$EUIRYY -Europe CPI (July/2025)ECONOMICS:EUIRYY

July/2025

source: EUROSTAT

- Eurozone consumer price inflation held steady at 2.0% year-on-year in July 2025, unchanged from June but slightly above market expectations of 1.9%, according to preliminary estimates.

This marks the second consecutive month that inflation has aligned with the European Central Bank’s official target.

A slowdown in services inflation (3.1% vs 3.3% in June) helped offset faster price increases in food, alcohol & tobacco (3.3% vs 3.1%) and non-energy industrial goods (0.8% vs 0.5%).

Energy prices continued to decline, falling by 2.5% following a 2.6% drop in June.

Meanwhile, core inflation—which excludes energy, food, alcohol, and tobacco—remained unchanged at 2.3%, its lowest level since January 2022.

Indexes

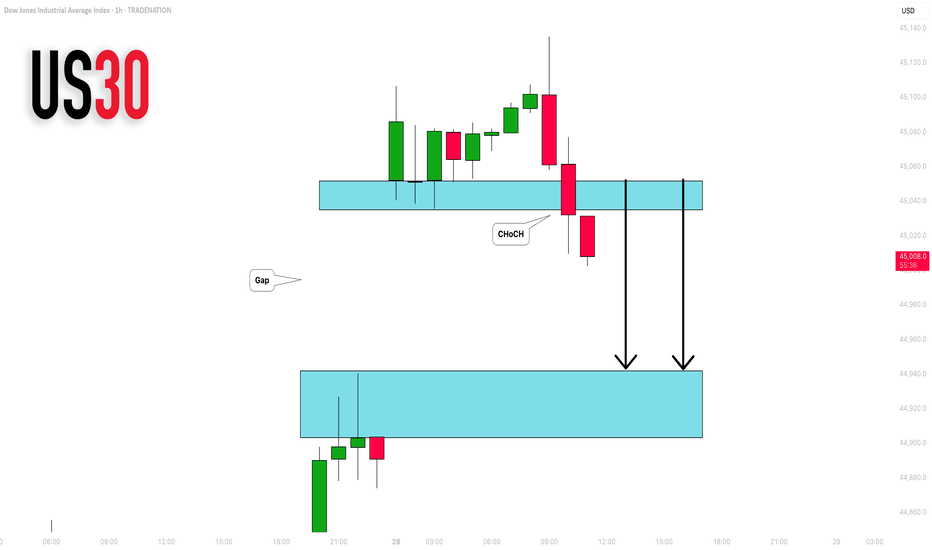

DOW JONES INDEX (US30): Another Gap For Today?

I see another gap up opening on US30 Index.

I think it will be filled today. A formation of an intraday

bearish CHoCH on an hourly time frame suggests

a highly probable bearish continuation.

Goal - 44943

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

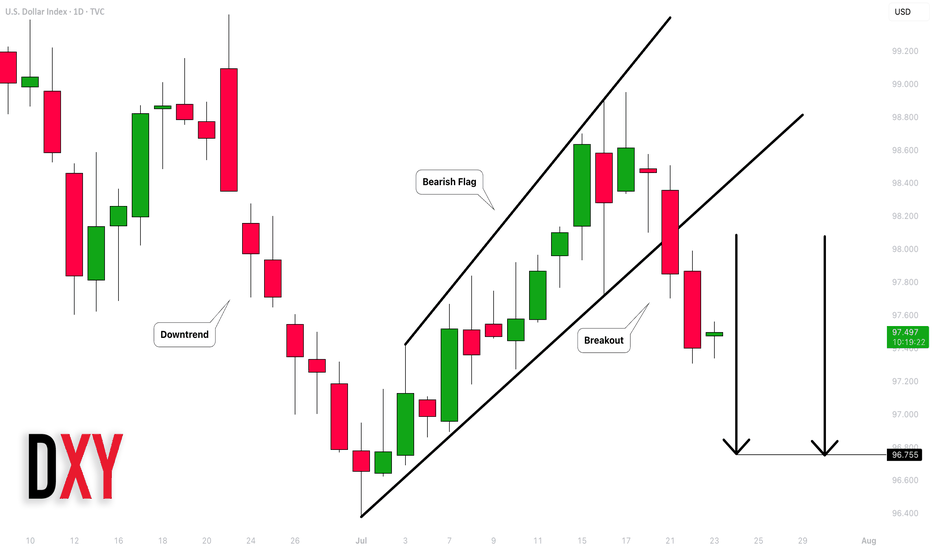

Dollar Index (DXY): Strong Bearish Price Action

Dollar Index broke and closed below a support line

of a bullish flag pattern on a daily.

Because the market is trading in a bearish trend,

this violation provides a strong bearish signal.

I expect a bearish movement to 96.75

❤️Please, support my work with like, thank you!❤️

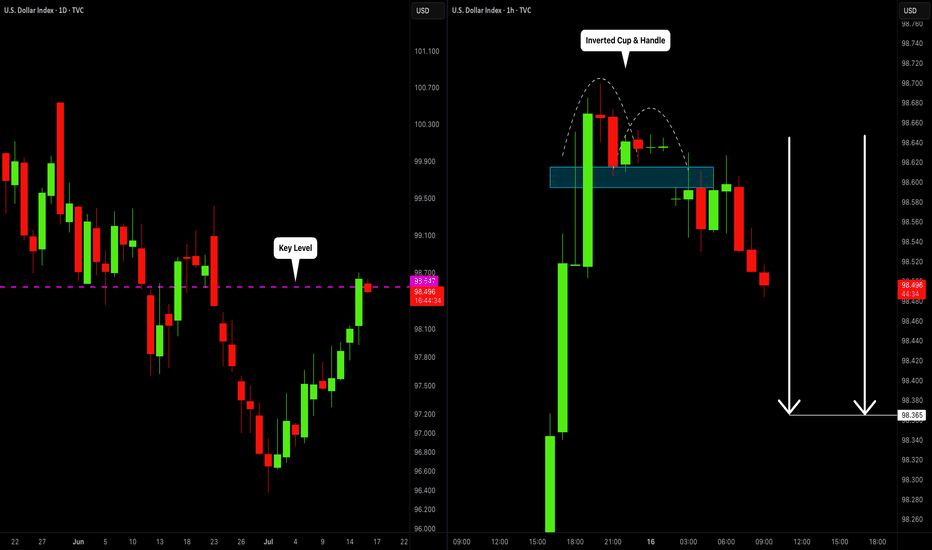

DOLLAR INDEX (DXY): Bearish Move From Key Level

I think that Dollar Index may drop from a key daily horizontal resistance level.

As a confirmation, I spotted an inverted cup & handle pattern on an hourly time frame

and a bearish violation of its neckline.

The market will most likely continue falling at least to 98.36

❤️Please, support my work with like, thank you!❤️

DOW JONES INDEX (US30): Classic Gap Trade

I see a gap down opening on US30 index.

As always, there is a high chance that this gap is going to be filled.

A bullish imbalance candle and a local change of character CHoCH

indicate a highly probable rise to a gap opening level.

Target - 44300

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

$CNIRYY -China's Inflation Data (June/2025)ECONOMICS:CNIRYY

June/2025

source: National Bureau of Statistics of China

- China’s consumer prices rose by 0.1% yoy in June 2025,

reversing a 0.1% drop in the previous three months and surpassing market forecasts of a flat reading.

It marked the first annual increase in consumer inflation since January, driven by e-commerce shopping events, increased subsidies for consumer goods from Beijing, and easing trade risks with the U.S.

Core inflation, which excludes volatile food and fuel prices, rose 0.7% yoy, marking the highest reading in 14 months and following a 0.6% gain in May.

On a monthly basis, the CPI fell 0.1%, after May's 0.2% drop, pointing to the fourth monthly decline this year.

DOW JONES INDEX (US30): Consolidation is Over

Dow Jones Index completed a bullish accumulation on a daily.

The price violated a key horizontal resistance cluster and closed above that.

Next goal for bulls is 43790.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

S&P500 INDEX (US500): More Growth Ahead

US500 broke and closed above a neckline of an ascending triangle

pattern on a daily time frame.

It is a strong bullish pattern that indicates a strong bullish interest.

With a high probability, buyers will push at least to 6124 resistance.

❤️Please, support my work with like, thank you!❤️

S&P500 Index (US500): Bullish Accumulation Pattern

I spotted a nice example of an ascending triangle pattern on a daily time frame.

To confirm a bullish continuation, we will need a bullish breakout

of its neckline.

A daily candle close above 5996 will provide a reliable confirmation.

A rise will be anticipated at least to 6080 resistance then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NASDAQ INDEX (US100): More Growth Ahead

For some unknown reason, I was asked by a dozen

of my subscribers to provide the update for US100.

Since early May, the index successfully updates the highs on a daily.

Such a tendency will remain at least till a test of a current ATH.

I think that the market is going to grow and reach at least 22100 level soon.

❤️Please, support my work with like, thank you!❤️

Nasdaq Next Week and June Month ForecastNotice Monthly Candle distribution phase prior to the closure. Today might remain still and whips recent swings highs and lows as a reaction from the D +orderblock

Next week is likely to decline and open the monthly range with an accumulation inside the W BISI and THEN continue higher throughout the rest of the month and reach 22,672.00

Nasdaq and Indexes Week 22 BiasWhile the Indexes maitain a Bullish perspective on Weekly right now, I would not dare to anticipate next week "Flavour" but rather wait for The New Week Opening and if necessary till FOMC Minutes on Wednesday.

I would like to see immediate rejection from where price it's right now (allowing it to reach the IFVG starting at 20,690.00) to maintain a bullish bias rather then a deeper retrace, otherwise Bias may change on a Daily basis and pause that Weekly View for a later time .

DOW JONES INDEX (US30): Your Plan to Buy Explained

There is a high chance that US30 will resume growth soon.

The index is currently testing a wide daily support cluster.

My signal to buy will be a bullish violation and a candle close above

41920 minor horizontal resistance.

A bullish movement will be anticipated at least to 42200 level then.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Indexes Daily "Slow" Trend anticipationExpecting a Daily slowliness a.k.a. HRLR (ICT Concepts) due to the Bonds decorrelation which is bearish. Once Bonds has reached Sell Side Liquidity Target, acceleration will be seen on Indexes higher. Meanwhile "give and take" is expected on a Daily and 4h basis.

DOLLAR INDEX (DXY): Bullish Reversal Confirmed?!

Dollar Index formed an inverted head and shoulders pattern on a daily.

Its neckline breakout is a strong bullish reversal signal.

The broken neckline of the pattern turns into a significant support now.

We can expect a growth from that at least to 101.25 resistance.

❤️Please, support my work with like, thank you!❤️