#AUDCHF - Short After Correction #ForexWith already being short, I am simply waiting for some sideways movement on a lot of the AUD pairs the beginning of next week.

If a corrective pattern does form and I get a reason to enter I will go short and bring my current positions stop loss to the same place my new one would be.

Any questions feel free to comment or drop me a message

Impulsecorrectioncontinuation

NZDCAD Continuation Looking to get into the continuation of the bearish momentum on this pair, a retracement looks to be occurring, I will have to wait for market open to see if price has begun its move lower or if it could possibly form a tight flag first. Either way this looks a very good setup on this pair.

ORBEX: EURUSD Triangle Wave Hints to Short-Term UpsideEURUSD triangle structure seems to suggest that we have a little more upside correction left before turning lower.

The test could take place near 1.13, the 78.6% Fibonacci and also a price/trendline intersection. Both MACD and the RSI support short-term bulls!

If successful, the chances of reaching a fresh multiyear low would increase.

Trade safe

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice

ORBEX: EURAUD Correction Likely To Lead To Further Upside!EURAUD could move higher to complete minor wave 2 above 1.6800 levels. Before continuing higher, it is necessary to complete the minute correction that started at 1.6800 top.

With a low at 1.618% FE at 1.5900 round level, which is also a double bottom level, the correction could have either ended as a single zigzag or has another bearish leg down between 1.59-1.55.

Look for a valid break above 1.6300 top but before reaching there focus on whether a potential upside is limited to 1.6240 -the 50% FR of 1.6435-1.6045 (minute x wave top to current low price).

Stavros Tousios

Head of Investment Research

Orbex

This analysis is provided as general market commentary and does not constitute investment advice.

ORBEX: CADCHF - Primary C Expected to End Near 0.7950!It looks like the corrective wave (2) of the bullish minor degree has ended at 0.7434 with an open complex w,x,y minute pattern. The recent upside looks impulsive (awe could expect a more complex pattern with a flat likely to appear) and fresh highs could be expected once a valid breakout of minor 1 top is seen.

In the short-term, we could receive a deeper pullback before continuing higher to take out minute wave ( iii ) near 0.77 round level. Or, we could get there first and then receive a pullback for a retest of minor 1 top.

Minor wave 3 is expected to end near 0.7764 and as part of the intermediate impulse to the upside, minor 5 has a medium-term potential near 1.79.

Intermediate wave 5 is part of the A,B,C primary correction (A: 0.7958, B: 0.7222)

This opportunity would be invalidated below 0.7350. A break below 0.7430 would be an early sign of invalidation!

Stavros Tousios

Head of Investment Research

Orbex

ORBEX: EURUSD - Are We Going Lower After Minor 4's Completion?It looks like the corrective minor wave 4 has ended a tad above the strong 1.1025 resistance, taking our breakeven stops. The recent attempt to push prices higher is most likely done for now and fresh lows could be expected.

Minor wave 5 is expected to end below the most recent low of 1.0880, where intermediate wave 3 will also see its end. The intermediate wave 3 is part of the primary A,B,C zigzag with waves A and B at 1.13 and 1.1816, respectively. C will finish this correction with an intermediate 5.

The minute upside correction is part of a bullish flag which could have prices sliding down to 1.07/1.06 medium-term

This opportunity would be invalidated above 1.1063 in the short-term, but in the medium-term, we could see an upside completing a deeper correction closer to minute wave 1 low near 1.1195. A break above the latter would most likely invalidate bears in the longer-term.

Stavros Tousios

Head of Investment Research

Orbex

SWISS FRANC CURRENCY INDEX (SXY) DAILY TIMEFRAME SHORTThe Swiss Franc currency index is currently moving in a series of lower highs and lower lows, characteristic of a downtrend. The price is clearly moving downwards with brief correctional pauses as shown by the ascending wedges and bear flag chart patterns. I am targeting a short trade toward the 97.8 area, which will be my profit taking zone. This area represents a potential buy zone as it is the bottom of the correctional structure. I certainly hope history repeats itself with this trade and the 90% rule sticks out!!!.

A break above 100 might change my bias a bit, but currently i am targeting the 07.8 price level for profit-taking.

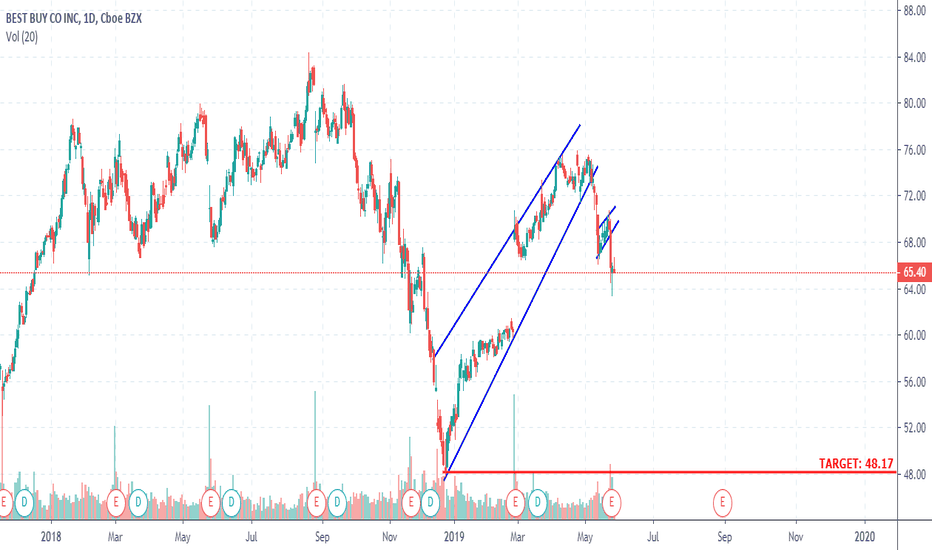

BEST BUY DAILY TIMEFRAME SHORTPrices dropped sharply before forming an ascending wedge, which topped out at the 76 price level. Now, price has already broken out of this corrective structure to the downside and is making a continuation move, with two opportunities to scale in already gone. But you can still jump in with proper risk management and target the bottom of the corrective structure, at the 48.17 price level. May the bears pounce on unsuspecting buyers lol!!

NVIDIA DAILY TIMEFRAME SHORTPrices have been tumbling down recently, having broken out of a corrective structure in the form of a bear flag pattern. This pattern was a good way for prices to blow off some steam, after the massive sell-off. Now we expect the prices to go towards the bottom of the corrective structure (bear flag pattern). This is a classic setup and there is no need to say much because price says it all. May the bears take over the world!!!

Target: 125.33

GBP/CAD SHORT 1-HOUR TIMEFRAME CONTINUATION (SCALING IN)Price formed another corrective structure in the form of a bear flag pattern after sellers struggled to hold ground. Now it has just broken to the downside and we are expecting further down movement. Things are a bit slow this week especially after the bank holidays yesterday. Risk management should be on point always. The technicals of this trade are;

Stop Loss: 1.70764

Target: 1.69140

NASPERS (NPN) DAILY TIMEFRAME SHORT The stock price is moving in a series of impulses and corrections , as it nears the ascending trendline. Possible targets are around the 271 330, which represents the bottom of the bear flag pattern. The price has already broken through the bear flag pattern and is moving closer to the target area.

WE CAUGHT 295 PIPS ON GBP/NZD!!! LET'S DO IT AGAINIf price should move below the 1.9350, i will be entering a short position again. Well this trade was obviously epic, as i entered it on a Thursday, on the daily timeframe, and Friday i spent half the morning in a gruesome Financial Reporting exam. Let it be known that i normally enter my trades using the 4-hour and the hourly timeframes. This was almost a first, if not a second. Can't say i wasn't pleased when i came back and the trade started moving in my favor. It was as if it was waiting for me to come back from the exam center. This trade has taught me a few things:

1. Don't focus on pips, focus on the strategy. If you want pips that bad, go on a higher timeframe. Otherwise focus on the process.

2. Set your stop loss and take profit levels and go meet some girls. I set my stops and had to go for an exam for three hours and i trusted that even if i was wrong, i would be taken out at a fairly reasonable level. There is more to life than trading.

3. The higher the timeframe, the more your patience is tested. I held this trade for close to a day before i could see some feasible profits. Don't just enter a trade on a higher timeframe (daily, weekly) and expect miracles immediately. An exception would be when there is a market crash (like the oil crash of 2018).

4. Trust the process. This is self explanatory. If you have a working trading system, why try and modify it? No system will give you 100% success. As long as it makes you profitable, it is a good system. So be content and scan for set-ups.

GBP/CAD 4-HOUR TIMEFRAME SHORTGBP/CAD recently broke out of the daily corrective structure that started out in early September 2018. This was in the form of an 800 pip move. We are expecting this drop to continue, as price is currently making a smaller corrective structure, and therefore we can expect a continuation to the downside after this bear flag is complete. It will also be interesting to note how the sterling will react to the resignation of the second woman-prime minister of the UK, Theresa May, thirteen days from now on the 7th of June. I hope there will be more selling. In bears we sell!!!

NZD/CHF DAILY TIMEFRAME SHORTNZD/CHF currency pair is moving in a gradual downtrend, making lower highs and lower lows. We can expect price to make a corrective structure and creep higher towards the 0.6700 area, before reversing and continuing with the current trend. We will wait for price to blow of some steam and slow down before we consider any shorting opportunities. Prices can also move closer towards the trendline, before resuming the downward trend. Always follow price and don't try to be a wizard. If wizards exist, then i am certainly not one of them.

CHF/JPY DAILY TIMEFRAME SHORTCHF/JPY is currently recuperating after the big sell we took. It seems history might repeat itself. Price is making a bear flag pattern on the 4-hour timeframe. If price does indeed break to the downside, i will be taking a short trade targeting the bottom of the flag pattern. Entries will be posted once the trade is ready. For now, we wait. Patience is the key.

Target Take Profit: 107.880

Trading Rules:

1. Trust the process

2. Patience is key

3. Secure the bag

4. Repeat

USD/JPY DAILY TIMEFRAME SHORTPrices formed an impulse to the downside and then moved up after a serious stop hunt, or rather rejection caused by the buyers, who came in and pushed prices higher. This was evidenced by the correctional structure (rising wedge pattern). Price is currently moving downwards after it retested the support turned resistance of the rising wedge pattern. On the 4-hour timeframe, price has already broken out of a second correction pattern (bear flag pattern in this instance) and is moving further downwards. This trade can be played both on higher timeframes as a swing, or on shorter timeframes. The choice will depend on your patience and account size. The technicals of the trade are as follows:

4-HOUR TIMEFRAME STOP LOSS: 113.043

4-HOUR TIMEFRAME TARGET: 109.090

DAILY TIMEFRAME STOP LOSS:

DAILY TIMEFRAME TARGET 2: 107.541

May the bears be with you!!!

GBP/NZD DAILY TIMEFRAME SHORTGBP/NZD has just broken out of the corrective structure to the downside, therefore we expect a further continuation to the downside over the next hours/days. Price formed a bearish flag pattern after a big impulsive move to the downside. The technicals of this trade are as follows:

Take Profit 1: 1.87247

Take Profit 2: 1.82568

"The definition of insanity is doing the same thing over and over again and expect different results" - Albert Einstein

CAD/CHF 4-HOUR TIMEFRAME SHORT ENTRYThis trade might/might not have been forecasted on this channel. Price is currently breaking out of a bear flag pattern and creeping to the downside. My take profit is placed at 0.74640, which is the bottom of the flag pattern. Patience is required as usual, as the market is heavily oversold and buyers might "taunt" us. May the bears be with us!!!

SASOL (SOL) 1-HOUR TIMEFRAME SHORTThis stock is moving in a downtrend, and the weekly timeframe shows a possible right shoulder forming. A break of the neckline on this weekly timeframe will signal further bearish momentum. On the 1-hour timeframe, price are trickling down as the momentary uptrend has finished and prices are below that ascending trendline, forming a series of lower highs and lower lows and also forming a series of bear flag patterns. My figures are as follows:

Entry: Now

Stop Loss:44 000

Target Take Profit: 40 000

Is it just a coincidence that the crude oil prices are also falling? We will never know.