Divis Laboratories potential Breakout ?The idea here is about Divis Laboratories:

Divis Laboratories Ltd is engaged in the manufacture of Active Pharma Ingredients (APIs) and intermediates. The company in a matter of short time expanded their breadth of operations to provide complete turnkey solutions to the domestic Indian pharmaceutical industry.They are actively involved in developing alternate, patent non-infringing processes for APIs, for the inventors to manage late life cycle and leading generic drug manufacturers.

My view is neutral at the moment for the below observed technical factors.

Points as per TA on a Weekly Chart:

1. Current market condition isn’t been good due to high volatility back in action any trade entries should be done very carefully and cautiously.

2. BSE 100 ( Divis lab included in) has lost 272.58 points on 11th Oct 2022. However, daily candle indicates it can still bounce back as Anti butterfly harmonic pattern observed as per below:

3. Currently under downtrend channel on a weekly chart as per below:

4. Contracting triangle formation inside downtrend channel as per below:

5. Bearish Bat harmonic pattern CD leg in progress at the time of publishing as per below:

6. Trading way above 200 EMA & below 20 EMA on a weekly chart.

7. Ichimoku Cloud analysis: Kumo Breakout strong downtrend & Kumo Twist weak trend on weekly,monthly chart is Strong for an upward momentum for Kumo breakout & kumo twist on daily both are strong downtrend at the time of publishing .

8. RSI is at 37.55 on a weekly Chart and 35.05 on daily chart at the time of publishing.

9. MACD above signal line on weekly & below on daily chart.

10. Hull Moving average and other moving averages on a daily,weekly chart is strong sell & monthly chart is a sell.

11. ADX (Average directional index ) trend strength is at 28.42 on a weekly(ADX between 25-50 is a strong trend) and 14.13 on a daily chart which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend).

Long Entry : if the price breaks above contracting triangle & breaks downtrend.

Short Entry : If price breaks below the contracting triangle and support zone.

Projected Target: provided in the chart as per bearish bat Crab harmonic pattern.

Stop Loss: Enter only if it breaks downtrend & contracting triangle.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

Indianmarket

JSW Steel Ltd Double Bottom BreakoutThe idea here is about JSW Steel Ltd:

JSW Steel Ltd. is a holding company, which engages in the production, distribution, and trade of iron and steel products. It offers hot rolled and cold rolled coils and sheets; galvanized coils and corrugated sheets; galvalume products; steel doors; and light steel building solutions.

My view is short term Bullish for the below observed technical factors.

Points as per TA observed on a daily Chart:

1. Broken out of Double Bottom pattern as per below:

2. Broken Out of Contracting Triangle on a daily chart on 27th Oct 2022 as per below:

3. Bearish Navarro 200 Harmonic Pattern observed on a daily chart & Price may retest 678.05 ( Swing B of Bearish Navarro 200) as per below:

4. Trading above 20 & 200 EMA on a weekly & daily chart.

5. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily is a strong upward momentum & weekly is Neutral at the time of publishing.

6. RSI is at 61.77 on a Daily Chart and 56.03 on weekly chart at the time of publishing.

7. MACD above signal line on weekly & daily chart.

8. Hull Moving average on daily is a sell and Strong buy on Weekly & monthly. Other averages are strong buy on daily, weekly & Monthly.

9. ADX ( Average directional index ) trend strength is at 18.30 on a daily & 7.45 on a weekly which indicates a absent or weak trend ( ADX between 0-25 is a Absent or weak trend.

10. No divergence observed.

Projected Target with %: Double bottom & contracting triangle provided in the chart. However, would recommend for retest to be completed.

Stop Loss: provided in chart.

Wait for retest confirmation on daily chart for double bottom.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So

Please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

GNFC Potential BreakoutThe idea here is about GNFC (Gujarat Narmada Valley Fertilizers & Chemicals Ltd):

Gujarat Narmada Valley Fertilizers & Chemicals Ltd.is engaged in the manufacturing and marketing of chemicals, fertilizers and information technology.The products and services offered by the company include Fertilizers- GNFC is one the leaders in the domestic fertilisers industry. The company manufactures and markets fertiliser such as urea, ammonium nitrophosphate and calcium ammonium nitrate under the brand NARMADA. It is also engaged in importing urea, diammonium phosphate (DAP) and muriate of potash (MOP).Chemicals- The company has also set up core chemical and petrochemical plants that manufactures products such as methanol, formic acid, nitric acid, acetic acid and many more

My view is Bullish for the below observed technical factors.

Points as per TA observed on a Weekly,Daily & Hourly Chart:

1. Contracting or symmetrical triangle observed on a weekly chart as per below:

2. Doji/Spinning top candle formation on weekly chart which indicates the continuation of trend (upward) as per below:

3. Apex point Breakout & Support established with huge breakout in volume & Bullish pin bar candle formation on a daily chart observed as per below:

4. Bullish Gartley, Bearish Anti Crab & Bullish Navarro 200 pattern formations completed within the range of contracting triangle with Gartley & Navarro 200 targets been still active on a weekly chart as per below :

5. Falling wedge observed on 1H chart with breakout & reconfirmation as per below:

6. Inverse Head & Shoulder formation in progress on 1H chart with completion of left Shoulder & Head completed with 20 & 200 EMA support established as per below :

Inverse H&S target once completed will lead to breakout of contracting triangle on weekly chart

7. Trading above 20 & 200 EMA on a weekly & 20 EMA support established on daily chart at the time of publishing.

8. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a weekly is a strong upward momentum & Daily is Neutral at the time of publishing.

9. RSI is at 52.64 on a Daily Chart and 53.03 on weekly chart at the time of publishing.

10. MACD almost touching the signal line on daily chart & below signal line on a weekly chart at the time of publishing. There is a high possibility of MACD crossover on weekly chart.

11. Hull Moving average & other averages are strong buy on daily & monthly. However Hull moving average is a sell on weekly and other averages is a Strong buy.

12. ADX ( Average directional index ) trend strength is at 14.02 on a weekly & 12.83 on daily chart, which indicates a absent or weak trend ( ADX between 0-25 is a Absent or weak trend).

13. No divergence observed.

Projected Target with %: provided in chart.

Stop Loss: provided in chart.

Entry point: Conservative trades can wait for breakout & retest of contracting triangle. Aggressive & risk trades can enter at CMP.

Note: The center has approved an additional Subsidy on fertilizers for winter planting season.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So

Please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & subscribe for more analysis. The more boost & comments further more motivation for publishing.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

Namaste, Tradingview Community 🙏Hi all 👋

We are extremely excited to be part of the Tradingview community and being the first Indian Broker which will enable Indian traders to place orders directly across all the segments NSE, BSE & MCX from Tradingview.com.

Dhan is a technology-led stock broking app built for super traders & long-term investors. Since our inception in 2021, we have been extremely focussed on bringing industry-first features along with a highly customer-centric approach providing round-the-clock support to the Traders.

We will be actively sharing articles, feature updates, blogs, actionable insights & everything (as per regulatory norms) that will be helpful to the Traders in the Tradingview community.

We are always focused on bringing exemplary product & customer experience, and look forward to your feedback & suggestions. Feel free to reach out to us at tradingview@dhan.co or drop a message here.

Regards,

Team Dhan

NIFTY 50 Weekly Forecast Analysis 28 Nov-2 Dec 2022 NIFTY 50 Weekly Forecast Analysis 28 Nov-2 Dec 2022

We can see that this week, the current implied volatility is around 1.85% , same as last week.

According to ATR calculations, we are currently on the 51th percentile, while with INDIA VIX we are on 12th percentile.

Based on this data, we can expect on average, the movement from open to close of the weekly candle to be :

In case of bullish - 1.82%

In case of bearish - 1.55%

With the current IV calculation, we have currently 24.3% that the close of the weekly candle is going to finish either above

or below the next channel:

TOP: 18771

BOT: 18090

At the same time, taking into consideration the high/low touch calculation from the previous values, we can expect for this week:

26% chance that we are going to touch the previous low of the weekly candle of 18125

78% chance that we are going to touch the previous high of the weekly candle of 18535(already hit)

Lastly from a technical analysis point of view, currently 80% of the moving averages rating, are insinuating we are in a BULLISH trend.

Nifty is looking Indecisive.

🤑 Nifty is likely to be INDECISIVE till it's between 17940 and 18155.

❓ Reason: Because Nifty is in between ATM Machine Yellow Zone.

🚧 Upside Hurdles: 18305.

🚧 Dowside Hurdles: 17860.

🌈 Advice: 1.) Take reversal trade near these levels, or 2.) Wait for Breakout and Sustainability.

🟡 Positional Trend is Indecisive.

🔴 Long Term Trend is Negative.

📢 Disclaimer: We are NISM Certified so we don't hold any position in Nifty Future or Options as per SEBI guidelines. Take trades as per your own technical analysis, we are just educating you. We are not using any type of indicators for finding out of levels.

🙏🏻 Come to Learn, Go to Earn🙏🏻

✅ We are NISM Certified. ✅

☔If you find us useful, Please help the helpless near you.☔

☺Happy to Help.☺

@ohotrading

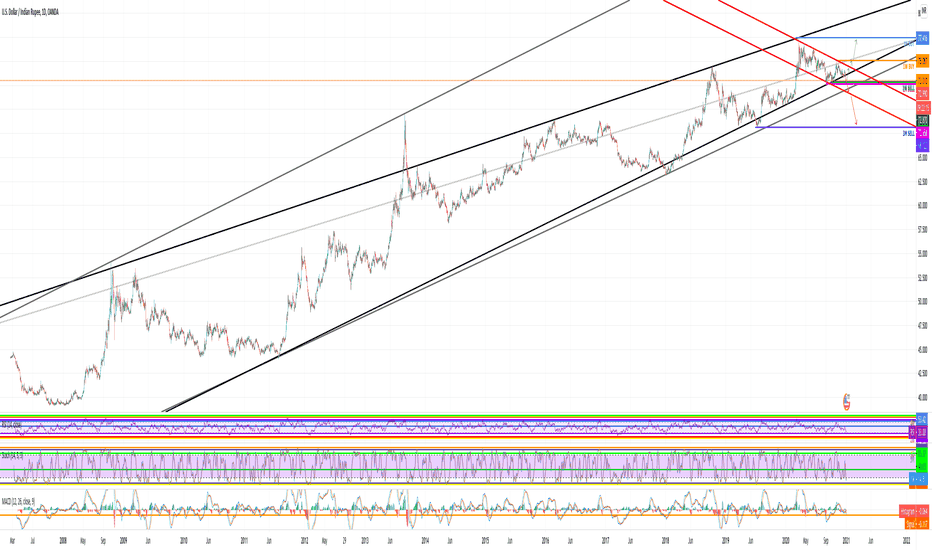

USDINR STRONG IMPORTANT LEVELHello friends,

First, I love India and the Indian people. I made an analysis for the Indian rupee and I think it is on a very important level now. You see the huge rising channel, in which a small falling one is formed. I have indicated the important levels on monthly and weekly charts, which were just hit. We saw a strong rejection from these levels, which means that the price is struggling to fall down further. If the daily candle closes today with a bullish candlestick pattern, I drew the path upside. However, my opinion is that we would only make a price correction in order to break those levels and fall further. Downside levels are really strong and if those are broken we might see a massive crash of the price. I advise you to follow the fundamental analysis of the Indian economy because it is an integral part of this trade. I will also upload pictures under this trade in order to see closer daily candle and fibonacci levels. I will update this trade and follow it closely!

This information is not a recommendation to buy or sell. It is to be used for educational purposes only.

Namaste! I wish you all the best and bags of profits during the new year.

Godfrey Phillips Possible BreakoutThe idea here is about Godfrey Phillips:

Godfrey Phillips India Ltd. operates as a holding company. It engages in the manufacture and marketing of tobacco related products. The firm operates through the following segments: Cigarette, Tobacco and Related Products and Retail and Related Products. Its cigarette brands include Marlboro, Red & White, Cavanders, Four Square, Stellar, and North Pole and Tipper.

My view is bullish short term(Swing trade) for the below observed technical factors.

Points as per TA on a Weekly Chart:

1.Contracting or Symmetrical Triangle formation on a weekly chart as per below:

2. Double Bottom formation on a weekly chart as per below:

3. Possible Bearish Gartley harmonic pattern in progress at the time of publishing as per below:

4. Ichimoku cloud Senkou Span A support established on weekly chart as per below:

5. Support established on 20 EMA & trading way above 200 EMA on a weekly chart as per below:

6. Trading above 20 & 200 EMA on daily chart.

7. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily, weekly & monthly chart is Strong for an upward momentum at the time of publishing.

8. RSI is at 52.44 on a weekly Chart and 53.73 on daily chart at the time of publishing.

9. MACD above signal line on weekly & daily chart.

10. Hull Moving average and other moving averages on a daily,weekly & monthly chart is a strong buy.

11. ADX (Average directional index ) trend strength is at 10.69 on a weekly and 8.70 on a daily chart which indicates a absent or weak trend ( ADX between 0-25 is a Absent or weak trend).

Projected Target: provided in the chart.

Stop Loss: Provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

JPPOWER Wait for Bulls & Trend ReversalThe idea here is about Jai Prakash Power Ventures:

Jai prakash Power Ventures Ltd. engages in the generation of power. It operates through the following segments: Power and Transmission, Coal, and Other. The Power and Transmission segment includes generation, sale, and transmission of power. The Coal segment refers to the coal mining for captive use in energy generation. The Other segment consists of cement grinding.

My view is short term bearish & long term Bullish for the below observed technical factors.

Points as per TA on a Monthly, Weekly & daily Chart:

1. Contracting or symmetrical triangle formation observed with ABCD completed and expected move towards E on Elliott’s triangle pattern on a weekly chart as per below:

2. Cup & Handle formation observed on a Monthly chart & under ranging market at the time of publishing as per below:

3. Bearish Anti Butterfly Harmonic pattern completed swing target 2: A Swing = 6.45 which is also contracting or symmetrical triangle support zone as per below:

4. Bullish Gartley Harmonic Pattern CD leg in progress, min & max XD distance on Fib is 0.786 for Gartley which is 6.30. Which is also approx to contracting or symmetrical triangle support zone & Target 2 on Bearish Anti Butterfly Harmonic Pattern as per below:

5. Possible Inverse Head & Shoulder Pattern observed & price to be rejected @ 8.50 due to resistance zone & Bearish Anti Butterfly B point on a weekly chart as per below :

6. Elliott’s Bullish triangle ABCD points completed and Price direction towards E point on a weekly chart as per below:

7. Possible Head & Shoulder pattern observed on daily chart with support zone @ 6.75 as per below:

8. Trading way above 20 & 200 EMA on a weekly chart & 20 EMA cross over expected soon.

9. Trading above 200 EMA & 20 EMA Support on weekly chart.

10. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily & weekly is strong uptrend & monthly chart is consolidating at the time of publishing.

11. RSI is at 54.17 on a weekly Chart and 49.44 on daily chart at the time of publishing.

12. MACD above signal line on weekly & daily chart, However it is converging towards signal line on weekly chart.

13. Hull Moving average on daily is a sell and other moving averages on weekly & monthly chart is a strong buy.

14. ADX ( Average directional index ) trend strength is at 23.43 on a weekly & 11.70 on daily chart, which indicates a absent or weak trend ( ADX between 0-25 is a Absent or weak trend).

Projected Target with %: Wait for bulls to take over once the price hits 6.60 to 6.45 and enter long since the Risk to Reward looks damn good(Final % provided in chart), since the Earnings report which was on 22nd Oct 2022, looks good this week will give more clarity on Entry points,

Stop Loss: Entry only once we have confirmation for long.

Note: Any dip can be considered as accumulation.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

INDIA50 15min chart, it will go up thousand percent sure this is 15 min chart, it will going up 1000% sure,

City Union Bank Breakout TradeA recent Breakout has been observed on the weekly timeframe of City Union Bank.

And as per the setup a 32% upside can been seen in near future in the stock , so don't miss the train.

Disclaimer: above trade is for educational purpose only, please consult your financial advisor before any trade...

Shree Renuka Sugar Clean BreakoutThe idea here is about Shree Renuka Sugar:

Shree Renuka Sugars Ltd is a fully integrated player focused on manufacturing and marketing of sugar, power and ethanol. The Products portfolio of the company includes: Sugar, the company manufactures refined sugar confirming to EU standards it is the higher end product consumed by European and African Countries and is also used for Industrial purpose.

1. Broken out of Symmetrical Triangle & retested with heavy volume at the time of publishing.

2. Navarro 200 Advanced harmonic completed from 26th May to 20th June 2022.

3. Trading above 20 & 200 EMA on daily chart.

4. Kumo Breakout & Kumo Twist on a daily chart is Strong for an upward momentum.

5. RSI is at 69.59 on a Daily Chart at the time of publishing.

6. MACD Way above signal line on daily chart.

7. Hull Moving & other moving average is a strong Buy Daily, Weekly & monthly chart.

8. Long Entry confirmed Target 1 achieved.

Projected targets as per Navarro 200 & Symmetrical triangle provided in the chart.

Stop Loss: provided in chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

NIFTY 50, MARKET TREND!!INDIA WILL ALWAYS BE THE BEST INVESTMENT AT ANY ANY TIME. NIFTY 50 IS A GREAT INDICES TO BE INVESTED IN.

many of them ask will nifty 50 cross 18000 again this year, i say yes, and even say yes for one more question: will nifty 50 be still bullish in 2023.

there are many reasons of it, and i have covered it in my previous analysis(check the lin section).

i have drawn out the support and resistance based on the markets getting consolidated.

look at the FIBONNACCI RETRACEMENT, how greatly nifty 50 is respecting towards it.

IDBI Bank Ltd Bat pattern Trade Set UpThe idea here is about IDBI Bank Ltd:

IDBI Bank Ltd. engages in the provision of commercial banking services to retail and corporate customers. It operates through the following segments: Corporate and Wholesale Banking; Retail Banking; Treasury; and Other Banking and Group Operations. The Corporate and Wholesale Banking segment includes corporate relationship covering deposit and credit activities other than retail, as well as corporate advisory and syndication, project appraisal, and investment portfolio.

My view is bullish (Swing trade) for the below observed News & technical factors.

News: There is a potential merger up news in air at the moment of publishing this idea. Do your own research to find out more information.

Points as per TA on a Daily & Weekly chart:

1.Downtrend channel breakout & retested & trading above 200 EMA & 20 EMA support established on daily chart as per below:

2. Trading below 200 EMA & 20 EMA support established on a weekly chart as per below:

3. Anti Cypher pattern completed on weekly chart, Target 1 achieved from entry point & due to lack of momentum or global uncertainty price has been pushed below Target 1. Price has taken support on 20 EMA as per below:

4. Bat Pattern completed on daily chart, Entry point confirmed price towards target 1 as per below:

5. MACD Converging towards signal line on daily as well as monthly chart which is a signal for upward momentum as per below(daily MACD):

MACD above signal line on weekly chart.

6. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily chart is strong upward momentum at the time of publishing. However on weekly it’s neutral.

7. RSI is at 53.68 on a weekly Chart and 52.63 on daily chart at the time of publishing.

8. Hull Moving average and other moving averages on weekly & monthly chart is a strong buy & on Daily Hull Moving average is sell.

9. ADX (Average directional index ) trend strength is at 20.54 on weekly & 16.58 on daily, which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) and 31.81 on monthly chart which indicates a strong trend .The trend seems to be picking up.

10. It is also suggested to keep a look on Bank Nifty, as its taken support on 20 EMA on Weekly and below on daily as per below :

11 Ichimoku cloud is strong upward moment for Bank Nifty on weekly and daily chart as per below :

Projected Target with %: provided in the chart as per Bat Harmonic pattern, coincidentally Target 4 of Bat is almost aligned with Target 3 of Anti Cypher.

Stop Loss: Provided in the chart for Bat .

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

BOROSIL LTD : Potential BreakoutThe idea here is about Borosil Ltd:

Borosil is India's most trusted glassware brand since 1962. Synonymous with heatproof glassware, it is the market leader for consumer glassware in India, USA & Netherlands.

mentioned below are the points to be considered.

Points as per TA on a Hourly, Daily &Weekly Chart:

1. Trading in Ranging Market(Daily chart) since 11th July 2022 after breakout of falling wedge as per below chart:

2. Gartley Harmonic Pattern completed on weekly chart since 23rd August 2021 till 20th June 2022. B Swing completed & momentum heading towards C Swing at the time of publishing as per below chart:

3. Bearish Bat pattern completed on daily chart since 4th August 2022 till 12th September 2022, price may touch B swing on the pattern since 20 EMA is just below the B swing point as per below chart:

4. Cup formation completed on daily & hourly chart since 4th August 2022 till 12th September 2022. Handle formation under process with a downtrend channel on hourly chart. Price did break out of trend on 14th September 2022 between 12.15 PM to 1.15 PM but was rejected as per below chart :

Expecting the price to break through the trend in tomorrow’s session.

5. Trading above 20 & 200 EMA on daily chart & daily chart.

6. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily is Strong buy for an upward momentum. Weekly & Monthly chart is Neutral at the moment.

7. RSI is at 63.94 on a Daily Chart & 58.68 on a weekly chart at the time of publishing.

8. MACD Way above signal line on daily & weekly chart .

9. Hull Moving & other moving average is a strong Buy on Weekly, monthly & sell on daily chart. If price sustains above 362.22 by end of the week then it is a very strong signal for upward momentum.

10. Long entry if price breaks above 379.55 & sustains, then we are in upward momentum. However, keep in watch list for the week & alert for price momentum.

Projected targets provided in the chart.

Stop Loss: Enter only once cup & handle & bearish Bat pattern Break out.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

VIP Industries Clean BreakoutThe idea here is about VIP Industries:

V.I.P. Industries Ltd. engages in manufacturing and marketing of luggage, bags, and accessories. The firm's product includes hard and soft luggage-trolleys; suitcases, duffle bags, overnight travel solutions, executive cases, backpacks, and travel accessories. Its brands include VIP, Carlton, Caprese, Footloose, Alfa, Aristocrat, and Skybags.

My view is bullish (Swing trade) for the below observed technical factors.

Points as per TA on a Daily & Weekly chart:

1.Contracting or Symmetrical triangle breakout & retested on weekly chart as per below:

2. Bearish Crab Harmonic CD leg under formation at the time of publishing as per below:

3. EMA 20 support established on weekly chart as per below:

4. Trading above 20 & 100 EMA on daily chart.

5. Double Bottom formation competed & Neck line breakout completed as per below:

6. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily,weekly & monthly chart is strong upward momentum at the time of publishing. This is a very good signal for upward momentum.

7. RSI is at 62.82 on a weekly Chart and 66.72 on daily chart at the time of publishing.

8. MACD above signal line on daily & weekly chart which is a signal for upward momentum.

9. Hull Moving average and other moving averages on a daily,weekly & monthly chart is a strong buy.

10. ADX (Average directional index ) trend strength is at 10.45 on a weekly which indicates a absent or weak trend (ADX between 0-25 is a Absent or weak trend) and 32.57 on a daily chart which indicates a strong trend .The trend seems to be picking up.

Projected Target: provided in the chart as per Cypher harmonic pattern.

Stop Loss: Provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Cheers.

Deepak Nitrite Breakout of wedgeThe idea here is about Deepak Nitrite:

Deepak Nitrite is a leading manufacturer of organic, inorganic, fine and specialty chemicals. The company`s product range includes a spectrum of chemicals which caters to a wide range of industries including Colorants, Agrochemicals, Pharmaceuticals, Rubber, Specialty & Fine chemicals.

1. Broken out of Falling Wedge on a weekly chart at the time of publishing.

2. Retesting of support line & breakout point completed on a daily chart as per below image. However, would recommend for a weekly retest of the breakout point.

3. Support established on 20 EMA & 200 EMA on a daily chart as per above image.

4. Trading above 20 & 200 EMA on Weekly chart.

5. Bearish Sea Pony (Advanced Harmonic pattern) formation on a weekly chart.

6. Sea Pony Pattern: Explained in the below image.

7. Ichimoku Cloud analysis: Kumo Breakout & Kumo Twist on a daily & monthly chart is Strong for an upward momentum. However, weekly chart is on a strong downward momentum at the time of publishing.

8. RSI is at 50.78 on a weekly Chart at the time of publishing.

9. MACD Way above signal line on weekly chart.

10. Hull Moving average on a daily & weekly is sell & on a monthly chart is a buy other moving averages are strong buy on Daily, Weekly & monthly chart.

11. Wait for retest completion for long entry. However, keep in watch list for the week & alert for price momentum.

Projected targets as per Sea Pony Pattern provided in the chart.

Stop Loss: Enter long only if retest & upward momentum continuation.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas !!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

Madras Fertilizers Traiangle breakout The idea here is about Madras Fertilizers:

Madras Fertilizers Ltd. engages in the manufacture and marketing of ammonia, urea, and complex fertilizers. It also produces bio-fertilizers and markets organic fertilizers and neem pesticides.

I am short term bullish on Madras Fertilizers due to below observed technical factors.

1. Contracting or Symmetrical triangle formation on a weekly chart as per below:

2. Possible bearish Butterfly pattern under formation as per below:

3. Trading above 200 EMA & Support established on 20 EMA on a weekly chart as per below:

4. Ichimoku Cloud analysis: Senkou Span B support established on a daily chart as per below:

5. Ichimoku Cloud analysis: Kumo Break out and kumo twist strong buy for upward momentum on daily & Weekly chart.

6. RSI is at 49.47 on a Daily Chart & 55.97 on a weekly chart at the time of publishing.

7. MACD below signal line on weekly chart & way converging towards signal line on daily chart.

8. Hull Moving average on daily & monthly chart is buy & sell on Weekly chart & other moving average is a strong buy on Weekly & monthly chart.

9. ADX (Average directional index) trend strength is at 24.93 on a weekly and 25.83 on a daily chart which indicates a strong trend ( ADX between 25 - 50 is a strong trend) in the current direction.

Projected targets as per bearish butterfly patterns provided in the chart.

Stop Loss: provided in chart as per contracting or symmetrical triangle.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis.

Do leave your valuable feedback & comments for any improvisations.

Note : use the Load new Bars forward button to know the current movement.

Cheers.

Lumax Industries Breakout & RetestThe idea here is about Lumax Industries:

The Company offers a range of complete automobile lighting systems and solutions, which includes head lamps and tail lamps, sundry and auxiliary lamps and other related products and accessories for four wheeler, two wheeler, trucks, buses, earth-movers, tractors and a range of applications.

Mentioned below are the points to be considered

Points as per TA on a Weekly Chart:

1. Shark Pattern Completed, Target 1 achieved momentum towards target 2.

2. Broken out & retested Symmetrical Triangle as per chart.

4. Crossover of 20 EMA & 200 EMA on weekly chart.

4. Kumo Twist & Breakout on a weekly chart is Strong buy with an upward momentum.

5. RSI is at 70.87 on a weekly Chart at the time of publishing.

6. MACD way above signal line on weekly chart.

7. Hull Moving Average is on day is sell, Weekly is buy & monthly is sell coming week will decide on the direction of momentum.

8. Keep a watch on price alert.

Projected targets as per Shark Pattern provided in the chart.

Disclaimer: “The above is an Educational idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas!!

Want to keep yourself updated with current market action? Then don’t forget boost & to subscribe for more analysis. Do leave your valuable feedback & comments for any improvisations.

Cheers.

ACC LTD Wait for breakout & retest.The idea here is about ACC LTD.

mentioned below are the points to be considered

Points as per TA on a Weekly Chart:

1. Inverse Head & Shoulder Pattern almost complete.

2. Bullish Ascending triangle formation with top flat & bottom rising.

3. Trading way above 20 & 200 EMA on weekly chart.

4. Strong Kumo breakout on weekly chart (Ichimoku Cloud).

5. RSI is at 60.28 on a weekly Chart.

6. MACD way above signal line.

7. Hull Moving Average is a Buy Signal on a weekly chart.

8. Wait for breakout & retest @ 2400.00.

9. Stop loss just below lower low of right shoulder.

10. Projected target as per inverse Head & Shoulder on the chart.

Disclaimer: “The above is an idea only and not any kind of financial or investment advice. So please do your own DD (Due Diligence) before any kind of investment”.

Do you like my TA & ideas !!

Want to keep yourself updated with current market action, then please follow my profile for more analysis.

Cheers.