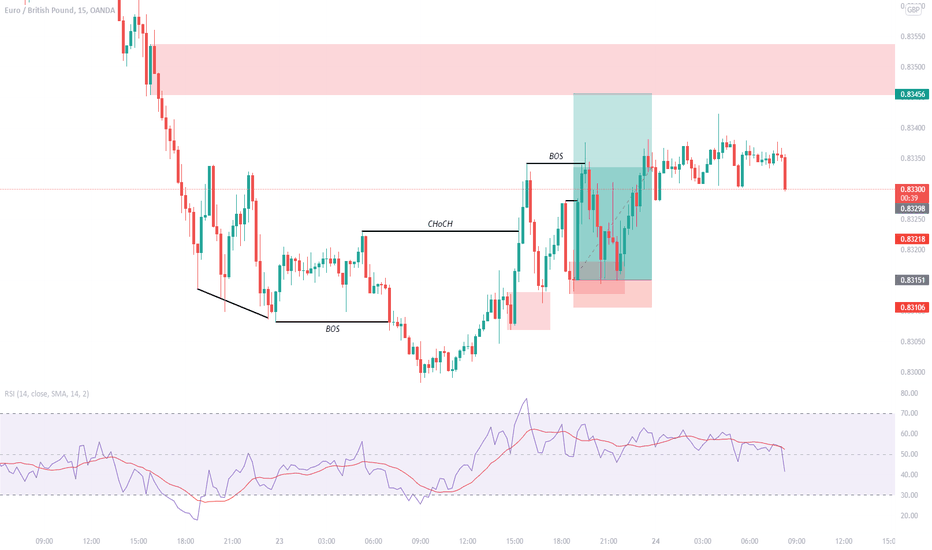

Imbalance

EURUSD - The Next Rally 🎯I have interest in buying EURUSD this morning.

It is pulling back to fill minor bullish imbalances below the Asian low.

When this is complete, I assume it will either use one of the imbalance levels or the major demand for the next rally to the upside.

Preferably the demand.

I will keep you updated on this one team! 🔥

USDJPY due to fill late buyers The dollar has truly shown its legs on this pair as of this year, currently floating at yearly highs.

As fundamental factors loomed and swayed the opinions of many retail investors and institutions in the last month or two when investors are looking towards safe haven pairs the dollar was clearly favoured over the Yen, for example.

Now, the majority see dollar strength and that’s all good but look, the higher time frames on this pair and correlating pairs alike show many major imbalances that are yet to be filled. This is my view based upon 1HR Time frame POIs.

I suspect a retracement to sub 118.500 before any upside continuations.

Let’s see what UJ can do this week!

CHFJPYCHFJPY Looking For Shorts

I'm Looking To Short Based On The Price Retesting/ Filling In The Daily Inefficiency

Price Rejection To That Level 126.460

We Have A Daily Rejection Block

After Price Took The Orders Resting Above The Old High

We Have Distribution Schematic (Which I Did not Mark Up)

Plan

We Have Our Maximum Stops =30 Pips

Targeting To Run Over 2 Asian Lows That Are Too Cleaned

PLEASE WATCH-OUT FOR THE 11 Mar Asian Low It Near Inefficiency Which Can Drive Price Higher Before Taking Out The Old March Low (124.250)

DISCLAIMER :

Before using this Tradingview account setups, please make sure that you note the following important information:

Do Your Own Research ( DYOR )

Our content is intended to be used and must be used for information and education purposes only.

It is very important to do your own analysis before making any investment based on your own personal circumstances.

You should take independent financial advice from a professional in connection with, or independently research and verify,

any information that you find on our Website and wish to rely upon, whether for the purpose of making an investment decision or otherwise.

No Investment Advice

Our Tradingview account is a financial data and news portal, discussion forum and content aggregator.

Circle Forex Institution is not a broker/dealer, we are not an investment advisor,

we have no access to non-public information about publicly traded companies,

and this is not a place for the giving or receiving of financial advice, advice concerning investment decisions or tax or legal advice.

We are not regulated by the Financial Services Authority.

We are an educational forum for analysing, learning & discussing general and generic information related to stocks, investments and strategies.

No content on the site constitutes - or should be understood as constituting - a recommendation to enter in any securities transactions or to engage in any of the investment strategies presented in our site content.

We do not provide personalised recommendations or views as to whether a stock or investment approach is suited to the financial needs of a specific individual.

EUR/JPY 4H SHORT OPPORTUNITYDisclaimer: For Education Purposes only

Technical Analysis

Price is Approaching Key Area after breaking out of Descending Channel.

The existence of an imbalance is a good reason for the price to make a move the downside.

Fundamental Analysis

Japan Quarterly GDP and Annual GDP is less than consensus and previous scores. So a weaker JPY is to be expected.

Because of this, I'm expecting a small reaction from Key Area before pushing to the upside.

EURUSD: Monday Buy Idea 🔥I am looking for buys on EURUSD.

We have footprint imbalance on the explosive candle this morning.

If we can pull back into that minor demand and fill the imbalance, I will consider joining the buyers if they appear.

This is the general idea of what I would like to see but we will work with what we are given.

I never set orders.

Good luck traders! 🏌️♂️

US30 TREND ANALYSIS AND PIVOTAL POINTS ALERTWe had a beautiful retracement that we expect to see closing the imbalanced H4 high before a probability of a sell, our fundamental views are generally sells because of the Ukraine issue mess that constantly involves USA... BUT!!! Our technical analysis will be our tour-guide in this jungle of US Market

UPDATE: EURUSD BUYUpdate of the previous idea: With a slightly wider stop, one would've avoided the spring of the accumulation that occurred in the demand zone on the . Yet, it rallied pretty nicely from there. Now, price seems to be coming back to the accumulation. I expect it to rally from the accumulation.

GBPUSD: Range Ready To Blow 💣What a boring week for GBPUSD. The price action within the range is suggesting price wants higher before we begin to see pullbacks to fill footprint imbalances.

As soon as we clear liquidity from this equal high, I will look for sells in the supply region.

Good luck traders! 🔥

GBPUSD: Join Buyers ⏏️The impulse breakout from the morning announcement has a bullish imbalance within it. As soon as the imbalance is filled on the footprint, we can proceed to buy into the trapped buyer zone.

Updates to follow Alkalites!

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------

AUDNZD: Asian Damage 🚨The Asian session wiped out all of the resistance sellers, they will be waking up sad this morning.

Since I waited for the liquidity grab, I can now consider sells if we get a pullback into the imbalance/supply with signs of rejection.

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------

GBPJPY: Sell Artwork 🧑🎨Look at how beautiful this setup is.

With the news volatility coming we may be able to get price into the supply/imbalance followed by rejection to the downside.

I will set an alert and monitor price shortly, if price surpasses the invalidation line, I have no interest in this setup.

Traders, if you have your own opinion about this idea, write in the comments section, I always reply. 💬

🚨 RISK DISCLAIMER:

Trading Crypto, Futures, Forex, CFDs, and Stocks involves a risk of loss.

Please consider carefully if such trading is appropriate for you.

Past performance is not indicative of future results.

Always limit your leverage and use a tight stop loss.

--------------------------------------------------------------------------------------------------------

Please like, subscribe, and share this idea with others! ⬇️

--------------------------------------------------------------------------------------------------------

EURUSD dailyChoppy and slow week at first with price being reluctant to come and fill the imbalance of the week before. eventually on Friday we got that after a sweep of the equal highs.

price is now heading back down towards the EQ of that daily swing. with some nice LTF order blocks to trade from.