India

Nifty in structural bull runRecent correction is just a block in long term bull trend of nifty, So does for indian market.

Till the time 10800 and 10600 is saved, I think market can bounce back to higher level. Long term support seems near 10k to 9800. If this comes then it would be wow point for heavy purchase.

$NCASH Nucleus Vision At Binance Unbanned In India! BUY NOW!India Government Unbanned Cryptocurrency and now a nation of investors will buy crypto!

Why is this Important for N C A S H!

It’s base of operations is in India with a market toward a Billion Ppl!

The project is heavily invested in retail locations in India and the world!

The news comes at alltime low prices!

I expect the dead cat bounce to slowly reverse towards a massive pump!

Targets Vs B T C

T1 .00000050 400 Percent Gains If You Buy now .00000010

T2 .00000090 800 Percent Gains If You Buy Now .00000010

Stop Loss On Current Near Alltime Low Prices now .00000060

This is my greatest call ever to recommend a buy signal!

Laugh at me for shilling it since August but I believe in this project long term and many of my calls made investors including myself millions of dollars!

Simple logic, buy alltime lows, buy what ppl fear, buy what ppl say is a scam, buy the negative news only if you believe in the project.

Scene Shot and save this message in a bottle. Later tell me how much you made listening to my non financial advice.

About myself, I’m a multi time crypto millionaire. A crypto hunter!

#WRX HUGE PROFIT - 74% so farHUGE PROFIT, 74% Profit so far.

After the good news today, #WRX pumped hard.

INDL - Positive INDL chart in a glimpse, on special request from some friends who have exposure in this

Direxion Daily MSCI India Bull 3x Shares (INDL)

Find below the fund summary as from their website:

The Direxion Daily MSCI India Bull 3X Shares seeks daily investment results, before fees and expenses, of 300% of the performance of the MSCI India Index. There is no guarantee this fund will meet its stated investment objective.

This leveraged ETF seeks a return that is 300% the return of its benchmark index for a single day. The fund should not be expected to provide three times the return of the benchmark’s cumulative return for periods greater than a day.

Target Index

The MSCI India Index (NDEUSIA) is designed to measure the performance of the large- and mid-capitalization segments of the Indian equity market, covering approximately 85% of companies in the Indian equity universe. One cannot invest directly in an Index.

A quick look at the charts, RSI has been more or less stagnant and the prices have continued to move upwards. I have created a uptrend line below the prices to gauge the support line and built faster support lines in green and blue (momentum gauge) to see if there is reason to worry if breached. I would like to look out for these lines in green and blue to be breached as the first couple of signals for caution of probable change in trend and the changing of havds of power from Bulls to the bears

RSI has been finding support between the 39 to 50 levels and seems to be bottoming out there and currently is finding resistance in the 55 to 65 levels. One would like to see either of these ranges being broken to show us further direction on the movement. As we speak, price is nicely making higher highs and higher lows

From a Gann Fan perspective, we could be a potential support level. In case price falls below this support level and gets lower in the lower zone, we could look for new support and resistance zones established

From a Fib retracement perspective, it also suggests that we found resistance and got rejected from the 78.6 Fib levels and has now found support at 61.8 fib levels

It all seems to be adding up!

Added below is my view on Nifty and other indices affecting India

Stay invested now, but look at cues what the chart shares

Trust this helps

If you like what you see, share a thumbs up and share your comments!

Cheers

Higher Low in consolidation range....LONGPetronet is in clear uptrend on weekly TF.

On Daily TF, it is consolidating in a range. Now has made a higher low with a strong Bullish Engulfing yesterday.

I am long. Target has been set as per classical charting rules i.e. equal to max width of ascending triangle.

BANK NIFTY BEARISH CRAB PATTERN FORMED IN 1 HRHI EVERYONE!

MY VIEW ON BANK NIFTY IS FORMED BEARISH CRAB PATTERN FORMED IN 1 HR

TARGET 26920 IT WILL ACHIEVE WITHIN THIS OCT MONTHLY EXPIRY

GO FOR SELL

I RECOMMEND DO THIS TRADE IN OCT MONTH PE OPTIONS..LESS INVESMENT HUGE PROFIT IS THERE!

LET"S WE WAIT FOR 26920

THANK YOU EVERYONE..!

KEEP SUPPORTING..!

BANK NIFTY SPOT CHART BEARISH BAT FORMATION IN 4 HR TIME FRAMEHI EVERYONE!

MY VIEW ON BANK NIFTY SELL DUE TO BEARISH BAT PATTERN FORMATION IN 4 HR TIME FRAME

GO POSITION BANK NIFTY FUTURES SELL ORELSE BANK NIFTY MONTHLY EXPIRY ATM PE OPTION STRIKE PRICE BUY

TARGET 1-28800

TARGET 2-27700

THANK YOU!

KEEP SUPPORTING!!

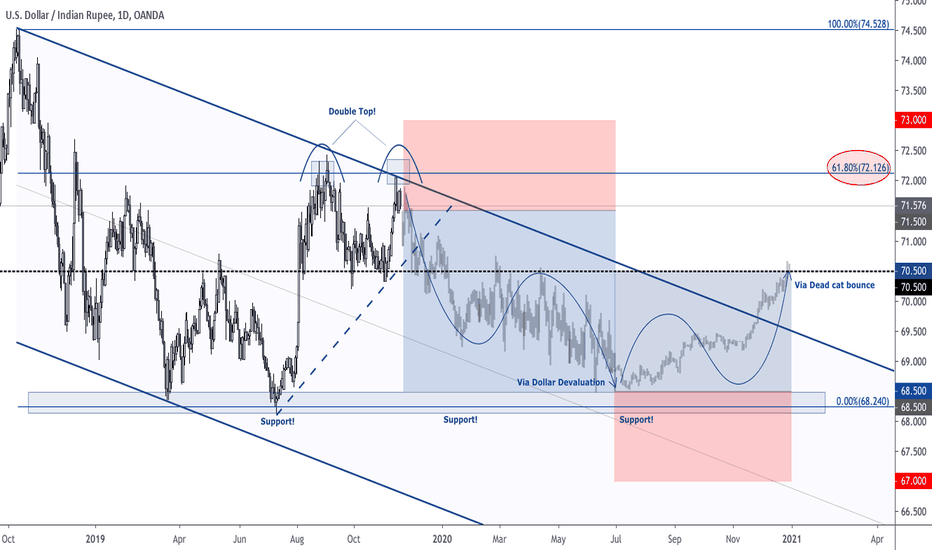

Large Swing In Play For USDINR in 2020Here we are tracking the 2020 macro map for USDINR, a high yielding EM currency. The expansion in volatility here will come from CB coordination, and being short USDINR which generally would also support a view for better risk appetite means it acts a great portfolio hedge for those looking for high carry.

On the INR side, macro figures are starting to indicate further upside although still stuck in low gears. The tax cuts from the fiscal side doing some of the heavy lifting thanks to Modi (India's version of Trump). Inflation is subdue with a lot more slack left in the labour market and a cheap commodity board.

Should investors see the deficit handled appropriately then all boxes are checked for capital flows into India. Demand for INR looks set to improve and combined with the USD devaluation theme it makes a great few months for INR to see some appreciation.

Risks to my thesis come from US-China protectionism, private capex not picking up (low odds after the attractive tax cuts) and to a lesser extent if RBI push the INR down by accumulating.