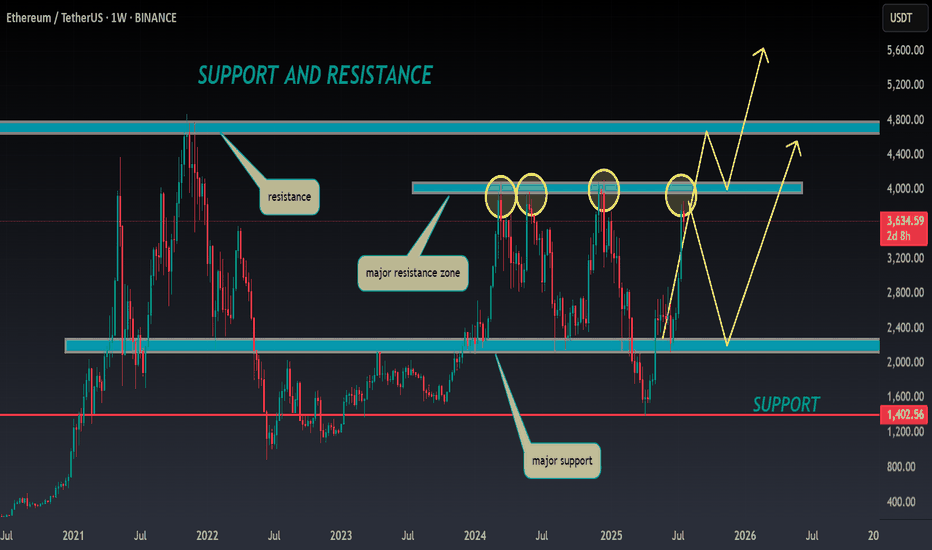

ETH ANALYSIS🔮 #ETH Analysis 🚀🚀

💲💲 #ETH is trading between support and resistance area. There is a potential rejection again from its resistance zone and pullback from support zone. If #ETH breaks the major resistance zone then we would see a bullish move

💸Current Price -- $3634

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#ETH #Cryptocurrency #DYOR

Indicatorstrategy

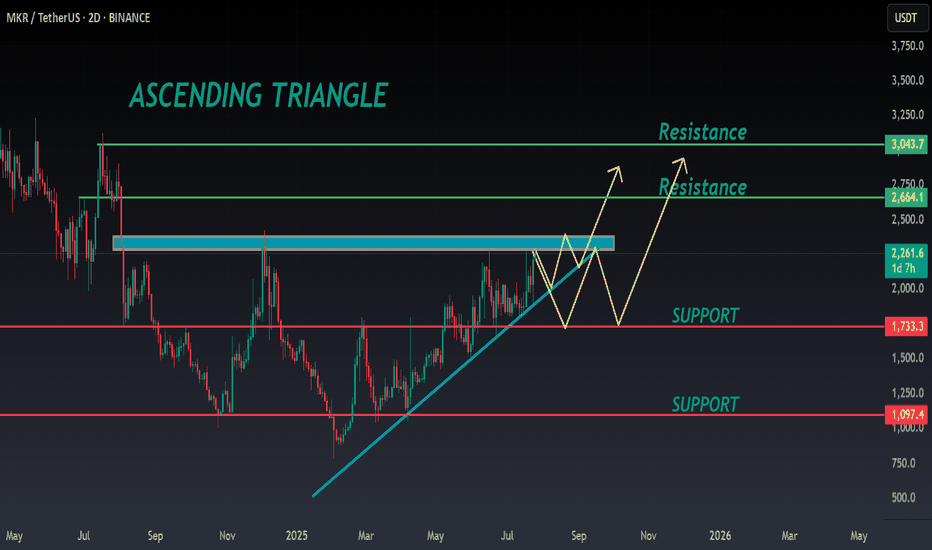

MKR ANALYSIS🔮 #MKR Analysis

🌟🚀 As we said earlier #MKR moved around 48%. Right now #MKR is trading in an Ascending Triangle Pattern and here we can see that #MKR moving again towards its neckline. We see see more bullish move in upcoming days

🔖 Current Price: $2260

⏳ Target Price: $2664

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#MKR #Cryptocurrency #Breakout #DYOR

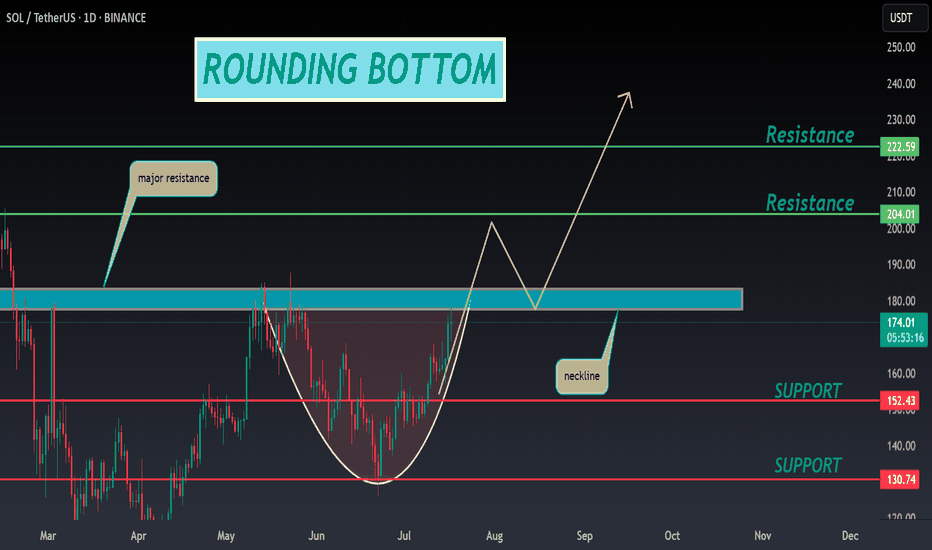

SOL ANALYSIS🔮 #SOL Analysis 💰💰

📊 #SOL is making perfect and huge rounding bottom pattern in daily time frame, indicating a potential bullish move. If #SOL retests little bit and breakout the pattern with high volume then we will get a bullish move📈

🔖 Current Price: $173.75

⏳ Target Price: $204.00

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#SOL #Cryptocurrency #Pump #DYOR

TATA STEEL at Resistance ZoneThis is Daily Chart of TATA STEEL.

Tata steel having good Law of Polarity at 163-168 range.

If this level is sustain , then We may see lower prices in the stock again.

Tata steel is a good support zone at 125-130 range.

Two EMAs are also supporting the stock, with the first EMA positioned at ₹140 and the second at ₹129.

THANK YOU !!

Do You Know the Difference Between an Indicator and a Strategy?A lot of traders jump into Pine Script or apply a script on TradingView without understanding one key difference:

Indicators and Strategies are not the same — especially when it comes to real-time performance and backtesting.

---

What’s the Key Difference?

Indicators

Indicators are visual tools designed to help you analyze price action in real time . They do not track trade performance or simulate trades automatically.

You can use them to:

- Generate signals

- Stack confluences

- Set custom alerts

- Overlay custom visuals on charts

Best for: Chart analysis, signal confirmation, and manual or semi-automated alerts.

---

Strategies

Strategies are built for backtesting . They simulate how your trade logic would have performed historically, using `strategy.entry`, `strategy.exit`, and related functions.

They automatically calculate:

- Hypothetical P&L

- Win/loss ratio

- Drawdowns

Best for: Validating trade logic, optimizing entries and exits, performance tracking.

---

But Here’s the Catch

Many traders assume that once a strategy backtest looks good, it will behave exactly the same in live trading. This assumption can lead to poor decision-making.

❌ Why Forward Testing Isn't Perfect

When you set alerts based on a strategy, you're asking a backtest engine to behave like a live trading engine — and that’s not what it was designed for.

TradingView strategies:

- Only execute on candle close

- Do not simulate intrabar price action

- Do not account for slippage

- Do not reflect real-time market volatility

So:

- Your strategy alert may fire late compared to actual price movement

- Your SL/TP may be hit within a candle, but the strategy won’t know until close

- You may see better backtest results than what happens live

---

Takeaway

If you're using strategies with alerts, it’s critical to understand these constraints:

TradingView’s strategy engine is optimized for historical testing, not for real-time execution. It provides insight into the validity of your logic — but it’s not a replacement for a live execution engine.

Best Practice Recommendations:

- Always forward-test on a demo or paper account first

- Monitor how alerts perform in real-time

- Be ready to adjust parameters based on your asset and timeframe

If you need better responsiveness or real-time adaptability, consider using indicators to generate your alerts. Indicators react to price in real time and are often more suitable for live market conditions.

---

Final Note

Some strategies are built with these limitations in mind. They can still be useful in real-time trading as long as you're aware of how they work.

Transparency is key. Backtesting is a guide, not a guarantee.

Trade smart, stay informed.

Feel free to reach out if you have questions or insights to share!

“ EUR/GBP Buy Setup – Demand Zone to the Moon? ”Key Zones & Levels

🟦 Demand Zone:

Between 0.85555 – 0.85200

Buyers previously pushed price up here — now acting as a strong support base!

🎯 Target Point:

0.87406

Potential upside of +179 pips / +2.09%

🟢 Entry Point:

Around 0.85555, just above the demand zone

Ideal spot for a Buy Entry if confirmation shows.

🛑 Stop Loss:

Set at 0.85200

Smart risk protection below the zone.

Indicators

📉 Downtrend Line:

A break above this could signal the start of a bullish Reversal.

📈 EMA (7-period):

Currently around 0.85796

Reclaiming above this line strengthens the buy signal.

Trade Plan Summary

✅ Buy on bounce from demand zone

🔓 Breakout of the trend line = confirmation

🎯 TP: 0.87406

🛡️ SL: 0.85200

⚖️ Risk-to-Reward Ratio: Excellent (about 1:6)

Final Thoughts

Wait for bullish candles near the entry point

Watch fundamentals too — EUR & GBP news could impact direction

Stay alert for false breakouts below the demand zone

EUR/AUD 4H Trade Setup: Demand Zone Bounce to 1.87500🔵 Key Zones and Levels

🟦 Demand Zone: Strong support area where price has bounced multiple times.

✅ Confluence with the trendline gives extra strength.

🎯 Entry Point: 1.78990

Perfect spot for a potential buy setup.

🛑 Stop Loss: 1.76962

Below the demand zone to protect against false breakouts.

🚀 Target Point: 1.87500

Profit goal with an impressive +4.85% potential (867.4 pips)!

📊 Price Action

📍Current price: 1.80528 (hovering near EMA and close to entry)

🔁 Price has tested the support zone several times — showing signs of accumulation.

⬆️ Potential bullish breakout from this zone.

🔍 Indicators & Patterns

📏 EMA (7): Price is near it, waiting for a clear move above for momentum.

📈 Trendline: Holding well as dynamic support.

🔶 Channel pattern: Higher highs and higher lows indicate uptrend structure.

📌 Summary

🟢 Buy Setup:

🛒 Entry: 1.78990

🛑 Stop Loss: 1.76962

🎯 Target: 1.87500

⚖️ Risk-Reward: Great R:R setup with strong technical backing!

XAU/USD15-Min Chart –Bullish Setup with RBR Zone & Breakout TRG🔷 Chart Structure

* 📊 Ascending Channel

↗️ Price is moving within an upward-sloping channel

• Higher Highs

• Higher Lows

* 🔍 Short-Term Trend: Bullish momentum is intact

🟦 Key Zones

* 🟦 RBR Zone (Rally-Base-Rally)

📌 Support area where buyers stepped in

🔄 Price bounced from this zone

* 🟥 Resistance Zone

🚫 Around 3,250 – sellers previously active here

👀 Watch for breakout confirmation

✅ Trade Setup

* 🎯 Entry Point: 3,226.38

* ⛔ Stop Loss: 3,216.30

* 🥅 Target: 3,267.00

* 💰 Potential Gain: 38.67 points (1.20%)

📊 Risk-Reward Ratio: ~1:3 — very favorable!

📍 Indicators

* 📉 EMA (7) — acts as short-term support

🟡 Price is consolidating near EMA — possible setup for next move.

📌 Outlook

* 🟢 Bullish Bias – As long as price stays above RBR zone

* 🔔 Breakout Alert – A break above resistance may lead to sharp upside move toward the target.

Multi-Timeframe XGBoost Approximation Templatewww.tradingview.com

Template Name:XGBoost Approx

Core Idea: This strategy attempts to mimic the output of an XGBoost model (a powerful machine learning algorithm) by combining several common technical indicators with the Rate of Change (ROC) , MACD, RSI and EMA across multiple timeframes. It uses a weighted sum of normalized indicators to generate a "composite indicator," and trades based on this indicator crossing predefined thresholds. The multi-timeframe ROC acts as a trend filter.

Key Features and How They Work:

Multi-Timeframe Analysis (MTF): This is the heart of the strategy. It looks at the price action on three different timeframes:

Trading Timeframe (tradingTF): The timeframe you're actually placing trades on (e.g., 1-minute, 5-minute, 1-hour, etc.). You set this directly in the strategy's settings. This is the most important timeframe.

Lower Timeframe (selectedLTF): A timeframe lower than your trading timeframe. Used to catch early signs of trend changes. The script automatically selects an appropriate lower timeframe based on your trading timeframe. This is primarily used for a more sensitive ROC filter.

Current Timeframe (tradingTF): The strategy uses the current (trading) timeframe, to include it in the ROC filter.

Higher Timeframe (selectedHTF): A timeframe higher than your trading timeframe. Used to confirm the overall trend direction. The script automatically selects this, too. This is the "big picture" timeframe.

The script uses request.security to get data from these other timeframes. The lookahead=barmerge.lookahead_on part is important; it prevents the strategy from "peeking" into the future, which would make backtesting results unrealistic.

Indicators Used:

SMA (Simple Moving Average): Smooths out price data. The strategy calculates a normalized SMA, which essentially measures how far the current SMA is from its own average, in terms of standard deviations.

RSI (Relative Strength Index): An oscillator that measures the speed and change of price movements. Normalized similarly to the SMA.

MACD (Moving Average Convergence Divergence): A trend-following momentum indicator. The strategy uses the difference between the MACD line and its signal line, normalized.

ROC (Rate of Change): Measures the percentage change in price over a given period (defined by rocLength). This is the key indicator in this strategy, and it's used on all three timeframes.

Volume: The strategy considers the change in volume, also normalized. This can help identify strong moves (high volume confirming a price move).

Normalization: Each indicator is normalized. This is done by subtracting the indicator's average and dividing by its standard deviation. Normalization puts all the indicators on a similar scale (roughly between -3 and +3, most of the time), making it easier to combine them with weights.

Weights: The strategy uses weights (e.g., weightSMA, weightRSI, etc.) to determine how much influence each indicator has on the final "composite indicator." These weights are crucial for the strategy's performance. You can adjust them in the strategy's settings.

Composite Indicator: This is the weighted sum of all the normalized indicators. It's the strategy's main signal generator.

Thresholds: The buyThreshold and sellThreshold determine when the strategy enters a trade. When the composite indicator crosses above the buyThreshold, it's a potential buy signal. When it crosses below the sellThreshold, it's a potential sell signal.

Multi-Timeframe ROC Filter: The strategy uses a crucial filter based on the ROC on all selected timeframes. For a long trade, the ROC must be positive on all three timeframes (ltf_roc_long, ctf_roc_long, htf_roc_long must all be true). For a short trade, the ROC must be negative on all three timeframes. This is a strong trend filter.

Timeframe Filter Selection The script intelligently chooses filter timeframes (selectedLTF, selectedHTF) based on the tradingTF you select. This is done by the switch_filter_timeframes function:

Trading Timeframe (tradingTF) Lower Timeframe Filter (selectedLTF) Higher Timeframe Filter (selectedHTF)

1 minute 60 minutes (filterTF1) 60 minutes (filterTF1)

5 minute 240 minutes (filterTF2) 240 minutes (filterTF2)

15 minute 240 minutes (filterTF2) 240 minutes (filterTF2)

30 minute, 60 minute 1 Day (filterTF3) 1 Day (filterTF3)

240 minute (4 hour) 1 Week (filterTF4) 1 Week (filterTF4)

1 Day 1 Month (filterTF5) 1 Month (filterTF5)

1 Week 1 Month (filterTF5) 1 Month (filterTF5)

How to Use and Optimize the Strategy (Useful Hints):

Backtesting: Always start by backtesting on historical data. TradingView's Strategy Tester is your best friend here. Pay close attention to:

Net Profit: The most obvious metric.

Max Drawdown: The largest peak-to-trough decline during the backtest. This tells you how much you could potentially lose.

Profit Factor: Gross profit divided by gross loss. A value above 1 is desirable.

Win Rate: The percentage of winning trades.

Sharpe Ratio: Risk-adjusted return. A Sharpe Ratio above 1 is generally considered good.

**Sortino Ratio:**Similar to Sharpe but it only takes the standard deviation of the downside risk.

Timeframe Selection: Experiment with different tradingTF values. The strategy's performance will vary greatly depending on the timeframe. Consider the asset you're trading (e.g., volatile crypto vs. a stable stock index). The preconfigured filters are a good starting point.

Weight Optimization: This is where the real "tuning" happens. The default weights are just a starting point. Here's a systematic approach:

Start with the ROC Weights: Since this is a ROC-focused strategy, try adjusting weightROC_LTF, weightROC_CTF, and weightROC_HTF first. See if increasing or decreasing their influence improves results.

Adjust Other Weights: Then, experiment with weightSMA, weightRSI, weightMACD, and weightVolume. Try setting some weights to zero to see if simplifying the strategy helps.

Use TradingView's Optimization Feature: The Strategy Tester has an optimization feature (the little gear icon). You can tell it to test a range of values for each weight and see which combination performs best. Be very careful with optimization. It's easy to overfit to past data, which means the strategy will perform poorly in live trading.

Walk-Forward Optimization: A more robust form of optimization. Instead of optimizing on the entire dataset, you optimize on a smaller "in-sample" period, then test on a subsequent "out-of-sample" period. This helps prevent overfitting. TradingView doesn't have built-in walk-forward optimization, but you can do it manually.

Threshold Adjustment: Experiment with different buyThreshold and sellThreshold values. Making them more extreme (further from zero) will result in fewer trades, but potentially higher-quality signals.

Filter Control (useLTFFilter, useCTFFilter, useHTFFilter): These booleans allow you to enable or disable the ROC filters for each timeframe. You can use this to simplify the strategy or test the importance of each filter. For example, you could try disabling the lower timeframe filter (useLTFFilter = false) to see if it makes the strategy more robust.

Asset Selection: This strategy may perform better on some assets than others. Try it on different markets (stocks, forex, crypto, etc.) and different types of assets within those markets.

Risk Management:

pyramiding = 0: This prevents the strategy from adding to existing positions. This is generally a good idea for beginners.

default_qty_type = strategy.percent_of_equity and default_qty_value = 100: This means the strategy will risk 100% of your equity on each trade. This is extremely risky! Change this to a much smaller percentage, like 1 or 2. You should never risk your entire account on a single trade.

Save Trading

Always use a demo account first.

Use a small percentage of equity.

Use a stop-loss and take-profit orders.

Example Optimization Workflow:

Set tradingTF: Choose a timeframe, e.g., 15 (15 minutes).

Initial Backtest: Run a backtest with the default settings. Note the results.

Optimize ROC Weights: Use TradingView's optimization feature to test different values for weightROC_LTF, weightROC_CTF, and weightROC_HTF. Keep the other weights at their defaults for now.

Optimize Other Weights: Once you have a good set of ROC weights, optimize the other weights one at a time. For example, optimize weightSMA, then weightRSI, etc.

Adjust Thresholds: Experiment with different buyThreshold and sellThreshold values.

Out-of-Sample Testing: Take the best settings from your optimization and test them on a different period of historical data (data that wasn't used for optimization). This is crucial to check for overfitting.

Filter Testing: Systematically enable/disable the time frame filters (useLTFFilter, useCTFFilter, useHTFFilter) to see how each impacts performance.

Secure Profits of LONGBTC/USDT 1H Technical Analysis – Updated Insights

🟢 BitcoinMF Signal: TP Hit – Key Resistance Zone

The BitcoinMF PRO indicator's long signal successfully hit the Take Profit (TP) target, aligning with a resistance level around $94,410. This area is now a critical decision point for BTC's next move.

📊 Advanced Technical Breakdown:

1️⃣ Fibonacci Retracement & Extensions:

To assess potential support and resistance levels, key Fibonacci levels have been recalculated based on the recent price movement:

0.236 Fib Retracement (Support) → $87,416

0.382 Fib Retracement (Support) → $85,991

0.618 Fib Retracement (Stronger Support) → $80,423

1.618 Fib Extension (Bullish Target) → $98,217

2.618 Fib Extension (Aggressive Target) → $104,500

These levels suggest that maintaining support above $87,000 could pave the way for a move toward 98K, while a breach below this support might lead to a deeper retracement.

2️⃣ CME Gap – Key Risk Factor

A CME gap exists between $77,930 and $81,210, formed in November 2024. Historically, such gaps tend to be filled over time, indicating a potential retracement to this zone before resuming the macro uptrend.

3️⃣ Bitcoin Dominance – Altcoin Impact

BTC Dominance is currently at 52.8%, indicating that Bitcoin is leading the market rally. This dominance suggests that if BTC corrects, altcoins may experience more significant declines in the short term.

4️⃣ Exchange Flows – Whale Activity

There has been a significant outflow of BTC from exchanges, signaling accumulation by investors and reduced selling pressure. This trend supports the potential for further upside unless a reversal pattern emerges.

5️⃣ Fear & Greed Index – Market Sentiment

The Fear & Greed Index currently reads 81 (Extreme Greed), reflecting strong bullish sentiment. While this indicates market confidence, it also warrants caution, as extreme greed can precede corrective phases.

6️⃣ Fisher Transform & Stochastic RSI

Fisher Transform: The indicator is in the overbought zone but has not yet signaled a reversal.

Stochastic RSI: Recently crossed above 80, indicating overheated conditions and suggesting a potential cooldown or sideways movement.

🔮 Next Most Probable Move:

📊 Probability Score (Scale 1-10)

Bullish Continuation Probability: 6.5/10

Short-Term Correction Probability: 7.5/10

🔹 Scenarios:

If BTC maintains support above

87K, a move toward

98K is plausible.

If BTC falls below 87K, the 80K region becomes the next significant support level.

🚨 Most Likely Outcome: A short-term retracement toward 87K-85K is anticipated before the uptrend potentially resumes, targeting 98K-100K.

XAU/USD: Waiting for the Perfect Reversal After Accumulation!Gold (XAU/USD) is currently in a crucial accumulation phase, where price is trapped in a narrow range (highlighted in red). With the market looking poised for a potential reversal, watch closely for a drop towards the distribution zone (green area) before a potential bounce. This setup could offer a strong entry for those looking to ride the next wave. Patience is key as we await the market’s next move!”

DAX Trade Recap!Sniped a perfect entry using the WiseOwl Indicator and caught the bullish momentum at just the right time. 🔥

Current Status: Floating at +9RR 🚀

Took 50% partials and holding the rest for much higher targets.

The structure was clear and bullish, making this setup a no-brainer.

Momentum is still strong—let’s see how far this one can run!

How did your week of trading go? Let me know in the comments! 💬

Another Buying Opportunity on $HIMS! 60% UpsideNYSE:HIMS 💊

We are only half way through the week and this is me telling you that THIS IS ANOTHER BUYING OPPORTUNITY!

I said the same thing when we had the Short Attack and flush to $19.

What you don't realize is that the Wr% at the top of the chart ran up into the barrier of the Williams Consolidation Box and now needs to create it's support and bounce in order to form the BOX. I still believe that's $30 (meaning we wick back above it before weeks end). Whether we do or don't doesn't really matter in the longer term (weeks/months).

The downside on the Wr% is limited as well due to the rising trendline (Arrow) we are on since September. If we fall to that I strongly believe we get a bounce off of it, thus creating the box there or where we currently are at.

The reason this is a buying opportunity and shouldn't matter to the majority of you is because IMO it will be at $40+ before EOY! Do what you want but I'm cashing in on my Covered Call Premium and Buying more!

Not Financial Advice.

Mister Car Wash $MCW about to SURGE! 160% Upside!NYSE:MCW - Mister Car Wash 🚗💦

No stock too small for the mighty H5 Setup! 💪✨

-Symmetrical Triangle Breakout & Retest

-H5 Indicator Flashing GREEN💚

-Creating Wr% consolidation box

Picked up 150 contracts at a steal! 🚀

Targets: 🎯 $9 🎯 $12.36 📏 $20.78

NFA #Trading

Home Depot sells CUPS with Handles Now?! 30%+ Move Inbound!When Did NYSE:HD Start Selling Cup w/ Handles? ☕️

Looks like NYSE:HD is introducing a new item for 2025 - the Cup with Handles! 🎉

I have a feeling this is going to be a BIG HIT! Just need to see XMAS RED➡️GREEN on the H5 Indicator before we go ahead and buy these new cups with handles.

I've added it to my watchlist and set an alert!

🎯$468

📏$532

High Tide - High Risk - High Reward $HITI 66%+ Move Inbound🚨CODE RED: NEW H5 TRADE BREAKING OUT RN

HIGH TIDE - NASDAQ:HITI

Happy Thanksgiving and Black Friday: No requirements for this one, just a freebie!

WARNING: HIGH RISK / HIGH REWARD MICROCAP 245M Mkt Cap - Cannabis Stock

Thanks to

@mvcinvesting

for putting this on my radar!

We have a H5 Setup that is BREAKING OUT as we speak of it's two year Cup&Handle Pattern. 66%+ Measured Move with more upside potential.

- H5 Indicator is GREEN

- Massive Volume Profile GAP

- Launching off Massive Volume Profile Shelf

- Wr% already in consolidation box and thriving

🎯 $4.15 (Before my B-day in Feb!)

📏 $4.95

Not Financial Advice - NFA

Bullish Gold: Recent Signals Point to Upward Momentum** Bullish Gold: Recent Signals Point to Upward Momentum **

Gold has been displaying strong bullish tendencies lately, and our latest analysis suggests that the price may continue its upward trajectory toward the next resistance level. After carefully analyzing the charts across multiple timeframes, from 1-minute to 45-minute intervals, we’ve identified compelling signals that favor a continuation of this upward movement.

**Key Observations**

1. **Technical Indicators:**

Recent price action shows a series of higher lows and consistent testing of key resistance zones. This structure aligns with a bullish trend, signaling strong buying pressure in the market.

2. **Momentum Analysis:**

Momentum indicators, such as the Relative Strength Index (RSI) and Moving Averages, confirm a positive trajectory. On smaller timeframes like 1-minute and 5-minute charts, gold has shown consistent breakouts during intraday trading, indicating sustained interest from buyers.

3. **Volume Support:**

Volume spikes during upward moves suggest institutional activity, further supporting the bullish case. Price movements are backed by strong participation, which enhances the reliability of the trend.

4. **Resistance and Next Targets:**

If gold maintains its current pace, the next key resistance level lies at . Breaking through this zone could open the door to higher price levels in the short term.

**Fundamental Context**

The recent strength in gold prices is supported by market uncertainty, with investors seeking safe-haven assets amidst global economic concerns. Additionally, a weaker USD or dovish signals from central banks can further fuel gold’s rally.

**What’s Next?**

We’ll continue to monitor the charts and provide updates as the situation evolves. The current bullish sentiment aligns with both technical and fundamental factors, suggesting that gold’s rally still has room to grow. However, traders should watch for any signs of reversal near key resistance levels and manage their risk accordingly.

Stay tuned for more updates as we track this movement closely!

Symbotic has broken out and is about to SQUEEZE! 145% UpsideSymbotic NASDAQ:SYM has broken out and is about to SQUEEZE! 145% Upside

- Green on the High Five Setup Indicator

- Bull Flag Breakout held this week

- Sitting on a large volume shelf with a free range above the ATH area.

- 17%+ Short Float

- Wr% has created support in the consolidation box.

Look Left Target: $64

Measure Move (MM): $95

NFA

CrowdStrike is about to push to ATH's, 60% Move Inbound!CrowdStrike is about to push to ATH's, 60% Move Inbound!

NASDAQ:CRWD is going higher and presenting a buying opportunity!

60% Potential Upside! 📈

In this video, we dive into this Cyber Security Goliath:

💡 Key Highlights:

-Breaking out of Bull Flag

-H5 Indicator: Flashing green for a bullish signal

-Volume Insights: Massive GAP to fill

-Technical Analysis: Consolidation box formed on WR%

Targets:

🎯$399

📏$537

Don't miss out on the potential explosive growth of CrowdStrike! Tune in to see why this stock could be a game-changer!

NFA

Shopify ain't done yet! Pullback then Higher, 50% Move Inbound! Shopify ain't done yet! Pullback then Higher, 50% Move Inbound!

NYSE:SHOP is going higher and presenting a buying opportunity!

50% Potential Upside! 📈

In this video, we dive into NYSE:SHOP , an Ecommerce powerhouse, currently breaking out of a Multi-Year Cup n Handle Pattern!

💡 Key Highlights:

-H5 Indicator: Flashing green for a bullish signal

-Flipping a 4-year resistance area to support

-Volume Insights: Massive GAP to fill

-Technical Analysis: Consolidation box formed on WR%

Targets:

🎯$110

🎯$121

📏$160

🎯$180

Don't miss out on the potential explosive growth of Shopify! Tune in to see why this stock could be a game-changer!

NFA

Short Squeeze is still on with Mobileye! H5 Indicator BUYNASDAQ:MBLY

- #HIGHFIVESETUP Indicator is Bullish

- Creating support on our Wr% Consolidation box

- Inverse H&S/ Symmetrical Triangle Breakout

- Volume Profile GAP x2

- 21% Short Float on Mobileye

🎯 $20

MM 🎯 $25

What are you worried about?!

NFA