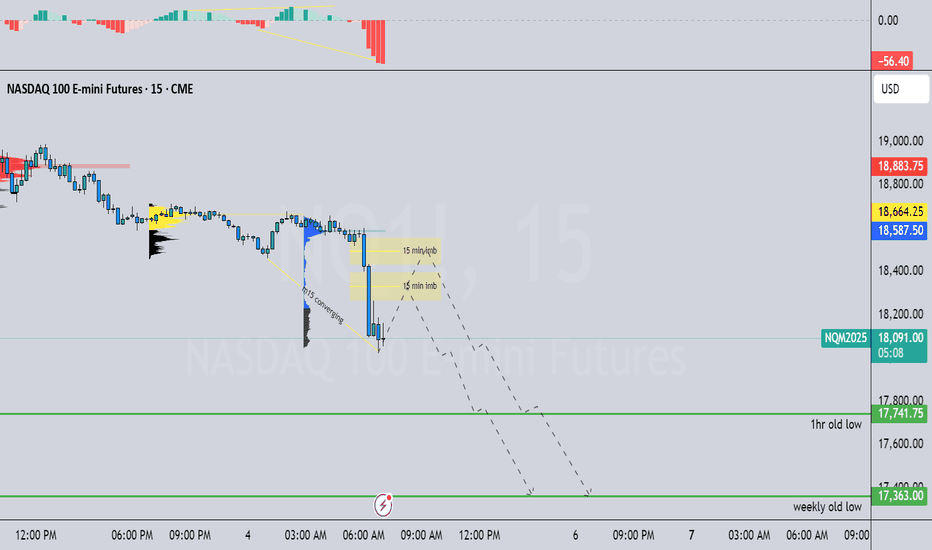

we might continue dropping daily hidden divergence, price might want to continue seeking sell side liquidity

4hr is making a new low and taking out old lows (sell side liquidity) to the left MACD is not converging as of yet

1hr hbrsh-div price is dropping ahead of red news this Friday, could head to 1hr old low or weekly low, waiting to see how price reacts to news

m15 price is below POC of previous NY session POC, as well as overnight Asian and London session converging nicely ahead of news I would favor price reacting short-term from m15 bearish imbalance before reaching the lows around the NY open after news but we will see

Imbalances

Overall Bullish on NXT ASX Currently in PubllBack phase overall im Bullish on NXT. i mainly trade forex using IMB'S on timeframes such as monthly weekly daily 4h and 1H. but nxt we need to look at longer term time frames like 12months, 6 months and 3 months. and i potentially see we are pulling back to the break of the 6month and 12month

once we tap these areas of interest we go down even lower to see a shift in market structure and Order flow. i dont really see price going lower then $12.53. we have just over 3 months left until a new 6 month candle is created which is when we could possibly see bullishness kick in again

EURAUD BUY SETUP1️⃣ Demand Zone Reaction

The price is currently in a clearly defined demand zone, where we’ve seen strong buying interest in the past. This zone has already shown signs of holding support, making it an ideal area to look for a long position.

2️⃣ Volume Profile Confirmation

The volume profile shows increased activity near the demand zone, indicating significant interest from buyers in this area.

3️⃣ Fibonacci Confluence

The demand zone aligns with the golden pocket area (61.8%–78.6%) of a Fibonacci retracement, adding strength to this level.

4️⃣ Bullish Momentum Potential

There are signs of rejection from lower levels, with wicks and candles showing hesitation in breaking lower, suggesting bullish momentum may build from here.

5️⃣ Liquidity Grab

The price recently swept the lows, grabbing liquidity from weak hands before a potential move to the upside.

Trade Plan:

Entry: 1.61900 (current demand zone).

Stop Loss: 1.61600 (below the demand zone and liquidity sweep).

Take Profit Levels:

TP1: 1.62500 (local resistance).

TP2: 1.63000 (higher timeframe resistance zone).

Bias:

The overall market structure remains bullish, with price expected to continue upward after this retracement.

Reminder:

Always manage your risk. Use proper position sizing and wait for confirmations if needed.

Update on teslaHi, quick update.

i do want to update some bearish technical scenerios that align with liquidity concepts. (neither bullish or bearish idea is 100% to occur and its important to prepare to all scenerios)

The latest test on demand was not what i was hoping to see. with prices making bad lows (confirm on TPO) and creating a liquidity pool, showing a lack of strength (market moves on the path of least resistance) from buyers(volume is low market shows uncertainty around current price).

We have a gap down (green rectangle) and bad lows, the last imbalances on the chart at 199.48 (if we dont consider the aug 5 bad lows duo to the japanese sell off)

These will hit stop losses and reset highly leveraged positions and most importantly will provide wallstreet a premium price on tsla shares.

That price aligns with targets from both bearish and bullish sides. as of now we are holding the daily 100 ema

the 200 EMA is 201 and the yearly VWAP is also confluencing with that EMA. SHOCKING!

If we are at the parliamentary supply a selling climax will follow.. and the target for it would close the imbalance and the gap would provide us a good low to buy from and grab upside liquidity if not break resistance finally.

in terms of RSI a sell off to that area will give us an oversold RSI on the daily and hit the orderblocks down there!

I am still bullish on tesla but acknowledging these bearish scenerios will help up understand what is happening if they happening. I closed my CFD position in tiny profit but i am still keeping my value investment on and havent sold a bit.

I will happily go further down and give myself a nice CFD trade on tesla from these price targets.!

This is not a financial advice but simply me sharing my ideas and journaling my investments and trading. I hope you all have a great day

I AM STILL BULLISH

THERES A REASON WHY THEY ARE CALLED SHORTS (SHORT TERM) AND LONGS (LONG TERM)

payo are you gonna correct?after the great boom payo brought us some great profits. tbh i havent closed anything and i am still bullish on payo.

payo accumulation and bingbongdingdong has been formed for 3 years as of this moment we are attempting to turn previous critical resistance into support.

2 scenerios according to wykoff theory.

1. correction then big money needs to defend its positions and at a reasonable price.

fundementally that could be previous value area high (vah upper white line) because we need to create a new value range it would only make sense to turn vah to the new point of control (poc) or the new value area low (where price is traded the most e.g mid range val bottom area)

another point to consider for the correction is the gap, so previous point of control to turn value area low or a sweep to that level would provide 4 things

first it will close the gap and get rid of that imbalance.

2nd it will shake off weak hands and get rid of breakout traders when it

grabs the single print

3rd it will provide a decent price for big money to enter at.. liquidity liquidity liqduidity.

4th provide the oprotunity for hedge shorting and basically thats more fuel to the upside when said shorts close. (so basically proffesionals get paid to pump the market for free)

2. leave everyone behind everyone whos waiting for the correction. that scenerio is less likely to anticipate, depends more on the company preformance and has less upside for big money that wants to accumulate low and provide big gains.

i believe the first scenerio is more likely that the other one.

the teal circles on the green lines are where i am looking to see reactions for swing fail patterns and adding to my positions

luckily i already have an open position on payo for quite a while now, so im chilling.

Unlocking the Secrets of Price Inefficiency: Dive Deep into FVG👑Price inefficiencies are also known as imbalances, gaps or voids. Healthy price action moves in a zigzag fashion, making highs and lows in line with the directional bias at any given moment. When price isn’t trending we find it consolidates, in which case highs lows are still being made. However, we may also see price move in straight lines with huge volume and momentum. When this happens, price finds itself unable to deliver price in an efficient manner. For example, in a bullish environment, price may continue to make higher highs without providing higher lows at a discount price. When price moves with this much momentum, it leaves behind imbalances.

🟠An imbalance can be identified by open space in price action, where the wicks on either side of a candle do not match each other. On the left is an example of price inefficiency, since the wick high of candle 1 does not meet the wick low of candle 3, leading to an imbalance on candle 2.

🟠This is an example of healthy price action with no imbalances. This is because all candles have wicks on either side of them. Since wicks were bodies during live price action and are bodies on lower time frames, this shows that price was delivered efficiently to buyers and sellers in this area. Whereas the example above shows an imbalance on a bullish candle, which shows that price was only available to buyers in that imbalance and therefore is not efficient.

👉For price to be efficient, it needs to be delivered to buyers and sellers. This helps us understand that in our original bullish imbalance, price has to come back and fill that imbalance using bearish price action in order to make that price available to sellers. This re-balancing could take hours, days, weeks or years, but it is our job to understand that it must happen at some point. Inline with the rest of the strategy, we can use this knowledge to pick out the specific imbalances that will be filled and how we can capitalise on this.

🟠This is an example of the correctly identified imbalance and where we expect price to react from

🟠This is an example when is our level being met, it is at this point that we use the rest of the strategy and knowledge to capitalise on the move that is about to unfold with high risk:reward entries.

🟠This is the completion of this particular market cycle, with our level being respected and price giving us a nice bullish leg.

🔴Bearish Order Flow:

🟢Bullish Order Flow:

XAUUSD | Trade Idea The XAU/USD pair shows a weak growth, again testing the psychological level of 2000.00 for a breakout. At the end of last week, gold quotes showed a sharp decline, retreating from their record highs of March 2022, falling under the influence of technical factors and a new phase of strengthening of the US currency. In addition, traders expect further tightening of monetary policy by the world's central banks in early May. In particular, the US Federal Reserve, the European Central Bank (ECB) and the Bank of England are likely to raise interest rates again. The pressure on the position of gold is also exerted by the fact of the growth in the yield of US Treasury bonds: the 10-year bonds corrected the day before from 3.522% to 3.595%. Today, the focus of investors will be American statistics on the dynamics of Housing Starts in March, where forecasts suggest a slowdown from 1.45 million to 1.40 million, and the Housing Starts Change may fall from 9.8% to 0.4%.

US30 BUY TO SELL MODELPrices took a short term high, giving us a shift in market structure, looking for pullback into a bullish order block or imbalance for a potential long entry. We are going to look for a fill of the sell-side imbalance.

⁉️ What is an Imbalance?‼️ Imbalances are also known as inefficiencies or FVG (Fair Value Gaps) these are periods in price action whereby means of lopsided order flow, which create porous wakes or gaps in fills. The market will slip to the only available trade levels as a result of thin liquidity and these voids in liquidity will be revisited at a later stage. The market will seek to fill in any missing gaps or missed levels on a trade. Impulse price swings are typically seen with this voids in liquidity. In simple terms imbalances are gaps in the market and the market will always seek in to close or fill those gaps.

⁉️ How to identify imbalances? ‼️ Imbalances are also known as inefficiencies or FVG (Fair Value Gaps) these are periods in price action whereby means of lopsided order flow, which create porous wakes or gaps in fills. The market will slip to the only available trade levels as a result of thin liquidity and these voids in liquidity will be revisited at a later stage. The market will seek to fill in any missing gaps or missed levels on a trade. Impulse price swings are typically seen with this voids in liquidity. In simple terms imbalances are gaps in the market and the market will always seek in to close or fill those gaps.

ICT IMBALANCE / FVG / LIQUIDITY VOIDLiquidity void, Fair Value Gap, Imbalance... These terms are interchangeable.

As a Charter Member ill tell you what I've shown here, is a basic depiction, as I got asked a question on what is an imbalance?

An imbalance, is an imbalance in price, where price has NOT efficiently delivered orders in the market, price will like to revisit these areas, of imbalance, as seen here. The diagram on the left depicts the ideal model of what an imbalance is, the chart on the right is an in time example.

if you notice one of these getting filled, at a place where you are bearish/bullish... well.... there is your trade!