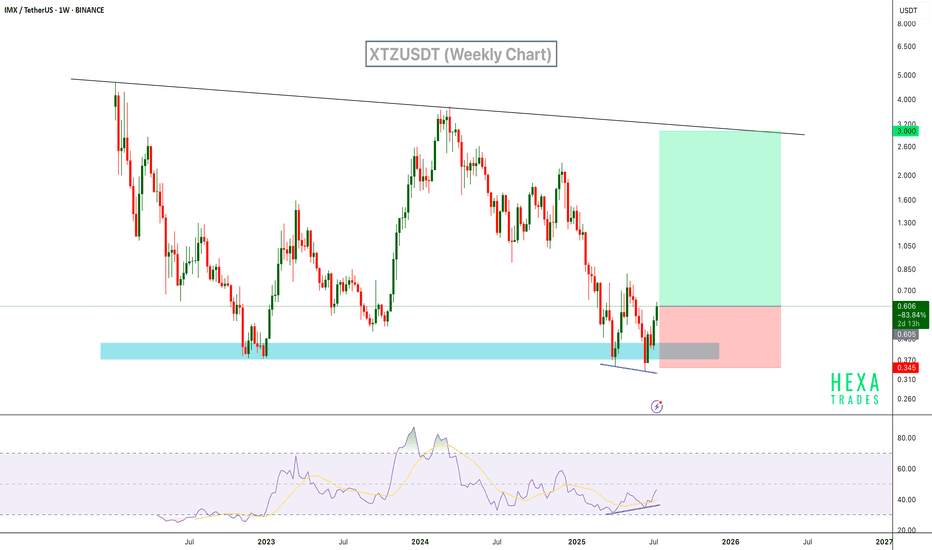

IMX Signals Reversal with RSI Bullish DivergenceIMX has shown a strong bounce from a demand zone, backed by clear bullish divergence on the RSI. Price printed a higher low on the oscillator while price action formed a lower low – a classic reversal signal. This area has acted as support multiple times in the past, and we can expect a reversal from the current support level.

Resistance 1:

Resistance 2:

Resistance 2:

Cheers

Hexa

BINANCE:IMXUSDT CRYPTO:IMXUSD

Imx

IMX – Range Low ReclaimedIMX has once again defended the $0.37–0.38 demand zone, bouncing sharply off the lows. This level has acted as a long-term accumulation base since late 2022, and price is now showing early signs of another range rotation.

Currently trading at $0.61, IMX is holding above the reclaimed support. As long as this level is maintained, the setup favors a move toward the mid-range and potentially the upper boundary of the established range.

🎯 Key Levels:

Support: $0.38 (range low & invalidation)

Mid-range: $1

Target: $2.65 (range high)

If bulls can push through the $1 mid-range resistance, the top of the range at $2.65 becomes the next magnet.

📌 Risk Management:

$0.38 is the line in the sand. A close below this level breaks the structure and invalidates the setup.

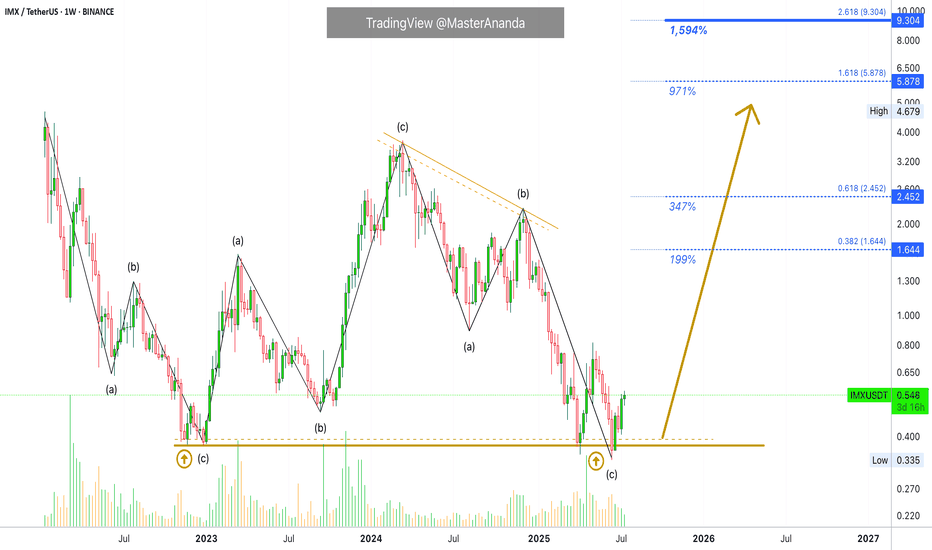

A New All-Time High Guaranteed for ImmutableX (1,600% PP)IMX produced a strong bullish cycle between December 2022 and March 2024. The entire bullish wave was corrected beyond 100%. This means that IMXUSDT hit a lower low. It went below the starting point of the last bullish wave. This is good in several ways.

The last move being deleted in its entirety opens the doors for a new bullish cycle with unlimited growth potential. We also know that all weak hands have been removed. Anybody who wanted to sell had more than a year to do so with all profits erased from the previous cycle. A total flush, a full reset.

The last bullish cycle produced more than 850%. We now know that this much is do-able so it becomes very easy. Last time market conditions were mixed to say the least, but not extremely bullish nor the best possible.

If IMXUSDT can grew this much in a mixed market, how much can it grow in a favorable market, in a bull market?

So, we aim for a strong higher high, a new all-time high. This opens up $5.9 an $9.3 as target for this newly developing bullish phase.

Thank you for reading.

Namaste.

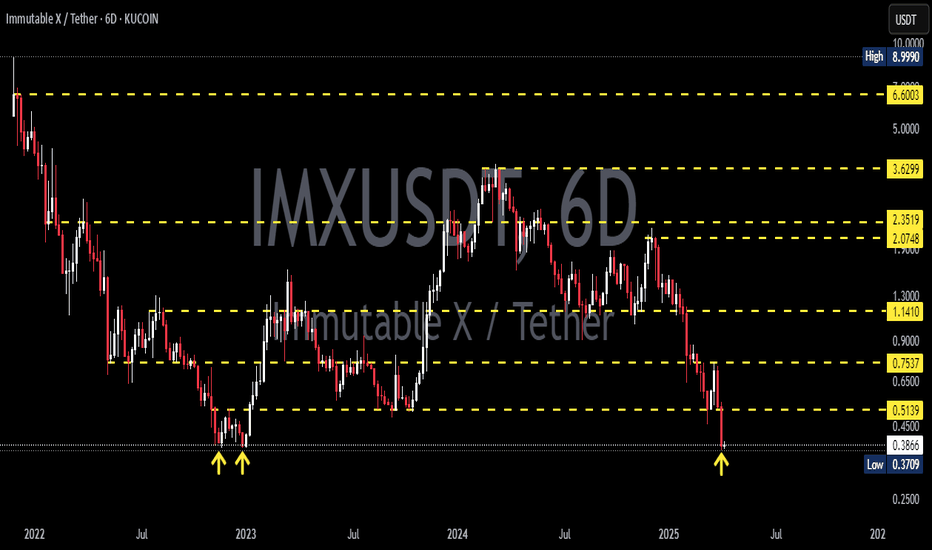

Immutable Long-Term Support Established (New 3000% Wave Starts)Here we have the establishment and confirmation of a long-term support and double-bottom. IMXUSDT activated in April 2025 the same level and low as back in November 2022.

From November 2022 through March 2024 IMX went bullish. This bullish cycle produced 900% total growth (10X).

From March 2024 through April 2025 IMX went bearish. This bearish period removed all gains from the previous bullish cycle. A complete reset.

Now IMXUSDT is back to zero and anything is possible. This project can grow 1,655% as shown on the chart just as it can grow 3,000% or even 10,000%.

The reason why I cannot make a more accurate prediction about the next All-Time High is because there is not enough chart data. Immutable was not present in the last bull market so we don't know how this pair is likely to behave in a similar cycle.

900% growth is quite decent in the transition/recovery year, so I wouldn't be surprised to see at the minimum 2,000% to 3,000% growth in the coming months. Can be more, can be less, but it will grow.

Looking closer, in the last three months IMXUSDT produced a classic rounded bottom pattern. This week, the action is moving back above the baseline; the bullish zone.

This weekly session closes in just a few hours. Once the week closes above the blue dotted line, this signal is fully confirmed. The same signal from early 2023. This clearly shows what I've been saying, we will have a bull market now, in 2025. Prepare for long-term growth.

Namaste.

Over 140% profit with IMX (3D)IMX appears to be in a large wave B, which is forming a triangle. It is currently at the end of wave d of B.

It is expected that upon touching the green zone, wave e of B will begin, pushing the price into a bullish phase.

We are looking for buy/long positions in the green zone.

A weekly candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

IMXUSDT Forming Inverse Head and Shoulder

IMXUSDT is currently showcasing one of the most reliable bullish reversal patterns on the charts – the inverse head and shoulders. This formation typically signals a shift from a bearish to a bullish trend, and with the neckline nearing a potential breakout point, this setup is becoming increasingly attractive. The current price action reflects a strong bounce from a key support level, aligning perfectly with the right shoulder of the pattern.

Volume has started to rise significantly during this bounce, which further validates the possibility of a confirmed breakout once the neckline is breached. Such volume activity typically precedes large price movements, especially when it coincides with technical patterns like this. Traders and investors are beginning to recognize this potential and are showing renewed interest in IMX.

With an expected gain of 150% to 160% from current levels, this setup could be one of the most explosive moves in the altcoin space. The pattern targets suggest a move toward previous highs, making IMXUSDT a strong candidate for mid-term bullish trades. The broader market sentiment also supports altcoin rallies, adding fuel to the bullish thesis for this coin.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.599.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.602

First target: 0.649

Second target: 0.682

Third target: 0.721

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.390

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.407

First target: 0.426

Second target: 0.449

Third target: 0.480

#IMX/USDT#IMX

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.503.

Entry price: 0.0528

First target: 0.540

Second target: 0.560

Third target: 0.587

IMX looks bullish (12H)The IMX pair has hunted a strong origin of movement, which is the key factor behind our bullish outlook on this coin.

After the hunt, this strong origin broke the trigger line, forming a bullish CH on the chart. Now, as the price pulls back toward support zones, we are looking for buy/long positions.

The targets are marked on the chart.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

IMX Long SL -12.83%IMX/USDT Long Setup

Reason:

Successfully Breakout from Major trend.

Break of Internal Structure.

Strong Bullish Momentum.

Resting on Major Support.

Taken All possible Liquidity.

All technical indicators suggesting Strong bullish Wave

Best Regards,

The Panda

Pro tip:

Hold !

BINANCE:IMXUSDT.P

BINANCE:IMXUSDT

COINBASE:IMXUSDC.P

MEXC:IMXUSDT

Alikze »» STRK | Trading range🔍 Technical analysis: Trading range

- It is in a downtrend on the 1D daily time frame.

- Currently, it is in the area between 0.33 and 0.42 as a trading range.

- In case of support in the 0.39 area, it can grow up to the supply area.

🛑 The most important resistance: 0.586

- Due to the fact that there is demand in the current area, this failure can happen from above.

- He has tested the swing several times. According to the momentum, there is an expectation of failure from above.

- But if there is consolidation below the 0.39 area and there is a break from the bottom, the bearish scenario will gain strength.

💎 Alternative scenario: Considering that the formation of a bearish flag pattern is given, if the 0.39 area is not maintained and stabilizes below the area, we can expect confirmation of the bearish flag pattern, which with the breaking of the trading range area can be a correction as much as the previous leg. experience another.

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««

BINANCE:STRKUSDT

Will #IMX Bulls Get Enough Momentum For a Bullish Reversal?Yello, Paradisers! Is #IMXUSDT ready to make a decisive move, or are we in for more consolidation? Let’s dive into the key levels of #Immutable:

💎#IMX has been trading within a descending channel on the 4-hour timeframe, creating a classic pattern of lower highs and lower lows. #IMXUSD got rejected from the descending resistance at $1.52 and is going to lower levels for liquidity capture.

💎For a bullish breakout, #IMX needs to push above the descending resistance near $1.524. A confirmed close above this level would pave the way for a potential rally toward the $2.000–$2.200 major resistance zone, where sellers are likely to step in. This scenario hinges on strong bullish momentum and volume so you can watch these for confirmation.

💎If #Immutable cannot get enough momentum to breach above the descending resistance then the probability is high that it will go lower for support. The support zone between $1.072 and $0.906 is crucial. This level has held firm during recent declines, providing a solid base for price action. The bulls have previously stepped here on these levels and defended them.

💎However, if #IMXUSDT breaks below $0.906 and closes a candle below this strong support, the bullish outlook will be invalidated. In this case, #IMX could retest lower levels, with the next key zone around $0.800 or lower, signaling a significant shift in market sentiment.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

#IMX/USDT Ready to launch upwards#IMX

The price is moving in a descending channel on the 4-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 1.30

We have an upward trend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.46

First target 1.56

Second target 1.64

Third target 1.74

Is GameFi Making a Comeback with Immutable X (IMX)?The blockchain gaming sector is experiencing a significant resurgence, with Immutable X (IMX) at the forefront of this revival. On December 19, 2024, at 11:00 AM UTC, "Oxya Origin," a game developed by Ubisoft’s French incubator studio, is set to launch on Immutable's platform. This collaboration underscores the renewed interest in GameFi, blending gaming with decentralized finance (DeFi) elements through Non-Fungible Tokens (NFTs).

Market Analysis and Technical Insights

As of December 18, 2024, IMX is trading at $1.69 with a 24-hour trading volume of $98,397,272 USD, down by 6.29% in the last day. Despite this dip, IMX holds a substantial market cap of $2.86 billion, ranking it at #53 on CoinMarketCap with a circulating supply of 1.69 billion tokens out of a max supply of 2 billion. This market cap reflects a robust growth trajectory since its inception, reaching an all-time high of $9.50, which signifies strong investor confidence and potential for future growth.

The recent price action of CRYPTOCAP_OLD:IMX suggests a possible bullish trend. The token has immediate support at the 65% Fibonacci retracement level, offering a potential bounce back point for those looking to trade. The Relative Strength Index (RSI) currently sits at 38, indicating there’s room for the token to rally before being considered overbought. With the upcoming launch of Oxya Origin, analysts predict a surge towards the $2 resistance, a pivotal level before any significant correction or further breakout.

Immutable X's Technological Edge

Immutable X is not just another blockchain; it's a layer-two scaling solution specifically designed for NFTs on Ethereum. It tackles the blockchain's notorious issues like scalability, user experience, liquidity, and developer speed. By employing zero-knowledge rollups (zk-rollups), Immutable X promises zero gas fees for NFT minting and trading, alongside instant transaction confirmations and a transaction speed of over 9,000 per second. This scalability is crucial for mainstream adoption in gaming where speed and cost-efficiency are key.

Unique Positioning: Immutable X's focus on NFTs using zk-rollups positions it uniquely in the market. It's seen as a potential "NFT blockchain" due to its specialized approach to scaling solutions. The API abstraction layer simplifies interactions for developers, making integration into games and platforms straightforward. This ease of use is expected to attract more established companies in the gaming and content creation sectors, further fueling the ecosystem's growth. Additionally, features like the "Link" allow for seamless wallet connectivity, enhancing user experience without compromising security.

Ecosystem Growth: The launch of Oxya Origin, which has already seen $7 million in NFT sales and 13,000 ETH in secondary market volume, indicates strong community and investor backing. Immutable's ecosystem has grown impressively, with over 4 million signups for its Passport service and more than 460 games signed on, showcasing its appeal and scalability in the gaming industry.

Conclusion

Immutable X ( CRYPTOCAP_OLD:IMX ) stands at a pivotal moment in the blockchain gaming space. With its technological innovations, strategic partnerships like the one with Ubisoft, and robust market performance, CRYPTOCAP_OLD:IMX is not just making a comeback for GameFi; it's setting the stage for a new era of blockchain-integrated gaming. The technical analysis suggests immediate opportunities for traders, while the fundamental strengths of the platform indicate long-term growth potential. As we watch Oxya Origin launch, the market's response could very well dictate the next significant move for IMX, potentially pushing it past the $2 resistance level into new highs.

IMX BUY!!!Hello friends

This currency has created a good position due to the failure of its downward structure.

In case of return, I have specified the areas where you can buy.

And if it reaches our buying range, it can move up to the specified targets.

This analysis is only reviewed from a technical point of view.

Don't forget capital management, friends.

be successful and profitable.

IMX looks bullish (2D)IMX appears to be within a large diametric pattern and is currently in the middle of Wave D. If it maintains the green zone, it could continue its upward movement for a long time to complete Wave E.

The long-term and mid-term targets are between $5.5 to $7.0.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You