IMX – Range Low ReclaimedIMX has once again defended the $0.37–0.38 demand zone, bouncing sharply off the lows. This level has acted as a long-term accumulation base since late 2022, and price is now showing early signs of another range rotation.

Currently trading at $0.61, IMX is holding above the reclaimed support. As long as this level is maintained, the setup favors a move toward the mid-range and potentially the upper boundary of the established range.

🎯 Key Levels:

Support: $0.38 (range low & invalidation)

Mid-range: $1

Target: $2.65 (range high)

If bulls can push through the $1 mid-range resistance, the top of the range at $2.65 becomes the next magnet.

📌 Risk Management:

$0.38 is the line in the sand. A close below this level breaks the structure and invalidates the setup.

Immutablex

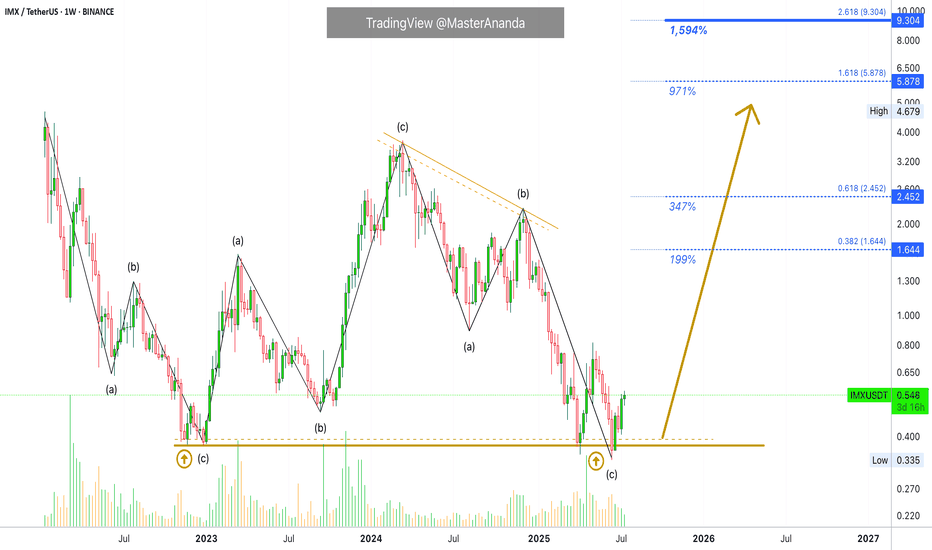

A New All-Time High Guaranteed for ImmutableX (1,600% PP)IMX produced a strong bullish cycle between December 2022 and March 2024. The entire bullish wave was corrected beyond 100%. This means that IMXUSDT hit a lower low. It went below the starting point of the last bullish wave. This is good in several ways.

The last move being deleted in its entirety opens the doors for a new bullish cycle with unlimited growth potential. We also know that all weak hands have been removed. Anybody who wanted to sell had more than a year to do so with all profits erased from the previous cycle. A total flush, a full reset.

The last bullish cycle produced more than 850%. We now know that this much is do-able so it becomes very easy. Last time market conditions were mixed to say the least, but not extremely bullish nor the best possible.

If IMXUSDT can grew this much in a mixed market, how much can it grow in a favorable market, in a bull market?

So, we aim for a strong higher high, a new all-time high. This opens up $5.9 an $9.3 as target for this newly developing bullish phase.

Thank you for reading.

Namaste.

Immutable Long-Term Support Established (New 3000% Wave Starts)Here we have the establishment and confirmation of a long-term support and double-bottom. IMXUSDT activated in April 2025 the same level and low as back in November 2022.

From November 2022 through March 2024 IMX went bullish. This bullish cycle produced 900% total growth (10X).

From March 2024 through April 2025 IMX went bearish. This bearish period removed all gains from the previous bullish cycle. A complete reset.

Now IMXUSDT is back to zero and anything is possible. This project can grow 1,655% as shown on the chart just as it can grow 3,000% or even 10,000%.

The reason why I cannot make a more accurate prediction about the next All-Time High is because there is not enough chart data. Immutable was not present in the last bull market so we don't know how this pair is likely to behave in a similar cycle.

900% growth is quite decent in the transition/recovery year, so I wouldn't be surprised to see at the minimum 2,000% to 3,000% growth in the coming months. Can be more, can be less, but it will grow.

Looking closer, in the last three months IMXUSDT produced a classic rounded bottom pattern. This week, the action is moving back above the baseline; the bullish zone.

This weekly session closes in just a few hours. Once the week closes above the blue dotted line, this signal is fully confirmed. The same signal from early 2023. This clearly shows what I've been saying, we will have a bull market now, in 2025. Prepare for long-term growth.

Namaste.

Is GameFi Making a Comeback with Immutable X (IMX)?The blockchain gaming sector is experiencing a significant resurgence, with Immutable X (IMX) at the forefront of this revival. On December 19, 2024, at 11:00 AM UTC, "Oxya Origin," a game developed by Ubisoft’s French incubator studio, is set to launch on Immutable's platform. This collaboration underscores the renewed interest in GameFi, blending gaming with decentralized finance (DeFi) elements through Non-Fungible Tokens (NFTs).

Market Analysis and Technical Insights

As of December 18, 2024, IMX is trading at $1.69 with a 24-hour trading volume of $98,397,272 USD, down by 6.29% in the last day. Despite this dip, IMX holds a substantial market cap of $2.86 billion, ranking it at #53 on CoinMarketCap with a circulating supply of 1.69 billion tokens out of a max supply of 2 billion. This market cap reflects a robust growth trajectory since its inception, reaching an all-time high of $9.50, which signifies strong investor confidence and potential for future growth.

The recent price action of CRYPTOCAP_OLD:IMX suggests a possible bullish trend. The token has immediate support at the 65% Fibonacci retracement level, offering a potential bounce back point for those looking to trade. The Relative Strength Index (RSI) currently sits at 38, indicating there’s room for the token to rally before being considered overbought. With the upcoming launch of Oxya Origin, analysts predict a surge towards the $2 resistance, a pivotal level before any significant correction or further breakout.

Immutable X's Technological Edge

Immutable X is not just another blockchain; it's a layer-two scaling solution specifically designed for NFTs on Ethereum. It tackles the blockchain's notorious issues like scalability, user experience, liquidity, and developer speed. By employing zero-knowledge rollups (zk-rollups), Immutable X promises zero gas fees for NFT minting and trading, alongside instant transaction confirmations and a transaction speed of over 9,000 per second. This scalability is crucial for mainstream adoption in gaming where speed and cost-efficiency are key.

Unique Positioning: Immutable X's focus on NFTs using zk-rollups positions it uniquely in the market. It's seen as a potential "NFT blockchain" due to its specialized approach to scaling solutions. The API abstraction layer simplifies interactions for developers, making integration into games and platforms straightforward. This ease of use is expected to attract more established companies in the gaming and content creation sectors, further fueling the ecosystem's growth. Additionally, features like the "Link" allow for seamless wallet connectivity, enhancing user experience without compromising security.

Ecosystem Growth: The launch of Oxya Origin, which has already seen $7 million in NFT sales and 13,000 ETH in secondary market volume, indicates strong community and investor backing. Immutable's ecosystem has grown impressively, with over 4 million signups for its Passport service and more than 460 games signed on, showcasing its appeal and scalability in the gaming industry.

Conclusion

Immutable X ( CRYPTOCAP_OLD:IMX ) stands at a pivotal moment in the blockchain gaming space. With its technological innovations, strategic partnerships like the one with Ubisoft, and robust market performance, CRYPTOCAP_OLD:IMX is not just making a comeback for GameFi; it's setting the stage for a new era of blockchain-integrated gaming. The technical analysis suggests immediate opportunities for traders, while the fundamental strengths of the platform indicate long-term growth potential. As we watch Oxya Origin launch, the market's response could very well dictate the next significant move for IMX, potentially pushing it past the $2 resistance level into new highs.

IMX | ALTCOINS | Altcoin that CAN STILL +25%Immutable (IMX) is one of few good alts tat hasn't quite seen the parabolic increases that the rest of the altcoin market has seen.

IMX still has some room for growth until it hits the next major resistance zone, and even more if you consider the previous ATH at 4.6 (currently at 2$).

Make sure you don't miss the Bitcoin update, and why I say the ATH is in :

___________________

BINANCE:IMXUSDT

Immutable Receives SEC Wells Notice, Vows to Defend IMX TokenImmutable, the Australian-based crypto gaming company renowned for its blockchain platform and CRYPTOCAP:IMX token, is facing a significant challenge. On November 1, the company disclosed that it had received a Wells notice from the U.S. Securities and Exchange Commission (SEC). Immutable has responded decisively, pledging to defend itself against any enforcement action and challenging the regulator's claims.

Understanding the Wells Notice

A Wells notice is an official letter issued by the SEC, signaling its intent to pursue enforcement action. It indicates that the agency believes it has gathered sufficient evidence of a potential violation of securities laws. Before the notice is issued, the SEC typically conducts extensive investigations and discussions with the involved entity. However, Immutable expressed discontent with the abruptness of the notice, which arrived with little warning despite previous engagements with the agency.

The Wells notice appears to focus on Immutable’s IMX token sales and listings dating back to 2021. According to Immutable, the SEC specifically raised concerns over a 2021 blog post. In that post, a pre-launch investment in CRYPTOCAP:IMX tokens at $0.10 was mentioned, alongside a note about a "$10 pre-100:1 split" that, in the SEC’s view, inaccurately suggested there was no exchange of value between parties. Immutable countered these claims, asserting that the transaction did have genuine economic substance and that the SEC’s interpretation stems from poor communication and a misreading of facts.

"Once again, the SEC is not correct," an Immutable spokesperson stated. "The details of the pre-launch investments were legitimate, and we are confident in our compliance with securities laws."

Immutable's Determination to Fight Back

Despite the gravity of the situation, Immutable remains resolute. The company expressed optimism in its ability to defend against the SEC’s allegations. "In spite of the SEC’s claims that tokens in the industry are securities, we strongly believe the IMX token does not fall under this category," Immutable said in its statement. The firm’s leadership emphasized its commitment to continue operations without disruptions and to protect the interests of its investors and community.

Immutable is not alone in its struggle; the SEC has targeted several major crypto firms in 2024, including OpenSea, Crypto.com, and Uniswap, as the regulator intensifies its scrutiny of the digital assets space. This broader regulatory crackdown has fueled debates about the future of token classifications and the impact on the crypto market as a whole.

Technical Outlook

From a technical standpoint, CRYPTOCAP:IMX has taken a hit. As of this writing, the token has dropped 6.41%, trading within a descending trend channel. The decline is likely driven by the uncertainty and negative sentiment surrounding the SEC allegations.

The daily price chart for CRYPTOCAP:IMX shows a bearish harami pattern, which typically signals increasing selling momentum. If this trend continues, IMX could potentially test the crucial support level at $0.90. This level may serve as a cooling-off point, offering a chance for the token to consolidate before determining its next direction.

Moreover, it is worth noting that IMX’s price movements are often correlated with Bitcoin. Currently, Bitcoin has struggled to maintain upward momentum, retreating from the $75,000 pivot and dipping to $68,000. This broader market pressure could exacerbate the downward trend for IMX, especially if Bitcoin fails to stabilize.

Implications and Market Sentiment

The SEC’s pursuit of Immutable underscores a fundamental risk facing the entire crypto industry: regulatory uncertainty. Token projects, especially those that engaged in early sales or complex transactions, are increasingly vulnerable to enforcement actions. If the SEC classifies CRYPTOCAP:IMX as a security, it could lead to further restrictions and compliance burdens, potentially affecting the token’s marketability and ecosystem development.

However, Immutable’s proactive approach and public commitment to fight the SEC’s claims may bolster investor confidence in the long term. The outcome of this regulatory clash could set a precedent for how other blockchain-based gaming and NFT platforms navigate securities laws. Investors and market participants will be watching closely to see whether Immutable’s defense holds up.

Conclusion

Immutable’s battle with the SEC is far from over, and the stakes are high for both the company and the broader crypto market. While the regulatory environment remains challenging, Immutable’s determination to protect the CRYPTOCAP:IMX token and its ecosystem could inspire similar companies facing regulatory hurdles. On the technical front, traders should be cautious as CRYPTOCAP:IMX navigates a bearish pattern, but all eyes remain on the $0.90 support level and Bitcoin’s broader influence on the market.

The coming weeks will be critical in shaping the narrative around CRYPTOCAP:IMX and the ongoing regulatory debate. Stay tuned for further updates as this story unfolds.

GOG - GUILD OF GUARDIANSDCA on GOG

I accumulate every time we approach or enter the green box.

GOG - Guild Of Guardians is a Blockchain mobile RPG published by Immutable.

guildofguardians.com

PARTNERS & BACKERS :

APEX CAPITAL

COINBASE

UBISOFT

IMMUTABLE

SANDBOX

etc.

icohigh.net

www.ubisoft.com

IMX middle term targets Watch this BINANCE:IMXUSDT middle term targets

Spot.

Possible Targets and explanation idea

➡️Weekly global fib levels. Zone (green box) marked in 2022 all zones you knew from last posts 2 years ago. Still relevant and will be relevant

➡️You can track with MP indicator how whales accumulate and distribute position

➡️From 0.38 IMX pumped to 3.70 and we got a 2 main signals to fix profit + RSI bearish div

➡️Now step by step they start accumulate position again. Green box relevant

➡️Tested on W tf fundamental value of token based on Take profit indicator

➡️Middle term target marked by green circle. Potential will be way higher

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

IMXUSDT Resistance Zone BreakoutIMXUSDT Technical analysis update

IMX price breaks the resistance zone on the 4H chart after multiple rejections. The 4H candle closed above the resistance zone, and the price is trading above the 100 and 200 EMA. We can expect a strong bullish move from here.

Buy Level: $1.66

Stop Loss: $1.46

Regards

Hexa

Alikze »» IMX | Head and shoulder pattern scenario🔍 Technical analysis: Head and shoulder pattern scenario

- In the weekly frame time, there was a three -wave move that has grown to 1.272 for its previous wave.

- According to the analysis presented before leaving the triangle density in the 4th wave of correction, it succeeded in the supply zone of growth and defeat it.

- After that, it faced a lack of stability at the top of the supply zone.

-This unsuccessful failure area of the supply area is a head and shoulder pattern.

- Currently, there is a currency pattern that can have a growth of a dynamic trigger.

- If the line is broken, the head and shoulder pattern will be approved and can be modified in the first step until the Golden Zone, and then the Priz area will continue and even move to the origin of the movement.

💎 Replacement scenario: If it can be removed from the corner, it can test the supply area, but the head and shoulder pattern will not be valid until the supply zone is broken and will confirm the pattern by defeating the line.

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

IMX Targets $1.89IMX has lost support and is now trading below the Value Area Low, signaling a selling imbalance. The next area of support (Demand Zone), sits at $1.89. With a nice reaction from that level, a solid bounce and follow.

Calculate Your Risk/Reward so you don't lose more than 1% of your account per trade.

Every day the charts provide new information. You have to adjust or get REKT.

Love it or hate it, hit that thumbs up and share your thoughts below!

This is not financial advice. This is for educational purposes only.

IMX: March 30th, 2024: BullishHi. Hope you're doing ok.

Today's setup is one of the neatest there is out there. Considering the narratives unfolding, GameFi is one of the areas where there is a lot of potential, and ImmutableX is definitely one of the leaders in this field.

The chart is incredibly bullish, and reminds me of Jasmy that I fumbled TBH. I saw a similar breakout and retest in Jasmy before that monstrous rally, but I didn't manage to get an entry. Am I implying that this will do a 200% as Jasmy did? No, honestly! When it comes to big rallies, market cap matters, and for IMX to move 200%, a lot more capital is needed. Each time IMX has rallied, we have seen diminishing results. The first rally recorded 400% while the second was about 110%. My expectation for the 5th impulsive wave is around 70% - 80%, maybe even lower depending on PA at levels of interest.

However, we have bullish break out of a HTF consolidation zone, and sooner than later a rally will probably begin. VWAPs and some major levels are viewed as support for me. EMAs 12, 21 are acting as support as well. Trend is definitely bullish, and a new impulse wave is in the cards IMO.

I have to note that I expect much higher prices in the long run, i.e. a new ATH.

IMXUSDT Bullish Surge from Demand Zone? 🚀 ImmutableX💎 Paradisers, gear up for an exciting trading moment with #IMXUSDT, showcasing signs of a bullish continuation from its vibrant demand zone and FVG.

💎 Treading through #ImmutableX journey, it's been ascending from a key supply level at $3.3580. Despite a brief slowdown, we're setting our sights on a bullish leap from the demand level of $3.1640. Maintaining momentum here could kickstart the bullish trek we're envisioning.

💎 If the drive behind #IMX starts to wane, anticipate a dynamic recovery from the robust demand at $2.8882. With the area's rich liquidity, we're optimistic about a bullish ascent from the Bullish OB. However, a fall beneath this pivotal point could signal a shift towards a more pronounced bearish trend.

IMXUSD This pull-back is the best buy entry.Immutable X (IMXUSD) has been rising non-stop since the January 23 Low and is now on a new 2 year High! However, the 1D RSI's Bearish Divergence, the entry on the Diagonal Resistance Zone since the June 2022 High, as well as the similarities with the previous Higher Highs formations, call for a short-term pull-back.

As long as that is contained above the 1D MA100 (green trend-line), we will buy it and target the All Time High Zone at 5.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

IMMUTABLEX #IMX to outperform #ETH by 3XCall it a 2024 Prediction

(Based on a technical foundation ofc :))

Simple trading range zone break out

and prediction of using that range to make a new trading range going forward.

You can also spot a W formation

which also would point towards a similar level

Hope you have profitable `24

Immutable ($IMX) Hits 20-Month High Gaming tokens are rising again, with Immutable's IMX token as well.

Crypto gaming firm Immutable’s CRYPTOCAP:IMX token has surged to highs not seen since April 2022, rising 77% in the past month to roughly $2.35, per CoinGecko data.

CRYPTOCAP:IMX is up about 428% in the past year and has a market cap of over $3 billion, making it one of the biggest gaming-focused cryptocurrencies. It’s up 11% in the last 24 hours alone.

Immutable, publisher of the NFT trading card game Gods Unchained, has continued to sign games to its upcoming zkEVM network this year, rolled out its single sign-on wallet solution called Immutable Passport, announced a mysterious collaboration with Ubisoft, and saw a number of games using its blockchain and marketplace listed on the Epic Games Store.

While blockchain games remain a niche interest among the crypto-native, development has continued on a number of upcoming games using Immutable, like Shardbound and Guild of Guardians.

Immutable Climbs 10% While Most Gaming coins Fall With BTC & ETHIMX is bucking the downward trend Monday following VanEck’s recent vote of confidence in crypto gaming platform Immutable.

The broader market may be down about 5% over the last 24 hours, per CoinGecko, but IMX has climbed a total of 10% during that span to a current price of $2.00. The price did dip briefly late Sunday along with other top tokens, but then quickly rebounded, popping as high as $2.06 early Monday. That’s a 20-month high for the gaming token.

Immutable is an Ethereum gaming platform that’s based around the current Immutable X scaling network, as well as the upcoming Immutable zkEVM network powered by Polygon zkEVM. IMX is now up 41% in the last week alone, pushing the token to an 83% jump in the last 30 days.

Following recent collaboration announcements with Amazon and major game publisher Ubisoft, IMX may have also seen a recent boost following a vote of confidence from investment firm VanEck late last week.

IMX (Immutable X): Riding the Wave of Gaming Revolution🎮 IMX (Immutable X): Riding the Wave of Blockchain Gaming Revolution! 🎮

Hey Gaming and Crypto Enthusiasts! 👋 The FXProfessor here, diving into the fascinating world of IMX, the token powering the Immutable ecosystem. Let's explore the exciting developments catapulting IMX into the spotlight.

Surge in IMX Value:

📈 IMX token recently experienced a significant surge, with a 7% rise in a single day, reaching $1.56. This uptick is attributed to the anticipation of new blockchain-based video games like Illuvium (The Block).

🚀 Investment manager VanEck predicts that IMX could become a top 25 coin by market cap, especially with the upcoming release of big-budget games in 2024 (The Block).

Impact of Upcoming Releases:

🌐 Illuvium, built on ImmutableX’s blockchain using Unreal Engine 5, is developing multiple titles aimed to rival top non-blockchain games. This project is gaining traction, potentially driving mainstream adoption of web3 gaming (The Block).

💥 VanEck analysts are bullish about IMX's prospects, citing the impact of multiple AAA games built on the Immutable platform. These games, funded with over $100m, are expected to be released in 2024 and could attract traditional AAA game-level player bases (The Block).

The Role of IMX:

🛠️ IMX is an ERC-20 utility token that is integral to the Immutable ecosystem, supporting the functionality and governance of the platform (The Block).

FXProfessor's Insight:

🌟 The developments around IMX and Immutable X mark a significant milestone in the integration of blockchain technology with high-quality gaming experiences.

🕹️ Keep an eye on IMX as it positions itself at the forefront of the blockchain gaming revolution, potentially reshaping the gaming industry and crypto space.

Stay informed, explore the convergence of gaming and crypto, and let’s witness the growth of IMX in the blockchain gaming arena!

One Love,

The FXProfessor 💙

Link: www.theblock.co

**IMX |Major resistance ahead |Break it out for 580% gain**BINANCE:IMXUSDT

Hi fam,

Thanks for being here.

I'm sure you are experiencing a good time in crypto market these days but always remember "every uphill will end to a downhill" so prepare yourself for other side of market soon.

As you already know many altcoins recently popped up and returned good profit for all of us.

I've checked IMX chart in both weekly, daily time frame and all i can say is currently price reached a critical level of 1.3$. This is a major level for overall trend of this coin. price once made several touched to this level previously and made a deviation above that ended in rejection eventually.

regarding overall condition of market (i expect to see a minor correction) and chart it self (RSI overbought +MACD in H12 is red +BB upper boundary rejecting the price in D1+Stoch RSI in W1 is overbought).

i believe price will give me the opportunity of buying IMX around 0.9$ which is a 10% discount and of course an aggressive buying move.

0.9$ is where kij & tenk of ICHI cloud located and getting flat.

0.9$ is MA20 in W1 time frame.

0.8$ to 0.9$ are the last broken resistance and last known support for this trend.

|But why I'm buying IMX ?

Price located above MAs in W1 time frame.

MACD in W1 is green and getting stronger.

Price printed an ascending channel which give us 9$ as upper boundary of channel (sitting around fib. level of 8)

Trend broken the W1 bearish dynamic resistance trend line and closed above.

Price printed a harmonic XABCD bearish BAT pattern that will end D leg touching upper bound of channel.

There are more parameters that i checked but i will as always ask you to DYOR.