Innovative Industrial Properties: Low AheadThe stock of Innovative Industrial Properties managed to stabilize somewhat at the upper edge of our green Target Zone (coordinates: $53.48 – $16.80) but should soon initiate the next downward impulse. In the short term, we expect a final corrective movement deeper into our green Target Zone to establish the low of the overarching wave in green. Once the wave low is settled, the impulsive wave in green should take over and carry the stock beyond the resistance at $137.90.

IIPR

Innovative Industrial Properties: Soon…⌛️👀IIPR is poised to dip into our blue Target Zone between $85.28 and $76.66 to settle the low of the blue wave (ii) and, thus, lay the foundation for the impulsive rise of the blue wave (iii). However, with a moderate probability of 25%, the price might also decide to head further south and breach the support at $69.08, pushing the turquoise wave alt.5 toward a new low.

MJ POTX CGC TRLY ACB SNDL IIPR Composite Index Update LONG This is an update of a previous recent idea. The MJ composite has had

a pullback and shows bullish RSI divergence. It is at support and has

various resistances dynamic and stationary above. The time is now

to analyse the preferred symbols / stocks within the composite.

( Alcohol thrived during the Great Depression, no reason not to assume

that cannabis will not thrive in the upcoming Great Depression V2).

IIPR Prommising uptrend establishmentDear Colleagues,

this is my first post in tradingview.com

IIPR is a promising company with rating of good to very good as per the QoQ performance. the price of the stock got oversold and start to rebound as per the technical indicators shown in the graph ( this is Weekly chart). new Elliot wave is expected to birth.

consider the following when trading this stock

1- Do not go all in. Allocate money for the buy and buy in steps ( Dollar Average )

2- Do not put more than 2-3% of your total investment. ( Risk Management )

3- stop loss is a must for all your trades and dont be greedy. ( Risk Management ).

I am expecting to reach our target by December 2022.

wish you all the best.

IIPR, Long to above 260 USD !IIPR can make a new ATH? Lets follow!

It seems that IIPR has recently completed or just near to complete wave 4 of a 5 segment up going wave. If true , It is going to make a new ATH.

Strong support is remarked on the chart with comprehensive information. Also, Next strong Resistance zone with detailed information is shown on the chart. We probably will have a strong decline after making a new ATH.

Stochastic indicator is in oversold zone in daily time frame and is making a bullish divergence.

This is a text book example of an ideal set up to go long and we certainly will try our chance to make profit but we keep in mind that we always have to trade objectively.

Good Luck Everyone.

$IIPR could make a run for $300The stock has been making a flag pattern after the market topped. If we take the runaway gap made at the beginning of July as the initial move before the flag, then is a 57 point move. According to the flag pattern measure rules, if a breakout above occurs, then the price of NYSE:IIPR should get to $300. Last week rebounded from its support at $222 with a nice hammer candlestick. But, until the breakout happens I won't make any trades. Always wait for confirmation.

The company is ranked #1 in the Finance-Property REIT Group by IBD Investors and has a IBD relative strength rating of 89. This indicates that is a leading stock.

For me it isn't a leading stock as is making lows with the SP:SPX , but if it holds the pattern is worth to keep an eye on.

IIPR Double Topped Blowoff - Valuation Matters - **WEEKLY***rising rates environment is a disaster for large cap stonks & Ponzi Pogs. BUYER BEWARE- FWD projections!!! Gems make money TODAY & years from now!!!

#cannabisreform

#jobsandjustice

#gnln

#thegem

Can't seem to edit the "monthly" on chart to "weekly"

THIS IS THE WEEKLY CHART

Innovative Industrial Properties (IIPR) BTFDInnovative Industrial Properties (IIPR) is primed to BTFD. I have a $220 target and could see upwards of $250 in the near to mid future. They're my "pick and shovels" play in the Devils lettuce industry. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) has been consistent and their debt to asset ratio is gnarly af. No need to thank me nerds (except if you lose money, dont blame me either lol)

“As far back as I can remember, I really just wanted to get me some money.”

-Gucci Mane

IIPR (Weed REIT)What more needs to be said. This company states that they are the first of its kind am I am blown away by their portfolio. Of course financials are great and within this year they have been active in their growth opportunities! Nice dividend increase from $1.17 to $1.24! Financials are impressive to a degree. I see room for growth. I bought 1 share and will buy dips as I go. The weed industry will up rise again...However, I'm playing it smart because weed is everywhere but who has the space availability and facilities needed for expansion? Hmmm...IIPR does.

What do you think?

Like, Follow, Agree, Disagree!

[TLRY/APHA] Get in Sub-21 Before PRICE Goes Up Like SMOKE! B)-~APHA was my #1 Cannabis play going into this year based on the fundamentals and it's held up very well, still my #1 long term pick today (along with tangential Cannabis play IIPR).

That was followed by CGC and ACB with TLRY coming in at #4. Now with my #1 and and #4 plays merging and largely rounding out their strengths and weaknesses, it is an even stronger #1 by a factor of 1, maybe 2 over each CGC and ACB.

Amazingly, TLRY is still dirt cheap sitting at 3% of it's $300 peak a year ago lol.

Price is even UNDER its IPO and BELOW its Value Channel here (magenta). Seems impossible it goes under $2 now so max temporary downside is very constrained.

TLRY now the Best Value Cannabis Stock out there supplanting long reigning champ OGI, which is my #5 play overall but quite underpriced ATM relative to the market.

I'm lookin to scale in most my position before $21 and watching it float up like smoke!

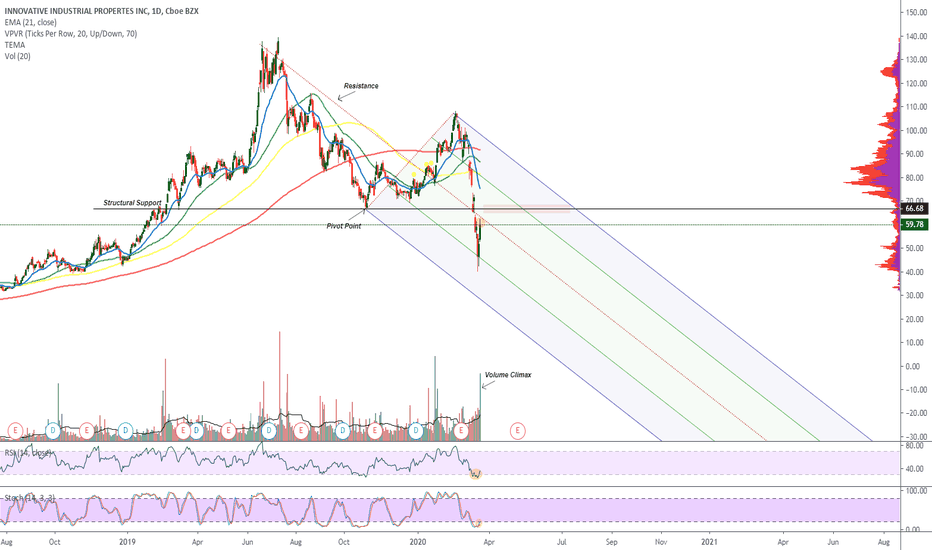

IIPR Pivot Points |Oversold Bounce| Structural Support Evening Traders,

Today’s analysis will be on IIPR, breaching structural support and currently is testing pitchforks median line (resistance)

Points to consider,

- Bearish trend, consecutive lower highs

- Median line tested

- Structural support breached

- RSI recovering from oversold

- Stochastics in lower regions

- Volume climax evident

IIPR’s overall trend is bearish, putting in consecutive lower highs on the macro timeframe. Current resistance is being tested (Median line), it is important to break this level in order to test previous support.

The Structural support breached is a major level to close above; a retest and failure will confirm a bearish retest.

RSI is recovering from oversold conditions, this has lead price to an oversold bounce. Stochastics on the other hand is trading in the lower regions, can stay trading here for an extended period of time, however lots of stored momentum to the upside.

Volume climax is evident, which puts emphasis on a temporary bottom, this will get taken out if a bearish retest is confirmed.

Overall, in my opinion, IIPR must break and close above structural resistance, failure will be very bearish.

What are your thoughts?

Please leave a like and comment,

And remember,

“You have power over how you'll respond to uncertainty.”

― Yvan Byeajee

IIPR: Broke $86 Key Level a While Ago: Now it Will Soar!I noted about a month ago that IIPR remained as neutral for investors until it broke the 86.00 level then re-tested it. Obviously, we have clearly done that and as such I am incredibly bullish on IIPR.

The stock found support about 40% off its peak to low during the weed bear market which is far better then many others that plummeted 100-200%+. During this time, IIPR actually hiked their dividends and continued to post record revenue, profit and EPS growth which are all signs of an excellently managed company.

IIPR will likely become one of the stock markets favourite stocks again (like it was back in early 2019) and will likely surge to over $150 before the end of 2020. The tables will slowly turn for the better in the weed sector later in 2020 and that will keep IIPR elevated inherently.

This will be one of the stock markets top dividend growth stocks and small cap stocks!

Technicals: Cup to Shallow Handle

2020 TP: 150+

- zSplit

IIPR Adam & Eve Pattern| Bull Flag| Bull Volume Needed!Hello Traders!

Today’s chart update will be on IIPR which has a potential bullish pattern playing out – an Adam and Ever reversal formation that will be confirmed by a break of structural resistance.

Points to consider,

- Bullish pattern coming to fruition

- Structural resistance to break

- EMA’s supporting price

- Stochastics in upper region

- RSI trending up

- Bull volume required

IIPR’s Adam and Eve will be confirmed by a break and a close above current structural resistance, price is now consolidating near this resistance in a potential bull flag, a hold of this level will mean a confirmed S/R flip.

EMA’s currently supporting price, needs to hold true when key levels are broken for a continued bullish bias.

Stochastics is trading in the upper regions, can stay here for an extended period of time, however lots of stored momentum to the downside. RSI as of now is respecting its uptrend, a break of its line will cool it off to neutral levels.

Bull volume needs to come true in this current bull flag otherwise this whole set up will be negated, we have notable bear volume as of now.

Overall, in my opinion, that chart will be confirmed bullish once structural resistance is broken with confirmed bull volume. IIPR does have bullish formations but are not confirmed as of yet.

What are your thoughts?

Please leave a like and comment,

And remember,

“Ultimately, consistent profitability comes down to choosing between the discomforts you feel when you follow your plan and the urge to let yourself be captures ( and ruled) by your emotions.”

― Yvan Byeajee,

IIPR – Cannabis REIT Bullish BreakoutTrade Entry

Feb. 21 Expiry - Put Credit Spread – 80/85 strikes – Trying for $3.00 credit. Lowest acceptable $2.80. Max risk $218. Max Gain $300. 62% POP

I will update if I get filled on this order. Better than 1:1 risk/reward and better than 60% probability of profit. Meets minimum requirement.

Personal opinion - this is great REIT. Previous high over $140 is almost a 2x from here. Good opportunity.

Chart Details

Bullish wedge price breakout.

Bullish EMA cross on 1/6 and Bullish 10WeekMA price cross on 1/9.

Next price targets in pink ($87 and $97). These are exits.

About Me

Thank you for liking, commenting, throwing up a chart, following, or viewing.

I am not a financial advisor. My comments and reviews are based on what I do with my personal accounts.

Website will be ready for launch mid-January 2020.

Disclosure - I am long BTCUSD, GBTC. Short term GDX Bullish, SPXS Bullish, MCD Bullish

IIPR bull breakBroke daily resistance and closed above. Indicators show underlying strength, but Stoch indicates a possible retest of local resistance at around $78 (both daily and hourly charts).

Currently closed at weekly resistance of $80.30. A break with volume above $80.30 could see IIPR look for a weekly lower high. If rejected, we'll be looking for a higher low.

Bottom for IIPR?3 new leaseback deals announced just before Christmas. Dividend coming up in just 4 days, expected to increase again. IIPR blew upward, riding the MJ bubble, and deflated when that bubble burst. The current valuation is quite high, comparing fundamentals to other REITs.

It is currently attempting to break its 50 day line, and we should expect a test of the current rally attempts. With pivot points posting higher highs and higher lowes, perhaps going long at the current levels doesn't seem like a bad idea. Even if the bottom isn't in, it doesn't seem reasonable to me, that this would drop below $70, perhaps $65. Providing that the Bull Market continues...

What are your thoughts?

IIPR: Strong Buy for 2020; May Have 'Broken Out' This TimeIIPR is one of my top 2020 picks as their dividend growth has been impeccable and their stock has really only plummeted from its highs because the cannabis sector essentially went through a major correction. I believe certain (not all) cannabis stocks will make a strong rebound in 2020, but the sector itself may be 2 or so years before attracting major buyers back again. Somewhere in the near-term would be a good time to buy IIPR as I see it being one of the most explosive REITs in the entire stock market for capital appreciation and dividend growth over the mid and long-term especially as speculative money re-enters cannabis in the next 2 or 3 years (again). The sector is expected to grow exponentially by 2022-2023.

This stock may have surpassed its R1 yearly pivot and should be safe for a small entry. However, for a larger entry (unless you have a high appetite for risk) waiting for a reaction tomorrow could be essential in determining if this is the "real" break-out or not.

Having said that, I expect the stock to break-out of its long anticipated descending triangular wedge from its ATH in the early days or weeks of 2020, if it hasn't today, already.

Technicals

- Bounced off lower base on descending triangular wedge (i.e. did not break to the downside)

- End of negative sinusoidal squeeze is fading (turning to bullish)

- RSI creating a floor (bullish indicator)

- Momentum is growing (bullish indicator)

- zSplit

IIPR Potential Weekly Inverse Head and ShouldersTicker: $IIPR

Can IIPR gain any traction and break weekly resistance of $87.20 these upcoming weeks to confirm the inverse head and shoulders?

Remember, Inverse head and shoulders is a pattern that signifies a trend change from bear to bulls. If bulls can break this weekly inside bar bullish, than the possibility is there.

I need to see an increase in bull volume this week with a bull break of $75.40 to be interested in this name. If we get that, I will be very interested in a position.

Let see if this bull market can provide any fuel for the bulls to run.