Options Blueprint Series [Intermediate]: Gold Triangle Trap PlayGold’s Volatility Decline Meets a Classic Chart Setup

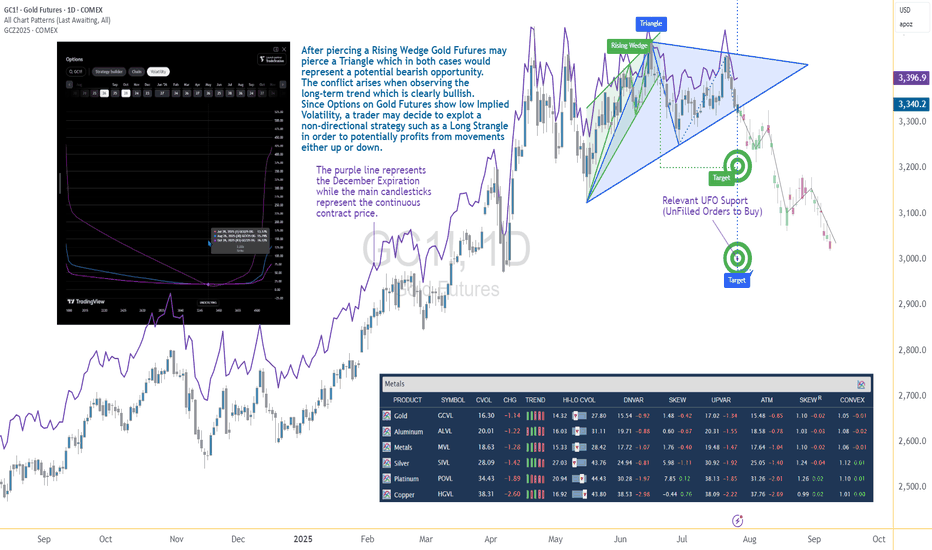

Gold Futures have been steadily declining after piercing a Rising Wedge on June 20. Now, the market structure reveals the formation of a Triangle pattern nearing its apex — a point often associated with imminent breakouts. While this setup typically signals a continuation or reversal, the direction remains uncertain, and the conflict grows when juxtaposed with the longer-term bullish trajectory Gold has displayed since 2022.

The resulting dilemma for traders is clear: follow the short-term bearish patterns, or respect the dominant uptrend? In situations like these, a non-directional approach may help tackle the uncertainty while defining the risk. This is where a Long Strangle options strategy becomes highly relevant.

Low Volatility Sets the Stage for an Options Play

According to the CME Group’s CVOL Index, Gold’s implied volatility currently trades near the bottom of its 1-year range — hovering just above 14.32, with a 12-month high around 27.80. Historically, such low readings in implied volatility are uncommon and often precede sharp price movements. For options traders, this backdrop suggests one thing: options are potentially underpriced.

Additionally, an IV analysis on the December options chain reveals even more favorable pricing conditions for longer-dated expirations. This creates a compelling opportunity to position using a strategy that benefits from volatility expansion and directional movement.

Structuring the Long Strangle on Gold Futures

A Long Strangle involves buying an Out-of-the-Money (OTM) Call and an OTM Put with the same expiration. The trader benefits if the underlying asset makes a sizable move in either direction before expiration — ideal for a breakout scenario from a compressing Triangle pattern.

In this case, the trade setup uses:

Long 3345 Put (Oct 28 expiration)

Long 3440 Call (Oct 28 expiration)

With Gold Futures (Futures December Expiration) currently trading near $3,392.5, this strangle places both legs approximately 45–50 points away from the current price. The total cost of the strangle is 173.73 points, which defines the maximum risk on the trade.

This structure allows participation in a directional move while remaining neutral on which direction that move may be.

Technical Backdrop and Support Zones

The confluence of chart patterns adds weight to this setup. The initial breakdown from the Rising Wedge in June signaled weakness, and now the Triangle’s potential imminent resolution may extend that move. However, technical traders must remain alert to a false breakdown scenario — especially in trending assets like Gold.

Buy Orders below current price levels show significant buying interest near 3,037.9 (UFO Support), suggesting that if price drops, it may find support and rebound sharply. This adds further justification for a Long Strangle — the market may fall quickly toward that zone or fail and reverse just as violently.

Gold Futures and Micro Gold Futures Contract Specs and Margin Details

Understanding the product’s specifications is crucial before engaging in any options strategy:

🔸 Gold Futures (GC)

Contract Size: 100 troy ounces

Tick Size: 0.10 = $10 per tick

Initial Margin: ~$15,000 (varies by broker and volatility)

🔸 Micro Gold Futures (MGC)

Contract Size: 10 troy ounces

Tick Size: 0.10 = $1 per tick

Initial Margin: ~$1,500

The options strategy discussed here is based on the standard Gold Futures (GC), but micro-sized versions could be explored by traders with lower capital exposure preferences.

The Trade Plan: Long Strangle on Gold Futures

Here's how the trade comes together:

Strategy: Long Strangle using Gold Futures options

Direction: Non-directional

Instruments:

Buy 3440 Call (Oct 28)

Buy 3345 Put (Oct 28)

Premium Paid: $173.73 (per full-size GC contract)

Max Risk: Limited to premium paid

Breakeven Points on Expiration:

Upper Breakeven: 3440 + 1.7373 = 3613.73

Lower Breakeven: 3345 – 1.7373 = 3171.27

Reward Potential: Unlimited above breakeven on the upside, substantial below breakeven on the downside

R/R Profile: Defined risk, asymmetric potential reward

This setup thrives on movement. Whether Gold rallies or plunges, the trader benefits if price breaks and sustains beyond breakeven levels by expiration.

Risk Management Matters More Than Ever

The strength of a Long Strangle lies in its predefined risk and unlimited reward potential, but that doesn’t mean the position is immune to pitfalls. Movement is key — and time decay (theta) begins to erode the premium paid with each passing day.

Here are a few key considerations:

Stop-loss is optional, as max loss is predefined.

Precise entry timing increases the likelihood of capturing breakout moves before theta becomes too damaging. Same for exit.

Strike selection should always balance affordability and distance to breakeven.

Avoid overexposure, especially in low volatility environments that can lull traders into overtrading due to the potentially “cheap” options.

Using strategies like this within a broader portfolio should always come with well-structured risk limits and position sizing protocols.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Impliedvolatility

Crude Oil Futures: Navigating Geopolitical Risk and VolatilityMarket Context:

NYMEX:CL1! COMEX:GC1! CBOT:ZN1! CME_MINI:ES1! CME_MINI:NQ1! CME:6E1!

Implied volatility (IV) in the front weeks (1W and 2W) is elevated, and the futures curve is in steep backwardation. This indicates heightened short-term uncertainty tied to geopolitical tensions, particularly in the Middle East involving Iran and Israel. The forward curve, however, suggests the market is not fully pricing in sustained or escalating conflict.

We evaluate three possible geopolitical scenarios and their implications for the Crude Oil Futures market:

Scenario 1: Ceasefire Within 1–2 Weeks

• Market Implication: Short-term geopolitical premium deflates.

• Strategy: Short front-month / Long deferred-month crude oil calendar spread.

o This position benefits from a reversion in front-month prices once the risk premium collapses, while deferred months—already pricing more stable conditions—remain anchored.

o Risk: If the ceasefire fails to materialize within this narrow window, front-month prices could spike further, causing losses.

Scenario 2: Prolonged War of Attrition (No Ceasefire, Ongoing Missile and Air War)

• Market Implication: Front-end volatility may ease slightly but remain elevated; deferred contracts may begin to price in more geopolitical risk.

• Strategy: Long back-month crude oil futures.

o The market is currently underpricing forward-looking risk premiums. A persistent conflict, even without full-scale escalation, may eventually force the market to adjust deferred pricing upward.

o Risk: Time decay and roll costs. Requires a longer holding horizon and conviction that the situation remains unresolved and volatile.

Scenario 3: Full-Scale Regional War

• Market Implication: Severe market dislocation, illiquidity, potential for capital flight, and broad-based risk-off sentiment across global assets.

• Strategy: Avoid initiating directional exposure in crude. Focus on risk management and capital preservation.

o In this tail-risk scenario, crude oil could spike sharply, but slippage, execution risk, and potential exchange halts or liquidity freezes make it unsuitable for new exposure.

o Alternative Focus: Allocate to volatility strategies, defensive hedging (e.g., long Gold, long VIX futures), and cash equivalents.

o Risk: Sudden market shutdowns or gaps may make exit strategies difficult to execute.

Broader Portfolio Considerations

Given the crude oil dynamics, there are knock-on effects across other markets:

• Gold Futures: Flight-to-safety bid in Scenarios 2 and 3. Long positioning in Gold (spot or near-month futures) with defined stop-loss levels is prudent as a hedge.

• Equity Index Futures (E-mini Nasdaq 100 / S&P 500): Vulnerable to risk-off flows in Scenarios 2 and 3. Consider long volatility (VIX calls or long VX futures) or equity index puts as portfolio hedges. In Scenario 1, equities could rally on resolution optimism—especially growth-heavy Nasdaq.

• Currency Futures: USD likely to strengthen as a safe haven in Scenarios 2 and 3. Consider long positions in Dollar and Short 6E futures.

• Bond Futures: Risk-off flows theoretically should support Treasuries in Scenarios 2 and 3. Long positions in 10Y or 30Y Treasury futures could serve as a defensive allocation. Yields may retrace sharply lower if escalation intensifies. However, given the current paradigm shift with elevated yields, higher for longer rates and long end remaining high, we would not bet too heavily on Bond futures to act as safe haven. Instead, inflows in Gold, strengthening of Chinese Yuan and Bitcoin will be key to monitor here.

Scenario-based planning is essential when markets are pricing geopolitical risk in a non-linear fashion. Crude oil currently reflects a consensus expectation of de-escalation (Scenario 1), which opens the door for relative value and mean-reversion strategies in the front-end of the curve.

However, given the asymmetric risks in Scenarios 2 and 3, prudent exposure management, optionality-based hedges, and a flexible risk framework are imperative. A diversified playbook; leveraging volatility structures, calendar spreads, and cross-asset hedges offers the best path to opportunity while managing downside risk.

[05/27] Weekly GEX Outlook for SPX⚠️ Unbalanced GEX & Institutional Hedging – A Closer Look

I haven’t seen such an asymmetric GEX setup in quite a while — and it’s definitely not a pretty one 😬. The current profile suggests a highly skewed positioning in the market:

📍 Massive upside expectation:

It feels like the market is almost exclusively preparing for a move toward 6000.

🛑 Limited downside protection:

Below the current level, there's very little hedging in place — especially unusual with Friday’s expiry approaching.

🔻 Current Key Zone: 5925-5930

The largest put open interest is sitting right around 5925, which is also close to spot.

Below that? Things get murky. The GEX profile becomes fragmented and mixed, with no clear put support until much lower.

Interestingly, most of the current downside hedging is clustered around the 5900–5925 range, which includes ITM puts — not OTM, as you’d typically expect from retail.

🧠 Institutional Footprint vs. Retail

This hedging pattern — closer to ATM rather than deep OTM — suggests institutional players are managing downside risk with precision.

In contrast, retail traders don’t seem to be actively hedging the downside with OTM puts, which is a notable shift from typical behavior in high-IV weeks like this.

🔼 What to Watch: The 5930 Breakout

If SPX can break and hold above 5930, it enters a clear, call-dominated zone.

From there, the path to 6000 looks much cleaner, with lighter resistance and the potential for a gamma-driven push 📈.

The details show the same picture when examining more details:

SPX conclusion

😬 In short: we’re at a tipping point.

Below 5900, hedging is tactical and institutional.

Above 5900, the path is open to 6000 — but only if bulls can take control at 5930!

NVDA GEX Earnings Outlook by OptionsNVDA reports earnings this Wednesday, and it’s a big deal. A major move could impact both the indexes and broader tech sector.

The OTM 16 delta curve essentially overlaps with both the GEX profile and the expected probability zone — signaling strong confluence.

📈 Rising IV with falling call skew: Volatility is rising into earnings, while the call skew is dropping — a sign of growing interest in downside hedging/speculation.

🔷 Key inflection zone (129): Above 129, the market is unlikely to surprise. Below it, however, a domino effect could trigger increased volatility and put-side flows.

Implied move into earnings is 6.62%, reflecting binary risk expectations from the options market.

Strong gamma squeeze territory exists between 140–145, with significant call wall buildup around 140.

The nearest expiry shows a positive net GEX — supporting short-term mean-reversion or hedging flow stability above 129, at least until the earnings print.

🔴 Downside risk scenario:

In the event of a downward move, the market is most heavily hedged around the 125 level, which aligns with the deepest put support.

💡 Wheeling Opportunity Idea

ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term), this might be a great time to start the wheeling strategy.

Because earnings inflate volatility, you can sell a near-term cash-secured put (CSP) for solid premium — even on a 53DTE (July) option.

Based on current GEX levels, we’re seeing:

-Support (squeeze zone) around $125

-Call resistance around $140

-A potential upside squeeze extending to $145-$150

These align roughly with ~20 delta OTM options, so the premium is attractive.

How would I personally start this:

Sell a CSP for May 30 with the intention to get assigned if NVDA drops.

If I do get assigned, I’m happy to own shares.

Then, I sell a 60DTE covered call right after to collect another round of premium.

If I’m not assigned, I sell a new 45–60DTE put the following week — still benefiting from the relatively high IV.

👉 Remember: High IV = synthetic time value. With this two-step method, you can harvest premium twice in quick succession.

I used the same technique with NASDAQ:INTC , and it’s been performing well.

💥 ONLY IF you want to own NVDA long-term around the $130 level (even if it drops short/mid-term)!

GEX Analysis & Options “Game Plan”🔶 Short- and longer-term perspective in a high IV, negative GEX environment

🔶 KEY LEVELS & RANGES

Spot: 221

Gamma Flip / Transition: around 250 (the turquoise zone on the chart)

– This zone typically marks a “power shift.” If price decisively breaks above 250 and holds, market makers’ gamma positioning could flip from neutral/negative to positive.

Put Support: 200

– A large negative gamma position has accumulated here, making 200 a strong support level. If it breaks, the downside may accelerate.

Call Resistance: 400

– A major long-term “call wall” where a significant amount of OTM calls are concentrated. It’s more relevant to LEAPS; currently far from spot, so not a realistic short-term target.

Call Resistance #2: 300

– A medium-term bullish objective, still above the 200-day MA. You’d need to be strongly bullish to aim for ~300 by May (e.g., going for a 16-delta OTM call).

Short-Term / Intermediate GEX Levels:

– There are gamma clusters around 220–230 and 250–260 . These areas often see higher volatility, possible bounces, or stalls (chop) due to hedging flows.

🔶 WHATEVER SCENARIO – SHORT TERM (0–30 DAYS)

A) Upside Continuation / Rebound

– If TSLA closes above 225–230 , the next target is 240–250 (transition / gamma flip).

– If it breaks above 250 and holds (e.g., successful retest), market makers may shift to “long gamma,” fueling a quicker move to 260–270 .

– Resistance: 250, 300, with an extreme LEAPS-level at 400.

B) Downside Move / Bearish Break

– If price dips below ~220 and sustains, the next targets are 210–200 (major put wall / negative gamma).

– If 200 fails, negative gamma may magnify the sell-off. It’s an extreme scenario but still on the table given high IV and macro/geopolitical risks.

– Support: 210, 200 — likely stronger buying interest near 200, possibly a short-term bounce.

– The options chain suggests near-term hedging via puts for this scenario.

C) Chop / Sideways

– If TSLA stays in 210–230 , market makers (short options) might benefit from high IV/time decay.

– Negative GEX, however, can trigger sudden moves in either direction; caution is advised.

🔶 LONGER-TERM FOCUS (6–12 MONTHS, LEAPS)

NET GEX = -61.97M (negative territory) suggests longer-dated positioning is also put-heavy or carries notable negative gamma.

HVL / pTrans = 250 is a key pivot; cTrans+ = 400 is distant call resistance. Between these levels, there’s a mix of put/call dominance.

If Tesla undergoes a fresh growth phase (AI, robotaxi, energy storage, etc.) and clears 250/300 , 400 could become the next significant call wall — but that’s more of a multi-month horizon.

🔶 STRATEGY IDEAS (High IV Environment)

1. Short-Term Bearish

– If you’re bearish and expecting TSLA to test 220–210, consider a bear put spread or net credit put butterfly (lower debit) to leverage high IV.

– Targeting 200, but keep in mind negative gamma may accelerate downside movement.

2. Medium-Term “Contra” Bullish (bounce to 250)

– If GEX suggests a bounce off 210–220, consider a bull call spread (e.g., 220/240) or a net debit call butterfly (220/240/250).

– Be mindful of sudden swings, as we remain in negative gamma territory.

3. Longer-Term Bullish (>3–6 months)

– A call butterfly with upper strikes around 300–350 offers capped debit and higher potential payoff if a bigger rally materializes.

– A diagonal spread (selling nearer-dated calls, buying further-out calls) exploits elevated front-end IV.

4. Neutral / Range-Bound

– If TSLA stays in 200–250 , you could use Iron Condors (e.g., 200/260) to benefit from time decay and any IV collapse.

– Exercise caution: negative gamma can generate abrupt, directional moves, making a neutral stance riskier than usual.

🔶 ADDITIONAL NOTES & “BIG PICTURE”

High IV & Negative GEX: TSLA has a track record of large swings. Negative GEX can intensify sell-offs, while forced hedging might trigger rapid rebounds.

Preferred Structures: With expensive premiums, spreads (vertical, diagonal) and butterfly configurations generally fare better than plain long options (less vulnerable to time decay).

Potential Catalysts: AI announcements, Autopilot breakthroughs, new product lines, and macro changes can swiftly alter market dynamics. Keep tracking GEX updates and news flow; TSLA tends to respond dramatically to fresh developments.

🔶 Bottom line: From 221 spot, watch 210–200 on the downside and 240–250 on the upside short term. Medium-term bullish target = 300 , while 400 remains a far LEAPS scenario. High IV + negative gamma = fast, potentially volatile moves — so risk management and spread-based approaches are crucial.

Options Blueprint Series [Intermediate]: Vega-Neutral Gold Play1. Introduction

Gold is currently in an uptrend, presenting a potentially favorable environment for bullish traders. However, with implied volatility (IV) sitting around its mean, there’s uncertainty about whether IV will rise or fall in the near future. In such a scenario, traders may want to neutralize their vega exposure to avoid being negatively affected by changes in volatility.

This article focuses on setting up a Call Ratio Spread, a bullish option strategy that provides positive delta while allowing for further adjustments that could keep vega neutral. This allows traders to capitalize on Gold’s potential uptrend while minimizing risk from changes in implied volatility.

2. Current Market Context

The Gold futures market shows strong levels of support, which reinforces the bullish outlook. On the continuous Gold futures chart above GC1!, we observe key support levels at 2646.2 and 2627.2-2572.5. These levels could act as price floors, helping the uptrend continue if tested.

Similarly, when examining the contract-specific below chart for GCQ2025, we identify supports at 2725.4 and 2729.5-2705.5. These levels provide solid ground for bullish trades on this specific contract, giving traders additional confidence in entering long positions.

With implied volatility near its average (see the chart below), the market’s future volatility direction is unclear. Traders using options may choose adapt to this environment, ensuring that changes in volatility do not work against them.

3. Options Strategy: Call Ratio Spread

To take advantage of Gold’s uptrend while neutralizing the risk from changes in volatility, we could employ a Call Ratio Spread. This strategy offers a bullish stance while maintaining vega neutrality, protecting the trader from swings in implied volatility.

Setup:

Buy 1x 2600 Call at 256.15

Sell 2x 3500 Calls at 23.32

Expiration: July 28, 2025

This configuration generates positive delta, meaning the strategy will benefit from upward price movement. At the same time, by selling two calls at a higher strike, we offset the vega exposure, ensuring that changes in volatility won’t dramatically affect the position.

The strike prices and expiration selected help create a risk profile that works well in a bullish market. The maximum gain potential occurs if Gold continues to rise but stays below the higher 3500 strike, while the vega neutrality minimizes any volatility risks as the trade begins.

Notice the breakeven point for this strategy is 2809.5, meaning the trade becomes profitable if Gold exceeds this level by expiration.

4. Why Use Micros?

Traders looking for a more flexible approach can consider using Micro Gold Futures (symbol: MGC) instead of standard Gold futures contracts. Micro Gold Futures offer smaller contract sizes, which translate into lower margin requirements and a more precise way to control risk. This makes them an attractive alternative for traders with smaller accounts or those looking to scale into positions gradually.

Additionally, Micro Gold Futures allow traders to fine-tune their exposure to Gold without the larger capital commitment required by standard contracts. For those implementing strategies like the Call Ratio Spread, Micros provide a cost-effective way to execute similar trades with a lower financial commitment.

Contract Specs and Margin Requirements

Gold Futures (symbol: GC) represent 100 troy ounces of gold, and their margin requirements can vary depending on market volatility and the broker. Typically, the initial margin requirement for a standard Gold futures contract is around $10,000 to $12,000, but this can fluctuate. For traders seeking more flexibility, Micro Gold Futures (symbol: MGC) offer a smaller contract size, representing 10 troy ounces of gold. The margin requirement for Micro Gold Futures is significantly lower, usually in the range of $1,000 to $1,200, making it a more accessible option for those with smaller accounts or those looking to fine-tune their exposure.

5. Risk Management

As with any options trade, managing risk is essential. In the case of a Call Ratio Spread, the primary risk comes from the naked short calls at the 3500 strike price. If Gold rallies aggressively beyond 3500, the trader faces unlimited risk due to the uncovered nature of the short positions.

To mitigate this risk, traders should consider using stop-loss orders or adjusting the trade if Gold's price approaches the 3500 level too quickly. Another way to eliminate the unlimited risk component to the upside would be to convert the Call Ratio Spread into a Call Butterfly by buying an additional call above the 3500 strike price, effectively capping the risk. This adjustment still allows for positive delta exposure while limiting potential losses if Gold moves sharply higher.

Additionally, monitoring implied volatility is key. While the position starts with neutral vega exposure, this will change as the underlying asset price moves and time passes, especially as expiration approaches. The vega exposure can increase or decrease depending on these factors. If maintaining the vega-neutral characteristic is a priority, further adjustments—such as rolling options or modifying strike prices—could be made to keep the position aligned with the trader’s volatility outlook.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com - This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

BTC Bullish Outlook Based on BVIV Indicators (Oct 2024)Overview:

I’m seeing a strong bullish signal for BTC based on the latest data from the Bitcoin Volmex Implied Volatility Index (BVIV) and related indicators. Here’s why I believe the current setup favors a potential move to the upside.

Technical Analysis:

BVIV (Volatility Index):

The BVIV is trending lower, signaling that implied volatility is cooling off. Historically, declining volatility often precedes price stabilization, which can be a precursor to a bullish breakout. While the Z-score hasn't crossed below 0 yet, the trend suggests that this could soon happen, reinforcing the idea that the market is bottoming out.

ATR Percentage:

The ATR% is nearing the midline, and a break above it could indicate the start of increasing price action. This typically signals momentum building up for a larger directional move. Given that volatility is cooling off, I interpret this as a bullish signal for BTC.

Z-Score of RSI:

The Z-score of RSI has yet to cross below 0, but it is approaching the threshold. Once it does, it would further confirm the dissipation of overbought conditions and signal that bearish momentum is fading, adding strength to the bullish case.

Macro Factors Supporting BTC:

Institutional Adoption:

With Bitcoin ETFs progressing toward approval and increasing institutional interest, BTC is poised to benefit from a shift in market sentiment.

Global Liquidity Trends:

Central banks have recently softened their stance on aggressive rate hikes, improving liquidity conditions for risk-on assets like BTC. This shift could support a price recovery.

Safe-Haven Narrative:

As inflation remains a concern, Bitcoin could reclaim its narrative as a store of value, particularly if traditional assets struggle amidst ongoing economic uncertainty.

Post-Halving Cycle:

Bitcoin is now several months into its post-halving phase (April 2024), a period that has historically seen significant price appreciation as supply constraints kick in. We could see this dynamic continue to play out, especially as the market anticipates further price gains in the months to come.

Conclusion:

Based on the alignment of these technical indicators and broader macroeconomic factors, I believe BTC is poised for a bullish breakout. While implied volatility is decreasing, rising ATR% suggests momentum is building for a strong move. I’ll be watching for confirmation of the Z-score crossing below 0 on the BVIV and ATR% breaking above the midline for additional conviction.

Option Chain Before Earnings - $NVDA huge CALL skewThis week, keep an eye on NASDAQ:NVDA , which will release its quarterly earnings on Wednesday.

Here are this week’s earnings releases implemented by the TanukiTrade Options Overlay indicator for Tradingview:

08/28 Wednesday after market close: NVDA , CRWD , CRM

08/29 Thursday after market close: MRVL

The Options Overlay indicates that NVDA's call skew is above 55% at 54DTE, meaning that CALL options are priced 55% higher than PUT options for the binary expected move distance .

This suggests that the market is pricing in a strong upward move.

The yellow curve represents the binary expected move, while the blue curve shows the 16-delta OTM options. The green rectangle highlights the area where you can potentially profit from the butterfly trade if the earnings report meets bullish market expectations.

Upward price levels:

7/8 - 138

8/8 - 150

Downward price levels:

6/8 - 125

5/8 - 112

If you agree with the market’s bullish sentiment, one of the best R:R trades might be a directional NVDA call butterfly. You can buy it for $109 with the nearest Friday expiration, with a maximum (theoretical) profit of nearly $900. It’s worth executing this trade before the earnings announcement. Note that the green dashed line is theoretical; while it's not a traditional trendline according to classic TA, the long-term upward trend is still quite clear

Expiry: Aug 30

Legs: 1x140C -2x150C + 1x160C

Net debit: ~$100

Max profit: $890

$BABA volatility pricing skew on CALL side before earningsThe high vertical CALL pricing skew on the options chain shows that the CALL options for the September expiration are already much more expensive than the PUT options at the same expected move distance. This suggests that market participants are pricing in an upward move.

Let's take a closer look at the probability curve formed by the options chain. I'm very curious to see whether the 8/8 to +1/8 quadrant line will hold the price for BABA, or if it will continue to surge into the Upper Extreme quadrant, heading towards +4/8 until $100.

If everything stays the same, something like this could be an interesting lottery ticket for me. I'm thinking about an OTM call butterfly with a short expiration before earnings.

I have to admit, I’m not a big fan of risking on this red/black roulette type of play, but if things stay as they are, I might consider combining it with a 40 or 68DTE credit put ratio below and the call butterfly above before earnings.

But we'll see how things look on the day before earnings!

Options Blueprint Series: Pre and Post OPEC+ WTI Options PlaysIntroduction

The world of crude oil trading is significantly influenced by the decisions made by the Organization of the Petroleum Exporting Countries (OPEC) and its allies, collectively known as OPEC+. These meetings, which often dictate production levels, can lead to substantial market volatility. Traders and investors closely monitor these events, not only for their immediate impact on oil prices but also for the broader economic implications.

In this article, we explore two sophisticated options strategies designed to capitalize on the volatility surrounding OPEC+ meetings, specifically focusing on WTI Crude Oil Futures Options. We will delve into the double calendar spread, a strategy to exploit the expected rise in implied volatility (IV) before the meeting, and the transition to a long iron condor, which aims to profit from potential post-meeting volatility adjustments.

Understanding the Market Dynamics

OPEC+ meetings are pivotal events in the global oil market, with decisions that can significantly influence crude oil prices. These meetings typically revolve around discussions on production quotas, which directly affect the supply side of the oil market. The anticipation and outcomes of these meetings create a fertile ground for volatility, especially in the days leading up to and immediately following the announcements.

Implied Volatility (IV) Dynamics

Pre-Meeting Volatility: In the days leading up to an OPEC+ meeting, implied volatility (IV) often rises. This increase is driven by market uncertainty and the potential for significant price moves based on the meeting's outcome. Traders buy options to hedge against or speculate on the potential price movements, thereby increasing the demand for options and pushing up IV.

Post-Meeting Volatility: After the meeting, IV can either spike or drop sharply, depending on whether the outcome aligns with market expectations. An unexpected decision can cause a significant IV spike due to the new uncertainty introduced, while a decision in line with expectations can lead to a sharp drop as the uncertainty dissipates.

Strategy 1: Double Calendar Spread

The double calendar spread is a sophisticated options strategy that can potentially take advantage of rising implied volatility (IV) leading up to significant market events, such as the OPEC+ meeting. This strategy involves establishing positions in options with different expiration dates but the same strike price, allowing traders to profit from the increase in IV while managing risk effectively.

Structure

Long Legs: Buy longer-term call and put options.

Short Legs: Sell shorter-term call and put options.

The strategy typically involves setting up two calendar spreads at different strike prices (one higher and one lower), thus the term "double calendar."

Rationale

The rationale behind this strategy is that the longer-term options will experience a greater increase in IV as the event approaches, inflating their premiums more than the shorter-term options. As the short-term options expire, traders can realize a profit from the difference in premiums, assuming IV rises as expected.

Strategy 2: Transition to Long Iron Condor

As the OPEC+ meeting date approaches and the double calendar spread positions reach their peak profitability due to the elevated implied volatility (IV), it becomes strategic to transition into a long iron condor. This shift aims to capitalize on potential volatility changes and capture profits from the expected IV drop.

Structure

Closing the Double Calendar: Close the short-term call and put options from the double calendar spread.

Setting Up the Long Iron Condor: Sell new OTM call and put options with the same expiration date as the long legs of the double calendar spread.

The result is a position where the trader holds long options closer to the money and short options further out, creating a long condor structure.

Rationale

The rationale for transitioning to a long iron condor is to capture profits from a potential decrease in IV after the OPEC+ meeting.

Practical Example

To illustrate the application of the double calendar spread and the transition to a long iron condor, let's walk through a detailed example using hypothetical WTI Crude Oil Futures prices.

Double Calendar Spread Setup

1. Initial Conditions:

Current price of WTI Crude Oil Futures: $77.72 per barrel.

Date: One week before the OPEC+ meeting.

2. Long Legs:

Buy a call option with a strike price of $81, expiring on Jun-7 2024 @ 0.32.

Buy a put option with a strike price of $74, expiring on Jun-7 2024 @ 0.38.

3. Short Legs:

Sell a call option with a strike price of $81, expiring on May-31 2024 @ 0.05.

Sell a put option with a strike price of $74, expiring on May-31 2024 @ 0.09.

Note: We are using the CME Group Options Calculator in order to generate fair value prices and Greeks for any options on futures contracts.

Transition to Long Iron Condor

1. Closing the Double Calendar:

Close the short-term call and put options just before they expire @ 0.01 (assuming they are OTM on Friday May-31, before the market closes for the weekend).

2. Setting Up the Iron Condor:

Sell a call option with a strike price of $82, expiring on Jun-7 2024 @ 0.13.

Sell a put option with a strike price of $73, expiring on Jun-7 2024 @ 0.18.

0.11 and 0.17 are estimated values assuming WTI Crude Oil Futures remains fairly centered around 77.50 and that IV has risen into the OPEC+ meeting weekend.

Transitioning from the Double Calendar to the Long Iron Condor would be done on Friday May-31.

3. Resulting Position:

You now hold a long call at $81, a long put at $74, a short call at $82, and a short put at $73, forming a long iron condor.

The risk of the trade has been reduced by half (assuming the real fills coincide with the estimated values above) from 0.56 to 0.27 = $270 with a potential for reward of up to 0.73 (1 – 0.27) = $730.

This practical example demonstrates how to effectively implement and transition between the double calendar spread and the long iron condor to navigate the volatility surrounding an OPEC+ meeting.

Importance of Risk Management

Effective risk management is crucial when implementing options strategies, particularly around significant market events like the OPEC+ meeting. The volatility and potential for sharp market moves require traders to have robust risk management practices to protect their capital and ensure long-term success.

Avoiding Undefined Risk Exposure

Undefined risk exposure occurs when traders have no clear limit on their potential losses. This can happen with certain options strategies that involve selling naked options. To avoid this, traders should always define their risk by using strategies that have built-in risk limits, such as spreads and condors.

Precise Entries and Exits

Making precise entries and exits is critical in options trading. This involves:

Entering trades at optimal times to maximize potential profits.

Exiting trades at predetermined levels to lock in gains or limit losses.

Adjusting trades based on market conditions and new information.

Additional Risk Management Practices

Diversification: Spread risk across different assets and strategies.

Position Sizing: Allocate only a small percentage of capital to each trade to avoid significant losses from a single position.

Continuous Monitoring: Regularly review and adjust positions as market conditions evolve.

By adhering to these risk management principles, traders can navigate the complexities of the options market and mitigate the risks associated with volatile events like OPEC+ meetings.

Conclusion

Navigating the volatility surrounding significant market events like the OPEC+ meeting requires strategic planning and effective risk management. By implementing the double calendar spread before the meeting, traders can capitalize on the anticipated rise in implied volatility (IV). Transitioning to a long iron condor after the meeting allows traders to benefit from potential post-meeting volatility adjustments or price stabilization.

These strategies, when executed correctly, offer a structured approach to managing market uncertainties and capturing profits from both pre- and post-event volatility. The key lies in precise timing, appropriate strike selection, and diligent risk management practices to protect against adverse market movements.

By understanding and applying these sophisticated options strategies, traders can enhance their ability to navigate the complexities of the crude oil market and leverage the opportunities presented by OPEC+ meetings.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

DAX - Bouhmidi-Reversal next targets After a nervous start and breaking through the previous day's low (17716) and the lower Bouhmidi bands (17678), a relaxation in the form of a reversal towards the range of the previous day is emerging around noon. This is initially a positive sign! The next intraday targets are:

If defending the previous day's low: 17761/17863/17996

If falling below the previous day's low: 17678/17598/17519..

Quiet Before the Volatility Storm: WTI Crude Oil Options PlaysStay tuned!

Beyond this exploration of WTI Crude Oil options plays, we're excited to bring you a series of educational ideas dedicated to all types of options strategies. More insights coming soon!

Introduction to Market Volatility

In the realm of commodity trading, WTI Crude Oil stands out for its susceptibility to rapid price changes, making market volatility a focal point for traders. This volatility, essentially the rate at which the price of oil increases or decreases for a given set of returns, is a crucial concept for anyone involved in the oil market. It affects not only the risk and return profile of direct investments in crude oil but also plays a pivotal role in the pricing of derivatives and options tied to this commodity.

Volatility in the crude oil market can be attributed to a myriad of factors, ranging from geopolitical developments and supply-demand imbalances to economic indicators and natural disasters. For options traders, understanding the nuances of volatility is paramount, as it directly influences option pricing models through metrics such as Vega, which indicates the sensitivity of an option's price to changes in the volatility of the underlying asset.

By delving into both historical and implied volatility, traders can gain insights into past market movements and future expectations, respectively. Historical volatility provides a retrospective view of price fluctuation intensity over a specific period, offering a statistical measure of market risk. Implied volatility, on the other hand, reflects the market's forecast of a likely range of movement in crude oil prices, derived from the price of options.

Incorporating volatility analysis into trading strategies enables options traders to make more informed decisions, particularly when considering positions in WTI Crude Oil options. Whether aiming to capitalize on anticipated market movements or to hedge against potential price drops, volatility remains a critical element of successful trading in the oil market.

News as a Catalyst for Volatility

The crude oil market, with its global significance, is incredibly sensitive to news, where even rumors can precipitate fluctuations in prices. Recent events have starkly demonstrated this phenomenon, showcasing how geopolitical tensions, OPEC+ decisions, and inventory data can serve as major catalysts for volatility in WTI Crude Oil markets.

1. Geopolitical Tensions: Middle East Conflicts

Geopolitical events, especially in oil-rich regions like the Middle East, have a pronounced impact on oil prices. For instance, conflicts or tensions in this area can lead to fears of supply disruptions, prompting immediate spikes in oil prices due to the region's significant contribution to global oil supply. Such events underscore the market's vulnerability to geopolitical instability and the swift reaction of oil prices to news suggesting potential supply threats.

2. OPEC+ Production Decisions

The Organization of Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, play a pivotal role in global oil markets through their production decisions. An announcement by OPEC+ to cut production usually leads to an increase in oil prices, as the market anticipates a tighter supply. Conversely, decisions to increase production can cause prices to drop. These actions directly influence market sentiment and volatility, illustrating the significant impact of OPEC+ policies on global oil markets.

3. Inventory Data Releases

Weekly inventory data from major consumers like the United States can lead to immediate reactions in the oil market. An unexpected increase in crude oil inventories often leads to a decrease in prices, reflecting concerns over demand or oversupply. Conversely, a significant draw in inventories can lead to price spikes, as it may indicate higher demand or supply constraints. These inventory reports are closely watched by market participants as indicators of supply-demand balance, affecting trading strategies and market volatility.

Each of these events has the potential to cause significant movements in WTI Crude Oil prices, affecting the strategies of traders and investors alike. By closely monitoring these developments, market participants can better anticipate volatility and adjust their positions accordingly, highlighting the importance of staying informed on current events and their potential impact on the market.

Technical Analysis Tools: Bollinger Bands and the 14-Day ADX

A sophisticated approach to navigating the fluctuating markets of WTI Crude Oil could involve the combined use of Bollinger Bands and the 14-day Average Directional Index (ADX). While Bollinger Bands measure market volatility and provide visual cues about the market's overbought or oversold conditions, the ADX offers a unique perspective on market momentum and trend strength.

The 14-Day ADX is pivotal in assessing the strength of a trend. A rising ADX indicates a strengthening trend, whether bullish or bearish, while a declining ADX suggests a weakening trend or the onset of a range-bound market. For options traders, particularly those interested in the long strangle strategy, the ADX provides valuable information. A low or declining ADX signals a weak or non-existent trend.

Bollinger Bands® serve as a dynamic guide to understanding market volatility. In this case an idea could be to apply Bollinger Bands® to the 14-Day ADX values instead of the WTI Crude Oil Futures prices. When combined, a pierce of the lower Bollinger Bands®, may suggest an opportune moment to establish a long strangle position in anticipation of a forthcoming breakout while options prices may be underpriced.

This combined approach allows traders to fine tune their entry and exit points. By waiting for the ADX to signal a nascent trend and Bollinger Bands to indicate a period of low volatility, traders can position themselves advantageously before significant market movements.

Strategizing with Bollinger Bands and ADX: In the dance of market analysis, the interplay between the ADX and Bollinger Bands choreographs a strategy of precision. Traders can look for moments when the market is quiet and options are underpriced. This dual-focus approach maximizes the potential of entering a long strangle options trade at the most opportune time, aiming for potential gains from subsequent volatility spikes in the WTI Crude Oil market.

Strategies for Trading WTI Crude Oil Options

In the volatile landscape of WTI Crude Oil trading, strategic agility is paramount. One strategy that stands out for its ability to harness volatility is the long strangle. This strategy is especially relevant in periods of low implied volatility (IV), providing traders with a unique opportunity to capitalize on potential market shifts without committing to a specific direction of the move.

Understanding the Long Strangle

The long strangle options strategy involves purchasing both a call option and a put option on the same underlying asset, WTI Crude Oil in this case, with the same expiration date but at different strike prices. The call option has a higher strike price than the current underlying price, while the put option has a lower strike price. This setup positions the trader to profit from significant price movements in either direction.

The beauty of the long strangle lies in its flexibility and the limited risk exposure it offers. The total risk is confined to the premiums paid for the options, making it a controlled way to speculate on expected volatility. This strategy is particularly appealing when the IV of options is low, implying that the market expects calm but the trader anticipates turbulence ahead.

Risk Management and the Importance of Timing

Risk management is a critical component of successfully implementing the long strangle strategy. The key to minimizing risk while maximizing potential reward is timing. Entering the trade when IV is low—and, consequently, the cost of options is relatively cheaper—allows for greater profitability if the anticipated volatility materializes and the price of the underlying asset moves significantly.

The Implications of a Limited Risk Strategy

A limited risk strategy like the long strangle ensures that traders know their maximum potential loss upfront—the total amount of premiums paid. This predefined risk exposure is particularly advantageous in the unpredictable oil market, where sudden price swings can otherwise lead to substantial losses.

Moreover, the limited risk nature of the long strangle allows traders to maintain a balanced portfolio, allocating a portion of their capital to speculative trades without jeopardizing their entire investment. It's a strategic approach that leverages the inherent volatility of WTI Crude Oil, potentially turning market uncertainties into opportunities.

Case Studies: Real-world Applications of the Long Strangle in WTI Crude Oil Trading

In the ever-volatile world of WTI Crude Oil trading, several events have starkly highlighted the efficacy of the long strangle strategy. These case studies exemplify how sudden market movements, driven by unforeseen news or geopolitical developments, can provide significant opportunities for prepared traders. Here, we explore instances where shifts in volatility facilitated lucrative trades, underscoring the potential of strategic options plays.

Case Study 1 : Geopolitical Escalation in the Middle East

Event Overview: An unexpected escalation in geopolitical tensions in the Middle East led to concerns over potential supply disruptions. Given the region's pivotal role in global oil production, any threat to its stability can significantly impact crude oil prices.

Trading Strategy: Anticipating increased volatility, traders employing the long strangle strategy before the escalation could imply significant gains. As prices surged in response to the tensions, the value of a strangle would have potentially increased.

Case Study 2 : Surprise OPEC+ Production Cut Announcement

Event Overview: In a move that caught markets off-guard, OPEC+ announced a substantial cut in oil production. The decision aimed at stabilizing prices instead triggered a sharp increase in volatility as traders scrambled to adjust their positions.

Trading Strategy: Traders with long strangle positions in place could have capitalized on the sudden price jump.

Case Study 3 : Major Hurricane Disrupts Gulf Oil Production

Event Overview: A major hurricane hit the Gulf Coast, disrupting oil production and refining operations. The immediate threat to supply lines led to a spike in oil prices, reflecting the market's rapid response to supply-side shocks.

Trading Strategy: The long strangle strategy could be invaluable for traders who had positioned themselves ahead of the hurricane season. The abrupt increase in crude oil prices following the hurricane highlighted the strategy's advantage in situations where directional market movements are expected but their exact nature is uncertain.

Conclusion

These case studies illustrate the practical application of the long strangle strategy in navigating the tumultuous waters of WTI Crude Oil trading. By strategically entering positions during periods of low implied volatility, traders can set themselves up for success, leveraging market movements to their advantage while maintaining a controlled risk profile. The key takeaway is the importance of vigilance and readiness to act on sudden market changes, employing comprehensive risk management practices to safeguard investments while exploring speculative opportunities.

The essence of trading in such a dynamic market lies not just in predicting future movements but in preparing for them through well-thought-out strategies and an acute understanding of market indicators and global events. The long strangle options strategy, with its limited risk and potential for significant returns, exemplifies this approach, offering a compelling method for traders aiming to capitalize on the inherent volatility of WTI Crude Oil.

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: www.tradingview.com This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

SPX - A day in a life of a short trader Even if we had the FED meeting today - It was a clear and visible that selling pressure will lead the way. SPX started with a gap down and showed no attempt to close the gap at open or within first hour (initial balance). Right after intial balance we broke wit lower Bouhmidi-Band indicating more selling pressure to come. After two attempts to regain the first lower BB we saw in the last 30 minutes of trading more sell orders coming in and confirmation for trend continuation. At the end we close below of 2 sigma Bouhmidi-Band. SPX lost 1,6% at the end.

Korea bullish trend, buying dipsThesis: South Korea is being considered as an AI startup hub as well as a chip source for AI.

it has a bullish trend. i am waiting for price to reach the lower end of the lower dynamic volatility range to start incrementally building a position in 0.25-0.5 basis points

ETH Risk RangeWith Implied Volatility @ 39.96% we can expect an 164 point move within the next 3 weeks. if your looking for buying opportunities your downside risk would be minimal at the lower end of the range and if your looking for selling opportunities your upside risk would be minkmal at the top end of the range.

Celebrating 50 Years of Equity Options TradingAmid serious pushback, Chicago Board of Options Exchange (CBOE) went live on 26th April 1973. Options are now a standard tool for portfolio risk management. Not so, back then. They were seen as gambling instruments for reckless speculators.

Shortly after CBOE launch, Fischer Black, Myron Scholes, and Robert Merton provided a mathematical model for computing options prices.

This Nobel Prize winning model allowed options to be priced theoretically for the first time. It was a key driver in making options markets sophisticated, more efficient and much larger.

The Black Scholes Merton model ("BSM") forms the fundamental basis of options pricing. It allows traders to compute a theoretical price to options based on the underlying asset’s expected volatility.

Expected volatility is referred to as implied volatility (IV). Why implied? Because it is the volatility implied from an options price given other parameters from the BSM model.

COMPREHENDING BSM & BLACK76

Options have existed since the 17th Century. Option were limited to speculation and gambling in the absence of a sound and suitable pricing model such as BSM.

BSM offers a mathematically sound framework to compute theoretical price of European options using five inputs:

1. Underlying Asset Price

2. Implied Volatility (IV) of the Underlying Asset

3. Interest rates

4. Exercise (Strike) Price of the option

5. Time to expiry

A variant of the BSM for pricing options on futures, bond options, and swaptions is the Black Model (also known as Black76) which forms the basis of pricing options on commodity futures.

BSM is far from perfect. For starters, it makes unrealistic assumptions. Such as that stock prices follow a log-normal distribution and are continuous. That future volatility is known and remains constant. BSM assumes no transaction costs or taxes, no dividends from the stocks, and a constant risk-free rate.

Even though these assumptions are impractical, the BSM provides a useful approximation. In fact, the model is so commonly used that options prices are often quoted as IV. On the assumption that given IV, options price can be computed using BSM.

Actual options prices vary from theoretical ones based on supply-demand dynamics and with reality being different from the assumptions baked into BSM.

For instance, actual prices for the same expiry and at different strike prices have been observed to have different IV. Primarily given a higher likelihood of a downside plunge relative to upside rally. This difference in IVs across different strikes is referred to as volatility skew.

OPTIONS IN SUMMARY

Options involve two parties whereby one party acquires a right to buy or sell a pre-agreed fixed quantity of a stock/commodity at a pre-agreed price (the strike or the exercise price) at or before a pre-agreed future date (Expiry Date).

One party acquires the right (Option Buyer or Option Holder) and the other party takes on the obligation (Option Seller).

In consideration for granting the right, the Option Seller collects a premium (Option Price) from the Option Buyer.

To ensure that the Seller keeps up their promise to trade, such Sellers are required to post margins with the Clearing House.

Once buyers pay premium upfront, they are not required to post any additional margins with the Clearing House.

Where the Option Holder secures a right to buy, it is known as a Call Option. However, if the Option Holder acquires the right to sell, such an option is referred to as Put Option.

Where the Option Holder can exercise their right at or before any time before expiry, such Options are referred to as American Options.

Options that can be exercised only at expiry are referred to as European Options. While exercising is permitted at expiry, these European options positions can be closed out before expiry by selling out a long position or by buying back a short position.

Premiums for European options are typically lower than premiums compared to American options.

COMPREHENDING WALLSTREET’S FEAR GUAGE, FADING VIX, AND VIX1D

The CBOE Volatility Index (famously referred to as VIX and is also knows as fear gauge) is a real time index measuring the implied volatility of the S&P 500 for the next 30 days based on SPX Index options prices for options expiring in 23 to 37 days.

There are a range of financial products based on the VIX index allowing investors to hedge volatility risk in their portfolios.

In recent months, VIX has been fading into insignificance. Despite huge price moves in the S&P 500, VIX has remained staid. Why such inertia? Primarily because options markets have started to shift towards shorter expiries. Zero-Days-To-Expiry (0DTE) options now account for more than 40% of overall S&P options market volumes.

These very short-dated options allow traders to express views around specific events such as monetary policy meetings and economic releases. Their popularity has increased dramatically over the past few years, with volumes today nearly 4x that of 2020.

To account for this shift in market behaviour, the CBOE has launched the VIX1D i.e., the One-Day VIX. This index tracks the expected volatility over the upcoming day as determined by zero-day options prices.

More on Options Greeks and Risk Management using Options in a future paper.

DISCLAIMER

This case study is for educational purposes only and does not constitute investment recommendations or advice. Nor are they used to promote any specific products, or services.

Trading or investment ideas cited here are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management or trading under the market scenarios being discussed. Please read the FULL DISCLAIMER the link to which is provided in our profile description.

High IV sets up premium selling environmentWith VIX ripping on today's bank FUD the IV Rank and IV Percentile of SPY is the highest in a year's worth of trading days. This sets up opportunities for premium selling that have not existed for a very long time.

Rules:

SELL the 20 Delta Strikes at 45 DTE or greater in monthly expirations.

BUY wings at 10 Delta Strikes same DTE

That ended up being:

SELL May 350 Put

SELL May 414 Call

BUY May 325 Put

BUY May 425 Call

For 4.64 Credit.

The plan is to "manage deltas" and keep this position delta neutral through the duration until 50% credit received. That means if the sides get tested directionally roll up the untested side, increasing credit, to get the delta back to as close to 0 as is reasonable.

SPY analysis-option and fundmental

the big topic of this month and July has been RECESSION . I believe it depends all on the labour market now if we start to see increasing unemployment that could tip us into a recession. this is why I am short on the SPY because I believe this rally will fizzle out because there have been no real positive changes in the macroeconomics currently to fuel this rally, today we have initial jobless claims which will give us a good insight to which way the labour market is moving. which now is the main factor into the decision if we are going into a recession because the realized strength of the consumer is purely based on them receiving an income. Because of their credit card debt, the US consumer heavily relies on credit cards which could possibly mean with the labour market becoming weaker consumer spending could decrease even further as this has already started to happen. another sign that supports my view is that implied volatility has decreased and the lower the implied volatility the lower the premium paid for the option which means it will fall in value. as well as a put-to-call ratio of 1.265 which shows an increase of negativity around the SPY. currently, we have a volatility smirk for the SPY which is where the implied volatility for lower strike prices so this means investors are buying more puts(short position). this option analysis gives us a good insight into which way the SPY will move. on a micro company level, the cost of debt is increasing because of Hawkish rate hikes. if the cost of debt increases the weighted average cost of capital will increase(WACC) so for a company to be creating value its return on invested capital has to be higher than WACC. the reason I have included this is that i gives a good insight into what is actually causing these companies' value to decrease.

SPY: Short & Long Trading OpportunitiesSPY Daily providing brief directional opportunities for acute trades to the upside. Higher levels of conviction support the control held by sellers in the market auction; With a volume shelf last revisited and sustained notable in March 2021. After holding fair price of 377.03, the next critical level on watch for acceptance or rejection of fair value is 381.58, then KL of 385.42 (20SMA). Trend has been shown to be weaker when reaching resistance levels originating from March 2022. Levels >389.78 sees a revisit of next favorable area of structure via a gap to late 390's. Directional performance is contingent on using combined volume and value area placements during current market conditions// IV: 24.79%, IV Percentile: 79% , ATR: 8.79, Beta: 1.00