Index

EU faces pressure to defuse mounting anger as farmers protest aGiven the mounting anger and protests by farmers across Europe, there appears to be a significant challenge stemming from contradictory and potentially detrimental agricultural policies. The grievances include increased costs for agricultural diesel, additional fees for water consumption, complex regulations, and objections to bans on pesticides and herbicides mandated by the EU's Green Deal. The farmers are also concerned about the import of beef from countries like Brazil and Argentina, which they argue have laxer rules on animal welfare, making competition difficult.

This unrest, originating in France but spreading to neighboring countries, signals a broader issue with unpredictable government decisions affecting agriculture. In the Netherlands and Germany, similar protests have arisen over regulations to cut nitrogen emissions and phase out fuel subsidies, respectively. In Germany, there is also resentment over what is perceived as the unfair application of environmental policies.

With protests extending to Poland, Romania, Slovakia, Hungary, and Bulgaria, concerns range from unfair competition from cut-price cereals to high taxes and tight regulations. The impact of droughts, floods, and wildfires, combined with the squeeze from green policies, has fueled discontent.

For investors, this could be a pivotal moment to consider commodities such as cereals, soybeans, and copper. The disruptions in European agriculture may create fluctuations in the market, making these commodities potentially attractive for investment. However, it is crucial to monitor developments closely as tensions continue to grow, and the agricultural sector shapes up to be a major issue in the upcoming European Parliament elections in June.

JSE 40 Index | Daily | Speculation Looking at the JSE 40 all-share Index on the daily chart we can take note that the index has been trading downwards since peaking sometime during Feb 23, now looking to the left again we can take note that after the release of the 1st quarter Dividend & Earnings release the JSE drop on both accounts.

Now looking to the right, we can take note that the JSE has been hovering/consolidating on our 8,988 level for the past few days ahead of this weeks CPI, PPI & SARB Interest Rate announcements.

Looking further to our right we can expect the JSE to push up from 8,988 to around 9,843 or 10,017 before heading down to 8,229.

Else we can expect the JSE to just tumble down to 8,229 if it closes below 8,988.

Potential Market Movers:

CPI (MoM) - Apr :: 24 May 2023

PPI (MoM) - Apr :: 25 May 2023

SARB Interest Rates :: 25 May 2023

2024 US Recession | Key Factors2000 DOT-COM CRISIS

The dot-com crisis, also known as the "dot-com bubble" or "dot-com crash," was a period of economic turbulence that affected the technology and telecommunications sectors in the late 1990s and early 2000s. Here are some key points:

Euphoria Phase: In the 1990s, there was a boom in the technology and dot-com industry fueled by irrational investor euphoria. Many companies secured significant funding, even if they had weak or nonexistent business models.

Excessive Valuations: Valuations of technology companies skyrocketed, often based on exaggerated growth projections and unrealistic expectations. This led to rampant speculation in financial markets.

Bubble and Collapse: In 2000, the dot-com bubble began to burst. Many investors realized that numerous technology companies were unable to generate profits in the short term. This triggered a massive sell-off of stocks and a collapse in tech stock prices.

Economic Impacts: The crisis had widespread economic impacts, with the loss of value in many technology stocks and the bankruptcy of numerous companies. Investors suffered heavy losses, and this had repercussions on the entire stock market.

Economic Lessons: The dot-com crisis led to a reassessment of investment practices and taught lessons about the importance of carefully analyzing companies' fundamentals and avoiding investments based solely on speculative expectations.

Following this crisis, the technology sector experienced a correction but also contributed to shaping the industry in a more sustainable way. Many companies that survived the crisis implemented more realistic and sustainable strategies, contributing to the subsequent growth and development of the technology sector.

2007-2008 FINANCIAL CRISIS

The 2007-2008 financial crisis was a widespread event that had a significant impact on the global economy. Here are some key points:

Origins in the Subprime Mortgage Crisis: The crisis originated in the U.S. real estate sector, particularly in subprime mortgages (high-risk). An increase in mortgage defaults led to severe losses for financial institutions holding securities tied to these loans.

Spread of Financial Problems: Losses in the mortgage sector spread globally, involving international financial institutions. Lack of transparency in complex financial products contributed to the crisis's diffusion.

Bank Failures and Government Bailouts: Several major financial institutions either failed or were on the brink of failure. Government interventions, including bailouts and nationalizations, were necessary to prevent the collapse of the financial system.

Stock Market Crashes: Global stock markets experienced significant crashes. Investors lost confidence in financial institutions, leading to a flight from risk and an economic contraction.

Impact on the Real Economy: The financial crisis directly impacted the real economy. The ensuing global recession resulted in the loss of millions of jobs, decreased industrial production, and a contraction in consumer spending.

Financial Sector Reforms: The crisis prompted a reevaluation of financial regulations. In response, many nations implemented reforms to enhance financial oversight and mitigate systemic risks.

Lessons Learned: The financial crisis underscored the need for more effective risk management, increased transparency in financial markets, and better monitoring of financial institutions.

The 2007-2008 financial crisis had a lasting impact on the approach to economic and financial policies, leading to greater awareness of systemic risks and the adoption of measures to prevent future crises.

2019 PRE COVID

In 2019, I closely observed a significant event in the financial markets: the inversion of the yield curve, with 3-month yields surpassing those at 2, 5, and 10 years. This phenomenon, known as an inverted yield curve, is generally considered an advanced signal of a potential economic recession and has often been linked to various financial crises in the past. The inversion of the yield curve occurred when short-term government bond yields, such as those at 3 months, exceeded those at long-term, like 2, 5, and 10 years. This situation raised concerns among investors and analysts, as historically, similar inversions have been followed by periods of economic contraction. Subsequently, in 2020, the COVID-19 pandemic occurred, originating in late 2019 in the city of Wuhan, Hubei province, China. The virus was identified as a new strain of coronavirus, known as SARS-CoV-2. The global spread of the virus was rapid throughout 2020, causing a worldwide pandemic. Countries worldwide implemented lockdown and social distancing measures to contain the virus's spread. The economic impact of the pandemic was significant globally, with sectors such as tourism, aviation, and hospitality particularly affected, leading to business closures and job losses. Efforts to develop a vaccine for COVID-19 were intense, and in 2020, several vaccines were approved, contributing to efforts to contain the virus's spread. In 2021, the Delta variant of the virus emerged as a highly transmissible variant, leading to new increases in cases in many regions worldwide. Subsequent variants continued to impact pandemic management. Government and health authorities' responses varied from country to country, with measures ranging from lockdowns and mass vaccinations to specific crisis management strategies. The pandemic highlighted the need for international cooperation, robust healthcare systems, and global preparedness to address future pandemics. In summary, the observation of the yield curve inversion in 2019 served as a predictive element, suggesting imminent economic challenges, and the subsequent pandemic confirmed the complexity and interconnectedness of factors influencing global economic health.

2024 Outlook

The outlook for 2024 presents significant economic challenges, outlined by a series of critical indicators. At the core of these dynamics are the interest rates, which have reached exceptionally high levels, fueling an atmosphere of uncertainty and impacting access to credit and spending by businesses and consumers. One of the primary concerns is the inversion of the yield curve, manifested between July and September 2022. This phenomenon, often associated with periods of economic recession, has heightened alarm about the stability of the economic environment. The upward break of the 3-month curve compared to the 2, 5, 10, and 30-year curves has raised questions about the future trajectory of the economy. Simultaneously, housing prices in the United States have reached historic highs, raising concerns about a potential real estate bubble. This situation prompts questions about the sustainability of the real estate market and the risks associated with a potential collapse in housing prices. Geopolitical instability further contributes to the complexity of the economic landscape. With ongoing conflicts in Russia, the Red Sea, Palestine, and escalating tensions in Taiwan, investors are compelled to assess the potential impact of these events on global economic stability. The S&P/Experian Consumer Credit Default Composite Index, showing an upward trend since December 2021, suggests an increase in financial difficulties among consumers. Similarly, the charge-off rate on credit card loans for all commercial banks, increasing since the first quarter of 2022, reflects growing financial pressure on consumers and the banking sector. In this context, it is essential to adopt a prudent approach based on a detailed analysis of economic and financial data. The ability to adapt to changing market conditions becomes crucial for individuals, businesses, and financial institutions. Continuous monitoring of the evolution of economic and geopolitical indicators will be decisive in understanding and addressing the challenges that 2024 may bring.

S&P500: Last rally before correction.S&P500 may be overbought on the 4H timeframe (RSI = 72.835, MACD = 15.590, ADX = 49.520) but not yet on the 1D technical outlook as the price hasn't yet made a HH on the two month Channel Up. The 4H RSI does show us though that it is starting that HH peak sequence as it can start a LH trendline like December 14th. We are expecting this wave to peak on a +5.55% rise at 4,920 like the Higher High of December 27th, where we will short and target the 0.5 Fibonacci level and 4H MA200 (TP = 4,800) like the index did on the January 5th HL.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

European Central Bank is holding rates untill Q3 Market Insight:

ECB policymaker Francois Villeroy de Galhau has emphasized that the decision on rate cuts in 2024 will be data-driven, rejecting a fixed timeline. ECB President Christine Lagarde, while suggesting a potential rate cut in the summer, emphasizes the importance of data in timing the decision. Central bank officials are cautious about immediate easing but acknowledge a long-term trajectory of lowering borrowing costs.

Rationale:

Anticipating the likelihood of a delayed rate cut by the European Central Bank (ECB), potentially impacting businesses' cost of borrowing and consumer spending, which could lead to lower revenues for companies in the European stock index.

Trade Strategy:

Short Position on European Stock Index: Consider initiating a short position in the European stock index (e.g., Euro Stoxx 50).

Entry Point: Look for technical signals indicating a reversal or weakness in the index.

Stop-Loss: Place above a recent significant peak to manage potential upward movements.

Take-Profit: Target the next support level, considering potential downward pressure on index components.

GOLD |BULL OR BEAR?Hello guys, gold could not continue the upward trend of last week and now I see that it has started a downward trend again.

I have identified the important supply and demand areas on the chart to enter trading positions.

Enter into the positions according to the time priorities and after getting confirmation.

Don't rush, if the market doesn't go as you think, stop trading at all, the market is always full of opportunities.

Inflation Higher = Stock Market LowerWhile higher inflation should be an indicator of a booming stock market since the consumers are spending more and the companies make more profit, this time the case is different.

The simple macroeconomics behind it:

Higher Inflation=Higher Interest Rates, which=Higher Borrowing Costs for the S&P companies

And as you have already connected the dots higher borrowing costs mean less profit, so that is indeed what we are expecting to see in the stock market.

The Seasonality for January for the S&P tends to be neutral to slightly bullish which is another confluence that we can see some pain in the coming weeks.

This is our second trade on the S&P as the first one was with half of the risk and tight stop loss which was triggered, so now is the perfect opportunity for our second part of the trade.

REMEMBER- Patience is the key for being consistently profitable

.

.

.

Comment your opinion below:)

Navigating Market Moves Amidst Geopolitical TensionsRecent geopolitical tensions triggered a 'flight to safety' impacting Asian equities. Japan's Nikkei fell by 0.6%, while Chinese equities, including the Shanghai Composite and Hong Kong's Hang Seng, experienced declines of 0.6% and nearly 2%, respectively.

Exercise caution regarding potential short squeezes, especially with markets at all-time highs.

Keep an eye on Japanese economic indicators influencing the yen.

Stay tuned for any announcements from Chinese authorities impacting market sentiment.

In times of geopolitical tension, a balanced approach is crucial. Watch equities and currencies, stay updated on economic indicators, and be prepared for short-term market fluctuations.

S&P500_4HAnalysis of the S&P index in the medium and long term

The market is in an upward wave and until we are above the number 4742, it is still an upward trend, and for short-term transactions, we can trade from buying to selling.

But for the long-term, we have the resistance of 4914, which is likely to react to this number, and the index can enter a fall, which can be considered as a target of 4440

EURUSD|The probability of breaking the support zoneHello friends, I hope you are doing well, let's go to the popular currency pair EURUSD.

In EURUSD, the selling pressure seems to be more, we can understand this from the powerful candles, broken trends.

For this reason, short positions have a higher winning percentage.

By reaching the supply area (1.1015), we can enter a sell position with confirmation until the price (1.90).

In the future, if it can break the demand area, we expect the price of 1.080 to continue falling

DXY Long From Support! Buy!

Hello,Traders!

DXY was falling down

Sharply but then hit

A horizontal support level

Of 100.57 from where

We are already seeing

A bullish reaction and

I think that we will see

A further move up

Buy!

Like, comment and subscribe to help us grow!

Check out other forecasts below too!

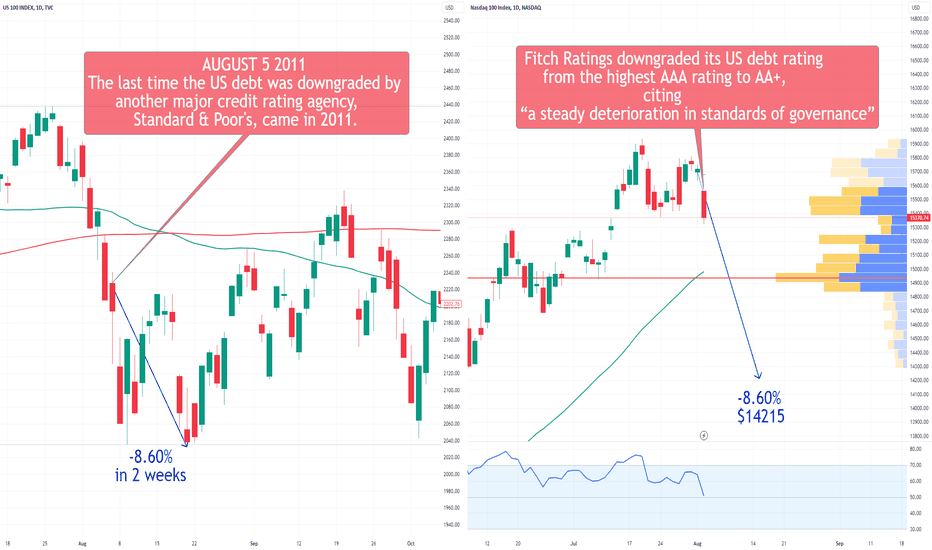

NDX Nasdaq100 Fell 8.60% After the Last U.S. Credit Downgradeitch Ratings downgraded the US debt rating on Tuesday, moving it from the highest AAA rating to AA+, citing concerns about "a steady deterioration in standards of governance."

This downgrade happened following last-minute negotiations among lawmakers to reach a debt ceiling deal earlier this year, raising the risk of the nation's first default.

In the past, a similar credit downgrade had a significant impact on the NDX, which fell 8.60% in just two weeks. Back in August 5, 2011, Standard & Poor's, one of the major credit rating firms, downgraded U.S. debt after another major debt ceiling battle.

Jim Reid, a strategist at Deutsche Bank, pointed out that while the news of Standard & Poor's being the first to downgrade 12 years ago was substantial, investors had already adjusted their perceptions of the world's most important bond market, recognizing that it was no longer a pure AAA. Nonetheless, Fitch's recent decision to downgrade is still significant.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, reaching its highest level since November 2022.

As for the price target for this year, it remains at $16650, as shown in the chart below:

Looking forward to read your opinion about it!

SPX S&P 500 Fell 10% After the Last U.S. Credit Downgrade !!!Fitch Ratings made a significant move by downgrading the US debt rating on Tuesday, shifting it from the highest AAA rating to AA+. The downgrade was attributed to a "steady deterioration in standards of governance." This decision followed intense negotiations among lawmakers to reach a debt ceiling deal, which posed a risk of the nation's first default.

The S&P 500 experienced a notable decline of 10% within three months after the previous U.S. credit downgrade. The downgrade occurred on August 5, 2011, by Standard & Poor's, one of the major credit rating firms, following another intense debt ceiling battle. The day after the S&P downgrade, the S&P 500 suffered a nearly 7% drop, dubbed "Black Monday." Subsequently, the benchmark index declined by 5.7% that month and an additional 7.2% in September.

Jim Reid, a strategist at Deutsche Bank, emphasized that the 12-year-old news of S&P being the first to downgrade was significant, allowing investors to adjust their perceptions of the world's most important bond market, which was no longer considered pure AAA. Nonetheless, Fitch's recent decision to downgrade remains impactful.

In the current scenario, the U.S. 10-year Treasury yield has risen to 4.15%, the highest since November 2022.

As for my price target for this year, it remains at $4900, as illustrated in the chart provided below:

Looking forward to read your opinion about it!

RUT 2K Price Prediction for 2024If you haven`t bought the Double Bottom on RUT 2K:

Then you probably know that small caps haven`t participated in the 2023 market rally.

That`s why I believe investors will will for opportunities in the small cap stocks in 2024, and Russell 2000 index might offer a bigger return than the S&P this year.

My price prediction for RUT 2K is $2560 by the end of the year.