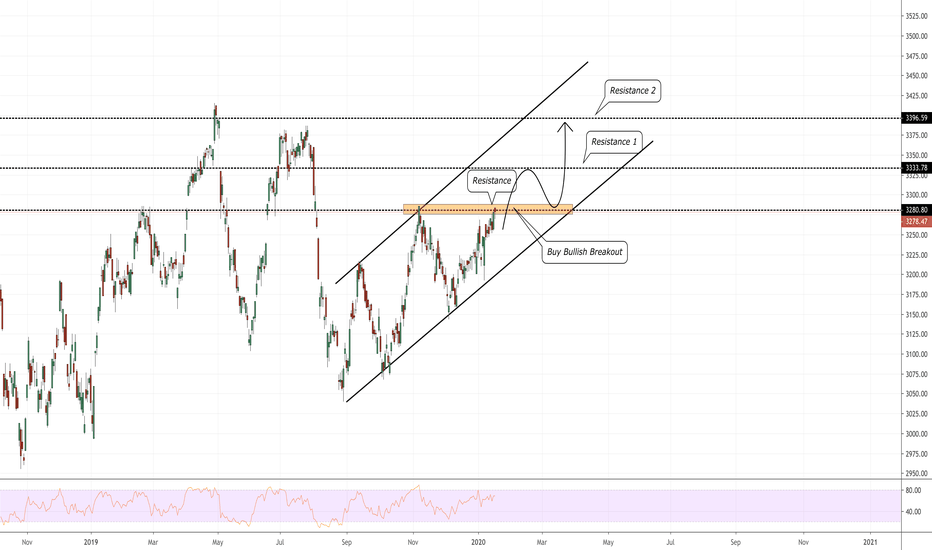

Straits Times Index (STI): Prepare To Buy Bullish Breakout!

Singapore stock market may set a new higher high soon.

Pay close attention to a current resistance level and buy the market after a breakout.

The next target levels will be:

3333

3400

Targets based on the structure on the left.

*the market may retrace to the support of the channel before setting a new higher high.

Indexes

UK 100 INDEX (UKX): Potential Short

UK 100 index is approaching 2019's high.

on 4H the price is consolidating within a horizontal range and I would suggest shorting the market in case of a bearish breakout of it.

Target levels will be 7450 / 7250 (based on structure)

* in case of a bullish breakout the setup will be invalid and the order will be canceled

EURO STOXX 50 (SX5E) May Drop Soon!

Euro stocks index is approaching a 4 years' high!

there is a high chance to see a strong bearish reaction from the underlined weekly resistance,

but because the trend is bullish, I will trade the market only with a good confirmation signal.

On 4H chart, the market is currently forming the right shoulder of a head and shoulders pattern.

I pay close attention to 3725.0 neckline.

Being broken, it will trigger a selling reaction and it will be a perfect signal for us to open short.

The initial target will be 3625.0 level

The second target 3410.0 level.

Stop will be above head!

Good luck!

Are more Mercantilist Global Markets Waiting for Us?Although the Major World Indices have also contributed to the rise of the S&P 500, it is seen that precious metals have been traded at a discount rate compared to the S&P 500 index in the last 14 weeks.

Palladium and Copper caught the Index on this rise.

But Gold, Silver, Iron Ore and Platinum are traded at a very discount.

14 weeks is a serious period of time and approximately 1 financial quarter.

This template may provide a clue to observe the stocks of Gold, Silver, Iron Ore and Platinum-bound companies.

In addition, investors who are undecided on precious metals and stocks in other sectors may prefer these stops.

NOTE : The S&P 500 Index was chosen in terms of market weight and impact on the world.

#NIK225,Signal with huge potentialPerfect resistance line, the NIK225 has already been stopped twice in the above resistance line and it seems that this time it will also fail to break.

The Stochastic in Overbought, and has the same model as it had in the previous 2 times.

The trend is an uptrend but following the data we mentioned above, we recommend sell

Target: 22000

Do You Believe in Santa Clause and... his rally?We're in the week that traditionally Santa's rally begins. Sales of tax losses usually end after the 15th of this month, so the coast is clear. At the same time, no one has forgotten the slaughter in the stock markets, which began at the same time last year. Well, do you believe in Santa and his rally in 2019?

Yes, I was an obedient child during the year and I believe Santa will give another gift to my wallet…

The second half of December is usually associated with stable seasonal demand for risky assets, especially given that the market cleared three significant overhanging clouds (UK elections, USMCA, US-China tariffs). China and the US have reached a first-phase deal in which the US will suspend tariffs in December and cut tariffs from 15% to 7.5% of the September list.

Looking at the rest of the world, we see that the OECD's leading indicator confirms current stabilization. After 21 months of delay, the composite leading indicator returned to recovery, which has been historically positive for risky assets.

The bearish scenarios and fears of recession were a large part of the investment markets throughout the year, and yet the global rally lifted almost all asset classes in 2019, except industrial metals, EUR and CHF. Looking at all mentioned above, the optimist in me suggests that the risk appetite among investors is likely to remain high despite the expected deviation in the trade talk story.

The pessimist in me says that there is no way after a whole year of growth that we will not see a retreat and Santa will not help us…

However, in a realistic view, a restricted deal means limited risk as investors become cautious, ultimately viewing Friday's partial deal as a short-term installment rather than a clear path to lasting and complete resolution of the trade tensions. In addition, the victory of Boris Johnson only brought more hope, but it did not draw the clear path of Brexit and the light in the tunnel is far away…

At the same time, US stock market is overbought, which means it is vulnerable to a fall if bad news hits us this week. If the momentum of the stock market turns, smart money with big profits, especially hedge funds, may want to sell to lock in the profits. And such sales can accelerate the downward momentum. Looking ahead, this is a scenario that requires cautious attention and investors should be vigilant.

Traders will now be forced to consider the prospect of the second phase of the trade deal and what will happen next. But for now, they might be just as happy to put the trade in the rearview mirror for a few weeks and to focus on economic data.

The structure of the calendar this year leaves this week as de facto the last week of the year. And this is what makes it harder to explain intraday movements. We are about to see…

In conclusion, I'll just say - don't be fooled, these stock markets are mostly controlled by the momentum crowd. Buying is not because of better earnings, better economy or better geopolitics, but because of the upside momentum. Keep in mind that sometimes the crowd is unshakable and can turn up for a penny.

Technically, the S&P 500 starts the week by jumping to the $ 3,200 level. This level is, of course, a psychologically important figure, so that in itself was a sensible event. In addition, we also had an ascending triangle on daily chart that was broken up and in fact the price hit our longer-term goal.

Now when that it has been reached, nothing is clear except that there is an obvious bullish pressure underneath. We prefer to Buy on the falls at this point, and I would not be surprised to see the S&P 500 drop to 3,100 before I weigh up.

Many experts call that the next bullish target is $ 3,250, and another 50 points from now until the end of the year would certainly not be a big challenge. We believe that short-term pullback should be seen as potential buying opportunities. Especially given that so many money managers outside have to pad their results for the year. After all, this is a market that has a direction and of course it is an upside trend. But remember that there is quite a bit of market noise.

What is your opinion? Do you already close your positions before the holidays or are you looking to capture the last moment?

S&P 500 STRATEGIC OVERVIEWStrategically the support resistance levels in S&P 500, the channel entered the index,

and here we can observe the distributional sell signal from last week for this week (current bar).

Do not forget to read the notes in the presentation.

In summary, this week has been affected by distributional sales and I think it will continue until the closing.

We have been under the influence of the positive trend since October 21st.

There is no mention of a bear market.

Could DAX 30 make recovery?The DAX 30 index surged to the highest since January 2018 on Friday following the US-China trade deal. But the index has come-off sharply from there. DAX is likely to trade sideways after the German Manufacturing PMI missed the estimates. Services PMI rose to 52.0, up from 51.7, matched expectations.

The nearest support bellow is H4 50 SMA and the middle line of the Bollinger Bands at the same chart. A breakout down that level could extend the further bearish pressure towards 12,923.20, the 78,6% Fibo retracement on the daily rally from 11,266.48 to 13,374.27. In that area is located also the lower boundary of H4 BBs. Underneath the support level at 12,650 should limit the sell-offs.

On upside, if the bulls could make recovery above the Friday's high at 13,423.41, further gains should continue to 13,505/525 (Oct. and Nov. 2017 highs). Obviously resistance at the all time high of 13,596.89 is then key to direction.

We prefer the bearish/consolidation scenario in near-term because of the negative Friday candle and therefore Stochastic is in its overbought area.

Trump and US-China Deal Attract the AttentionIt was risk-on mood after yesterday Trump teased traders with hope of a US-China trade deal by tweeting “Getting VERY close to a BIG DEAL with China. They want it, and so do we!”

If the both sides can’t reach an agreement within the next few days, additional tariffs will be imposed on imported Chinese goods on Sunday, December 15th. If a deal is reached before Sunday, the tariffs will likely not be imposed, and current tariffs may be rolled back. The big question that remains is, “How much of the existing tariffs will be rolled back?” We saw following reports by the Wall Street Journal that U.S. negotiators offered to cut tariffs by 50%. But until Trump makes an official announcement, which must occur before December 15, the tariffs could still be imposed.

The Dow Jones index has touched new record highs yesterday at $28,225. At this point in time it’s likely that we will continue to see pullbacks as buying opportunities. If the price break above the yesterday's high we could expect the bulls to extend the upside momentum towards 28,250 (the upper line of Bollinger Bands).

But we wouldn’t be surprised at all that if by the end of the day Friday we don’t get any hint of a delay of the tariffs by Donald Trump and than the stock market pulls back significantly. The first support of course is the psychological 28,000 level. The 50-day SMA follow it, which has risen to 27,374. A clear break here could send DJIA 30 to retest the Dec. low at 27,325. If the tariffs do in fact go into effect, it’s likely that this market will gap down on Monday, so at this point it’s probably best to stay aside.

All things being equal, but we think that the next 24 hours or so could be a bit dicey. In the next trading day you can throw out technicals of the window and it's possible to see "Buy the rumor, sell the fact" trading. Don’t forget the “Santa Claus rally” either.

DAX30 Still Looks Neutral in Short-termThe DAX30 index currently faces a challenging resistance area at 13,190. The index is holding the rebound from the 23.6% Fibonacci retracement of the October 4 low (13,879) to November 19 high (13,338.25) rally at 12,970. The 55-day moving average has risen to 12,827. Yet the positive slope in the 55-day SMA that increases distance above the 200-day EMA suggests that the bullish trend is intact and an eventual reversal could come later rather than sooner.

On upside, if the price break above upper border of Bollinger Bands at 13,350, our first target is Nov. high 13,374.27. A clear break of which could see the bulls to retest the all-time high level of 13,597 registered in late January 2018.

A closing price below Tuesday’s low of 12,927 and the 55-day SMA could encourage more selling pressure. However, only a significant fall below 12,660 would put the current uptrend under speculation, shifting the medium-term picture from positive to neutral first. There is located also 50% Fibo level on the above-mentioned rally.

S&P 500 RecoverWall Street reversed its three-day sell-off overnight on renewed US-China trade hopes as investors piled back into the global recovery trade.

We think that the market probably goes higher, reaching towards the $ 3,200 level based upon the bullish triangle on the daily chart. Overall, this is a time year the typically works out well for stock markets anyway, as the money managers out there look to pad results for clients.

We're in buying position with the nearest Take Profit at 3,137, followed by 3,200. We putted our Stop Loss bellow 3,030. The price right now is trading above 50-day and 100-day SMAs and RSI indicator pointing higher above its 50 level, which mean that the bullish momentum should continue.

We believe that the 3,030 level underneath continues to be a hard “floor” in the market extending down to the 3000 level.

Remember, that at the end of the day it’s the Fed that supports the market, not the US/China trade situation. As long as the Federal Reserve is willing to step in and help the market along, it will continue to do what is done over the last 10 years - rally.

Potential Pullback on S&P 500?The American S&P 500 returned to the region above 3100. Recently the index testing the upper limit of the daily Bollinger Bands, which is also near to the bullish channel resistance line. That's why we may looking to short this market rather we would like to see a buying opportunity underneath.

The 50-day SMA is currently trading around the 3030 level, which is the top of the support “zone” that extends down to the 3000 handle. We like the idea of buying a bounce that we can take advantage of cheaper pricing. On upside the first target is at 3137, followed by 3200.

DJIA Struggle to Stay Above 28,000 It didn’t take long for the major indices to get back to all-time highs, as they began this shortened holiday week with a solid rally on hopes for a trade deal. The prospect of renewed economic growth and favorable monetary policy have also played some roles for the rally.

Overnight, DOW rose 0.68%, but lagged comparing it with S&P 500 and NASDAQ. Obviously, the market will continue reacting to whatever the current trade headline is - bad or good - with the relevant price action.

The H4 RSI indicator is going to test the 70% area now. This could imply an aggressive profit-taking activity for the coming sessions. The inability to keep above 28,000 will be the first sign of selling pressure. Taking out 27,675 will indicate the selling pressure is getting stronger. The next support in that case will be the 50-day SMA on 4-hour chart which has risen to 27,489.

On upside, the index seems ready to re-test the record high at 28,090. A clear break above it could extend the bullish pressure towards the upper line of daily Bollinger Bands at 28,237.

Take in mind, that the trading activity will decline in the coming days because Thanksgiving Day, and of course the market is closed on Thursday and closes early on Friday.