Nasdaq: End of Bullish Wave, 10%+ Downside in Sight?Hey Realistic Traders!

Has CAPITALCOM:US100 (Nasdaq) Finally Peaked? A Reversal Signal Just Flashed. Is This the Turning Point Toward a Deeper Pullback?

Let’s dive into the technicals to see what the chart is really telling us.

Technical Analysis

On the daily chart, the Nasdaq is starting to show signs of weakness. A bearish divergence has formed between the MACD and price movement , which is a classic signal that bullish momentum may be fading. This often indicates the potential for a trend reversal or a deeper correction.

A recent drop, confirmed by a strong bearish full-body candlestick, suggests that selling pressure is increasing. If this continues, we expect a breakdown from the current bullish channel.

In this scenario, the extended Wave 3 may have reached its peak. A correction could follow, with the first target at 21484, which lines up with the 0.382 Fibonacci retracement level. If the decline continues, the next downside target would be around 20067, where a previous gap may be filled.

This bearish outlook remains valid as long as the price stays below 23800 . A move above that level would invalidate the setup and return the outlook to neutral.

Support the channel by engaging with the content, using the rocket button, and sharing your opinions in the comments below.

Disclaimer: "Please note that this analysis is solely for educational purposes and should not be considered a recommendation to take a long or short position on Nasdaq.

Indexanalysis

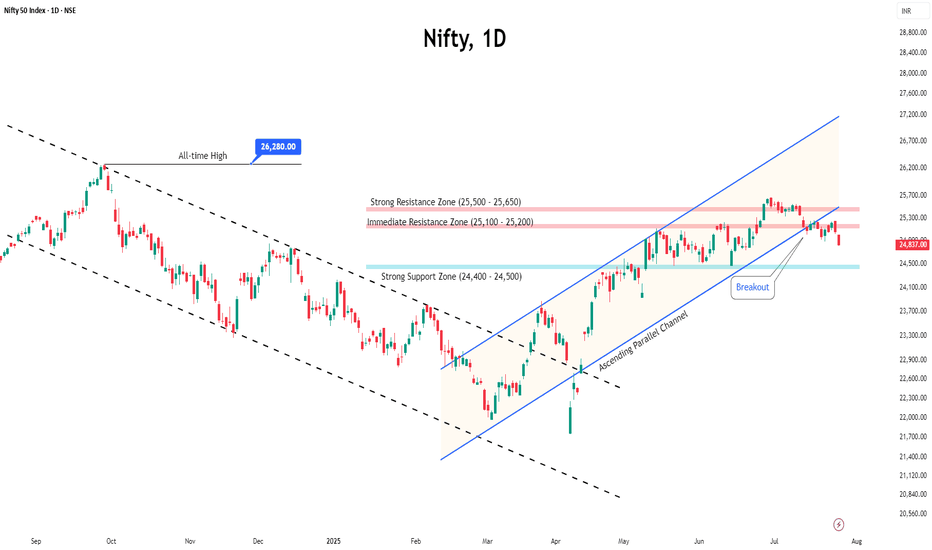

Pressure Builds on Nifty Before ExpiryThe Nifty traded in a tight range for most of the week but eventually slipped below the 25,000 mark, ending on a weak note.

With the monthly expiry approaching, the index is likely to remain under pressure, and volatility may pick up in the coming sessions.

Key resistance levels are seen at 25,200 and 25,500. A decisive move above 25,500 could trigger an upside breakout. On the downside, support is expected around 24,500 and 24,400.

Given the current structure, traders are advised to stay cautious, focus on selective opportunities, and avoid aggressive positions until a clearer trend emerges.

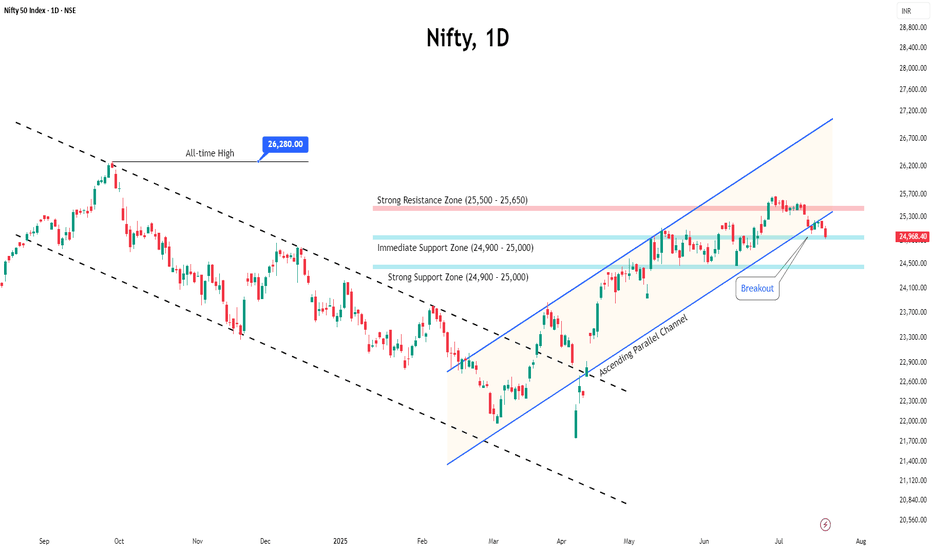

Nifty Closes Below 25,000 — What Lies Ahead?The Indian market's recent uptrend appears to be losing momentum, as the benchmark Nifty index extended its decline for the third consecutive week, ending just below the important 25,000 mark.

This pullback has been largely driven by weakness in the Financial and IT sectors, with major players like NSE:TCS , NSE:HCLTECH , and NSE:AXISBANK posting disappointing earnings.

From a technical perspective, the index is now approaching a key support zone near 24,900. A decisive break below this level could open the door for a further slide towards 24,500.

Open Interest (OI) data reinforces this view, with the 25,000–24,900 zone seeing the highest put writing, marking it as an immediate support area. On the upside, strong call writing at 25,100 and 25,200 on Friday suggests these levels will act as immediate resistance.

Given the current structure, the outlook for the coming week remains neutral to bearish.

Traders are advised to stay cautious, manage risk effectively, and keep a close watch on these crucial levels.

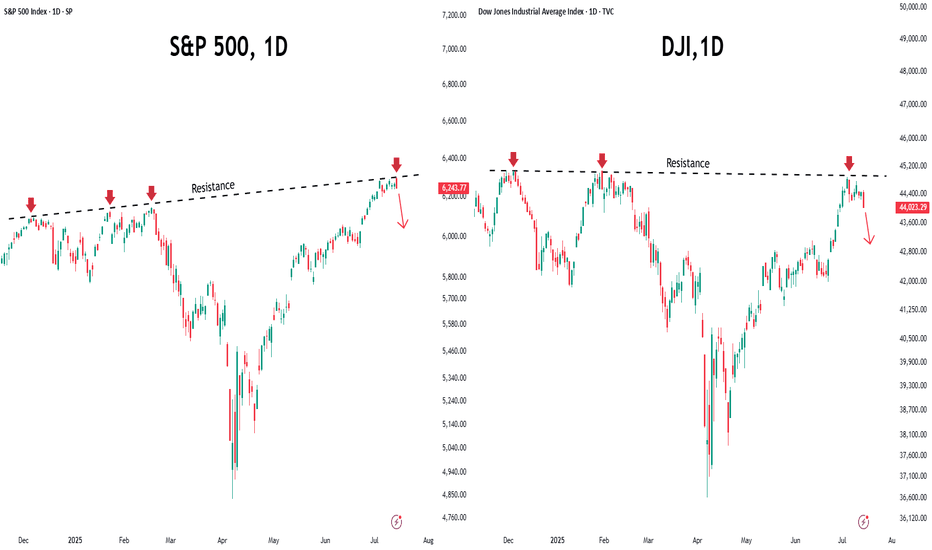

Market Mood Sours as Inflation Surprises AgainU.S. stock markets were under pressure on Tuesday after new inflation data came in higher than expected. This has made investors rethink how soon the Federal Reserve might cut interest rates.

What Happened?

● The Consumer Price Index (CPI) recorded its biggest monthly rise in 5 months.

● Core inflation (which excludes food and energy) jumped by 2.9% compared to last year — more than the Fed's 2% target.

What It Means

● Investors had expected the Fed to cut interest rates multiple times in 2025.

● After the inflation report, they now think the Fed will cut less than expected.

● The chances of a rate cut in September also dropped sharply.

Market Impact

● Bond yields went up — the 10-year U.S. government bond yield rose to 4.49%, making borrowing more expensive.

● Stock futures fell (Dow, S&P 500, Nasdaq), as higher yields tend to hurt company profits and stock prices.

S&P 500 and Dow Struggle at Resistance

● Both the S&P 500 and Dow Jones faced resistance near all-time highs.

● This rejection suggests potential for further short-term pullback, especially if macro pressures like inflation and rate uncertainty persist.

Near-Term Outlook

With inflation running hotter than expected, hopes for early Fed rate cuts have cooled. Traders and investors should remain cautious, manage risk actively, and prepare for continued volatility in the coming weeks.

Nifty Dips, Suggests Range-Bound Movement AheadIndian markets ended the week with a decline of nearly one percent, driven by lingering concerns over global tariffs and a weak start to the earnings season.

The 25,500 level has now turned into a strong resistance zone, marked by heavy call writing, while 25,000 continues to act as a solid support level backed by significant put writing.

Given these dynamics, the index is likely to enter a consolidation phase, with upcoming earnings announcements expected to keep sectoral volatility elevated.

S&P500: Top Within ReachThe S&P has recently continued its upward movement, climbing higher into the magenta-colored Short Target Zone between 5,880 and 6,166 points. Primarily, we expect the top of the current wave (X) in magenta within this price range, after which a downtrend should follow with wave (Y). This final phase of the magenta three-part movement should lead the index into the green Long Target Zone between 4,988 and 4,763 points, completing the overarching green wave there. A rise above the upper boundary of the Target Zone and a breach of resistance at 6,675 points would trigger our alternative scenario.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

US30 Locked & Loaded – Get In, Get Profit, Get Out!**💰 Market Heist Alert: US30 Setup 🔥**

Yo Money Raiders & Chart Bandits! 🏴☠️📈

US30 is ripe for the taking, and we’re rollin’ in with the *Thief Trading Style*—a slick mix of sniper-level technicals and street-smart fundamentals. Whether it’s bull or bear, we strike fast, grab profit, and vanish! 💨💸

---

**🧠 The Blueprint – US30 Hit Plan**

**📍 Entry Zones:**

🔹 **Bullish Strike 1**: Look for a pullback and **buy at 42400** – clean signal to enter the action!

🔹 **Bullish Strike 2**: Set your sights on **40900 - 40800**, inside the Institutional Buy Zone. Wait for an MA pullback, then hit it hard. Fortune favors the bold! ⚔️

🔹 **Bearish Ambush**: If price breaks down below **41600**, it’s time to ride that bear wave 🐻💨

💡 **Pro Bandit Tip**: Set alerts on key levels so you never miss the moment! 🔔

---

**🛑 Stop Loss Defense:**

Protect the stash! Use the **nearest 4H low** as your SL for day/swing trades.

Tweak based on your risk level, lot size, and open positions. 🛡️

---

**🎯 Profit Targets – Take the Loot:**

💥 **Bullish Goal**: Lock in at **44200** – or escape early if momentum cools 😎

💥 **Bearish Goal**: Target **40600** – but don’t overstay if signs reverse 🚪

🚨 Watch out for overbought/oversold traps – this is where many fall.

---

**⚠️ Risk Alert – News Incoming!**

News events = wild moves. Handle with care:

📰 Avoid new entries during major news drops

📉 Use **trailing SL** to secure profits and manage risk like a pro

Stay smart. Stay ready. This is a heist, not a gamble! 💼💣

---

**🚀 Boost the Thief Trading Movement!**

If this setup hits your style, smash that **boost** and show love to the Thief Crew! 💪

We raid charts daily with precision, profit, and a bit of outlaw swagger. Let’s own the US30 together! 🤝💵

Stay sharp, alerts on, and eyes wide—more setups coming soon.

Catch you in the green, bandits! 🤑🎉📊

S&P500 - The bottom we have been waiting for!The S&P500 - TVC:SPX - officially created the bottom:

(click chart above to see the in depth analysis👆🏻)

This month we officially saw one of the craziest stock market fakeouts of the past decade. With a drop and reversal rally of about +15%, the S&P500 is about to even close with a green monthly candle, which then indicates that the stock market bottom was created.

Levels to watch: $120, $250

Keep your long term vision!

Philip (BasicTrading)

DXY 4H Chart AnalysisThe U.S. Dollar Index is currently consolidating near the 99.400 level, within a broader bearish trend. Price is sitting just above key H4 support (~99.000), making this a critical decision zone.

Bullish scenario: Rejection from 99.000 could lead to a retracement towards 100.000, and potentially 102.500 if momentum holds.

Bearish scenario: A break below 99.000 would confirm further downside, possibly targeting 97.500 and beyond.

Traders should wait for clear price action confirmation before committing to a direction.

Head & Shoulder Breakdown: Will S&P 500 Drop Another 10%?● The S&P 500 has experienced significant volatility recently, mainly due to President Donald Trump's announcement of new tariffs.

● On April 3, 2025, the index saw a nearly 5% drop, its worst single-day loss in five years.

● The recent price action suggests that the index has broken below the neckline of the Head and Shoulder pattern, indicating a potential continuation of the downward trend.

◉ Key support levels to watch

● 1st Support - 5,200 - 5,250

● 2nd Support - 4,950 - 5,000

Emergence of Bear Flag in Nasdaq The price action seems to be suggesting the formation of Bear Flag Pattern.

The price fell steeply and then gave a pullback, which is getting sold into.

As the channel of flag breaks downwards, the fall may gain momentum.

Further price action will confirm or negate the pattern, it may move cleanly or will have whipsaws.

If the price starts consolidating for long here, rather than breaking downwards, the pattern may fail.

Trade Safe

S&P 500's Big Drop Raises Alarm: Is a Market Correction Looming?◉ Fundamental Rationale:

● US stocks fell sharply on Friday, with major indices like the S&P 500 SP:SPX and Dow Jones Industrial Average TVC:DJI experiencing significant losses.

● The sell-off was triggered by a warning from Walmart NYSE:WMT , which raised concerns about weakening consumer demand, rising costs, or other challenges impacting its business. As a retail giant, Walmart's outlook is seen as a barometer for consumer health.

● The decline coincided with the release of consumer sentiment data, which dropped to a 15-month low, signalling growing pessimism among consumers about the economy.

● The market reacted to fears of inflation, rising interest rates, and the potential for a recession, which could further weigh on corporate earnings and economic growth.

● The sell-off was not limited to retail stocks but reflected broader anxieties about the economy and future market performance.

◉ Technical Observations:

● Following a significant sell-off of nearly 1.7%, the index is expected to find initial support at the trendline.

● If the index breaches this support level, the next strong support zone is anticipated in the range of 5,650 to 5,700.

US Stocks Surge as Trump Takes Office: Will the Rally Continue?The US stock market is buzzing with excitement as President-elect Donald Trump's inauguration on January 20 approaches. On Friday, January 17, the major indices saw significant gains, with:

● S&P 500 SP:SPX rose 59 points, or 1%

● Dow Jones Industrial Average TVC:DJI increased 335 points, or 0.8%

● Nasdaq composite NASDAQ:IXIC surged 292 points, or 1.5%

◉ Major Sector Driving Gains

The technology sector, particularly the "Magnificent Seven" stocks, has been instrumental in this upward momentum.

◉ Investor Sentiment

Investors are optimistic about Trump's policies, but concerned about potential inflationary pressures. Experts believe Trump's administration could lead to significant growth due to:

1. Increased Government Stimulus: Trump's background as a real estate developer may result in policies designed to stimulate economic growth.

2. Technological Innovation: Rapid advancements in technology are expected to create new industries and opportunities.

3. Lower Interest Rates: There is speculation that Trump may implement lower interest rates to further encourage economic expansion.

Overall, the market is cautiously optimistic, with investors closely monitoring Trump's policies.

Nifty50 Trendline Retest – What’s Next for Traders?The Nifty50 is at a decisive point, retesting a key breakout level. Here's my take on the key levels to watch and how traders can approach the market

Nifty50 Analysis - 5th January

What's Happening?

Nifty 50 is at a make-or-break point. It recently broke out of a downward trendline, which is usually a good sign for bulls, but now the index is retesting that breakout. How it reacts at these levels will set the tone for the next move.

Key Levels to Watch:

- Resistance Zones:

- 24,222

- 24,347

- 24,528

- Support Zones:

- 23,990

- 23,897

- 23,790

- 23,592

Possible Scenarios:

1. The Bullish Path:

If Nifty holds above 24,057 and shows strength, we could see a move to 24,222, and if the momentum is strong enough, it might even test 24,347 or 24,528.

2. The Bearish Path:

If the price drops below 23,897, things could get dicey, with the index likely heading toward 23,790 and 23,592.

How to Trade This?

- For the Bulls:

Look for sustained buying above 24,057 to go long. Targets: 24,222, 24,347. Stop loss: Below 23,897.

- For the Bears:

If the price slips below 23,897, you might want to short. Targets: 23,790, 23,592. Stop loss: Above 24,057.

Final Thoughts:

This is one of those moments where patience pays off. Let Nifty show its hand before jumping in. Watch those key levels closely, and always trade with a plan (and a stop loss!).

NSE:NIFTY

Let me know your thoughts on this setup! Do you think bulls will hold, or will bears take over?

Major Indexes Face Downturn: What's Coming Next?◉ S&P 500 SP:SPX

● The long-term trendline support has been breached.

● The immediate support range is identified around the 5,650 to 5,700 levels.

◉ Nasdaq Composite NASDAQ:IXIC

● The Nasdaq Composite has rebounded from its long-term trendline support, demonstrating resilience amid economic uncertainty.

◉ NYSE Composite TVC:NYA

● The NYSE Composite has found support at its trendline and may bounce back from this important level.

◉ Dow Jones Industrial Average TVC:DJI

● After a consecutive decline over ten days, the index has surpassed its trendline support and is approaching the next support zone between 41,500 and 42,800.

Overall, all indices are anticipated to recover shortly, with expectations of robust performance from major stocks.

ASI - All time high in 2025 Q1?1. Observations on Fibonacci Levels

Current Resistance at 0.786 Fib Level (~12,123):

The index has successfully moved past several key Fibonacci retracement levels and is now approaching the 0.786 level.

A confirmed breakout above this level, with a daily/weekly candle close, would further strengthen the bullish momentum.

Golden Pocket (~10,969 - 11,189):

The golden pocket zone (0.618) previously acted as strong resistance, but it has now turned into a support zone, affirming the current uptrend.

Target: 1.618 Extension (~17,837):

The 1.618 Fibonacci extension level at 17,837 is a likely target if the index maintains its bullish momentum throughout 2025.

This projection aligns with a potential all-time high under strong market conditions.

2. Channel Observation

The ASI is trading within a clear upward parallel channel, with higher highs and higher lows forming a solid bullish structure.

The upper bound of this channel aligns with the 1.618 Fibonacci extension level, further strengthening the case for 17,837 as a medium- to long-term target.

3. Indicators

RSI:

The RSI is nearing overbought levels, suggesting that the index might face short-term resistance or a pullback before continuing its upward trajectory.

MACD:

The MACD is showing bullish momentum, with a positive crossover and rising histogram bars. This supports the upward trend.

4. Key Levels to Watch

Support Levels:

12,123 (0.786 Fib): Needs to hold as support if the index retraces.

10,969 - 11,189 (Golden Pocket): Acts as the next strong support zone.

10,158 (0.5 Fib): A deeper retracement level, likely to hold during a major pullback.

Resistance Levels:

Immediate resistance is at 13,593 (1.0 Fib).

The next major resistance is the 1.272 extension (~15,257) before targeting 1.618 (~17,837).

5. Risks and Considerations

The overbought RSI could lead to short-term corrections.

Macro-economic factors, such as local and global economic conditions, could impact the bullish scenario.

Disclaimer: The information and analysis provided in this publication are for educational purposes only and should not be construed as financial advice or recommendations to buy, sell, or hold any securities. The author and TradingView are not responsible for any investment decisions made based on the content presented herein. Always consult a financial professional before making any investment decisions.

NIFTY50 || RSI positive divergence As mention in my previous idea, the recent rally was indeed a 'Dead Cat Bounce' as NIFTY50 has experienced another significant drop. However, examining the charts above reveals positive RSI divergence in both the 2-hour timeframe (TF) and the daily timeframe (DTF), with NIFTY reversing from a marked support zone.

For the next bull run to be confirmed, NIFTY should hold above today’s low and meet the following two criteria:

1. The index begins trading above the 20 EMA band.

2. The RSI surpasses the 70 mark.

This setup could indicate a more sustainable upward trend if both conditions are fulfilled.

Disclaimer: This analysis is for informational purposes only and should not be considered as financial advice. Trading involves significant risk, and it’s essential to perform your own research or consult a financial advisor before making any investment decisions.

Essential principles for traders:

1. Be Disciplined, Avoid FOMO: Maintain a disciplined approach to avoid impulsive decisions based on the "fear of missing out" (FOMO), which can lead to risky trades.

2. Risk and Reward Management: Always assess potential rewards relative to risks before entering a trade. Proper risk management ensures long-term success by limiting losses on any single trade.

3. Follow Stop Losses: Calculate and set a stop loss for every trade to protect against significant losses. Make it a habit to adhere to it without exception, even if the market seems to be in your favor.

4. Journal Your Trades: Maintain a trading journal to track decisions, wins, and losses. Analyzing past trades can help improve future strategies and identify patterns in behavior or biases.

5. Master One Strategy Before Expanding: It’s beneficial to focus on mastering a single trading strategy before exploring others. Once consistent, you can broaden your approach to diversify risk and opportunities.

6. Control Emotions: Emotions, especially greed and fear, can cloud judgment. Cultivating a mindset that balances confidence and caution is key to maintaining objectivity.

Election Volatility Shakes Up US MarketsS&P 500

● The index retreated from its all-time high of 5,880, initiating a downward trend.

● A breakdown below the Rising Wedge pattern has been confirmed.

● Key support levels to watch:

➖ Immediate support: 5,670

➖ Strong support: 5,400

Nasdaq Composite

● The index has hit an all-time high near the 18,750 level before beginning to retreat.

● After breaking through the trendline support, the index is currently hovering slightly above the next immediate support level.

● If it dips below this support, we could see a significant drop, potentially driving the index down to the 16,670 level.

**This market volatility is consistent with historical trends during US presidential election years. The 2024 election is particularly unpredictable due to conflicting economic indicators and potential delays in results.

US Markets Demonstrate Confidence Despite Election JittersThe US markets are currently demonstrating a bullish sentiment, despite concerns surrounding the upcoming election.

All major indices, including the S&P 500, NYSE Composite, and Nasdaq Composite, have formed a bullish Cup & Handle chart pattern and have subsequently broken to follow an upward trend.

While the S&P 500 and NYSE Composite have reached new all-time highs, the Nasdaq Composite is close to its highest peak, further reinforcing the positive market outlook.

'This overall bullish sentiment suggests that the upward trend in the US markets is likely to continue, even in the face of election-related uncertainties.

"DAX Index Rises Ahead of ECB Meeting"In the U.S., the consumer price index increased by 0.2% in August, while the annual rise was 2.5%, aligning with forecasts. Following the drop in inflation, the likelihood of the Fed implementing a 25 basis point rate cut next week has risen to 85%. After this data release, market risk appetite increased, leading to intensified buying activity in the DAX index.

Today, there is an expectation of a 25 basis point rate cut in the European Central Bank (ECB) meeting.

Technically, on the upside if the price holds above the 18,500 resistance, buying could push the index first toward the 18,700 resistance and then to 18,900. if the 18,500 level is broken to the downside, a pullback could extend first to the 18,285 support and then to 18.075.

DAX Index Recovers Its Losses!Following the release of the U.S. non-farm payroll report, which came in below expectations, market risk appetite weakened. The DAX index also accelerated its decline, targeting the 18,257 support level. Expectations for a Fed rate cut have strengthened to 50 basis points, while the ECB is expected to lower rates by 25 basis points at its meeting this week.

Technically, if the 18,285 level is broken on the downside, a pullback could extend first to the 18,075 support and then to 17,920. On the upside, if the price holds above the 18,500 resistance, buying could push the index first towards the 18,700 resistance and then to 18,900.

SPX: A Double Top at the peak could lead to a short-term fall!

The chart depicts a steady upward trend of the index.

After reaching an all-time high close to the 5,670 level, the index saw a significant decline, dropped by nearly 550 points.

However, after a recovery, the index once again neared its previous high, but experienced another setback.

The emergence of a Double Top pattern, along with a clear RSI divergence, indicates that the index may face difficulties in the near future.

On the downside, immediate support is found between the 5,250 and 5,300 levels.

A break below this support could lead to a considerable drop in the index.

Major Sectors that may influence US Markets this week!Health Care

Following an extended consolidation phase from December 2021 to August 2024, the healthcare index has developed an Inverted Head & Shoulder pattern.

With a recent breakout, the index is now set to experience significant upward momentum.

Industrials

Similar to the healthcare index, the industrials sector has also established an Inverted Head & Shoulder pattern. Following its breakout, this index has shown positive movement.

With a recent breakout from a brief consolidation phase, the index is ready to climb once more.

Financials

The financial sector plays a vital role in the US stock market. Recently, the financial index experienced a robust breakout after a lengthy consolidation phase, indicating that this sector could enhance the overall US market.

Real Estate

The real estate sector has faced challenges for a considerable time, with the index suffering a significant downturn. However, following a recent breakthrough, the index is making progress toward recovery.