USDINR Best sell signal you can find.The USDINR pair has been rising parabolically since the late September 2024 bottom. This rise has however most likely come to an end as the 1W RSI hit the top of its 16-year Resistance Zone.

This Zone has been holding since the October 2008 High and as you can see, it has offered 7 excellent sell signals. Most of those times, the rejection hit at least the 1W MA50 (blue trend-line), so if you are looking for a long-term short trade, you can consider this.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Indianrupee

USDINR The 2-year Rising Wedge is holding.The USDINR pair continues to respect the Rising Wedge that we mentioned more than 2 months ago (July 24, see chart below), giving us both excellent buy and sell signals:

This 2-year Rising Wedge pattern is approaching its top (Higher Highs trend-line) once more so we're preparing for a sell signal again. The confirmation to sell within this pattern is given when the 1W RSI breaks above its MA line (yellow trend-line).

Our Target is 83.7500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Year long wedge- Chart patterns dont tell the whole storyIndian Rupee is on year long wedge formation

But its not strictly a technical pattern because INR is in dirty float meaning Central Bank manages its levels. Therefore the chart does not reflect the market participants view

Can't trade this kinda managed chart patterns

USDINR Bullish break-out signalThe USDINR pair broke this week above Resistance 1 (83.700), the long lasting level since the week of March 18 and following a strong rebound on the 1W MA50 (blue trend-line), the break-out should technically lead higher.

The long-term pattern remains a Rising Wedge and we expect at least a symmetrical +1.29% Bullish Leg to price the Higher High, similar to the March High. Our Target is 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Bearish unless it breaks that Resistance.The USDINR pair has been trading within a long-term Rising Wedge pattern since the November 11 2022 Low. The 1W MA50 (red trend-line) has been supporting all the way and in fact has made contact with the price and held on 3 occasions, with the most recent being on June 03.

We are currently bearish as the price remains within the Rising Wedge, targeting its bottom (Higher Lows trend-line) at 83.2150. If however the pair manages to close a 1D candle above Resistance 1 (83.7000), we will take the small loss and open a buy, targeting the Higher Highs at 84.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Sell opportunity to the 1D MA50The USDINR pair made a direct hit on our 82.700 Target, which we set on our last analysis (January 10, see chart below):

Right now we see the price pulling back within a Channel Down. This is a standard pattern within the long-term Rising Wedge pattern, which as you see out of 7 Bearish Legs all broke below the 1D MA50 (blue trend-line) and only 1 managed to make just a hit-and-rebound.

As a result we are going for a moderate sell Target at 83.100 and then we will reverse to buying, targeting Resistance 1 at 83.700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Still bearish but we move our target a little higher.This is an update to our November 27 2023 idea on the USDINR pair where we issued a sell signal exactly at the top (Higher Highs trend-line) of the 1 year Rising Wedge pattern:

Our 82.600 Target hasn't yet been hit but due to the slower than expected decline, we have to modify our target and move it a little higher to 82.700, which marks a projected contact with the 1W MA50 (blue trend-line).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR Neutral but needs a medium-term pull-back.The USDINR pair has been practically ranged around the 1D MA50 (blue trend-line) since September but on a long-term perspective, close to the top (Higher Highs trend-line) of the Rising Wedge. This calls for a technical medium-term pull-back, especially with the Bearish Divergence on the 1D RSI, which is trading within a Channel Down. Our target is the 1D MA200 (orange trend-line) at the bottom of the Wedge at 82.600.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR: Watch closely for an insane 2024 rally.USDINR is trading inside an Ascending Triangle on the 1W timeframe, with the 1W technical outlook constantly bullish (RSI = 59.515, MACD = 0.267, ADX = 38.795). This is despite 8 failed attempts in the last 9 weeks to close a 1W candle over the top of the Ascending Triangle, which on any other occasion would be considered a sign of weakness. With the 1W MACD on a Bullish Cross though and the whole pattern supported by the 1W MA50 in July, we expect a bullish breakout to take place soon.

The chart on the right which is on the 1M timeframe shows the incredible upside potential of the pair every time it breaks out. If we get the candle close we want, look for a buy and at least a +12.60% rise (TP = 92.000).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

USDINR Stuck in a Triangle. Trade the break-out.The USDINR pair is trading inside a 1.5 month Triangle (blue), following the upward break-out of the 1 year Ascending Triangle. The 1D MA50 (blue trend-line) has been supporting for 2 months and as long as it holds, buy when the price breaks above Resistance 1 (83.4200). The target can be 84.500, representing a +2.13% leg extension on a potential emerging Channel Up. If the 1D MA50 breaks, we will sell instead and target the 1D MA200 (orange trend-line) at 82.4500, which is marginally above Support 2.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR is on verge of break out. USDINR has been trading in the 83-80 area since October 2022. The USDINR has been consolidating for nine months and is on the verge of breaking over the 83 barrier. If it breaks over 83 per USD, the pair might go to 86 within 6 months. When the rupee reaches 86 per USD, the Indian central bank may interfere. The ultimate target for Primary Degree Wave 3 may be 90 per USD in the next couple of years, as illustrated in the graph.

USDINR Triangle pattern on the 1D MA200. Trade the break-out.The USDINR pair is trading within a Triangle pattern with the 1D MA200 (orange trend-line) supporting on its bottom (Higher Lows trend-line). You can scalp inside the pattern for as long as it lasts (RSI also in a Triangle), but when a 1D candle closes outside the Triangle, trade the break-out's direction. Buy and target the 83.2900 Resistance in case of a bullish break-out, and the 80.500 Support in case of a bearish break-out.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR (U.S.Dollar / Indian Rupee) Currency Analysis 29/03/2021on a bullish impulsive wave we can see there exist a Hidden Bullish Divergence with MACD which is the sign of trend Continuation, followed by a Milled Bullish Divergence

there total of 2 Targets Defined by Fibonacci projection,

79.50 Rs seem to be a good target for the end of 2021

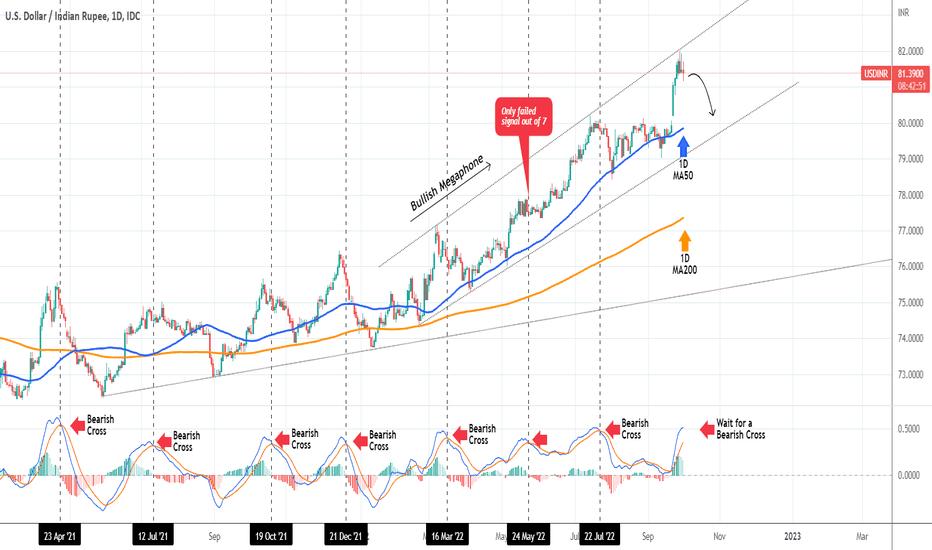

USDINR Sell when the MACD gives a Bearish CrossThe USDINR pair has been trading within a Bullish Megaphone since February 21 2022. Just 2 days ago, the price hit the top (Higher Highs trend-line) of this pattern and got rejected. We may see a pull-back towards the 1D MA50 (blue trend-line) or even the bottom of the Megaphone.

The best confirmation to take that sell trade would be to wait for the 1D MACD to form a Bearish Cross. As you see, since April 23 2021 all seven MACD Bearish Cross occurrences have delivered substantial Lower Lows on the short-term, except for one time (May 24 2022).

-------------------------------------------------------------------------------

** Please LIKE 👍, SUBSCRIBE ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support me, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

You may also TELL ME 🙋♀️🙋♂️ in the comments section which symbol you want me to analyze next and on which time-frame. The one with the most posts will be published tomorrow! 👏🎁

-------------------------------------------------------------------------------

👇 👇 👇 👇 👇 👇

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDINR- Broke the resistance zoneUSDINR has broken the falling trendline and also broke past an important horizontal resistance region of 78.15 - 78.20. This was broken with a huge candle.

With this move, it has not only broken the horizontal and trendline supports, but also the tend of LL-LH. This is a clear bullish signal. However, we can't go away with the fact that the central bank may step in to control these levels.

Let's see how the follow-through candles develop today and tomorrow on Daily timeframe. It shall retain the 78.15 - 78.20 region for further up-move.

GOLD TO ₹66,000 BEFORE DIWALI 2021Gold has always been the flight to safety.

With ongoing economic turbulence across countries due to Corona V2.0 aka Lockdowns v2.0, gold will prove itself as the numero uno store of value this year.

Needless to say Q1 2021 has been the worst for the Indian Rupee. Indians don't have the option to hoard $$ legally but only GOLD.

INDIAN RUPEE| STRUCTURE ANALYSIS

USD_INR BROKE THE CHANNEL AND IS FORMING A TRIANGLE, SQUEEZED BETWEEN RESISTANCE AND A 2 YEAR SUPPORT LINE.

THE PAIR EITHER BREAKS UPWARDS AND CONTINUES TRADING INSIDE WIDER OR NARROWER CHANNEL>>> LONG AFTER CONFIRMED BREAKOUT.

OR THE TRIANGLE BREAKS DOWNWARDS>>>SHORT AFTER PULLBACK. ULTIMATE TARGET=SUPPORT 1.

LIKE AND SUBSCRIBE FOR MORE!

USDINR sell setup to look for.last leg of corrective structure is about to form. look for sell setup while going downhill for a while.

/TC/

Singapore Dollar RangeboundSGDINR is trading in the 50.1 to 53.89 range (shown in the box). It will continue to be range bound until there is a breakout. I anticipate an upside breakout eventually. The target then will be the equivalent to the box height. But the timeline will be much shorter.

NeatTrade

#USDINR | Double TopPlease support this idea with LIKE if you find it useful.

Price was rejected by the horizontal resistance which gives us a Double Top pattern, also we have an RSI is in an overbought zone. The price can retest the previous resistance of the Channel (currently support), so we can initiate a short position with a stop-loss above horizontal resistance

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.

USDINR | Channel's Resistance BrokenPlease support this idea with LIKE if you find it useful.

Price broke the Channel's resistance zone. Price was trading with good volumes inside the channel, which points out it could be an accumulation. When price fixes above we can initiate a long position

Thank you for reading this idea! Hope it's been useful to you and some of us will turn it into profitable.

Remember this analysis is not 100% accurate. No single analysis is. To make a decision follow your own thoughts.

The information given is not a Financial Advice.