. TTM YoY: +111.05%.

d. Annual YoY: +94.02%.

(-)

1. Trump Implements a 32% Increase in Tariffs on Indonesia

2. The market is volatile due to the ongoing war

DKFT - POWER PLAYIDX:DKFT - POWER PLAY

(+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (98).

8. There has been a significant breakout with substantial volume with VCP There has been a significant breakout with substantial volume, with VCP characteristic.

9. The price shoot up by 102% and paused only for 18%, indicating a strong uptrend

**EPS Growth:**

a. Quarterly QoQ: +79.70%.

b. Quarterly YoY: +819.89%.

c. TTM YoY: +356.12%.

d. Annual YoY: +484.31%.

(-)

1. Trump Implements a 32% Increase in Tariffs on Indonesia

2. The market is volatile due to the ongoing war

BNLI - VCP (11W 21/4 3T)IDX:BNLI - VCP

(+)

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending upwards for over a month.

7. The RS Rating is above 70 (98).

8. There has been a significant breakout with substantial volume.

9. The price surged up by 150% and paused only for 24%, indicating a strong uptrend.

10. The stock is the leader of its sector.

**EPS Growth:**

a. Quarterly QoQ: +0.96%.

b. Quarterly YoY: -2.27%.

c. TTM YoY: +34.60%.

d. Annual YoY: +38.06%.

(-)

1. The major market is focused on Danantara and Hilirisasi stocks.

TRUK - VCP (118W 66/27 3T)IDX:TRUK - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (84)

9. Breakout with huge volume

(-)

1. There is nothing good with the fundamental

IHSG / COMPOSITE (IDX) DAILY CHART DOUBLE TOP DETECTEDIHSG going to close the gap at 65xx.. (first gap).

the worst case IHSG will close the 2nd gap (61xx) << Mostly happened.

after that we hope IHSG will start to Bullish once more.

so just wait n see for now. After IHSG closing all the gap, we can start buying all the bluchip stock like banking sector (BBRI, BBCA, BMRI, BBNI).

JARR VCP - (144W 80/28 4T)IDX:JARR - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (85)

9. EPS Growth:

a. Quarterly QoQ: +56.12%

b Quarrerly YoY: +255.56%

b. TTM YoY: +208.21%

c. Annual YoY: +237.44%

10. Breakout with huge volume

(-)

1. Nothing, just perfect :)

PSAB - CUP WITH HANDLEIDX:PSAB - CUP WITH HANDLE

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (92)

9. EPS Growth:

a. Quarterly QoQ: +47.80%

b. Quarterly YoY: +436.36%

b. TTM YoY: +436.36%

c. Annual YoY: +197.07%

10. Breakout with huge volume

11. Gold price is all time high, but this stock is still lagging

(-)

1. Need to break another high, to let this stock all time high

SAME - VCP (10W 25/5 3T)IDX:SAME - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (80)

9. 9. EPS Growth:

a. Quarterly QoQ: +852.30%

b. Quarterly YoY: +570.99%

b. TTM YoY: -3.34%

c. Annual YoY: -3.36%

(-)

1. Breakout with huge volume but long wick

Note: I will sell half if hit first Stop Loss, and sell remaining on the last stop loss on first cheat buy

IHSG 36000IHSG will go to 36000

Currently, the prediction for the Jakarta Composite Index (JCI) is still far from 36,000. Based on the latest analysis, the JCI is estimated to move in the range of 6,800 to 7,150 in the short term. Positive sentiment from the trade deal between the United States and China has indeed provided encouragement, but this strengthening is still considered limited and prone to technical corrections. If there are major factors that can push the JCI to a much higher level, such as extraordinary economic growth or a surge in foreign investment, then there may be an opportunity to achieve a more ambitious figure. However, for now, the realistic target is still in the range mentioned.

MFIN - VCP (16W 41/18)IDX:MFIN - VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (95)

9. EPS Growth:

a. Quarterly QoQ: +22.24%

b Quarrerly YoY: +185.92%

b. TTM YoY: +22.24%

c. Annual YoY: +23.08%

(-)

1. Breakout with red candle

2. Lack of liquidity

TAPG - VCP (20/5 3T)IDX:TAPG VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (84)

9. Biggest net income +197.70% on Q4 2024 vs Q4 2023

(-)

1. Breakout with huge volume but created long red candle

NICL - VCP (192W 82/24)IDX:NICL VCP

(+):

1. Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (93)

9. EPS Growth:

a. Quarterly QoQ: +45.05%

b. TTM YoY: +872.03%

c. Annual YoY: +1,029.03%

(-)

1. Breakout with low volume

MUTU - 3 WEEKS TIGHTIDX:MUTU - 3 Weeks Tight

(+):

1. Low risk entry point when stock pause

2. Volume significantly drop on week 2, and huge volume on week 1

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (90)

9. High volume on breakout

(-)

1. In the text book, 2nd candle on 3 weeks tight is must corrected by 3% but this stock it was corrected by 9%

WIFI: Bangkit dari Koreksi! Rebound atau Dead Cat Bounce?Trading langsung melalui TradingView x STAR!

Teknikal:

• Last: 1935

• Resist: 2170 : 2730

• Support: 1825 : 1550

• Cutloss: < 1550

Sales Note:

• WIFI through its brand Surge is a co providing internet connecticity through a fiber optic network along railroad tracks on Java island , partnering with local ISPs via revenue sharing system.

• Surge offers affordable (start from IDR100k/month), high quality and unlimited internet access to households located within 1-5km from KAI railroad – this has achieved so far an solid 90% take-up rate.

• WIFI owns 6,972km of fiber optic lines along railway tracks and highways in Java. As of 9M24, WIFI owner fixed assets in the form of project equipment worth IDR890bn and more than IDR800bn worth of fiber optic lines .

• In 9M24, Surged booked revenue growth of 46% y-y to IDR505bn. The company aims to roll out up to 40mn homepasses in 2025 – this coupled with a conservative 45% EBITDA margin, could translate to more than IDR250bn in profit .

• B/S is also manageable, with net gearing of 1.4x in 2024; with potentially increasing debt but reasonable given the exponential revenue growth.

• PT Investasi Sukses Bersama (ISB) owns 50.4% stake in WIFI, whereas around 45% of that is owned by PT Arsari Sentra Data (co owned by Hashim S Djojohadikusumo) .

• The stock trades at 7x EV/EBITDA 2025E , which is lower than global telco, especially fiber optic names avg of 8x.

Anthony Yunus

Head of Sales

PT Samuel Sekuritas Indonesia

__

Jika Anda memiliki pertanyaan, jangan ragu untuk menuliskannya kepada kami di kolom komentar di bawah.

PT Samuel Sekuritas Indonesia berizin dan diawasi oleh Otoritas Jasa Keuangan

BBRI BUY NOW 3350! Support level at 3050-3150BBRI is now probably trade in the end of its deep correction, as on the technical view, by the Elliot Waves count, it is now completing the WAVE 5 of C (it confirmed by the Bullish Divergence on MACD).

The price could be be a little lower on the next 1-5 trading days to the 3050-3150, which is the 78.6% fibonacci retracement from broken uptrend. It is really strong support and i believe i would not be broken.

For about 6-12 months ahead, aim for minimum target of 30% return from this level.

Are you going with me???

CHEEERRRSSS...

MLPL - LOW CHEATIDX:MLPL - Low Cheat

(+):

1. Very Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is over 30% of 52 weeks low

5. 200 day MA trending up over 1 month

6. RS Rating is over 70 (93)

7. VCP characteristic

10. Price breakout with huge volume

(-)

1. Price is below 25% of 52 weeks high

Try to Adding with some basic fundamental about EPS growth:

a. Quarterly QoQ: −91.66%

b. Quarterly YoY: −71.13%

c. TTM YoY: +12.23%

d. Annual YoY: −13.30%

About fundamental aspect, maybe is time to turn around

WIRG - VCP (18W 45/6/3T)IDX:WIRG

(+):

1. Very Low risk entry point on pivot level

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (84)

9. Additional aspect about AI sentiment

10. Price breakout with huge volume

(-)

1. I am not sure about Volume from 15 January until today, i think it is a sign of taking profit action of big institute. Let see what's going on with this stock after i bought it

2. There is gap below on 17 january 2025, i am not a big fan of gap

Try to Adding with some basic fundamental about EPS growth:

a. Quarterly QoQ: −32.06%

b. Quarterly YoY: −14.26%

c. Annual YoY: +77.44%

d. TTM YoY: +46.99%

About fundamental aspect, maybe the stock is time to turn around

ELIT - LOW CHEATELIT - LOW CHEAT

(+):

1. Low risk entry point

2. Volume dries up

3. Price above MA 50 > 150 > 200 over 10 weeks

4. Price is within 25% of 52 weeks high

6. Price is over 30% of 52 weeks low

7. 200 day MA trending up over 1 month

8. RS Rating is over 70 (82)

9. Stock build VCP Characteristic

Try to Adding with some basic fundamental about EPS growth:

a. Quarterly QoQ: +31.29%

b. Quarterly YoY: 653.96%

c. Annual YoY: +75.48%

d. TTM YoY: +220.19%

(-):

1. Stock not confirm on stage 2 uptrend if not break the blue line

Note:

- Consider to add some position if break the blue line

- Market look bottoming, just wait this stock to breakout with high volume