India

NIFTY50,1H Heikin Ashi BullishThe hourly Heikin-Ashi chart of NSE:NIFTY has retested the prior top at 11100 area.

There is a bullish signal (3 green arrows) on the Multiple Super-trend indicator that I use.

These arrows need not be on consecutive candles but when they are the signal strength is higher.

BANKNIFTY,1W (Log) Rising WedgeThis rising wedge of NSE:BANKNIFTY in LOG scale starts from 2008 and is active even today on October of 2019. The scale of this chart pattern is now more than 10 years which is massive in terms of time and this can only increase the significance of the chart pattern. As you can see from the chart the bottom support line has never been broken on a closing basis. I am not forecasting any trade here, but the break of this wedge to the bottom will definitely not support the current bullishness in the Indian market after the Corporate tax cuts.

I will update this if and once we break any of the two lines.

Follow us on Twitter

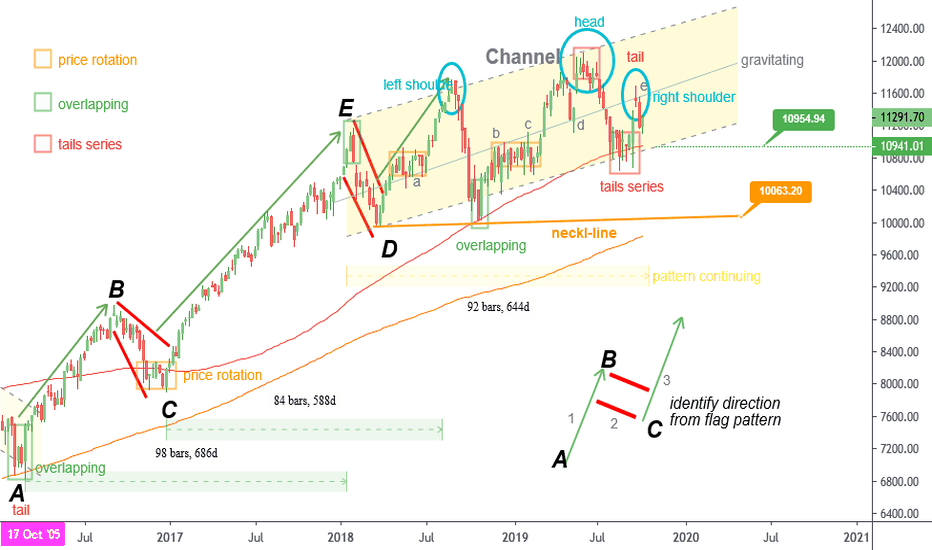

Nifty long-term chart analysis give a story from 2000 to 2020.Following patterns are found for data of 2015 to 2019 (5 years data) on weekly candle chart.

Channel pattern

Flag Patterns

Currently running Head and Shoulders pattern

Remarkable zone 1, 2 and 3

Head & Shoulders pattern is still uncompleted with right shoulder. The neckline target is 10063

At the remarkable zone, its has highly price rotatio n detected with tails

As per channel pattern , the range is 12600 to 10900. The gravitating target 12000 for nifty.

Conclusion, break 10900 below nifty can draw more downward.

History may not repeat itself, but Chart pattern gives you data points and insights to understand how the market can behave in the future.

Weekly candle chart for the spot NIFTY from 2000 to 2020 until the present. Patterns, uptrend, downtrend, or sideways trend, etc are drawn. We have divided this data in 5 years data chart. Comparing the four charts that We have generated, conclusions was written. There're many similarities and difference was found. We can get clear picture of NIFTY for next price move.

Case 1 (2000-2005)

Lot of time and brainpower attempting for technical analysis.

Case 2 (2005-2010)

Technical Chart patterns on nifty.

Case 3 (2010-2015)

Chart the weekly data for the NIFTY.

EROS a mid-to-long-term gap fill candidate with earnings Oct 8EROS is a Bollywood production company making big moves to try to dominate India's booming streaming market. Eros recently went on a 200% run after signing several major streaming contracts, including a deal with Microsoft to stream Eros content on the Azure platform. The stock price then cut in half as it first pulled back from overbought territory, then broke down even further on news that the company took on a $27.5 million debt due in 2020.

(This is something that often happens after announcement of a new product offering: the stock price initially shoots up, then breaks down on news of a new shares or senior notes offering to raise capital for manufacturing or marketing the new product. Shorting cash-poor companies after a big product announcement runs up the stock price wouldn't be a bad strategy.)

Anyway, for the moment Eros has found a floor around 1.80. It has support from there all the way down to about 1.14, with the strongest support nodes around 1.65 and 1.32. This is a decent time to take a small position for a mid-term swing. The stock is likely to get further news boosts as it implements its streaming deals and launches its content on the various platforms.

One short-term risk is the earnings report on October 8. Eros is reporting earnings later than usual, which often bodes ill for earnings results. (Late earnings tend to be worse than expected, whereas early earnings tend to be better than expected.) If Eros's earnings miss, the stock is likely to break down to one of its lower support levels-- perhaps even the very bottom of the support range. I would look at that as an entry opportunity. So if you do take a small position now, save enough cash to at least triple the size of the position after earnings if the price breaks down.

In the event that Eros beats earnings and/or begins to run up again on implementation news, it's got plenty of room to run. 3.00, 4.00, and 5.00 are all conceivable in the mid-term. In the longer term, this stock has the potential to break out above 5.49 and then very quickly fill the gap up to 7.23.

(For weekly news and educational videos, check out my new YouTube show, Wall Street Petting Zoo!)

USD/INR: Uptrend about to resume?The USD/INR (Indian Rupee) pair triggered a bullish wedge pattern recently and entered into a consolidation.

The price is now trading near the 38.2% Fib level which aligns with a horizontal support level, signaling a potential continuation of the underlying downtrend.

Notice that the pair hasn't reached the profit target projected by the wedge pattern yet, which lies around the 73.50 level.

We are following this setup in our Telegram group and wait for a buy confirmation

article 370 and j&k bank FUDOn 5 August 2019, President Ram Nath Kovind issued a constitutional order superseding the 1954 order, and making all the provisions of the Indian constitution applicable to Jammu and Kashmir.

Share Rose 60% in 3 days

Came back to same level upcoming days LOL

Thats why Reversal traders loose and Trading on news events is risky

In market there are no coincidences & insider trading is rampantReliance Chronology of Insider Trading

August 07, 2019 Wednesday: On it made its low and closed around 1110,

August 08, 2019 Thursday: Reliance Gains 4% (13M vol) ~1500Cr @ median price of day

August 09, 2019 Friday: Reliance Gains ~1% (10M vol) ~1100Cr @ median price of day

August 10, 2019 Saturday: Market Remain Closed

August 11, 2019 Sunday: Market Remain Closed

August 12, 2019, Monday (Bakarid Holiday): RIL Annual General Meeting was held | Market Remain Closed Bakarid Holiday

www.timesnownews.com

Highlights of AGM can be seen at

Reliance AGM 2019 Key Announcements | The Quint

www.youtube.com

www.financialexpress.com

August 13, 2019 Tuesday: Markets open with a gap of 6% and the stock gains ~10% in a day (47Millon volume in a day) total ~70M Volume in 3 trading days making it about

8,400cr Buying volume.

August 14, 2019 Wednesday : ~1.5% Down with same (13-14M vol) ~1800Cr @1294 median price of day

August 15, 2019 Thursday: National Holiday

August 16, 2019 Friday: ~1.5% Down with same (10M vol) ~1280Cr @1285 median price of day

So who ever had the insider information gained about ~500cr in 4 trading days or a week

August 17, 2019 Saturday: Market Remain Closed

August 18, 2019 Sunday: Market Remain Closed

== Media Hears the News ===

Aug 19, 2019 | Source: PTI

RIL shares have gained ground since the announcement of a host of investor-friendly proposals at its annual general meeting held early last week.

www.moneycontrol.com

I am starting to believe that in market there are no coincidences & insider trading is rampant

Well i can be wrong who am i a nobody.