Deep Dive Into Relative Strength Index (RSI)The Relative Strength Index (RSI) is a momentum oscillator developed by J. Welles Wilder Jr. that measures the speed and magnitude of price changes.

Introduction

In the world of trading, timing is everything — and few indicators have stood the test of time like the Relative Strength Index (RSI). Introduced by J. Welles Wilder in 1978, the RSI is a momentum oscillator that helps traders evaluate the strength and speed of price movements. Whether you're trading stocks, forex, or crypto, understanding how RSI is calculated and how to interpret its signals can give you a critical edge.

In this article, we’ll break down exactly how the RSI works, explore its formula, and dive into practical ways you can incorporate it into your trading strategies. From spotting potential reversals to identifying overbought and oversold conditions, the RSI remains a cornerstone of technical analysis — but only if you know how to use it properly.

Let’s explore the mechanics and the mindset behind this powerful indicator.

What Is RSI and How Is It Calculated?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements over a defined period. It outputs a value between 0 and 100, which helps traders determine whether an asset is overbought or oversold.

The default RSI setting uses a 14-period lookback window and is calculated with the following steps:

🔷Calculate the average gain and loss over the last 14 periods:

Average Gain = Sum of all gains over the past 14 periods / 14

Average Loss = Sum of all losses over the past 14 periods / 14

🔷Compute the Relative Strength (RS):

RS = Average Gain / Average Loss

🔷Apply the RSI formula:

RSI=100−(100/(1+RS))

The result is a single number between 0 and 100 that indicates the asset's momentum.

How to Use RSI in Trading Strategies

⚡️Overbought and Oversold Conditions Strategy

RSI > 70 typically signals that an asset may be overbought and due for a pullback.

RSI < 30 suggests the asset might be oversold, potentially primed for a bounce.

However, these levels aren’t absolute sell or buy signals. In strong trends, RSI can stay overbought or oversold for extended periods.

📈Long Trading Strategy Example:

1. Identify the major trend, to find the long trades it shall be uptrend. On the screen below you can see 1D time frame for BITMART:BTCUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI falls below 30. This is our oversold condition and we are going to look for long trade.

3. Find the local support zone and open long trade.

4. Take profit when price reaches resistance level next to the previous swing high

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

📉Short Trading Strategy Example

1. Identify the major trend, to find the short trades it shall be downtrend. On the screen below you can see 1D time frame for BITMART:ETHUSDT.P .

2. Move to lower time frame (in our case 4h) and find the moment when RSI grows above 70. This is our overbought condition and we are going to look for short trade.

3. Find the local resistance zone and open short trade.

4. Take profit when price reaches support level next to the previous swing low

5. Don’t forget to put initial stop loss when enter position. The best stop loss which will give you 3:1 risk to reward ratio.

⚡️RSI Breakout Strategy

RSI is breaking through 60 indicating bullish momentum shift if the long-term trend is bullish can be the potential long signal

RSI is breaking down 40 indicating bearish momentum shift if the long-term trend is bearish can be the potential short signal

This strategy works great only on the trending market, don’t use it on the range bounded market to avoid whiplashes.

📈Long trading strategy example:

1. Make sure that long-term trend is bullish. Use 200 period EMA as its approximation. If price remains above it we can look for potential long trade setup.

2. If RSI crossed above the level 60 open long trade.

3. Put the initial stop-loss under the signal candle’s low.

4. Take profit when price reached 3:1 risk-to-reward ratio.

📉Short trading strategy example

1. Make sure that long-term trend is bearish. Use 200 period EMA as it’s approximation. If price remains below it we can look for potential short trade setup.

2. If RSI crossed below the level 40 open short trade.

3. Put the initial stop-loss above the signal candle’s high.

4. Take profit when price reached 3:1 risk-to-reward ratio. In our case we received very fast and profitable trade

⚡️RSI Divergence Strategy

RSI can be used also as a trend reversal indicator if we are looking for divergences. This is very reliable sign of current trend weakness and great opportunity open trade against the trend. Usually it’s not recommended, but in case if divergence can be applicable.

Bullish divergence is the situation when price created the lower low, while RSI made the lower low. Usually, it indicates that current downtrend is weakening and we can look for long trades

Bearish divergence is the situation when price created the higher high, while RSI made the lower high. Usually, it indicates that current uptrend is weakening and we can look for short trades

😎Important hint: it’s rarely covered in textbooks about technical analysis, but in our opinion it’s better to used divergences when RSI was able to cross level 50 between two lows/highs.

📈Long trading strategy example

1. Find at the chart situation, when the price made the lower low

2. At the same time RSI shall set the higher low

3. RSI shall break level 50 between these lows indicating shift to the bullish momentum

4. If price failed to set the clean breakdown open long trade on the candle which set the lower low. Put stop loss under it’s low

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

📉Short trading strategy example

1. Find at the chart situation, when the price made the higher high

2. At the same time RSI shall set the lower high

3. RSI shall break level 50 between these highs indicating shift to the bearish momentum

4. If price failed to set the clean breakout open short trade on the candle which set the higher high. Put stop loss above it’s high

5. Take profit at 3:1 RR. When you master this concept, you will be able to have much more RR trades, even 10:1. This is possible because when trend finish you have the highest potential upside

Conclusion

The Relative Strength Index (RSI) remains one of the most powerful and flexible tools in a trader’s technical arsenal — but its real value lies in how you use it.

We’ve explored three key RSI strategies:

✅ Overbought/Oversold setups offer simple entry signals in ranging markets, where price tends to revert to the mean.

✅ Breakout strategies unlock RSI’s momentum-tracking potential, helping you ride strong directional moves with confidence.

✅ Divergence detection reveals hidden shifts in market sentiment, giving you an early warning of possible reversals or trend continuations.

Each approach has its strengths — and its risks — but together, they offer a complete framework for using RSI across different market conditions

🔑 Key Takeaways:

RSI is not just a “buy low, sell high” tool — it’s a multi-dimensional indicator that adapts to trends, momentum, and market structure.

The best RSI signals come from confluence: combining RSI with price action, support/resistance, volume, or trend filters like moving averages.

Patience and discipline are essential — RSI signals are only effective when paired with proper risk management and confirmation.

By mastering RSI beyond the basics, you'll be better equipped to make timely, confident, and informed trading decisions — whether you're entering a pullback, chasing a breakout, or spotting the early signs of reversal.

Index

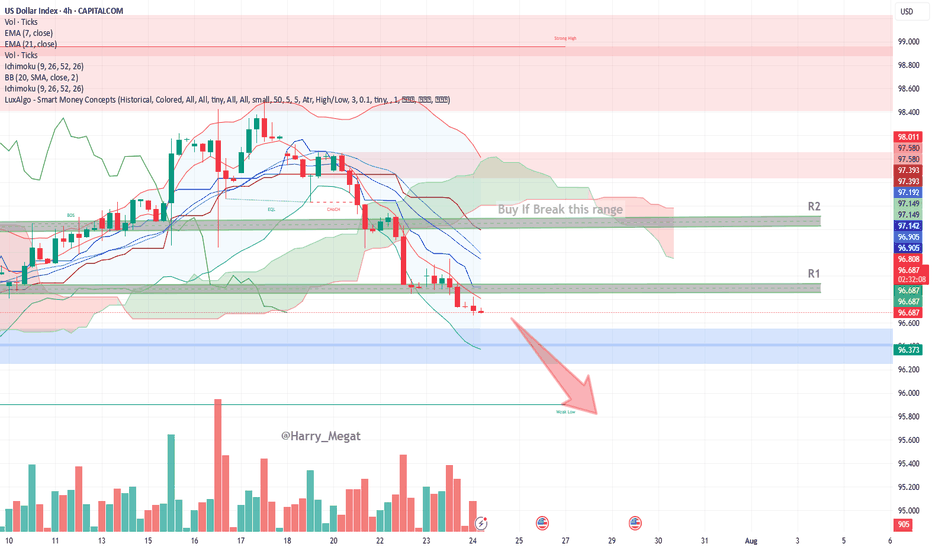

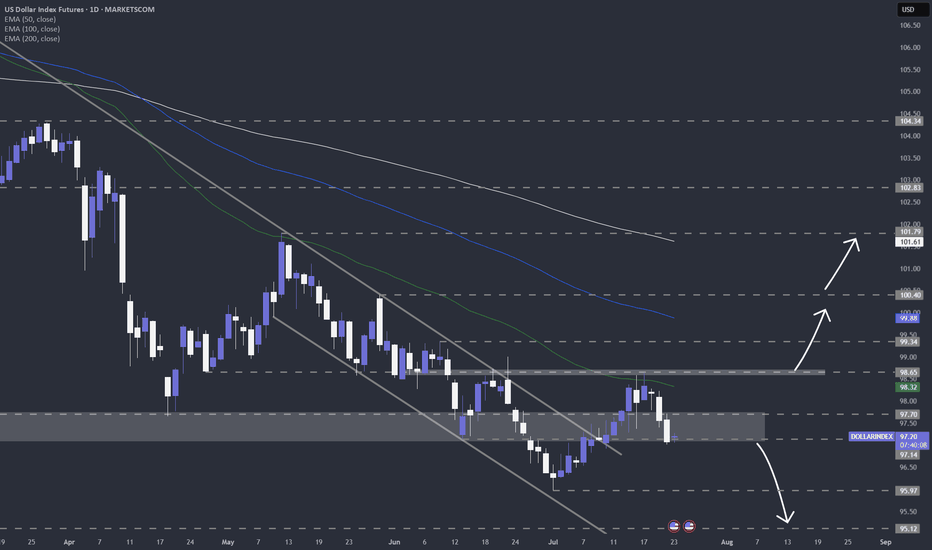

US Dollar Index (DXY) – 4H Chart AnalysisUS Dollar Index (DXY) – 4H Chart Analysis

**Current Trend:** Bearish

Price trades below EMAs, Ichimoku Cloud, and within a bearish channel.

#**Bearish Scenario (Favorable)**

* **Conditions:**

* Price remains below EMA 7 & 21

* Stays under Ichimoku Cloud and 96.812 resistance (R1)

* Lower lows forming, bearish momentum increasing

* **Confirmation:**

Break below **96.37 (blue zone)**

* **Target:**

* TP1: 96.00

* TP2: 95.60 (next weak support)

**Bullish Scenario (Reversal)**

* **Conditions:**

* Price must break above **96.81 (EMA 7 + resistance)**

* Break above **R1 → 96.90**, and then above **R2 → 97.14–97.19**

* Bullish candles close above the Ichimoku cloud

* **Confirmation:**

Break and retest of **97.20**

* **Target:**

* TP1: 97.39

* TP2: 97.58 (key structure)

* TP3: 98.00 (major resistance)

**Bias:** Bearish unless DXY breaks above **97.20** with strong volume and bullish structure.

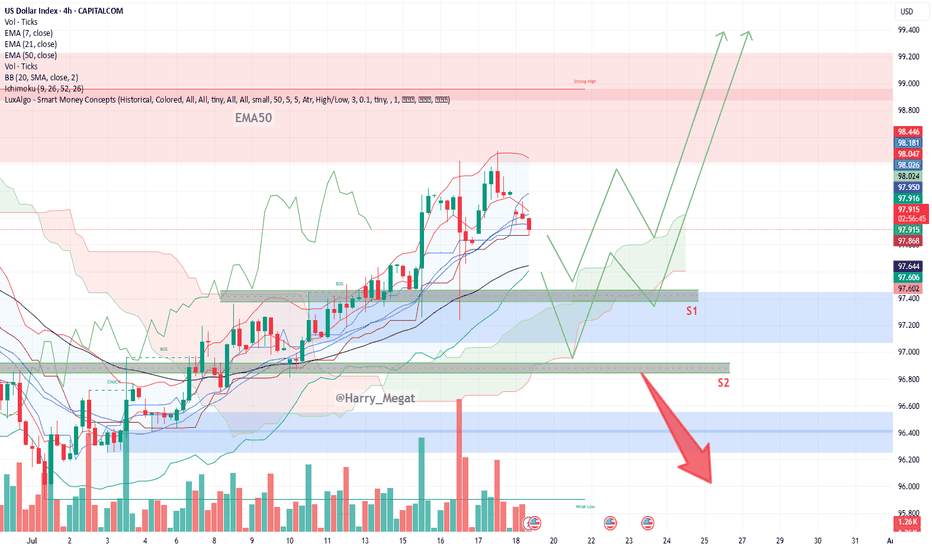

DXY Chart Outlook: Trend, Support, and Price Objectives**DXY Chart Outlook: Trend, Support, and Price Objectives (Reworded Analysis)**

**Trend Overview**

* The DXY chart reflects a **clear upward trajectory**, characterized by a sequence of **ascending highs and higher lows** — a classic sign of bullish momentum.

* Currently, the price is **retracing toward the 50-day EMA**, which appears to be holding as **dynamic support**.

* Two important **horizontal support zones** are marked:

* **Support 1 (S1):** \~97.400 (aligned with EMA-50)

* **Support 2 (S2):** \~96.800 (a deeper correction level)

**Projected Price Zones**

* **Near-Term Objective:** **98.800 to 99.000**

* A rebound from the EMA or S1 could send price higher toward this zone, continuing the current bullish structure.

* **Mid-Term Target:** **99.200 to 99.400**

* If the price successfully clears the 99.000 resistance, further bullish continuation could aim for this intermediate target range.

* **Extended Target:** **100.000+**

* A sustained breakout beyond 99.400 could open the path toward **psychological resistance at 100.000**, possibly higher on strong momentum.

**Support Zones to Watch**

* **S1 (97.400):** This level coincides with the 50-day EMA and represents a **first line of defense**.

* **S2 (96.800):** Should the price fall below S1, this secondary level could provide **stronger support** and potential bounce opportunity.

**Risk Management**

* Consider placing a **protective stop** just below S2 — around **96.500** — to safeguard against a potential trend reversal or deeper correction.

**Summary**

* The DXY remains **technically bullish**, with potential upside targets at **98.800**, **99.400**, and eventually **100.000+**.

* Traders can monitor **S1 and S2** for potential entries or trend confirmation.

* A **breakdown below 96.500** would invalidate the bullish setup and warrant caution.

DXY LOCAL SHORT|

✅DXY is going up now

But a strong resistance level is ahead at 98.948

Thus I am expecting a pullback

And a move down towards the target of 98.451

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

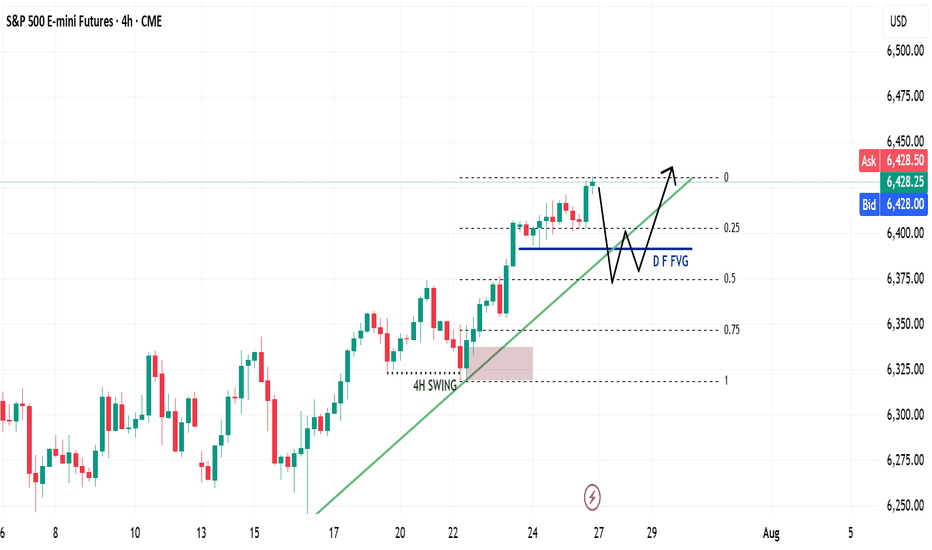

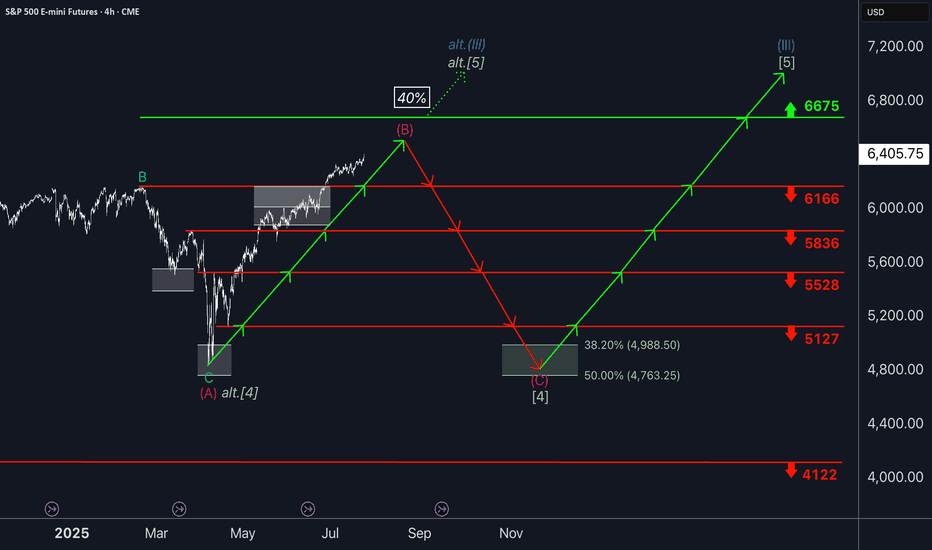

ES Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Declining inflation figures

• Trump’s pivot toward aggressive rate cuts

This shift reinforces a risk-on environment across U.S. indices.

🔙 Previous Week Recap

• ES continued its price discovery journey

• Price ran the 4H swing liquidity and shifted market structure

• A clean 1H demand zone was established post-MSS, leading to a strong move toward new ATH

• A bullish trendline has also formed as a visual representation of this momentum

• I anticipated a deeper retracement last week but adjusted my execution based on the ICT SMT concept — see previous week’s ES plan for details

📊 Technical Analysis

Looking forward:

• My expectation is a continued bullish price discovery

• Watching for price to tap into and potentially deviate below the Daily Fair Value Gap (D-FVG)

• This zone also aligns with the 0.5 Fibonacci equilibrium level, which I consider a discounted entry zone

• Confluence of liquidity + trendline + FVG + Fib makes this an ideal location for new long setups

⚙️ Setup Trigger & Trade Plan

Entry Strategy:

• Wait for a clear 1H–4H market structure shift

• Look for demand zone formation within the discount zone

• Execute long trades after confirmation and retracement into this zone

Trade Management:

🎯 Target: New All-Time Highs

⛔ Stoploss: Swing low beneath 1H–4H demand structure

🗨️ If you found this analysis helpful, don’t forget to like and drop a comment below — I’d love to hear your thoughts and setups for the week!

📥 Follow me for more weekly breakdowns and real-time updates throughout the trading week.

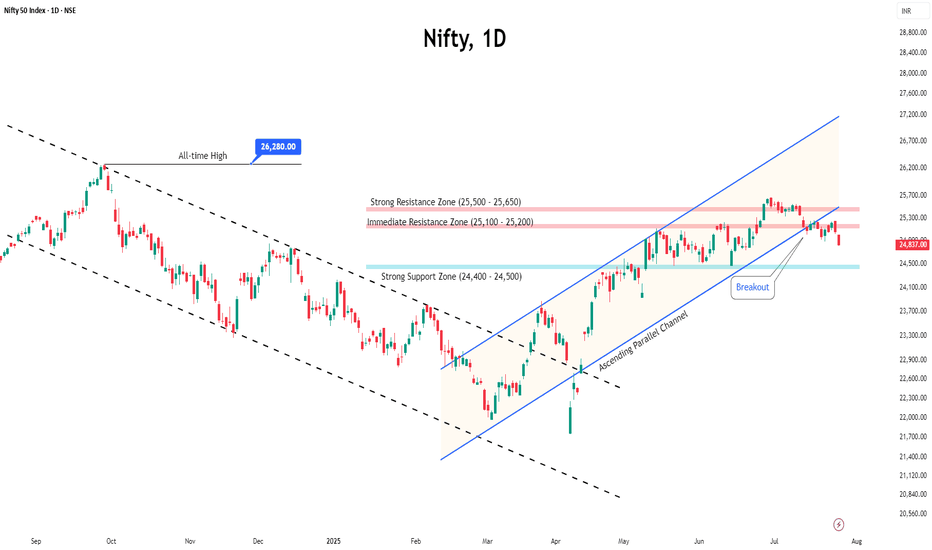

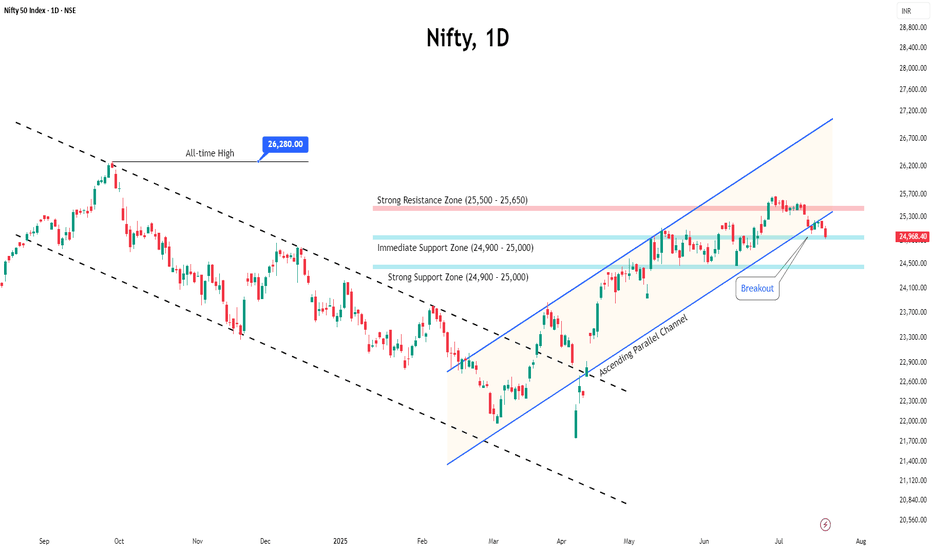

Pressure Builds on Nifty Before ExpiryThe Nifty traded in a tight range for most of the week but eventually slipped below the 25,000 mark, ending on a weak note.

With the monthly expiry approaching, the index is likely to remain under pressure, and volatility may pick up in the coming sessions.

Key resistance levels are seen at 25,200 and 25,500. A decisive move above 25,500 could trigger an upside breakout. On the downside, support is expected around 24,500 and 24,400.

Given the current structure, traders are advised to stay cautious, focus on selective opportunities, and avoid aggressive positions until a clearer trend emerges.

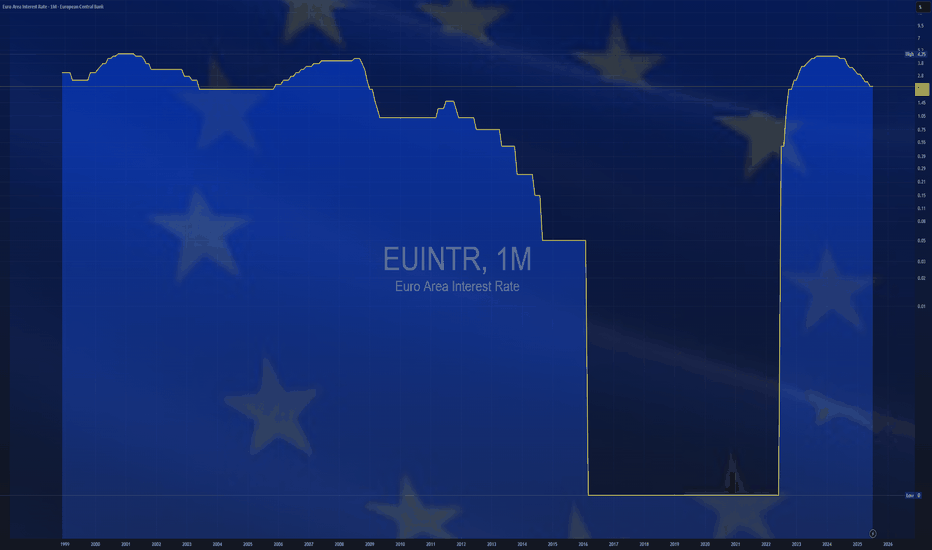

$EUINTR - Europe Interest Rates (July/2025)ECONOMICS:EUINTR

July/2025

source: European Central Bank

- The ECB kept interest rates unchanged in July, effectively marking the end of its current easing cycle after eight cuts over the past year that brought borrowing costs to their lowest levels since November 2022.

The main refinancing rate remains at 2.15%, while the deposit facility rate holds at 2.0%. Policymakers struck a wait-and-see stance, as they evaluate the impact of lingering trade uncertainty and the potential fallout from proposed US tariffs on economic growth and inflation.

Inflation hit the ECB’s 2% target in June, adding to the case for a pause in policy adjustments. Speaking at the ECB press conference, President Lagarde said the central bank is “in a good place” but acknowledged the difficulty in assessing how tariffs will affect price outlooks, given the mix of both inflationary and disinflationary pressures.

On the recent euro appreciation, Lagarde reiterated that the ECB does not target exchange rates directly but considers them when forecasting inflation.

S&P500: Rally ContinuesYesterday, the S&P 500 managed to notch modest gains once again. In line with our primary scenario, the ongoing magenta wave (B) is likely to continue climbing toward resistance at 6,675 points. Once this corrective upswing reaches its peak—still below that level—we anticipate a pullback as part of wave (C), which should drive the index below support at 5,127 points. Beneath this threshold, our green long Target Zone spans from 4,988 to 4,763 points. We expect the low of wave (C) and the conclusion of the broader green wave to occur within this range. From there, a sustained rally is expected to unfold in wave , which should lift the index above resistance at 6,675 points and complete the cyclical blue wave (III). As a result, this price range can be considered for long entries. The alternative scenario, which calls for a direct breakout above the 6,675-point level without a prior pullback, remains in play with a 40% probability.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

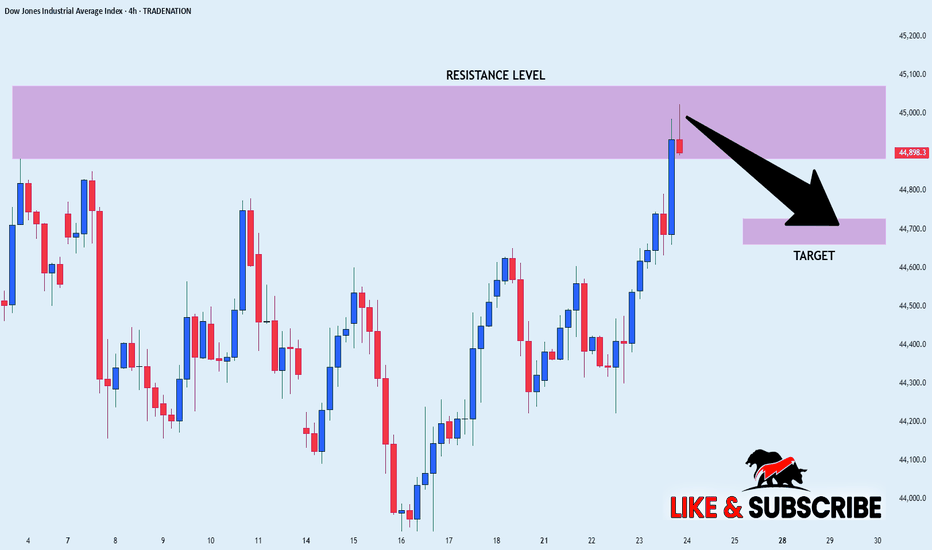

US30 SHORT FORM RESISTANCE|

✅DOW JONES index keeps

Growing in a strong uptrend

And we are bullish biased long-term

However the price has hit an all-time-high

Resistance level of 45,072(which can be seen

Further left you zoom out on higher TF)

So as we are already seeing a local

Bearish reaction we will be

Expecting a local bearish correction

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

US dollar index (DXY) still looks weakAfter finding resistance near my 50-day EMA on the daily chart, TVC:DXY is now showing signs of continued weakness. Let's dig in.

MARKETSCOM:DOLLARINDEX

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

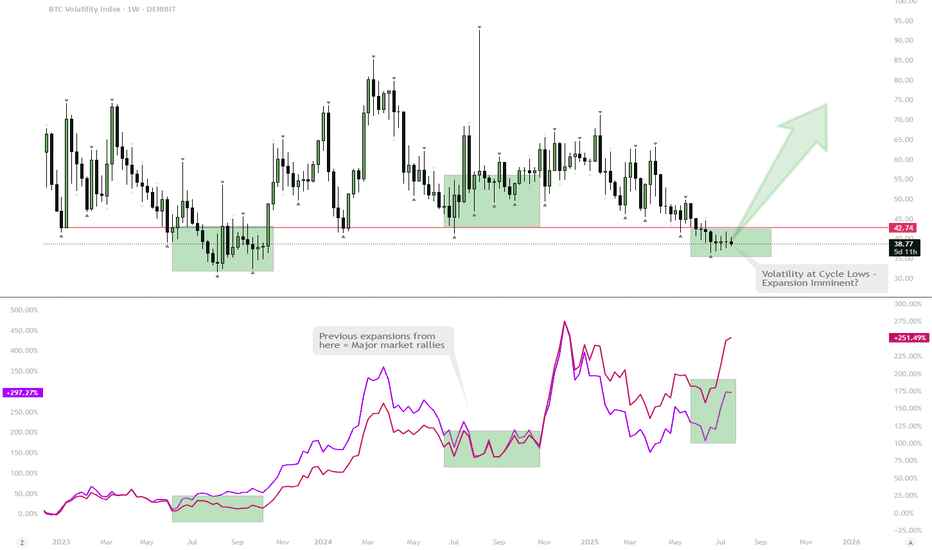

BTC Volatility at Lows: Next Expansion Will Reshape the CycleBTC Volatility Index is at a major support zone, where past cycle lows led to massive trend reversals and strong price expansions.

Every time BTC volatility reached this level (highlighted boxes), it was followed by a sharp move upward in both volatility and BTC price.

Currently, ETH and altcoins are leading, showing strong performance in the “catch-up” phase, but this typically precedes the main BTC-led move.

Next expected phase: A volatility spike (potentially in Q4) that sends BTC into a parabolic uptrend.

During this phase, alt/BTC pairs usually drop sharply (“nuke”) as capital rotates back to BTC.

After BTC’s explosive move, a true altseason begins as capital rotates back into alts.

Key signal: Watch for an expansion in BTC volatility from these historic lows as the “real fun” starts.

BTC volatility is at cycle lows, a zone that historically triggers major directional moves. Previous bounces from this area have coincided with powerful market expansions, first led by BTC, then followed by altcoins. While ETH and alts are currently showing strength, history suggests the cycle’s final stage begins with a BTC volatility spike—pushing BTC up rapidly, causing alt/BTC pairs to drop, and only then ushering in a real altseason. The next volatility expansion (likely Q4) could mark this transition.

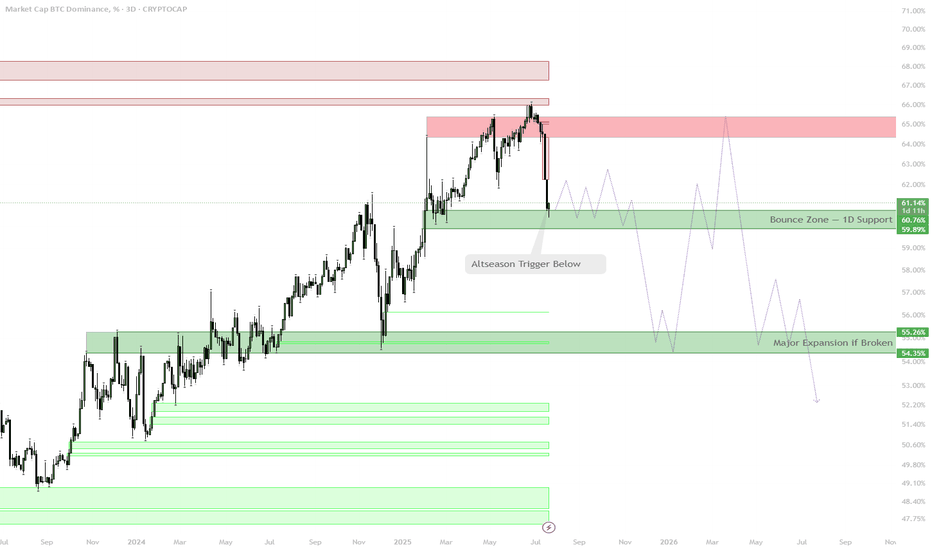

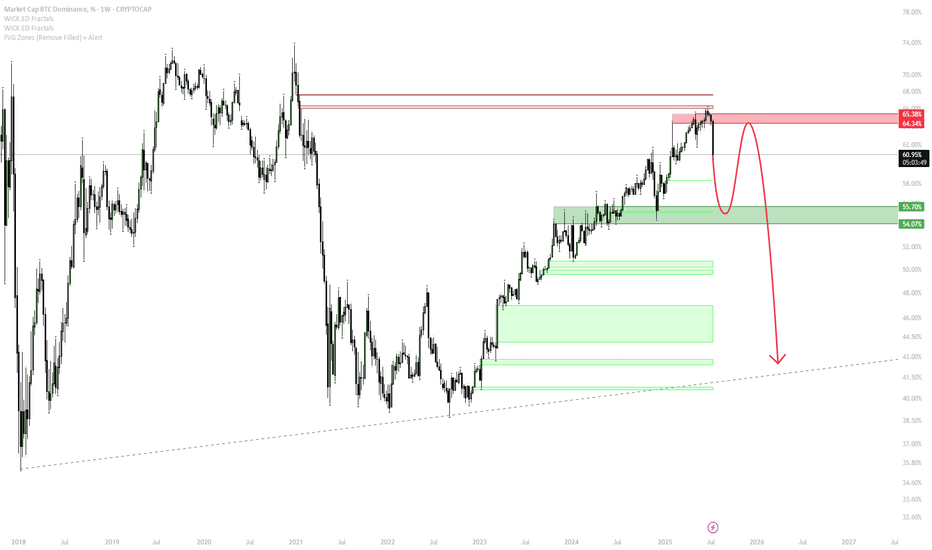

BTC Dominance — Bounces, Chop, and Next Wave Setup

BTC.D reached strong support, confirming euphoria top for now.

Currently, BTC.D is at the first key support (green zone 59.8–61.1%). This is a logical bounce zone where dominance could chop or rebound short-term.

If BTC.D holds and bounces here, expect more range-bound action, potentially retesting 64–65% (red zone).

If this support breaks, the next area of interest is the 54–55% green box. This would open the door for more sustained altcoin strength (altseason continuation).

Ultimately, a decisive break below both green boxes signals the start of a major altcoin expansion phase, with BTC.D trending lower toward 48–50% support.

BTC Dominance (BTC.D) is at a critical inflection point after rejecting at strong resistance and reaching daily support. Bounces from this area are typical as traders rotate profits, but sustained breakdown below support would mark a shift in market regime, favoring alts. Watching for confirmation — the next parabolic move in alts begins if BTC.D loses these green boxes.

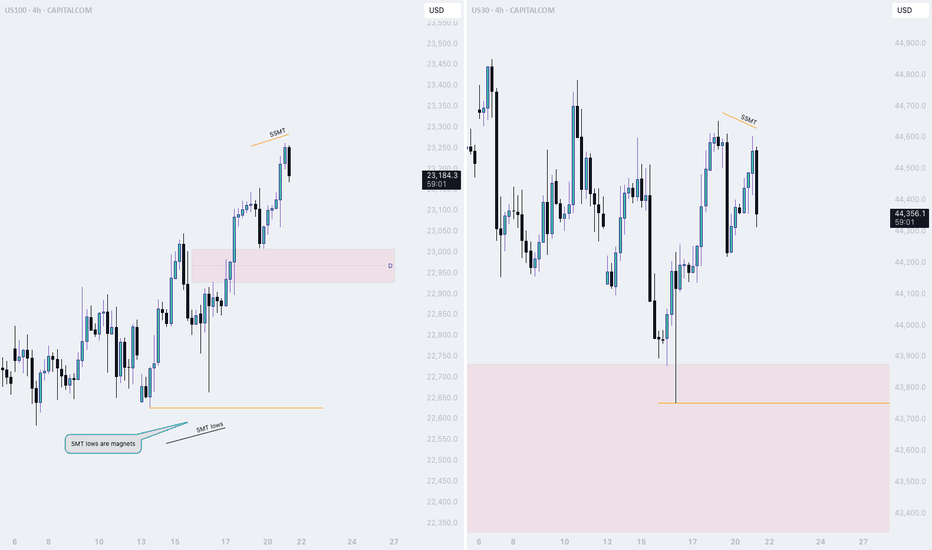

NQ thread: Short ideaMonday started off bullish, but only to drop at the end of the session.

Here is a thread on what is happening and on which narratives I view the market

Starting off with the 4H Time frame, we witnessed NQ and ES taking last weeks high.

YM did not.

This is the first stage of the movement. To find the second stage, we need to dive deeper into the lower timeframes..

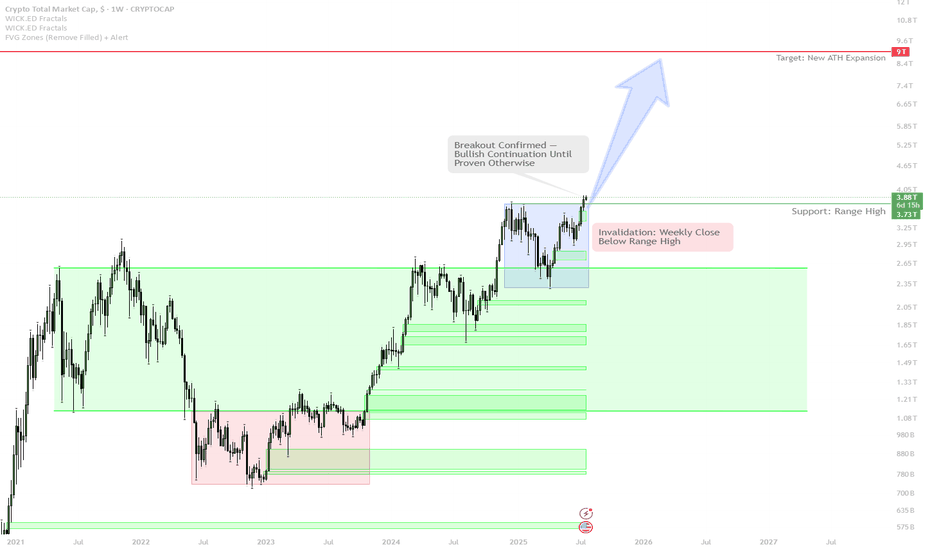

Total Crypto Market Cap: Weekly Breakout Signals Bull Run Contin

The weekly candle has closed above the key range high — this is a major bullish signal, similar to the breakout seen in early 2021.

As long as price remains above this breakout level, the scenario is a continuation uptrend — expect further expansion and strong price action.

If the market fails and closes back below the range high, the breakout will be invalidated — this would signal a potential range or pullback phase.

Current strategy is to trade with the trend:

Hold spot exposure and add on confirmed breakouts.

Do NOT short without a clear breakdown and structure reversal.

If a failed breakout occurs (weekly candle closes back below range high), take profit quickly and switch to risk-off mode.

Market psychology: Most buyers hesitate at lows, but FOMO after a strong move is classic. The disciplined approach is to buy the setup, not the hype.

This is a textbook technical breakout with historical precedence for explosive upside. As long as Total Market Cap holds above the range high, the path of least resistance is up. Attempting to fade the breakout is risky unless there is a clear weekly close back below the level. Trend continuation is favored until proven otherwise. The correct approach is to stay with the trend and manage risk only if a breakdown occurs.

BTC Dominance: Local Top Forming – Prepping for Major Rotation

BTC Dominance ( CRYPTOCAP:BTC.D ) is hitting the major weekly resistance (red box, ~64–65%).

Expectation is for a short-term rejection here, as BTC rotation into ETH and alts begins.

A pullback toward the green support area (54–56%) is likely as ETH and altcoins start outperforming BTC.

After the initial drop, anticipate a strong bounce in BTC.D as late BTC buyers rotate back in, typically mid-altseason.

This bounce often provides the best opportunity for altcoin entries, historically marking a sweet spot for outperformance.

Where the bounce ends (possibly around 56% or lower) will be a question for future analysis; for now, focus is on the rejection and initial drop.

BTC dominance is testing a historically significant resistance zone after a prolonged uptrend. This level has previously marked local tops and initiated sharp reversals into altseason. The scenario is supported by rotation narratives—capital typically flows from BTC into ETH and alts as dominance peaks. A retracement to the green support zone is probable, after which a sharp bounce could trap late BTC buyers before another leg down. Watching the initial rejection and first bounce zone will help identify the next major altcoin opportunity.

Nifty Closes Below 25,000 — What Lies Ahead?The Indian market's recent uptrend appears to be losing momentum, as the benchmark Nifty index extended its decline for the third consecutive week, ending just below the important 25,000 mark.

This pullback has been largely driven by weakness in the Financial and IT sectors, with major players like NSE:TCS , NSE:HCLTECH , and NSE:AXISBANK posting disappointing earnings.

From a technical perspective, the index is now approaching a key support zone near 24,900. A decisive break below this level could open the door for a further slide towards 24,500.

Open Interest (OI) data reinforces this view, with the 25,000–24,900 zone seeing the highest put writing, marking it as an immediate support area. On the upside, strong call writing at 25,100 and 25,200 on Friday suggests these levels will act as immediate resistance.

Given the current structure, the outlook for the coming week remains neutral to bearish.

Traders are advised to stay cautious, manage risk effectively, and keep a close watch on these crucial levels.

$JPIRYY -Japan Inflation Hits 7-Month Low (June/2025)ECONOMICS:JPIRYY 3.3%

June/2025

source: Ministry of Internal Affairs & Communications

-Japan’s annual inflation rate eased to 3.3% in June 2025 from 3.5% in May, marking the lowest reading since last November, as a sharp slowdown in electricity and gas prices offset persistent upward pressure from rice.

Core inflation also matched the headline rate at 3.3%, pointing to a three-month low and aligning with expectations.

Fibonacci Retracement: The Hidden Key to Better EntriesIf you’ve ever wondered how professional traders predict where price might pull back before continuing... the secret lies in Fibonacci Retracement.

In this post, you’ll learn:

What Fibonacci retracement is

Why it works

How to use it on your charts (step-by-step)

Pro tips to increase accuracy in the market

🧠 What Is Fibonacci Retracement?:

Fibonacci Retracement is a technical analysis tool that helps traders identify potential support or resistance zones where price is likely to pause or reverse during a pullback.

It’s based on a mathematical sequence called the Fibonacci Sequence, found everywhere in nature — from galaxies to sunflowers — and yes, even in the markets.

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones, starting with 0 and 1. The sequence typically begins with 0, 1, 1, 2, 3, 5, 8, 13, and so on. This pattern can be expressed as a formula: F(n) = F(n-1) + F(n-2), where F(n) is the nth Fibonacci number.

The key Fibonacci levels traders use are:

23.6%

38.2%

50%

61.8%

78.6%

These levels represent percentages of a previous price move, and they give us reference points for where price might pull back before resuming its trend and where we can anticipate price to move before showing support or resistance to the trend you are following.

💡Breakdown of Each Fib Level:

💎 0.236 (23.6%) – Shallow Pullback

What it indicates:

Weak retracement, often signals strong trend momentum.

Buyers/sellers are aggressively holding the trend.

Best action:

Aggressive entry zone for continuation traders.

Look for momentum signals (break of minor structure, bullish/bearish candles). Stay out of the market until you see more confirmation.

💎 0.382 (38.2%) – First Strong Area of Interest

What it indicates:

Healthy pullback in a trending market.

Seen as a key area for trend followers to step in.

Best action:

Look for entry confirmation: bullish/bearish engulfing, pin bars, Elliott Waves, or break/retest setups.

Ideal for setting up trend continuation trades.

Stop Loss 0.618 Level

💎 0.500 (50.0%) – Neutral Ground

What it indicates:

Often marks the midpoint of a significant price move.

Market is undecided, can go either way.

Best action:

Wait for additional confirmation before entering.

Combine with support/resistance or a confluence zone.

Useful for re-entry on strong trends with good risk/reward.

Stop Loss 1.1 Fib Levels

💎 0.618 (61.8%) – The “Golden Ratio”

What it indicates:

Deep pullback, often seen as the last line of defense before trend reversal.

High-probability area for big players to enter or add to positions.

Best action:

Look for strong reversal patterns (double bottoms/tops, engulfing candles).

Excellent area for entering swing trades with tight risk and high reward.

Use confluence (structure zones, moving averages, psychological levels, Elliott Waves).

Wait for close above or below depending on the momentum of the market.

Stop Loss 1.1 Fib Level

💎 0.786 (78.6%) – Deep Correction Zone

What it indicates:

Very deep retracement. Often a final “trap” zone before price reverses.

Risk of trend failure is higher.

Best action:

Only trade if there's strong reversal evidence.

Use smaller position size or avoid unless other confluences are aligned.

Can act as an entry for counter-trend trades in weaker markets.

Stop Loss around 1.1 and 1.2 Fib Levels

⏱️Best Timeframe to Use Fibs for Day Traders and Swing Traders:

Day trading:

Day traders, focused on capturing short-term price movements and making quick decisions within a single day, typically utilize shorter timeframes for Fibonacci retracement analysis, such as 15-minute through hourly charts.

They may also use tighter Fibonacci levels (like 23.6%, 38.2%, and 50%) to identify more frequent signals and exploit short-term fluctuations.

Combining Fibonacci levels with other indicators such as moving averages, RSI, or MACD, and focusing on shorter timeframes (e.g., 5-minute or 15-minute charts) can enhance signal confirmation for day traders.

However, relying on very short timeframes for Fibonacci can lead to less reliable retracement levels due to increased volatility and potential for false signals.

Swing trading:

Swing traders aim to capture intermediate trends, which necessitates giving trades more room to fluctuate over several days or weeks.

They typically prefer utilizing broader Fibonacci levels (like 38.2%, 50%, and 61.8%) to identify significant retracement points for entering and exiting trades.

Swing traders often focus on 4-hour and daily charts for their analysis, and may even consult weekly charts for a broader market perspective.

🎯 Why Does Fibonacci Work?:

Fibonacci levels work because of:

Mass psychology – many traders use them

Natural rhythm – markets move in waves, not straight lines

Institutional footprint – smart money often scales in around key retracement zones

It's not magic — it's structure, and it's surprisingly reliable when used correctly.

🛠 How to Draw Fibonacci Retracement (Step-by-Step):

Let’s say you want to trade XAU/USD (Gold), and price just had a strong bullish run.

✏️ Follow These Steps:

Identify the swing low (start of move)

Identify the swing high (end of move)

Use your Fibonacci tool to draw from low to high (for a bullish move)

The tool will automatically mark levels like 38.2%, 50%, 61.8%, etc.

These levels act as pullback zones, and your job is to look for entry confirmation around them.

🔁 For bearish moves, draw from high to low. (I will show a bearish example later)

Now let’s throw some examples and pictures into play to get a better understanding.

📈 XAU/USD BULLISH Example:

1.First we Identify the direction of the market:

2.Now we set our fibs by looking for confirmations to get possible entry point:

Lets zoom in a bit:

Now that we have a break of the trendline we wait for confirmation and look for confluence:

Now we set our fibs from the last low to the last high:

This will act as our entry point for the trade.

3. Now we can look for our stop loss and take profit levels:

Stop Loss:

For the stop loss I like to use the fib levels 1.1 and 1.2 when I make an entry based upon the 0.618 level. These levels to me typically indicate that the trade idea is invalid once crossed because it will usually violate the prior confirmations

Take Profit:

For the take profit I like to use the Fib levels 0.236, 0, -0.27, and -0.618. This is based upon your personal risk tolerance and overall analysis. You can use 0.236 and 0 level as areas to take partial profits.

Re-Entry Point Using Elliott Waves as Confluence Example:

This is an example of how I used Elliott Waves to enter the trade again from the prior entry point. If you don’t know what Elliott Waves are I will link my other educational post so you can read up on it and have a better understanding my explanation to follow.

After seeing all of our prior confirmations I am now confident that our trend is still strongly bullish so I will mark my Waves and look for an entry point.

As we can see price dipped into the 0.38-0.5 Fib level and rejected it nicely which is also in confluence with the Elliott Wave Theory for the creation of wave 5 which is the last impulse leg before correction.

🔻 In a downtrend:

Same steps, but reverse the direction — draw from high to low and look to short the pullback.

XAU/USD Example:

As you can see the same basic principles applied for bearish movement as well.

⚠️ Pro Tips for Accuracy:

✅ Always use Fib in confluence with:

Market structure (higher highs/lows or lower highs/lows)

Key support/resistance zones

Volume or momentum indicators

Candle Patterns

Elliott Waves, etc.

❌ Don’t trade Fib levels blindly — they are zones, not guarantees.

📊 Use higher timeframes for cleaner levels (4H, Daily)

💡 Final Thought

Fibonacci retracement doesn’t predict the future — it reveals probability zones where price is likely to react.

When combined with structure and confirmation, it becomes one of the most reliable tools for new and experienced traders alike.

🔥 Drop a comment if this helped — or if you want a Part 2 where I break down Fibonacci Extensions and how to use them for take-profit targets.

💬 Tag or share with a beginner who needs to see this!

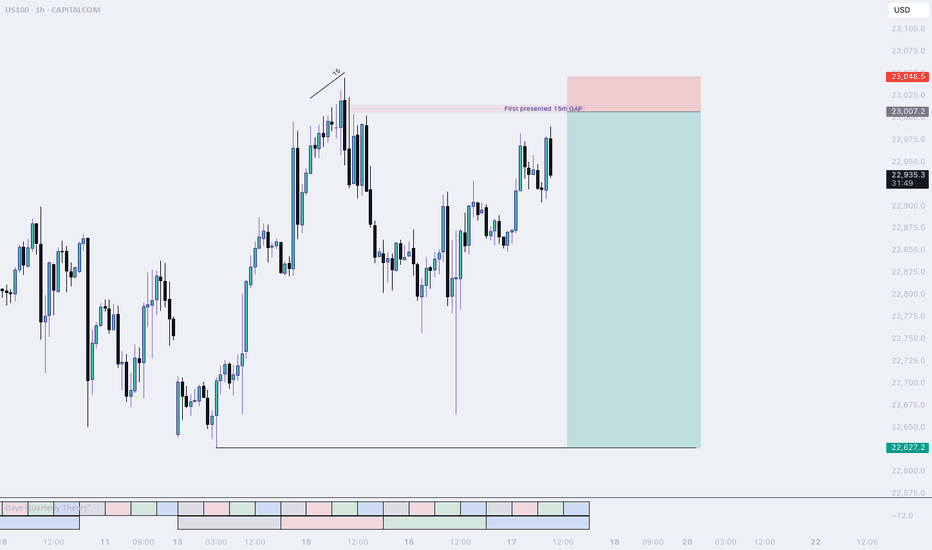

NQ, Short setupJust before market Open price dropped lower, I expect price to travel back up into the 15 m Gap and then sell off. This is the only setup I am interested in today.

The 15m level will be a resistance level for price. This level is derived from the last reversal. Since NQ was lagging, i expect price to use his level to squeeze the shorts out and start a new down trend.

If this does not happen and the highs get taken out, I will be flat today

Goodluck, Good trading.

F